By Melanie Evans

Early-stage deal talks between Walmart Inc. and Humana Inc. are

deepening anxiety in the hospital sector, which already has been

grappling with sluggish growth and competition from cheaper

health-care options.

Hospitals have been eyeing Walmart nervously for years as it

advances into health care, seeking to leverage its enormous

purchasing heft, physical reach and focus on price. The

Bentonville, Ark., retailer already operates pharmacies and

primary-care clinics and plans to begin offering lab-testing

services. It has also recently increased its direct negotiations

with hospitals for competitive prices on some procedures for its

employees.

Now, a deal for Louisville, Ky.-based insurer Humana could

accelerate Walmart's transformation into a direct competitive

threat and a force in tamping down spending on hospital services,

according to industry executives and consultants.

A deal isn't guaranteed. But a merger could add to the wave of

consolidation in U.S. health care, pairing insurers with other

sectors of the industry that offer cheaper care through clinics and

pharmacies. CVS Health Corp. announced last year a $69 billion deal

for insurer Aetna Inc. Cigna Corp. early last month said it would

buy Express Scripts Holding Co. for $54 billion, in a combination

that would marry a health insurer and the largest U.S.

pharmacy-benefit manager.

"These vertical deals are super exciting, mostly for the

potential to keep people out of the hospital," said Zack Cooper,

health economist at Yale University.

With a potential Walmart-Humana deal, "there is scope for this

new entity to, in a sense, offer a product that has less bells and

whistles and is more efficient and lower cost," he said.

Outside its pharmacies -- which operate across 4,700 U.S.

Walmart stores -- the retailer's health-service offerings are

currently limited. Walmart operates 19 clinics in Georgia, South

Carolina and Texas and other providers operate about 50 additional

clinics. But Walmart's expansive retail footprint would make it a

formidable competitor should it build out low-cost outpatient

offerings, said industry executives and consultants.

Humana, one of the nation's largest insurers, already announced

in December it would jointly acquire home-health-care and hospice

provider Kindred Healthcare Inc. with two private-equity firms.

A potential Walmart-Humana deal "should be a concern to

everybody in health care," said Randy Oostra, president and chief

executive officer of nonprofit hospital system ProMedica, based in

Toledo, Ohio.

Walmart would join an increasingly crowded field of competitors

poised to siphon patients and revenue from ProMedica's outpatient

business, which Mr. Oostra said helps to subsidize money-losing

hospital services.

"What worries us is death by a thousand cuts," he said. "Another

deal and another deal."

ProMedica, which operates 13 hospitals in Ohio and Michigan, is

looking to diversify its revenue with international expansion and

new businesses, he said.

Walmart is "a huge presence in a lot of people's lives" and has

price-conscious consumers who trust the company's brand, said Lisa

Bielamowicz, president of health-care consultancy Gist Healthcare

LLC. A competitively priced health-care option would be attractive

to some patients, she said.

As an employer, Walmart has been a very sophisticated negotiator

as it buys health benefits, which could increase competitive

pressure on services delivered inside the hospital as well, said

Dr. Bielamowicz and other industry experts.

Walmart in recent years has increased its use of direct

contracting, offering to send employees from around the country to

a small group of hospitals that agree to a fixed price and submit

data on performance for review, such as rates of infections.

The retailer and other companies that employ the strategy use

their employee health-plan and other outside data to analyze trends

and identify hospital candidates, said David Lansky, president and

chief executive of Pacific Business Group on Health, which works

with the companies to run the contracting.

Walmart, the nation's largest private employer, declined to

disclose how many employees have sought care from the 12 facilities

with which it contracts for certain spine, cardiac, weight-loss and

hip and knee replacement procedures and some cancer care.

"Our focus has been on improving quality and identifying

outstanding hospital systems for our associates," the company said

in a statement.

Walmart could combine this experience building selective,

competitive hospital networks with Humana's infrastructure and data

to create new health-plan products for other employers, said Dr.

Bielamowicz.

Geisinger Health System in Danville, Pa., one of the providers

in Walmart's program, is paid rates about 10% to 15% lower for

Walmart employees who travel to its facilities for procedures, said

Jonathan Slotkin, a Geisinger Health System physician involved with

the health system's direct employer contracts.

For the chosen hospitals, that business is "true growth," he

said, because none of those patients would have been treated by

Geisinger otherwise.

The hospitals excluded from Walmart's network, however, lose

that business. That could increase operating pressure on those

hospitals, said Dr. Bielamowicz, but it could also ultimately

benefit employers and patients by forcing more competition among

hospitals to make the cut.

"The cost is going to be the bar" for entry, she said.

--Anna Wilde Mathews and Sarah Nassauer contributed to this

article.

Write to Melanie Evans at Melanie.Evans@wsj.com

(END) Dow Jones Newswires

April 01, 2018 09:14 ET (13:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

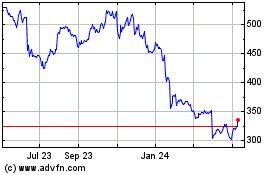

Humana (NYSE:HUM)

Historical Stock Chart

From Jul 2024 to Aug 2024

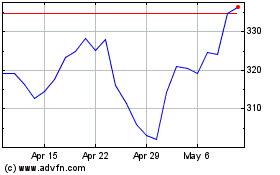

Humana (NYSE:HUM)

Historical Stock Chart

From Aug 2023 to Aug 2024