JBG SMITH (NYSE: JBGS), a leading owner and developer of

high-quality, mixed-use properties in the Washington, DC market,

today filed its Form 10-Q for the quarter ended June 30, 2024 and

reported its financial results.

Additional information regarding our results of operations,

properties, and tenants can be found in our Second Quarter 2024

Investor Package, which is posted in the Investor Relations section

of our website at www.jbgsmith.com. We encourage investors to

consider the information presented here with the information in

that document.

Second Quarter 2024 Highlights

- Net income (loss), Funds From Operations ("FFO") and Core FFO

attributable to common shareholders were:

SECOND QUARTER AND

YEAR-TO-DATE COMPARISON

in millions, except per share amounts

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Amount

Per Diluted Share

Amount

Per Diluted Share

Amount

Per Diluted Share

Amount

Per Diluted Share

Net income (loss) (1) (2)

$

(24.4

)

$

(0.27

)

$

(10.5

)

$

(0.10

)

$

(56.6

)

$

(0.63

)

$

10.6

$

0.09

FFO (2)

$

14.3

$

0.16

$

33.4

$

0.30

$

25.0

$

0.27

$

66.4

$

0.59

Core FFO

$

16.1

$

0.18

$

39.8

$

0.36

$

43.0

$

0.47

$

76.9

$

0.69

_____________

(1)

Includes gain on the sale of real estate

totaling $286,000 and $40.7 million recorded during the six months

ended June 30, 2024 and 2023.

(2)

Includes impairment loss of $1.0 million

and $18.2 million related to non-depreciable real estate assets

recorded during the three and six months ended June 30, 2024.

- Annualized Net Operating Income ("NOI") for the three months

ended June 30, 2024 was $286.4 million, compared to $307.5 million

for the three months ended March 31, 2024, at our share. Excluding

the assets that were sold or taken out of service, Annualized NOI

for the three months ended June 30, 2024 was $283.9 million,

compared to $292.6 million for the three months ended March 31,

2024, at our share.

- The decrease in Annualized NOI excluding the assets that were

sold or taken out of service was substantially attributable to (i)

tenant vacates and higher non-reimbursable operating expenses,

partially offset by higher parking revenue and lower bad debt

reserves in our commercial portfolio; and (ii) higher repair and

maintenance expense, unit turn costs, and marketing expense as a

result of higher expirations due to the seasonality in multifamily

leasing, partially offset by higher revenue in our multifamily

portfolio.

- Same Store NOI ("SSNOI") at our share increased 3.2%

quarter-over-quarter to $71.4 million for the three months ended

June 30, 2024.

- The increase in SSNOI was substantially attributable to (i)

higher rents and occupancy and lower concessions, partially offset

by higher operating expenses in our multifamily portfolio; and (ii)

lower real estate taxes and operating expenses, partially offset by

lower occupancy in our commercial portfolio.

Operating Portfolio

- The operating multifamily portfolio was 96.9% leased and 94.3%

occupied as of June 30, 2024, compared to 95.9% and 94.3% as of

March 31, 2024.

- In our multifamily portfolio, we increased effective rents by

4.6% blended across new and renewal leases and 8.6% upon renewal

for second quarter lease expirations while achieving a 50.9%

renewal rate.

- The operating commercial portfolio was 82.3% leased and 80.6%

occupied as of June 30, 2024, compared to 84.6% and 83.1% as of

March 31, 2024, at our share.

- Executed approximately 248,000 square feet of office leases at

our share during the three months ended June 30, 2024, including

approximately 166,000 square feet of new leases. Second-generation

leases generated a 2.0% rental rate increase on a cash basis and a

12.7% rental rate increase on a GAAP basis.

- Executed approximately 347,000 square feet of office leases at

our share during the six months ended June 30, 2024, including

approximately 197,000 square feet of new leases. Second-generation

leases generated a 1.6% rental rate increase on a cash basis and a

10.0% rental rate increase on a GAAP basis.

Development Portfolio

Under-Construction

- As of June 30, 2024, we had two multifamily assets under

construction consisting of 1,583 units at our share, including 1900

Crystal Drive comprising two towers, The Grace and Reva, which

delivered in the second quarter and was 49.5% leased as of July 28,

2024.

Development Pipeline

- As of June 30, 2024, we had 18 assets in the development

pipeline consisting of 9.3 million square feet of estimated

potential development density at our share.

Third-Party Asset Management and Real Estate Services

Business

- For the three months ended June 30, 2024, revenue from

third-party real estate services, including reimbursements, was

$17.4 million. Excluding reimbursements and service revenue from

our interests in real estate ventures, revenue from our third-party

asset management and real estate services business was $8.1

million, primarily driven by $5.1 million of property and asset

management fees, $1.3 million of other service revenue and $1.1

million of leasing fees.

