00010259960001493976false00010259962024-07-302024-07-300001025996krc:KilroyRealtyL.P.Member2024-07-302024-07-300001025996krc:KilroyRealtyL.P.Member2024-01-012024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2024

KILROY REALTY CORPORATION

KILROY REALTY, L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Kilroy Realty Corporation | Maryland | 001-12675 | 95-4598246 |

| (State or other jurisdiction of

incorporation or organization) | (Commission File No.) | (I.R.S. Employer

Identification No.) |

| | | | |

| Kilroy Realty, L.P. | Delaware | 000-54005 | 95-4612685 |

| (State or other jurisdiction of

incorporation or organization) | (Commission File No.) | (I.R.S. Employer

Identification No.) |

12200 W. Olympic Boulevard, Suite 200, Los Angeles, California, 90064

(Address of principal executive offices) (Zip Code)

(310) 481-8400

| | | | | | | | |

| (Registrant's telephone number, including area code) |

| | |

| N/A |

| (Former name, former address and former fiscal year, if changed since last report) |

| | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Registrant | Title of each class | Name of each exchange on which registered | Ticker Symbol |

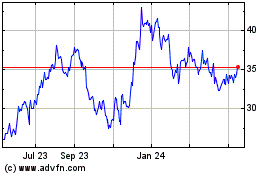

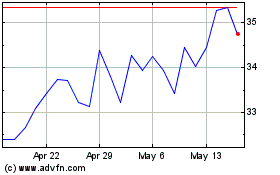

| Kilroy Realty Corporation | Common Stock, $.01 par value | New York Stock Exchange | KRC |

| | | | | |

| Securities registered pursuant to Section 12(g) of the Act: |

| Registrant | Title of each class |

| Kilroy Realty, L.P. | Common Units Representing Limited Partnership Interests |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Kilroy Realty Corporation:

Emerging growth company ☐

Kilroy Realty, L.P.:

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| | | | | |

Kilroy Realty Corporation ☐ | Kilroy Realty, L.P. ☐ |

Item 2.02 Results of Operations and Financial Condition.

On July 31, 2024, Kilroy Realty Corporation (the “Company”) issued a press release announcing its earnings for the quarter ended June 30, 2024 and distributed certain supplemental financial information. On July 31, 2024, the Company also posted the supplemental information on its website located at www.kilroyrealty.com. The text of the supplemental information and the related press release are furnished herewith as Exhibits 99.1 and 99.2, respectively, and are incorporated by reference herein.

Exhibits 99.1 and 99.2 are being furnished pursuant to Item 2.02 and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act regardless of any general incorporation language in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Chief Financial Officer Appointment; Chief Financial Officer Employment Agreement

On July 30, 2024, the Board of Directors (the “Board”) of the Company appointed Jeffrey Kuehling to serve as Executive Vice President, Chief Financial Officer, effective on a date on or before September 3, 2024, to be mutually agreed between Mr. Kuehling and the Company (the “Transition Date”). In such capacity, Mr. Kuehling shall serve as the principal financial officer of the Company and Kilroy Realty, L.P. (the “Operating Partnership”), the Company’s operating partnership.

Jeffrey Kuehling, age 39, joins the Company from Brixmor Property Group (“Brixmor”), a publicly-traded real estate investment trust, where he has served as the Vice President, Corporate Strategy and then the Senior Vice President, Corporate Strategy since 2018. Prior to Brixmor, Mr. Kuehling served as the Director of Corporate Finance at RPT Realty and held several finance positions at Retail Properties of America, Inc. Mr. Kuehling received his bachelor’s degree from Indiana University, his master of science from the University of Florida, and his master of business administration from the University of Chicago. Mr. Kuehling is also a Certified Public Accountant and a Chartered Financial Analyst.

There are no arrangements or understandings between Mr. Kuehling and any other persons pursuant to which he was selected as an officer of the Company. There are also no family relationships between Mr. Kuehling and any director or executive officer of the Company, and Mr. Kuehling does not have any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

On July 30, 2024, the Company, the Operating Partnership, and Mr. Kuehling entered into an Employment Agreement (the “Employment Agreement”) that provides for Mr. Kuehling’s employment with the Operating Partnership and to serve in the position of Executive Vice President, Chief Financial Officer of the Company beginning on the Transition Date. The Employment Agreement includes the following compensation and benefits for Mr. Kuehling while he serves in these positions:

•Mr. Kuehling will be entitled to an annual base salary of $475,000, which may be increased (but not decreased) by the Board (or a committee thereof) from time to time.

