Hexcel Prices $300 Million of 5.875% Senior Notes Due 2035

February 11 2025 - 4:37PM

Business Wire

Hexcel Corporation (NYSE: HXL) today priced an offering of $300

million of unsecured 5.875% Senior Notes due 2035. The notes will

be sold at a price of 99.985% of their face value.

The net proceeds from this offering are estimated to be

approximately $298 million. Hexcel intends to use the net proceeds

from the offering to fund the redemption of its unsecured 4.700%

Senior Notes due 2025, of which $300 million was outstanding as of

the date hereof.

The offering is expected to close on February 26, 2025, subject

to customary closing conditions. BofA Securities, Inc., Goldman

Sachs & Co. LLC and J.P. Morgan Securities LLC are acting as

joint book-running managers for the offering.

This offering of notes may be made only by means of a prospectus

supplement and a prospectus. A copy of the prospectus supplement

and the prospectus relating to the offering will be filed with the

Securities and Exchange Commission and, when available, can be

obtained from: (i) BofA Securities, Inc., NC1-022-02-25, 201 North

Tryon Street, Charlotte, NC 28255-0001, Attention: Prospectus

Department, by phone at (800) 294-1322 or by email at

dg.prospectus_requests@bofa.com; (ii) Goldman Sachs & Co. LLC,

Attention: Prospectus Department, 200 West Street, New York, NY

10282, by phone at (866) 471-2526, by facsimile at (212) 902-9316

or by email at prospectus-ny@ny.email.gs.com; or (iii) J.P. Morgan

Securities LLC, c/o Broadridge Financial Solutions, 1155 Long

Island Avenue, Edgewood, NY 11717 or by email at

prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com.

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification thereof under the securities laws of any such state

or jurisdiction.

Disclaimer on Forward-Looking Statements This press release

contains statements that are forward-looking, including statements

relating to analyses and other information that are based on

forecasts of future results and estimates of amounts not yet

determinable. Actual results may differ materially from the results

anticipated in the forward-looking statements due to a variety of

factors, including but not limited to general economic and business

conditions and the ability of Hexcel to complete the offering and

deploy the resulting proceeds as indicated above, including the

risk that the offering described above will not close on the

indicated timetable or at all, and that the proceeds may not be

able to be deployed as so indicated. Additional risk factors are

described in Hexcel’s filings with the Securities and Exchange

Commission. Hexcel does not undertake an obligation to update its

forward-looking statements to reflect future events or

circumstances, except as otherwise required by law.

About Hexcel Hexcel Corporation is a global leader in

advanced lightweight composites technology. We propel the future of

flight, energy generation, transportation, and recreation through

excellence in providing innovative high-performance material

solutions that are lighter, stronger and tougher, helping to create

a better world for us all. Our broad and unrivaled product range

includes carbon fiber, specialty reinforcements, prepregs and other

fiber-reinforced matrix materials, honeycomb, resins, engineered

core and composite structures for use in commercial aerospace,

space and defense, and industrial applications.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211771734/en/

Kurt Goddard | Vice President Investor Relations |

Kurt.Goddard@Hexcel.com | +1 (203) 352-6826

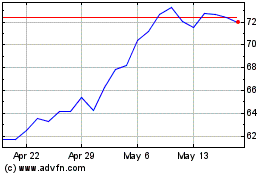

Hexcel (NYSE:HXL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hexcel (NYSE:HXL)

Historical Stock Chart

From Feb 2024 to Feb 2025