Kosmos Energy Ltd. (“Kosmos” or the “Company”) (NYSE/LSE: KOS)

announced today its financial and operating results for the second

quarter of 2024. For the quarter, the Company generated a net

income of $60 million, or $0.12 per diluted share. When adjusted

for certain items that impact the comparability of results, the

Company generated an adjusted net income(1) of $80 million, or

$0.17 per diluted share for the second quarter of 2024.

SECOND QUARTER 2024 HIGHLIGHTS

- Net Production(2): ~62,100 barrels of oil equivalent per day

(boepd), representing ~7% growth year over year, with sales of

~65,400 boepd

- Revenues: $451 million, or $75.73 per boe (excluding the impact

of derivative cash settlements)

- Production expense: $151 million or $25.32 per boe ($22.27 per

boe excluding $18 million of production expenses associated with

the Greater Tortue Ahmeyim (GTA) project)

- Capital expenditures: $215 million

- Arrival on location and successful mooring of the floating

production, storage and offtake (FPSO) vessel for the GTA

project

- Post quarter end, in the US Gulf of Mexico achieved first oil

at Winterfell (with the first two wells online in early July),

successfully completed the operated Kodiak-3 well workover and the

startup of the Odd Job subsea pump project

- Post quarter end, in Equatorial Guinea the drilling rig for the

infill and infrastructure-led exploration (ILX) campaign arrived on

location and successfully drilled the first infill well

Commenting on the Company’s second quarter 2024 performance,

Chairman and Chief Executive Officer Andrew G. Inglis said: "It has

been a busy period for Kosmos with significant progress in the

delivery of our development projects. Production is rising in the

US Gulf of Mexico with the startup of Winterfell and the successful

completion of our production optimization activities. The drilling

campaign in Equatorial Guinea has now commenced and we continue to

see good progress across all major workstreams on the GTA project

in Mauritania and Senegal. With these projects online, we expect to

exit the year at our production goal of around 90,000 boepd. In

addition, we have completed the concept development work on

Yakaar-Teranga in Senegal and are progressing Tiberius in the US

Gulf of Mexico towards final investment decision, providing

high-quality investment opportunities beyond 2024.

As production ramps up and capital expenditures are expected to

fall, we remain committed to delivering free cash flow within a

disciplined capital framework, to further enhance the financial

resilience of the company, after which we will consider shareholder

returns."

FINANCIAL UPDATE

Net capital expenditure for the second quarter of 2024 was $215

million, below our guidance range primarily due to the timing of

capital expenditures accruals related to GTA in Mauritania and

Senegal, which we now expect will be recognized in the third

quarter. With the completion of the Ghana infill drilling program

and the startup of Winterfell, capital expenditures in the second

half of the year are expected to be materially lower than the first

half. As previously guided, with the resumption of the drilling

campaign in Equatorial Guinea, full year capital expenditure is

expected to be around $750 million.

Kosmos exited the second quarter of 2024 with approximately $2.7

billion of total long-term debt and approximately $2.5 billion of

net debt(1) and available liquidity of approximately $793

million.

The Company generated net cash provided by operating activities

of approximately $224 million and free cash flow(1) of

approximately $(15) million in the second quarter.

OPERATIONAL UPDATE

Production

Total net production(2) in the second quarter of 2024 averaged

approximately 62,100 boepd, within guidance range, representing a

~7% increase compared to the second quarter of 2023. This growth

largely reflects higher production in Ghana following completion of

the infill drilling campaign offset by lower production in the US

Gulf of Mexico due to planned downtime and a delay to startup of

the Winterfell project. The Company exited the quarter in a net

overlift position of approximately 0.1 million barrels.

Ghana

Production in Ghana averaged approximately 41,900 boepd net in

the second quarter of 2024. Kosmos lifted four cargos from Ghana

during the quarter, in line with guidance.

