0001437071false00014370712024-05-072024-05-070001437071us-gaap:CommonStockMember2024-05-072024-05-070001437071ivr:SeriesBCumulativeRedeemablePreferredStockMember2024-05-072024-05-070001437071ivr:SeriesCCumulativeRedeemablePreferredStockMember2024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2024

Invesco Mortgage Capital Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Maryland | | 001-34385 | | 26-2749336 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 1331 Spring Street, N.W., Suite 2500, | | |

| Atlanta, | Georgia | | 30309 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (404) 892-0896

n/a

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

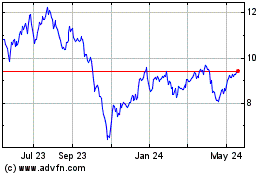

| Common Stock, par value $0.01 per share | | IVR | | New York Stock Exchange |

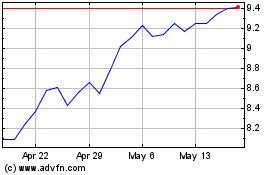

| 7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock | | IVR PrB | | New York Stock Exchange |

| 7.50% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock | | IVR PrC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 2.02 | Results of Operations and Financial Condition. |

On May 8, 2024, Invesco Mortgage Capital Inc. (the “registrant”) issued a press release announcing its financial results for the quarter ended March 31, 2024 (the “Release”).

The Release is attached to this Report as Exhibit 99.1 and the information contained in the Release is incorporated into this Item 2.02 by this reference. The information contained in this Item 2.02 is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section. The information in this Item 2.02 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act, except as otherwise expressly stated in such filing.

| | | | | |

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

The Annual Meeting of Stockholders of Invesco Mortgage Capital Inc. (the “Company”) was held on May 7, 2024. Proxies for the meeting were solicited pursuant to Section 14(a) of the Securities Exchange Act of 1934, and there was no solicitation in opposition to the Board's solicitations. At this meeting, the stockholders were requested to: (1) elect a Board of Directors, (2) approve, on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed in the proxy statement, (3) approve the amendment and restatement of the Invesco Mortgage Capital Inc. 2009 Equity Incentive Plan (the “Amended and Restated Plan”), and (4) appoint the independent registered public accounting firm for the fiscal year ending December 31, 2024, all of which were described in the proxy statement. The following actions were taken by the Company's stockholders with respect to each of the foregoing items:

1. Election of a Board of Directors. All the nominees for director were re-elected with at least 95% of the votes cast. With respect to each nominee, the total number of broker non-votes was 12,368,174. The table below sets forth the voting results for each director.

| | | | | | | | | | | |

| Name of Nominee | Votes Cast “For” | Votes Cast “Against” | Abstentions |

| John S. Day | 16,615,384 | 762,931 | 157,522 |

| Carolyn L. Gibbs | 16,855,844 | 521,786 | 158,207 |

| Carolyn B. Handlon | 16,729,948 | 649,991 | 155,898 |

| Katharine W. Kelley | 16,728,220 | 651,467 | 156,150 |

| Don H. Liu | 16,728,733 | 657,055 | 150,049 |

| Dennis P. Lockhart | 16,725,449 | 653,464 | 156,924 |

| Beth A. Zayicek | 16,834,036 | 555,845 | 145,956 |

2. Advisory vote on executive compensation. Our stockholders approved, on an advisory, non-binding basis, the compensation of our named executive officers by the affirmative vote of 92% of the votes cast. The total number of broker non-votes was 12,368,174. The table below sets forth the voting results.

| | | | | | | | |

| Votes Cast “For” | Votes Cast “Against” | Abstentions |

| 15,887,471 | 1,448,413 | 199,953 |

3. Approval of the Amendment and Restatement of the Invesco Mortgage Capital Inc. 2009 Equity Incentive Plan. Our stockholders approved the Amended and Restated Plan by an affirmative vote of 92% of the votes cast. The total number of broker non-votes was 12,368,174.

| | | | | | | | |

| Votes Cast “For” | Votes Cast “Against” | Abstentions |

| 16,014,085 | 1,310,323 | 211,429 |

4. Appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. The proposal was approved by the stockholders by 94% of the votes cast, and the voting results were as follows. There were no broker non-votes.

| | | | | | | | |

| Votes Cast “For” | Votes Cast “Against” | Abstentions |

| 27,765,128 | 1,809,879 | 329,004 |

On May 7, 2024 the stockholders of the Company approved the Amended and Restated Plan as described above. A description of the material terms of the Amended and Restated Plan is set forth in the Company’s definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on March 22, 2024. The description of the Amended and Restated Plan is summary in nature and is qualified in its entirety by reference to the Amended and Restated Plan, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

On May 8, 2024, the registrant issued a press release announcing that as of May 3, 2024, its book value per common share is estimated to be in the range of $9.64 to $10.04.(1)

(1)Book value per common share as of May 3, 2024 is adjusted to exclude a pro rata portion of the current quarter’s common stock dividend (which for purposes of this calculation is assumed to be the same as the previous quarter) and is calculated as total stockholders' equity less the liquidation preference of the Company's Series B Preferred Stock and Series C Preferred Stock ($106.4 million and $184.9 million as of May 3, 2024, respectively), divided by total common shares outstanding of 48.8 million.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

| | |

Exhibit No. | | Description |

| 10.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Invesco Mortgage Capital Inc.

By: /s/ R. Lee Phegley, Jr.

R. Lee Phegley, Jr.

Chief Financial Officer

Date: May 8, 2024

Amended and Restated Invesco Mortgage Capital Inc. 2009 Equity Incentive Plan

1. Purpose

The purpose of the Invesco Mortgage Capital Inc. 2009 Equity Incentive Plan (the “Plan”) is to give Invesco Mortgage Capital, Inc., a Maryland corporation (the “Company”) a competitive advantage in attracting, retaining and motivating officers, employees, directors and/or consultants and to provide the Company, Participating Companies, and any Affiliates with a long-term incentive plan providing incentives directly linked to Stockholder value.

2. Effective Date and Term of Plan

The Plan was initially effective as of June 30, 2009 and was most recently amended and restated May 3, 2022. This amendment and restatement was adopted by the Board on February 21, 2024 and, pending Stockholder approval, is effective as of May 7, 2024 (the “Effective Date”). This amendment and restatement is effective with respect to Awards made on or after May 7, 2024. Awards may be granted under the Plan until the date that is ten years after the Effective Date, unless the Plan is discontinued earlier pursuant to Section 14.

3. Types of Awards

Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units and Other Stock-Based Awards may be granted under the Plan.

4. Definitions

Except as otherwise specifically provided in an Award Agreement, each capitalized word, term or phrase used in the Plan shall have the meaning set forth in this Section 4 or, if not defined in this Section, the first place that it appears in the Plan.

“Affiliate” means a corporation or other entity controlled by, controlling or under common control with, the Company; provided, however, that solely for purposes of determining whether a Participant has a Termination of Service that is a “separation from service” within the meaning of Section 409A of the Code, an “Affiliate” of a corporation or other entity means all other entities with which such corporation or other entity would be considered a single employer under Sections 414(b) or 414(c) of the Code.

“Applicable Exchange” means the New York Stock Exchange or such other securities exchange as may at the applicable time be the principal market for the Shares.

“Award” means an Option, Stock Appreciation Right, Restricted Stock, Restricted Stock Unit or Other Stock-Based Award granted pursuant to the terms of the Plan.