Balance Sheet

- As of June 30, 2024, our total enterprise value was

approximately $4.1 billion, comprising 101.1 million common shares

and units valued at $1.5 billion, and debt (net of premium /

(discount) and deferred financing costs) at our share of $2.7

billion, less cash and cash equivalents at our share of $169.3

million.

- As of June 30, 2024, we had $163.5 million of cash and cash

equivalents ($169.3 million of cash and cash equivalents at our

share), and $694.3 million of availability under our revolving

credit facility.

- Net Debt to annualized Adjusted EBITDA at our share for the

three months ended June 30, 2024 was 11.9x, and our Net Debt /

total enterprise value was 62.1% as of June 30, 2024.

Investing and Financing Activities

- We repurchased and retired 4.7 million common shares for $68.7

million, a weighted average purchase price per share of $14.62. In

July 2024, through the date of this release, we repurchased and

retired 0.9 million common shares for $14.0 million, a weighted

average purchase price per share of $15.55, pursuant to a

repurchase plan under Rule 10b5-1 of the Securities Exchange Act of

1934, as amended.

Dividends

- On July 24, 2024, our Board of Trustees declared a quarterly

dividend of $0.175 per common share, payable on August 21, 2024 to

shareholders of record as of August 7, 2024.

About JBG SMITH

JBG SMITH owns, operates, invests in, and develops mixed-use

properties in high growth and high barrier-to-entry submarkets in

and around Washington, DC, most notably National Landing. Through

an intense focus on placemaking, JBG SMITH cultivates vibrant,

amenity-rich, walkable neighborhoods throughout the Washington, DC

metropolitan area. Approximately 75.0% of JBG SMITH's holdings are

in the National Landing submarket in Northern Virginia, which is

anchored by four key demand drivers: Amazon's new headquarters;

Virginia Tech's under-construction $1 billion Innovation Campus;

the submarket’s proximity to the Pentagon; and our retail and

digital placemaking initiatives and public infrastructure

improvements. JBG SMITH's dynamic portfolio currently comprises

13.4 million square feet of high-growth multifamily, office and

retail assets at share, 98% of which are Metro-served. It also

maintains a development pipeline encompassing 9.3 million square

feet of mixed-use, primarily multifamily, development

opportunities. JBG SMITH is committed to the operation and

development of green, smart, and healthy buildings and plans to

maintain carbon neutral operations annually. For more information

on JBG SMITH please visit www.jbgsmith.com.

Forward-Looking Statements

Certain statements contained herein may constitute

"forward-looking statements" as such term is defined in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are not guarantees of performance. They represent our

intentions, plans, expectations and beliefs and are subject to

numerous assumptions, risks and uncertainties. Consequently, the

future results, financial condition and business of JBG SMITH

Properties ("JBG SMITH," the "Company," "we," "us," "our" or

similar terms) may differ materially from those expressed in these

forward-looking statements. You can find many of these statements

by looking for words such as "approximate," "hypothetical,"

"potential," "believes," "expects," "anticipates," "estimates,"

"intends," "plans," "would," "may" or similar expressions in this

earnings release. We also note the following forward-looking

statements: whether in the case of our under-construction assets

and assets in the development pipeline, estimated square feet,

estimated number of units and estimated potential development

density are accurate; expected timing, completion, modifications

and delivery dates for the projects we are developing; the ability

of any or all of our demand drivers to materialize and their effect

on economic impact, job growth, expansion of public transportation

and related demand in the National Landing submarket; planned

infrastructure and educational improvements related to Amazon's

additional headquarters and the Virginia Tech Innovation Campus;

our development plans related to National Landing; and our plans to

maintain carbon neutral operations annually.

Many of the factors that will determine the outcome of these and

our other forward-looking statements are beyond our ability to

control or predict. These factors include, among others: adverse

economic conditions in the Washington, DC metropolitan area, the

timing of and costs associated with development and property

improvements, financing commitments, and general competitive

factors. For further discussion of factors that could materially

affect the outcome of our forward-looking statements and other

risks and uncertainties, see "Risk Factors," "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" and the Cautionary Statement Concerning Forward-Looking

Statements in the Company's Annual Report on Form 10‑K for the year

ended December 31, 2023 and other periodic reports the Company

files with the Securities and Exchange Commission. For these

statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. You are cautioned not to place undue

reliance on our forward-looking statements. All subsequent written

and oral forward-looking statements attributable to us or any

person acting on our behalf are expressly qualified in their

entirety by the cautionary statements contained or referred to in

this section. We do not undertake any obligation to release

publicly any revisions to our forward-looking statements to reflect

events or circumstances occurring after the date hereof.

Pro Rata Information

We present certain financial information and metrics in this

release "at JBG SMITH Share," which refers to our ownership

percentage of consolidated and unconsolidated assets in real estate

ventures (collectively, "real estate ventures") as applied to these

financial measures and metrics. Financial information "at JBG SMITH

Share" is calculated on an asset-by-asset basis by applying our

percentage economic interest to each applicable line item of that

asset's financial information. "At JBG SMITH Share" information,

which we also refer to as being "at share," "our pro rata share" or

"our share," is not, and is not intended to be, a presentation in

accordance with GAAP. Given that a portion of our assets are held

through real estate ventures, we believe this form of presentation,

which presents our economic interests in the partially owned

entities, provides investors valuable information regarding a

significant component of our portfolio, its composition,

performance and capitalization.

