- Cloud Subscription Annualized Recurring Revenue (ARR) increased

36% year-over-year to $748 million

- Total ARR increased 6.7% year-over-year to $1.68 billion

- Surpassed 100 trillion in monthly processed cloud

transactions

Informatica (NYSE: INFA), a leader in enterprise AI-powered

cloud data management, today announced financial results for its

third quarter 2024, ended September 30, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241030921377/en/

Source: Informatica Q3 2024

“Q3 was another impressive quarter for us, driven by customer

demand for the IDMC platform and continued successful execution of

our cloud-only, consumption-driven strategy. We achieved a historic

milestone at Informatica by surpassing 101 trillion processed cloud

transactions per month. This accomplishment reflects our commitment

to product innovation, customer-centricity, and our goal of being

the Switzerland of Data and AI,” said Amit Walia, Chief Executive

Officer at Informatica. “We see great momentum in AI-powered data

management use cases. We believe Informatica is well-positioned to

strategically support enterprises and empower customers to leverage

AI for data readiness and simplify their data estates.”

Third Quarter 2024 Financial Highlights:

- GAAP Total Revenues increased 3.4% year-over-year to $422.5

million. Total revenues included a negative impact of approximately

$1.2 million from foreign currency exchange rates (FX)

year-over-year. Adjusted for FX rates, total revenues increased

3.7% year-over-year.

- GAAP Subscription Revenues increased 10% year-over-year to

$287.9 million. GAAP Cloud Subscription Revenue increased 37%

year-over-year to $175.8 million and represented 61% of

subscription revenues.

- Total ARR increased 6.7% year-over-year to $1.68 billion. Total

ARR included a positive impact of approximately $1.4 million from

FX rates year-over-year. Subscription ARR increased 13%

year-over-year to $1.22 billion. Subscription ARR included a

positive impact of approximately $0.9 million from FX rates

year-over-year.

- Cloud Subscription ARR increased 36% year-over-year to $747.8

million. Cloud Subscription ARR included a positive impact of

approximately $0.3 million from FX rates year-over-year.

- GAAP Operating Income of $50.9 million and Non-GAAP Operating

Income of $151.0 million. GAAP Operating Margin increased 430 basis

points to 12.1% and Non-GAAP Operating Margin increased 450 basis

points to 35.8% compared to the prior year period.

- GAAP Operating Cash Flow of $106.5 million.

- Adjusted Unlevered Free Cash Flow (after-tax) of $144.0

million. Cash paid for interest of $36.2 million.

A reconciliation of GAAP to non-GAAP financial measures has been

provided in the tables included in this press release. An

explanation of these measures is also included below under the

heading “Non-GAAP Financial Measures.”

Third Quarter 2024 Business Highlights:

- Processed 101.3 trillion cloud transactions per month for the

quarter ended September 30, 2024, compared to 71.3 trillion cloud

transactions per month in the same quarter last year, an increase

of 42% year-over-year.

- Reported 264 customers that spend more than $1 million in

subscription ARR at the end of September 30, 2024, an increase of

18% year-over-year.

- Reported 2,074 customers that spend more than $100,000 in

subscription ARR at the end of September 30, 2024, an increase of

5% year-over-year.

- Achieved a Cloud Subscription net retention rate (NRR) of 120%

at the end-user level and 126% at the global parent level as of

September 30, 2024.

Product Innovation and Business Updates:

- Expanded partnership with Oracle: announced general

availability of Informatica’s Intelligent Data Management Cloud

(IDMC) platform services for Oracle Cloud Infrastructure (OCI) that

includes Cloud Data Governance & Catalog, PowerCenter Cloud

Edition, and Metadata Scanners for Oracle GoldenGate 23ai.

- Announced the availability of Gen AI blueprints for AWS,

Databricks, Google Cloud, Microsoft Azure, Oracle Cloud and

Snowflake ecosystems. The blueprints include standard reference

architectures, prebuilt, ecosystem-specific “recipes” and Gen AI

model-as-a-service and vector database connectors to minimize Gen

AI development complexity and accelerate implementation.

- Celebrated the 20th anniversary of Innovation Labs (iLabs),

Informatica's flagship research and development center in

Bangalore, India.

- Announced the appointment of Mitesh Dhruv to the Board of

Directors and Chair of the Audit Committee.

Industry Recognition:

- Named “An Outstanding Customer Service Experience” by J.D.

Power for the fourth consecutive year in the Certified Assisted

Technical Support Program.

- Named a Winner in the Technology & Services Industry

Association (TSIA) 2024 for the Leveraging AI in Revenue Generation

Workflows and the Innovation in Knowledge Management categories.

Named a finalist in the Leveraging AI in Education Services, the

Leveraging AI in Professional Services and the Best Practices in

Aligning Sales and Customer Success categories.

- Named a winner in the 2024 Oracle Partner Awards - Global

Business Impact Category.

- Named a Leader in The Forrester Wave™ Enterprise Data Catalogs,

Q3 2024.

- Achieved Highest Rating in the Dresner Advisory Services Data

Catalog Market Study and Services Master Data Management Market

Study, 2024 Edition.

- Recognized as a Top Leader in SPARK Matrix: Enterprise Data

Fabric, Q3, 2024.

- Recognized in Q3 2024 Constellation ShortList Metadata

Management, Data Catalog, and Data Governance.

