JBG SMITH (NYSE: JBGS), a leading owner and developer of

high-quality, mixed-use properties in the Washington, DC market,

today filed its Form 10-Q for the quarter ended September 30, 2024

and reported its financial results.

Additional information regarding our results of operations,

properties, and tenants can be found in our Third Quarter 2024

Investor Package, which is posted in the Investor Relations section

of our website at www.jbgsmith.com. We encourage investors to

consider the information presented here with the information in

that document.

Third Quarter 2024 Highlights

- Net loss, Funds From Operations ("FFO") and Core FFO

attributable to common shareholders were:

THIRD QUARTER AND YEAR-TO-DATE

COMPARISON

in millions, except per share amounts

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Amount

Per Diluted

Share

Amount

Per Diluted

Share

Amount

Per Diluted

Share

Amount

Per Diluted

Share

Net loss (1) (2)

$

(27.0

)

$

(0.32

)

$

(58.0

)

$

(0.58

)

$

(83.6

)

$

(0.95

)

$

(47.4

)

$

(0.45

)

FFO (2)

$

19.5

$

0.23

$

40.1

$

0.40

$

44.5

$

0.50

$

106.5

$

0.98

Core FFO

$

19.3

$

0.23

$

41.0

$

0.40

$

62.3

$

0.69

$

118.0

$

1.09

_____________

(1)

Includes loss on the sale of real estate

of $5.4 million and $5.1 million for the three and nine months

ended September 30, 2024. Includes gain on the sale of real estate

of $41.6 million for the nine months ended September 30, 2023.

Includes impairment loss of $59.3 million related to real estate

assets, and impairment losses recorded by our unconsolidated real

estate ventures, of which our proportionate share was $3.3 million,

for the three and nine months ended September 30, 2023.

(2)

Includes impairment loss of $18.2 million

related to non-depreciable real estate assets for the nine months

ended September 30, 2024.

- Annualized Net Operating Income ("NOI") for the three months

ended September 30, 2024 was $282.4 million, compared to $286.4

million for the three months ended June 30, 2024, at our share.

Excluding the assets that were sold or taken out of service,

Annualized NOI for the three months ended September 30, 2024 was

$278.1 million, compared to $278.4 million for the three months

ended June 30, 2024, at our share.

- The decrease in Annualized NOI excluding the assets that were

sold or taken out of service was substantially attributable to (i)

tenant vacates, partially offset by lower real estate tax expense

as a result of successful appeals in our commercial portfolio; and

(ii) transitioning The Grace and Reva into the operating portfolio,

partially offset by higher concessions at certain assets in our

multifamily portfolio.

- Same Store NOI ("SSNOI") at our share increased 0.5%

quarter-over-quarter to $68.6 million for the three months ended

September 30, 2024.

- The increase in SSNOI was substantially attributable to (i)

higher rents and occupancy and lower concessions, partially offset

by higher operating expenses in our multifamily portfolio; and (ii)

lower occupancy and recovery revenue in our commercial portfolio,

partially offset by lower real estate taxes.

Operating Portfolio

- The operating multifamily portfolio was 92.7% leased and 90.6%

occupied as of September 30, 2024, compared to 96.9% and 94.3% as

of June 30, 2024. Our operating In-Service multifamily portfolio

was 97.0% leased and 95.7% occupied as of September 30, 2024,

compared to 96.9% and 94.3% as of June 30, 2024.

- In our Same Store multifamily portfolio, we increased effective

rents by 4.5% for new leases and 6.1% upon renewal for third

quarter lease expirations while achieving a 60.0% renewal

rate.

- The operating commercial portfolio was 80.7% leased and 79.1%

occupied as of September 30, 2024, compared to 82.3% and 80.6% as

of June 30, 2024, at our share.

- Executed approximately 150,000 square feet of office leases at

our share during the three months ended September 30, 2024,

including approximately 46,000 square feet of new leases.

Second-generation leases generated a 1.2% rental rate increase on a

cash basis and an 8.4% rental rate increase on a GAAP basis.

- Executed approximately 496,000 square feet of office leases at

our share during the nine months ended September 30, 2024,

including approximately 241,000 square feet of new leases.

Second-generation leases generated a 1.5% rental rate increase on a

cash basis and a 9.6% rental rate increase on a GAAP basis.

Development Portfolio

Under-Construction

- As of September 30, 2024, we had one multifamily asset under

construction consisting of 775 units at our share.

- In the second quarter, The Grace and Reva (formerly known

collectively as 1900 Crystal Drive) were placed into the operating

multifamily portfolio as recently delivered.

Development Pipeline

- As of September 30, 2024, we had 18 assets in the development

pipeline consisting of 9.3 million square feet of estimated

potential development density at our share.

Third-Party Asset Management and Real Estate Services

Business

- For the three months ended September 30, 2024, revenue from

third-party real estate services, including reimbursements, was

$17.1 million. Excluding reimbursements and service revenue from

our interests in real estate ventures, revenue from our third-party

asset management and real estate services business was $8.3

million, primarily driven by $5.0 million of property and asset

management fees, $1.6 million of other service revenue and $1.0

million of leasing fees.