At Jubilee (38.6% working interest), oil production in the

second quarter averaged approximately 87,300 bopd gross with one

producer well brought online in April and one water injector well

brought online in June. As the operator in Ghana recently

communicated, the ramp up in production at Jubilee has been slower

than expected, primarily as a result of one producer well (J-69)

under performing expectations and a temporary reduction in water

injection. Voidage replacement during the second quarter was

approximately 80% (compared to the 100% target). The Jubilee FPSO

reliability remains high with uptime approximately 99% for the

second quarter.

Following the completion of the water injector well in June, the

three-year drilling campaign has concluded. The partnership now

plans to conduct a new 4D seismic survey in early 2025. This

survey, using enhanced seismic technology, will support the

partnership in high grading the optimal drilling locations for the

planned 2025/2026 drilling campaign.

In the second quarter, Jubilee gas production net to Kosmos was

approximately 6,200 boepd. The onshore gas plant that receives

Jubilee gas was originally expected to be offline for approximately

two weeks for planned routine maintenance during the second

quarter. This is now expected in the third quarter, with the impact

included in third quarter guidance. Following the J-69 well

underperformance, we now expect Jubilee production for the full

year to be around 90,000 bopd gross. Longer-term, with enhanced 4D

seismic imaging and a material 2P reserve base remaining, we remain

confident of the field’s production potential through the end of

the decade.

At TEN (20.4% working interest), production averaged

approximately 19,300 bopd gross for the second quarter, slightly

above expectations. Uptime on the TEN FPSO was approximately 99%

for the second quarter.

U.S. Gulf of Mexico

Production in the U.S. Gulf of Mexico averaged approximately

11,700 boepd net (~83% oil) during the second quarter.

The first two wells at Winterfell (25% working interest) were

drilled and completed by April with startup occurring in early

July, later than planned impacting production in the quarter. The

third development well was successfully drilled in the second

quarter, encountering approximately 50 feet of net oil pay, in line

with expectations. First production from this well is expected by

the end of this quarter. Gross production from the first phase of

Winterfell is expected to be around 20,000 boepd when the initial

three wells are online.

Enhanced imaging from recent ocean bottom node (OBN) seismic,

calibrated with data from the first three Winterfell wells, gives

Kosmos increased confidence in the recovery of approximately 100

million boe gross in the first phase of the project (5 wells in

total) and greater visibility to additional upside potential in

adjacent prospectivity.

The Company’s production enhancement activities for 2024

concluded in July, with the completion of the Kodiak-3 well

workover and startup of the Odd Job subsea pump project, both

operated by Kosmos. Current production in the US Gulf of Mexico has

increased to approximately 20,000 boepd, a 40% increase over the

first quarter of the year.

The Tiberius project, (50% working interest and operator)

continues to progress as a phased development, with final

investment decision expected later this year. Long lead items and a

drilling rig have been secured to manage the development timeline

and project costs. Kosmos plans to farm down to optimize its

working interest to fit within the targeted 2025+ capital program.

Estimated gross resource at Tiberius is approximately 100 million

boe.

Equatorial Guinea

Production in Equatorial Guinea averaged approximately 24,200

bopd gross and 8,500 bopd net in the second quarter. Kosmos lifted

0.5 cargos from Equatorial Guinea during the quarter, in line with

guidance.

As previously announced, the Noble Venturer rig was contracted

to resume the infill and ILX drilling campaign and arrived on

location in July. The rig has successfully completed drilling the

first infill well in Block G with positive initial results. Post

completion, we plan to drill the second infill well. Both wells are

expected online in the fourth quarter, after which the rig is

contracted to drill the Akeng Deep ILX prospect in Block S, with

results expected around the end of the year.

Mauritania and Senegal

The Greater Tortue Ahmeyim liquefied natural gas (LNG) project

continues to make good progress. The following milestones have been

achieved:

- Drilling: The first batch of four wells has been completed with

expected production capacity significantly higher than what is

required for first gas.

- Hub Terminal: The Hub Terminal has been handed over to

operations.

- Subsea: The subsea workscope is progressing in line with

expectations with final connection work ongoing. Mechanical

completion for first gas is expected this month.