Ithaca L.P. Update:

- As disclosed in the Company's Form 10-Q for the quarter ended

June 30, 2024, approximately 33.4 million of our Class A shares are

owned by Ithaca L.P. (Ithaca), a limited partnership affiliated

with the funds advised by Permira Advisors LLC (Permira). We have

been advised that in early November 2024, Ithaca plans to

distribute approximately 9.3 million of these shares to certain of

its limited partners. The remaining shares will continue to be held

by Ithaca, where Permira will continue to retain voting and

investment power. The Class A shares to be distributed by Ithaca to

its limited partners will be available for immediate resale in the

public market at the discretion of the applicable limited

partner.

Share Repurchase Authorization:

- On October 29, 2024, the Company's Board of Directors (the

Board) approved a new share repurchase authorization which enables

the company to repurchase up to $400 million of its Class A common

stock through privately-negotiated purchases with individual

holders or in the open market. This new authorization replaces the

prior $200 million repurchase authorization. No repurchases have

been made under the existing authorization. A committee of the

Board will determine the timing, amount and terms of any

repurchase.

Upcoming Events:

- On Tuesday, November 19, 2024, the Company is scheduled to

participate in a fireside chat discussion at the RBC Capital

Markets Global Technology, Internet, Media and Telecommunications

Conference in New York, at 1:20 p.m. Eastern Time. A live webcast

and replay will be available on the Company's Investor Relations

website.

- On Tuesday, December 3, 2024, the Company is scheduled to

participate in a fireside chat discussion at the UBS Global

Technology and AI Conference in Scottsdale, AZ, at 2:15 p.m.

Mountain Time. A live webcast and replay will be available on the

Company's Investor Relations website.

- On Wednesday, December 4, 2024, the Company is scheduled to

participate in a fireside chat discussion at the Wells Fargo

Technology, Media and Telecommunications Summit in Rancho Palos

Verdes, CA, at 8:45 a.m. Pacific Time. A live webcast and replay

will be available on the Company's Investor Relations website.

- On Tuesday, December 10, 2024, the Company is scheduled to host

investor meetings at the Scotiabank Global Technology Conference in

San Francisco, CA.

- On Thursday, December 12, 2024, the Company is scheduled to

host investor meetings at the Barclays Annual Global Technology

Conference in San Francisco, CA.

Fourth Quarter and Full-Year 2024 Financial Outlook

The Company provides the financial guidance below based on

current market conditions and expectations and it is subject to

various important cautionary factors described below. Guidance

includes the impact from macroeconomic conditions and expected

foreign exchange headwinds versus the prior year comparable

periods.

Based on information available as of October 30, 2024, guidance

for the fourth quarter 2024 is as follows:

Fourth Quarter 2024 Ending December 31, 2024:

- GAAP Total Revenues are expected to be in the range of $448

million to $468 million, representing approximately 2.9%

year-over-year growth at the midpoint of the range.

- Subscription ARR is expected to be in the range of $1.265

billion to $1.299 billion, representing approximately 13.2%

year-over-year growth at the midpoint of the range.

- Cloud Subscription ARR is expected to be in the range of $829

million to $843 million, representing approximately 35.5%

year-over-year growth at the midpoint of the range.

- Non-GAAP Operating Income is expected to be in the range of

$162 million to $182 million, representing approximately 6.3%

year-over-year growth at the midpoint of the range.

Based on information available as of October 30, 2024, the

Company is reaffirming guidance for the full-year 2024 as

follows:

Full-Year 2024 Ending December 31, 2024:

- GAAP Total Revenues are expected to be in the range of $1.660

billion to $1.680 billion, representing approximately 4.7%

year-over-year growth at the midpoint of the range.

- Total ARR is expected to be in the range of $1.718 billion to

$1.772 billion, representing approximately 7.3% year-over-year

growth at the midpoint of the range.

- Subscription ARR is expected to be in the range of $1.265

billion to $1.299 billion, representing approximately 13.2%

year-over-year growth at the midpoint of the range.

- Cloud Subscription ARR is expected to be in the range of $829

million to $843 million, representing approximately 35.5%

year-over-year growth at the midpoint of the range.

- Non-GAAP Operating Income is expected to be in the range of

$538 million to $558 million, representing approximately 18.5%

year-over-year growth at the midpoint of the range.

- Adjusted Unlevered Free Cash Flow (after-tax) is expected to be

in the range of $545 million to $565 million, representing

approximately 23.0% year-over-year growth at the midpoint of the

range.

The Company is assuming constant FX rates for the year based on

the rates at the start of the full-year 2024. For reference

purposes, the assumed FX rates for our top four currencies in

full-year 2024 are as follows:

Currency

Planned Rate (as of

1/1/24)

Forecast Rate (as of

10/1/24)

EUR/$

1.10

1.11

GBP/$

1.27

1.34

$/CAD

1.32

1.35

$/JPY

141

143

Using the foreign exchange rate assumptions noted above, the

Company has incorporated the following FX impacts into 2024

guidance:

Q4 2024

Full-Year 2024

Total Revenues

~$3.0m positive impact y/y

~$2.0m positive impact y/y

Total ARR

~$0.6m positive impact y/y

~$1.2m negative impact y/y

Subscription ARR

~$0.2m positive impact y/y

~$1.2m negative impact y/y

Cloud Subscription ARR

~$0.1m positive impact y/y

~$1.1m negative impact y/y

In addition to the above guidance, the Company is also providing

fourth quarter 2024 Total ARR for modeling purposes. Total ARR is

expected to be in the range of $1.718 billion to $1.772 billion,

representing approximately 7.3% year-over-year growth at the

midpoint of the range.

