Filed by: The Interpublic Group of Companies, Inc.

Pursuant to Rule 425 Under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-6(b)

under the Securities Exchange Act of 1934

Subject Company: The Interpublic Group of Companies, Inc.

SEC File No.: 001-06686

On March 4, 2025, The Interpublic Group of Companies, Inc. participated in the 2025 Morgan Stanley Technology, Media & Telecom Conference.

CONFERENCE PARTICIPANTS

IPG PARTICIPANTS

Philippe Krakowsky

Chief Executive Officer

Ellen Johnson

Executive Vice President, Chief Financial Officer

ANALYST PARTICIPANTS

Cameron McVeigh

Morgan Stanley Research

QUESTIONS AND ANSWERS

Cameron McVeigh, Morgan Stanley Research:

Good morning, everyone. My name is Cameron McVeigh. I cover advertising and media at Morgan Stanley, and it’s my pleasure to introduce Philippe Krakowsky, CEO, and Ellen Johnson, CFO, of the Interpublic Group. Welcome. Thank you for being here.

Philippe Krakowsky, Chief Executive Officer:

Thank you.

Ellen Johnson, Executive Vice President, Chief Financial Officer:

Thank you.

Mr. McVeigh:

To start, please note that important disclosures including my personal holdings disclosures and Morgan Stanley disclosures, all appear as a handout available in the registration area and on the Morgan Stanley public website.

So with that, to start, Philippe, what ultimately convinced you to merge with Omnicom? Where do you see the largest potential benefits consolidating to become the world’s largest ad agency holding company?

Mr. Krakowsky:

Lots of ways to unlock that. But I guess I would point to the degree to which, given what you’re all talking about over the course of these few days — so, technology and the pace of change in our industry and the requirement to be able to bring clients solutions that incorporate data, technology, increasingly AI, obviously — so I think that one of the biggest drivers of value that we see is the resulting offering that we can bring to clients and the tools that we’ll be able to put at our people’s disposal to solve a broad range of business problems for our clients. And to understand the value that our work is having, the impact it’s having in market. So I think if you look at it, that’s a very, very sizable component of it.

And from a capabilities perspective, very, very complementary offerings in terms of what we bring on the data side, what Omnicom brings on the commerce side, what we can do together with our media offerings.

And then the talent base across both organizations geography-wise, we’re very, very consonant.

And so all of that, I think, has meaningful benefits to clients and then to all of the client-facing folks in our organization. So it’s a big question, which probably could take the better part of the 25 minutes, but I will try to sum it up there for you.

Mr. McVeigh:

Great. That’s helpful. The shareholder vote to approve the transaction, set for March

18, is coming up. In your view, when would you start to see some of these incremental revenue growth opportunities hit numbers? And how easy is it to integrate IPG’s assets and systems within Omnicom?

Mr. Krakowsky:

I’m not sure that, I mean, connecting the two — so, until such time as the deal closes, we each continue to be in market as independent companies, right? And so I think that the revenue synergies that John and I have been talking about and that we’re focused on would clearly come to bear once the transaction is closed. But there’s a great deal of lean in and interest already on the part of marketers who understand that there will be benefits and would like to get a sense of what’s possible.

We can spend time planning for integration at this point. So we can’t be in market together. But we can definitely be — the integration planning kind of allows us to see how we’ll be able to kind of roll out those offerings, whether it’s what Acxiom can and will do to database decisioning inside of a bigger media business with a principal product, what we can do together in terms of really understanding consumers. So, broadly, that we can solve sales problems as well as marketing problems.

But I don’t know that we can point to any period until post the acquisition, and that has some open-endedness to it. But the planning is sort of ongoing in a way that is appropriate and coordinated but not — does not involve us showing up to clients or net new opportunities together.

Mr. McVeigh:

Okay. Got it. Okay, looking to the remainder of 2025, and aside from the transaction, what do you see as the biggest areas for opportunities for growth?

Mr. Krakowsky:

Biggest opportunities for us, I mean, I think that you know that we come into the year precisely because in an area like media, where we’ve got an offering that had been leading the industry for a period of time, and then, as the underlying trading terms in media have shifted, has had some issues. So I think that opportunities to focus on our media offering that incorporates principal, independent of what it will be, where the possibilities of a combination are quite powerful.

