As filed with the Securities and Exchange Commission on May 28, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

THE HERSHEY COMPANY

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 23-0691590 (I.R.S. Employer Identification Number) |

19 East Chocolate Avenue

Hershey, Pennsylvania 17033

(717) 534-4200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James Turoff

Senior Vice President, General Counsel and Secretary

The Hershey Company

19 East Chocolate Avenue

Hershey, Pennsylvania 17033

(717) 534-4200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

J. Steven Patterson, Esq. Courtney Cochran Butler

Hunton Andrews Kurth LLP Hunton Andrews Kurth LLP

2200 Pennsylvania Avenue, N.W. 600 Travis, Suite 4200

Washington, D.C. 20037 Houston, Texas 77002

(202) 955-1500 (713) 220-4200

Approximate date of commencement of proposed sale to public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, please check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | ¨ | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ¨

PROSPECTUS

Debt Securities

____________________________________________________

We may offer and sell our debt securities (the “Debt Securities”) from time to time in amounts, at prices and on other terms to be determined at the time of offering. The Debt Securities may be issued in one or more series with the same or various maturities. The particular terms of the Debt Securities that may be offered from time to time will be described in the prospectus supplement related to such offering (the “Prospectus Supplement”). If indicated in an applicable Prospectus Supplement, the terms of the Debt Securities offered thereby may differ from the terms summarized in this prospectus (this “Prospectus”).

We may supplement, update or change any of the information contained in this Prospectus by incorporating information by reference in this Prospectus. Any Prospectus Supplement may also add, update, or change information contained in this Prospectus. You should read this Prospectus, any accompanying Prospectus Supplement and any incorporated documents carefully before you invest.

We may offer and sell the Debt Securities, on a continuous or delayed basis, to or through one or more underwriters, dealers, agents or other third parties or directly to purchasers, as described in the applicable Prospectus Supplement. See “Plan of Distribution” for additional information.

This Prospectus may not be used to sell Debt Securities unless it is accompanied by a Prospectus Supplement.

____________________________________________________

Investing in our Debt Securities involves risks. Before you invest in any series of our Debt Securities, you should consider carefully the risk referred to under “Risk Factors” on page 6 of this Prospectus, which risks are incorporated by reference into this Prospectus from our periodic reports filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended. In addition, the Prospectus Supplement relating to an offering of our Debt Securities may also discuss certain risks that are particular to investing in the Debt Securities offered thereby. You should carefully consider all such risks before investing in our Debt Securities. ____________________________________________________

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is May 28, 2024.

No person has been authorized to give any information or to make any representations other than those contained or incorporated by reference in this Prospectus, any accompanying Prospectus Supplement or any free writing prospectus prepared by or on behalf of us, which we refer to as a free writing prospectus, and, if given or made, such information or representations must not be relied upon as having been authorized. This Prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of the Debt Securities or an offer to buy or the solicitation of an offer to sell the Debt Securities in any circumstances in which such offer or solicitation would be unlawful. Neither the delivery of this Prospectus nor any sale made under this Prospectus shall, under any circumstances, create any implication that the information contained herein is correct as of any time subsequent to the date of such information.

Unless otherwise specified or unless the context requires otherwise, all references in this Prospectus to “Hershey,” “we,” “us,” “our,” or the “Company” refer to The Hershey Company and its subsidiaries.

Table of Contents

Forward-Looking Statement Safe Harbor

We are subject to changing economic, competitive, regulatory and technological risks and uncertainties that could have a material impact on our business, financial condition or results of operations. In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we note the following factors that, among others, could cause future results to differ materially from the forward-looking statements, expectations and assumptions that we have discussed directly or implied in this Prospectus. Many of these forward-looking statements can be identified by the use of words such as “anticipate,” “assume,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “future,” “intend,” “plan,” “potential,” “predict,” “project,” “strategy,” “target” and similar terms, and future or conditional tense verbs like “could,” “may,” “might,” “should,” “will” and “would,” among others.

The factors that could cause our actual results to differ materially from the results projected in our forward-looking statements include, but are not limited to the following:

•Our Company’s reputation or brand image might be impacted as a result of issues or concerns relating to the quality and safety of our products, ingredients or packaging, human and workplace rights, and other environmental, social or governance matters, which in turn could result in litigation or otherwise negatively impact our operating results;

•Disruption to our manufacturing operations or supply chain could impair our ability to produce or deliver finished products, resulting in a negative impact on our operating results;

•We might not be able to hire, engage and retain the talented global human capital we need to drive our growth strategies;

•Risks associated with climate change and other environmental impacts, and increased focus and evolving views of our customers, stockholders and other stakeholders on climate change issues, could negatively affect our business and operations;

•Increases in raw material and energy costs, along with the availability of adequate supplies of raw materials and our ability to successfully hedge against volatility in raw material pricing, could affect future financial results;

•Price increases may not be sufficient to offset cost increases and maintain profitability or may result in sales volume declines associated with pricing elasticity;

•Market demand for new and existing products could decline;

•Increased marketplace competition could hurt our business;

•Our financial results may be adversely impacted by the failure to successfully execute or integrate acquisitions, divestitures and joint ventures;

•Our international operations may not achieve projected growth objectives, which could adversely impact our overall business and results of operations;

•We may not fully realize the expected cost savings and/or operating efficiencies associated with our strategic initiatives or restructuring programs, which may have an adverse impact on our business;

•Changes in governmental laws and regulations could increase our costs and liabilities or impact demand for our products;

•Political, economic and/or financial market conditions, including impacts on our business arising from armed conflict or geopolitical instability (such as the ongoing conflict between Russia and Ukraine and the Israel-Hamas conflict in the Gaza strip), could negatively impact our financial results

•Disruptions, failures or security breaches of our information technology infrastructure could have a negative impact on our operations;

•Complications with the design, implementation or usage of our new enterprise resource planning system, including the ability to support post-implementation efforts and maintain enhancements, new features or modifications, could adversely impact our business and operations; and

•Such other matters as discussed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024.

Our forward-looking statements speak only as of the date of this Prospectus or as of the date they are made, and we undertake no obligation to update our forward-looking statements.