In addition to the above guidance, the Company is also providing

fourth quarter and full-year 2024 cash paid for interest estimates

for modeling purposes. For the fourth quarter 2024, we estimate

cash paid for interest to be approximately $32 million. For the

full-year 2024, we estimate cash paid for interest to be

approximately $144 million, using forward rates based on 1-month

SOFR and a credit spread of 225 basis points.

In addition to the above guidance, the Company is also providing

a fourth quarter and full-year 2024 weighted-average number of

basic and diluted share estimates for modeling purposes. For the

fourth quarter 2024, we expect basic weighted-average shares

outstanding to be approximately 307 million shares and diluted

weighted-average shares outstanding to be approximately 315 million

shares. For the full-year 2024, we expect basic weighted-average

shares outstanding to be approximately 303 million shares and

diluted weighted-average shares outstanding to be approximately 313

million shares.

Reconciliation of Non-GAAP Operating Income and Adjusted

Unlevered Free Cash Flow after-tax guidance to the most directly

comparable GAAP measures is not available without unreasonable

effort, as certain items cannot be reasonably predicted because of

their high variability, complexity, and low visibility. In

particular, the measures and effects of our stock-based

compensation expense specific to our equity compensation awards and

employer payroll tax-related items on employee stock transactions

are directly impacted by the timing of employee stock transactions

and unpredictable fluctuations in our stock price, which we expect

to have a significant impact on our future GAAP financial

results.

Webcast and Conference Call

A conference call to discuss Informatica’s third quarter 2024

financial results and financial outlook for the fourth quarter and

full-year 2024 is scheduled for 2:00 p.m. Pacific Time today. To

participate, please dial 1-833-470-1428 from the U.S. or

1-404-975-4839 from international locations. The conference

passcode is 408713. A live webcast of the conference call will be

available on the Investor Relations section of Informatica’s

website at investors.informatica.com where presentation materials

will also be posted prior to the conference call. A replay will be

available online approximately two hours following the live call

for a period of 30 days.

Forward-Looking Statements

This press release and the related conference call and webcast

contain forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. These statements

may relate to, but are not limited to, expectations of future

operating results or financial performance, including our GAAP and

non-GAAP guidance for the fourth quarter and 2024 fiscal year, the

effect of foreign currency exchange rates, the effect of

macroeconomic conditions, management’s plans, priorities,

initiatives, and strategies, our efforts to reduce operating

expenses and adjust cash flows in light of current business needs

and priorities, our expected costs related to restructuring and

related charges, including the timing of such charges, the impact

of the restructuring and related charges on our business, results

of operations and financial condition, plans regarding the

distribution of Class A common stock by certain of our

stockholders, plans regarding our stock repurchase authorization,

management's estimates and expectations regarding growth of our

business, the potential benefits realized by customers by the use

of artificial intelligence and machine learning in our products and

the potential benefits realized by customers from our cloud

modernization programs, market, and partnerships. Forward-looking

statements are inherently subject to risks and uncertainties, some

of which cannot be predicted or quantified. In some cases, you can

identify forward-looking statements because they contain words such

as “anticipate,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “toward,” “will,” or

“would,” or the negative of these words or other similar terms or

expressions. You should not put undue reliance on any

forward-looking statements. Forward-looking statements should not

be read as a guarantee of future performance or results and will

not necessarily be accurate indications of the times at, or by,

which such performance or results will be achieved, if at all.

Forward-looking statements are based on information available at

the time those statements are made and are based on current

expectations, estimates, forecasts, and projections as well as the

beliefs and assumptions of management as of that time with respect

to future events. These statements are subject to risks and

uncertainties, many of which involve factors or circumstances that

are beyond our control, that could cause actual performance or

results to differ materially from those expressed in or suggested

by the forward-looking statements. In light of these risks and

uncertainties, the forward-looking events and circumstances

discussed in this press release and the related conference call and

webcast may not occur and actual results could differ materially

from those anticipated or implied in the forward-looking

statements. These risks, uncertainties, assumptions, and other

factors include, but are not limited to, those related to our

business and financial performance, the effects of adverse global

macroeconomic conditions and geopolitical uncertainty, the effects

of public health crises on our business, results of operations, and

financial condition, our ability to attract and retain customers,

our ability to develop new products and services and enhance

existing products and services, our ability to respond rapidly to

emerging technology trends, our ability to execute on our business

strategy, including our strategy related to the Informatica IDMC

platform and key partnerships, our ability to increase and predict

customer consumption of our platform, our ability to compete

effectively, and our ability to manage growth.

Further information on these and additional risks,

uncertainties, and other factors that could cause actual outcomes

and results to differ materially from those included in or

contemplated by the forward-looking statements contained in this

press release and the related conference call and webcast are

included under the caption “Risk Factors” and elsewhere in our

Annual Report on Form 10-K that was filed for the fiscal year ended

December 31, 2023, and other filings and reports we make with the

Securities and Exchange Commission from time to time, including our

Quarterly Report on Form 10-Q that will be filed for the third

quarter ended September 30, 2024. All forward-looking statements

contained herein are based on information available to us as of the

date hereof and we do not assume any obligation to update these

statements as a result of new information or future events.