•Mr. Kuehling will be entitled to an annual incentive bonus opportunity based on the achievement of performance criteria to be established by the Board (or a committee thereof). Mr. Kuehling’s annual target and maximum bonus opportunities will be 100% and 150%, respectively, of his base salary for the corresponding fiscal year.

•On or promptly following the Transition Date, the Company will grant Mr. Kuehling a stock unit award under the Company’s Amended and Restated 2006 Incentive Award Plan, as amended. The award will cover a number of shares of Company common stock equal to $700,000 divided by the closing price for a share of the Company’s common stock (in regular trading) on the New York Stock Exchange on the Transition Date (or, if the Transition Date is not a trading day, the last trading day prior to such date). The award will vest in one installment on January 6, 2026, subject to Mr. Kuehling’s continued employment through that date.

•Additional equity awards for Mr. Kuehling, commencing with awards for fiscal year 2025, will be in the discretion of the Board (or a committee thereof), provided that Mr. Kuehling’s annual equity award for fiscal year 2025 will have a grant date fair value (as determined in accordance with the Company’s equity award valuation methodology used for its financial reporting purposes) of not less than $750,000.

•Mr. Kuehling will be entitled to certain employee benefits, such as participation in the Company’s retirement and welfare benefit plans and programs, and fringe benefit plans and programs, made available to the Company’s executive officers generally.

•In connection with his relocation to the Los Angeles area, Mr. Kuehling will also be entitled to reimbursement for up to $50,000 in the aggregate for relocation costs, plus reimbursement for any taxes he may incur in connection with such reimbursements, provided that Mr. Kuehling must complete his relocation by September 30, 2024.

The term of Mr. Kuehling’s employment under the Employment Agreement will be for an initial term commencing on the Transition Date and ending on March 1, 2027, with automatic one-year renewals unless one party has provided the other party with at least 60 days’ advance notice of non-renewal of the term and subject to earlier termination by either the Company (which term includes the Operating Partnership, as the context may require, for purposes of employment and severance benefit provisions) or Mr. Kuehling.

The Employment Agreement generally provides that if Mr. Kuehling’s employment with the Company is terminated by the Company without Cause or by Mr. Kuehling for Good Reason, Mr. Kuehling will be entitled to receive the following separation benefits: (1) a severance payment equal to one times the sum of his annual base salary and target annual incentive bonus, paid out in installments over the one-year period following his separation date; (2) payment of any bonus due for a fiscal year that ended prior to his separation date plus a pro-rata portion of his target bonus for the year in which his employment ends (pro-rata based on the number of days of employment during the year); and (3) payment or reimbursement of Mr. Kuehling’s premiums to continue healthcare coverage under COBRA for up to 18 months. If such a termination of Mr. Kuehling’s employment by the Company without Cause or by him for Good Reason occurs during the period within 60 days before a Change in Control (as defined in the Employment Agreement) of the Company or at any time after such a Change in Control, Mr. Kuehling will be entitled to (a) a severance payment equal to one times the sum of his annual base salary and his target annual incentive bonus (with such amount to be paid generally in a lump sum if the termination occurs on or within two years after the Change in Control); (b) payment of any bonus due for a fiscal year that ended prior to his separation date plus a pro-rata portion of his target bonus for the year in which his employment ends (pro-rata based on the number of days of employment during the year); (c) payment or reimbursement of Mr. Kuehling’s premiums to continue healthcare coverage under COBRA for up to 18 months; (d) as to each then-outstanding equity-based award granted by the Company to Mr. Kuehling that vests based solely on continued service with the Company, accelerated vesting of the entire outstanding and unvested portion of the award; and (e) as to each outstanding equity-based award granted by the Company to Mr. Kuehling that is subject to performance-based vesting requirements, any service-based vesting requirement under the award will be deemed satisfied in full but the performance-based vesting measurement will still apply and will be treated as provided in the applicable award agreement. Mr. Kuehling’s receipt of the separation benefits described above is conditioned on him delivering a release of claims in favor of the Company. Mr. Kuehling is not entitled to a tax gross-up payment if any of his benefits are subject to taxation under Sections 280G and 4999 of the Internal Revenue Code, but his benefits will be reduced to the extent necessary to avoid such taxes if such a reduction in benefits would put Mr. Kuehling in a better after-tax position than receiving the benefits in full.

