JBG SMITH Reports Taxable Composition of 2024 Distributions

January 16 2025 - 3:15PM

Business Wire

JBG SMITH (NYSE: JBGS), a leading owner and developer of

high-quality, mixed-use properties in the Washington, DC market,

today announced the tax treatment of the Company's 2024

distributions on its common shares. The income allocations as they

will be reported on Form 1099-DIV are set forth in the following

table. JBG SMITH recommends consultation with a tax advisor

regarding the federal, state, and local income tax consequences of

these distributions.

Common Shares – CUSIP number 46590V100

Distribution Per Share

2024 Tax Treatment

Record Date

Payable Date

Total

Taxable in 2024

Taxable in 2025

Total Ordinary

Dividends

Qualified Dividends

Total Capital Gain

Distributions

Non-Dividend

Distribution

Section 199A Dividends

Form 1099-Div Box:

1a

1b

2a

3

5

03/01/2024

03/15/2024

$

0.175

$

0.175

$

0.000

$

0.135

$

0.042

$

0.000

$

0.040

$

0.093

05/10/2024

05/24/2024

$

0.175

$

0.175

$

0.000

$

0.135

$

0.042

$

0.000

$

0.040

$

0.093

08/07/2024

08/21/2024

$

0.175

$

0.175

$

0.000

$

0.135

$

0.042

$

0.000

$

0.040

$

0.093

11/07/2024

11/22/2024

$

0.175

$

0.175

$

0.000

$

0.135

$

0.042

$

0.000

$

0.040

$

0.093

12/30/2024

01/14/2025

$

0.175

$

0.000

$

0.175

$

0.000

$

0.000

$

0.000

$

0.000

$

0.000

Totals:

$

0.875

$

0.700

$

0.175

$

0.540

$

0.168

$

0.000

$

0.160

$

0.372

About JBG SMITH

JBG SMITH owns, operates, invests in, and develops mixed-use

properties in high growth and high barrier-to-entry submarkets in

and around Washington, DC, most notably National Landing. Through

an intense focus on placemaking, JBG SMITH cultivates vibrant,

amenity-rich, walkable neighborhoods throughout the Washington, DC

metropolitan area. Approximately 75.0% of JBG SMITH's holdings are

in the National Landing submarket in Northern Virginia, which is

anchored by four key demand drivers: Amazon's new headquarters;

Virginia Tech's under-construction $1 billion Innovation Campus;

the submarket’s proximity to the Pentagon; and our retail and

digital placemaking initiatives and public infrastructure

improvements. JBG SMITH's dynamic portfolio currently comprises

13.1 million square feet of high-growth multifamily, office and

retail assets at share, 98% of which are Metro-served. It also

maintains a development pipeline encompassing 9.3 million square

feet of mixed-use, primarily multifamily, development

opportunities. JBG SMITH is committed to the operation and

development of green, smart, and healthy buildings and plans to

maintain carbon neutral operations annually. For more information

on JBG SMITH please visit www.jbgsmith.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250116716247/en/

Kevin Connolly JBG SMITH Executive Vice President, Portfolio

Management & Investor Relations (240) 333-3837

kconnolly@jbgsmith.com

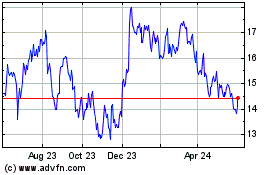

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

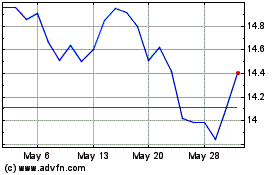

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Jan 2024 to Jan 2025