0001173514false12/3100011735142024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________________________________________________________________________________________________________________________________________

FORM 8-K | | |

| CURRENT REPORT |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

|

| | | | | | | | |

| Date of Report (Date of earliest event reported): | May 8, 2024 |

| | |

| HYSTER-YALE MATERIALS HANDLING, INC. |

| (Exact name of registrant as specified in its charter) |

| | |

| Delaware | 000-54799 | 31-1637659 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| 5875 Landerbrook Drive, Suite 300 | | |

| Cleveland | (440) | |

| OH | 449-9600 | 44124-4069 |

| (Address of principal executive offices) | (Registrant's telephone number, including area code) | (Zip code) |

| N/A | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value per share | HY | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On May 8, 2024, at the 2024 Annual Meeting of Stockholders (the "Annual Meeting") of Hyster-Yale Materials Handling, Inc. (the "Company"), the stockholders of the Company approved the amendment and restatement of the Hyster-Yale Materials Handling, Inc.2020 Long-Term Equity Incentive Plan (the “Equity Plan”), effective May 8, 2024. We refer to the Equity Plan, as amended and restated at the Annual Meeting, as the “Revised Equity Plan”.

In general, the Revised Equity Plan will continue to be administered by the Compensation Committee (the "Committee") of the Company's Board of Directors, and will continue to enable the Company to provide long-term, performance-based incentive compensation opportunities (payable partly in cash and partly in the Company's Class A Common Stock ("Award Shares") to certain salaried employees who will be in a position to make contributions to the Company and its subsidiaries.Subject to the adjustment provisions of the Revised Equity Plan, the total enumerated share pool for the Revised Equity Plan is 1,708,570 shares (consisting of 800,000 shares of Class A Common Stock that were approved by the Company’s stockholders in 2020, plus 108,570 shares of Class A Common Stock remaining available for awards under the predecessor to the Equity Plan as of the Equity Plan's effective date that were approved by the Company’s stockholders in 2020, plus an additional 800,000 shares of Class A Common Stock approved by the Company’s stockholders at the Annual Meeting). The term for issuances or transfers of Award Shares under the Revised Equity Plan will end on May 8, 2034 (extended from May 19, 2030).

In terms of performance objectives for awards under the Revised Equity Plan, the Committee in general may choose any measurable objective(s), including those in the following non-exhaustive list: return on equity, return on total capital employed, diluted earnings per share, total earnings, earnings growth, return on capital, return on assets, return on sales, earnings before interest and taxes, revenue, revenue growth, gross margin, net or standard margin, return on investment, increase in the fair market value of shares, share price (including, but not limited to, growth measures and total stockholder return), operating profit, net earnings, cash flow (including, but not limited to, operating cash flow and free cash flow), inventory turns, financial return ratios, market share, earnings measures/ratios, economic value added, balance sheet measurements (such as receivable turnover), internal rate of return, customer satisfaction surveys or productivity, net income, operating profit or increase in operating profit, market share, increase in market share, sales value increase over time, economic value added, economic value increase over time, new project development, achievement of long-term strategic goals or net sales. The Committee may modify performance objectives (or goals or actual levels of achievement) if a change in the business, operations, corporate structure or capital structure of the Company, or the manner in which it conducts its business, or other events or circumstances, render the performance objectives unsuitable.

Company shareholder approval of the Revised Equity Plan also approved certain other conforming, clarifying or non-substantive changes to the Equity Plan, and approved updated provisions clarifying that awards are subject to the Company’s clawback policies. The Revised Equity Plan administrator generally will be able to amend the Revised Equity Plan subject to Company stockholder approval and/or awardee consent in certain circumstances, as described in the Revised Equity Plan.

This description of the Revised Equity Plan is qualified in its entirety by reference to the full text of the Revised Equity Plan, which is incorporated by reference as Exhibit 10.1 to this Current Report on Form 8-K.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On May 8, 2024, at the Company’s Annual Meeting of Stockholders, the stockholders of the Company approved an amendment to the Company's Second Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to provide for the exculpation of certain of the Company’s officers from liability in specific circumstances, as permitted by Delaware law.

This description of the amendment to the Certificate of Incorporation is qualified in its entirety by reference to the full text of the amendment, which is incorporated by reference as Exhibit 3.1 to this Current Report on Form 8-K.

Item 5.07. Submission of Matters to a Vote of Security Holders.

The Company held its Annual Meeting of Stockholders on May 8, 2024.

The stockholders elected the following fourteen nominees to the Board of Directors until the next annual meeting and until their successors are elected: | | | | | | | | | | | |

