Form 8-K - Current report

February 11 2025 - 3:11PM

Edgar (US Regulatory)

0001674335false00016743352025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 5, 2025

JELD-WEN HOLDING, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-38000 | | 93-1273278 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification Number) |

2645 Silver Crescent Drive

Charlotte, North Carolina 28273

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (704) 378-5700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock (par value $0.01 per share) | | JELD | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 5, 2025, the Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of JELD-WEN Holding, Inc. (the “Company”) approved the Company’s 2025 Management Incentive Plan (the “MIP”). The MIP is substantially similar to the Management Incentive Plan previously in effect for the Company. The purpose of the MIP is to promote the interests of the Company and its stockholders by motivating superior performance by executive officers and other key personnel with annual cash bonus opportunities based on corporate and individual performance. The MIP is administered by the Committee. Executive officers and other employees and consultants identified by the Committee are eligible to participate in the MIP. The Committee will determine the amount, if any, of an award, the performance criteria applicable to an award, the performance goals related to performance criteria and the amount and terms of payment of any earned award. In no event may an award payable to a participant for any plan year exceed 200% of the participant’s target award. The MIP authorizes the Committee to adjust or modify the terms of awards or performance objectives, or specify new awards, due to extraordinary items, transactions, events or developments, or in recognition of, or in anticipation of, any other unusual, nonrecurring or infrequent events affecting the Company or the financial statements of the Company. The Committee and the Board have the authority to amend, modify, suspend or terminate the MIP, subject to the terms of the MIP and applicable legal requirements.

The foregoing summary of the MIP is qualified in its entirety by reference to the full text of the MIP, which is filed hereto as Exhibit 10.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| |

| Exhibit No. | Description |

| |

| 10.1 | |

| |

| 104 | Cover Page Interactive Data file (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| Date: February 11, 2025 | | | | JELD-WEN HOLDING, INC. |

| | | |

| | | By: | /s/ James S. Hayes |

| | | | James S. Hayes |

| | | | Executive Vice President, General Counsel and Corporate Secretary |

1 JELD-WEN HOLDING, INC. 2025 MANAGEMENT INCENTIVE PLAN 1. Purpose. The purpose of this JELD-WEN Holding, Inc. Management Incentive Plan is to promote the interests of the Company and its shareholders by motivating superior performance by executive officers and other key personnel with annual bonus opportunities based upon corporate and individual performance. 2. Definitions. (a) “Award” means an award granted to a Participant under the Plan subject to such terms and conditions as the Plan Administrator may establish under the terms of the Plan. (b) “Base Salary” means a Participant’s annual base salary determined as of the last day of a Plan Year. (c) “Board” means the Board of Directors of the Company. (d) “Company” means JELD-WEN Holding, Inc. and its subsidiaries. (e) “Participant” means an officer, key employee or consultant of the Company who is in a position to make contributions to the growth and financial success of the Company and who has been granted an Award under the Plan. (f) “Performance Criteria” shall have the meaning set forth in Section 5(b) hereof. (g) “Performance Goals” shall have the meaning set forth in Section 5(c) hereof. (h) “Plan” means this JELD-WEN Holding, Inc. Management Incentive Plan, as it may be amended and restated from time to time. (i) “Plan Administrator” means the Compensation Committee of the Board, or such other committee of the Board that the Board shall designate from time to time to administer the Plan. (j) “Plan Year” means the twelve consecutive month period beginning each January 1 and ending on the following December 31. 3. Plan Administration. (a) General. The Plan shall be administered by the Plan Administrator. The Plan Administrator shall have such powers and authority as may be necessary or appropriate for the Plan Administrator to carry out its functions as described in the Plan. No member of the Plan Administrator shall be liable for any action or determination made in good faith by the Plan Administrator with respect to the Plan or any Award hereunder. The Plan Administrator may delegate, to any appropriate officer or employee of the Company, responsibility for performing certain ministerial functions under this Plan. (b) Discretionary Authority. Subject to the express limitations of the Plan, the Plan Administrator shall have authority in its discretion to determine the time or times at which Awards may be granted, the recipients of Awards, the Performance Criteria, the Performance Goals and all other terms of an Award. The Plan Administrator shall also have discretionary authority to interpret the Plan, to make all Exhibit 10.1

