0000055242falsetrue00000552422025-01-282025-01-280000055242exch:XNYSkmt:CapitalStockParValue1.25PerShareMember2025-01-282025-01-280000055242exch:XNYSkmt:PreferredStockPurchaseRightsMember2025-01-282025-01-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 28, 2025

Kennametal Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | | | | |

| Pennsylvania | | 1-5318 | | 25-0900168 |

| | |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

| 525 William Penn Place | | | | |

| Suite 3300 | | | | |

| Pittsburgh, | Pennsylvania | | | | 15219 |

| | |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (412) 248-8000

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Capital Stock, par value $1.25 per share | KMT | New York Stock Exchange |

| Preferred Stock Purchase Rights | | New York Stock Exchange |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 28, 2025, the Board of Directors (the “Board”) of Kennametal Inc. (the “Company”) announced the appointment of Doug Dietrich, age 55, to serve as a member of the Board of Directors to hold office from February 1, 2025 until the Annual Meeting of Shareholders in October 2025, where he would be proposed to be elected. He will also serve on the Audit Committee of the Board.

Mr. Dietrich is the Chairman of the Board and Chief Executive Officer of Minerals Technologies Inc. (“MTI”), serving in the role of Chief Executive Officer since 2016 and Chairman of the Board since March 2021. MTI is a publicly traded specialty minerals company that develops, produces, and markets a broad range of mineral and mineral-based products, related systems and services. Since joining MTI in 2007, Mr. Dietrich held numerous key management positions, including Senior Vice President, Finance and Treasury and Chief Financial Officer with responsibility for the overall finance function, and Vice President, Corporate Development and Treasury where he led Corporate Strategy and M&A initiatives.

Mr. Dietrich is eligible to participate in all customary compensation plans applicable to non-employee members of the Board, as described in the Company’s definitive proxy statement filed on September 17, 2024. He is also entitled to reimbursement of reasonable out-of-pocket expenses incurred in connection with his service on the Board and his attendance at Board and Committee meetings.

Mr. Dietrich will be entering into an Indemnification Agreement with the Company in the form previously approved by the Board. Under the Indemnification Agreement, a form of which was filed as Exhibit 10.2 to the Form 8-K filed by the Company on March 22, 2005 and is incorporated herein by reference, Mr. Dietrich will be entitled to be held harmless and indemnified by the Company against liability other than for willful misconduct or recklessness. The Indemnification Agreement also provides for the advancement of expenses.

There are no arrangements or understandings between Mr. Dietrich and any other person pursuant to which Mr. Dietrich was appointed to the Board. Mr. Dietrich has not entered into any transactions with the Company that are required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 8.01 Other Events.

On January 28, 2025, the Company’s Board of Directors declared a quarterly cash dividend of $.20 per share. The dividend is payable on February 25, 2025 to shareholders of record as of the close of business on February 11, 2025.

On January 30, 2025, the Company issued a press release announcing Mr. Dietrich’s election as a member of the Board of Directors. A copy of this press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | KENNAMETAL INC. | | |

| | | | | |

| Date: | January 30, 2025 | | | By: | | /s/ Michelle R. Keating | | |

| | | | | | | Michelle R. Keating | | |

| | | | | | | Vice President, Secretary and General Counsel | | |

Exhibit 99.1

FOR IMMEDIATE RELEASE:

DATE: January 30, 2025

| | | | | |

| Investor Relations | Media Relations |

| CONTACT: Michael Pici | CONTACT: Lori Lecker |

| PHONE: 412-790-0792 | PHONE: 412-248-8224 |

| michael.pici@kennametal.com | lori.lecker@kennametal.com |

Kennametal Names Douglas Dietrich to Board of Directors

PITTSBURGH, January 30, 2025 — Kennametal Inc. (NYSE: KMT) today announced the election of Douglas Dietrich to its Board of Directors, effective February 1, 2025. Dietrich is currently the Executive Chairman and CEO of Minerals Technologies, a publicly traded specialty minerals company.

“Doug brings over 30 years of business and industry experience, most recently driving transformative change at Minerals Technologies through his strategic, operational and financial leadership,” said Sanjay Chowbey, President & CEO of Kennametal. “We’re excited to welcome him to our Board and confident that his expertise and global perspective will be key to advancing our strategy and enhancing shareholder value.”

William M. Lambert, Chairman of Kennametal’s Board of Directors, added: “Doug’s track record of delivering long-term growth through strategy, innovation and targeted M&A will be invaluable as we continue our transformational journey. We look forward to leveraging his insights and leadership as a member of our Board."

About Dietrich

Douglas T. Dietrich was elected Minerals Technologies Chairman of the Board in March 2021. He has served as the Chief Executive Officer of Minerals Technologies Inc. (MTI) since December 2016.

Dietrich has over 30 years of experience in the industrial goods, mining and metals manufacturing sector as well as significant expertise in engineering, management and operations.

Since joining MTI in 2007, Dietrich has held numerous key management positions, including Senior Vice President, Finance and Treasury and Chief Financial Officer with responsibility for the overall finance function, and Vice President, Corporate Development and Treasury where he led Corporate Strategy and M&A initiatives.

Prior to his tenure at MTI, Dietrich held several positions of increasing leadership responsibility at Alcoa Inc. These roles included Vice President, Alcoa Wheel Products - Automotive Wheels; President, Alcoa Latin America Extrusions; General Manager, Global Rod and Bar Products; and Manager, Business Development and Strategic Global Sourcing – Asia and Latin America.

Earlier in his career, Dietrich worked for Eaton Corporation and Westinghouse Electric Corporation where he held various positions in Engineering and Operations Management.

He holds a Bachelor of Science degree in Mechanical Engineering from the University of Michigan and an MBA in Finance from The Wharton School at the University of Pennsylvania.

About Kennametal

With over 85 years as an industrial technology leader, Kennametal Inc. delivers productivity to customers through materials science, tooling and wear-resistant solutions. Customers across aerospace and defense, earthworks, energy, general engineering and transportation turn to Kennametal to help them manufacture with precision and efficiency. Every day approximately 8,400 employees are helping customers in nearly 100 countries stay competitive. Kennametal generated $2 billion in revenues in fiscal 2024. Learn more at www.kennametal.com. Follow @Kennametal: Instagram, Facebook, LinkedIn and YouTube.

v3.24.4

Cover Cover

|

Jan. 28, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 28, 2025

|

| Entity Registrant Name |

Kennametal Inc.

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity File Number |

1-5318

|

| Entity Tax Identification Number |

25-0900168

|

| Entity Address, Address Line One |

525 William Penn Place

|

| Entity Address, Address Line Two |

Suite 3300

|

| Entity Address, City or Town |

Pittsburgh,

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

15219

|

| City Area Code |

412

|

| Local Phone Number |

248-8000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000055242

|

| Amendment Flag |

false

|

| Capital Stock, Par Value $1.25 Per Share | NEW YORK STOCK EXCHANGE, INC. |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Capital Stock, par value $1.25 per share

|

| Trading Symbol |

KMT

|

| Security Exchange Name |

NYSE

|

| Preferred Stock Purchase Rights | NEW YORK STOCK EXCHANGE, INC. |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock Purchase Rights

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kmt_CapitalStockParValue1.25PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kmt_PreferredStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

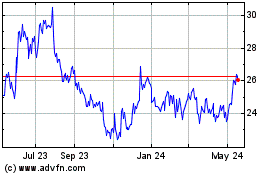

Kennametal (NYSE:KMT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kennametal (NYSE:KMT)

Historical Stock Chart

From Feb 2024 to Feb 2025