0000055785FALSE00000557852024-12-102024-12-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: December 10, 2024

(Date of earliest event reported)

KIMBERLY-CLARK CORPORATION

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | 1-225 | 39-0394230 |

| (State or other jurisdiction of incorporation) | (Commission file number) | (I.R.S. Employer Identification No.) |

P.O. Box 619100

Dallas, TX

75261-9100

(Address of principal executive offices)

(Zip code)

Registrant’s telephone number, including area code: (972) 281-1200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | KMB | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

Change in Segments

In the fourth quarter of 2024, Kimberly-Clark Corporation (the "Corporation") realigned its internal operating and management structure to streamline its supply chain and improve the efficiency of its corporate and regional overhead cost structures. Subsequently, the Corporation manages and reports its operations through three reportable segments defined by geographic regions and product groupings: North America ("NA"), International Personal Care ("IPC") and International Family Care and Professional ("IFP"). Prior to the reorganization of its segments in the fourth quarter of 2024, the Corporation managed and reported its operating results through three reportable segments defined by product groupings: Personal Care, Consumer Tissue, and K-C Professional.

The Corporation is providing supplemental historical segment financial information that conforms to the new reportable segments structure in Exhibit 99.1 hereto.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

99.1 Supplemental Historical Financial Information for the New Reportable Segments for each of the quarters ended September 30, 2024, June 30, 2024, March 31, 2024, December 31, 2023, September 30, 2023, June 30, 2023, and March 31, 2023, the year-to-date period ended September 30, 2024, and the years ended December 31, 2023, December 31, 2022 and December 31, 2021.

104 The cover page of the Kimberly-Clark Corporation's Current Report on Form 8-K, formatted in iXBRL.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | KIMBERLY-CLARK CORPORATION |

| |

| | |

| | |

| | |

| | |

| | |

| |

| By: | | /s/ Andrew S. Drexler |

| | Andrew S. Drexler |

| | Vice President and Controller |

| | |

December 10, 2024

Exhibit 99.1

SUPPLEMENTAL HISTORICAL SEGMENT FINANCIAL INFORMATION

Unless the context otherwise requires, the terms "Corporation," "Kimberly-Clark," "K-C," "we," "our" and "us" refer to Kimberly-Clark Corporation and its consolidated subsidiaries.

Forward Looking Statements

Certain matters contained in this supplemental information concerning the business outlook, including raw material, energy and other input costs, the anticipated charges and savings from the 2024 Transformation Initiative, cash flow and uses of cash, growth initiatives, innovations, marketing and other spending, net sales, anticipated currency rates and exchange risks, including the impact in Argentina and Türkiye, effective tax rate, contingencies and anticipated transactions of Kimberly-Clark, including dividends, share repurchases and pension contributions, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and are based upon management's expectations and beliefs concerning future events impacting Kimberly-Clark. There can be no assurance that these future events will occur as anticipated or that our results will be as estimated. Forward-looking statements speak only as of the date they were made, and we undertake no obligation to publicly update them.

The assumptions used as a basis for the forward-looking statements include many estimates that, among other things, depend on the achievement of future cost savings and projected volume increases. In addition, many factors outside our control, including the risk that we are not able to realize the anticipated benefits of the 2024 Transformation Initiative (including risks related to disruptions to our business or operations or related to any delays in implementation), war in Ukraine (including the related responses of consumers, customers, and suppliers and sanctions issued by the U.S., the European Union, Russia or other countries), pandemics, epidemics, fluctuations in foreign currency exchange rates, the prices and availability of our raw materials, supply chain disruptions, disruptions in the capital and credit markets, counterparty defaults (including customers, suppliers and financial institutions with which we do business), failure to realize the expected benefits or synergies from our acquisition and disposition activity, impairment of goodwill and intangible assets and our projections of operating results and other factors that may affect our impairment testing, changes in customer preferences, severe weather conditions, regional instabilities and hostilities (including the war in Israel), government trade or similar regulatory actions, potential competitive pressures on selling prices for our products, energy costs, general economic and political conditions globally and in the markets in which we do business, as well as our ability to maintain key customer relationships, could affect the realization of these estimates.

The factors described under Item 1A, “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 (the "2023 Form 10-K"), or in our other SEC filings, among others, could cause our future results to differ from those expressed in any forward-looking statements made by us or on our behalf. Other factors not presently known to us or that we presently consider immaterial could also affect our business operations and financial results.

