Form N-CEN - Annual Report for Registered Investment Companies

August 09 2024 - 9:53AM

Edgar (US Regulatory)

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of Western Asset High Yield Defined Opportunity Fund Inc.

In planning and performing our audit of the financial statements of Western Asset High Yield Defined Opportunity Fund Inc. (the “Fund”) as of and for the year ended May 31, 2024, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), we considered the Fund’s internal control over financial reporting, including controls over safeguarding securities, as a basis for designing our auditing procedures for the purpose of expressing our opinion on the financial statements and to comply with the requirements of Form N-CEN, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we do not express an opinion on the effectiveness of the Fund’s internal control over financial reporting.

The management of the Fund is responsible for establishing and maintaining effective internal control over financial reporting. In fulfilling this responsibility, estimates and judgments by management are required to assess the expected benefits and related costs of controls. A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of a company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

A deficiency in internal control over financial reporting exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent or detect misstatements on a timely basis. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis.

Our consideration of the Fund’s internal control over financial reporting was for the limited purpose described in the first paragraph and would not necessarily disclose all deficiencies in internal control over financial reporting that might be material weaknesses under standards established by the PCAOB. However, we noted no deficiencies in the Fund’s internal control over financial reporting and its operation, including controls over safeguarding securities, that we consider to be a material weakness as defined above as of May 31, 2024.

This report is intended solely for the information and use of the Board of Directors of Western Asset High Yield Defined Opportunity Fund Inc. and the Securities and Exchange Commission and is not intended to be and should not be used by anyone other than these specified parties.

/s/PricewaterhouseCoopers LLP

Baltimore, Maryland

July 19, 2024

PricewaterhouseCoopers LLP, 100 East Pratt Street, Suite 2600, Baltimore, Maryland 21202 T: (410) 783 7600, www.pwc.com/us

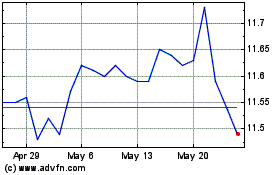

Western Asset High Yield... (NYSE:HYI)

Historical Stock Chart

From Oct 2024 to Oct 2024

Western Asset High Yield... (NYSE:HYI)

Historical Stock Chart

From Oct 2023 to Oct 2024