If Mr. Kuehling’s employment terminates due to his death or disability, he would be entitled to payment of any bonus due for a fiscal year that ended prior to his separation date plus a pro-rata portion of his target bonus for the year in which his employment ends.

The foregoing description of the Employment Agreement is a summary, does not purport to be complete and is qualified in its entirety by reference to the Employment Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Chief Investment Officer Employment Agreement

In connection with Mr. Kuehling’s appointment as the Company’s Executive Vice President, Chief Financial Officer as of the Transition Date, Eliott Trencher, the Company’s current Executive Vice President, Chief Financial Officer and Chief Investment Officer, will no longer serve as the Company’s Chief Financial Officer, effective as of the Transition Date. Mr. Trencher will continue to serve as the Company’s Executive Vice President, Chief Investment Officer.

On July 30, 2024, the Company, the Operating Partnership and Mr. Trencher entered into an amendment (the “Amendment”) to Mr. Trencher’s employment agreement with the Company and the Operating Partnership dated March 3, 2023. The Amendment reflects such change in Mr. Trencher’s position effective as of the Transition Date.

The foregoing description of the Amendment is qualified in its entirety by reference to the text of the Amendment, a copy of which is attached hereto as Exhibit 10.2 and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

As discussed in Item 2.02 above, the Company issued a press release announcing its earnings for the quarter ended June 30, 2024 and distributed certain supplemental information. On July 31, 2024, the Company also posted the supplemental information on its website located at www.kilroyrealty.com.

The information being furnished pursuant to Item 7.01 shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit | | Description |

| 10.1* | | |

| 10.2* | | |

| 99.1* | | |

| 99.2* | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

_______________

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | Kilroy Realty Corporation | |

| Date: July 31, 2024 | | | |

| | | | |

| | | By: | | /s/ Merryl E. Werber | |

| | | | | Merryl E. Werber

Senior Vice President,

Chief Accounting Officer and Controller | |

| | | | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | Kilroy Realty, L.P. | |

| Date: July 31, 2024 | | | |

| | | | |

| | | By: | | Kilroy Realty Corporation, |

| | | | | Its general partner | |

| | | | | | |

| | | By: | | /s/ Merryl E. Werber | |

| | | | | Merryl E. Werber

Senior Vice President,

Chief Accounting Officer and Controller | |

| | | | | | |

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (this “Agreement”) is made and entered into this 30th day of July, 2024, by and among Kilroy Realty Corporation, a Maryland corporation (“Kilroy”), Kilroy Realty, L.P., a Delaware limited partnership (“KRLP”), and Jeffrey Kuehling (the “Executive”). (For purposes of this Agreement, the term “Company” means Kilroy, KRLP, either of them, or both of them together, as the context may require.)

RECITALS

THE PARTIES ENTER THIS AGREEMENT on the basis of the following facts, understandings and intentions:

A. KRLP desires to employ the Executive, and the Executive desires to accept such employment, on the terms and conditions set forth in this Agreement.

B. This Agreement shall be effective as set forth herein and shall govern the relationship between the Executive, on the one hand, and Kilroy and KRLP, on the other hand, from and after the Effective Date, and, as of the Effective Date, supersedes and negates all previous agreements and understandings between them with respect to such relationship.

AGREEMENT

NOW, THEREFORE, in consideration of the above recitals incorporated herein and the mutual covenants and promises contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby expressly acknowledged, the parties agree as follows:

1. Retention and Duties.

1.1 Retention. KRLP does hereby hire, engage and employ the Executive for the Period of Employment (as such term is defined in Section 2) on the terms and conditions expressly set forth in this Agreement. The Executive does hereby accept and agree to such hiring, engagement and employment, on the terms and conditions expressly set forth in this Agreement. Certain capitalized terms used herein are defined in Section 5.5 of this Agreement.

1.2 Duties. While the Executive shall be employed by KRLP during the Period of Employment, during such Period of Employment the Executive shall also serve as Kilroy’s Executive Vice President, Chief Financial Officer and shall have such powers, authorities, duties and obligations commensurate with such position as Kilroy’s Board of Directors (the “Board”) or its Chief Executive Officer (the “CEO”) may assign from time to time, all subject to the directives of the Board (or a committee thereof) or the CEO, and to the corporate policies of Kilroy, and the corporate and employment policies of KRLP, as they are in effect from time to time throughout the Period of Employment (including, without limitation, the Company’s Code of Business Conduct and Ethics, Insider Trading Compliance Policy, and Related Party Transactions Policy, as they may change from time to time). The Executive agrees to comply with such corporate and employment policies as they are in effect from time to time throughout the Period of Employment. During the Period of Employment, the Executive shall report to the CEO.