Where You Can Find More Information

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance therewith, file or furnish annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding registrants that file electronically with the SEC, including us. You may also obtain a copy of any of our SEC filings, free of charge, from the Investors section of our website at www.thehersheycompany.com as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information contained on, or that is accessible through, our website is not incorporated by reference into this Prospectus or any Prospectus Supplement, and you should not consider such information as part of this Prospectus or any Prospectus Supplement.

We have filed with the SEC a registration statement on Form S-3 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”) with respect to the Debt Securities. This Prospectus does not contain all of the information set forth in the Registration Statement, certain parts of which have been omitted in accordance with the rules and regulations of the SEC. Reference is made to the Registration Statement and to the exhibits relating thereto for further information with respect to us and the Debt Securities.

Documents Incorporated by Reference

The SEC allows us to “incorporate by reference” information into this Prospectus. This means that we can disclose important information to you by referring you to other documents that we file with the SEC. The information incorporated by reference is considered to be part of this Prospectus, and the information we file later with the SEC will automatically update and supersede the previously filed information. We incorporate by reference the following documents that we have filed with the SEC (File No. 001-00183), unless otherwise indicated herein:

(a)Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed on February 20, 2024, including the information specifically incorporated by reference in our Annual Report on Form 10-K from our Definitive Proxy Statement on Schedule 14A filed on March 26, 2024;

(b)Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed on May 3, 2024; and

We will not, however, incorporate by reference in this Prospectus any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant to Item 2.02 or Item 7.01 of our Current Reports on Form 8-K or Form 8-K/A, including any financial statements or exhibits related thereto and furnished pursuant to Item 9.01, after the date of this Prospectus unless, and except to the extent, specified in such Current Reports.

All documents we file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this Prospectus shall be deemed to be incorporated by reference in this Prospectus so long as the Registration Statement of which this Prospectus is a part remains effective. Such documents shall be deemed to be a part of this Prospectus from the date of their filing. We may file one or more Current Reports on Form 8-K specifically in connection with an offering of the Debt Securities in order to incorporate by reference in this Prospectus or the applicable Prospectus Supplement information concerning The Hershey Company, the terms and conditions of the Debt Securities offered thereby or the offering of such Debt Securities to you. When we use the term “Prospectus” in this Prospectus and any Prospectus Supplement, we are referring to this Prospectus as updated and supplemented by all information incorporated by reference herein from any Annual Report on Form 10-K, Quarterly Report on Form 10-Q or Current Report on Form 8-K and any other documents incorporated by reference in this Prospectus as described above.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein or in any Prospectus Supplement modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus.

We will provide, without charge, a copy of any or all of the documents mentioned above to each person, including any beneficial owner, receiving this Prospectus who requests them in writing or by telephone. Requests for such copies should be addressed to The Hershey Company, Attn: Investor Relations Department, 19 East Chocolate Avenue, Hershey, Pennsylvania 17033-0810, Telephone: (717) 534-4200.

The Hershey Company

The Hershey Company was incorporated under the laws of the State of Delaware on October 24, 1927 as a successor to a business founded in 1894 by Milton S. Hershey.

Hershey is a global confectionery leader known for bringing goodness to the world through chocolate, sweets, mints and other great tasting snacks. We are the largest producer of quality chocolate in North America, a leading snack maker in the United States and a global leader in chocolate and non-chocolate confectionery. We market, sell and distribute our products under more than 90 brand names in approximately 80 countries worldwide.

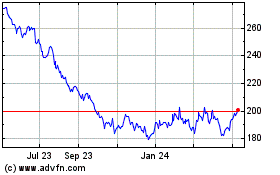

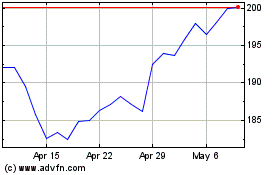

Our common stock is traded on the New York Stock Exchange under the symbol “HSY.” Our principal executive offices are located at 19 East Chocolate Avenue, Hershey, Pennsylvania 17033, and our telephone number is (717) 534-4200.

Risk Factors

An investment in our securities involves risks. You should carefully consider each of the risks described in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February 20, 2024 and updated in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 3, 2024, as such factors may be further updated from time to time in our periodic filings with the SEC which are accessible on the SEC’s website at www.sec.gov, and all of the other information included or incorporated by reference in this Prospectus and any applicable Prospectus Supplement, before deciding to invest in any of our Debt Securities.

Use of Proceeds

We currently have no plans for specific use of the net proceeds from the sale of the Debt Securities. We will specify the principal purposes for which the net proceeds from each offering will be used in the Prospectus Supplement related to such offering. Except as may be otherwise set forth in the applicable Prospectus Supplement, the net proceeds from the sale of the Debt Securities will be added to our general funds to meet capital additions and working capital requirements, to repay debt, to fund any pension liability requirements, to fund the repurchase of shares of our common stock and/or to fund acquisitions that we may make from time to time. Pending our use, we may invest such proceeds temporarily in cash equivalents and/or short-term marketable securities.

Description of Debt Securities

Unless otherwise set forth in the applicable Prospectus Supplement related to an offering, the Debt Securities offered hereby will be issuable in one or more series under the indenture dated as of May 14, 2009 (the “Indenture”) between us and U.S. Bank National Association, as trustee (the “Trustee”). The following statements are subject to the detailed provisions of the Indenture, which is incorporated by reference as an exhibit to the Registration Statement of which this Prospectus forms a part. Wherever references are made to particular provisions of the Indenture or terms defined therein are referred to, such provisions or definitions are incorporated by reference as a part of the statements made and such statements are qualified in their entirety by such references.

General

The Indenture does not limit the amount of Debt Securities which may be issued thereunder. Except as described in “Covenants” below and as otherwise provided in the Prospectus Supplement relating to a particular series of Debt Securities and/or documents incorporated by reference, the Indenture does not limit the amount of other debt, secured or unsecured, which we may issue. We may issue the Debt Securities in one or more series, as we may authorize from time to time (Section 2.5).