Background

Prior to the reorganization of our segments in the fourth quarter of 2024, we managed and reported our operating results through three reportable segments defined by product groupings: Personal Care, Consumer Tissue and K-C Professional.

In the fourth quarter of 2024, we realigned our internal operating and management structure to streamline our supply chain and improve the efficiency of our corporate and regional overhead cost structures. As a result of this realignment, we manage and report our operations through operating segments that have been aggregated into three reportable segments defined by geographic regions and product groupings: North America ("NA"), International Personal Care ("IPC") and International Family Care and Professional ("IFP"). Further, our measure of segment profitability was changed to include the effects of changes in exchange rates on monetary assets and liabilities for subsidiaries where we have adopted highly inflationary accounting. These changes reflect the manner in which our chief operating decision maker ("CODM") develops, executes and evaluates global strategies to drive growth and profitability.

The primary measure of segment profitability utilized by our CODM is segment operating profit. Segment operating profit excludes Corporate & Other, which primarily encompasses certain unallocated general corporate expenses,

impairment charges, one-time (gains) or losses associated with acquisitions and divestitures, and costs related to our reorganization activities that are not associated with the ongoing operations of the segments.

For informational purposes only, we have recast our historical segment results to reflect the changes discussed above for each of the quarters ended September 30, 2024, June 30, 2024, March 31, 2024, December 31, 2023, September 30, 2023, June 30, 2023, and March 31, 2023, the year-to-date period ended September 30, 2024, and the years ended December 31, 2023, December 31, 2022, and December 31, 2021. These changes had no impact on our consolidated financial results for any of the periods presented in our Quarterly Reports on Form 10-Q for the respective interim periods outlined above, or any of the annual periods presented in our 2023 Form 10-K.

The following unaudited financial information is based on our historical consolidated financial statements after giving effect to the segment reorganization discussed above. You should read this supplemental information together with our unaudited consolidated financial statements and related notes in each of our Quarterly Reports on Form 10-Q for the respective interim periods outlined above, and our audited consolidated financial statements and related notes in our 2023 Form 10-K. The financial information contained in this supplemental information is not indicative of future or annual results.

Non-GAAP Financial Measures

In this supplemental information, in addition to results prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"), we disclose total segment operating profit, which in the context of this supplemental information is considered to be a non-GAAP financial measure as it is being presented outside of the required financial statement footnote requirements of Accounting Standards Codification 280. As discussed above, segment operating profit excludes unallocated general corporate expenses and other income and expense not associated with the ongoing operations of the segments.

We use this non-GAAP financial measure to assist in comparing our performance on a consistent basis for purposes of business decision making by removing the impact of certain items that we do not believe reflect our underlying and ongoing operations. We believe that presenting this non-GAAP financial measure is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items, (ii) permits investors to view performance using the same tools that management uses to budget, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating our results. We believe that the presentation of this non-GAAP financial measure, when considered together with the corresponding U.S. GAAP financial measure and the reconciliation between these measures, provides investors with additional understanding of the factors and trends affecting our business than could be obtained absent these disclosures.

This non-GAAP financial measure is not meant to be considered in isolation or as a substitute for the comparable GAAP measure, and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. There is limitation to this non-GAAP financial measure because it is not prepared in accordance with GAAP and may not be comparable to similarly titled measures of other companies due to potential differences in methods of calculation and items being excluded. We compensate for these limitations by using this non-GAAP financial measure as a supplement to the GAAP measure and by providing reconciliation of the non-GAAP and comparable GAAP financial measure.

Kimberly-Clark Corporation and Subsidiaries

Segment Information (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

| | September 30 | | June 30 | | March 31 |

| (In millions) | | 2024 | | 2024 | | 2024 |

| Net Sales | | | | | | |

| NA | | $ | 2,734 | | | $ | 2,778 | | | $ | 2,774 | |

| IPC | | 1,403 | | | 1,419 | | | 1,518 | |

| IFP | | 815 | | | 832 | | | 857 | |

| Total Net Sales | | $ | 4,952 | | | $ | 5,029 | | | $ | 5,149 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Operating Profit | | | | | | |