| DIRECTOR | VOTES FOR | VOTES WITHHELD | BROKER NON-VOTES |

| Colleen R. Batcheler | 42,552,236 | | 2,116,154 | | 1,400,693 | |

| James B. Bemowski | 44,573,632 | | 94,758 | | 1,400,693 | |

| J.C. Butler, Jr. | 41,937,842 | | 2,730,548 | | 1,400,693 | |

| Gary L. Collar | 44,601,362 | | 67,028 | | 1,400,693 | |

| Carolyn Corvi | 42,552,454 | | 2,115,936 | | 1,400,693 | |

| Edward T. Eliopoulos | 44,420,637 | | 247,753 | | 1,400,693 | |

| John P. Jumper | 42,526,321 | | 2,142,069 | | 1,400,693 | |

| Dennis W. LaBarre | 40,392,116 | | 4,276,274 | | 1,400,693 | |

| Rajiv K. Prasad | 44,520,005 | | 148,385 | | 1,400,693 | |

| H. Vincent Poor | 42,558,218 | | 2,110,172 | | 1,400,693 | |

| Alfred M. Rankin, Jr. | 42,285,983 | | 2,382,407 | | 1,400,693 | |

| Claiborne R. Rankin | 42,214,856 | | 2,453,534 | | 1,400,693 | |

| Britton T. Taplin | 42,228,723 | | 2,439,667 | | 1,400,693 | |

| David B.H. Williams | 42,223,500 | | 2,444,890 | | 1,400,693 | |

The stockholders approved, on an advisory basis, the Company's named executive officer compensation: | | | | | |

| For | 44,260,149 | |

| Against | 323,189 | |

| Abstain | 85,052 | |

| Broker non-votes | 1,400,693 | |

The stockholders approved the amendment and restatement of the Hyster-Yale Materials Handling, Inc. 2020 Long-Term Equity Incentive Plan (Amended and Restated Effective May 8, 2024): | | | | | |

| For | 44,495,970 | |

| Against | 107,463 | |

| Abstain | 64,957 | |

| Broker non-votes | 1,400,693 | |

The stockholders approved an Amendment to the Company's Second Amended and Restated Certificate of Incorporation: | | | | | |

| For | 41,082,319 | |

| Against | 3,573,892 | |

| Abstain | 12,179 | |

| Broker non-votes | 1,400,693 | |

The stockholders confirmed the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for the current fiscal year: | | | | | |

| For | 45,877,873 | |

| Against | 174,894 | |

| Abstain | 16,316 | |

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| 3.1 | | |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Date: | May 13, 2024 | | HYSTER-YALE MATERIALS HANDLING, INC. |

| | | |

| | By: | /s/ Suzanne Schulze Taylor |

| | | Name: Suzanne Schulze Taylor |

| | | Title: Senior Vice President, General Counsel and Secretary |

| | | |

STATE OF DELAWARE

CERTIFICATE OF AMENDMENT

OF CERTIFICATE OF INCORPORATION

The corporation organized and existing under the General Corporation Law of the State of Delaware, hereby certifies as follows:

1. The name of the corporation is Hyster-Yale Materials Handling, Inc.

2. The Certificate of Incorporation of the corporation is hereby amended by changing the Article thereof numbered VIII so that, as amended, said Article shall be and read as follows:

To the fullest extent permitted by the General Corporation Law of the State of Delaware and any other applicable laws currently or hereafter in effect, no director or officer of the Corporation shall be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer with respect to any acts or omissions in the performance of his or her duties as a director or officer of the Corporation. Solely for purposes of this Article VIII, “officer” shall have the meaning provided in Section 102(b)(7) of the General Corporation Law of the State of Delaware or any amendment or successor provision thereto. No amendment to or repeal of this Article VIII shall apply to or have any effect on the liability or alleged liability of any director or officer of the Corporation for or with respect to any acts or omissions of such director or officer occurring prior to the effectiveness of such amendment or repeal.

3. That said amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

By: /s/ Suzanne Schulze Taylor

Authorized Officer

Name: /s/ Suzanne Schulze Taylor

Print or Type

HYSTER-YALE MATERIALS HANDLING, INC.

2020 LONG-TERM EQUITY INCENTIVE PLAN

(AMENDED AND RESTATED EFFECTIVE MAY 8, 2024)

1.Purpose of the Plan

The purpose of this Hyster-Yale Materials Handling, Inc. 2020 Long-Term Equity Incentive Plan, as may be amended or amended and restated from time to time (this “Plan”), is to help further the long-term profits and growth of Hyster-Yale Materials Handling, Inc. (the “Company”) by enabling the Company and/or its subsidiaries (together with the Company, the “Employers”) to attract, retain and reward executive employees of the Employers by offering long-term incentive compensation to those executive employees who will be in a position to make contributions to Employers. This incentive compensation is in addition to annual compensation and is intended to encourage enhancement of the Company’s stockholder value. Subject to the Amendment and Restatement Date, this Plan was last amended and restated effective May 8, 2024.

2.Definitions

a. “Average Award Share Price” means the lesser of (i) the average of the closing price per share of Class A Common Stock on the New York Stock Exchange on the Friday (or if Friday is not a trading day, the last trading day before such Friday) for each week during the calendar year preceding the commencement of the Performance Period (or such other previous calendar year as determined by the Committee and specified in the Guidelines) and (ii) the average of the closing price per share of Class A Common Stock on the New York Stock Exchange on the Friday (or if Friday is not a trading day, the last trading day before such Friday) for each week of the applicable Performance Period.

b. “Award” means an award paid to a Participant under this Plan for a Performance Period (or portion thereof) the actual amount of which is determined pursuant to a formula based upon the achievement of Performance Objectives established by the Committee. The Committee shall allocate the amount of an Award between the cash component, to be paid in cash, and the equity component, to be paid in Award Shares, pursuant to a formula which is established by the Committee.