“Award Agreement” means a written document or agreement setting forth the terms and conditions of a specific Award and any addendum thereto.

“Beneficiary” means the person(s) or trust(s) entitled by will or the laws of descent and distribution to receive any amounts payable or exercise any applicable rights under the Participant’s Awards after the Participant’s death.

“Board” means the Board of Directors of the Company.

“Cause” means, with respect to a Participant, (i) if such Participant is a party to an Individual Agreement at the time of the Termination of Service that defines such term (or word(s) of similar meaning), the meaning given in such Individual Agreement or (ii) if there is no such Individual Agreement or if it does not define Cause (or word(s) of similar meaning): (A) the Participant’s plea of guilty or nolo contendere to, or conviction of, (1) a felony (or its equivalent in a non-United States jurisdiction) or (2) other conduct of a criminal nature that has or is likely to have

an adverse effect on the reputation or standing in the community of the Company, Participating Company, or any Affiliates, as determined by the Committee in its sole discretion, or that legally prohibits the Participant from working for the Company, Participating Company, or any Affiliates; (B) a breach by the Participant of a regulatory rule that adversely affects the Participant’s ability to perform the Participant’s employment duties to the Company, Participating Company, or any Affiliates in any material respect; (C) the Participant’s failure, in each case in any material respect, to (1) perform the Participant’s employment duties, (2) comply with the applicable policies, codes of conduct or employee manuals of the Company, Participating Company, or any Affiliates, (3) follow reasonable directions received from the Company, Participating Company, or any Affiliates or (4) comply with covenants contained in any Individual Agreement or Award Agreement to which the Participant is a party; or (D) with respect to Participants employed outside of the United States, such other definition as may be codified under local laws, rules and regulations. With respect to a Participant’s termination of directorship, “Cause” shall include only an act or failure to act that constitutes cause for removal of a director under the Company’s bylaws.

“Change in Control” means any of the following events:

(i) the acquisition by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act) (a “Person”) of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of twenty-five percent (25%) or more of either (A) the then outstanding shares of the Company (the “Outstanding Company Shares”) or (B) the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors (the “Outstanding Company Voting Securities”); provided, however, that for purposes of this subsection (i), the following acquisitions shall not constitute a Change in Control: (1) any acquisition directly from the Company; (2) any acquisition by the Company; (3) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Company or any corporation controlled by the Company; or (4) any acquisition pursuant to a transaction which complies with clauses (A), (B) and (C) of subsection (iii) below; or

(ii) during any period of twelve (12) consecutive months, individuals who, as of January 1, 2024, constitute the Board (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board; provided, however, that any individual becoming a director subsequent to January 1, 2024 whose election, or nomination for election by the Company’s Stockholders, was approved by a vote of at least two-thirds (2/3) of the directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board; or

(iii) consummation of a reorganization, merger or consolidation or sale or other disposition of all or substantially all of the assets of the Company or the acquisition of assets of another entity (each, a “Corporate Transaction”), in each case, unless, following such Corporate Transaction, (A) all or substantially all of the individuals and entities who were the beneficial owners, respectively, of the Outstanding Company Shares and Outstanding Company Voting Securities immediately prior to such Corporate Transaction beneficially own, directly or indirectly, more than fifty percent (50%) of, respectively, the then outstanding shares and the combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of the corporation or other entity resulting from such Corporate Transaction (including, without limitation, a corporation which as a result of such transaction owns the Company or all or substantially all of the Company’s assets either directly or through one or more subsidiaries) in substantially the same proportions as their ownership, immediately prior to such Corporate Transaction of the Outstanding Company Shares and Outstanding Company Voting Securities, as the case may be, (B) no Person (excluding any employee benefit plan or related trust of the Company or of such corporation resulting from such Corporate Transaction) beneficially owns, directly or indirectly, twenty-five percent (25%) or more of, respectively, the then outstanding shares of the corporation resulting from such Corporate Transaction or the combined voting power of the then outstanding voting securities of such corporation except to the extent that such ownership existed prior to the Corporate Transaction and (C) at least a majority of the members of the board of directors of the corporation (or other governing board of a non-corporate entity) resulting from such Corporate Transaction

were members of the Incumbent Board at the time of the execution of the initial agreement, or of the action of the Board, providing for such Corporate Transaction; or

(iv) approval by the Stockholders of the Company of a complete liquidation or dissolution of the Company.

Notwithstanding the foregoing, an event described above shall be a Change in Control with respect to an Award that constitutes a “nonqualified deferred compensation plan” within the meaning of Section 409A of the Code only if such event is also a change in the ownership or effective control of the Company or a change in the ownership of a substantial portion of the assets of the Company within the meaning of Section 409A of the Code to the extent necessary to avoid the imposition of any tax or interest or the inclusion of any amount in income thereunder.

“Code” means the Internal Revenue Code of 1986, as amended from time to time, and any successor thereto, the Treasury Regulations thereunder and other relevant interpretive guidance issued by the Internal Revenue Service or the Treasury Department. Reference to any specific section of the Code shall be deemed to include such regulations and guidance, as well as any successor section, regulations and guidance.

“Committee” means the Compensation Committee of the Board or such other committee or subcommittee of the Board as may be appointed by the Board to act as the Committee under the Plan. If at any time there is no such Compensation Committee or other committee or subcommittee appointed by the Board, the Board shall be the Committee. The Committee shall consist of two or more directors, each of whom is intended to be, to the extent required by Rule 16b-3 of the Exchange Act, a “non-employee director” as defined in Rule 16b-3 of the Exchange Act. Any member of the Committee who does not meet the foregoing requirements shall abstain from any decision regarding an Award and shall not be considered a member of the Committee to the extent required to comply with Rule 16b-3 of the Exchange Act.

“Disability” means, with respect to a Participant, (i) a “disability” (or words of similar meaning) as defined in any Individual Agreement to which the Participant is a party at the relevant time or (ii) if there is no such Individual Agreement or it does not define “disability” (or words of similar meaning): (A) a permanent and total disability as determined under the long-term disability plan applicable to the Participant; (B) if there is no such plan applicable to the Participant, “Disability” as determined by the Committee in its sole discretion; or (C) with respect to Participants employed outside the United States, such other definition as may be codified under local laws, rules and regulations. The Committee may require such medical or other evidence as it deems necessary to judge the nature and permanency of the Participant’s condition. Notwithstanding the foregoing, with respect to an Incentive Stock Option, “Disability” shall mean a “Permanent and Total Disability” as defined in Section 22(e)(3) of the Code and, with respect to any Award that constitutes a “nonqualified deferred compensation plan” within the meaning of Section 409A of the Code, “Disability” shall mean a “disability” as defined under Section 409A of the Code to the extent necessary to avoid the imposition of any tax or interest or the inclusion of any amount in income thereunder.

“Disaffiliation” means an Affiliate’s or business division’s ceasing to be an Affiliate or business division for any reason (including, without limitation, as a result of a public offering, or a spinoff or sale by the Company, of the stock of the Affiliate or a sale of a business division of the Company).

“Eligible Individuals” means non-employee directors, officers, employees and consultants of the Company or any of its Affiliates, including a Participating Company, and prospective officers, employees and consultants who have accepted offers of employment or consultancy from a Company Affiliate or a Participating Company.