Non-GAAP Financial Measures and Key Business Metrics

We review several operating and financial metrics, including the

following unaudited non-GAAP financial measures and key business

metrics to evaluate our business, measure our performance, identify

trends affecting our business, formulate business plans, and make

strategic decisions:

Non-GAAP Financial Measures

In addition to our results determined in accordance with U.S.

generally accepted accounting principles (GAAP), we believe the

following non-GAAP measures are useful in evaluating our operating

performance. We use the following non-GAAP financial measures to

evaluate our ongoing operations and for internal planning and

forecasting purposes. We believe that these non-GAAP financial

measures, when taken collectively, may be helpful to investors

because they provide consistency and comparability with past

financial performance. However, non-GAAP financial measures are

presented for supplemental informational purposes only, have

limitations as an analytical tool, and should not be considered in

isolation or as a substitute for financial information presented in

accordance with GAAP. In addition, other companies, including

companies in our industry, may calculate similarly titled non-GAAP

measures differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of our

non-GAAP financial measures as tools for comparison. A

reconciliation is provided below for our non-GAAP financial

measures to the most directly comparable financial measures stated

in accordance with GAAP. Investors are encouraged to review the

related GAAP financial measures and the reconciliation of these

non-GAAP financial measures to their most directly comparable GAAP

financial measures, and not to rely on any single financial measure

to evaluate our business. Starting the second quarter of fiscal

year 2024, we adjusted certain of our non-GAAP metrics for employer

payroll tax expense related to equity incentive plans, as the

amount of employer payroll tax expense is dependent on our stock

price and other factors that are beyond our control and does not

correlate to the operation of our business. The stock-based

compensation related employer tax-related expense for comparative

periods were immaterial and are not reflected in the prior period

balances.

Non-GAAP Income from Operations and Operating Margin and

Non-GAAP Net Income exclude the effect of stock-based

compensation expense-related charges, including employer payroll

tax-related items on employee stock transactions starting Q2 2024,

amortization of acquired intangibles, equity compensation related

payments, expenses associated with acquisitions, debt refinancing

costs, sponsor-related costs and expenses associated with

restructuring efforts, and are adjusted for income tax effects. We

believe the presentation of operating results that exclude these

non-cash or non-recurring items provides useful supplemental

information to investors and facilitates the analysis of our

operating results and comparison of operating results across

reporting periods.

Adjusted EBITDA represents GAAP net income (loss) as

adjusted for income tax benefit (expense), interest income,

interest expense, debt refinancing costs, other income (expense)

net, stock-based compensation-related charges, including employer

payroll tax-related items on employee stock transactions starting

Q2 2024, amortization of intangibles, expenses associated with

restructuring efforts, expenses associated with acquisitions,

sponsor-related costs and depreciation. We believe adjusted EBITDA

is an important metric for understanding our business to assess our

relative profitability adjusted for balance sheet debt levels.

Adjusted Unlevered Free Cash Flow (after-tax) represents

operating cash flow less purchases of property and equipment and is

adjusted for interest payments, equity compensation payments,

sponsor-related costs, expenses associated with acquisitions and

restructuring costs (including payments for impaired leases). We

believe this measure provides useful supplemental information to

investors because it is an indicator of our liquidity over the long

term needed to maintain and grow our core business operations. We

also provide actual and forecast cash interest expense to aid in

the calculation of adjusted free cash flow (after-tax).

Key Business Metrics

Annual Recurring Revenue ("ARR") represents the expected

annual billing amounts from all active maintenance and subscription

agreements. ARR is calculated based on the contract Monthly

Recurring Revenue (MRR) multiplied by 12. MRR is calculated based

on the accounting adjusted total contract value divided by the

number of months of the agreement based on the start and end dates

of each contracted line item. The aggregate ARR calculated at the

end of each reported period represents the value of all contracts

that are active as of the end of the period, including those

contracts that have expired but are still under negotiation for

renewal. We typically allow for a grace period of up to 6 months

past the original contract expiration quarter during which we

engage in the renewal process before we report the contract as

lost/inactive. This grace-period ARR amount has been less than 2%

of the reported ARR in each period presented. If there is an actual

cancellation of an ARR contract, we remove that ARR value at that

time. We believe ARR is an important metric for understanding our

business since it tracks the annualized cash value collected over a

12-month period for all of our recurring contracts, irrespective of

whether it is a maintenance contract on a perpetual license, a

ratable cloud contract, or a self-managed term-based subscription

license. ARR should be viewed independently of total revenue and

deferred revenue related to our software and services contracts and

is not intended to be combined with or to replace either of those

items.

Cloud Subscription Annual Recurring Revenue ("Cloud

Subscription ARR") represents the portion of ARR that is

attributable to our hosted cloud contracts. We believe that Cloud

Subscription ARR is a helpful metric for understanding our business

since it represents the approximate annualized cash value collected

over a 12-month period for all of our recurring Cloud contracts.

Cloud Subscription ARR is a subset of our overall Subscription ARR,

and by providing this breakdown of Cloud Subscription ARR, it

provides visibility on the size and growth rate of our Cloud

Subscription ARR within our overall Subscription ARR. Cloud

Subscription ARR should be viewed independently of subscription

revenue and deferred revenue related to our subscription contracts

and is not intended to be combined with or to replace either of

those items.