c. “Award Shares” means fully-paid, non-assessable shares of Class A Common Stock that are issued or transferred pursuant to, and with such restrictions as are imposed by or under, the terms of this Plan and the Guidelines. Such Award Shares may be shares of original issuance or treasury shares or a combination of the foregoing and, in the discretion of the Company, may be issued as certificated or uncertificated shares.

d. “Change in Control” means the occurrence of an event described in Appendix 1 hereto.

e. “Class A Common Stock” means the Company’s Class A Common Stock, par value $0.01 per share, or any security into which such Class A Common Stock may be changed by reason of any transaction or event of the type referred to in Section 9(b) of this Plan.

f. “Code” means the Internal Revenue Code of 1986, as amended from time to time, and the regulations thereunder, as amended from time to time.

g. “Committee” means the Compensation Committee of the Company’s Board of Directors or any other committee appointed by the Company’s Board of Directors to administer this Plan in accordance with Section 3, so long as any such Committee consists of not less than two directors of the Company and so long as each member of the Committee is (i) an “independent director” under the rules of the New York Stock Exchange and (ii) a “non-employee director” for purposes of Rule 16b-3.

h. “Disability” or “Disabled.” A Participant shall be deemed to have a Disability or be Disabled if he qualifies for disability benefits under an Employer’s long-term disability plan.

i. “Guidelines” means the guidelines that are approved by the Committee for the administration of the Target Awards and Awards granted under this Plan. To the extent that there is any inconsistency between the Guidelines and this Plan other than the time and form of payment of the Awards, the Guidelines will control, so long as this Plan could have been amended to resolve such inconsistency without the need for further stockholder approval.

j. “Participant” means any person who is classified as a salaried employee of the Employers (including directors of the Employers who are also salaried employees of the Employers) who, in the judgment of the Committee, occupies a position in which his efforts may contribute to the interests of the Company and who is designated by the Committee as a Participant in the Plan for a particular Performance Period. A “Non-U.S. Participant” shall mean a Participant who resides outside of the U.S. and a “U.S. Participant” shall mean any Participant who is not a Non-U.S. Participant. Notwithstanding the foregoing, (A) leased employees (as defined in Code Section 414) and (B) persons who are participants in the Nuvera Fuel Cells, LLC Long-Term Incentive Compensation Plan for a particular Performance Period shall not be eligible to participate in this Plan for the same Performance Period.

k. “Payment Period” means, with respect to any Performance Period, the period from January 1 to March 15 of the calendar year immediately following the calendar year in which such Performance Period ends.

l. “Performance Objectives” means the measurable performance objectives established pursuant to this Plan for Participants who have received grants of Target Awards. If the Committee determines that a change in the business, operations, corporate structure or capital structure of the Company, or the manner in which it conducts its business, or other events or circumstances render the Performance Objectives unsuitable, the Committee may in its discretion modify such Performance Objectives or the goals or actual levels of achievement regarding the Performance Objectives, in whole or in part, as the Committee deems appropriate and equitable. A non-exhaustive list of Performance Objectives that may be used for performance-based Awards under this Plan includes the following: return on equity, return on total capital employed, diluted earnings per share, total earnings, earnings growth, return on capital, return on assets, return on sales, earnings before interest and taxes, revenue, revenue growth, gross margin, net or standard margin,

return on investment, increase in the fair market value of shares, share price (including, but not limited to, growth measures and total stockholder return), operating profit, net earnings, cash flow (including, but not limited to, operating cash flow and free cash flow), inventory turns, financial return ratios, market share, earnings measures/ratios, economic value added, balance sheet measurements (such as receivable turnover), internal rate of return, customer satisfaction surveys or productivity, net income, operating profit or increase in operating profit, market share, increase in market share, sales value increase over time, economic value added, economic value increase over time, new project development, achievement of long-term strategic goals or net sales.

m. “Performance Period” means any period of one or more years (or portion thereof) on which an Award is based, as established by the Committee and specified in the Guidelines.

n. “Retire” or “Retirement” means a termination of employment after reaching age 60 with at least 5 years of service with one or more of the Employers.

o. “Rule 16b-3” means Rule 16b-3 promulgated under the Securities Exchange Act of 1934 (or any successor rule to the same effect), as in effect from time to time.

p. “Salary Points” means the salary points assigned to a Participant by the Committee for the applicable Performance Period pursuant to the Korn Ferry salary point system, or any successor salary point system adopted by the Committee.

q. “Target Award” means a dollar amount calculated by multiplying (i) the designated salary midpoint that corresponds to a Participant’s Salary Points by (ii) the long-term incentive compensation target percent for those Salary Points for the applicable Performance Period, as determined by the Committee. The Target Award is the award that would be paid to a Participant under this Plan if each Performance Objective was met at a target level.