I think that — so that client focus on areas that have been traditionally strong for us, the healthcare sector, some of the marketing services spaces around experiential, sports marketing. So I think those are all opportunities.

I think seeing the transaction through to conclusion is a huge opportunity and an area of focus for a small group of us at the center. And then the restructuring that we announced and ensuring that we’re moving faster against a set of priorities that we’d actually put out there sort of going back to the early part of last year around centralization and standardization across a kind of number of areas, whether they are

support functions at corporate or whether they’re centers of excellence that support client delivery in areas like production.

Mr. McVeigh:

Okay, got it. Switching to the guide, you provided a guidance for the year for a 1% to 2% organic decline, flat EBITA margins, given $250 million in cost savings. I guess, first, how should investors view this guidance in terms of the current macro environment and some of the account losses you’re lapping?

Mr. Krakowsky:

I mean, I think they reflect the account losses. And, when we guided just a month ago, give or take, we tried to dimensionalize for everybody that three of those sizable losses, primarily on the media side, account for about a 4.5% to 5% organic drag on the top line. So you’ve got some things happening in the business at an underlying level that are clearly positive.

And I think we also guided to, or at least talked a bit about, the sense that we had that the degree to which the back half of last year saw more conviction on the part of marketers and sort of affirming of focus on being in market, we got the sense that there was a bit more uncertainty coming into the equation. And so that’s reflected in kind of where and how the guide on the top line was sort of arrived at.

Mr. McVeigh:

Okay. You had mentioned solid tech & telecom ad spend, after it’s been a headwind for over a year across the industry. What do you think is driving this improvement? And any color on maybe the sustainability of the rebound?

Mr. Krakowsky:

Look, I mean we — again, we talked about it, and, as you said, I think it impacted the industry at large, I think that — we talked about it as something that was very concentrated on a small number of quite large clients kind of in the tech space, names that all of us know. And I think it was — it went sort of hand-in-glove with some broader, whatever you want to call it, but I mean I think they were looking broadly at their businesses with an eye to sort of operating them more efficiently.

I think that innovation requires investment, and some of that investment has to be in helping consumers understand where and how all of that innovation you’re bringing to market impacts their lives, how they can incorporate it into their behavior. And so we always believed that there would be a return to being much more active in marketing and much more active in kind of engaging with consumers. I think we were always pretty clear that it wasn’t going to come back as fast as it had been sort of turned off. And I think that’s, again, sort of a kind of syncopated, a graduated reengagement with consumers, is definitely what we’re seeing.

Mr. McVeigh:

Okay. We’ve made it to March.

Mr. Krakowsky:

We’ve made it to March, yes.

Mr. McVeigh:

How are you thinking — how are clients talking about the next, I don’t know, nine to 12 months? Are there any specific vertical categories that you’d call out, either positive or negative?

Mr. Krakowsky:

I mean I think it sort of, that falls under the — that falls under the comment to your earlier question about kind of what informed the guide. I mean I think that, as I said, I think that the early part of ’24 reflected uncertainty around fiscal policy, it reflected geopolitical uncertainty, and it reflected kind of uncertainty around kind of the back half as you prepared to go through kind of a cycle around the world of people kind of going to the polls. I think people got meaningfully more comfortable with that. And now some of the bigger geo- and policy questions are the ones that are a bit open.

So I think that it’s sort of market-by-market and category-by-category. So you’re sort of thinking, okay, what will consumer goods tell us about the mindset of the consumer? Kind of, where will some of the geopolitics — I think it’s kind of early to determine how that’s going to play out in manufacturing or in some of these other areas.

But I don’t think we can guide incrementally to what we said a month ago about — the fact that they just felt like there was just a bit more caution than when we last talked to shareholders three, four months previous.

Mr. McVeigh:

I wanted to ask about the guidance and maybe the current puts and takes to the margin guide. Curious where you’re investing to look for efficiencies. And especially in the context of the $250 million in the cost savings?

Ms. Johnson:

Sure. There is definitely a reinvestment assumption in our numbers for the year. I mean, as Philippe alluded to, the $250 million is in-year savings from a major restructuring transformation that we were doing.

I would point to the fact that we started it last year, when we were really rolling out common systems and standardizing our processes, which really allows you to right-shore, and the efficiencies that we’re gaining from those types of functions, we’re investing back in the business, whether it’s in new technology or in higher talent.