Subscription Annual Recurring Revenue ("Subscription

ARR") represents the portion of ARR only attributable to our

subscription contracts. Subscription ARR includes Cloud

Subscription ARR and self-managed Subscription Annual Recurring

Revenue. We believe that Subscription ARR is a helpful metric for

understanding our business since it represents the approximate

annualized cash value collected over a 12-month period for all of

our recurring subscription contracts. Subscription ARR excludes

maintenance contracts on our perpetual licenses. Subscription ARR

should be viewed independently of subscription revenue and deferred

revenue related to our subscription contracts and is not intended

to be combined with or to replace either of those items.

Maintenance Annual Recurring Revenue ("Maintenance ARR")

represents the portion of ARR only attributable to our maintenance

contracts. We believe that Maintenance ARR is a helpful metric for

understanding our business since it represents the approximate

annualized cash value collected over a 12-month period for all our

maintenance contracts. Maintenance ARR includes maintenance

contracts supporting our perpetual licenses. Maintenance ARR should

be viewed independently of maintenance revenue and deferred revenue

related to our maintenance contracts and is not intended to be

combined with or to replace either of those items. As we continue

to shift our focus from perpetual to cloud, we expect Maintenance

ARR will decrease in future quarters.

Cloud Subscription Net Retention Rate ("Cloud Subscription

NRR") compares the contract value for Cloud Subscription ARR

from the same set of customers at the end of a period compared to

the prior year. We treat divisions, segments or subsidiaries inside

companies with us as separate customers when defining the End-user

level. We treat divisions, segments, or subsidiaries of a company

as one customer when defining the Global Parent level. Global

Parent customers are determined using Dun & Bradstreet GDUNS

identifiers. To calculate our Cloud Subscription NRR for a

particular period, we first establish the Cloud Subscription ARR

value at the end of the prior year period. We subsequently measure

the Cloud Subscription ARR value at the end of the current period

from the same cohort of customers. Cloud Subscription NRR is then

calculated by dividing the aggregate Cloud Subscription ARR in the

current period by the prior year period. An increase in the Cloud

Subscription NRR occurs as a result of price increases on existing

contracts, higher consumption of existing products, and sales of

additional new subscription products to existing customers

exceeding losses from subscription contracts due to price

decreases, usage decreases and cancellations. We believe Cloud

Subscription NRR is an important metric for understanding our

business since it measures the rate at which we are able to sell

additional products into our cloud subscription customer base.

Subscription Net Retention Rate ("Subscription Net Retention"

NRR) compares the contract value for Subscription ARR from the

same set of customers at the end of a period compared to the prior

year. We treat divisions, segments, or subsidiaries inside

companies as separate customers when defining the End-user level.

To calculate our Subscription NRR for a particular period, we first

establish the Subscription ARR value at the end of the prior-year

period. We subsequently measure the Subscription ARR value at the

end of the current period from the same cohort of customers. The

net retention rate is then calculated by dividing the aggregate

Subscription ARR in the current period by the prior-year period. An

increase in the Subscription NRR occurs as a result of price

increases on existing contracts, higher consumption of existing

products, and sales of additional new subscription products to

existing customers exceeding losses from subscription contracts due

to price decreases, usage decreases and cancellations. Our Cloud

Subscription NRR continues to outpace total Subscription NRR as

self-managed subscription customers are moving to cloud offerings

which is net neutral to Subscription NRR but will be additive to

Cloud Subscription NRR for the same cohort of customers.

Supplemental Information

Subscription revenue disaggregation:

- Cloud subscription revenue represents revenues from

cloud subscription offerings, which deliver applications and

infrastructure technologies via cloud-based deployment models for

which we develop functionality, provide unspecified updates and

enhancements, host, manage, upgrade, and support, and that

customers access by entering into a subscription agreement with us

for a stated period.

- Self-managed subscription license revenue represents

revenues from customers and partners contracted to use our

self-managed software during a subscription term.

- Self-managed subscription support and other revenue

represents revenues generated primarily through the sale of license

support contracts sold together with the self-managed subscription

license purchased by the customer. Self-managed subscription

license support contracts provide customers with rights to

unspecified software product upgrades, maintenance releases and

patches released during the term of the support period and include

internet access to technical content, as well as internet and

telephone access to technical support personnel.

About Informatica

Informatica (NYSE: INFA), a leader in enterprise AI-powered

cloud data management, brings data and AI to life by empowering

businesses to realize the transformative power of their most

critical assets. We have created a new category of software, the

Informatica Intelligent Data Management Cloud™ (IDMC). IDMC is an

end-to-end data management platform, powered by CLAIRE AI, that

connects, manages and unifies data across any multi-cloud or hybrid

system, democratizing data and enabling enterprises to modernize

and advance their business strategies. Customers in approximately

100 countries, including more than 80 of the Fortune 100, rely on

Informatica to drive data-led digital transformation. Informatica.

Where data and AI come to life.