3.Administration

This Plan shall be administered by the Committee. The Committee shall have complete authority to interpret all provisions of this Plan consistent with law, to prescribe the form of any instrument evidencing any Award granted under this Plan, to adopt, amend and rescind general and special rules and regulations for its administration (including, without limitation, the Guidelines), and to make all other determinations necessary or advisable for the administration of this Plan. A majority of the Committee shall constitute a quorum, and the action of members of the Committee present at any meeting at which a quorum is present, or acts unanimously approved in writing, shall be the act of the Committee. All acts and decisions of the Committee with respect to any questions arising in connection with the administration and interpretation of this Plan or of any documents evidencing Awards under this Plan, including the severability of any or all of the provisions hereof and thereof, shall be conclusive, final and binding upon the Employers and all present and former Participants, all other employees of the Employers, and their respective descendants, successors and assigns. No member of the Committee shall be liable for any such act or decision made in good faith. In addition, the Committee is authorized to take any action it determines in its sole discretion to be appropriate subject only to the express limitations contained in this Plan, and no authorization in any Plan section or other provision of this Plan is intended or may be deemed to constitute a limitation on the authority of the Committee.

4.Eligibility

Each Participant shall be eligible to participate in this Plan and receive Target Awards in accordance with Section 5. Notwithstanding the foregoing, the Committee shall have the discretion to provide an Award to a Participant who does not meet the requirements specified in Section 5.

5.Awards

The Committee may, from time to time and upon such conditions as it may determine, authorize grants of Target Awards and payment of Awards to Participants, which shall be consistent with, and shall be subject to all of the requirements of, the following provisions:

a. The Committee shall approve (i) a Target Award to be granted to each Participant and (ii) a formula for determining the payout of each Award, which formula is based upon the Company’s achievement of Performance Objectives as set forth in the Guidelines. Each grant shall specify an initial allocation between the cash portion of the Award and the equity portion of the Award.

b. Prior to the end of the Payment Period, the Committee shall approve (i) a preliminary calculation of the amount of the payout of each Award based upon the application of the formula and actual performance relative to the Target Awards previously determined in accordance with Section 5(a); and (ii) a final calculation of the amount of each Award to be paid to each Participant for the Performance Period. Notwithstanding the foregoing, the Committee shall have the power to (1) decrease the amount of the payout of any Award below the amount determined in accordance with Section 5(b)(i); (2) increase the amount of the payout of any Award above the amount determined in accordance with Section 5(b)(i) or adjust the amount thereof in any other manner determined by the Committee in its sole and absolute discretion; and/or (3) adjust the allocation between the cash portion of the Award and the equity portion of the Award; provided, however, that no such decrease described in clause (1) may occur following a Change in Control that occurs during or after the applicable Performance Period. No Award, including any Award equal to the Target Award, shall be payable under this Plan to any Participant except as determined and approved by the Committee.

c. Calculations of Target Awards for a Performance Period shall initially be based on the Participant’s Salary Points as of January 1st of the first year of the Performance Period. However, such Target Awards shall be changed during or after the Performance Period under the following circumstances: (i) if a Participant receives a change in Salary Points, salary midpoint and/or long-term incentive compensation target percentage during a Performance Period, such change shall be reflected in a pro-rata Target Award, (ii) an employee hired into or promoted into a position eligible to become a Plan Participant during a Performance Period will be assigned a pro-rated Target Award based on his length of service during the Performance Period; provided that the employee has been employed by the Employers for at least 90 days during the Performance Period and has been designated as a Plan Participant by the Committee; and (iii) the Committee may increase or decrease the amount of a Target Award at any time, in its sole and absolute discretion; provided, however, that no such decrease described in clause (iii) may occur following a Change in Control that occurs during or after the applicable Performance Period. Unless otherwise determined by the Committee (in its sole and absolute

discretion), in order to be eligible to receive payment of an Award for a Performance Period, the Participant must be employed by an Employer and must be a Participant on December 31st of the last year of the Performance Period. Notwithstanding the foregoing, if a Participant terminates employment during the Performance Period due to death, Disability or Retirement, the Participant shall be entitled to a pro-rata payment of the Award for such Performance Period, calculated based on actual Company performance for the entire Performance Period and the number of days the Participant was actually employed by the Employers during the Performance Period.

d. Each Award shall be 100% vested when and to the extent the Committee determines that it has been earned pursuant to Section 5(b) and shall be fully paid to the Participants no later than the last day of the Payment Period. Awards shall be paid partly in cash and partly in Award Shares; provided that the Committee, in its sole and absolute discretion, may require that an Award that is payable to a Non-U.S. Participant may be paid fully in cash. The whole number of Award Shares to be issued or transferred to a Participant shall be determined by dividing the equity portion of the Award payout by the Average Award Share Price (subject to adjustment as described in Subsection (b) above), with any fractional Award Shares resulting from such calculation payable in cash. The Company shall pay any and all brokerage fees and commissions incurred in connection with any purchase by the Company of shares which are to be issued or transferred as Award Shares and the transfer thereto to Participants. Awards shall be paid subject to all withholdings and deductions pursuant to Section 6. Notwithstanding any other provision of this Plan, the maximum amount paid to a Participant in a single calendar year as a result of Awards under this Plan (including the fair market value of any Award Shares paid to the Participant) shall not exceed the greater of (i) $12,000,000 or (ii) the fair market value of 50,000 Award Shares, determined at the time of payment.