Balance Sheet

- As of September 30, 2024, our total enterprise value was

approximately $4.3 billion, comprising 98.4 million common shares

and units valued at $1.7 billion, and debt (net of premium /

(discount) and deferred financing costs) at our share of $2.7

billion, less cash and cash equivalents at our share of $141.7

million.

- As of September 30, 2024, we had $137.0 million of cash and

cash equivalents ($141.7 million of cash and cash equivalents at

our share), and $644.3 million of availability under our revolving

credit facility.

- Net Debt to annualized Adjusted EBITDA at our share for the

three months ended September 30, 2024 was 10.6x, and our Net Debt /

total enterprise value was 59.6% as of September 30, 2024.

Investing and Financing Activities

- In September 2024, we sold Fort Totten Square, a multifamily

asset with 345 units and 130,664 square feet of retail space in

Washington, DC, for $86.8 million.

- In September 2024, we repaid the $83.3 million mortgage loan

collateralized by 201 12th Street S., 200 12th Street S. and 251

18th Street S.

- In September 2024, we extended the maturity date of the $200.0

million Tranche A-1 Term Loan by one year to January 2026. The

Tranche A-1 Term Loan has an additional one-year extension option

that would extend the maturity date to January 2027.

- We repurchased and retired 3.1 million common shares for $50.2

million, a weighted average purchase price per share of

$16.23.

Dividends

- On October 24, 2024, our Board of Trustees declared a quarterly

dividend of $0.175 per common share, payable on November 22, 2024

to shareholders of record as of November 7, 2024.

About JBG SMITH

JBG SMITH owns, operates, invests in, and develops mixed-use

properties in high growth and high barrier-to-entry submarkets in

and around Washington, DC, most notably National Landing. Through

an intense focus on placemaking, JBG SMITH cultivates vibrant,

amenity-rich, walkable neighborhoods throughout the Washington, DC

metropolitan area. Approximately 75.0% of JBG SMITH's holdings are

in the National Landing submarket in Northern Virginia, which is

anchored by four key demand drivers: Amazon's new headquarters;

Virginia Tech's under-construction $1 billion Innovation Campus;

the submarket’s proximity to the Pentagon; and our retail and

digital placemaking initiatives and public infrastructure

improvements. JBG SMITH's dynamic portfolio currently comprises

13.1 million square feet of high-growth multifamily, office and

retail assets at share, 98% of which are Metro-served. It also

maintains a development pipeline encompassing 9.3 million square

feet of mixed-use, primarily multifamily, development

opportunities. JBG SMITH is committed to the operation and

development of green, smart, and healthy buildings and plans to

maintain carbon neutral operations annually. For more information

on JBG SMITH please visit www.jbgsmith.com.

Forward-Looking Statements

Certain statements contained herein may constitute

"forward-looking statements" as such term is defined in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are not guarantees of performance. They represent our

intentions, plans, expectations and beliefs and are subject to

numerous assumptions, risks and uncertainties. Consequently, the

future results, financial condition and business of JBG SMITH

Properties ("JBG SMITH," the "Company," "we," "us," "our" or

similar terms) may differ materially from those expressed in these

forward-looking statements. You can find many of these statements

by looking for words such as "approximate," "hypothetical,"

"potential," "believes," "expects," "anticipates," "estimates,"

"intends," "plans," "would," "may" or similar expressions in this

earnings release. We also note the following forward-looking

statements: whether in the case of our under-construction assets

and assets in the development pipeline, estimated square feet,

estimated number of units and estimated potential development

density are accurate; expected timing, completion, modifications

and delivery dates for the projects we are developing; the ability

of any or all of our demand drivers to materialize and their effect

on economic impact, job growth, expansion of public transportation

and related demand in the National Landing submarket; planned

infrastructure and educational improvements related to Amazon's

additional headquarters and the Virginia Tech Innovation Campus;

our development plans related to National Landing; and our plans to

maintain carbon neutral operations annually.

Many of the factors that will determine the outcome of these and

our other forward-looking statements are beyond our ability to

control or predict. These factors include, among others: adverse

economic conditions in the Washington, DC metropolitan area, the

timing of and costs associated with development and property

improvements, financing commitments, and general competitive

factors. For further discussion of factors that could materially

affect the outcome of our forward-looking statements and other

risks and uncertainties, see "Risk Factors," "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" and the Cautionary Statement Concerning Forward-Looking

Statements in the Company's Annual Report on Form 10‑K for the year

ended December 31, 2023 and other periodic reports the Company

files with the Securities and Exchange Commission. For these

statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. You are cautioned not to place undue

reliance on our forward-looking statements. All subsequent written

and oral forward-looking statements attributable to us or any

person acting on our behalf are expressly qualified in their

entirety by the cautionary statements contained or referred to in

this section. We do not undertake any obligation to release

publicly any revisions to our forward-looking statements to reflect

events or circumstances occurring after the date hereof.