We do not control the unconsolidated real estate ventures and do

not have a legal claim to our co-venturers' share of assets,

liabilities, revenue and expenses. The operating agreements of the

unconsolidated real estate ventures generally allow each

co-venturer to receive cash distributions to the extent there is

available cash from operations. The amount of cash each investor

receives is based upon specific provisions of each operating

agreement and varies depending on certain factors including the

amount of capital contributed by each investor and whether any

investors are entitled to preferential distributions.

With respect to any such third-party arrangement, we would not

be in a position to exercise sole decision-making authority

regarding the property, real estate venture or other entity, and

may, under certain circumstances, be exposed to economic risks not

present were a third-party not involved. We and our respective

co-venturers may each have the right to trigger a buy-sell or

forced sale arrangement, which could cause us to sell our interest,

or acquire our co-venturers' interests, or to sell the underlying

asset, either on unfavorable terms or at a time when we otherwise

would not have initiated such a transaction. Our real estate

ventures may be subject to debt, and the repayment or refinancing

of such debt may require equity capital calls. To the extent our

co-venturers do not meet their obligations to us or our real estate

ventures or they act inconsistent with the interests of the real

estate venture, we may be adversely affected. Because of these

limitations, the non-GAAP "at JBG SMITH Share" financial

information should not be considered in isolation or as a

substitute for our financial statements as reported under GAAP.

Occupancy, non-GAAP financial measures, leverage metrics,

operating assets and operating metrics presented in our investor

package exclude our 10.0% subordinated interest in one commercial

building, our 33.5% subordinated interest in four commercial

buildings and our 49.0% interest in three commercial buildings, as

well as the associated non-recourse mortgage loans, held through

unconsolidated real estate ventures, as our investment in each real

estate venture is zero, we do not anticipate receiving any

near-term cash flow distributions from the real estate ventures,

and we have not guaranteed their obligations or otherwise committed

to providing financial support.

Non-GAAP Financial Measures

This release includes non-GAAP financial measures. For these

measures, we have provided an explanation of how these non-GAAP

measures are calculated and why JBG SMITH's management believes

that the presentation of these measures provides useful information

to investors regarding JBG SMITH's financial condition and results

of operations. Reconciliations of certain non-GAAP measures to the

most directly comparable GAAP financial measure are included in

this earnings release. Our presentation of non-GAAP financial

measures may not be comparable to similar non-GAAP measures used by

other companies. In addition to "at share" financial information,

the following non-GAAP measures are included in this release:

Earnings Before Interest, Taxes, Depreciation and

Amortization ("EBITDA"), EBITDA for Real Estate ("EBITDAre") and

"Adjusted EBITDA" are non-GAAP financial measures. EBITDA and

EBITDAre are used by management as supplemental operating

performance measures, which we believe help investors and lenders

meaningfully evaluate and compare our operating performance from

period-to-period by removing from our operating results the impact

of our capital structure (primarily interest charges from our

outstanding debt and the impact of our interest rate swaps and

caps) and certain non-cash expenses (primarily depreciation and

amortization expense on our assets). EBITDAre is computed in

accordance with the definition established by the National

Association of Real Estate Investment Trusts ("Nareit"). Nareit

defines EBITDAre as GAAP net income (loss) adjusted to exclude

interest expense, income taxes, depreciation and amortization

expense, gains and losses on sales of real estate and impairment

write-downs of certain real estate assets and investments in

entities when the impairment is directly attributable to decreases

in the value of depreciable real estate held by the entity,

including our share of such adjustments of unconsolidated real

estate ventures. These supplemental measures may help investors and

lenders understand our ability to incur and service debt and to

make capital expenditures. EBITDA and EBITDAre are not substitutes

for net income (loss) (computed in accordance with GAAP) and may

not be comparable to similarly titled measures used by other

companies.

Adjusted EBITDA represents EBITDAre adjusted for items we

believe are not representative of ongoing operating results, such

as Transaction and Other Costs, impairment write-downs of

non-depreciable real estate, gain (loss) on the

extinguishment of debt, earnings (losses) and distributions in

excess of our investment in unconsolidated real estate ventures,

lease liability adjustments, income from investments, business

interruption insurance proceeds, litigation settlement proceeds and

share-based compensation expense related to the Formation

Transaction and special equity awards. We believe that adjusting

such items not considered part of our comparable operations,

provides a meaningful measure to evaluate and compare our

performance from period-to-period.