6.Withholding Taxes/Offsets

a. To the extent that an Employer is required to withhold federal, employment, state or local taxes or other amounts in connection with any Award paid to a Participant under this Plan, and the amounts available to the Employer for such withholding are insufficient, it shall be a condition to the receipt of such Award that the Participant make arrangements satisfactory to the Company for the payment of the balance of such taxes or other amounts required to be withheld, which arrangements (in the discretion of the Committee) may include relinquishment of a portion of such Award. If a Participant’s benefit is to be received in the form of shares of Class A Common Stock, and such Participant fails to make arrangements for the payment of taxes or other amounts, then, unless otherwise determined by the Committee, the Company will withhold shares of Class A Common Stock having a value equal to the amount required to be withheld. Notwithstanding the foregoing, when a Participant is required to pay the Company an amount required to be withheld under applicable income, employment, tax or other laws, the Participant may elect, unless otherwise determined by the Committee, to satisfy the obligation, in whole or in part, by having withheld, from the shares of Class A Common Stock required to be delivered to the Participant, shares of Class A Common Stock having a value equal to the amount required to be withheld or by delivering to the Company other shares of Class A Common Stock held by such Participant. The shares of Class A Common Stock used for tax or other withholding will be valued at an amount equal to the fair market value of such shares of Class A Common Stock on the date the

benefit is to be included in Participant’s income. In no event shall the market value of the Class A Common Stock to be used pursuant to this Section 6(a) to satisfy applicable withholding taxes or other amounts in connection with the Award exceed the maximum amount of taxes that could be required to be withheld.

b. If, prior to the payment of any Award, it is determined by an Employer, in its sole and absolute discretion that any amount of money is owed by the Participant to the Employer, the Award otherwise payable to the Participant (to the extent permitted under Section 409A of the Code) may be reduced in satisfaction of the Participant’s debt to such Employer. Such amount(s) owed by the Participant to the Employer may include, but is not limited to, the unused balance of any cash advances previously obtained by the Participant, or any outstanding credit card debt incurred by the Participant.

7. Change in Control

a. The following provisions shall apply notwithstanding any other provision of this Plan to the contrary.

b. Amount of Award for Year of Change In Control. In the event of a Change in Control during a Performance Period, the amount of the Award payable to a Participant who is employed by an Employer on the date of the Change in Control (or who terminated employment as a result of death, Disability or Retirement during such Performance Period and prior to the Change in Control) for such Performance Period shall be equal to the Participant’s Target Award for such Performance Period, multiplied by a fraction, the numerator of which is the number of days during the Performance Period during which the Participant was employed by the Employers prior to the Change in Control and the denominator of which is the number of days in the Performance Period.

c. Time of Payment. In the event of a Change in Control, the payment date of all outstanding Awards (including, without limitation, the pro-rata Target Award for the Performance Period during which the Change in Control occurred) shall be the date that is between two days prior to and within 30 days after, the date of the Change in Control, as determined by the Committee in its sole and absolute discretion.

8.Award Shares Terms and Restrictions

a. Award Shares granted to a Participant shall entitle such Participant to voting, dividend and other ownership rights. Each payment of Award Shares shall be evidenced by an agreement between the Company and the Participant. Each such agreement shall contain such terms and provisions, consistent with this Plan, as the Committee may approve, including, without limitation, prohibitions and restrictions regarding the transferability of Award Shares.

b. Except as otherwise set forth in this Section, Award Shares shall not be assigned, transferred, exchanged, pledged, hypothecated or encumbered (a “Transfer”) by a Participant or any other person, voluntarily or involuntarily, other than a Transfer of Award Shares (i) by will or the laws of descent and distribution, (ii) pursuant to a domestic relations order that would meet the definition of a qualified domestic relations order under Section 206(d)(3)(B) of the Employee Retirement Income Security Act of

1974, as amended (“QDRO”), if such provisions applied to the Plan, or a similar binding judicial order, (iii) directly or indirectly to a trust or partnership for the benefit of a Participant or his spouse, children or grandchildren (provided that Award Shares transferred to such trust or partnership shall continue to be Award Shares subject to the terms of this Plan) or (iv) with the consent of the Committee, after the substitution by a Participant of a number of shares of Class A or Class B Common Stock of the Company (the “New Shares”) for an equal number of Award Shares, whereupon the New Shares shall become and be deemed for all purposes to be Award Shares, subject to all of the terms and conditions imposed by this Plan and the Guidelines on the shares for which they are substituted, including the restrictions on Transfer, and the restrictions hereby imposed on the shares for which the New Shares are substituted shall lapse and such shares shall no longer be subject to this Plan or the Guidelines. The Company shall not honor, and shall instruct the transfer agent not to honor, any attempted Transfer and any attempted Transfer shall be invalid, other than Transfers described in clauses (i) through (iv) above. In no event will any Award Shares granted under this Plan be transferred for value.

c. Each Award shall provide that a Transfer of the Award Shares shall be prohibited or restricted for periods of up to ten years from the last day of the Performance Period. The Committee (in its sole and absolute discretion) from time to time may determine any other shorter or longer restriction period. Notwithstanding the foregoing, such restrictions shall automatically lapse on the earliest of (i) the date the Participant dies or becomes Disabled, (ii) four years (or earlier with the approval of the Committee) after the Participant Retires, (iii) an extraordinary release of restrictions pursuant to Subsection (d) below, or (iv) a release of restrictions as determined by the Committee in its sole and absolute discretion (including, without limitation, a release caused by a termination of this Plan). Following the lapse of restrictions pursuant to this Subsection or Subsection (d) below, the shares shall no longer be “Award Shares” and, at the Participant's request, the Company shall take all such action as may be necessary to remove such restrictions from the stock certificates, or other applicable records with respect to uncertificated shares, representing the Award Shares, such that the resulting shares shall be fully paid, nonassessable and unrestricted by the terms of this Plan.