Reference is made to the Prospectus Supplement relating to the Debt Securities and/or documents incorporated by reference for the following terms, where applicable, of the Debt Securities: (1) the designation, the aggregate principal amount and the authorized denominations of the Debt Securities; (2) the percentage of their principal amount at which the Debt Securities will be issued; (3) the currency or currencies (including composite currencies) in which the principal of and interest, if any, on the Debt Securities will be payable; (4) the date or dates on which the Debt Securities will mature; (5) the rate or rates at which the Debt Securities will bear interest, if any, or the method by which such rate or rates will be determined and the date or dates from which such interest will accrue; (6) the dates on which and places at which interest, if any, will be payable and the record dates for payment of such interest; (7) the terms of any mandatory or optional repayment or redemption (including any sinking fund); and (8) any other terms of the Debt Securities (Section 2.5). The Indenture provides that Debt Securities of a single series may be issued at various times, with different maturity dates and may bear interest at different rates (Section 2.5).

The Debt Securities will be our unsecured, unsubordinated indebtedness and will rank on parity with all of our other unsecured, unsubordinated indebtedness.

Debt Securities of a series may be issued in fully registered form or in the form of one or more global securities, (each a "Global Security") and, with regard to each series of Debt Securities in respect of which this Prospectus is being delivered or made available, in the denominations set forth in the Prospectus Supplement relating to such series and/or documents incorporated by reference. With regard to each series of Debt Securities, we will maintain in the Borough of Manhattan, The City of New York and in such other place or places, if any, specified in the Prospectus Supplement relating to such series and/or documents incorporated by reference, an office or agency where the Debt Securities of such series may be transferred or exchanged and may be presented for payment of principal, premium, if any, and interest; provided that if such securities are not Global Securities, at our option, payment of interest may be made by check mailed to the address of the person entitled thereto as it appears in the register for the Debt Securities (Sections 2.2 and 3.2). No service charge will be made for any transfer or exchange of the Debt Securities, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection therewith (Section 2.10).

Some of the Debt Securities may be issued as discounted Debt Securities (bearing no interest or interest at a rate which at the time of issuance is below market rates) to be sold at a substantial discount below their stated principal amount. Such discounted Debt Securities will be treated as having been issued with original issue discount for United States federal income tax purposes pursuant to Section 1273 of the Internal Revenue Code of 1986, as amended, if the discount is in excess of a minimum threshold amount. Federal income tax consequences and other special considerations applicable to any Debt Securities with original issue discount will be described in the Prospectus Supplement relating thereto and/or documents incorporated by reference.

Definitions

“Attributable Debt” is defined, in brief, to mean, as to any lease under which any person is at the time liable, at any date as of which the amount thereof is to be determined, the total net amount of rent required to be paid by such person under such lease during the remaining term thereof (including in respect of contingent rents, amounts based on the amount thereof, if any, being paid on the date of determination and excluding amounts on account of maintenance and repairs, insurance, taxes, assessments, water rates and similar charges), discounted from the respective due dates thereof at the weighted average of the rates of interest (and Yields to Maturity, in the case of Original Issue Discount Securities) borne by the Debt Securities then Outstanding, compounded annually (Section 1.1).

“Consolidated Net Tangible Assets” is defined to mean the aggregate amount of assets (less applicable reserves and other properly deductible items) after deducting therefrom (a) all current liabilities (excluding any portion thereof constituting Funded Debt by reason of being renewable or extendible) and (b) all goodwill, trade names, trademarks, patents, unamortized debt discount and expense and other like intangibles, all as set forth on our and our Domestic Subsidiaries’ most recent consolidated balance sheet, prepared in accordance with U.S. generally accepted accounting principles (Section 1.1).

“Debt” is defined to mean any notes, bonds, debentures or other similar evidences of indebtedness for money borrowed and does not include Attributable Debt (Section 1.1).

“Domestic Subsidiary” is defined to mean a subsidiary of ours except a subsidiary (a) which neither transacts any substantial portion of its business nor regularly maintains any substantial portion of its fixed assets within the States of the United States, or (b) the principal purpose of which is to engage in financing our operations or the operations of our subsidiaries, or both, outside the States of the United States (Section 1.1).

“Funded Debt” is defined to mean all indebtedness for money borrowed having a maturity of more than 12 months from the date as of which the amount thereof is to be determined or having a maturity of less than 12 months but by its terms being renewable or extendible beyond 12 months from such date at the option of the borrower (Section 1.1).

“Government Obligations” is defined to mean either (i) direct obligations of the United States of America for the payment of which its full faith and credit is pledged or (ii) obligations of a person controlled or supervised by and acting as an agency or instrumentality of the United States of America, the payment of which is unconditionally guaranteed as a full faith and credit obligation of the United States of America, which, in either case, are not callable or redeemable at the option of the issuer thereof (Section 13.1).

“Mortgage” is defined to mean any pledge, mortgage, lien, encumbrance or security interest (Section 1.1).

“Original Issue Discount Security” is defined to mean any Security that provides for an amount less than the principal amount thereof to be due and payable upon a declaration of acceleration of the maturity thereof pursuant to the Indenture (Section 1.1).

“Principal Domestic Operating Property” is defined, in brief, to mean any land or any facility (together with the land on which it is erected and fixtures comprising a part thereof) located in the United States used primarily for manufacturing, processing or production, owned or leased by us or any of our subsidiaries and having a gross book value in excess of 2% of Consolidated Net Tangible Assets other than any such land, facility or portion thereof which in the opinion of our Board of Directors, is not of material importance to the total business conducted by us and our subsidiaries as an entity (Section 1.1).

“subsidiary” of our company, is defined to mean a corporation a majority of the outstanding voting stock of which is owned, directly or indirectly, by us and/or by one or more of our subsidiaries (Section 1.1).

Other capitalized terms used in this “Description of Debt Securities” have the meanings given them in the Indenture, unless otherwise indicated or unless the context otherwise requires.

Covenants

Limitation on Liens

If we or any Domestic Subsidiary shall incur, issue, assume or guarantee any Debt secured by a Mortgage on any Principal Domestic Operating Property or on any shares of stock or Debt, held by us or any Domestic Subsidiary, of any Domestic Subsidiary, we will secure, or cause such Domestic Subsidiary to secure, the Debt Securities equally and ratably with (or prior to) such Debt, unless after giving effect thereto the aggregate amount of all such Debt so secured together with all Attributable Debt in respect of sale and leaseback transactions involving Principal Domestic Operating Properties would not exceed 15% of our and our Domestic Subsidiaries’ Consolidated Net Tangible Assets. This restriction will not apply to, and there shall be excluded in computing secured Debt for the purpose of such restriction, Debt secured by (a) Mortgages on property of, or on any shares of stock or Debt of, any corporation existing at the time such corporation becomes a Domestic Subsidiary, (b) Mortgages in our favor or in favor of any Domestic Subsidiary, (c) Mortgages in favor of U.S. governmental bodies to secure progress, advance or other payments pursuant to any contract or provision of any statute, (d) Mortgages on property, shares of stock or Debt existing at the time of acquisition thereof (including acquisition through merger or consolidation), purchase money Mortgages and construction cost Mortgages, and (e) any extension, renewal or refunding of any Mortgage referred to in the foregoing clauses (a) through (d), inclusive (Section 3.4). The Indenture will not restrict our or our subsidiaries’ ability to incur unsecured debt.

