Informatica Announces Approval to Commence Open Market Repurchases

November 18 2024 - 7:30AM

Business Wire

Informatica (NYSE: INFA), a leader in enterprise AI-powered

cloud data management, today announced that a committee of its

Board of Directors approved the commencement of repurchases of its

Class A common stock through open market transactions under a $400

million stock repurchase authorization that was approved by

Informatica's Board of Directors on October 29, 2024.

Informatica expects to repurchase approximately $100 million of

its Class A common stock by the end of 2024. The actual amount

repurchased will depend on a variety of factors, including stock

price, trading volume, and general business and market conditions.

Therefore, there can be no assurances as to the timing and quantity

of any repurchases. Open market repurchases may be structured to

occur in accordance with the requirements of Rule 10b-18 under the

Securities Exchange Act of 1934, as amended. Informatica may also,

from time to time, enter into Rule 10b5-1 plans to facilitate

repurchases of shares of its Class A common stock under this

authorization.

The repurchases will be funded with Informatica’s cash on hand.

As of September 30, 2024, Informatica had approximately 313 million

diluted shares outstanding and $1.2 billion in cash, cash

equivalents and short-term investments.

Forward-Looking Statements

This news release contains forward-looking statements, including

statements that relate to Informatica’s stock repurchase

authorization and expected funding for those repurchases.

Forward-looking statements contained in this news release relating

to expectations about future events or results are based upon

information available to Informatica as of the date hereof. Readers

are cautioned that these forward-looking statements are only

predictions and are subject to risks, uncertainties and assumptions

that are difficult to predict. As a result, actual results may

differ materially and adversely from those expressed in any

forward-looking statement.

The foregoing and other risks are detailed from time to time in

our periodic reports filed with the Securities and Exchange

Commission ("SEC"), including, but not limited to, our Annual

Report on Form 10-K for the year ended December 31, 2023, which was

filed with the SEC on February 22, 2024, and our latest Quarterly

Report on Form 10-Q for the quarter ended September 30, 2024, which

was filed with the SEC on November 5, 2024. Informatica undertakes

no obligation to revise or update publicly any forward-looking

statements for any reason.

About Informatica

Informatica (NYSE: INFA), a leader in enterprise AI-powered

cloud data management, brings data and AI to life by empowering

businesses to realize the transformative power of their most

critical assets. We have created a new category of software, the

Informatica Intelligent Data Management Cloud™ (IDMC). IDMC is an

end-to-end data management platform, powered by CLAIRE AI, that

connects, manages and unifies data across any multi-cloud or hybrid

system, democratizing data and enabling enterprises to modernize

and advance their business strategies. Customers in approximately

100 countries, including more than 80 of the Fortune 100, rely on

Informatica to drive data-led digital transformation. Informatica.

Where data and AI come to life.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241118988914/en/

Investor Relations Victoria Hyde-Dunn

vhydedunn@informatica.com

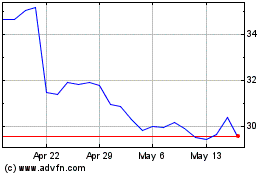

Informatica (NYSE:INFA)

Historical Stock Chart

From Jan 2025 to Feb 2025

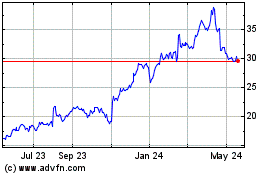

Informatica (NYSE:INFA)

Historical Stock Chart

From Feb 2024 to Feb 2025