Johnson & Johnson Talc Supplier Files for Bankruptcy

February 13 2019 - 12:38PM

Dow Jones News

By Katy Stech Ferek and Sara Randazzo

Imerys Talc America Inc. has filed for bankruptcy protection as

it faces accusations that the talc it supplied for Johnson &

Johnson's baby powder causes cancer.

The company filed for chapter 11 protection Wednesday after

spending tens of millions of dollars to defend itself against

lawsuits alleging its talcum powder causes ovarian cancer and

mesothelioma. The talc supplier faces claims from more than 14,600

people, a number that has grown dramatically in recent years in the

wake of large verdicts against Imerys and baby powder maker Johnson

& Johnson.

The two companies contend talc doesn't cause cancer or contain

asbestos and have succeeded in getting some verdicts overturned on

appeal.

The Imerys filing in U.S. Bankruptcy Court in Wilmington, Del.,

immediately suspends all talc-related litigation against the

U.S.-based mining company and will enable Imerys officials to

negotiate payouts with those who have sued them.

Imerys Talc America and another affiliate that filed for

bankruptcy employ more than 200 people at a Texas processing plant

and at mining operations in Montana and Vermont. The companies are

owned indirectly by French minerals company Imerys SA, which bought

the U.S. entities in 2011 when they were facing only a handful of

talc-related lawsuits.

Imerys Talc America President Giorgio La Motta said in a press

release that bankruptcy "is the best course of action to address

our historic talc-related liabilities and position the filing

companies for continued growth."

Documents made public through the litigation have shown efforts

that Imerys predecessor Luzenac America allegedly took to keep talc

from being listed as potentially carcinogenic by regulatory

authorities.

The company by 2006 became less involved in attempts to prove

talcum powder's safety, according to court-filed documents. After a

World Health Organization branch that year listed perineal use of

talcum powder as possibly carcinogenic, a Luzenac executive said

they were no longer interested in funding ovarian cancer research

because the "horse has already left the barn," according to an

email shown to jurors by plaintiffs lawyers.

In response to the release of those documents, Imerys has denied

wrongdoing.

Imerys also put its Canadian operations into bankruptcy. The

Imerys companies that filed for bankruptcy recorded $174 million in

revenue last year. Their operations will not be affected by the

filings, company officials said.

Bankruptcy rules give troubled organizations the chance to pool

money for victims from their assets, including insurance coverage,

and set deadlines for claimants to come forward -- a process

overseen by a federal judge. Imerys officials also may set aside a

pool of money for those who have not yet become ill but could later

sue over health problems.

U.S. bankruptcy law doesn't require companies to be insolvent to

seek court protection. For decades, major corporations facing

massive litigation liabilities have turned to bankruptcy to defend

themselves from lawsuits -- including those with claims from

asbestos-related illnesses -- that threaten to overwhelm their

businesses.

In 1982, Johns-Manville Corp. became the first manufacturer to

file for bankruptcy to deal with asbestos lawsuits. Dozens of

manufacturers have followed their lead, using the process to form

trusts for people with asbestos-related health problems.

Write to Katy Stech Ferek at katherine.stech@wsj.com and Sara

Randazzo at sara.randazzo@wsj.com

(END) Dow Jones Newswires

February 13, 2019 13:23 ET (18:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

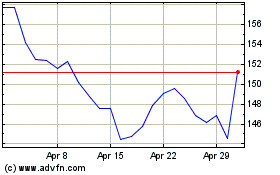

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Nov 2024 to Dec 2024

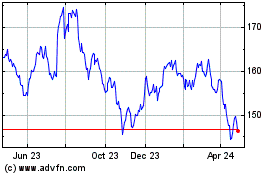

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Dec 2023 to Dec 2024