INFORMATICA INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share data)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues:

Subscriptions

$

287,934

$

261,828

$

804,217

$

703,339

Perpetual license

—

205

21

1,024

Software revenue

287,934

262,033

804,238

704,363

Maintenance and professional services

134,547

146,530

407,475

445,619

Total revenues

422,481

408,563

1,211,713

1,149,982

Cost of revenues:

Subscriptions

48,768

39,133

142,973

113,443

Perpetual license

—

162

5

555

Software costs

48,768

39,295

142,978

113,998

Maintenance and professional services

31,894

41,533

100,273

128,556

Amortization of acquired technology

947

3,013

3,008

8,776

Total cost of revenues

81,609

83,841

246,259

251,330

Gross profit

340,872

324,722

965,454

898,652

Operating expenses:

Research and development

80,316

85,862

239,204

255,608

Sales and marketing

133,517

129,997

418,403

393,035

General and administrative

44,707

41,911

144,115

122,027

Amortization of intangible assets

29,845

34,481

93,302

103,120

Restructuring

1,554

407

6,808

28,131

Total operating expenses

289,939

292,658

901,832

901,921

Income (loss) from operations

50,933

32,064

63,622

(3,269

)

Interest income

14,829

10,447

42,001

27,950

Interest expense

(36,345

)

(39,327

)

(113,775

)

(111,844

)

Other (expense) income, net

(14,011

)

5,519

(6,825

)

8,680

Income (loss) before income taxes

15,406

8,703

(14,977

)

(78,483

)

Income tax expense (benefit)

29,391

(70,573

)

(15,154

)

111,061

Net (loss) income

$

(13,985

)

$

79,276

$

177

$

(189,544

)

Net (loss) income per share attributable

to Class A and Class B-1 common stockholders:

Basic

$

(0.05

)

$

0.27

$

—

$

(0.66

)

Diluted

$

(0.05

)

$

0.27

$

—

$

(0.66

)

Weighted-average shares used in computing

net (loss) income per share:

Basic

303,954

289,354

300,606

287,133

Diluted

303,954

296,556

313,363

287,133

INFORMATICA INC.

CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value data)

(Unaudited)

September 30,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

932,573

$

732,443

Short-term investments

307,558

259,828

Accounts receivable, net of allowances of

$4,411 and $4,414, respectively

278,998

500,068

Contract assets, net

85,814

79,864

Prepaid expenses and other current

assets

236,094

180,383

Total current assets

1,841,037

1,752,586

Property and equipment, net

141,406

149,266

Operating lease right-of-use-assets

53,693

57,799

Goodwill

2,366,858

2,361,643

Customer relationships intangible asset,

net

584,803

669,781

Other intangible assets, net

6,783

17,393

Deferred tax assets

15,101

15,237

Other assets

164,163

178,377

Total assets

$

5,173,844

$

5,202,082

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

11,697

$

18,050

Accrued liabilities

41,548

61,194

Accrued compensation and related

expenses

107,435

167,427

Current operating lease liabilities

15,264

16,411

Current portion of long-term debt

18,750

18,750

Income taxes payable

919

4,305

Deferred revenue

651,444

767,244

Total current liabilities

847,057

1,053,381

Long-term operating lease liabilities

41,855

46,003

Long-term deferred revenue

11,917

19,482

Long-term debt, net

1,794,259

1,805,960

Deferred tax liabilities

21,570

22,425

Long-term income taxes payable

42,116

37,679

Other liabilities

7,374

4,554

Total liabilities

2,766,148

2,989,484

Stockholders’ equity:

Class A common stock; $0.01 par value per

share; 2,000,000 and 2,000,000 shares authorized as of September

30, 2024 and December 31, 2023, respectively; 261,260 and 250,874

shares issued and outstanding as of September 30, 2024 and December

31, 2023, respectively

2,614

2,510

Class B-1 common stock; $0.01 par value

per share; 200,000 and 200,000 shares authorized as of September

30, 2024 and December 31, 2023, respectively; 44,050 and 44,050

shares issued and outstanding as of September 30, 2024 and December

31, 2023, respectively

440

440

Class B-2 common stock; $0.00001 par value

per share; 200,000 and 200,000 shares authorized as of September

30, 2024 and December 31, 2023, respectively; 44,050 and 44,050

shares issued and outstanding as of September 30, 2024 and December

31, 2023, respectively

—

—

Additional paid-in-capital

3,725,523

3,540,502

Accumulated other comprehensive loss

(12,562

)

(22,370

)

Accumulated deficit

(1,308,319

)

(1,308,484

)

Total stockholders’ equity

2,407,696

2,212,598

Total liabilities and stockholders’

equity

$

5,173,844

$

5,202,082

INFORMATICA INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Operating activities:

Net (loss) income

$

(13,985

)

$

79,276

$

177

$

(189,544

)

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Depreciation and amortization

3,911

4,203

9,977

12,674

Non-cash operating lease costs

3,592

3,776

10,927

12,800

Stock-based compensation

66,000

56,508

195,600

162,058

Deferred income taxes

1,743

358

167

4,356

Amortization of intangible assets and

acquired technology

30,792

37,494

96,310

111,896

Amortization of debt issuance costs

933

870

2,723

2,574

Amortization of investment discount, net

of premium

(1,222

)

(1,225

)

(4,070

)

(2,976

)

Debt refinancing costs

—

—

1,366

—

Changes in operating assets and

liabilities:

Accounts receivable

42,149

23,303

218,567

182,550

Prepaid expenses and other assets

276

(1,187

)