- FPSO: The vessel arrived on location offshore Mauritania and

Senegal during the second quarter of 2024 with mooring now

complete. All risers were installed in June and commissioning of

the FPSO is ongoing with handover to operations targeted in

September with first gas expected shortly thereafter.

- FLNG: The vessel arrived on location offshore Mauritania and

Senegal during the first quarter of 2024 and is now moored to the

Hub Terminal. The partnership is working with the vessel operator

to advance commissioning work and plans to bring in a

pre-commissioning cargo to accelerate the cool down of the vessel

later this month. First LNG is expected in the fourth quarter of

2024.

On Yakaar-Teranga in Senegal, Kosmos has completed the concept

development work, which supports a cost competitive LNG/domestic

gas project. Work will now transition towards finalizing the

partnership to support advancement of the project.

(1) A Non-GAAP measure, see attached reconciliation of non-GAAP

measure.

(2) Production means net entitlement volumes. In Ghana and

Equatorial Guinea, this means those volumes net to Kosmos' working

interest or participating interest and net of royalty or production

sharing contract effect. In the U.S. Gulf of Mexico, this means

those volumes net to Kosmos' working interest and net of

royalty.

Conference Call and Webcast Information

Kosmos will host a conference call and webcast to discuss second

quarter 2024 financial and operating results today, August 5, 2024,

at 10:00 a.m. Central time (11:00 a.m. Eastern time). The live

webcast of the event can be accessed on the Investors page of

Kosmos’ website at

http://investors.kosmosenergy.com/investor-events. The dial-in

telephone number for the call is +1-877-407-0784. Callers in the

United Kingdom should call 0800 756 3429. Callers outside the

United States should dial +1-201-689-8560. A replay of the webcast

will be available on the Investors page of Kosmos’ website for

approximately 90 days following the event.

About Kosmos Energy

Kosmos is a full-cycle, deepwater, independent oil and gas

exploration and production company focused along the offshore

Atlantic Margins. Our key assets include production offshore Ghana,

Equatorial Guinea and the U.S. Gulf of Mexico, as well as

world-class gas projects offshore Mauritania and Senegal. We also

pursue a proven basin exploration program in Equatorial Guinea and

the U.S. Gulf of Mexico. Kosmos is listed on the New York Stock

Exchange and London Stock Exchange and is traded under the ticker

symbol KOS. As an ethical and transparent company, Kosmos is

committed to doing things the right way. The Company’s Business

Principles articulate our commitment to transparency, ethics, human

rights, safety and the environment. Read more about this commitment

in the Kosmos Sustainability Report. For additional information,

visit www.kosmosenergy.com.

Non-GAAP Financial Measures

EBITDAX, Adjusted net income (loss), Adjusted net income (loss)

per share, free cash flow, and net debt are supplemental non-GAAP

financial measures used by management and external users of the

Company's consolidated financial statements, such as industry

analysts, investors, lenders and rating agencies. The Company

defines EBITDAX as Net income (loss) plus (i) exploration expense,

(ii) depletion, depreciation and amortization expense, (iii) equity

based compensation expense, (iv) unrealized (gain) loss on

commodity derivatives (realized losses are deducted and realized

gains are added back), (v) (gain) loss on sale of oil and gas

properties, (vi) interest (income) expense, (vii) income taxes,

(viii) debt modifications and extinguishments, (ix) doubtful

accounts expense and (x) similar other material items which

management believes affect the comparability of operating results.

The Company defines Adjusted net income (loss) as Net income (loss)

adjusted for certain items that impact the comparability of

results. The Company defines free cash flow as net cash provided by

operating activities less Oil and gas assets, Other property, and

certain other items that may affect the comparability of results

and excludes non-recurring activity such as acquisitions,

divestitures and National Oil Company ("NOC") financing. NOC

financing refers to the amounts funded by Kosmos under the Carry

Advance Agreements that the Company has in place with the national

oil companies of each of Mauritania and Senegal related to the

financing of the respective national oil companies’ share of

certain development costs at Greater Tortue Ahmeyim. The Company

defines net debt as total long-term debt less cash and cash

equivalents and total restricted cash.