d. Extraordinary Release of Restrictions.

i. A Participant may request in writing that a Committee member authorize the lapse of restrictions on a Transfer of such Award Shares if the Participant desires to dispose of such Award Shares for (A) the purchase of a principal residence for the Participant, (B) payment of medical expenses for the Participant, his spouse or his dependents, (C) payment of expenses for the education of the Participant, his spouse or his dependents for the next 18 months or (D) any other extraordinary reason which the Committee approves in writing. The Committee shall have the sole power to grant or deny any such request. Upon the granting of any such request, the Company shall cause the release of restrictions in the manner described in Subsection (c) on such number of Award Shares as the Committee shall authorize.

ii. A Participant who is employed by the Employers may request such a release at any time following the third anniversary of the date the Award Shares were

issued or transferred; provided that the restrictions on no more than 20% of such Award Shares may be released pursuant to this Subsection (d) for such a Participant. A Participant who is no longer employed by the Employers may request such a release at any time following the second anniversary of the date the Award Shares were issued or transferred; provided that the restrictions on no more than 35% of such Award Shares may be released pursuant to this Subsection (d) for such a Participant.

e. Legend. The Company shall cause an appropriate legend to be placed on each certificate, or other applicable records with respect to uncertificated shares, for the Award Shares, reflecting the foregoing restrictions.

9.Amendment, Termination and Adjustments

a. The Committee, subject to approval by the Board of Directors of the Company, may alter or amend this Plan from time to time or terminate it in its entirety; provided, however, that, subject to Subsection (b), no such action shall, without the consent of a Participant, affect the rights in (i) an outstanding Award of a Participant that was previously approved by the Committee for a Performance Period but has not yet been paid or (ii) any Award Shares that were previously issued to a Participant under this Plan. In any event, no Award Shares will be issued or transferred under this Plan on or after the tenth anniversary of the Amendment and Restatement Date. Unless otherwise specified by the Committee, all Award Shares that were issued or transferred prior to the termination of this Plan shall continue to be subject to the terms of this Plan following such termination; provided that the Transfer restrictions on such Shares shall lapse as otherwise provided in Section 8.

b. The Committee will make or provide for an adjustment (i) in the total number of Award Shares to be issued or transferred under this Plan specified in Section 10, (ii) in outstanding Award Shares, (iii) in the definition of Average Award Share Price, and (iv) in other Award or Target Award terms, as the Committee in its sole discretion, exercised in good faith, may determine is equitably required to reflect (x) any stock dividend, stock split, combination of shares, recapitalization or any other change in the capital structure of the Company, (y) any merger, consolidation, spin-off, split-off, spin-out, split-up, reorganization, partial or complete liquidation or other distribution of assets, issuance of rights or warrants to purchase securities, or (z) any other corporate transaction or event having an effect similar to any of the foregoing (collectively, the “Extraordinary Events”). Moreover, in the event of any such Extraordinary Event or in the event of a Change in Control, the Committee may provide in substitution for any or all outstanding Award Shares under this Plan such alternative consideration (including cash), if any, as it, in good faith, may determine to be equitable in the circumstances and shall require in connection therewith the surrender of all Target Awards and/or Award Shares so replaced in a manner that complies with or is exempt from Section 409A of the Code and applicable Treasury Regulations issued thereunder. Any securities that are distributed in respect to Award Shares in connection with any of the Extraordinary Events shall be deemed to be Award Shares and shall be subject to the Transfer restrictions set forth herein to the same extent and for the same period as if such securities were the original Award Shares with respect to which they were issued, unless such restrictions are waived or otherwise altered by the Committee.

c. Notwithstanding the provisions of Subsection (a), without further approval by the stockholders of the Company, no amendment to this Plan shall (i) materially increase the maximum number of Award Shares to be issued or transferred under this Plan specified in Section 10 (except that adjustments expressly authorized by Subsection (b) shall not be limited by this clause (i)), (ii) cause Rule 16b-3 to become inapplicable to this Plan, or (iii) make any other change for which stockholder approval would be required under applicable law or stock exchange requirements.

10.Award Shares Subject to Plan

Subject to adjustment as provided in this Plan, the total number of shares of Class A Common Stock that may be issued as Award Shares under this Plan shall be 1,708,570 shares (consisting of 800,000 shares of Class A Common Stock that were approved by the Company’s stockholders in 2020, plus 108,570 shares of Class A Common Stock remaining available for awards under the Hyster-Yale Materials Handling, Inc. Long-Term Equity Incentive Plan as of the Effective Date that were approved by the Company’s stockholders in 2020, plus an additional 800,000 shares of Class A Common Stock to be approved by the Company’s stockholders in 2024).

Notwithstanding anything to the contrary contained in this Plan, shares of Class A Common Stock withheld by the Company, tendered or otherwise used to satisfy a tax withholding obligation will count against the aggregate number of shares of Class A Common Stock available under this Section 10.