Pro Rata Information

We present certain financial information and metrics in this

release "at JBG SMITH Share," which refers to our ownership

percentage of consolidated and unconsolidated assets in real estate

ventures (collectively, "real estate ventures") as applied to these

financial measures and metrics. Financial information "at JBG SMITH

Share" is calculated on an asset-by-asset basis by applying our

percentage economic interest to each applicable line item of that

asset's financial information. "At JBG SMITH Share" information,

which we also refer to as being "at share," "our pro rata share" or

"our share," is not, and is not intended to be, a presentation in

accordance with GAAP. Given that a portion of our assets are held

through real estate ventures, we believe this form of presentation,

which presents our economic interests in the partially owned

entities, provides investors valuable information regarding a

significant component of our portfolio, its composition,

performance and capitalization.

We do not control the unconsolidated real estate ventures and do

not have a legal claim to our co-venturers' share of assets,

liabilities, revenue and expenses. The operating agreements of the

unconsolidated real estate ventures generally allow each

co-venturer to receive cash distributions to the extent there is

available cash from operations. The amount of cash each investor

receives is based upon specific provisions of each operating

agreement and varies depending on certain factors including the

amount of capital contributed by each investor and whether any

investors are entitled to preferential distributions.

With respect to any such third-party arrangement, we would not

be in a position to exercise sole decision-making authority

regarding the property, real estate venture or other entity, and

may, under certain circumstances, be exposed to economic risks not

present were a third-party not involved. We and our respective

co-venturers may each have the right to trigger a buy-sell or

forced sale arrangement, which could cause us to sell our interest,

or acquire our co-venturers' interests, or to sell the underlying

asset, either on unfavorable terms or at a time when we otherwise

would not have initiated such a transaction. Our real estate

ventures may be subject to debt, and the repayment or refinancing

of such debt may require equity capital calls. To the extent our

co-venturers do not meet their obligations to us or our real estate

ventures or they act inconsistent with the interests of the real

estate venture, we may be adversely affected. Because of these

limitations, the non-GAAP "at JBG SMITH Share" financial

information should not be considered in isolation or as a

substitute for our financial statements as reported under GAAP.

Occupancy, non-GAAP financial measures, leverage metrics,

operating assets and operating metrics presented in our investor

package exclude our 10.0% subordinated interest in one commercial

building, our 33.5% subordinated interest in four commercial

buildings and our 49.0% interest in three commercial buildings, as

well as the associated non-recourse mortgage loans, held through

unconsolidated real estate ventures, as our investment in each real

estate venture is zero, we do not anticipate receiving any

near-term cash flow distributions from the real estate ventures,

and we have not guaranteed their obligations or otherwise committed

to providing financial support.

Non-GAAP Financial Measures

This release includes non-GAAP financial measures. For these

measures, we have provided an explanation of how these non-GAAP

measures are calculated and why JBG SMITH's management believes

that the presentation of these measures provides useful information

to investors regarding JBG SMITH's financial condition and results

of operations. Reconciliations of certain non-GAAP measures to the

most directly comparable GAAP financial measure are included in

this earnings release. Our presentation of non-GAAP financial

measures may not be comparable to similar non-GAAP measures used by

other companies. In addition to "at share" financial information,

the following non-GAAP measures are included in this release:

Earnings Before Interest, Taxes, Depreciation and

Amortization ("EBITDA"), EBITDA for Real Estate ("EBITDAre") and

"Adjusted EBITDA" are non-GAAP financial measures. EBITDA and

EBITDAre are used by management as supplemental operating

performance measures, which we believe help investors and lenders

meaningfully evaluate and compare our operating performance from

period-to-period by removing from our operating results the impact

of our capital structure (primarily interest charges from our

outstanding debt and the impact of our interest rate swaps and

caps) and certain non-cash expenses (primarily depreciation and

amortization expense on our assets). EBITDAre is computed in

accordance with the definition established by the National

Association of Real Estate Investment Trusts ("Nareit"). Nareit

defines EBITDAre as GAAP net income (loss) adjusted to exclude

interest expense, income taxes, depreciation and amortization

expense, gains and losses on sales of real estate and impairment

write-downs of certain real estate assets and investments in

entities when the impairment is directly attributable to decreases

in the value of depreciable real estate held by the entity,

including our share of such adjustments for unconsolidated real

estate ventures. These supplemental measures may help investors and

lenders understand our ability to incur and service debt and to

make capital expenditures. EBITDA and EBITDAre are not substitutes

for net income (loss) (computed in accordance with GAAP) and may

not be comparable to similarly titled measures used by other

companies.

Adjusted EBITDA represents EBITDAre adjusted for items we

believe are not representative of ongoing operating results, such

as Transaction and Other Costs, impairment write-downs of

non-depreciable real estate, gain (loss) on the

extinguishment of debt, earnings (losses) and distributions in

excess of our investment in unconsolidated real estate ventures,

lease liability adjustments, income from investments, business

interruption insurance proceeds, litigation settlement proceeds and

share-based compensation expense related to the Formation

Transaction and special equity awards. We believe that adjusting

such items not considered part of our comparable operations,

provides a meaningful measure to evaluate and compare our

performance from period-to-period.