“Exchange Act” means the Securities Exchange Act of 1934, as amended from time to time, and any successor thereto. Reference to any specific section of the Exchange Act shall be deemed to include such regulations and guidance issued thereunder, as well as any successor section, regulations and guidance.

“Fair Market Value” means, unless otherwise determined by the Committee, the closing price of a Share on the Applicable Exchange on the date of measurement or, if Shares are not traded on the Applicable Exchange on such measurement date, then on the next preceding date on which Shares are traded, all as reported by such source

as the Committee may select. If the Shares are not listed on a national securities exchange, Fair Market Value shall be determined by the Committee in its good faith discretion.

“Good Reason” means, with respect to a Participant, (i) if such Participant is a party to an Individual Agreement at the time of the Termination of Service that defines such term (or word(s) of similar meaning), the meaning given in such Individual Agreement or (ii) if there is no such Individual Agreement or if it does not define Good Reason (or word(s) of similar meaning), during the 24-month period following a Change in Control, actions taken by the Company, Participating Company, or any Affiliates resulting in a material negative change in the employment relationship of the Participant who is an officer or an employee including, without limitation:

(i) the assignment to the Participant of duties materially inconsistent with the Participant’s position (including status, titles and reporting requirements), authority, duties or responsibilities, or a material diminution in such position, authority, duties or responsibilities, in each case from those in effect immediately prior to the Change in Control;

(ii) a material reduction of the Participant’s aggregate annual compensation, including, without limitation, base salary and annual bonus opportunity, from that in effect immediately prior to the Change in Control;

(iii) a change in the Participant’s principal place of employment that increases the Participant’s commute by 40 or more miles or materially increases the time of the Participant’s commute as compared to the Participant’s commute immediately prior to the Change in Control but excluding, for the avoidance of doubt, a change that requires a Participant to forego one or more days of remote work and perform such work in person at a Company office; or

(iv) any other action or inaction that constitutes a material breach by the Company, Participating Company, or any Affiliates of any Individual Agreement.

In order to invoke a Termination of Service for Good Reason, a Participant must provide written notice to the Company, Participating Company, or any Affiliates with respect to which the Participant is employed or providing services of the existence of one or more of the conditions constituting Good Reason within ninety (90) days following the Participant’s knowledge of the initial existence of such condition or conditions, specifying in reasonable detail the conditions constituting Good Reason, and the Company shall have thirty (30) days following receipt of such written notice (the “Cure Period”) during which it may remedy the condition. In the event that the Company, Participating Company, or any Affiliate fails to remedy the condition constituting Good Reason during the applicable Cure Period, the Participant’s Termination of Service must occur, if at all, within ninety (90) days following such Cure Period in order for such termination as a result of such condition to constitute a Termination of Service for Good Reason.

“Grant Date” means (i) the date on which the Committee by resolution selects an Eligible Individual to receive a grant of an Award, establishes the number of Shares to be subject to such Award and, in the case of an Option or Stock Appreciation Right, establishes the exercise price of such Award or (ii) such later date as the Committee shall provide in such resolution.

“Incentive Stock Option” means any Option that is designated in the applicable Award Agreement as an “incentive stock option” within the meaning of Section 422 of the Code and otherwise meets the requirements to be an “incentive stock option” set forth in Section 422 of the Code. Each Option granted pursuant to the Plan will be treated as a Nonqualified Option unless, as of the Grant Date, it is expressly designated as an Incentive Stock Option in the applicable Award Agreement.

“Individual Agreement” means a written employment, consulting or similar agreement between a Participant and the Company, Participating Company, or any Affiliates.

“ISO Eligible Employees” means an employee of the Company, any subsidiary corporation (within the meaning of Section 424(f) of the Code) or parent corporation (within the meaning of Section 424(e) of the Code), or Participating Company.

“Manager” means Invesco Advisers, Inc. the Company’s manager.

“Nonqualified Option” means any Option that is not an Incentive Stock Option.

“Option” means an Incentive Stock Option or Nonqualified Option granted under Section 8.

“Other Stock-Based Award” means an Award of Shares or any other Award that is valued in whole or in part by reference to, or is otherwise based upon, Shares, including (without limitation) unrestricted stock, dividend equivalents and convertible debentures, granted under Section 11.

“Participant” means an Eligible Individual to whom an Award is or has been granted and who has accepted the terms and conditions of the Plan as set forth in Section 5(f) hereof.

“Participating Company” means the Company, the Subsidiaries, the Manager and any of their respective Affiliates, which with the consent of the Board participates in the Plan.

“Performance Goals” means specified goals, other than the mere continuation of employment or the mere passage of time, the satisfaction of which is a condition for the grant, exercisability, vesting or full enjoyment of an Award. A Performance Goal and any targets with respect thereto need not be based upon an increase, a positive or improved result or avoidance of loss and may be applied, without limitation, to a Participant individually, or to a business unit or division of the Company or an Affiliate or to the Company as a whole. A Performance Goal may also be based on individual performance and/or subjective performance goals (or any combination of any of the goals described in this definition). The Committee may provide that one or more of the Performance Goals applicable to an Award will be adjusted in a manner to reflect events (for example, but without limitation, acquisitions, dispositions or material financial market movements) occurring during the Performance Period that affect the applicable Performance Goal(s).

“Performance Period” means that period established by the Committee during which any Performance Goals specified by the Committee with respect to such Award are to be measured.

“Restricted Stock” means an Award granted under Section 9.

“Restricted Stock Unit” means an Award granted under Section 10.

“Restriction Period” means, with respect to Restricted Stock and Restricted Stock Units, the period commencing on the date of such Award to which vesting restrictions apply and ending upon the expiration of the applicable vesting conditions and/or the achievement of the applicable Performance Goals (it being understood that the Committee may provide that restrictions shall lapse with respect to portions of the applicable Award during the Restriction Period).

“Retirement” means, subject to and in accordance with such rules as may be prescribed by the Committee, retirement from active employment with the Company (other than at a time when Cause exists or as a result of a termination for Cause) at or after satisfying an age and/or years of service requirement established by the Committee.

“Share” or “Shares” means common shares, par value $0.01 each, of the Company or such other equity securities that may become subject to an Award.

“Stockholder” has the meaning set forth in the Maryland General Corporation Law.

“Stock Appreciation Right” means an Award granted under Section 8(b).

“Subsidiary” means any corporation, partnership, limited liability company or other entity at least 50% of the economic interest in the equity of which is owned, directly or indirectly, by the Company or by another subsidiary.

“Term” means the maximum period during which an Option, Stock Appreciation Right or, if applicable, Other Stock-Based Award may remain outstanding as specified in the applicable Award Agreement.