11.Plan Approval by Stockholders; Plan Effective Date; Amendment and Restatement Date

The Board of Directors of the Company adopted the Hyster-Yale Materials Handling, Inc. 2020 Long-Term Equity Incentive Plan on February 19, 2020, contingent on receiving stockholder approval. The Effective Date of the Plan was May 19, 2020, the date the Plan was approved by the Company’s stockholders. This 2024 amendment and restatement of the Hyster-Yale Materials Handling, Inc. 2020 Long-Term Equity Incentive Plan will be effective as of the date on which such amendment and restatement is approved by the Company’s stockholders (the “Amendment and Restatement Date”). If such approval is not obtained, then (a) this 2024 amendment and restatement of the Hyster-Yale Materials Handling, Inc. 2020 Long-Term Equity Incentive Plan will not become effective, and (b) the Hyster-Yale Materials Handling, Inc. 2020 Long-Term Equity Incentive Plan, in the form as became effective on the Effective Date, will remain the form of the Plan thereafter in effect.

12.General Provisions

a. No Right of Employment. Neither the adoption or operation of this Plan, nor any document describing or referring to this Plan, or any part thereof, shall confer upon any employee any right to continue in the employ of the Employers, or shall in any way affect the right and power of the Employers to terminate the employment of any employee at any time with or without assigning a reason therefor to the same extent as the Employers might have done if this Plan had not been adopted.

b. Governing Law. The provisions of this Plan shall be governed by and construed in accordance with the laws of the State of Delaware.

c. Miscellaneous. Headings are given to the sections of this Plan solely as a convenience to facilitate reference. Such headings, numbering and paragraphing shall not in any case be

deemed in any way material or relevant to the construction of this Plan or any provisions thereof. The use of the masculine gender shall also include within its meaning the feminine. The use of the singular shall also include within its meaning the plural, and vice versa.

d. Limitation on Rights of Employees. No Trust. No trust has been created by the Employers for the payment of Awards under this Plan; nor have the employees been granted any lien on any assets of the Employers to secure payment of such benefits. This Plan represents only an unfunded, unsecured promise to pay by the Company and a participant hereunder is a mere unsecured creditor of the Company.

e. Transferability of Target Awards and Awards. Target Awards shall not be transferable by a Participant. Award Shares paid pursuant to an Award shall be transferable, subject to the restrictions described in Section 8.

f. Section 409A of the Internal Revenue Code. This Plan is intended to be exempt from the requirements of Section 409A of the Code and applicable Treasury Regulations issued thereunder, and shall be administered in a manner that is consistent with such intent. Notwithstanding any provision of this Plan and Awards hereunder to the contrary, in light of the uncertainty with respect to the proper application of Section 409A of the Code, the Company reserves the right to make amendments to this Plan and Awards hereunder as the Company deems necessary or desirable to avoid the imposition of taxes or penalties under Section 409A of the Code without the consent of any Participant. In any case, a Participant will be solely responsible and liable for the satisfaction of all taxes and penalties that may be imposed on a Participant or for a Participant’s account in connection with this Plan and grants hereunder (including any taxes and penalties under Section 409A of the Code), and neither the Company nor any of its affiliates will have any obligation to indemnify or otherwise hold a Participant harmless from any or all of such taxes or penalties.

g. Clawback Policy.

i. Awards granted under this Plan (plus Award Shares and any other payments or benefits received under this Plan) are subject to the terms and conditions of the Company’s clawback provisions, policy or policies (if any) as may be in effect from time to time, including specifically to implement Section 10D of the Securities Exchange Act of 1934, as amended, and any applicable rules or regulations promulgated thereunder (including applicable rules and regulations of any national securities exchange on which the Class A Common Stock at any point may be traded) (the “Compensation Recovery Policy”), and relevant sections of any Award agreement to which this Plan is applicable (or any related documents) shall be interpreted consistently with (or deemed superseded by and/or subject to, as applicable) the terms and conditions of the Compensation Recovery Policy. Further, by accepting any Award (or related benefit) under the Plan, a Participant agrees (or has agreed) to fully cooperate with and assist the Company in connection with any of such Participant’s obligations to the Company pursuant to the Compensation Recovery Policy, and agrees (or has agreed) that the Company may enforce its rights under the Compensation Recovery Policy through any and all reasonable means permitted under

applicable law as it deems necessary or desirable under the Compensation Recovery Policy, in each case from and after the effective dates thereof. Such cooperation and assistance shall include, but is not limited to, executing, completing and submitting any documentation necessary to facilitate the recovery or recoupment by the Company from such Participant of any such amounts, including from such Participants’ accounts or from any other compensation, to the extent permissible under Section 409A of the Code.

ii. Otherwise, any agreement (or any part thereof) reasonably related to an Award (or other benefit under this Plan) may provide for the cancellation or forfeiture of an Award or the forfeiture and repayment to the Company of any gain or earnings related to an Award (or other provisions intended to have similar effects), including upon such terms and conditions as may be determined by the Company’s Board of Directors or its Compensation Committee in accordance with the Compensation Recovery Policy or any applicable laws, rules, regulations or requirements that impose mandatory clawback or recoupment requirements under the circumstances set forth in such laws, rules, regulations or requirements in effect from time to time (including as may operate to create additional rights for the Company with respect to such awards and the recovery of amounts or benefits relating thereto).