8,473

25,894

Accounts payable and accrued

liabilities

(3,461

)

(4,740

)

(95,483

)

(108,067

)

Income taxes payable

16,903

(96,176

)

(57,909

)

32,574

Deferred revenue

(41,133

)

(43,742

)

(123,833

)

(81,484

)

Net cash provided by operating

activities

106,498

58,718

262,992

165,305

Investing activities:

Purchases of property and equipment

(772

)

(1,804

)

(2,337

)

(4,919

)

Purchases of investments

(124,378

)

(107,148

)

(393,933

)

(255,073

)

Maturities of investments

148,400

28,307

350,432

180,007

Sales of investments

—

15,712

—

39,510

Business acquisition, net of cash

acquired

—

(12,476

)

—

(12,476

)

Other

—

—

1,878

—

Net cash provided by / (used in) investing

activities

23,250

(77,409

)

(43,960

)

(52,951

)

Financing activities:

Payment of debt

(4,688

)

(4,688

)

(16,035

)

(14,064

)

Payment of debt refinancing costs

—

—

(1,349

)

—

Proceeds from issuance of debt

—

—

1,971

—

Proceeds from issuance of common stock

under employee stock purchase plan

11,470

12,098

25,267

28,229

Payments for dividends related to Class

B-2 shares

—

—

(12

)

(12

)

Payments for taxes related to net share

settlement of equity awards

(22,128

)

(15,152

)

(98,819

)

(26,252

)

Proceeds from issuance of shares under

equity plans

5,385

12,039

63,106

19,692

Net cash (used in) / provided by financing

activities

(9,961

)

4,297

(25,871

)

7,593

Effect of foreign exchange rate changes on

cash and cash equivalents

14,321

(6,302

)

6,969

(5,719

)

Net increase in cash and cash

equivalents

134,108

(20,696

)

200,130

114,228

Cash and cash equivalents at beginning of

period

798,465

632,803

732,443

497,879

Cash and cash equivalents at end of

period

$

932,573

$

612,107

$

932,573

$

612,107

Supplemental disclosures:

Cash paid for interest

$

36,188

$

38,027

$

111,892

$

109,089

Cash paid for income taxes, net of

refunds

$

10,745

$

25,224

$

42,588

$

74,110

INFORMATICA INC.

NON-GAAP FINANCIAL MEASURES

AND KEY BUSINESS METRICS

(in thousands, except per

share data and percentages)

(unaudited)

RECONCILIATIONS OF GAAP TO

NON-GAAP

Reconciliation of GAAP net income

(loss) to Non-GAAP net income

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

(in thousands)

(in thousands)

GAAP net income (loss)

$

(13,985

)

$

79,276

$

177

$

(189,544

)

Stock-based compensation-related charges

(1)

67,401

56,508

200,078

162,058

Amortization of intangibles

30,792

37,494

96,310

111,896

Restructuring

1,554

407

6,808

28,131

Debt refinancing costs

—

—

1,366

—

Acquisition-related costs

364

1,584

7,569

1,584

Sponsor-related costs

—

—

773

—

Income tax effect

2,822

(94,653

)

(83,677

)

59,269

Non-GAAP net income

$

88,948

$

80,616

$

229,404

$

173,394

Net income (loss) per share:

Net income (loss) per share—basic

$

(0.05

)

$

0.27

$

—

$

(0.66

)

Net income (loss) per share—diluted

$

(0.05

)

$

0.27

$

—

$

(0.66

)

Non-GAAP net income per share—basic

$

0.29

$

0.28

$

0.76

$

0.60

Non-GAAP net income per share—diluted

$

0.28

$

0.27

$

0.73

$

0.59

Share count (in thousands):

Weighted-average shares used in computing

net income (loss) per share—basic

303,954

289,354

300,606

287,133

Weighted-average shares used in computing

net income (loss) per share—diluted

303,954

296,556

313,363

287,133

Weighted-average shares used in computing

Non-GAAP net income per share—basic

303,954

289,354

300,606

287,133

Weighted-average shares used in computing

Non-GAAP net income per share—diluted

312,619

296,556

313,363

292,072

(1)

Beginning with the second quarter of 2024,

the Company adjusted for employer payroll tax-related items on

employee stock transactions in certain non-GAAP metrics. The

stock-based compensation related employer tax-related expense for

comparative periods were immaterial and are not reflected in the

balances above.

Reconciliation of GAAP income (loss)

from operations to Non-GAAP income from operations

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

(in thousands)

(in thousands)

GAAP income (loss) from operations

$

50,933

$

32,064

$

63,622

$

(3,269

)

Stock-based compensation-related

charges

67,401

56,508

200,078

162,058

Amortization of intangibles

30,792

37,494

96,310

111,896

Restructuring

1,554

407

6,808

28,131

Acquisition-related costs

364

1,584

7,569

1,584

Sponsor-related costs

—

—

773

—

Non-GAAP income from operations

$

151,044

$

128,057

$

375,160

$

300,400

GAAP operating margin (% of total

revenue)

12.1

%

7.8

%

5.3

%

(0.3

)%

Non-GAAP operating margin (% of total

revenue)

35.8

%

31.3

%

31.0

%

26.1

%

INFORMATICA INC.