We believe that EBITDAX, Adjusted net income (loss), Adjusted

net income (loss) per share, free cash flow, Net debt and other

similar measures are useful to investors because they are

frequently used by securities analysts, investors and other

interested parties in the evaluation of companies in the oil and

gas sector and will provide investors with a useful tool for

assessing the comparability between periods, among securities

analysts, as well as company by company. EBITDAX, Adjusted net

income (loss), Adjusted net income (loss) per share, free cash

flow, and net debt as presented by us may not be comparable to

similarly titled measures of other companies.

This release also contains certain forward-looking non-GAAP

financial measures, including free cash flow. Due to the

forward-looking nature of the aforementioned non-GAAP financial

measures, management cannot reliably or reasonably predict certain

of the necessary components of the most directly comparable

forward-looking GAAP measures, such as future impairments and

future changes in working capital. Accordingly, we are unable to

present a quantitative reconciliation of such forward-looking

non-GAAP financial measures to their most directly comparable

forward-looking GAAP financial measures. Amounts excluded from

these non-GAAP measures in future periods could be significant.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that Kosmos

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Kosmos’ estimates and

forward-looking statements are mainly based on its current

expectations and estimates of future events and trends, which

affect or may affect its businesses and operations. Although Kosmos

believes that these estimates and forward-looking statements are

based upon reasonable assumptions, they are subject to several

risks and uncertainties and are made in light of information

currently available to Kosmos. When used in this press release, the

words “anticipate,” “believe,” “intend,” “expect,” “plan,” “will”

or other similar words are intended to identify forward-looking

statements. Such statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of

Kosmos, which may cause actual results to differ materially from

those implied or expressed by the forward-looking statements.

Further information on such assumptions, risks and uncertainties is

available in Kosmos’ Securities and Exchange Commission (“SEC”)

filings. Kosmos undertakes no obligation and does not intend to

update or correct these forward-looking statements to reflect

events or circumstances occurring after the date of this press

release, except as required by applicable law. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this press release. All

forward-looking statements are qualified in their entirety by this

cautionary statement.

Kosmos Energy Ltd.

Consolidated Statements of

Operations

(In thousands, except per

share amounts, unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Revenues and other income:

Oil and gas revenue

$

450,900

$

273,255

$

870,003

$

667,495

Other income, net

36

60

72

(313

)

Total revenues and other income

450,936

273,315

870,075

667,182

Costs and expenses:

Oil and gas production

150,733

63,579

244,351

147,515

Exploration expenses

13,235

11,015

25,295

23,015

General and administrative

25,161

23,444

53,426

52,611

Depletion, depreciation and

amortization

90,094

89,913

191,022

199,287

Interest and other financing costs,

net

37,279

24,371

53,727

48,939

Derivatives, net

(2,852

)

3,031

20,970

(3,809

)

Other expenses, net

2,162

4,779

4,191

6,809

Total costs and expenses

315,812

220,132

592,982

474,367

Income before income taxes

135,124

53,183

277,093

192,815

Income tax expense

75,354

29,838

125,637

86,161

Net income

$

59,770

$

23,345

$

151,456

$

106,654

Net income per share:

Basic

$

0.13

$

0.05

$

0.32

$

0.23

Diluted

$

0.12

$

0.05

$

0.32

$

0.22

Weighted average number of shares used to

compute net income per share:

Basic

471,599

459,984

469,821

459,155

Diluted

480,172

479,016

479,824

478,902

Kosmos Energy Ltd.

Condensed Consolidated Balance

Sheets

(In thousands,

unaudited)

June 30,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

173,813

$

95,345

Receivables, net

113,124

120,733

Other current assets

190,694

206,635

Total current assets

477,631

422,713

Property and equipment, net

4,558,313

4,160,229

Other non-current assets

353,366

355,192

Total assets

$

5,389,310

$

4,938,134

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

345,258

$

248,912

Accrued liabilities

302,903

302,815

Other current liabilities

6,710

3,103

Total current liabilities

654,871

554,830

Long-term liabilities:

Long-term debt, net

2,595,296

2,390,914

Deferred tax liabilities

370,840

363,918

Other non-current liabilities

626,412

596,135

Total long-term liabilities

3,592,548

3,350,967

Total stockholders’ equity

1,141,891

1,032,337

Total liabilities and stockholders’

equity

$

5,389,310

$

4,938,134

Kosmos Energy Ltd.