| NA | | $ | 639 | | | $ | 680 | | | $ | 667 | |

| IPC | | 191 | | | 199 | | | 242 | |

| IFP | | 85 | | | 93 | | | 110 | |

Segment Operating Profit(a) | | 915 | | | 972 | | | 1,019 | |

| Corporate & Other | | 239 | | | (317) | | | (166) | |

| | | | | | |

| Total Operating Profit | | $ | 1,154 | | | $ | 655 | | | $ | 853 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

| | December 31 | | September 30 | | June 30 | | March 31 |

| (In millions) | | 2023 | | 2023 | | 2023 | | 2023 |

| Net Sales | | | | | | | | |

| NA | | $ | 2,736 | | | $ | 2,813 | | | $ | 2,742 | | | $ | 2,697 | |

| IPC | | 1,393 | | | 1,470 | | | 1,493 | | | 1,543 | |

| IFP | | 841 | | | 849 | | | 899 | | | 955 | |

| Total Net Sales | | $ | 4,970 | | | $ | 5,132 | | | $ | 5,134 | | | $ | 5,195 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Operating Profit | | | | | | | | |

| NA | | $ | 609 | | | $ | 682 | | | $ | 627 | | | $ | 589 | |

| IPC | | 114 | | | 146 | | | 175 | | | 197 | |

| IFP | | 68 | | | 78 | | | 44 | | | 97 | |

Segment Operating Profit(a) | | 791 | | | 906 | | | 846 | | | 883 | |

| Corporate & Other | | (121) | | | (132) | | | (733) | | | (96) | |

| | | | | | | | |

| Total Operating Profit | | $ | 670 | | | $ | 774 | | | $ | 113 | | | $ | 787 | |

(a) Total Segment Operating Profit is a non-GAAP financial measure as it excludes certain unallocated general corporate expenses and income and expense not associated with the ongoing operations of the segments. Refer to the Non-GAAP Financial Measures section above for further discussion of how we utilize this non-GAAP financial measure. As shown above, we have included a reconciliation to Total Operating Profit, as determined in accordance with GAAP.

Kimberly-Clark Corporation and Subsidiaries

Segment Information (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Nine Months Ended September 30 | | For the Years Ended December 31 |

| (In millions) | | 2024 | | 2023 | | 2022 | | 2021 |

| Net Sales | | | | | | | | |

| NA | | $ | 8,286 | | | $ | 10,988 | | | $ | 10,470 | | | $ | 9,871 | |

| IPC | | 4,340 | | | 5,899 | | | 6,054 | | | 5,977 | |

| IFP | | 2,504 | | | 3,544 | | | 3,651 | | | 3,592 | |

| Total Net Sales | | $ | 15,130 | | | $ | 20,431 | | | $ | 20,175 | | | $ | 19,440 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Operating Profit | | | | | | | | |

| NA | | $ | 1,986 | | | $ | 2,507 | | | $ | 2,110 | | | $ | 2,097 | |

| IPC | | 632 | | | 632 | | | 670 | | | 746 | |

| IFP | | 288 | | | 287 | | | 256 | | | 305 | |

Segment Operating Profit(a) | | 2,906 | | | 3,426 | | | 3,036 | | | 3,148 | |

| Corporate & Other | | (244) | | | (1,082) | | | (355) | | | (587) | |

| | | | | | | | |

| Total Operating Profit | | $ | 2,662 | | | $ | 2,344 | | | $ | 2,681 | | | $ | 2,561 | |

(a) Total Segment Operating Profit is a non-GAAP financial measure as it excludes certain unallocated general corporate expenses and income and expense not associated with the ongoing operations of the segments. Refer to the Non-GAAP Financial Measures section above for further discussion of how we utilize this non-GAAP financial measure. As shown above, we have included a reconciliation to Total Operating Profit, as determined in accordance with GAAP.