Because EBITDA, EBITDAre and Adjusted EBITDA have limitations as

analytical tools, we use EBITDA, EBITDAre and Adjusted EBITDA to

supplement GAAP financial measures. Additionally, we believe that

users of these measures should consider EBITDA, EBITDAre and

Adjusted EBITDA in conjunction with net income (loss) and other

GAAP measures in understanding our operating results.

Funds from Operations ("FFO"), "Core FFO" and Funds Available

for Distribution ("FAD") are non-GAAP financial measures. FFO

is computed in accordance with the definition established by Nareit

in the Nareit FFO White Paper - 2018 Restatement. Nareit defines

FFO as net income (loss) (computed in accordance with GAAP),

excluding depreciation and amortization expense related to real

estate, gains and losses from the sale of certain real estate

assets, gains and losses from change in control and impairment

write-downs of certain real estate assets and investments in

entities when the impairment is directly attributable to decreases

in the value of depreciable real estate held by the entity,

including our share of such adjustments for unconsolidated real

estate ventures.

Core FFO represents FFO adjusted to exclude items which we

believe are not representative of ongoing operating results, such

as Transaction and Other Costs, impairment write-downs of

non-depreciable real estate, gain (loss) on the

extinguishment of debt, earnings (losses) and distributions in

excess of our investment in unconsolidated real estate ventures,

share-based compensation expense related to the Formation

Transaction and special equity awards, lease liability adjustments,

income from investments, business interruption insurance proceeds,

litigation settlement proceeds, amortization of the management

contracts intangible and the mark-to-market of derivative

instruments, including our share of such adjustments for

unconsolidated real estate ventures.

FAD represents Core FFO adjusted for recurring tenant

improvements, leasing commissions and other capital expenditures,

net deferred rent activity, third-party lease liability assumption

(payments) refunds, recurring share-based compensation expense,

accretion of acquired below-market leases, net of amortization of

acquired above-market leases, amortization of debt issuance costs

and other non-cash income and charges, including our share of such

adjustments for unconsolidated real estate ventures. FAD is

presented solely as a supplemental disclosure that management

believes provides useful information as it relates to our ability

to fund dividends.

We believe FFO, Core FFO and FAD are meaningful non‑GAAP

financial measures useful in comparing our levered operating

performance from period-to-period and as compared to similar real

estate companies because these non‑GAAP measures exclude real

estate depreciation and amortization expense, which implicitly

assumes that the value of real estate diminishes predictably over

time rather than fluctuating based on market conditions, and other

non-comparable income and expenses. FFO, Core FFO and FAD do not

represent cash generated from operating activities and are not

necessarily indicative of cash available to fund cash requirements

and should not be considered as an alternative to net income (loss)

(computed in accordance with GAAP) as a performance measure or cash

flow as a liquidity measure. FFO, Core FFO and FAD may not be

comparable to similarly titled measures used by other

companies.

"Net Debt" is a non-GAAP financial measurement. Net Debt

represents our total consolidated and unconsolidated indebtedness

less cash and cash equivalents at our share. Net Debt is an

important component in the calculations of Net Debt to Annualized

Adjusted EBITDA and Net Debt / total enterprise value. We believe

that Net Debt is a meaningful non-GAAP financial measure useful to

investors because we review Net Debt as part of the management of

our overall financial flexibility, capital structure and leverage.

We may utilize a considerable portion of our cash and cash

equivalents at any given time for purposes other than debt

reduction. In addition, cash and cash equivalents at our share may

not be solely controlled by us. The deduction of cash and cash

equivalents at our share from consolidated and unconsolidated

indebtedness in the calculation of Net Debt, therefore, should not

be understood to mean that it is available exclusively for debt

reduction at any given time.

Net Operating Income ("NOI") and "Annualized NOI" are

non-GAAP financial measures management uses to assess an asset's

performance. The most directly comparable GAAP measure is net

income (loss) attributable to common shareholders. We use NOI

internally as a performance measure and believe NOI provides useful

information to investors regarding our financial condition and

results of operations because it reflects only property related

revenue (which includes base rent, tenant reimbursements and other

operating revenue, net of Free Rent and payments associated with

assumed lease liabilities) less operating expenses and ground rent

for operating leases, if applicable. NOI also excludes deferred

rent, related party management fees, interest expense, and certain

other non-cash adjustments, including the accretion of acquired

below-market leases and the amortization of acquired above-market

leases and below-market ground lease intangibles. Management uses

NOI as a supplemental performance measure of our assets and

believes it provides useful information to investors because it

reflects only those revenue and expense items that are incurred at

the asset level, excluding non-cash items. In addition, NOI is

considered by many in the real estate industry to be a useful

starting point for determining the value of a real estate asset or

group of assets. However, because NOI excludes depreciation and

amortization expense and captures neither the changes in the value

of our assets that result from use or market conditions, nor the

level of capital expenditures and capitalized leasing commissions

necessary to maintain the operating performance of our assets, all

of which have real economic effect and could materially impact the

financial performance of our assets, the utility of NOI as a

measure of the operating performance of our assets is limited. NOI

presented by us may not be comparable to NOI reported by other

REITs that define these measures differently. We believe to

facilitate a clear understanding of our operating results, NOI

should be examined in conjunction with net income (loss)

attributable to common shareholders as presented in our financial

statements. NOI should not be considered as an alternative to net

income (loss) attributable to common shareholders as an indication

of our performance or to cash flows as a measure of liquidity or

our ability to make distributions. Annualized NOI represents NOI

for the three months ended June 30, 2024 multiplied by four.