Condensed Consolidated

Statements of Cash Flow

(In thousands,

unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Operating activities:

Net income

$

59,770

$

23,345

$

151,456

$

106,654

Adjustments to reconcile net income to net

cash provided by operating activities:

Depletion, depreciation and amortization

(including deferred financing costs)

92,350

92,443

195,677

204,368

Deferred income taxes

12,515

(997

)

5,199

(9,029

)

Unsuccessful well costs and leasehold

impairments

2,219

9

2,685

1,313

Change in fair value of derivatives

(5,904

)

2,118

21,106

(220

)

Cash settlements on derivatives,

net(1)

(1,172

)

725

(7,366

)

(10,632

)

Equity-based compensation

10,487

11,105

17,815

21,198

Debt modifications and extinguishments

22,531

—

22,531

—

Other

(6,280

)

799

(11,988

)

(1,474

)

Changes in assets and liabilities:

Net changes in working capital

37,141

(111,437

)

99,105

(90,215

)

Net cash provided by operating

activities

223,657

18,110

496,220

221,963

Investing activities

Oil and gas assets

(238,171

)

(193,182

)

(552,993

)

(416,867

)

Notes receivable from partners

(47

)

(17,624

)

(2,575

)

(33,295

)

Net cash used in investing activities

(238,218

)

(210,806

)

(555,568

)

(450,162

)

Financing activities:

Borrowings under long-term debt

—

150,000

175,000

150,000

Payments on long-term debt

(50,000

)

—

(350,000

)

(7,500

)

Net proceeds from issuance of senior

notes

—

—

390,430

—

Purchase of capped call transactions

—

—

(49,800

)

—

Dividends

—

(1

)

—

(166

)

Other financing costs

(19,234

)

(1

)

(30,925

)

(11,811

)

Net cash provided by (used in) financing

activities

(69,234

)

149,998

134,705

130,523

Net increase (decrease) in cash, cash

equivalents and restricted cash

(83,795

)

(42,698

)

75,357

(97,676

)

Cash, cash equivalents and restricted cash

at beginning of period

257,913

131,843

98,761

186,821

Cash, cash equivalents and restricted cash

at end of period

$

174,118

$

89,145

$

174,118

$

89,145

______________________________

(1)

Cash settlements on commodity hedges were

$(4.5) million and $(4.0) million for the three months ended June

30, 2024 and 2023, respectively, and $(7.4) million and $(8.2)

million for the six months ended June 30, 2024 and 2023,

respectively.

Kosmos Energy Ltd.

EBITDAX

(In thousands,

unaudited)

Three Months Ended

Six months ended

Twelve Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

June 30, 2024

Net income

$

59,770

$

23,345

$

151,456

$

106,654

$

258,322

Exploration expenses

13,235

11,015

25,295

23,015

44,558

Depletion, depreciation and

amortization

90,094

89,913

191,022

199,287

436,662

Impairment of long-lived assets

—

—

—

—

222,278

Equity-based compensation

10,487

11,105

17,815

21,198

39,310

Derivatives, net

(2,852

)

3,031

20,970

(3,809

)

35,907

Cash settlements on commodity

derivatives

(4,489

)

(4,030

)

(7,423

)

(8,213

)

(15,658

)

Other expenses, net(1)

2,162

4,779

4,191

6,809

21,038

Interest and other financing costs,

net

37,279

24,371

53,727

48,939

100,692

Income tax expense

75,354

29,838

125,637

86,161

197,691

EBITDAX

$

281,040

$

193,367

$

582,690

$

480,041

$

1,340,800

______________________________

(1)

Commencing in the first quarter of 2023,

the Company combined the lines for "Restructuring and other" and

"Other, net" in its presentation of EBITDAX into a single line

titled "Other expenses, net."