“Termination of Service” means the termination of the Participant’s employment or consultancy with, or performance of services (including as a director) for, the Company, a Participating Company, and any Affiliates or, in the case of a director, when a director no longer holds office as a director of the Company. For Participants employed outside the United States, the date on which such Participant incurs a Termination of Service shall be the earlier of (i) the last day of the Participant’s active service with the Company, a Participating Company, and any Affiliates or (ii) the last day on which the Participant is considered an employee of the Company, a Participating Company, and any Affiliates, as determined in each case without including any required advance notice period and irrespective of the status of the termination under local labor or employment laws. Temporary absences from employment because of illness, vacation or approved leave of absence and transfers among the Company, a Participating Company, and any Affiliates shall not be considered Terminations of Service. With respect to any Award that constitutes a “nonqualified deferred compensation plan” within the meaning of Section 409A of the Code, “Termination of Service” shall mean a “separation from service” as defined under Section 409A of the Code to the extent required by Section 409A of the Code to avoid the imposition of any tax or interest or the inclusion of any amount in income thereunder. A Participant has a separation from service within the meaning of Section 409A of the Code if the Participant terminates employment with the Company, Participating Company and any Affiliates for any reason. A Participant will generally be treated as having terminated employment with the Company, Participating Company, and any Affiliates as of a certain date if the Participant and the Company, Participating Company, or Affiliate that employs the Participant reasonably anticipate that the Participant will perform no further services for the Company, Participating Company, or any Affiliate after such date or that the level of bona fide services that the Participant will perform after such date (whether as an employee or an independent contractor) will permanently decrease to no more than 20 percent of the average level of bona fide services performed (whether as an employee or an independent contractor) over the immediately preceding 36-month period (or the full period of services if the Participant has been providing services for fewer than 36 months); provided, however, that the employment relationship is treated as continuing while the Participant is on military leave, sick leave or other bona fide leave of absence if the period of leave does not exceed six months or, if longer, so long as the Participant retains the right to reemployment with the Company, Participating Company, or any Affiliate.

5. Administration

(a) Committee. The Plan shall be administered by the Committee. The Committee shall, subject to Section 13, have plenary authority to grant Awards pursuant to the terms of the Plan to Eligible Individuals. Among other things, the Committee in its sole discretion shall have the authority, subject to the terms and conditions of the Plan:

(i) to select the Eligible Individuals to whom Awards may from time to time be granted;

(ii) to determine whether and to what extent Awards are to be granted hereunder;

(iii) to determine the number of Shares to be covered by each Award granted hereunder;

(iv) to determine the terms and conditions of each Award granted hereunder, including but not limited to the form of settlement of Awards, based on such factors as the Committee shall determine, and to approve the form of Award Agreement and any related addendum;

(v) to adopt sub-plans and special provisions applicable to Awards granted to Participants employed outside of the United States, which sub-plans and special provisions may take precedence over other provisions of the Plan, and to approve the form of Award Agreement and any related addendum as may be applicable to such Awards;

(vi) subject to Sections 6(e), 8(e), 13 and 14, to modify, amend or adjust the terms and conditions of any Award;

(vii) to adopt, alter and repeal such administrative rules, guidelines and practices governing the Plan as it shall from time to time deem advisable;

(viii) to interpret the terms and provisions of the Plan and any Award issued under the Plan (and any Award Agreement relating thereto);

(ix) subject to Section 13, to accelerate the vesting or lapse of restrictions of any outstanding Award, based in each case on such considerations as the Committee determines;

(x) to decide all other matters to be determined in connection with an Award;

(xi) to determine whether, to what extent and under what circumstances cash, Shares and other property and other amounts payable with respect to an Award under the Plan shall be deferred either automatically or at the election of the Participant;

(xii) to establish any “blackout” period that the Committee deems necessary or advisable; and

(xiii) to otherwise administer the Plan.

(b) Delegation of Authority. To the extent permitted under applicable law and Section 13, the Committee may delegate any of its authority to administer the Plan to any person or persons selected by the Committee, including one or more members of the Committee, and such person or persons shall be deemed to be the Committee with respect to, and to the extent of, its or their authority.

(c) Procedures.

(i) The Committee may act by a majority of its members and, except to the extent prohibited by applicable law or the listing standards of the Applicable Exchange and subject to Section 13, through any person or persons to whom it has delegated its authority pursuant to Section 5(b).

(ii) Any authority granted to the Committee may also be exercised by the independent directors of the full Board. To the extent that any permitted action taken by the Board conflicts with action taken by the Committee, the Board action shall control.

(d) Discretion of Committee and Binding Effect. Any determination made by the Committee or an appropriately delegated person or persons with respect to the Plan or any Award shall be made in the sole discretion of the Committee or such delegate, including, without limitation, any determination involving the appropriateness or equitableness of any action, unless in contravention of any express term of the Plan. All decisions made by the Committee or any appropriately delegated person or persons shall be final and binding on all persons, including the Company, Participants and Eligible Individuals. Notwithstanding the foregoing, following a Change in Control, any determination by the Committee as to whether “Cause” or “Good Reason” exists shall be subject to de novo review.

(e) Cancellation or Suspension. Notwithstanding any other terms of the Plan (other than Section 8(e)), an Award Agreement or an Award, the Committee or an appropriately delegated person or persons, in its or their sole discretion, shall have full power and authority to determine whether, to what extent and under what circumstances any Award or any portion thereof shall be cancelled or suspended and may cancel or suspend any Award or any portion thereof. Without in any way limiting the generality of the preceding sentence, the following are examples, without limitation, of when all or any portion of an outstanding Award to any Participant may be canceled or suspended: (1) in the sole discretion of the Committee or any appropriately delegated person or persons, a Participant materially breaches (A) any duties of Participant’s employment (whether express or implied), including without limitation Participant’s duties of fidelity, good faith and exclusive service, (B) any general terms and conditions of Participant’s employment such as an employee handbook or guidelines, (C) any policies and procedures of the Company, Participating Company, or any Affiliates applicable to the Participant, or (D) any other agreement regarding Participant’s employment with the Company, Participating Company, or any Affiliates, (2) without the prior written explicit consent of the Committee or any appropriately delegated person or persons (which consent may be granted or denied in the sole discretion of the Committee or such person or persons), a Participant,

while employed by, or providing services to, the Company, Participating Company, or any Affiliates, becomes associated with, employed by, renders services to, or owns any interest in (other than any nonsubstantial interest, as determined by the Committee or any appropriately delegated person or persons in its or their sole discretion), any business that is in competition with the Company, Participating Company, or any Affiliates or with any business in which the Company, Participating Company, or any Affiliates has a substantial interest, as determined by the Committee or any appropriately delegated person or persons in its or their sole discretion or (3) as a result of the application to an Award of any compensation recovery or recoupment policy or policies adopted by the Company, including but not limited to the Invesco Mortgage Capital Inc. Policy for Recoupment of Incentive Compensation.

(f) Award Agreements. The terms and conditions of each Award, as determined by the Committee, shall be set forth in a written (including electronic) Award Agreement, which shall be delivered to the Participant receiving such Award upon, or as promptly as is reasonably practicable following, the grant of such Award. Except (i) as otherwise specified by the Committee, in its sole discretion, (ii) as otherwise provided in the Award Agreement, or (iii) in the case of non-executive directors who may not be required to sign or accept an Award, an Award shall not be effective unless the Award Agreement is signed or otherwise accepted by the Participant receiving the Award (including by electronic signature or acceptance). The Committee, in its sole discretion, may deliver any documents related to an Award or Award Agreement by electronic means. Award Agreements may be amended only in accordance with Section 14.

6. Shares Subject to Plan

(a) Plan Maximums. Subject to adjustment as described in Section 6(e), the maximum number of Shares that may be issued pursuant to Awards under the Plan shall be 325,000 shares.

(b) Individual and Award Limits. Subject to adjustment as described in Section 6(e), the maximum number of Shares that may be issued pursuant to Options intended to be Incentive Stock Options shall be 2,000 Shares.

(c) Source of Shares. Shares subject to Awards under the Plan may be authorized but unissued Shares or, if required by local law, Shares delivered from a trust established pursuant to applicable law.