Kimberly-Clark Corporation and Subsidiaries

Analysis of Segment Net Sales (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Percent Change in Net Sales for the Three Months Ended | | Volume | | Mix/Other | | Net Price | | Divestitures and Business Exits(c) | | Currency Translation | | Total(a) | | Organic(b) | | | | |

| September 30, 2024 | | | | | | | | | | | | | | | | | | |

| Consolidated | | (0.1) | | 0.4 | | 1.0 | | (1.3) | | (3.5) | | (3.5) | | 1.3 | | | | |

| NA | | (1.0) | | 0.5 | | (0.5) | | (1.7) | | (0.2) | | (2.8) | | (1.0) | | | | |

| IPC | | (0.4) | | 0.2 | | 6.5 | | — | | (10.7) | | (4.6) | | 6.3 | | | | |

| IFP | | 3.1 | | 0.3 | | (3.4) | | (2.2) | | (1.8) | | (3.9) | | 0.1 | | | | |

| June 30, 2024 | | | | | | | | | | | | | | | | | | |

| Consolidated | | 1.3 | | 0.4 | | 1.9 | | (1.1) | | (4.6) | | (2.0) | | 3.6 | | | | |

| NA | | 0.5 | | 0.4 | | 0.5 | | — | | — | | 1.3 | | 1.4 | | | | |

| IPC | | 1.2 | | 0.4 | | 7.6 | | — | | (14.1) | | (5.0) | | 9.2 | | | | |

| IFP | | 3.8 | | 0.4 | | (3.0) | | (6.0) | | (2.6) | | (7.5) | | 1.2 | | | | |

| March 31, 2024 | | | | | | | | | | | | | | | | | | |

| Consolidated | | 0.6 | | 0.9 | | 4.1 | | (1.2) | | (5.2) | | (0.9) | | 5.6 | | | | |

| NA | | 0.6 | | 1.0 | | 1.2 | | — | | — | | 2.9 | | 2.8 | | | | |

| IPC | | 2.0 | | 0.9 | | 12.6 | | — | | (17.0) | | (1.6) | | 15.4 | | | | |

| IFP | | (1.7) | | 0.4 | | (1.2) | | (6.6) | | (1.2) | | (10.3) | | (2.5) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Percent Change in Net Sales for the Three Months Ended | | Volume | | Mix/Other | | Net Price | | Divestitures and Business Exits(c) | | Currency Translation | | Total(a) | | Organic(b) |

| December 31, 2023 | | | | | | | | | | | | | | |

| Consolidated | | (0.3) | | 1.0 | | 2.4 | | (1.3) | | (1.7) | | 0.1 | | 3.2 |

| NA | | 1.6 | | 0.6 | | 0.6 | | — | | — | | 2.8 | | 2.8 |

| IPC | | (2.0) | | 1.5 | | 6.6 | | — | | (7.3) | | (1.1) | | 6.2 |

| IFP | | (3.4) | | 1.5 | | 1.4 | | (7.3) | | 1.9 | | (5.9) | | (0.5) |

| September 30, 2023 | | | | | | | | | | | | | | |

| Consolidated | | (0.9) | | 1.0 | | 5.0 | | (1.2) | | (2.4) | | 1.5 | | 5.1 |

| NA | | 2.1 | | 0.7 | | 4.1 | | — | | (0.2) | | 6.7 | | 6.9 |

| IPC | | (1.1) | | 1.5 | | 5.2 | | — | | (8.0) | | (2.4) | | 5.6 |

| IFP | | (9.2) | | 0.9 | | 7.3 | | (6.7) | | 0.7 | | (7.0) | | (1.0) |

| June 30, 2023 | | | | | | | | | | | | | | |

| Consolidated | | (3.4) | | 0.9 | | 7.9 | | (0.3) | | (3.6) | | 1.4 | | 5.4 |

| NA | | (0.3) | | 0.3 | | 5.7 | | — | | (0.5) | | 5.2 | | 5.7 |

| IPC | | (4.4) | | 1.6 | | 9.4 | | — | | (9.0) | | (2.3) | | 6.7 |

| IFP | | (10.3) | | 1.0 | | 11.7 | | (1.8) | | (3.7) | | (3.1) | | 2.5 |

| March 31, 2023 | | | | | | | | | | | | | | |

| Consolidated | | (5.3) | | 0.7 | | 9.7 | | 0.4 | | (3.6) | | 2.0 | | 5.1 |

| NA | | (2.3) | | (0.3) | | 7.0 | | 0.8 | | (0.4) | | 4.8 | | 4.4 |

| IPC | | (8.7) | | 2.0 | | 10.1 | | — | | (7.3) | | (3.9) | | 3.4 |

| IFP | | (7.6) | | 1.2 | | 16.6 | | — | | (6.0) | | 4.2 | | 10.2 |

(a) Total may not equal the sum of volume, mix/other, net price, divestitures and business exits and currency translation due to rounding and excludes intergeographic sales.