Management believes Annualized NOI provides useful information in

understanding our financial performance over a 12‑month period,

however, investors and other users are cautioned against

attributing undue certainty to our calculation of Annualized NOI.

Actual NOI for any 12‑month period will depend on a number of

factors beyond our ability to control or predict, including general

capital markets and economic conditions, any bankruptcy,

insolvency, default or other failure to pay rent by one or more of

our tenants and the destruction of one or more of our assets due to

terrorist attack, natural disaster or other casualty, among others.

We do not undertake any obligation to update our calculation to

reflect events or circumstances occurring after the date of this

earnings release. There can be no assurance that the Annualized NOI

shown will reflect our actual results of operations over any

12‑month period.

Definitions

"Development Pipeline" refers to assets that have the

potential to commence construction subject to receipt of full

entitlements, completion of design and market conditions where we

(i) own land or control the land through a ground lease or (ii) are

under a long-term conditional contract to purchase, or enter into,

a leasehold interest with respect to land.

"Estimated Potential Development Density" reflects

management's estimate of developable gross square feet based on our

current business plans with respect to real estate owned or

controlled as of June 30, 2024. Our current business plans may

contemplate development of less than the maximum potential

development density for individual assets. As market conditions

change, our business plans, and therefore, the Estimated Potential

Development Density, could change accordingly. Given timing, zoning

requirements and other factors, we make no assurance that Estimated

Potential Development Density amounts will become actual density to

the extent we complete development of assets for which we have made

such estimates.

"First-generation" is a lease on space that had been

vacant for at least nine months or a lease on newly delivered

space.

"Formation Transaction" refers collectively to the

spin-off on July 17, 2017 of substantially all of the assets and

liabilities of Vornado Realty Trust's Washington, DC segment, which

operated as Vornado / Charles E. Smith, and the acquisition of the

management business and certain assets and liabilities of The JBG

Companies.

"Free Rent" means the amount of base rent and tenant

reimbursements that are abated according to the applicable lease

agreement(s).

"GAAP" means accounting principles generally accepted in

the United States of America.

"In-Service" refers to multifamily or commercial

operating assets that are at or above 90% leased or have been

operating and collecting rent for more than 12 months as of June

30, 2024.

"Non-Same Store" refers to all operating assets excluded

from the Same Store pool.

"Same Store" refers to the pool of assets that were

In-Service for the entirety of both periods being compared,

excluding assets for which significant redevelopment, renovation or

repositioning occurred during either of the periods being

compared.

"Second-generation" is a lease on space that had been

vacant for less than nine months.

"Transaction and Other Costs" include pursuit costs

related to completed, potential and pursued transactions,

demolition costs, and severance and other costs.

"Under-Construction" refers to assets that were under

construction during the three months ended June 30, 2024.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

in thousands

June 30, 2024

December 31, 2023

ASSETS

Real estate, at cost:

Land and improvements

$

1,196,065

$

1,194,737

Buildings and improvements

4,323,620

4,021,322

Construction in progress, including

land

425,653

659,103

5,945,338

5,875,162

Less: accumulated depreciation

(1,418,923

)

(1,338,403

)

Real estate, net

4,526,415

4,536,759

Cash and cash equivalents

163,536

164,773

Restricted cash

42,366

35,668

Tenant and other receivables

31,427

44,231

Deferred rent receivable

181,295

171,229

Investments in unconsolidated real estate

ventures

101,043

264,281

Deferred leasing costs, net

80,179

81,477

Intangible assets, net

52,421

56,616

Other assets, net

146,434

163,481

TOTAL ASSETS

$

5,325,116

$

5,518,515

LIABILITIES, REDEEMABLE NONCONTROLLING

INTERESTS AND EQUITY

Liabilities:

Mortgage loans, net

$

1,876,459

$

1,783,014

Revolving credit facility

40,000

62,000

Term loans, net

717,610

717,172

Accounts payable and accrued expenses

107,810

124,874

Other liabilities, net

111,982

138,869

Total liabilities

2,853,861

2,825,929

Commitments and contingencies

Redeemable noncontrolling interests

436,673

440,737

Total equity

2,034,582

2,251,849

TOTAL LIABILITIES, REDEEMABLE

NONCONTROLLING INTERESTS AND EQUITY

$

5,325,116

$

5,518,515

_____________

Note: For complete financial statements, please refer to our

Quarterly Report on Form 10-Q for the quarter ended June 30,

2024.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

in thousands, except per share data

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

REVENUE

Property rental

$

112,536

$

120,592

$

235,172

$

244,625

Third-party real estate services,

including reimbursements

17,397

22,862

35,265

45,646

Other revenue

5,387

8,641

10,067

14,786

Total revenue

135,320

152,095

280,504

305,057

EXPENSES

Depreciation and amortization

51,306

49,218

108,161

102,649

Property operating

36,254

35,912

71,533

71,524

Real estate taxes

14,399

14,424

28,194

29,648

General and administrative:

Corporate and other

17,001

15,093

31,974

31,216

Third-party real estate services

18,650

22,105

40,977

45,928

Share-based compensation related to

Formation Transaction and special equity awards

—

—

—

351

Transaction and other costs

824

3,492

2,338

5,964

Total expenses

138,434

140,244

283,177

287,280

OTHER INCOME (EXPENSE)

Income (loss) from unconsolidated real

estate ventures, net

(226

)

510

749

943

Interest and other income, net

3,432

2,281

5,532

6,358

Interest expense

(31,973

)

(25,835

)

(62,133

)

(52,677

)

Gain on the sale of real estate, net

89

—

286

40,700

Loss on the extinguishment of debt

—

(450

)

—

(450

)

Impairment loss

(1,025

)

—

(18,236

)

—

Total other income (expense)

(29,703

)

(23,494

)

(73,802

)

(5,126

)

INCOME (LOSS) BEFORE INCOME TAX (EXPENSE)

BENEFIT

(32,817

)

(11,643

)

(76,475

)

12,651

Income tax (expense) benefit

(597

)

(611

)

871

(595

)

NET INCOME (LOSS)

(33,414

)

(12,254

)

(75,604

)

12,056

Net (income) loss attributable to

redeemable noncontrolling interests

3,454

1,398

7,988

(1,965

)

Net loss attributable to noncontrolling

interests

5,587

311

10,967

535

NET INCOME (LOSS) ATTRIBUTABLE TO

COMMON SHAREHOLDERS

$

(24,373

)

$

(10,545

)

$

(56,649

)

$

10,626

EARNINGS (LOSS) PER COMMON SHARE - BASIC

AND DILUTED

$

(0.27

)

$

(0.10

)

$

(0.63

)

$

0.09

WEIGHTED AVERAGE NUMBER OF COMMON SHARES

OUTSTANDING - BASIC AND DILUTED

91,030

109,695

91,832

111,862

_____________

Note: For complete financial statements, please refer to our

Quarterly Report on Form 10-Q for the quarter ended June 30,

2024.

EBITDA, EBITDAre AND ADJUSTED

EBITDA RECONCILIATIONS (NON-GAAP)

(Unaudited)

dollars in thousands

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

EBITDA, EBITDAre and Adjusted

EBITDA

Net income (loss)

$

(33,414

)

$

(12,254

)

$

(75,604

)

$

12,056

Depreciation and amortization expense

51,306

49,218

108,161

102,649

Interest expense

31,973

25,835

62,133

52,677

Income tax expense (benefit)

597

611

(871

)

595

Unconsolidated real estate ventures

allocated share of above adjustments

1,830

4,618

4,382

8,282

EBITDA attributable to noncontrolling

interests

—

(32

)

—

(2

)

EBITDA

$

52,292

$

67,996

$

98,201

$

176,257

Gain on the sale of real estate, net

(89

)

—

(286

)

(40,700

)

Gain on the sale of unconsolidated real

estate assets

—

—

(480

)

—

EBITDAre

$

52,203

$

67,996

$

97,435

$

135,557

Transaction and other costs, net of

noncontrolling interests (1)

824

3,492

2,338

5,964

(Income) loss from investments, net

(614

)

526

(672

)

(1,335

)

Impairment loss related to non-depreciable

real estate

1,025

—

18,236

—

Loss on the extinguishment of debt

—

450

—

450

Share-based compensation related to

Formation Transaction and special equity awards

—

—

—

351

Earnings and distributions in excess of

our investment in unconsolidated real estate venture

(458

)

(341

)

(671

)

(508

)

Lease liability adjustments

—

(154

)

—

(154

)

Unconsolidated real estate ventures

allocated share of above adjustments

—

—

—

2

Adjusted EBITDA

$

52,980

$

71,969

$

116,666

$

140,327

Net Debt to Annualized Adjusted EBITDA

(2)

11.9

x

8.3

x

10.8

x

8.5

x

June 30, 2024

June 30, 2023

Net Debt (at JBG SMITH Share)

Consolidated indebtedness (3)

$

2,625,329

$

2,454,311

Unconsolidated indebtedness (3)

66,553

87,886

Total consolidated and unconsolidated

indebtedness

2,691,882

2,542,197

Less: cash and cash equivalents

169,278

165,834

Net Debt (at JBG SMITH Share)

$

2,522,604

$

2,376,363

_____________

Note: All EBITDA measures as shown above are attributable to

common limited partnership units ("OP Units") and certain fully

vested incentive equity awards that may be convertible into OP

Units.