Merger and Consolidation

The Indenture provides that no consolidation or merger of our company with or into any other corporation and no sale or conveyance of its property as an entirety, or substantially as an entirety, may be made to another corporation if, as a result thereof, any Principal Domestic Operating Property or any shares of stock or Debt, held by us or any Domestic Subsidiary, of a Domestic Subsidiary would become subject to a Mortgage, unless either (i) the Debt Securities shall be equally and ratably secured with (or prior to) the Debt secured by such Mortgage or (ii) such Mortgage could be created pursuant to Section 3.4 (See “Limitation on Liens” above) without equally and ratably securing the Debt Securities (Section 9.3). In addition, as a result of the consolidation, merger or conveyance, either we shall be the continuing corporation or the successor corporation shall be a corporation organized and existing under the laws of the United States or a state thereof and the successor corporation shall expressly assume the due and punctual payment of principal of (and premium, if any) and interest on all Debt Securities and our obligations under the Indenture in a supplemental indenture satisfactory to the Trustee (Section 9.1).

Limitations on Sales and Leasebacks

Neither we nor any Domestic Subsidiary may enter into any sale and leaseback transaction involving any Principal Domestic Operating Property, completion of construction and commencement of full operation of which has occurred more than 120 days prior thereto, unless (a) we or such Domestic Subsidiary could mortgage such property pursuant to Section 3.4 (see “Limitation on Liens” above) in an amount equal to the Attributable Debt with respect to the sale and leaseback transaction without equally and ratably securing the Debt Securities or (b) we, within 120 days after completion of the sale and leaseback transaction, apply to the retirement of our Funded Debt an amount (subject to credits for certain voluntary retirements of Funded Debt) not less than the greater of (i) the net proceeds of the sale of the Principal Domestic Operating Property so leased or (ii) the fair market value of the Principal Domestic Operating Property so leased. This restriction will not apply to any sale and leaseback transaction (a) between us and a Domestic Subsidiary or between Domestic Subsidiaries or (b) involving the taking back of a lease for a period of not more than three years (Section 3.5).

Unless otherwise indicated in a Prospectus Supplement and/or documents incorporated by reference, certain of the covenants described above would not necessarily afford holders of the Debt Securities protection in the event of a highly leveraged transaction involving us, such as a leveraged buyout. In this regard, however, it should be noted that voting control of our company is held by Hershey Trust Company, as trustee for the Milton Hershey School Trust. As of March 8, 2024, Hershey Trust Company, as trustee for the Milton Hershey School Trust, had the right to cast 1.41% of all of the votes entitled to be cast on matters requiring the vote of our common stock voting separately and 78.8% of all of the votes entitled to be cast on matters requiring the vote of our common stock and Class B common stock voting together. Hershey Trust Company, as trustee for the Milton Hershey School Trust, currently has three representatives who are members of the Board of Directors of the Company. These representatives, from time to time in performing their responsibilities on the Company’s Board, may exercise influence with regard to the ongoing business decisions of our Board of Directors or management. Hershey Trust Company, as trustee for the Milton Hershey School Trust, has indicated that, in its role as controlling stockholder of the Company, it intends to retain its controlling interest in The Hershey Company, and that the Company Board, not the Hershey Trust Company board, is solely responsible and accountable for the Company’s management and performance. Hershey Trust Company, as trustee for Milton Hershey School, or any successor trustee, or Milton Hershey School, as appropriate, must approve the issuance of shares of

common stock or any other action that would result in Hershey Trust Company, as trustee for Milton Hershey School, or any successor trustee, or Milton Hershey School, as appropriate, not continuing to have voting control of our Company.

Events of Default, Waiver and Notice

Except as may otherwise be provided in the Prospectus Supplement and/or documents incorporated by reference, as to any series of Debt Securities, an Event of Default is defined in the Indenture as (a) default in the payment of any installment of interest, if any, on the Debt Securities of such series when due and the continuance of such default for a period of 30 days; (b) default in payment of the principal of (and premium, if any, on) any of the Debt Securities of such series when due, whether at maturity, upon redemption, by declaration or otherwise; (c) default in the payment of a sinking fund installment, if any, on the Debt Securities of such series when due; (d) default by us in the performance of any other covenant or agreement contained in the Indenture, other than a covenant expressly included in the Indenture solely for the benefit of series of Debt Securities other than such series, and the continuance of such default for a period of 90 days after appropriate notice; (e) certain events of bankruptcy, insolvency and reorganization of our company; and (f) any other Event of Default established with respect to Debt Securities of that series (Sections 2.5 and 5.1).

An Event of Default with respect to a particular series of Debt Securities issued under the Indenture does not necessarily constitute an Event of Default with respect to any other series of Debt Securities issued thereunder.

The Indenture provides that the Trustee shall, within 90 days after the occurrence of a default with respect to Debt Securities of any series, give all the holders of Debt Securities of such series then outstanding notice of all uncured defaults known to it (the term default to mean the events specified above, not including grace periods); provided that, except in the case of a default in the payment of principal of (and premium, if any) or interest, if any, on any Debt Security of any series, or in the payment of any sinking fund installment with respect to Debt Securities of any series, the Trustee shall be protected in withholding such notice if it in good faith determines that the withholding of such notice is in the interest of all the holders of Debt Securities of such series then outstanding (Section 5.11).

The Indenture provides that if an Event of Default with respect to any series of Debt Securities shall have occurred and be continuing, either the Trustee or the holders of at least 25% in principal amount (calculated as provided in the Indenture) of the Debt Securities of such series then outstanding may declare the principal (or, in the case of Original Issue Discount Securities, the portion thereof as may be specified in the Prospectus Supplement relating to such series and/or documents incorporated by reference) of all of the Debt Securities of such series and the interest accrued thereon, if any, to be due and payable immediately (Section 5.1).