2 factual determinations under the Plan, and to make all other determinations necessary or advisable for the administration of the Plan. The Plan Administrator may prescribe, amend, and rescind rules and regulations relating to the Plan. All interpretations, determinations, and actions by the Plan Administrator shall be final, conclusive, and binding upon all parties. 4. Eligibility and Participation. Employees of the Company who hold a position as an executive officer of the Company shall be eligible to participate in the Plan for a Plan Year on such basis and on such terms and conditions as determined by the Plan Administrator. In addition, any other employees and consultants of the Company designated by the Plan Administrator to receive an Award for a Plan Year shall become a Participant in the Plan with respect to such Plan Year. 5. Awards. (a) Amount of Awards. The Plan Administrator will determine in its discretion the amount of an Award, the Performance Criteria, the applicable Performance Goals relating to the Performance Criteria, and the amount and terms of payment to be made upon achievement of the Performance Goals for each Plan Year. All Awards will be paid in cash; in no event may any Award payable to any Participant under the Plan for any Plan Year exceed two hundred percent (200%) of the Participant’s Target Award. (b) Performance Criteria. For purposes of Awards granted under the Plan, the “Performance Criteria” for a given Plan Year shall be one or any combination of the following as they relate to the Company, one or more of its operating segments, , as may be selected by the Plan Administrator in its sole discretion at the time of an Award, : (i) earnings per share; (ii) operating income; (iii) return on equity or assets; (iv) cash flow; (v) net cash flow; (vi) cash flow from operations; (vii) EBITDA and/or adjusted EBITDA; (viii) revenue growth, product revenue and/or comparable sales growth; (ix) revenue ratios; (x) cost reductions; (xi) cost ratios or margins; (xii) overall revenue or sales growth; (xiii) expense reduction or management; (xiv) market position or market share; (xv) total shareholder return; (xvi) return on investment; (xvii) earnings before interest and taxes (EBIT); (xviii) net income (before or after taxes); (xix) return on assets or net assets; (xx) economic value added; (xxi) shareholder value added; (xxii) cash flow return on investment; (xxiii) net operating profit; (xxiv) net operating profit after tax; (xxv) return on capital; (xxvi) return on invested capital; (xxvii) customer growth; (xxviii) supply chain achievements, (xxix) financial ratios, including those measuring liquidity, activity, profitability or leverage; (xxx) financing and other capital raising transactions (xxxi); strategic partnerships or transactions net revenue; or (xxxii) any combination of or a specified increase in any of the foregoing, or such other performance criteria determined to be appropriate by the Plan Administrator in its sole discretion. (c) Performance Goals; Adjustments. For purposes of Awards granted under the Plan, the “Performance Goals” for a given Plan Year shall be the levels of achievement relating to the Performance Criteria as may be selected by the Plan Administrator for the Award. Performance Goals shall be established for each Participant each Plan Year. The Plan Administrator may establish such Performance Goals relative to the applicable Performance Criteria as it determines in its sole discretion at the time of an Award. The Performance Goals for the Global MIP pool calculation are applied individually to each Performance Criteria. The Award issued for each Plan Year shall specify the Performance Goal threshold, target, and attainment levels. The Award made to an individual Participant may be less (including no Award) than the percentage of the Target Award determined based on the level of achievement of applicable Performance Goals. The Plan Administrator shall be precluded from increasing the Target Award but may apply its discretion to increase, reduce or eliminate such Award without the consent of the Participant, which determination shall be final and binding on the Participant. The Plan Administrator is authorized at any time before, during or after the completion of a performance period, in its sole discretion, to adjust or modify