And some of the other things that we’re looking at when you standardize your technology, you have the opportunity to rationalize others. We’re looking at our real

estate footprint again. We’re looking at how do we bring together our production and centralize it, spans and layers of management.

So we’re really looking across and getting a lot a lot of efficiencies out, which will accrue to more than $250 million post this year and, we believe, will set us up to be really healthy as we become part of Omnicom.

Mr. McVeigh:

Great. Is there — would you pare back on any of the tech or AI-related investments in terms of the cost savings? Or is that full steam ahead and then you expect to see efficiencies from the investments?

Ms. Johnson:

We are continuing to invest full steam ahead. I mean one of the benefits, I think, of the acquisition by Omnicom is we’ll have a greater platform to invest that over. But all the decisions we’re making this year, we believe, will be enduring and ones that will be valued post the acquisition, and AI is one of them.

Mr. McVeigh:

Great. Okay. Let’s move to AI, one of the key topics. Maybe if you could just discuss IPG’s use of artificial intelligence, how it’s being used to improve data and analytics, creative and targeting capabilities.

Mr. Krakowsky:

Well it’s been a part of our business for some time in some of the areas that you called out, which is in media, in performance or precision marketing and then inside of Acxiom. So you’ve got large, large data sets, and you are mining them and looking for ways to apply them so that, ultimately, you can be more precise, you can inform decision-making, and you can help clients be more successful across a range of marketing activity and marketing channels.

I think that the genAI piece of it is perhaps newer, but the observation that I’d point out is that, in the areas where we’ve used it for longer, a thing that those of you who followed us for some time will recall is that those parts of the business that had more tech and data in them have consistently been the parts of the business that we call out as accretive to our growth and accretive to our margin. And that progress over time was fueled by that.

So when you then think about genAI bringing some of that to the creative side of the business and to some of the parts of the business that had not had the opportunity to benefit from it, we have a shared platform, which is sort of our technology platform and our stack. And what you’re increasingly able to do now is put those capabilities into the hands of strategists, into the hands of creative people across more and more of our business in order to, in those areas, bring some of the same kind of rigor, precision, and then the ability to do what every client is looking for, which is to have

audience-led insights lead all of the work, have it be targeted more precisely and then understand how consumers are engaging with that content.

So I think the focus tends to be on the fact that AI will bring efficiency, but we actually see a lot of opportunity to do more of a certain kind of high-value work with clients in some of the areas of the business that had yet to be able to adopt that.

Mr. McVeigh:

Great. That’s helpful. On the earnings call you mentioned very strong growth at Acxiom in 2024. It sounds like one of the largest benefits with the combination with Omnicom is the potential integration of Acxiom, Omni and Flywheel. Can you talk a little bit about Acxiom’s current marketplace fit and where you see it adding value to some of these future offerings?

Mr. Krakowsky:

I think that you’re sort of in a world where we build principal independent of the combination, clearly, digital data as a component of that, as part of a blended and sophisticated proprietary product, is an opportunity. I think that John and his team understand the value that Acxiom brings, and they have a very successful and established proprietary trading approach to media. So there’ll be meaningful opportunity, we believe, there.

And, like I said, there’s an IPG-only opportunity, then there’s an opportunity that comes from the combination. And then, as I mentioned a bit earlier, the complementarity of the data that Flywheel has line of sight to and the tools that they’ve built around that, and then the kind of data that sits inside of Acxiom, means that we have a high degree of confidence that there really won’t be anybody in the space that has — maybe beyond the space, but there’ll be very few companies full stop that have as holistic an understanding of consumers. And that, when and how we put that to work for our clients to solve business problems for them, there’s a lot that we can unlock there in terms of service offerings and also in terms of just product.

Mr. McVeigh:

Got it. Philippe, I wanted to ask about principal-based media buying. And you had said recently that a decisive factor in a few of the media account losses, with the commercial terms enabled by principal media buying, is scale. And as you approach 2025, are you continuing to invest in building out IPG’s own principle-based capabilities? Or do you expect to fully merge with Omnicom’s offering?

Mr. Krakowsky:

Well I think, to Ellen’s point, as part of the restructuring, and given that for the pendency of the deal, we continue as an independent, then that investment, which moved very quickly through the kind of the back half of last year, continues. But there is thinking and planning ongoing in the appropriate way as to how those two . . . as to how those two capabilities are going to come together. And we think that that will

happen very organically, and we can see where that is something that that can happen quickly, post-close.