Upon certain conditions such declarations of acceleration with respect to Debt Securities of any series may be annulled and past defaults (except for defaults in the payment of principal (or premium, if any) or interest, if any, on such Debt Securities not theretofore cured or in respect of a covenant or provision of the Indenture which cannot be amended or modified without the consent of the holder of each outstanding Debt Security of that series affected) may be waived with respect to such series by the holders of not less than a majority in principal amount (calculated as provided in the Indenture) of the Debt Securities of such series then outstanding (Section 5.10).

The Indenture requires that we file with the Trustee annually a written statement as to the presence or absence of certain defaults under the terms thereof and as to performance and fulfillment of certain covenants or agreements therein (Section 3.6).

The Indenture provides that the holders of not less than a majority in principal amount (calculated as provided in the Indenture) of the Debt Securities of any series then outstanding shall have the right to direct the time, method and place of conducting any proceeding or remedy available to the Trustee, or exercising any trust or power conferred on the Trustee by the Indenture with respect to defaults or Events of Default with respect to Debt Securities of such series (Section 5.9).

The Indenture provides that the Trustee shall be under no obligation, subject to the duty of the Trustee during default to act with the required standard of care, to exercise any of the rights or powers vested in it by the Indenture at the direction of the holders of Debt Securities unless such holders shall have offered to the Trustee reasonable security or indemnity against expenses and liabilities (Section 6.2).

Defeasance

The Indenture provides that we may terminate our obligations under Sections 3.4, 3.5 and 9.3 of the Indenture (being the restrictions described under “Covenants-Limitation on Liens” and “Covenants-Limitations on Sales and Leasebacks” and the first sentence under “Covenants-Merger and Consolidation” above) with respect to the Debt Securities of any series, on the terms and subject to the conditions contained in the Indenture, by depositing in trust with the Trustee money or Government Obligations sufficient to pay the principal of (and premium, if any) and interest on the Debt Securities of such series and any mandatory sinking fund or analogous payments thereon, on the scheduled due dates therefor. Such deposit and termination is conditioned upon, among other things, our delivery of an opinion of counsel that the holders of the Debt Securities of such series will not recognize income, gain or loss for Federal income tax purposes as a result of such deposit and termination and will be subject to Federal income tax on the same amounts, in the same manner and at the same times as would have been the case had such deposit and termination not occurred. Such termination will not relieve us of our obligation to pay when due the principal of or interest on the Debt Securities of such series if the Debt Securities of such series are not paid from the money or Government Obligations held by the Trustee for the payment thereof (Section 13.1).

Modification of the Indenture

The Indenture contains provisions permitting us and the Trustee, with the consent of the holders of not less than a majority in principal amount (calculated as provided in the Indenture) of the outstanding Debt Securities of each series affected by such modification, to modify the Indenture or any supplemental indenture or the rights of the holders of the Debt Securities of any series; provided that no such modification shall, without the consent of the holders of each Debt Security affected thereby, extend the maturity of any Debt Security, or reduce the principal amount thereof, or reduce the rate or extend the time of payment of interest thereon, or reduce the portion of the principal amount of an Original Issue Discount Security due and payable upon acceleration of the maturity thereof or the portion of the principal amount thereof provable in bankruptcy, or reduce any amount payable upon redemption of any Debt Security, or reduce the overdue rate thereof, or impair any right of repayment at the option of the holder of any Debt Security or change the currency of payment of principal or interest on any Debt Security or reduce the percentage in principal amount of Outstanding Debt Securities of any series the consent of the holders of which is required for modification or amendment of the Indenture or for waiver of compliance with certain provisions of the Indenture or for waiver of certain defaults (Section 8.2).

The holders of not less than a majority in principal amount of the Outstanding Debt Securities of any series may on behalf of the holders of all Debt Securities of such series waive, insofar as that series is concerned, our compliance with certain restrictive provisions (Limitation on Liens and Limitations on Sales and Leasebacks) of the Indenture (Section 3.9).

The Indenture also permits us and the Trustee to amend the Indenture in certain circumstances without the consent of the holders of any Debt Securities to evidence the merger of our company or the replacement of the Trustee and for certain other purposes (Section 8.1).

Indenture Trustee

In the ordinary course of business, we and our subsidiaries are engaged, have engaged and from time to time in the future may engage in commercial banking and/or investment banking transactions with the Trustee and certain of its affiliates, for which they have in the past received, and may in the future receive, customary fees. U.S. Bancorp Investments, Inc., an affiliate of the Trustee, has been an underwriter in the offering and sale of certain series of our debt securities previously issued pursuant to the Indenture. The Trustee is also a lender under our existing Five-Year Credit Agreement, dated as of April 26, 2023.

The Trust Indenture Act provides that, upon the occurrence of a default under the Indenture, if the Trustee has a conflicting interest (as defined in the Trust Indenture Act), the Trustee must, within 90 days after it ascertains that it has that conflicting interest, either eliminate that conflicting interest or resign as Trustee unless the default has been cured, waived or otherwise eliminated before the end of the 90-day period. If the Trustee fails to resign in those circumstances, it is required to provide, within ten days after the 90-day period expires, notice of the conflicting interest to the holders of the Debt Securities outstanding under the Indenture. Any security holder that has been a bona fide holder of Debt Securities issued for at least six months may petition a court of competent jurisdiction to remove the Trustee and to appoint a successor trustee under the Indenture if the Trustee does not eliminate its conflicting interest or resign as Indenture Trustee upon the written request of such holder during the 90-day period described above. A security holder filing such a petition may be required by the court to undertake to pay the costs of such court action.

Plan of Distribution

We may sell Debt Securities to or through underwriters or dealers and also may sell Debt Securities directly to one or more other purchasers or through agents. The Prospectus Supplement and/or documents incorporated by reference will set forth the names of any underwriters or agents involved in the sale of the Debt Securities and any applicable commission or discounts.

The distribution of Debt Securities may be effected from time to time in one or more transactions at a fixed price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices related to such prevailing market prices or at negotiated prices.