1.3 No Other Employment; Minimum Time Commitment. During the Period of Employment, the Executive shall (i) devote substantially all of the Executive’s business time, energy and skill to the performance of the Executive’s duties for Kilroy and KRLP, (ii) perform such duties in a faithful, effective and efficient manner to the best of the Executive’s abilities, and (iii) hold no other employment. The Executive’s service on the boards of directors (or similar body) of other business entities is subject to the prior written approval of the Board (or a committee thereof). The

Company shall have the right to require the Executive to resign from any board or similar body (including, without limitation, any association, corporate, civic or charitable board or similar body) which the Executive may then serve if the CEO or the Board (or a committee thereof) reasonably determines that the Executive’s service on such board or body interferes with the effective discharge of the Executive’s duties and responsibilities to the Company or that any business related to such service is then in direct or indirect competition with any business of the Company or any of its Affiliates, successors or assigns.

1.4 No Breach of Contract. The Executive hereby represents to each of Kilroy and KRLP and agrees that: (i) the execution and delivery of this Agreement by the Executive and the Company and the performance by the Executive of the Executive’s duties hereunder do not and shall not constitute a breach of, conflict with, or otherwise contravene or cause a default under, the terms of any other agreement or policy to which the Executive is a party or otherwise bound or any judgment, order or decree to which the Executive is subject; (ii) the Executive will not enter into any new agreement that would or reasonably could contravene or cause a default by the Executive under this Agreement; (iii) the Executive has no information (including, without limitation, confidential information and trade secrets) relating to any other Person which would prevent, or be violated by, the Executive entering into this Agreement or carrying out the Executive’s duties hereunder; (iv) the Executive is not bound by any consulting, non-compete, non-solicitation, confidentiality, trade secret or similar agreement (other than this Agreement and the Restrictive Covenants Agreement (as defined below)) with any other Person (other than ongoing, customary confidentiality obligations as to confidential information obtained from prior employers in the course of the Executive’s prior employment with them) which would prevent, or be violated by, the Executive entering into this Agreement or carrying out the Executive’s duties hereunder; (v) to the extent the Executive has any confidential or similar information that the Executive is not free to disclose to the Company, the Executive will not disclose or bring on to the Company’s premises, computer networks, communications or systems, computers or any other devices or accounts, any such information to the extent such disclosure or transmission would violate applicable law or any other agreement or policy to which the Executive is a party or by which the Executive is otherwise bound; and (vi) the Executive understands the Company will rely upon the accuracy and truth of the representations and warranties of the Executive set forth herein and the Executive consents to such reliance.

1.5 Location. The Executive’s principal place of employment shall be the Company’s principal executive office (currently located in Los Angeles, California) as it may be located from time to time. The Executive agrees that the Executive will be regularly present at that office during regular business hours (except for required business travel, holidays, vacation and other leaves consistent with this Agreement). The Executive acknowledges that the Executive will be required to travel from time to time in the course of performing the Executive’s duties for the Company.

2. Period of Employment. The “Period of Employment” shall be a period of time commencing on a date, no later than September 3, 2024, to be mutually agreed between the Executive and the CEO (the date the Executive actually commences employment with KRLP, the “Effective Date”) and ending at the close of business on March 1, 2027 (the “Termination Date”); provided, however, that this Agreement shall be automatically renewed, and the Period of Employment shall be automatically extended for one (1) additional year on the Termination Date and each anniversary of the Termination Date thereafter, unless the Executive or the Company gives written notice at least sixty (60) days prior to the expiration of the Period of Employment (including any renewal thereof) of such party’s desire to terminate the Period of Employment (such notice to be delivered in accordance with Section 18). The term “Period of Employment” shall include any extension thereof pursuant to the preceding sentence. Provision of notice that the Period of Employment shall not be extended or further extended, as the case may be, shall not constitute a breach of this Agreement and, in the case of a provision of such notice by the Company, shall not constitute either a termination of the Executive’s employment by the Company without “Cause” or grounds for a termination by the Executive for “Good Reason” for purposes of this Agreement.

Notwithstanding the foregoing, the Period of Employment is subject to earlier termination as provided below in this Agreement.

