FALSE000146608500014660852024-09-032024-09-03

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 3, 2024

_____________________________________________

Independence Realty Trust, Inc.

(Exact name of registrant as specified in its charter)

_____________________________________________

| | | | | | | | |

Maryland | 001-36041 | 26-4567130 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1835 Market Street, Suite 2601

Philadelphia, Pennsylvania, 19103

(Address of Principal Executive Office) (Zip Code)

(267) 270-4800

(Registrant’s telephone number, including area code)

N/A

Former name or former address, if changed since last report

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common stock | | IRT | | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 3, 2024, the Board of Directors of Independence Realty Trust, Inc. (the “Company”) appointed James J. Sebra, its Chief Financial Officer, to the additional position of President of the Company. Scott F. Schaeffer, who previously held the positions of Chairman of the Board of Directors, President and Chief Executive Officer of the Company, will continue as Chairman of the Board of Directors and Chief Executive Officer of the Company.

Biographical information for Mr. Sebra is set forth in the Company’s 2024 definitive proxy statement on Schedule 14A, filed with the Securities and Exchange Commission on March 21, 2024, and such biographical information is incorporated herein by reference. No family relationship exists between Mr. Sebra and any of the Company’s directors or executive officers. There are no arrangements or understandings between Mr. Sebra and any other person pursuant to which Mr. Sebra was selected as an officer of the Company, nor are there any transactions to which the Company is or was a participant and in which Mr. Sebra had or will have a direct or indirect material interest subject to disclosure under Item 404(a) of Regulation S-K.

On September 3, 2024, the Company issued a press release announcing the executive changes. A copy of such press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 8.01 Other Events.

On July 28, 2023, the Company entered into its previously disclosed equity distribution agreement pursuant to which the Company may from time to time offer and sell shares of its common stock having an aggregate offering price of up to $450,000,000 (the “ATM Program”) in negotiated transactions or transactions that are deemed to be “at the market” offerings as defined in Rule 415 under the Securities Act of 1933, as amended. Under the ATM Program, the Company may also enter into one or more forward sale transactions for the sale of shares of its common stock on a forward basis. During August 2024, the Company entered into forward sale transactions under the ATM Program for the forward sale of an aggregate of 1,500,000 shares of its common stock. The forward sale transactions have not settled as of the date of this Current Report on Form 8-K. Subject to the Company’s right to elect net share settlement, the Company expects to physically settle the forward sale transactions by their maturity dates of September 30, 2025 for gross proceeds of approximately $29,600,000.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Independence Realty Trust, Inc. |

| | |

| September 3, 2024 | By: | /s/ James J. Sebra |

| Name: | James J. Sebra |

| Title: | President and Chief Financial Officer |

Exhibit 99.1

Independence Realty Trust Promotes Jim Sebra to President

PHILADELPHIA--(BUSINESS WIRE) — September 3, 2024. Independence Realty Trust, Inc. (NYSE: IRT) (“IRT”) announced today that Jim Sebra, the Company’s Chief Financial Officer has been appointed to President and Chief Financial Officer. Mr. Sebra will retain his current responsibilities for overseeing the finance, accounting, tax, IT and investor relations functions, and will now also oversee the Company’s operational functions.

“These changes are part of good corporate governance and recognize Jim’s contribution to IRT’s success,” said Scott Schaeffer, IRT’s Chairman and CEO.

About Independence Realty Trust, Inc.

Independence Realty Trust, Inc. (NYSE: IRT) is a real estate investment trust that owns and operates multifamily communities, across non-gateway U.S. markets including Atlanta, GA, Dallas, TX, Denver, CO, Columbus, OH, Indianapolis, IN, Raleigh-Durham, NC, Oklahoma City, OK, Nashville, TN, Houston, TX, and Tampa, FL. IRT’s investment strategy is focused on gaining scale near major employment centers within key amenity rich submarkets that offer good school districts and high-quality retail. IRT aims to provide stockholders attractive risk-adjusted returns through diligent portfolio management, strong operational performance, and a consistent return on capital through distributions and capital appreciation. More information may be found on the Company’s website www.irtliving.com.

Independence Realty Trust, Inc.

Edelman Smithfield

Lauren Torres

917-365-7979

IRT@edelman.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

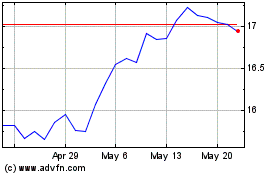

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Sep 2024 to Oct 2024

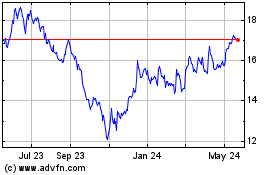

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Oct 2023 to Oct 2024