Each series of Debt Securities will be a new issue with no established trading market. We may elect to list any series of Debt Securities on an exchange, but we will not be obligated to do so. It is possible that one or more underwriters may make a market in a series of Debt Securities, but will not be obligated to do so and may discontinue any market making at any time without notice. Therefore, we can give no assurance as to the liquidity of the trading market for Debt Securities.

If Debt Securities are sold by means of an underwritten offering, we anticipate such sale will be pursuant to the form of Underwriting Agreement (the “Form Underwriting Agreement”) and the form of Pricing Agreement (“Form Pricing Agreement”), filed as Exhibits 1.1 and 1.2, respectively to the Registration Statement of which this Prospectus forms a part. Under the Form Pricing Agreement, each underwriter agrees, severally and not jointly, to purchase its allocated amount of Debt Securities. The Form Underwriting Agreement provides that the obligations of the underwriters to purchase Debt Securities are subject to approval of certain legal matters by counsel and to certain other conditions. The underwriters are committed to take and pay for all Debt Securities to be offered, if any are taken. In the event of a default by any underwriter, the Form Underwriting Agreement provides that, in certain circumstances, the purchase commitments of the non-defaulting underwriters may be increased or the Form Underwriting Agreement may be terminated.

In connection with the sale of Debt Securities, underwriters may receive compensation from us or from purchasers of Debt Securities for whom they may act as agents in the form of discounts, concessions or commissions. Underwriters may sell Debt Securities to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agents. Underwriters, dealers and agents that participate in the distribution of Debt Securities may be deemed to be underwriters, and any discounts or commissions received by them from us and any profit on the resale of Debt Securities by them may be deemed to be underwriting discounts and commissions under the Securities Act. Any such underwriter or agent will be identified, and any such compensation received from us will be described in the Prospectus Supplement and/or documents incorporated by reference.

Agents, underwriters and dealers may engage in transactions with, or perform services for, us and our subsidiaries in the ordinary course of business.

Under agreements which we may enter into, we may be required to indemnify the underwriters and agents who participate in the distribution of Debt Securities against certain liabilities, including liabilities under the Securities Act, or contribute to payments that they may be required to make in respect of any such liabilities. The Form Underwriting Agreement provides for such an indemnity in favor of the underwriters.

If so indicated in the Prospectus Supplement and/or documents incorporated by reference, we will authorize underwriters or other persons acting as our agents to solicit offers by certain institutions to purchase Debt Securities from us pursuant to contracts providing for payment and delivery on a future date. Institutions with which such contracts may be made include commercial savings banks, insurance companies, pension funds, investment companies, educational and charitable institutions and others, but in all cases we must approve such institutions. The obligations of any purchaser under any such contract will be subject to the condition that the purchase of the Offered Securities shall not at the time of delivery be prohibited under the laws of the jurisdiction to which such purchaser is subject. The underwriters and such other agents will not have any responsibility in respect of the validity or performance of such contracts.

Legal Matters

The validity of, and certain other legal matters with respect to, the Debt Securities will be passed upon for us by Hunton Andrews Kurth LLP, Houston, Texas. Certain legal matters in connection with this offering will be passed upon for the underwriters by Cleary Gottlieb Steen & Hamilton LLP, New York, New York.

Experts

The consolidated financial statements and schedule of The Hershey Company appearing in The Hershey Company’s Annual Report (Form 10-K) for the year ended December 31, 2023 and the effectiveness of The Hershey Company’s internal control over financial reporting as of December 31, 2023 have been audited by Ernst & Young LLP, an independent registered public accounting firm, as set forth in their reports thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such reports given on the authority of such firm as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

ITEM 14. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION.

The following table lists the expenses expected to be incurred in connection with the preparation and filing of the registration statement, including amendments thereto, and the printing and distribution of the prospectus contained therein, all of which will be paid by the registrant.

| | | | | |

| Securities and Exchange Commission registration fee | (1) |

Printing and duplicating expenses | (2) |

Rating agency fees | (2) |

Trustee fees and expenses | (2) |

Accounting fees and expenses | (2) |

Legal fees and expenses | (2) |

| Total | (2) |

(1) Deferred in accordance with Rules 456(b) and 457(r) under the Securities Act. SEC registration fees are determined based upon the aggregate initial offering price of the securities being offered from time to time. As of the date of this registration statement, the Section 6(b) fee rate applicable to the registration of securities is $147.60 per million.

(2) These fees are calculated based on the securities offered and the number of issuances and, accordingly, cannot be estimated at this time.

ITEM 15. INDEMNIFICATION OF DIRECTORS AND OFFICERS.

Section 145 of the Delaware General Corporation Law (the “DGCL”) grants each corporation organized thereunder the power to indemnify any person who is or was a director, officer, employee or agent of a corporation or enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, other than an action by or in the right of the corporation, by reason of being or having been in any such capacity, if such person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe that the person’s conduct was unlawful.

Section 102(b)(7) of the DGCL enables a corporation in its certificate of incorporation or an amendment thereto to eliminate or limit the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) pursuant to Section 174 of the DGCL (providing for liability of directors for unlawful payment of dividends or unlawful stock purchases or redemptions) or (iv) for any transaction from which the director derived an improper personal benefit.

The Sixth Article of the registrant’s Restated Certificate of Incorporation provides that to the fullest extent permitted by the DGCL, no director of the registrant shall be personally liable to the registrant or its stockholders for monetary damages for breach of fiduciary duty as a director.

Article VI of the Bylaws of the registrant provides that the registrant shall indemnify, in the manner and to the fullest extent permitted by the DGCL, any person who is, was or is threatened to be made a defending party to any proceeding (including any pending or threatened civil or criminal action, suit, arbitration, alternate dispute resolution mechanism, investigation or administrative hearing) by reason of the fact that such person is or was (i) a director or officer of the registrant or its subsidiaries, or (ii) a director, officer or employee of the registrant and is or was serving, at the request of the registrant, as a director, officer, employee, agent or fiduciary for another enterprise. The registrant will pay in advance of final disposition all expenses incurred by a director or officer in defending a proceeding which is subject to indemnification. The registrant has the burden of proving that a director or officer was not entitled to indemnification.

The registrant’s directors and officers are insured against losses arising from any claim against them as such for wrongful acts or omissions, subject to certain limitations.

ITEM 16. EXHIBITS.

The following exhibits are filed as part of this registration statement.

| | | | | | | | |

Exhibit Number | | Description of Exhibits |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

(1) Filed herewith.