(b) Combined impact of changes in volume, mix/other and net price excluding prior year's impact of divestitures and business exits.

(c) Impact of the sale of Brazil tissue and K-C Professional business, sale of the personal protective equipment business and other exited businesses and markets in conjunction with the 2024 Transformation Initiative.

Kimberly-Clark Corporation and Subsidiaries

Analysis of Segment Net Sales (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Percent Change in Net Sales for the Years Ended (d) | | Volume | | Mix/Other | | Net Price | | Divestitures and Business Exits(c) | | Currency Translation | | Total(a) | | Organic(b) | | | | |

| September 30, 2024 | | | | | | | | | | | | | | | | | | |

| Consolidated | | 0.6 | | 0.5 | | 2.4 | | (1.2) | | (4.4) | | (2.1) | | 3.5 | | | | |

| NA | | — | | 0.7 | | 0.4 | | (0.6) | | (0.1) | | 0.4 | | 1.0 | | | | |

| IPC | | 0.9 | | 0.5 | | 8.9 | | (0.1) | | (14.0) | | (3.7) | | 10.4 | | | | |

| IFP | | 1.6 | | 0.3 | | (2.5) | | (5.0) | | (1.9) | | (7.4) | | (0.5) | | | | |

| December 31, 2023 | | | | | | | | | | | | | | | | | | |

| Consolidated | | (2.5) | | 0.9 | | 6.3 | | (0.6) | | (2.8) | | 1.3 | | 4.7 | | | | |

| NA | | 0.3 | | 0.4 | | 4.3 | | 0.2 | | (0.3) | | 5.0 | | 5.0 | | | | |

| IPC | | (4.2) | | 1.6 | | 7.9 | | — | | (7.9) | | (2.6) | | 5.3 | | | | |

| IFP | | (7.6) | | 1.1 | | 9.3 | | (3.9) | | (1.8) | | (2.9) | | 2.8 | | | | |

| December 31, 2022 | | | | | | | | | | | | | | | | | | |

| Consolidated | | (2.7) | | 1.2 | | 8.7 | | 0.1 | | (3.5) | | 3.8 | | 7.2 | | | | |

| NA | | (1.9) | | 0.5 | | 7.2 | | 0.5 | | (0.2) | | 6.1 | | 5.9 | | | | |

| IPC | | (3.4) | | 2.2 | | 9.2 | | — | | (6.8) | | 1.3 | | 8.1 | | | | |

| IFP | | (3.6) | | 1.2 | | 11.7 | | (0.6) | | (7.0) | | 1.7 | | 9.3 | | | | |

| December 31, 2021 | | | | | | | | | | | | | | | | | | |

| Consolidated | | (3.6) | | 0.8 | | 1.8 | | 1.5 | | 1.1 | | 1.6 | | (1.0) | | | | |

| NA | | (6.1) | | 0.2 | | 2.3 | | (0.3) | | 0.4 | | (3.5) | | (3.6) | | | | |

| IPC | | 2.2 | | 2.1 | | 0.8 | | 6.3 | | 1.3 | | 12.8 | | 5.2 | | | | |

| IFP | | (5.1) | | 0.3 | | 1.9 | | (0.4) | | 2.8 | | (0.4) | | (2.8) | | | | |

(a) Total may not equal the sum of volume, mix/other, net price, divestitures and business exits and currency translation due to rounding and excludes intergeographic sales.

(b) Combined impact of changes in volume, mix/other and net price excluding prior year's impact of divestitures and business exits.

(c) Impact of the sale of Brazil tissue and K-C Professional business, sale of the personal protective equipment business and other exited businesses and markets in conjunction with the 2024 Transformation Initiative.

(d) Results shown for September 30, 2024 are for the nine-month period then ended.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

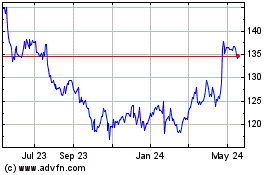

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Nov 2024 to Dec 2024

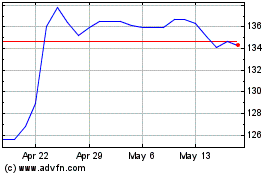

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Dec 2023 to Dec 2024