Mr. McVeigh:

And how would you rate the level of complexity to scale up Omnicom’s offering into some of the IPG agencies post-close?

Mr. Krakowsky:

As we said, I mean, within the context of how we are allowed to plan for integration, we have a high degree of confidence, and we think that that’s something that represents a meaningful opportunity.

Ms. Johnson:

I think the similarity of the cultures as well will make it that much easier. And that’s a benefit of the deal as well.

Mr. McVeigh:

Got it. Okay, great. Let’s move on to creative, which has had a lot of structural pressure on fees over the years as the cost of production has fallen. Is this an area that’s a headwind to overall media growth for you? And how are you thinking about the future of creative?

Mr. Krakowsky:

Well, I mean, I think, to Ellen’s point, I think the complementarity of our organizations from a cultural point of view, and when you think about the strength of the talent that we have in a potential combination, we and Omnicom are quite similar in that we see the value of how powerful ideas can be and how you need kind of agency brands to bring the talent.

Now the question you had about AI is, I think, the unlock for your question around creativity, which is that what you need is, you need that to be connected to an ecosystem that allows you to have a better understanding of who you’re building messages to reach, when and how you’re going to reach them, the degree to which you then get signals back from those consumers and you understand how it is that all of that is working across all of their behaviors. So we think there’s meaningful opportunity there with — but it has to be plugged into these platform pieces and the tech-enabled pieces of the model.

Mr. McVeigh:

Okay. Over the years, the threat of clients bringing ad spend in-house has been a concern. What would your response be to a client debating bringing their ad spend or creative work in-house?

Mr. Krakowsky:

I mean I think the pendulum on that swings fairly regularly, I mean, over many, many

years. I think that the advantages that clients appreciate is that, you sort of — you talked about in-housing creativity, whereas I don’t know whether — I mean when you think about the range of things that have been in-housed over the years — but back to the comment around the caliber of talent that we’re able to get, the breadth of that talent across geographies. Which is particularly important now because the messaging has to be so attuned to what’s going on in culture across the world for our really sizable clients, the exposure that our people have to kind of a broad range of categories and channel types.

And I think that if you try to in-house and encapsulate that, it sort of kind of ends up with a fairly brief sell-by date. And so like I said, I think we’ve seen in-housing swing back and forth. It’s tended to be, I think, more around the kind of activity that is understood to benefit from efficiency more than creativity. And I don’t think it’s anything that’s particularly new to the sector.

Mr. McVeigh:

Great. I wanted to ask about healthcare marketing. In your view, how has that evolved over the last few years? What are the trends in the sector that are driving growth? And how is IPG benefiting?

Mr. Krakowsky:

I mean, along with media, it’s been our biggest driver of growth. It’s been kind of the other engine that we tend to point to as having — and I think it’s because what you have is, you’ve got clients who are much more embracing of the tech and the data side of the business. A lot of complexity on the media side, it’s because of what technology has brought in that space. It’s just because it’s an ecosystem that involves providers, consumers, the folks around the consumers who are ensuring that kind of the patient is either being looked after or looking after themselves.

And I think it’s another area, I didn’t mention at the outset, but it’s another area where there’s a lot of confidence. And we think there’s a lot of opportunity, because it’s an area where we’re very strong in our vertical that is specializes, and it also sits inside of media, inside of PR, for us. But the Omnicom offering in that space is also very, very strong. So it’s a place where, combined, the breadth of what we’ll bring to clients will be quite differentiated.

Mr. McVeigh:

Maybe just a follow-up there: curious how you see it complementing Omnicom’s offering. Is there a specific type that you’d see either one excelling at, or the combination of the two?

Mr. Krakowsky:

I mean I think it’s a function of — it’s the same thing that I was mentioning earlier about the geographic fit is really strong, and that will be important. I think that some of the capabilities that we bring around specialty medical education, medical

publishing, medical affairs, there’s just — there’s a lot of ways in which sort of the breadth of the cross-sell, the ability to just bring a very, very comprehensive set of offerings to the client.

But I don’t know that I’d sort of call out one sort of piece above or beyond others. I think we just both happened to spend some time and built businesses in that space that are particularly strong.