Because EBITDA, EBITDAre and Adjusted EBITDA have limitations as

analytical tools, we use EBITDA, EBITDAre and Adjusted EBITDA to

supplement GAAP financial measures. Additionally, we believe that

users of these measures should consider EBITDA, EBITDAre and

Adjusted EBITDA in conjunction with net income (loss) and other

GAAP measures in understanding our operating results.

Funds from Operations ("FFO"), "Core FFO" and Funds Available

for Distribution ("FAD") are non-GAAP financial measures. FFO

is computed in accordance with the definition established by Nareit

in the Nareit FFO White Paper - 2018 Restatement. Nareit defines

FFO as net income (loss) (computed in accordance with GAAP),

excluding depreciation and amortization expense related to real

estate, gains and losses from the sale of certain real estate

assets, gains and losses from change in control and impairment

write-downs of certain real estate assets and investments in

entities when the impairment is directly attributable to decreases

in the value of depreciable real estate held by the entity,

including our share of such adjustments for unconsolidated real

estate ventures.

Core FFO represents FFO adjusted to exclude items which we

believe are not representative of ongoing operating results, such

as Transaction and Other Costs, impairment write-downs of

non-depreciable real estate, gain (loss) on the

extinguishment of debt, earnings (losses) and distributions in

excess of our investment in unconsolidated real estate ventures,

share-based compensation expense related to the Formation

Transaction and special equity awards, lease liability adjustments,

income from investments, business interruption insurance proceeds,

litigation settlement proceeds, amortization of the management

contracts intangible and the mark-to-market of derivative

instruments, including our share of such adjustments for

unconsolidated real estate ventures.

FAD represents Core FFO adjusted for recurring tenant

improvements, leasing commissions and other capital expenditures,

net deferred rent activity, third-party lease liability assumption

(payments) refunds, recurring share-based compensation expense,

accretion of acquired below-market leases, net of amortization of

acquired above-market leases, amortization of debt issuance costs

and other non-cash income and charges, including our share of such

adjustments for unconsolidated real estate ventures. FAD is

presented solely as a supplemental disclosure that management

believes provides useful information as it relates to our ability

to fund dividends.

We believe FFO, Core FFO and FAD are meaningful non‑GAAP

financial measures useful in comparing our levered operating

performance from period-to-period and as compared to similar real

estate companies because these non‑GAAP measures exclude real

estate depreciation and amortization expense, which implicitly

assumes that the value of real estate diminishes predictably over

time rather than fluctuating based on market conditions, and other

non-comparable income and expenses. FFO, Core FFO and FAD do not

represent cash generated from operating activities and are not

necessarily indicative of cash available to fund cash requirements

and should not be considered as an alternative to net income (loss)

(computed in accordance with GAAP) as a performance measure or cash

flow as a liquidity measure. FFO, Core FFO and FAD may not be

comparable to similarly titled measures used by other

companies.

"Net Debt" is a non-GAAP financial measurement. Net Debt

represents our total consolidated and unconsolidated indebtedness

less cash and cash equivalents at our share. Net Debt is an

important component in the calculations of Net Debt to Annualized

Adjusted EBITDA and Net Debt / total enterprise value. We believe

that Net Debt is a meaningful non-GAAP financial measure useful to

investors because we review Net Debt as part of the management of

our overall financial flexibility, capital structure and leverage.

We may utilize a considerable portion of our cash and cash

equivalents at any given time for purposes other than debt

reduction. In addition, cash and cash equivalents at our share may

not be solely controlled by us. The deduction of cash and cash

equivalents at our share from consolidated and unconsolidated

indebtedness in the calculation of Net Debt, therefore, should not

be understood to mean that it is available exclusively for debt

reduction at any given time.

Net Operating Income ("NOI") and "Annualized NOI" are

non-GAAP financial measures management uses to assess an asset's

performance. The most directly comparable GAAP measure is net

income (loss) attributable to common shareholders. We use NOI

internally as a performance measure and believe NOI provides useful

information to investors regarding our financial condition and

results of operations because it reflects only property related

revenue (which includes base rent, tenant reimbursements and other

operating revenue, net of Free Rent and payments associated with

assumed lease liabilities) less operating expenses and ground rent

for operating leases, if applicable. NOI also excludes deferred

rent, related party management fees, interest expense, and certain

other non-cash adjustments, including the accretion of acquired

below-market leases and the amortization of acquired above-market

leases and below-market ground lease intangibles. Management uses

NOI as a supplemental performance measure of our assets and

believes it provides useful information to investors because it

reflects only those revenue and expense items that are incurred at

the asset level, excluding non-cash items. In addition, NOI is

considered by many in the real estate industry to be a useful

starting point for determining the value of a real estate asset or

group of assets. However, because NOI excludes depreciation and

amortization expense and captures neither the changes in the value

of our assets that result from use or market conditions, nor the

level of capital expenditures and capitalized leasing commissions

necessary to maintain the operating performance of our assets, all

of which have real economic effect and could materially impact the

financial performance of our assets, the utility of NOI as a

measure of the operating performance of our assets is limited. NOI

presented by us may not be comparable to NOI reported by other real

estate investment trusts that define these measures differently. We

believe to facilitate a clear understanding of our operating

results, NOI should be examined in conjunction with net income

(loss) attributable to common shareholders as presented in our

financial statements. NOI should not be considered as an

alternative to net income (loss) attributable to common

shareholders as an indication of our performance or to cash flows

as a measure of liquidity or our ability to make distributions.