3 the terms of awards or performance objectives, or specify new awards, due to extraordinary items, transactions, events or developments, or in recognition of, or in anticipation of, any other unusual, nonrecurring or infrequent events affecting the Company or the financial statements of the Company, or in response to, or in anticipation of, changes in applicable law, accounting principles, tax rates (and interpretations thereof), business conditions, and/or the Plan Administrator’s assessment of the business strategy of the Company, in each case as determined by the Plan Administrator, and to make any other adjustments or modifications to the terms of awards or performance objectives selected by the Plan Administrator. By way of example but not limitation, the Plan Administrator may provide with respect to any award that any evaluation of performance shall exclude or otherwise adjust for any specified circumstance or event that occurs during a performance period, including but not limited to circumstances or events such as the following: currency fluctuations; discontinued operations; noncash items, such as amortization, depreciation or reserves; asset write-downs or impairments; significant litigation or claim judgments or settlements; the effect of changes in tax laws, accounting standards or principles or other laws or regulatory rules; any recapitalization, restructuring, reorganization, merger, acquisition, divestiture, consolidation, spin-off, split-up, combination, liquidation, dissolution, sale of assets or other similar corporate transaction or event; the effects of stock-based compensation (including any modification charges) or other compensation; foreign exchange gains and losses; a change in the Company’s fiscal year; extraordinary nonrecurring items as described in then-current accounting principles; extraordinary nonrecurring items as described in management’s discussion and analysis of financial condition and results of operations appearing in the Company’s annual report to stockholders; and/or any other specific unusual or infrequent events or objectively determinable category thereof. (d) Payment of Awards. An Award shall be earned prior to any claimed obligation to pay by the Company. The payment of Awards under the Plan shall be made during the calendar year following the applicable Plan Year and within thirty days following the Committee’s certification of the achievement of applicable Performance Goals, which payment shall be within two and one half months following the end of the applicable Plan Year, or otherwise shall be made in a manner intended to be exempt from or in compliance with Section 409A. (e) Awards upon Leave of Absence. For purposes of the application of this Section under the Plan, a Participant’s “Leave of Absence” and the duration thereof shall be deemed as recorded in the regular business records of the Company’s Human Resources. If a Participant has a Leave of Absence that is six (6) months or less during the Plan Year, the Participant will be considered as active under the Plan for the entire Plan Year. As a result, any earned Award will not be prorated for the Plan Year. If a Participant has a Leave of Absence that exceeds six (6) months during the Plan Year, the Leave of Absence time in excess of six (6) months will be deemed inactive time under the Plan. As a result, any earned Award will be prorated in accordance with the time (if any) deemed active in the Plan. Human Resources shall have sole discretion to determine and record Participant’s “active employment” under this Section. (f) Form of Payment. Awards under the Plan shall be paid in cash to Participant’s banking account of record with the Company’s Human Resources. (g) Tax Withholding. Any payment under this Plan shall be subject to applicable income and employment taxes and any other amounts that the Company is required by law to deduct and withhold from such payment. To the extent that shares of Company stock are used to satisfy withholding obligations of a Participant (whether previously-owned shares or shares withheld from a stock award), they may be used only to satisfy the minimum tax withholding required by law (or such other amount as will not have any adverse accounting impact as determined by the Committee).