Mr. McVeigh:

Okay. Great. There has been some sustained growth in competition from some of the consultancies. What’s your perspective on them as competitors? Do you see risk of share loss to the consultancies or, maybe, some smaller independent agencies?

Mr. Krakowsky:

It’s funny, we were asked in one of our earlier small meetings — I think that the narrative around independence also tends to sort of wax and wane in the industry. And so I think that at the moment, there is, there are headlines around that. But I don’t know that either of those we see that much in competitive settings.

I mean, I think that on the consultant side, talking about some of the benefits that kind of we led off with, whether it’s kind of a powerful data asset or, in the case of the combination, data assets, plural, whether it’s media, which is so important because it’s where you really interface with the ways in which technology is shaping consumer behavior and kind of where and how we can help clients be in markets in a way that works. So I think both of those make for better headlines. And the reality isn’t quite consistent with what you read.

Mr. McVeigh:

Great. Okay. As we wrap I wanted to see if you have any closing remarks.

Mr. Krakowsky:

Well I think you were talking to Phil earlier, correct?

Mr. McVeigh:

I was.

Mr. Krakowsky:

So I just — I think that the one question that we do get a lot has to do with whether and when we would hear from the proxy advisories. Which have, in fact, weighed in, and are both supportive of the transaction. So that’s probably just an important fact for the folks in this room that might or might not have crossed their radar given that I don’t know how much overlap it was in this room relative to the session that took place an hour-and-a-half ago.

Mr. McVeigh:

Got it. All right. Okay, great. Thank you so much.

Mr. Krakowsky:

Thank you.

Ms. Johnson:

Thank you.

CAUTIONARY STATEMENT

This transcript contains forward-looking statements. Statements in this transcript that are not historical facts, including statements regarding goals, intentions, and expectations as to future plans, trends, events, or future results of operations or financial position, constitute forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “project,” “forecast,” “plan,” “intend,” “could,” “would,” “should,” “estimate,” “will likely result” or comparable terminology are intended to identify forward-looking statements. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results and outcomes to differ materially from those reflected in the forward-looking statements, and are subject to change based on a number of factors, including those outlined under Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K, and our other filings with the Securities and Exchange Commission (“SEC”). Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events.

On December 8, 2024, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Omnicom Group Inc. (“Omnicom”), pursuant to which a merger subsidiary of Omnicom will merge with and into IPG, with IPG surviving the merger as a direct wholly owned subsidiary of Omnicom. The forward-looking statements in this transcript, other than the statements regarding the proposed merger transaction with Omnicom, do not assume the consummation of the proposed transactions unless specifically stated otherwise.

Actual results and outcomes could differ materially for a variety of reasons, including, among others:

•risks relating to the pending merger transaction with Omnicom, including: the occurrence of any event, change, or other circumstances that could delay or prevent closing of the proposed transactions with Omnicom, or give rise to the termination of the Merger Agreement; unanticipated costs or restrictions resulting from regulatory review of the merger transactions; restrictions on our business activities imposed by the Merger Agreement; costs incurred in connection with the merger and subsequent integration with Omnicom; litigation risks relating to the merger; any failure to integrate successfully the business and operations of Omnicom and IPG in the expected time frame, to realize all of the anticipated benefits of the combination or to effectively manage the combined companies’ expanded operations; and any merger-related loss of clients, service providers, vendors, or other business counterparties;

•the effects of a challenging economy on the demand for our advertising and marketing services, on our clients’ financial condition and on our business or financial condition;

•our ability to attract new clients and retain existing clients; including as a result of the announced merger transaction with Omnicom;

•our ability to retain and attract key employees; including as a result of the announced merger transaction with Omnicom;

•unanticipated changes in the competitive environment in the marketing and communications services industry, including risks and challenges from new or developing technologies such as artificial intelligence (AI);

•risks associated with the effects of global, national and regional economic and political conditions, including counterparty risks and fluctuations in interest rates, inflation rates and currency exchange rates;

•the economic or business impact of military or political conflict in key markets; or any significant market disruptions as a result of factors like public health crises;

•developments from changes in the regulatory and legal environment for advertising and marketing services companies around the world, including laws and regulations related to data protection and consumer privacy;

•the impact on our business as a result of general or directed cybersecurity events; and

•risks associated with assumptions we make in connection with our critical accounting estimates, including changes in assumptions associated with any effects of a challenging economy, and potential adverse effects if we are required to recognize impairment charges or other adverse accounting-related developments.