Annualized NOI represents NOI for the three months ended September

30, 2024 multiplied by four. Management believes Annualized NOI

provides useful information in understanding our financial

performance over a 12‑month period, however, investors and other

users are cautioned against attributing undue certainty to our

calculation of Annualized NOI. Actual NOI for any 12‑month period

will depend on a number of factors beyond our ability to control or

predict, including general capital markets and economic conditions,

any bankruptcy, insolvency, default or other failure to pay rent by

one or more of our tenants and the destruction of one or more of

our assets due to terrorist attack, natural disaster or other

casualty, among others. We do not undertake any obligation to

update our calculation to reflect events or circumstances occurring

after the date of this earnings release. There can be no assurance

that the Annualized NOI shown will reflect our actual results of

operations over any 12‑month period.

Definitions

"Development Pipeline" refers to assets that have the

potential to commence construction subject to receipt of full

entitlements, completion of design and market conditions where we

(i) own land or control the land through a ground lease or (ii) are

under a long-term conditional contract to purchase, or enter into,

a leasehold interest with respect to land.

"Estimated Potential Development Density" reflects

management's estimate of developable gross square feet based on our

current business plans with respect to real estate owned or

controlled as of September 30, 2024. Our current business plans may

contemplate development of less than the maximum potential

development density for individual assets. As market conditions

change, our business plans, and therefore, the Estimated Potential

Development Density, could change accordingly. Given timing, zoning

requirements and other factors, we make no assurance that Estimated

Potential Development Density amounts will become actual density to

the extent we complete development of assets for which we have made

such estimates.

"First-generation" is a lease on space that had been

vacant for at least nine months or a lease on newly delivered

space.

"Formation Transaction" refers collectively to the

spin-off on July 17, 2017 of substantially all of the assets and

liabilities of Vornado Realty Trust's Washington, DC segment, which

operated as Vornado / Charles E. Smith, and the acquisition of the

management business and certain assets and liabilities of The JBG

Companies.

"Free Rent" means the amount of base rent and tenant

reimbursements that are abated according to the applicable lease

agreement(s).

"GAAP" means accounting principles generally accepted in

the United States of America.

"In-Service" refers to multifamily or commercial

operating assets that are at or above 90% leased or have been

operating and collecting rent for more than 12 months as of

September 30, 2024.

"Non-Same Store" refers to all operating assets excluded

from the Same Store pool.

"Same Store" refers to the pool of assets that were

In-Service for the entirety of both periods being compared,

excluding assets for which significant redevelopment, renovation or

repositioning occurred during either of the periods being

compared.

"Second-generation" is a lease on space that had been

vacant for less than nine months.

"Transaction and Other Costs" include costs related to

completed, potential and pursued transactions, demolition costs,

and severance and other costs.

"Under-Construction" refers to assets that were under

construction during the three months ended September 30, 2024.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

in thousands

September 30, 2024

December 31, 2023

ASSETS

Real estate, at cost:

Land and improvements

$

1,171,458

$

1,194,737

Buildings and improvements

4,243,690

4,021,322

Construction in progress, including

land

443,908

659,103

5,859,056

5,875,162

Less: accumulated depreciation

(1,429,079

)

(1,338,403

)

Real estate, net

4,429,977

4,536,759

Cash and cash equivalents

136,983

164,773

Restricted cash

33,161

35,668

Tenant and other receivables

30,734

44,231

Deferred rent receivable

185,221

171,229

Investments in unconsolidated real estate

ventures

100,682

264,281

Deferred leasing costs, net

78,171

81,477

Intangible assets, net

49,045

56,616

Other assets, net

138,503

163,481

TOTAL ASSETS

$

5,182,477

$

5,518,515

LIABILITIES, REDEEMABLE NONCONTROLLING

INTERESTS AND EQUITY

Liabilities:

Mortgage loans, net

$

1,816,156

$

1,783,014

Revolving credit facility

90,000

62,000

Term loans, net

717,578

717,172

Accounts payable and accrued expenses

99,773

124,874

Other liabilities, net

118,373

138,869

Total liabilities

2,841,880

2,825,929

Commitments and contingencies

Redeemable noncontrolling interests

444,945

440,737

Total equity

1,895,652

2,251,849

TOTAL LIABILITIES, REDEEMABLE

NONCONTROLLING INTERESTS AND EQUITY

$

5,182,477

$

5,518,515

________________

Note: For complete financial statements,

please refer to our Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

in thousands, except per share data

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

REVENUE

Property rental

$

113,349

$

120,294

$

348,521

$

364,919

Third-party real estate services,

including reimbursements

17,061

23,942

52,326

69,588

Other revenue

5,616

7,326

15,683

22,112

Total revenue

136,026

151,562

416,530

456,619

EXPENSES

Depreciation and amortization

50,050

50,265

158,211

152,914

Property operating

39,258

37,588

110,791

109,112

Real estate taxes

11,812

14,413

40,006

44,061

General and administrative:

Corporate and other

11,881

11,246

43,855

42,462

Third-party real estate services

16,088

21,405

57,065

67,333

Share-based compensation related to

Formation Transaction and special equity awards

—

46

—

397

Transaction and other costs

667

1,830

3,005

7,794

Total expenses

129,756

136,793

412,933

424,073

OTHER INCOME (EXPENSE)

Income (loss) from unconsolidated real

estate ventures, net

(745

)

(2,263

)

4

(1,320

)

Interest and other income, net

4,573

7,774

10,105

14,132

Interest expense

(35,267

)

(27,903

)

(97,400

)

(80,580

)

Gain (loss) on the sale of real estate,

net

(5,352

)

906

(5,066

)

41,606

Gain (loss) on the extinguishment of

debt

43

—

43

(450

)

Impairment loss

—

(59,307

)

(18,236

)

(59,307

)

Total other income (expense)

(36,748

)

(80,793

)

(110,550

)

(85,919

)

LOSS BEFORE INCOME TAX (EXPENSE)

BENEFIT

(30,478

)

(66,024

)

(106,953

)

(53,373

)

Income tax (expense) benefit

(831

)

(77

)

40

(672

)

NET LOSS

(31,309

)

(66,101

)

(106,913

)

(54,045

)

Net loss attributable to redeemable

noncontrolling interests

4,365

7,926

12,353

5,961

Net (income) loss attributable to

noncontrolling interests

(36

)

168

10,931

703

NET LOSS ATTRIBUTABLE TO COMMON

SHAREHOLDERS

$

(26,980

)

$

(58,007

)

$

(83,629

)

$

(47,381

)

LOSS PER COMMON SHARE - BASIC AND

DILUTED

$

(0.32

)

$

(0.58

)

$

(0.95

)

$

(0.45

)

WEIGHTED AVERAGE NUMBER OF COMMON SHARES

OUTSTANDING - BASIC AND DILUTED

85,292

101,445

89,637

108,351

________________

Note: For complete financial statements,

please refer to our Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024.

EBITDA, EBITDAre AND ADJUSTED

EBITDA RECONCILIATIONS (NON-GAAP)

(Unaudited)

dollars in thousands

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

EBITDA, EBITDAre and Adjusted

EBITDA

Net loss

$

(31,309

)

$

(66,101

)

$

(106,913

)

$

(54,045

)

Depreciation and amortization expense

50,050

50,265

158,211

152,914

Interest expense

35,267

27,903

97,400

80,580

Income tax expense (benefit)

831

77

(40

)

672

Unconsolidated real estate ventures

allocated share of above adjustments

1,837

4,499

6,219

12,781

EBITDA attributable to noncontrolling

interests

—

(2

)

—

(4

)

EBITDA

$

56,676

$

16,641

$

154,877

$

192,898

(Gain) loss on the sale of real estate,

net

5,352

(906

)

5,066

(41,606

)

Gain on the sale of unconsolidated real

estate assets

—

(641

)

(480

)

(641

)

Real estate impairment loss

—

59,307

—

59,307

Impairment related to unconsolidated real

estate ventures (1)

—

3,319

—

3,319

EBITDAre

$

62,028

$

77,720

$

159,463

$

213,277

Transaction and other costs, net of

noncontrolling interests (2)

667

1,830

3,005

7,794

Litigation settlement proceeds, net

—

(3,455

)

—

(3,455

)

(Income) loss from investments, net

(2,534

)

221

(3,206

)

(1,114

)

Impairment loss related to non-depreciable

real estate

—

—

18,236

—

(Gain) loss on the extinguishment of

debt

(43

)

—

(43

)

450

Share-based compensation related to

Formation Transaction and special equity awards

—

46

—

397

Earnings and distributions in excess of

our investment in unconsolidated real estate venture

(335

)

(80

)

(1,006

)

(588

)

Lease liability adjustments

—

—

—

(154

)

Unconsolidated real estate ventures

allocated share of above adjustments

227

31

227

33

Adjusted EBITDA

$

60,010

$

76,313

$

176,676

$

216,640

Net Debt to Annualized Adjusted EBITDA

(3)

10.6

x

8.1

x

10.8

x

8.5

x

September 30, 2024

September 30, 2023

Net Debt (at JBG SMITH Share)

Consolidated indebtedness (4)

$

2,615,724

$

2,523,354

Unconsolidated indebtedness (4)

66,693

79,992

Total consolidated and unconsolidated

indebtedness

2,682,417

2,603,346

Less: cash and cash equivalents

141,669

138,282

Net Debt (at JBG SMITH Share)

$

2,540,748

$

2,465,064

________________

Note: All EBITDA measures as shown above

are attributable to common limited partnership units ("OP Units")

and certain fully vested incentive equity awards that may be

convertible into OP Units.

(1)

Related to decreases in the value of the

underlying real estate assets.