The following table presents our net debt as of June 30, 2024

and December 31, 2023:

June 30,

December 31,

2024

2023

Total long-term debt

$

2,650,000

$

2,425,000

Cash and cash equivalents

173,813

95,345

Total restricted cash

305

3,416

Net debt

$

2,475,882

$

2,326,239

Kosmos Energy Ltd.

Adjusted Net Income

(Loss)

(In thousands, except per

share amounts, unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net income

$

59,770

$

23,345

$

151,456

$

106,654

Derivatives, net

(2,852

)

3,031

20,970

(3,809

)

Cash settlements on commodity

derivatives

(4,489

)

(4,030

)

(7,423

)

(8,213

)

Other, net(2)

2,130

4,838

3,927

6,737

Debt modifications and extinguishments

22,531

—

22,531

—

Total selected items before tax

17,320

3,839

40,005

(5,285

)

Income tax (expense) benefit on

adjustments(1)

3,392

277

(3,917

)

3,785

Impact of valuation adjustments and other

tax items

—

—

(7,963

)

—

Adjusted net income

$

80,482

27,461

179,581

105,154

Net income per diluted share

$

0.12

$

0.05

$

0.32

$

0.22

Derivatives, net

(0.01

)

0.01

0.04

(0.01

)

Cash settlements on commodity

derivatives

(0.01

)

(0.01

)

(0.02

)

(0.02

)

Other, net(2)

—

0.01

0.01

0.01

Debt modifications and extinguishments

0.05

—

0.05

—

Total selected items before tax

0.03

0.01

0.08

(0.02

)

Income tax (expense) benefit on

adjustments(1)

0.02

—

(0.01

)

0.02

Impact of valuation adjustments and other

tax items

—

—

(0.02

)

—

Adjusted net income per diluted share

$

0.17

$

0.06

$

0.37

$

0.22

Weighted average number of diluted

shares

480,172

479,016

479,824

478,902

______________________________

(1)

Income tax expense is calculated at the

statutory rate in which such item(s) reside. Statutory rates for

the U.S. and Ghana/Equatorial Guinea are 21% and 35%,

respectively.

(2)

Commencing in the first quarter of 2023,

the Company combined the lines for "Restructuring and other" and

"Other, net" in its presentation of Adjusted net income into a

single line titled "Other, net."

Kosmos Energy Ltd.

Free Cash Flow

(In thousands,

unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Reconciliation of free cash

flow:

Net cash provided by operating

activities

$

223,657

$

18,110

$

496,220

$

221,963

Net cash used for oil and gas assets -

base business

(120,525

)

(117,772

)

(275,385

)

(214,946

)

Base business free cash flow

103,132

(99,662

)

220,835

7,017

Net cash used for oil and gas assets -

Mauritania/Senegal

(117,646

)

(75,410

)

(277,608

)

(201,921

)

Free cash flow

$

(14,514

)

$

(175,072

)

$

(56,773

)

$

(194,904

)

Kosmos Energy Ltd.

Operational Summary

(In thousands, except barrel

and per barrel data, unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net Volume Sold

Oil (MMBbl)

5.210

3.547

10.099

8.492

Gas (MMcf)

4.101

2.774

8.437

5.535

NGL (MMBbl)

0.060

0.107

0.148

0.203

Total (MMBoe)

5.954

4.116

11.653

9.618

Total (Mboepd)

65.423

45.234

64.028

53.135

Revenue

Oil sales

$

435,100

$

267,149

$

837,217

$

655,248

Gas sales

14,494

3,568

29,632

7,434

NGL sales

1,306

2,538

3,154

4,813

Total oil and gas revenue

450,900

273,255

870,003

667,495

Cash settlements on commodity

derivatives

(4,489

)

(4,030

)

(7,423

)

(8,213

)