ITEM 17. UNDERTAKINGS.

The undersigned registrant hereby undertakes:

1.To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(a)To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933, as amended (the “Securities Act”);

(b)To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(c)To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

2.That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3.To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

4.That, for the purpose of determining liability under the Securities Act to any purchaser:

(a)Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(b)Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

5.That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(a)Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(b)Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(c)The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(d)Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

6.That, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

7.Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the Township of Derry, Commonwealth of Pennsylvania, on May 28, 2024.

| | | | | | | | |

| THE HERSHEY COMPANY |

| | |

| By: | /s/ STEVEN E. VOSKUIL |

| Name: | Steven E. Voskuil |

| Title: | Senior Vice President, Chief Financial Officer |

SIGNATURES AND POWERS OF ATTORNEY

Each of the directors and/or officers of The Hershey Corporation, that each person whose signature appears below constitutes and appoints Steven E. Voskuil, James Turoff and Bjork Hupfeld, or any of them, his or her attorneys-in-fact, each with the power of substitution, for him or her in any and all capacities to sign any and all amendments to this registration statement (including post-effective amendments), and to sign any registration statement for the same offering covered by this registration statement that is to be effective upon filing pursuant to Rule 462(e) promulgated under the Securities Act, and all post-effective amendments thereto, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that such attorneys-in-fact, or his or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof. This Power of Attorney may be signed in several counterparts.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated:

| | | | | | | | | | | | | | |

Signature | | Title | | Date |

| | | | |

| /s/ MICHELE G. BUCK | | Chairman of the Board, President and Chief Executive Officer | | May 28, 2024 |

| Michele G. Buck | | (Principal Executive Officer) | | |

| | | | |

| /s/ STEVEN E. VOSKUIL | | Senior Vice President, Chief Financial Officer | | May 28, 2024 |

| Steven E. Voskuil | | (Principal Financial Officer) | | |

| | | | |

| /s/ JENNIFER L. MCCALMAN | | Vice President, Chief Accounting Officer | | May 28, 2024 |

| Jennifer L. McCalman | | (Principal Accounting Officer) | | |

| | | | |

| /s/ VICTOR L. CRAWFORD | | Lead Independent Director | | May 28, 2024 |

| Victor L. Crawford | | | | |

| | | | |

| /s/ MARY KAY HABEN | | Director | | May 28, 2024 |

| Mary Kay Haben | | | | |

| | | | |

| /s/ M. DIANE KOKEN | | Director | | May 28, 2024 |

| M. Diane Koken | | | | |

| | | | |

| /s/ HUONG MARIA T. KRAUS | | Director | | May 28, 2024 |

| Huong Maria T. Kraus | | | | |

| | | | |

| /s/ ROBERT M. MALCOLM | | Director | | May 28, 2024 |

| Robert M. Malcolm | | | | |

| | | | |

| /s/ KEVIN M. OZAN | | Director | | May 28, 2024 |

| Kevin M. Ozan | | | | |

| | | | |

| /s/ ANTHONY J. PALMER | | Director | | May 28, 2024 |

| Anthony J. Palmer | | | | |

| | | | |

| /s/ JUAN R. PEREZ | | Director | | May 28, 2024 |

| Juan R. Perez | | | | |

| | | | |

| /s/ CORDEL ROBBIN-COKER | | Director | | May 28, 2024 |

| Cordel Robbin-Coker | | | | |

Calculation of Filing Fee Tables

S-3

(Form Type)

The Hershey Company

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation or Carry Forward Rule | Amount Registered | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee | Carry Forward Form Type | Carry Forward File Number | Carry Forward Initial effective date | Filing Fee Previously Paid In Connection with Unsold Securities to be Carried Forward |

| Newly Registered Securities |

| Fees to Be Paid | Debt | Debt Securities | Rules 456(b) and 457(r) | (2) | (2) | (2) | (1) | (1) | | | | |

| Fees Previously Paid | - | - | - | - | - | - | | - | | | | |

| Carry Forward Securities |

| Carry Forward Securities | - | - | - | - | | - | | | - | - | - | - |

| Total Offering Amounts | | N/A | | N/A | | | | |

| Total Fees Previously Paid | | | | N/A | | | | |

| Total Fee Offsets | | | | N/A | | | | |

| Net Fee Due | | | | N/A | | | | |

| | | | | | | | |

| | |

(1) The registrant is relying on Rule 456(b) and Rule 457(r) under the Securities Act of 1933, as amended, to defer payment of all of the registration fee. In connection with the securities offered hereby, the registrant is deferring payment of all registration fees and will pay the registration fees subsequently in advance or on a “pay-as-you-go” basis. The registrant will calculate the registration fee applicable to an offer of securities pursuant to this Registration Statement based on the fee payment rate in effect on the date of such fee payment. (2) An indeterminate aggregate initial offering price and amount of the securities of each identified class is being registered and may from time to time be offered hereunder at indeterminate prices. |

The Hershey Company

Debt Securities

———————————

Form of Underwriting Agreement

The Underwriters listed on Schedule I

to the applicable Pricing Agreement

(as defined herein)

Ladies and Gentlemen:

From time to time The Hershey Company, a Delaware corporation (the “Company”), proposes to enter into one or more Pricing Agreements (each a “Pricing Agreement”) in the form of Annex I hereto, with such additions and deletions as the parties thereto may determine, and, subject to the terms and conditions stated herein and therein, to issue and sell to the firms named in Schedule I to the applicable Pricing Agreement (such firms constituting the “Underwriters” with respect to such Pricing Agreement and the securities specified therein) certain of its debt securities (the “Securities”) specified in Schedule II to such Pricing Agreement (with respect to such Pricing Agreement, the “Designated Securities”).

The terms of any particular issuance of Designated Securities and the rights of the holders of such Designated Securities shall be as specified in the Pricing Agreement relating thereto and in or pursuant to the indenture (the “Indenture”) identified in such Pricing Agreement. References in this Agreement to the “Pricing Agreement” are to the applicable Pricing Agreement relating to the particular issuance and sale of Designated Securities specified therein.