(2)

Includes costs related to completed,

potential and pursued transactions, demolition costs, severance and

other costs.

(3)

Quarterly Adjusted EBITDA is annualized by

multiplying by four. Adjusted EBITDA for the nine months ended

September 30, 2024 and 2023 is annualized by multiplying by

1.33.

(4)

Net of premium/discount and deferred

financing costs.

FFO, CORE FFO AND FAD

RECONCILIATIONS (NON-GAAP)

(Unaudited)

in thousands, except per share data

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

FFO and Core FFO

Net loss attributable to common

shareholders

$

(26,980

)

$

(58,007

)

$

(83,629

)

$

(47,381

)

Net loss attributable to redeemable

noncontrolling interests

(4,365

)

(7,926

)

(12,353

)

(5,961

)

Net income (loss) attributable to

noncontrolling interests

36

(168

)

(10,931

)

(703

)

Net loss

(31,309

)

(66,101

)

(106,913

)

(54,045

)

(Gain) loss on the sale of real estate,

net of tax

5,352

(906

)

3,854

(41,606

)

Gain on the sale of unconsolidated real

estate assets

—

(641

)

(480

)

(641

)

Real estate depreciation and

amortization

48,385

48,568

153,203

147,681

Real estate impairment loss

—

59,307

—

59,307

Impairment related to unconsolidated real

estate ventures (1)

—

3,319

—

3,319

Pro rata share of real estate depreciation

and amortization from unconsolidated real estate ventures

796

2,984

3,086

8,855

FFO attributable to noncontrolling

interests

—

168

—

703

FFO Attributable to OP Units

$

23,224

$

46,698

$

52,750

$

123,573

FFO attributable to redeemable

noncontrolling interests

(3,725

)

(6,600

)

(8,238

)

(17,050

)

FFO Attributable to Common

Shareholders

$

19,499

$

40,098

$

44,512

$

106,523

FFO attributable to OP Units

$

23,224

$

46,698

$

52,750

$

123,573

Transaction and other costs, net of tax

and noncontrolling interests (2)

754

1,755

2,738

7,465

Litigation settlement proceeds, net

—

(3,455

)

—

(3,455

)

(Income) loss from investments, net of

tax

(1,919

)

165

(2,428

)

(836

)

Impairment loss related to non-depreciable

real estate

—

—

18,236

—

Loss from mark-to-market on derivative

instruments, net of noncontrolling interests

7

1,572

77

6,714

(Gain) loss on the extinguishment of

debt

(43

)

—

(43

)

450

Earnings and distributions in excess of

our investment in unconsolidated real estate venture

(335

)

(80

)

(1,006

)

(588

)

Share-based compensation related to

Formation Transaction and special equity awards

—

46

—

397

Lease liability adjustments

—

—

—

(154

)

Amortization of management contracts

intangible, net of tax

1,059

1,031

3,178

3,161

Unconsolidated real estate ventures

allocated share of above adjustments

230

63

230

104

Core FFO Attributable to OP

Units

$

22,977

$

47,795

$

73,732

$

136,831

Core FFO attributable to redeemable

noncontrolling interests

(3,685

)

(6,755

)

(11,438

)

(18,858

)

Core FFO Attributable to Common

Shareholders

$

19,292

$

41,040

$

62,294

$

117,973

FFO per common share - diluted

$

0.23

$

0.40

$

0.50

$

0.98

Core FFO per common share - diluted

$

0.23

$

0.40

$

0.69

$

1.09

Weighted average shares - diluted (FFO and

Core FFO)

85,446

101,461

89,806

108,359

See footnotes under table below.

FFO, CORE FFO AND FAD

RECONCILIATIONS (NON-GAAP)

(Unaudited)

in thousands, except per share data

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

FAD

Core FFO attributable to OP Units

$

22,977

$

47,795

$

73,732

$

136,831

Recurring capital expenditures and

Second-generation tenant improvements and leasing commissions

(3)

(10,221

)

(9,225

)

(31,351

)

(28,621

)

Straight-line and other rent adjustments

(4)

(3,817

)

(5,226

)

(7,756

)

(19,914

)

Third-party lease liability assumption

(payments) refunds

—

—

(25

)

70

Share-based compensation expense

4,810

5,995

25,053

24,480

Amortization of debt issuance costs

4,030

3,372

11,963

6,022

Unconsolidated real estate ventures

allocated share of above adjustments

381

875

1,041

1,918

Non-real estate depreciation and

amortization

290

323

883

1,019

FAD available to OP Units (A)

$

18,450

$

43,909

$

73,540

$

121,805

Distributions to common shareholders and

unitholders (B)

$

17,891

$

26,801

$

55,901

$

84,104

FAD Payout Ratio (B÷A) (5)