Investors should carefully consider the foregoing factors and the other risks and uncertainties that may affect our business, including those outlined under Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K, and our other SEC filings. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any of them in light of new information, future events, or otherwise.

NO OFFER OR SOLICITATION

This communication is not intended to be, and shall not constitute, an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

ADDITIONAL INFORMATION ABOUT THE TRANSACTION WITH OMNICOM AND WHERE TO FIND IT

In connection with the proposed transaction, IPG and Omnicom have filed a joint proxy statement with the SEC on January 17, 2025, and Omnicom has filed with the SEC a registration statement on Form S-4 on January 17, 2025 (File No.333-284358) (“Form S-4”) that includes the joint proxy statement of IPG and Omnicom and that also constitutes a prospectus of Omnicom. Each of IPG and Omnicom may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that IPG or Omnicom may file with the SEC. The definitive joint proxy statement/prospectus have been mailed to stockholders of IPG and Omnicom. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT HAVE BEEN AND MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT IPG, OMNICOM AND THE PROPOSED TRANSACTION.

Investors and security holders are able to obtain free copies of the registration statement, joint proxy statement/prospectus and other documents containing important information about IPG, Omnicom and the proposed transaction, through the website maintained by the SEC at http://www.sec.gov. Copies of the registration statement, joint proxy statement/prospectus and other documents (if and when available) filed with the SEC by IPG may be obtained free of charge on IPG’s website at https://investors.interpublic.com/sec-filings/financial-reports or, alternatively, by directing a request by mail to IPG’s Corporate Secretary at The Interpublic Group of Companies, Inc., 909 Third Avenue, New York, NY 10022, Attention: SVP & Secretary. Copies of the registration statement and joint proxy statement/prospectus and other documents (if and when available) filed with the SEC by Omnicom may be obtained free of charge on Omnicom’s website at https://investor.omnicomgroup.com/financials/sec-filings/default.aspx or, alternatively, by directing a request by mail to Omnicom’s Corporate Secretary at Omnicom Group Inc., 280 Park Avenue, New York, New York 10017.

PARTICIPANTS IN THE SOLICITATION

IPG, Omnicom, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of IPG, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in IPG’s Annual Report on Form 10-K, including under the heading “Executive Officers of the Registrant,” and proxy statement for IPG’s 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 12, 2024, including under the headings “Board Composition,” “Non-Management Director Compensation,” “Executive Compensation” and “Outstanding Shares and Ownership of Common Stock.” To the extent holdings of IPG common stock by the directors and executive officers of IPG have changed from the amounts reflected therein, such changes have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3 (“Form 3”), Statements of Changes in Beneficial Ownership on Form 4 (“Form 4”) or Annual Statements of Changes in Beneficial Ownership of Securities on Form 5 (“Form 5”), subsequently filed by IPG’s directors and executive officers with the SEC. Information about the directors and executive officers of Omnicom, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Omnicom’s Annual Report on Form 10-K, including under the heading “Information About Our Executive Officers,” and proxy statement for Omnicom’s 2024 Annual Meeting of Stockholders, which was filed with the SEC on March 28, 2024, including under the headings “Executive Compensation,” “Omnicom Board of Directors,” “Directors’ Compensation for Fiscal Year 2023” and “Stock Ownership Information.” To the extent holdings of Omnicom common stock by the directors and executive officers of Omnicom have changed from the amounts reflected therein, such changes have been or will be reflected on Forms 3, Forms 4 or Forms 5, subsequently filed by Omnicom’s directors and executive officers with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the registration statement and joint proxy statement/prospectus and other relevant materials filed or to be filed with the SEC regarding the proposed transaction when such materials become available. Investors and security holders should read the registration statement and joint proxy statement/prospectus carefully before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein from IPG or Omnicom using the sources indicated above.

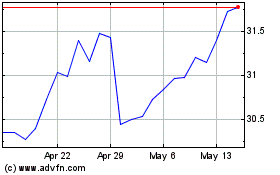

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From Feb 2025 to Mar 2025

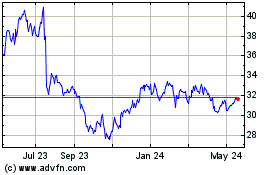

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From Mar 2024 to Mar 2025