1.Introduction. Particular sales of Designated Securities may be made from time to time to the Underwriters of such Designated Securities, for whom the firms designated as representatives of the Underwriters of such Designated Securities in the Pricing Agreement relating thereto will act as representatives (the “Representatives”). The term “Representatives” also refers to a single firm acting as sole representative of the Underwriters and to Underwriters who act without any firm being designated as their representative. This Agreement shall not be construed as an obligation of the Company to sell any of the Designated Securities or as an obligation of any of the Underwriters to purchase the Designated Securities. The obligation of the Company to issue and sell any of the Securities and the obligation of any of the Underwriters to purchase any of the Securities shall be evidenced by the Pricing Agreement with respect to the Designated Securities specified therein. Each Pricing Agreement shall specify the aggregate principal amount of such Designated Securities, the initial public offering price of such Designated Securities, the purchase price to the Underwriters of such Designated Securities, the names of the Underwriters of such Designated Securities, the names of the Representatives of such Underwriters and the principal amount of such Designated Securities to be purchased by each Underwriter and shall set forth the date, time and manner of delivery of such Designated Securities and payment therefor. The Pricing Agreement shall also specify (to the extent not set forth in the Indenture and the registration statement and prospectus with respect thereto) the terms of such Designated Securities. A Pricing Agreement shall be in the form of an executed writing (which may be in counterparts), and may be evidenced by an exchange of telegraphic communications or any other rapid transmission device designed to produce a written record of communications transmitted. The obligations of the Underwriters under this Agreement and each Pricing Agreement shall be several and not joint.

2.Representations, Warranties and Agreements of the Company. The Company represents and warrants to, and agrees with, each of the Underwriters that:

(a) The Company has filed with the Securities and Exchange Commission (the “Commission”) an “automatic shelf registration statement” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Act”) on Form S-3 (File No. 333- ) not earlier than three years prior to the date hereof in respect of the Securities; such registration statement and any post-effective amendment thereto, each in the form heretofore delivered or to be delivered to the Representatives and, excluding exhibits thereto but including all documents incorporated by reference in the prospectus contained therein, to the Representatives for each of the other Underwriters, became effective under the Act upon filing with the Commission and no stop order suspending the effectiveness of such registration statement, any post-effective amendment thereto, or any part thereof, or preventing or suspending the use of any Preliminary Prospectus, any Issuer Free Writing Prospectus or the Prospectus, each as defined herein, has been issued and no proceeding for any of those purposes has been initiated or, to the best of the Company’s knowledge, threatened by the Commission, and no notice of objection of the Commission to the use of such registration statement or any post-effective amendment thereto pursuant to Rule 401(g)(2) under the Act has been received by the Company (the base prospectus filed as part of such registration statement, in the form in which it has most recently been filed with the Commission on or prior to the date of the Pricing Agreement relating to the Designated Securities, is hereinafter called the “Base Prospectus”; any preliminary prospectus (including any preliminary prospectus supplement) relating to the Designated Securities filed with the Commission pursuant to Rule 424(b) under the Act is hereinafter called a “Preliminary Prospectus”; the Base Prospectus, as amended or supplemented immediately prior to the Applicable Time (as defined in Section 2(d) herein), including, without limitation, the last Preliminary Prospectus filed prior to the Applicable Time, is hereinafter called the “Pricing Prospectus”; the various parts of such registration statement, including all exhibits thereto (other than Forms T-1) and any prospectus supplement relating to the Designated Securities that is filed with the Commission and deemed by Rule 430B under the Act to be part of such registration statement, each as amended at the time such part of such registration statement became effective, is hereinafter called the “Registration Statement”; the form of the final prospectus (including the final prospectus supplement) relating to the Designated Securities filed with the Commission pursuant to Rule 424(b) under the Act in accordance with Section 5(a) hereof is hereinafter called the “Prospectus”; any reference herein to the Base Prospectus, the Pricing Prospectus, any Preliminary Prospectus or the Prospectus shall be deemed to refer to and include the documents incorporated by reference therein pursuant to Item 12 of Form S-3 under the Act, as of the date of such prospectus; any reference to any amendment or supplement to the Base Prospectus, any Preliminary Prospectus, the Pricing Prospectus or the Prospectus shall be deemed to refer to and include any post-effective amendment to the Registration Statement and any documents filed after the date of such Base Prospectus, Preliminary Prospectus, Pricing Prospectus or the Prospectus, as the case may be, under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and incorporated by reference in such Base Prospectus, Preliminary Prospectus, Pricing Prospectus or the Prospectus, as the case may be; any reference to any amendment or supplement to the Base Prospectus, any Preliminary Prospectus or the Prospectus shall be deemed to refer to and include any prospectus supplement relating to the Designated Securities filed with the Commission pursuant to Rule 424(b) under the Act and any documents filed after the date of such Base Prospectus, Preliminary Prospectus or the Prospectus, as the case may be, under the Exchange Act, and incorporated by reference in such Base Prospectus, Preliminary Prospectus or the Prospectus, as the case may be; any reference to any amendment to the Registration Statement shall be deemed to refer to and include any annual report of the Company filed pursuant to Section 13(a) or 15(d) of the Exchange Act after the applicable effective date of the Registration Statement and that is incorporated by reference in the Registration Statement; any reference to the Registration Statement shall be deemed to refer to only such registration statement, as amended by any post-effective amendments thereto, pursuant to which the Designated Securities

were registered; and any “issuer free writing prospectus” (as defined in Rule 433(h) under the Act) relating to the Designated Securities is hereinafter referred to as an “Issuer Free Writing Prospectus”);

(b) The documents incorporated by reference in the Pricing Prospectus and Prospectus, when they became effective or were filed with the Commission, as the case may be, conformed in all material respects to the requirements of the Act or the Exchange Act, as applicable, and the rules and regulations of the Commission thereunder, and none of such documents contained an untrue statement of a material fact or omitted to state a material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading; and any further documents so filed and incorporated by reference in the Prospectus or any further amendment or supplement thereto, when such documents become effective or are filed with the Commission, as the case may be, will conform in all material respects to the requirements of the Act or the Exchange Act, as applicable, and the rules and regulations of the Commission thereunder and will not contain an untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading; provided, however, that this representation and warranty shall not apply to any statements or omissions made in reliance upon and in conformity with information furnished in writing to the Company by any Underwriter of Designated Securities through the Representatives expressly for use in any Preliminary Prospectus or the Prospectus relating to such Designated Securities;