Appendix 1. Change in Control.

Change in Control. The term “Change in Control” shall mean the occurrence of (i), (ii) or (iii) below; provided that such occurrence occurs on or after the Effective Date and meets the requirements of Treasury Regulation Section 1.409A-3(i)(5) (or any successor or replacement thereto) with respect to a Participant:

i. Any “Person” (as such term is used in Sections 13(d)(3) or 14(d)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), other than one or more Permitted Holders, is or becomes the “beneficial owner”(as defined in Rules 13d-3 and 13d-5 of the Exchange Act), directly or indirectly, of more than 50% of the combined voting power of the then outstanding voting securities of Hyster-Yale Materials Handling, Inc. (“HY”), other than any direct or indirect acquisition, including but not limited to an acquisition by purchase, distribution or otherwise, of voting securities:

(A) directly from HY that is approved by a majority of the Incumbent Directors (as defined below); or

(B) by any Person pursuant to an Excluded HY Business Combination (as defined below);

provided, that if at least a majority of the individuals who constitute Incumbent Directors determine in good faith that a Person has become the “beneficial owner”(as defined in Rules 13d-3 and 13d-5 of the Exchange Act) of more than 50% of the combined voting power of the outstanding voting securities of HY inadvertently, and such Person divests as promptly as practicable a sufficient number of shares so that such Person is the “beneficial owner”(as defined in Rules 13d-3 and 13d-5 of the Exchange Act) of 50% or less of the combined voting power of the outstanding voting securities of HY, then no Change in Control shall have occurred as a result of such Person’s acquisition; or

ii. a majority of the Board of Directors of HY ceases to be comprised of Incumbent Directors; or

iii. the consummation of a reorganization, merger or consolidation or sale or other disposition of all or substantially all of the assets of HY or the acquisition of assets of another corporation, or other transaction involving HY (“HY Business Combination”) excluding, however, such a Business Combination pursuant to which both of the following apply (such a Business Combination, an “Excluded HY Business Combination”):

(A) the individuals and entities who beneficially owned, directly or indirectly, HY immediately prior to such HY Business Combination beneficially own, directly or indirectly, more than 50% of the combined voting power of the then outstanding voting securities of the entity resulting from such HY Business Combination (including, without limitation, an entity that as a result

of such transaction owns HY or all or substantially all of the assets of HY, either directly or through one or more subsidiaries); and

(B) at the time of the execution of the initial agreement, or of the action of the Board of Directors of HY, providing for such HY Business Combination, at least a majority of the members of the Board of Directors of HY were Incumbent Directors.

III. Definitions. The following terms as used herein shall be defined as follow:

1. “Incumbent Directors” means the individuals who, as of the Effective Date, are Directors of HY and any individual becoming a Director subsequent to such date whose election, nomination for election by HY’s stockholders, or appointment, was approved by a vote of at least a majority of the then Incumbent Directors (either by a specific vote or by approval of the proxy statement of HY in which such person is named as a nominee for director, without objection to such nomination); provided, however, that an individual shall not be an Incumbent Director if such individual’s election or appointment to the Board of Directors of HY occurs as a result of an actual or threatened election contest (as described in Rule 14a-12(c) of the Exchange Act) with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a person other than the Board of Directors of HY.

2. “Permitted Holders” shall mean, collectively, (i) the parties to the Amended and Restated Stockholders’ Agreement dated September 28, 2012, as amended from time to time, by and among the “Participating Stockholders” HY and other signatories thereto; provided, however, that for purposes of this definition only, the definition of Participating Stockholders contained in the Stockholders’ Agreement shall be such definition in effect on the date of the Change in Control, (ii) any direct or indirect subsidiary of HY and (iii) any employee benefit plan (or related trust) sponsored or maintained by HY or any direct or indirect subsidiary of HY.

v3.24.1.1.u2

Cover Page

|

May 08, 2024 |

| Cover [Abstract] |

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value per share

|

| Document Period End Date |

May 08, 2024

|

| Entity Registrant Name |

HYSTER-YALE MATERIALS HANDLING, INC.

|

| Document Type |

8-K

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| Entity Central Index Key |

0001173514

|

| Trading Symbol |

HY

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-54799

|

| Entity Tax Identification Number |

31-1637659

|

| Entity Address, Address Line One |

5875 Landerbrook Drive, Suite 300

|

| Entity Address, Postal Zip Code |

44124-4069

|

| Entity Address, City or Town |

Cleveland

|

| City Area Code |

(440)

|

| Entity Address, State or Province |

OH

|

| Local Phone Number |

449-9600

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

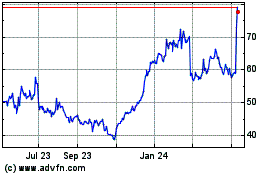

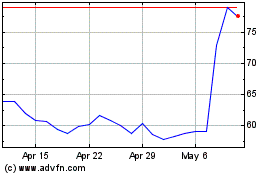

Hyster Yale Materials Ha... (NYSE:HY)

Historical Stock Chart

From Apr 2024 to May 2024

Hyster Yale Materials Ha... (NYSE:HY)

Historical Stock Chart

From May 2023 to May 2024