(d) Rules for Calculating Shares Issued; No “Share Recycling” for Options or Stock Appreciation Rights. Shares that are subject to Awards granted under the Plan shall be deemed not to have been issued for purposes of the Plan maximums set forth in Section 6(a) and 6(b)(ii) to the extent that:

(i) the Award is forfeited or canceled, or the Award terminates, expires or lapses for any reason without Shares having been delivered;

(ii) the Award is settled in cash; or

(iii) the Shares are withheld by the Company to satisfy all or part of any tax withholding obligation related to an Award of Restricted Stock or an Award of a Restricted Stock Unit.

Shares that are tendered or withheld by the Company in payment of the exercise price of Options or Stock Appreciation Rights or to satisfy all or part of any tax withholding obligation related to such an Option or Stock Appreciation Right shall be counted as Shares that were issued. For the avoidance of doubt, Shares subject to an Option or a Stock Appreciation Right issued under the Plan that are not issued in connection with the stock settlement of that Option or Stock Appreciation Right upon its exercise shall not again become available for Awards or increase the number of Shares available for grant.

(e) Adjustment Provision.

(i) In the event of a merger, consolidation, stock rights offering, liquidation, or similar event affecting the Company, a Participating Company, or any Affiliates (each, a “Corporate Event”) or a stock dividend, stock split, reverse stock split, separation, spinoff, Disaffiliation, reorganization, extraordinary dividend of cash or other property, share combination, or recapitalization or similar event affecting the

capital structure of the Company (each, a “Share Change”), the Committee or the Board shall make such equitable and appropriate substitutions or adjustments to (A) the aggregate number and kind of Shares or other securities reserved for issuance and delivery under the Plan, (B) the various maximum limitations set forth in Sections 6(a) and 6(b) upon certain types of Awards and upon the grants to individuals of certain types of Awards, (C) the number and kind of Shares or other securities subject to outstanding Awards and (D) the exercise price of outstanding Awards.

(ii) In the case of Corporate Events, such adjustments may include, without limitation, (A) the cancellation of outstanding Awards in exchange for payments of cash, securities or other property or a combination thereof having an aggregate value equal to the value of such Awards, as determined by the Committee or the Board in its sole discretion (it being understood that in the case of a Corporate Event with respect to which Stockholders receive consideration other than publicly traded equity securities of the ultimate surviving entity, any such determination by the Committee that the value of an Option or Stock Appreciation Right shall for this purpose be deemed to equal the excess, if any, of the value of the consideration being paid for each Share pursuant to such Corporate Event over the exercise price of such Option or Stock Appreciation Right shall conclusively be deemed valid), and (B) the substitution of securities or other property (including, without limitation, cash or other securities of the Company and securities of entities other than the Company) for the Shares subject to outstanding Awards.

(iii) In connection with any Disaffiliation, separation, spinoff, or other similar event, the Committee or the Board may arrange for the assumption of Awards, or replacement of Awards with new awards based on securities or other property (including, without limitation, other securities of the Company and securities of entities other than the Company), by the affected Affiliate (or Participating Company) or business division or by the entity that controls such Affiliate (or Participating Company) or business division following such event (as well as any corresponding adjustments to Awards that remain based upon Company securities). Such replacement with new awards may include revision of award terms reflective of circumstances associated with the Disaffiliation, separation, spinoff or other similar event.

(iv) The Committee may, in its discretion, adjust the Performance Goals applicable to any Awards to reflect any unusual or non-recurring events and other extraordinary items, impact of charges for restructurings, discontinued operations and the cumulative effects of accounting or tax changes, each as defined by generally accepted accounting principles or as identified in the Company’s financial statements, notes to the financial statements, management’s discussion and analysis or other Company filings with the Securities and Exchange Commission. If the Committee determines that a change in the business, operations, corporate structure or capital structure of the Company, Participating Company, or the applicable Affiliate, business division or other operational unit of, or the manner in which any of the foregoing conducts its business, or other events or circumstances render the Performance Goals to be unsuitable, the Committee may modify such Performance Goals or the related minimum acceptable level of achievement, in whole or in part, as the Committee deems appropriate and equitable.

(f) Section 409A. Notwithstanding the foregoing: (i) any adjustments made pursuant to Section 6(e) to Awards that are considered “deferred compensation” within the meaning of Section 409A of the Code shall be made in compliance with the requirements of Section 409A of the Code; (ii) any adjustments made pursuant to Section 6(e) to Awards that are not considered “deferred compensation” subject to Section 409A of the Code shall be made in such a manner as to ensure that after such adjustment, the Awards either (A) continue not to be subject to Section 409A of the Code or (B) comply with the requirements of Section 409A of the Code; and (iii) in any event, neither the Committee nor the Board shall have the authority to make any adjustments pursuant to Section 6(e) to the extent the existence of such authority would cause an Award that is not intended to be subject to Section 409A of the Code at the Grant Date to be subject thereto.

7. Eligibility and Participation

Awards may be granted under the Plan to Eligible Individuals; provided, however, that Incentive Stock Options may be granted only to ISO Eligible Employees.

8. Options and Stock Appreciation Rights

(a) Options. An Option is a right to purchase a specified number of Shares at a specified price that continues for a stated period of time. Options granted under the Plan may be Incentive Stock Options or Nonqualified Options. The Award Agreement for an Option shall indicate whether the Option is intended to be an Incentive Stock Option or a Nonqualified Option.

(b) Stock Appreciation Rights. A Stock Appreciation Right is a right to receive upon exercise of the Stock Appreciation Right an amount in cash, Shares or both, in value equal to the product of (i) the excess of the Fair Market Value of one Share over the exercise price per Share subject to the applicable Stock Appreciation Right, multiplied by (ii) the number of Shares in respect of which the Stock Appreciation Right has been exercised. The applicable Award Agreement shall specify whether such payment is to be made in cash or Shares or both, or shall reserve to the Committee or the Participant the right to make that determination prior to or upon the exercise of the Stock Appreciation Right.

(c) Award Agreement. Each grant of an Option and Stock Appreciation Right shall be evidenced by an Award Agreement that shall specify Grant Date, the exercise price, the term, vesting schedule, and such other provisions as the Committee shall determine.

(d) Exercise Price; Not Less Than Fair Market Value. The exercise price per Share subject to an Option or Stock Appreciation Right shall be determined by the Committee and set forth in the applicable Award Agreement, and shall not be less than the Fair Market Value of a Share on the Grant Date, except as provided under Section 6(e) or with respect to Options or Stock Appreciation Rights that are granted in substitution of similar types of awards of a company acquired by the Company, Participating Company, or an Affiliate or with which the Company, Participating Company, or an Affiliate combines (whether in connection with a corporate transaction, such as a merger, combination, consolidation or acquisition of property or stock, or otherwise) to preserve the intrinsic value of such awards.

(e) Prohibition on Repricing; No Cash Buyouts. Except as provided in Section 6(e) relating to adjustments due to certain corporate events, the exercise price of outstanding Options or Stock Appreciation Rights may not be amended to reduce the exercise price of such Options or Stock Appreciation Rights, nor may outstanding Options or Stock Appreciation Rights be canceled in exchange for (i) cash, (ii) Options or Stock Appreciation Rights with an exercise price that is less than the exercise price of the original outstanding Options or Stock Appreciation Rights or (iii) other Awards, unless in each case such action is approved by the Company’s Stockholders.