(1)

Includes pursuit costs related to

completed, potential and pursued transactions, demolition costs,

severance and other costs.

(2)

Quarterly Adjusted EBITDA is annualized by

multiplying by four. Adjusted EBITDA for the six months ended June

30, 2024 and 2023 is annualized by multiplying by two.

(3)

Net of premium/discount and deferred

financing costs.

FFO, CORE FFO AND FAD

RECONCILIATIONS (NON-GAAP)

(Unaudited)

in thousands, except per share data

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

FFO and Core FFO

Net income (loss) attributable to common

shareholders

$

(24,373

)

$

(10,545

)

$

(56,649

)

$

10,626

Net income (loss) attributable to

redeemable noncontrolling interests

(3,454

)

(1,398

)

(7,988

)

1,965

Net loss attributable to noncontrolling

interests

(5,587

)

(311

)

(10,967

)

(535

)

Net income (loss)

(33,414

)

(12,254

)

(75,604

)

12,056

Gain on the sale of real estate, net of

tax

(89

)

—

(1,498

)

(40,700

)

Gain on the sale of unconsolidated real

estate assets

—

—

(480

)

—

Real estate depreciation and

amortization

49,631

47,502

104,818

99,113

Pro rata share of real estate depreciation

and amortization from unconsolidated real estate ventures

799

3,111

2,290

5,871

FFO attributable to noncontrolling

interests

—

311

—

535

FFO Attributable to OP Units

$

16,927

$

38,670

$

29,526

$

76,875

FFO attributable to redeemable

noncontrolling interests

(2,592

)

(5,247

)

(4,513

)

(10,450

)

FFO Attributable to Common

Shareholders

$

14,335

$

33,423

$

25,013

$

66,425

FFO attributable to OP Units

$

16,927

$

38,670

$

29,526

$

76,875

Transaction and other costs, net of tax

and noncontrolling interests (1)

840

3,337

1,984

5,710

(Income) loss from investments, net of

tax

(465

)

404

(509

)

(1,001

)

Impairment loss related to non-depreciable

real estate

1,025

—

18,236

—

Loss from mark-to-market on derivative

instruments, net of noncontrolling interests

28

2,601

70

5,142

Loss on the extinguishment of debt

—

450

—

450

Earnings and distributions in excess of

our investment in unconsolidated real estate venture

(458

)

(341

)

(671

)

(508

)

Share-based compensation related to

Formation Transaction and special equity awards

—

—

—

351

Lease liability adjustments

—

(154

)

—

(154

)

Amortization of management contracts

intangible, net of tax

1,065

1,024

2,119

2,130

Unconsolidated real estate ventures

allocated share of above adjustments

—

5

—

41

Core FFO Attributable to OP

Units

$

18,962

$

45,996

$

50,755

$

89,036

Core FFO attributable to redeemable

noncontrolling interests

(2,904

)

(6,241

)

(7,753

)

(12,103

)

Core FFO Attributable to Common

Shareholders

$

16,058

$

39,755

$

43,002

$

76,933

FFO per common share - diluted

$

0.16

$

0.30

$

0.27

$

0.59

Core FFO per common share - diluted

$

0.18

$

0.36

$

0.47

$

0.69

Weighted average shares - diluted (FFO and

Core FFO)

91,154

109,708

91,989

111,868

See footnotes under table below.

FFO, CORE FFO AND FAD

RECONCILIATIONS (NON-GAAP)

(Unaudited)

in thousands, except per share data

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

FAD

Core FFO attributable to OP Units

$

18,962

$

45,996

$

50,755

$

89,036

Recurring capital expenditures and

Second-generation tenant improvements and leasing commissions

(2)

(12,095

)

(11,602

)

(21,130

)

(19,396

)

Straight-line and other rent adjustments

(3)

(2,509

)

(6,311

)

(3,939

)

(14,688

)

Third-party lease liability assumption

(payments) refunds

(25

)

(25

)

(25

)

70

Share-based compensation expense

10,864

9,137

20,243

18,485

Amortization of debt issuance costs

4,031

1,343

7,933

2,650

Unconsolidated real estate ventures

allocated share of above adjustments

201

641

660

1,043

Non-real estate depreciation and

amortization

299

341

593

696

FAD available to OP Units (A)

$

19,728

$

39,520

$

55,090

$

77,896

Distributions to common shareholders and

unitholders (B)

$

19,012

$

27,684

$

38,010

$

57,303

FAD Payout Ratio (B÷A) (4)