NON-GAAP FINANCIAL MEASURES

AND KEY BUSINESS METRICS

Adjusted EBITDA Reconciliation

Three Months Ended

September 30,

Nine Months Ended

September 30,

Trailing Twelve Months ("TTM")

Ended September 30,

2024

2023

2024

2023

2024

(in thousands)

(in thousands)

(in thousands)

GAAP net income (loss)

$

(13,985

)

$

79,276

$

177

$

(189,544

)

$

64,438

Income tax expense (benefit)

29,391

(70,573

)

(15,154

)

111,061

(78,104

)

Interest income

(14,829

)

(10,447

)

(42,001

)

(27,950

)

(53,737

)

Interest expense

36,345

39,327

113,775

111,844

153,327

Debt refinancing costs

—

—

1,366

—

1,366

Other expense (income), net

14,011

(5,519

)

5,459

(8,680

)

13,164

Stock-based compensation-related

charges

67,401

56,508

200,078

162,058

256,119

Amortization of intangibles

30,792

37,494

96,310

111,896

133,694

Restructuring

1,554

407

6,808

28,131

38,432

Acquisition-related costs

364

1,584

7,569

1,584

7,569

Sponsor-related costs

—

—

773

—

773

Depreciation

3,745

4,132

9,816

12,540

14,359

Adjusted EBITDA

$

154,789

$

132,189

$

384,976

$

312,940

$

551,400

Adjusted Unlevered Free Cash

Flow

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in thousands, except

percentages)

(in thousands, except

percentages)

Total GAAP Revenue

$

422,481

$

408,563

$

1,211,713

$

1,149,982

Net cash provided by operating

activities

$

106,498

$

58,718

$

262,992

$

165,305

Less: Purchases of property, plant, and

equipment

(772

)

(1,804

)

(2,337

)

(4,919

)

Add: Equity compensation payments

—

47

—

168

Add: Restructuring costs

1,686

1,144

18,159

26,764

Add: Acquisition related costs

297

—

6,979

—

Add: Sponsor-related costs

70

—

499

—

Adjusted Free Cash Flow (after-tax)(1)

$

107,779

$

58,105

$

286,292

$

187,318

Add: Cash paid for interest

36,188

38,027

111,892

109,089

Adjusted Unlevered Free Cash Flow

(after-tax)(1)

$

143,967

$

96,132

$

398,184

$

296,407

Adjusted Free Cash Flow (after-tax)

margin(1)

26

%

14

%

24

%

16

%

Adjusted Unlevered Free Cash Flow

(after-tax) margin(1)

34

%

24

%

33

%

26

%

(1)

Includes cash tax payments of $10.8

million and $25.3 million for the three months ended September 30,

2024 and 2023, respectively and $42.6 million and $74.1 million for

the nine months ended September 30, 2024 and 2023,

respectively.

Key Business Metrics

September 30,

2024

2023

(in thousands, except

percentages)

Cloud Subscription Annual Recurring

Revenue

$

747,811

$

549,507

Self-managed Subscription Annual Recurring

Revenue

471,030

527,687

Subscription Annual Recurring Revenue

1,218,841

1,077,194

Maintenance Annual Recurring Revenue on

Perpetual Licenses

462,935

498,697

Total Annual Recurring Revenue

$

1,681,776

$

1,575,891

Subscription Net Retention Rate (End-user

level)

105

%

106

%

Cloud Subscription Net Retention Rate

(End-user level)

120

%

118

%

Cloud Subscription Net Retention Rate

(Global Parent level)

126

%

124

%

INFORMATICA INC.

SUPPLEMENTAL

INFORMATION

Additional Business Metrics

September 30,

2024

2023

Maintenance Renewal Rate

94

%

95

%

Subscription Renewal Rate

89

%

94

%

Customers that spend more than $1 million

in Subscription Annual Recurring Revenue(1)

264

224

Customers that spend more than $100,000 in

Subscription Annual Recurring Revenue(2)

2,074

1,978

Cloud transactions processed per month in

trillions(3)

101.3

71.3

(1)

Total number of customers that spend more

than $1 million in Subscription Annual Recurring Revenue.

(2)

Total number of customers that spend more

than $100,000 in Subscription Annual Recurring Revenue.

(3)

Total number of cloud transactions

processed on our platform per month in trillions, which measures

data processed.

Disaggregation of Subscription

Revenues

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

(in thousands)

(in thousands)

Revenues:

Cloud subscription

$

175,809

$

128,581

$

488,669

$

359,604

Self-managed subscription license

65,498

81,705

171,422

189,132

Self-managed subscription support and

other

46,627

51,542

144,126

154,603

Subscription revenues

$

287,934

$

261,828

$

804,217

$

703,339

Net Debt Reconciliation

September 30,

December 31,

2024

2023

(in millions)

Dollar Term Loan

$

1,828

$

1,842

Less: Cash, cash equivalents, and

short-term investments

(1,240

)

(992

)

Total net debt

$

588

$

850

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030921377/en/

Investor Relations: Victoria Hyde-Dunn

vhydedunn@informatica.com

Public Relations: prteam@informatica.com

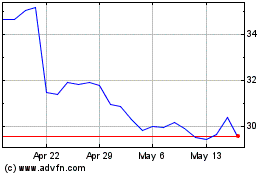

Informatica (NYSE:INFA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Informatica (NYSE:INFA)

Historical Stock Chart

From Nov 2023 to Nov 2024