(f) Prohibition on Reloads. Options or Stock Appreciation Rights shall not be granted under the Plan that contain a reload or replenishment feature pursuant to which a new Option or Stock Appreciation Right would be granted upon receipt or delivery of Shares to the Company in payment of the exercise price or any tax withholding obligation under any other stock option, stock appreciation right or other Award.

(g) Term. The term of an Option or Stock Appreciation Right granted under the Plan shall be determined by the Committee, in its sole discretion; provided however, that such term shall not exceed ten (10) years.

(h) Accelerated Expiration Date. Unless the Committee specifies otherwise in the applicable Award Agreement, an Option or Stock Appreciation Right granted under the Plan will expire upon the earliest to occur of the following:

(i) The original expiration date of the Option or Stock Appreciation Right;

(ii) Death. The one-year anniversary of the Participant’s death;

(iii) Disability. The one-year anniversary of the Participant’s termination of employment with the Company and all Related Companies due to Disability;

(iv) Termination of Employment. The date of the Participant’s termination of employment with the Company and all Related Companies for any reason other than death or Disability; provided, however, that if the Participant is terminated by the Company other than for Cause or unsatisfactory performance, then 60 days following the Participant’s termination of employment.

(i) Vesting.

(i) Generally. Options and Stock Appreciation Rights shall have a vesting period of not less than one year from the date of grant except with respect to the death, Disability, involuntary termination (other than for Cause or unsatisfactory performance) of a Participant, the occurrence of a Change in Control as outlined in Section 12 of this Plan, or as may be required or otherwise be deemed advisable by the Committee, whether in connection with an Award granted through the assumption of, or substitution for, outstanding awards previously granted by a company acquired by the Company or any Affiliate or with which the Company or any Affiliate combines or otherwise. The Committee shall, prior to or at the time of grant, condition the grant or vesting of an Award of Options or Stock Appreciation Rights upon such terms as outlined in the Award Agreement, which may include terms regarding Retirement.

(j) Method of Exercise and Payment.

(i) Generally. Subject to the provisions of this Section 8 and the terms of the applicable Award Agreement, Options and Stock Appreciation Rights may be exercised, in whole or in part, by giving written (including electronic) notice of exercise specifying the number of Shares as to which such Options or Stock Appreciation Rights are being exercised and paying, or making arrangements satisfactory to the Company for the payment of, all applicable taxes pursuant to Section 16(d).

(ii) In the case of the exercise of an Option, such notice shall be accompanied by payment in full of the exercise price by (A) certified or bank check (B) delivery of unrestricted Shares of the same class as the Shares subject to the Option already owned by the Participant (based on the Fair Market Value of the Shares on the date the Option is exercised), provided that the Shares have been held by the Participant for such period as may established by the Committee to comply with applicable law or (C) such other method as the Committee shall permit in its sole discretion (including a broker-assisted cashless exercise or netting of Shares).

(k) No Stockholder Rights. A Participant shall have no right to dividends or any other rights as a Stockholder with respect to Shares subject to an Option or Stock Appreciation Right until such Shares are issued to the Participant pursuant to the terms of the Award Agreement.

9. Restricted Stock

(a) Nature of Awards and Certificates. Shares of Restricted Stock are actual Shares that are issued to a Participant subject to forfeiture under certain circumstances and shall be evidenced in such manner as the Committee may deem appropriate, including book-entry registration.

(b) Award Agreement. Each grant of Restricted Stock shall be evidenced by an Award Agreement that shall specify the Grant Date, the period of restriction, the number of shares of Restricted Stock, vesting schedule, and such other provisions as the Committee shall determine. The Committee may, prior to or at the time of grant, condition the grant or vesting of an Award of Restricted Stock upon (A) the continued service of the Participant, (B) the attainment of Performance Goals or (C) the attainment of Performance Goals and the continued service of the Participant. The conditions for grant or vesting and the other provisions of Restricted Stock Awards (including, without limitation, any applicable Performance Goals) need not be the same with respect to each Participant.

(c) Vesting.

(i) Generally. Shares of Restricted Stock shall have a vesting period of not less than one year from the date of grant except with respect to the death, Disability, involuntary termination (other than for Cause or unsatisfactory performance) of a Participant, the occurrence of a Change in Control as outlined in Section 12 of this

Plan, or as may be required or otherwise be deemed advisable by the Committee, whether in connection with an Award granted through the assumption of, or substitution for, outstanding awards previously granted by a company acquired by the Company or any Affiliate or with which the Company or any Affiliate combines, or otherwise. The Committee shall, prior to or at the time of grant, condition the grant or vesting of an Award of Restricted Stock upon such terms as outlined in the Award Agreement, which may include terms regarding Retirement.

For purposes of an Award to a non-executive director that is granted as of the date of the annual meeting of stockholders, a vesting period shall be deemed to be one year if it runs from the date of one annual meeting of stockholders to the next annual meeting of stockholders provided that such next meetings are at least 50 weeks apart.

(ii) Accelerated Vesting. Unless the Committee specifies otherwise in the applicable Award Agreement, in the event of the death, Disability or involuntary termination (other than for Cause or unsatisfactory performance) of a Participant, a Change in Control as outlined in Section 12 of this Plan, or special circumstances determined by the Committee, an Award of Restricted Stock shall vest as of the termination of employment.

(d) Restricted Shares Non-Transferrable. Subject to the provisions of the Plan and the applicable Award Agreement, during the Restriction Period, the Participant shall not be permitted to sell, assign, transfer, pledge or otherwise encumber Shares of Restricted Stock.

(e) Rights of a Stockholder. Except as otherwise provided in this Section 9 or in the applicable Award Agreement, the Participant shall have, with respect to the Shares of Restricted Stock, all of the rights of a Stockholder of the Company holding the class or series of Shares that is the subject of the Restricted Stock, including, if applicable, voting and dividend rights.

(f) Dividends. Except as otherwise provided in the applicable Award Agreement, cash dividends with respect to the Restricted Stock will be currently paid to the Participant and, subject to Section 16(e) of the Plan, dividends payable in Shares shall be paid in the form of Restricted Stock of the same class as the Shares with which such dividend was paid, held subject to the vesting of the underlying Restricted Stock; provided, however, that no dividends shall be paid with respect to Restricted Stock that is subject to one or more Performance Goals unless and until the Committee has certified that the applicable Performance Goals for such award have been met. Dividends shall accrue at the same rate as cash dividends paid on the Shares and applied to the number of shares that vest. Such dividend equivalents shall be paid to the Participant in cash at the time the Shares are delivered. If any Shares of Restricted Stock are forfeited, the Participant shall have no right to future cash dividends with respect to such Restricted Stock, withheld stock dividends or earnings with respect to such Shares of Restricted Stock.

(g) Delivery of Shares. If and when any applicable Performance Goals are satisfied and/or the Restriction Period expires without a prior forfeiture of the Shares of Restricted Stock, unrestricted Shares shall be delivered to the Participant as soon as administratively practicable.

(h) Termination of Service. Except as otherwise provided in the applicable Award Agreement as provided in subsection (c)(ii) above, a Participant’s Shares of Restricted Stock shall be forfeited upon his or her Termination of Service.

10. Restricted Stock Units

(a) Nature of Awards. Restricted Stock Units represent a contractual obligation by the Company to deliver a number of Shares, an amount in cash or a combination of Shares and cash equal to the specified number of Shares subject to the Award, or the Fair Market Value thereof, in accordance with the terms and conditions set forth in the Plan and any applicable Award Agreement.

