Antitrust Suits Could Upend Health Insurers' Strategies

July 21 2016 - 5:51PM

Dow Jones News

By Anna Wilde Mathews

If the Justice Department wins its two health-insurance

antitrust cases, the four companies involved would face business

challenges as they move forward alone.

All four -- Aetna Inc., Humana Inc., Anthem Inc. and Cigna Corp.

-- would be left without the additional scale that they said would

help them pare costs and boost their products. They would remain

substantially smaller than the industry's largest player by

revenue, UnitedHealth Group Inc., and could turn to other smaller

deals to gain at least some heft in key markets.

The cases are likely to take months to resolve, leaving the

companies with continued uncertainty in the medium term.

Aetna and Humana said they would battle the Justice Department

suit, as did Anthem. Cigna issued a statement that was less

clear-cut, leading analysts to speculate that, in light of earlier

tension between the two partners, Anthem and Cigna might ultimately

choose to abandon their agreement. Anthem and Cigna declined to

comment beyond their statements.

Without Aetna, Humana will maintain a narrow focus on Medicare

Advantage, which is a rapidly growing business but can be

operationally difficult. On Thursday Humana flagged improvements in

its Medicare business and announced a substantial upgrade to its

2016 earnings projection. Humana is already pulling back from its

Affordable Care Act marketplace business, which has run up

losses.

Humana would also come out of a busted deal with a substantial

cash cushion -- $1 billion from Aetna. Chief Executive Bruce D.

Broussard said Thursday that the company's "core business continues

to do well," and money from a breakup fee would be used according

to previous capital-allocation plans, which include possible

spending on acquisitions, share buybacks and dividends.

Aetna Chief Executive Mark T. Bertolini would lose the chance to

quickly forge a diversified insurance powerhouse with government

business balanced against traditional commercial coverage, though

Aetna had previously been working to build up its Medicare and

Medicaid businesses.

Aetna would likely be less inclined to remain a major player in

the challenging ACA exchange business if its combination with

Humana fell through. As a solo company, with the costs associated

with the busted deal, Aetna would have "less bandwidth to take

risk," a person with knowledge of the matter said. Lacking Humana,

Aetna would continue with its long-term strategy of investing in

opportunities for organic growth, potential acquisitions and share

buybacks, this person said.

If both deals are blocked, Anthem would remain the

second-biggest insurer, with a large Medicaid business and powerful

commercial franchise in its 14 main states. But Chief Executive

Joseph R. Swedish would still face a continuing legal battle with

pharmacy-benefit manager Express Scripts Holdings Inc., as well as

difficulties with the ACA exchanges.

Anthem has told investors that if the Cigna combination

collapsed, it would move to purchase its own shares, as well as

consider other acquisitions in the Medicaid and Medicare

categories.

According to the merger agreement, Anthem will have to pay Cigna

$1.85 billion if the deal is blocked on regulatory grounds, but the

fee won't be owed if Cigna makes a "willful breach of its

obligations" to complete the deal, leaving the door open to

litigation by Anthem against Cigna.

Cigna's CEO, David Cordani, will likely get tough questions from

investors about the fate of the Anthem deal, if it does collapse.

Cigna would remain the smallest of the big five national insurers,

with about $38 billion in revenue last year.

Analysts have said that, armed with the Anthem breakup fee and a

substantial existing cash stash, Cigna would likely move to bulk up

with an acquisition, perhaps of a Medicaid-focused insurer, or

Medicare assets.

In its Thursday statement, Cigna highlighted its strength as a

stand-alone company, saying it has "remained strong by continuing

to invest in innovative solutions...."

Write to Anna Wilde Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

July 21, 2016 18:36 ET (22:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

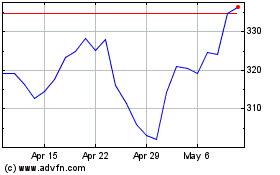

Humana (NYSE:HUM)

Historical Stock Chart

From Jun 2024 to Jul 2024

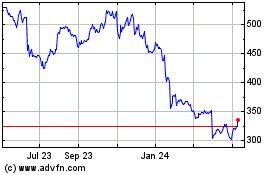

Humana (NYSE:HUM)

Historical Stock Chart

From Jul 2023 to Jul 2024