97.0

%

61.0

%

76.0

%

69.0

%

Capital Expenditures

Maintenance and recurring capital

expenditures

$

4,808

$

3,964

$

10,365

$

11,644

Share of maintenance and recurring capital

expenditures from unconsolidated real estate ventures

—

10

16

45

Second-generation tenant improvements and

leasing commissions

5,413

5,222

20,949

16,769

Share of Second-generation tenant

improvements and leasing commissions from unconsolidated real

estate ventures

—

29

21

163

Recurring capital expenditures and

Second-generation tenant improvements and leasing commissions

10,221

9,225

31,351

28,621

Non-recurring capital expenditures

1,718

10,422

8,508

31,019

Share of non-recurring capital

expenditures from unconsolidated real estate ventures

—

—

28

5

First-generation tenant improvements and

leasing commissions

1,367

7,288

6,584

14,587

Share of First-generation tenant

improvements and leasing commissions from unconsolidated real

estate ventures

18

94

105

647

Non-recurring capital expenditures

3,103

17,804

15,225

46,258

Total JBG SMITH Share of Capital

Expenditures

$

13,324

$

27,029

$

46,576

$

74,879

________________

(1)

Related to decreases in the value of the

underlying real estate assets.

(2)

Includes costs related to completed,

potential and pursued transactions, demolition costs, severance and

other costs.

(3)

Includes amounts, at JBG SMITH Share,

related to unconsolidated real estate ventures.

(4)

Includes straight-line rent, above/below

market lease amortization and lease incentive amortization.

(5)

The FAD payout ratio is not necessarily

indicative of an amount for the full year due to fluctuation in the

timing of capital expenditures, the commencement of new leases and

the seasonality of our operations.

NOI RECONCILIATIONS

(NON-GAAP)

(Unaudited)

dollars in thousands

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net loss attributable to common

shareholders

$

(26,980

)

$

(58,007

)

$

(83,629

)

$

(47,381

)

Net loss attributable to redeemable

noncontrolling interests

(4,365

)

(7,926

)

(12,353

)

(5,961

)

Net income (loss) attributable to

noncontrolling interests

36

(168

)

(10,931

)

(703

)

Net loss

(31,309

)

(66,101

)

(106,913

)

(54,045

)

Add:

Depreciation and amortization expense

50,050

50,265

158,211

152,914

General and administrative expense:

Corporate and other

11,881

11,246

43,855

42,462

Third-party real estate services

16,088

21,405

57,065

67,333

Share-based compensation related to

Formation Transaction and special equity awards

—

46

—

397

Transaction and other costs

667

1,830

3,005

7,794

Interest expense

35,267

27,903

97,400

80,580

(Gain) loss on the extinguishment of

debt

(43

)

—

(43

)

450

Impairment loss

—

59,307

18,236

59,307

Income tax expense (benefit)

831

77

(40

)

672

Less:

Third-party real estate services,

including reimbursements revenue

17,061

23,942

52,326

69,588

Other revenue

2,827

2,704

16,216

8,276

Income (loss) from unconsolidated real

estate ventures, net

(745

)

(2,263

)

4

(1,320

)

Interest and other income, net

4,573

7,774

10,105

14,132

Gain (loss) on the sale of real estate,

net

(5,352

)

906

(5,066

)

41,606

Consolidated NOI

65,068

72,915

197,191

225,582

NOI attributable to unconsolidated real

estate ventures at our share

1,292

5,374

5,506

14,977

Non-cash rent adjustments (1)

(3,817

)

(5,226

)

(7,756

)

(19,914

)

Other adjustments (2)

5,793

5,803

16,486

17,820

Total adjustments

3,268

5,951

14,236

12,883

NOI

$

68,336

$

78,866

$

211,427

$

238,465

Less: out-of-service NOI loss (3)

(2,261

)

(995

)

(7,632

)

(2,606

)

Operating Portfolio NOI

$

70,597

$

79,861

$

219,059

$

241,071

Non-Same Store NOI (4)

2,012

11,607

7,466

37,961

Same Store NOI (5)

$

68,585

$

68,254

$

211,593

$

203,110

Change in Same Store NOI

0.5

%

4.2

%

Number of properties in Same Store

pool

39

39

________________

(1)

Adjustment to exclude straight-line rent,

above/below market lease amortization and lease incentive

amortization.

(2)

Adjustment to include other revenue and

payments associated with assumed lease liabilities related to

operating properties and to exclude commercial lease termination

revenue and related party management fees.

(3)

Includes the results of our

Under-Construction assets and assets in the Development

Pipeline.

(4)

Includes the results of properties that

were not In-Service for the entirety of both periods being

compared, including disposed properties, and properties for which

significant redevelopment, renovation or repositioning occurred

during either of the periods being compared.

(5)

Includes the results of the properties

that are owned, operated and In-Service for the entirety of both

periods being compared.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029229327/en/

Kevin Connolly Executive Vice President, Portfolio Management

& Investor Relations (240) 333‑3837 kconnolly@jbgsmith.com

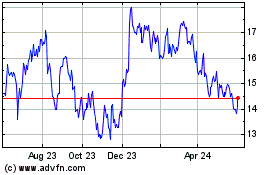

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

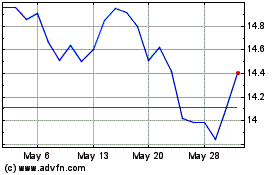

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Jan 2024 to Jan 2025