(b) Award Agreement. Each grant of Restricted Stock Units shall be evidenced by an Award Agreement that shall specify the Grant Date, the period of restriction, the number of Restricted Stock Units, vesting schedule, and such other provisions as the Committee shall determine. The Committee may, prior to or at the time of grant, condition the grant or vesting of an Award of Restricted Stock Units upon (A) the continued service of the Participant, (B) the attainment of Performance Goals or (C) the attainment of Performance Goals and the continued service of the Participant. The conditions for grant or vesting and the other provisions of Restricted Stock Units

(including, without limitation, any applicable Performance Goals) need not be the same with respect to each Participant.

(c) Vesting.

(i) Generally. Restricted Stock Units shall have a vesting period of not less than one year from the date of grant except with respect to the death, Disability, involuntary termination (other than for Cause or unsatisfactory performance) of a Participant, the occurrence of a Change of Control as outlined in Section 12 of this Plan, or as may be required or otherwise be deemed advisable by the Committee, whether in connection with an Award granted through the assumption of, or substitution for, outstanding awards previously granted by a company acquired by the Company or any Affiliate or with which the Company or any Affiliate combines or otherwise. The Committee shall, prior to or at the time of grant, condition the grant or vesting of an Award of Restricted Stock Units upon such terms as outlined in the Award Agreement, which may include terms regarding Retirement.

For purposes of an Award to a Non-Executive Director that is granted as of the date of the annual meeting of stockholders, a vesting period shall be deemed to be one year if it runs from the date of one annual meeting of stockholders to the next annual meeting of stockholders provided that such next meetings are at least 50 weeks apart.

(ii) Accelerated Vesting. Unless the Committee specifies otherwise in the applicable Award Agreement, in the event of the death, Disability or involuntary termination (other than for Cause or unsatisfactory performance) of a Participant, a Change in Control as outlined in Section 12 of this Plan, or special circumstances determined by the Committee, an Award of Restricted Stock Units shall vest as of the termination of employment.

(d) Dividend Equivalents. The Committee may, in its discretion, provide for current or deferred payments of cash, Shares or other property corresponding to the dividends payable on the Shares (subject to Section 16(e) below), as set forth in an applicable Award Agreement; provided, however, that no such dividend equivalents shall be paid with respect to Restricted Stock Units that are subject to one or more Performance Goals unless and until the Committee has certified that the applicable Performance Goals for such award have been met. Dividend equivalents shall accrue at the same rate as cash dividends paid on the Shares and applied to the number of Shares that vest. Such dividend equivalents shall be paid to the Participant in cash at the time the Shares are delivered. If a Participant’s Restricted Stock Units are forfeited, the Participant shall have no right to future dividend equivalents with respect to such Restricted Stock Units, withheld stock dividends or earnings with respect to such Restricted Stock Units.

(e) Termination of Service. Except as otherwise provided in the applicable Award Agreement or as provided in subsection (c)(ii) above, a Participant’s Restricted Stock Units shall be forfeited upon his or her Termination of Service.

(f) Payment. Except as otherwise provided in the applicable Award Agreement, Shares, cash or a combination of Shares and cash, as applicable, payable in settlement of Restricted Stock Units shall be delivered to the Participant as soon as administratively practicable after the date on which payment is due under the terms of an Award Agreement.

(g) No Stockholder Rights. Except as otherwise provided in the applicable Award Agreement, a Participant shall have no rights as a Stockholder with respect to Shares subject to Restricted Stock Units until such Shares are issued to the Participant pursuant to the terms of the Award Agreement.

11. Other Stock-Based Awards

Other Stock-Based Awards may be granted under the Plan; provided, that any Other Stock-Based Awards that are Awards of Shares that are unrestricted or with a minimum vesting schedule of less than one year shall only be granted in lieu of other compensation due and payable to the Participant. Notwithstanding the foregoing, no more than 5% of the Shares authorized to grant under Section 6 may be granted with a minimum vesting schedule of less than one year.

12. Change in Control Provisions

The provisions of this Section 12 shall apply in the case of a Change in Control, unless otherwise provided in the applicable Award Agreement or any other provision of the Plan.

(a) Awards Not Assumed, Etc. in Connection with Change in Control. Upon the occurrence of a transaction that constitutes a Change in Control, if any Awards are not assumed, converted or otherwise equitably converted or substituted in a manner approved by the Committee, then such Awards shall vest immediately at 100 percent before the Change in Control.

(b) Awards Assumed, Etc. in Connection with Change in Control. Upon the occurrence of a transaction that constitutes a Change in Control, with respect to any Awards that are assumed, converted or otherwise equitably converted or substituted in a manner approved by the Committee, then, in the event of a Participant’s Termination of Service during the twenty-four (24) month period following such Change in Control, (x) by the Company other than for Cause or unsatisfactory performance, or (y) by the Participant for Good Reason:

(i) each outstanding Award shall be deemed to satisfy any applicable Performance Goals at 100 percent as set forth in the applicable Award Agreement;

(ii) any Options and Stock Appreciation Rights outstanding which are not then exercisable and vested shall become fully exercisable and vested. Any such Option or Stock Appreciation Right held by the Participant as of the date of the Change in Control that remain outstanding as of the date of such Termination of Service may thereafter be exercised until the earlier of the third anniversary of such Change in Control and the last date on which such Option or Stock Appreciation Right would have been exercisable in the absence of this Section 12(b) (ii) (taking into account the applicable terms of any Award Agreement);

(iii) the restrictions and deferral limitations applicable to any Shares of Restricted Stock shall lapse and such Shares of Restricted Stock shall become free of all restrictions and become fully vested and transferable;

(iv) all Restricted Stock Units shall be considered to be earned and payable in full, and any deferral or other restriction shall lapse, and any Restriction Period shall terminate, and such Restricted Stock Units shall be settled in cash or Shares (consistent with the terms of the Award Agreement after taking into account the effect of the Change in Control transaction on the Shares) as promptly as is practicable; and

(v) subject to Section 14, the Committee may also make additional adjustments and/or settlements of outstanding Awards as it deems appropriate and consistent with the Plan’s purposes.

(c) 409A Matters. Notwithstanding the foregoing, if any Award to a Participant who is subject to U.S. income tax is considered a “nonqualified deferred compensation plan” within the meaning of Section 409A of the Code, this Section 12 shall apply to such Award only to the extent that its application would not result in the imposition of any tax or interest or the inclusion of any amount in income under Section 409A of the Code.

(d) Other. In the event of a Change in Control, the Committee may in its discretion and upon at least ten (10) days’ advance notice to the affected Participants, cancel any outstanding Awards and pay to the holders thereof, in cash or Shares, or any combination thereof, the value of such Awards based upon the price per Share received or to be received by other Stockholders of the Company as a result of the Change in Control.

13. Section 16(b); Section 409A

(a) Section 16(b). The provisions of the Plan are intended to ensure that transactions under the Plan are not subject to (or are exempt from) the short-swing recovery rules of Section 16(b) of the Exchange Act and shall be construed and interpreted in a manner so as to comply with such rules.

Notwithstanding any other provision of the Plan to the contrary, if for any reason the appointed Committee does not meet the requirements of Rule 16b-3 of the Exchange Act, such noncompliance with the requirements of Rule 16b-3 of the Exchange Act shall not affect the validity of Awards, grants, interpretations or other actions of the Committee.