Realized revenue

$

446,411

$

269,225

$

862,580

$

659,282

Oil and Gas Production Costs

$

150,733

$

63,579

$

244,351

$

147,515

Sales per Bbl/Mcf/Boe

Average oil sales price per Bbl

$

83.51

$

75.32

$

82.90

$

77.16

Average gas sales price per Mcf

3.53

1.29

3.51

1.34

Average NGL sales price per Bbl

21.77

23.72

21.31

23.71

Average total sales price per Boe

75.73

66.38

74.66

69.40

Cash settlements on commodity derivatives

per Boe

(0.75

)

(0.98

)

(0.64

)

(0.85

)

Realized revenue per Boe

74.98

65.40

74.02

68.55

Oil and gas production costs per

Boe

$

25.31

$

15.45

$

20.97

$

15.34

______________________________

(1)

Cash settlements on commodity derivatives

are only related to Kosmos and are calculated on a per barrel basis

using Kosmos' Net Oil Volumes Sold.

Kosmos was overlifted by approximately 0.1 million barrels as of

June 30, 2024.

Kosmos Energy Ltd.

Hedging Summary

As of June 30, 2024(1)

(Unaudited)

Weighted Average Price per

Bbl

Index

MBbl

Floor(2)

Sold Put

Ceiling

2024:

Three-way collars

Dated Brent

4,000

$

70.00

$

45.00

$

93.12

Two-way collars

Dated Brent

1,000

70.00

—

100.00

1H 2025:

Two-way collars

Dated Brent

2,000

70.00

—

95.00

______________________________

(1)

Please see the Company’s filed 10-Q for

additional disclosure on hedging material. Includes hedging

position as of June 30, 2024 and hedges put in place through filing

date.

(2)

“Floor” represents floor price for collars

and strike price for purchased puts.

2024 Guidance

3Q 2024

FY 2024 Guidance

Production(1,2)

65,000 - 69,000 boe per day

67,000 - 71,000 boe per day

Opex(3)

$17.50 - $19.50 per boe

$16.50 - $18.50 per boe

DD&A

$19.50 - $21.50 per boe

$18.00 - $20.00 per boe

G&A(~60% cash)

$25 - $30 million

$100 - $120 million

Exploration Expense(4)

$10 - $15 million

$40 - $60 million

Net Interest Expense(5)

$25 - $30 million

~$140 million

Tax

$9.00 - $11.00 per boe

$10.00 - $12.00 per boe

Capital Expenditure

$175 - $200 million

~$750 million

______________________________

Note: Ghana / Equatorial Guinea revenue

calculated by number of cargos.

(1)

3Q 2024 cargo forecast – Ghana: 3 cargos /

Equatorial Guinea 1 cargo. FY 2024 Ghana: 13 cargos / Equatorial

Guinea 3.5 cargos. Average cargo sizes 950,000 barrels of oil.

(2)

U.S. Gulf of Mexico Production: 3Q 2024

forecast 15,500-16,500 boe per day; includes assumed downtime for

weather. FY 2024: 15,500-17,000 boe per day. Oil/Gas/NGL split for

2024: ~83%/~11%/~6%.

(3)

FY 2024 opex excludes operating costs

associated with GTA, which are expected to total approximately $115

- $130 million ($50 - $70 million in 3Q 2024)

(4)

Excludes leasehold impairments and dry

hole costs

(5)

Includes impact of capitalized interest;

~$35 million related to GTA in 3Q 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240804056117/en/

Investor Relations Jamie Buckland +44 (0) 203 954 2831

jbuckland@kosmosenergy.com

Media Relations Thomas Golembeski +1-214-445-9674

tgolembeski@kosmosenergy.com

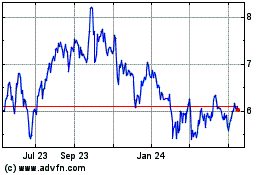

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

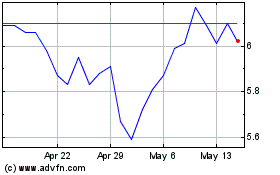

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Jan 2024 to Jan 2025