4 (h) Award Deductions. Any Award under the Plan may be reduced by a Participant’s outstanding debts owed to the Company at the time payment of the Award is made and shall be subject to the terms of the Company’s Clawback Policy, as it may be amended from time to time. 6. Termination of Employment. (a) General Rule. Subject to the provisions of Section 6(b), and 6(c) below (and except as may be otherwise determined by the Plan Administrator), the obligation of the Company to satisfy payment of an Award to a Participant hereunder is conditioned upon the continued employment of the Participant with the Company until the date of payment of an Award. If the employment of a Participant with the Company is terminated for any reason, at any time prior to the date of payment, the Award shall be forfeited and automatically be cancelled without further action of the Company, unless otherwise provided by the Plan Administrator or as provided in Section 6(b) and Section 6(c) herein. (b) Termination Due to Retirement. For purposes of the application of this section under the Plan, unless otherwise expressly defined by an applicable jurisdiction, “Retirement” shall refer to a Participant’s voluntary cessation of employment marked by a Human Resources record of Participant’s intent to retire and (1) the Participant’s attainment of age 55 with a minimum of ten completed years of service to Company, or (2) attainment of age 60 with a minimum of five completed years of service to the Company. In the event of a Retirement, a Participant’s Award shall be prorated based on the percentage of time during the Plan Year the Participant was employed with the Company and eligible to participate with the Plan. Payment shall be made on or before March 15 of the year following the performance period or otherwise in a manner intended to be exempt from or compliant with Code Section 409A. Human Resources shall have sole discretion to determine and record Participant’s “years of service” under this section. (c) Termination Due to Death. In the event of a Participant’s death during the Plan Year, the Participant’s Award shall be paid to Participant’s estate and the Award shall be equivalent to the target award amount applicable to Participant under the Plan. For clarity, such target award amount shall not be prorated and shall be determined assuming Participant’s full participation under the Plan through the end of the Plan Year. Payment shall be made within 90 days following the Participant’s date of termination due to death or otherwise in a manner intended to be exempt from or compliant with Code Section 409A and in accordance with applicable law. (d) Consideration for Terminations Excepted from General Rule. As determined by the Company in its sole discretion, payment of a prorated Award under this Section may be conditioned on the Participant (or the Participant’s estate in the case of Death) executing, delivering and not timely revoking a general release of claims against the Company and its affiliates (in the form and manner to be provided by the Company) prior to the Award payment date, 7. General Provisions. (a) Effective Date. The Plan shall be effective commencing January 1, 2025. (b) Amendment and Termination. The Company may, from time to time, by action of the Board, amend, suspend or terminate any or all of the provisions of the Plan with respect to the then current Plan Year and any future Plan Year, without the requirement of obtaining the consent of the affected Participants. The Committee and the Board shall have the authority to amend, modify, suspend or terminate the Plan, subject to applicable legal requirements. Subject to the above provisions, the Board and the Committee shall have authority to amend the Plan to make changes that are consistent with the purpose of the Plan or to take into account changes in law and tax and accounting rules, as well as other developments and to make Awards which qualify for beneficial treatment under such rules without shareholder approval.

5 (c) No Right to Employment. Nothing in the Plan shall be deemed to give any Participant the right to remain employed by the Company or to limit, in any way, the right of the Company to terminate, or to change the terms of, a Participant’s employment at any time. (d) Governing Law. The Plan shall be governed by and construed in accordance with the laws of Delaware, without regard to the choice-of-law rules thereof. (e) Section 409A. The Company intends that that payments and benefits under this Plan will either comply with or be exempt from Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) and the regulations and guidance promulgated thereunder (collectively “Section 409A”) and, accordingly, to the maximum extent permitted, this Plan shall be interpreted to be exempt from Section 409A or in compliance therewith, as applicable. Nothing contained herein shall constitute any representation or warranty by the Company regarding compliance with Section 409A. The Company shall have no obligation to take any action to prevent the assessment of any additional income tax, interest or penalties under Section 409A on any person and the Company, its subsidiaries and affiliates, and each of their respective employees or representatives, shall have no liability to any person with respect thereto. A termination of employment shall not be deemed to have occurred for purposes of any provision of the Plan providing for the payment of any amounts or benefits that are considered nonqualified deferred compensation under Section 409A upon or following a termination of employment, unless such termination is also a “separation from service” within the meaning of Section 409A and the payment thereof prior to a “separation from service” would violate Section 409A. For purposes of any such provision of the Plan or relating to any such payments or benefits, references to a “termination,” “termination of employment,” or like terms shall mean “separation from service.” If an amount is paid in two or more installments, for purposes of Section 409A, each installment shall be treated as a separate payment. Notwithstanding any contrary provision in the Plan, any payment(s) of nonqualified deferred compensation (within the meaning of Section 409A) that are otherwise required to be made under the Plan to a “specified employee” (as defined under Section 409A) as a result of his or her separation from service (other than a payment that is not subject to Section 409A) shall be delayed for the first six months following such separation from service (or, if earlier, until the date of death of the specified employee) and shall instead be paid on the day that immediately follows the end of such six-month period.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

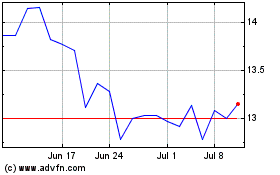

JELD WEN (NYSE:JELD)

Historical Stock Chart

From Jan 2025 to Feb 2025

JELD WEN (NYSE:JELD)

Historical Stock Chart

From Feb 2024 to Feb 2025