96.4

%

70.1

%

69.0

%

73.6

%

Capital Expenditures

Maintenance and recurring capital

expenditures

$

4,362

$

4,707

$

5,557

$

7,680

Share of maintenance and recurring capital

expenditures from unconsolidated real estate ventures

14

35

16

35

Second-generation tenant improvements and

leasing commissions

7,719

6,805

15,536

11,547

Share of Second-generation tenant

improvements and leasing commissions from unconsolidated real

estate ventures

—

55

21

134

Recurring capital expenditures and

Second-generation tenant improvements and leasing commissions

12,095

11,602

21,130

19,396

Non-recurring capital expenditures

3,268

10,904

6,790

20,597

Share of non-recurring capital

expenditures from unconsolidated real estate ventures

14

3

28

5

First-generation tenant improvements and

leasing commissions

2,322

4,174

5,217

7,299

Share of First-generation tenant

improvements and leasing commissions from unconsolidated real

estate ventures

36

240

87

553

Non-recurring capital expenditures

5,640

15,321

12,122

28,454

Total JBG SMITH Share of Capital

Expenditures

$

17,735

$

26,923

$

33,252

$

47,850

_____________

(1)

Includes pursuit costs related to

completed, potential and pursued transactions, demolition costs,

severance and other costs.

(2)

Includes amounts, at JBG SMITH Share,

related to unconsolidated real estate ventures.

(3)

Includes straight-line rent, above/below

market lease amortization and lease incentive amortization.

(4)

The FAD payout ratio is not necessarily

indicative of an amount for the full year due to fluctuation in the

timing of capital expenditures, the commencement of new leases and

the seasonality of our operations.

NOI RECONCILIATIONS

(NON-GAAP)

(Unaudited)

dollars in thousands

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss) attributable to common

shareholders

$

(24,373

)

$

(10,545

)

$

(56,649

)

$

10,626

Net income (loss) attributable to

redeemable noncontrolling interests

(3,454

)

(1,398

)

(7,988

)

1,965

Net loss attributable to noncontrolling

interests

(5,587

)

(311

)

(10,967

)

(535

)

Net income (loss)

(33,414

)

(12,254

)

(75,604

)

12,056

Add:

Depreciation and amortization expense

51,306

49,218

108,161

102,649

General and administrative expense:

Corporate and other

17,001

15,093

31,974

31,216

Third-party real estate services

18,650

22,105

40,977

45,928

Share-based compensation related to

Formation Transaction and special equity awards

—

—

—

351

Transaction and other costs

824

3,492

2,338

5,964

Interest expense

31,973

25,835

62,133

52,677

Loss on the extinguishment of debt

—

450

—

450

Impairment loss

1,025

—

18,236

—

Income tax expense (benefit)

597

611

(871

)

595

Less:

Third-party real estate services,

including reimbursements revenue

17,397

22,862

35,265

45,646

Other revenue

2,126

3,846

13,389

5,572

Income (loss) from unconsolidated real

estate ventures, net

(226

)

510

749

943

Interest and other income, net

3,432

2,281

5,532

6,358

Gain on the sale of real estate, net

89

—

286

40,700

Consolidated NOI

65,144

75,051

132,123

152,667

NOI attributable to unconsolidated real

estate ventures at our share

1,168

5,175

4,215

9,604

Non-cash rent adjustments (1)

(2,509

)

(6,311

)

(3,939

)

(14,688

)

Other adjustments (2)

5,450

5,163

10,684

12,008

Total adjustments

4,109

4,027

10,960

6,924

NOI

$

69,253

$

79,078

$

143,083

$

159,591

Less: out-of-service NOI loss (3)

(2,341

)

(902

)

(5,374

)

(1,611

)

Operating Portfolio NOI

$

71,594

$

79,980

$

148,457

$

161,202

Non-Same Store NOI (4)

225

10,853

3,389

23,317

Same Store NOI (5)

$

71,369

$

69,127

$

145,068

$

137,885

Change in Same Store NOI

3.2

%

5.2

%

Number of properties in Same Store

pool

40

40

_____________

(1)

Adjustment to exclude straight-line rent,

above/below market lease amortization and lease incentive

amortization.

(2)

Adjustment to include other revenue and

payments associated with assumed lease liabilities related to

operating properties and to exclude commercial lease termination

revenue and related party management fees.

(3)

Includes the results of our

Under-Construction assets and assets in the Development

Pipeline.

(4)

Includes the results of properties that

were not In-Service for the entirety of both periods being

compared, including disposed properties, and properties for which

significant redevelopment, renovation or repositioning occurred

during either of the periods being compared.

(5)

Includes the results of the properties

that are owned, operated and In-Service for the entirety of both

periods being compared.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730384942/en/

Kevin Connolly Executive Vice President, Portfolio Management

& Investor Relations (240) 333‑3837 kconnolly@jbgsmith.com

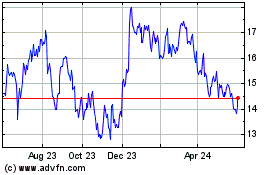

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

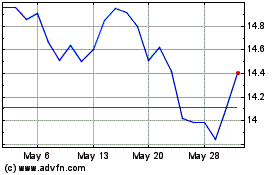

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Jan 2024 to Jan 2025