(c) Section 409A. It is the intention of the Company that any Award to a Participant who is subject to U.S. income tax that constitutes a “nonqualified deferred compensation plan” within the meaning of Section 409A of the Code shall comply in all respects with the requirements of Section 409A of the Code to avoid the imposition of any tax or interest or the inclusion of any amount in income thereunder, and the terms of each such Award shall be interpreted, administered and deemed amended, if applicable, in a manner consistent with this intention. Notwithstanding the foregoing, neither the Company, a Participating Company, nor any of its Affiliates nor any of its or their directors, officers, employees, agents or other service providers will be liable for any taxes, penalties or interest imposed on any Participant, Beneficiary or other person with respect to any amounts paid or payable (whether in cash, Shares or other property) under any Award, including any taxes, penalties or interest imposed under or as a result of Section 409A of the Code. Notwithstanding any other provision of the Plan to the contrary, with respect to any Award to any Participant who is subject to U.S. income tax that constitutes a “nonqualified deferred compensation plan” within the meaning of Section 409A of the Code:

(i) any payments (whether in cash, Shares or other property) to be made with respect to the Award upon the Participant’s Termination of Service that would otherwise be paid within six months after the Participant’s Termination of Service shall be accumulated (without interest, to the extent applicable) and paid on the first day of the seventh month following the Participant’s Termination of Service if the Participant is a “specified employee” within the meaning of Section 409A of the Code (as determined in accordance with the uniform policy adopted by the Committee with respect to all of the arrangements subject to Section 409A of the Code maintained by the Company, a Participating Company and any Affiliates);

(ii) each payment made under the Plan shall be treated as a separate payment and the right to a series of installment payments under the Plan is to be treated as a right to a series of separate payments; and

(ii) unless otherwise determined by Committee, any payment to be made with respect to an Award of Restricted Stock Units shall be delivered no later than 60 days after the date on which payment is due under the Award or as otherwise permitted under Treasury Regulations section 1.409A-3(g) for any portion of the payment subject to a dispute.

14. Amendment and Discontinuance

(a) Amendment and Discontinuance of the Plan. The Board or the Committee may amend, alter or discontinue the Plan, but no amendment, alteration or discontinuation shall be made which would materially impair the rights of a Participant with respect to a previously granted Award without such Participant’s consent, except such an amendment made to comply with applicable law or Applicable Exchange rule or to prevent adverse tax or accounting consequences to the Company or Participants.

(b) Amendment of Awards. Subject to Section 8(d), the Committee may unilaterally amend the terms of any Award theretofore granted, but no such amendment shall materially impair the rights of any Participant with respect to an Award without the Participant’s consent, except such an amendment made to cause the Plan or Award to comply with applicable law, Applicable Exchange rule or to prevent adverse tax or accounting consequences for the Participant or the Company, a Participating Company, or any Affiliates.

15. Unfunded Status of Plan

It is currently intended that the Plan constitute an “unfunded” plan. The Committee may authorize the creation of trusts or other arrangements to meet the obligations created under the Plan to deliver Shares or make payments; provided, however, that unless the Committee otherwise determines, the existence of such trusts or other arrangements is consistent with the “unfunded” status of the Plan.

16. General Provisions

(a) Conditions for Issuance. The Committee may require each person purchasing or receiving Shares pursuant to an Award to represent to and agree with the Company in writing that such person is acquiring the Shares without a view to the distribution thereof. The certificates or book entry for such Shares may include any legend or appropriate notation that the Committee deems appropriate to reflect any restrictions on transfer, and the Committee may take such other steps as it deems necessary or desirable to restrict the transfer of Shares issuable under the Plan to comply with applicable law or Applicable Exchange rules. Notwithstanding any other provision of the Plan or agreements made pursuant thereto, the Company shall not be required to issue or deliver Shares under the Plan unless such issuance or delivery complies with all applicable laws, rules and regulations, including the requirements of any Applicable Exchange or similar entity and the Company has obtained any consent, approval or permit from any federal, state or foreign governmental authority that the Committee determines to be necessary or advisable.

(b) Additional Compensation Arrangements. Nothing contained in the Plan shall prevent the Company, Participating Company, or any Affiliate from adopting other or additional compensation arrangements for its employees.

(c) No Contract of Employment. Neither the Plan nor any Award Agreement shall constitute a contract of employment, and neither the adoption of the Plan nor the granting of any Award shall confer upon any employee any right to continued employment. Neither the Plan nor any Award Agreement shall interfere in any way with the right of the Company, a Participating Company, or any Affiliate to terminate the employment of any employee at any time.

(d) Required Taxes; No Tax Gross Ups. No later than the date as of which an amount first becomes includible in the gross income of a Participant for federal, state, local or foreign income or employment or other tax purposes with respect to any Award under the Plan, such Participant shall pay to the Company, or make arrangements satisfactory to the Company regarding the payment of, any federal, state, local or foreign taxes of any kind required by law to be withheld with respect to such amount. Unless otherwise determined by the Company, withholding obligations may be settled with Shares, including Shares that are part of the Award that gives rise to the withholding requirement, having a Fair Market Value on the date of withholding equal to the rate required to be withheld for tax purposes under applicable law, all in accordance with such procedures as the Committee establishes. The obligations of the Company under the Plan shall be conditional on such payment or arrangements, and the Company, Participating Company, and any Affiliates shall, to the extent permitted by law, have the right to deduct any such taxes from any payment otherwise due to such Participant. The Committee may establish such procedures as it deems appropriate, including making irrevocable elections, for the settlement of withholding obligations with Shares. Regardless of any arrangements made by the Company, Participating Company, any Affiliate or the Committee with respect to the withholding or other payment of any federal, state, local or foreign taxes of any kind, the liability for all such taxes legally due from a Participant remains the responsibility of the Participant. By accepting an Award, a Participant consents to the methods of tax withholding established by the Committee or otherwise made or arranged by the Company.

(e) Limitation on Dividend Reinvestment and Dividend Equivalents. Reinvestment of dividends in additional Restricted Stock at the time of any dividend payment, and the payment of Shares with respect to dividend equivalents to Participants holding Awards of Restricted Stock Units, shall only be permissible if sufficient Shares are available under Section 6 for such reinvestment or payment (taking into account then outstanding Awards). In the event that sufficient Shares are not available for such reinvestment or payment, then in the Committee’s discretion such payment shall be made in cash.

(f) Rights of a Beneficiary. Any amounts payable and any rights exercisable under an Award after a Participant’s death shall be paid to and exercised by the Participant’s Beneficiary, except to the extent prohibited by applicable law, Applicable Exchange rule or the terms of an applicable Award Agreement.

(g) Affiliate Employees. In the case of a forfeiture or cancellation of an Award to an employee of any Affiliate, all Shares underlying such Awards shall revert to the Company.

(h) Governing Law and Interpretation. The Plan and all Awards made and actions taken thereunder shall be governed by and construed in accordance with the laws of the State of Georgia, without reference to principles of conflict of laws. The captions of the Plan are not part of the provisions hereof and shall have no force or effect.

(i) Non-Transferability. Awards under the Plan cannot be sold, assigned, transferred, pledged or otherwise encumbered other than by will or the laws of descent and distribution, except as provided in Section 6(e).