3. Compensation.

3.1 Base Salary. During the Period of Employment, the Company shall pay the Executive a base salary (“Base Salary”), which shall be paid in accordance with the Company’s regular payroll practices in effect from time to time but not less frequently than in monthly installments. The Executive’s Base Salary shall be at an annualized rate of Four Hundred Seventy Five Thousand Dollars ($475,000). The Board (or a committee thereof) may, in its sole discretion, increase (but not decrease) the Executive’s rate of Base Salary.

The allocation of the rights and obligations between Kilroy and KRLP shall be determined by separate agreement of those parties. (For clarity, as to any specific salary, award, benefit, severance or other compensation provided for in this Agreement, Executive shall be entitled to the amount specified in this Agreement from either Kilroy or KRLP, as Kilroy and KRLP may determine in their discretion unless otherwise expressly provided in this Agreement, and not from each of them.)

3.2 Incentive Bonus. The Executive shall be eligible to receive an incentive bonus for each fiscal year of the Company that occurs during the Period of Employment (“Incentive Bonus”). Notwithstanding the foregoing and except as otherwise expressly provided in this Agreement, the Executive must be employed by the Company at the time the Company pays incentive bonuses to employees generally with respect to a particular fiscal year in order to earn and be eligible for an Incentive Bonus for that year (and, if the Executive is not so employed at such time, in no event shall the Executive have been considered to have “earned” any Incentive Bonus with respect to the fiscal year). The Executive’s target Incentive Bonus amount for a particular fiscal year of the Company shall equal One Hundred Percent (100%) of the Executive’s Base Salary paid by the Company to the Executive for that fiscal year; provided that the Executive’s actual Incentive Bonus amount for a particular fiscal year (which may range from 0% of the target Incentive Bonus amount for that year up to a maximum percentage of the target Incentive Bonus amount for such year, with the maximum amount being One Hundred and Fifty Percent (150%) of the target annual Incentive Bonus amount) shall be determined by the Board (or a committee thereof) in its sole discretion, based on specific performance objectives (which may include corporate, business unit or division, financial, strategic, individual or other objectives) established with respect to that particular fiscal year by the Board (or a committee thereof) or such other factors it may consider relevant in the circumstances.

3.3 Initial Equity Award. On or promptly following the Effective Date, Kilroy will grant the Executive a restricted stock unit award covering a number of shares of Kilroy common stock equal to Seven Hundred Thousand Dollars ($700,000) divided by the closing price (in regular trading) of a share of Kilroy common stock on the New York Stock Exchange on the Effective Date (or, if the Effective Date is not a trading day on the New York Stock Exchange, on the last trading day prior to the Effective Date) and rounded to the nearest whole unit (such award, the “Initial Award”). The restricted stock units subject to the Initial Award will be scheduled to vest in full on January 5, 2026, subject to the Executive’s continued employment with the Company through such date (except as otherwise provided in Section 5.3(b)). The Initial Award will be granted under Kilroy’s Amended and Restated 2006 Incentive Award Plan, as amended (the “2006 Plan”). The Initial Award will be subject to the terms and conditions of the 2006 Plan as well as the terms and conditions of a written restricted stock unit award agreement (in substantially the form provided by the Company to the Executive) to be entered into by Kilroy and the Executive to evidence the Initial Award.

3.4 Annual Equity Awards. Additional equity awards for the Executive during the Period of Employment, commencing with awards for fiscal year 2025, will be in the sole discretion of the Board (or a committee thereof), except as provided below with respect to the annual equity awards for fiscal year 2025. Provided that the Executive is employed with the Company on the date Kilroy grants annual equity awards to its executive officers generally for that fiscal year, Kilroy will grant the Executive an annual equity award for fiscal year 2025 with a grant date fair value (as determined by Kilroy applying the equity award valuation methodology used by Kilroy for its financial reporting purposes) of an amount no less than Seven Hundred and Fifty Thousand Dollars ($750,000) (subject to rounding for whole share increments). The types of equity awards granted, the allocation of that value between those types of awards granted, specific vesting terms, and other terms and conditions of the awards will be determined by the Board (or a committee thereof).

4. Benefits.

4.1 Retirement, Welfare and Fringe Benefits. During the Period of Employment, the Executive shall be entitled to participate in all employee retirement and welfare benefit plans and programs, and fringe benefit plans and programs, made available by the Company to Kilroy’s then-current executive officers generally, in accordance with the eligibility and participation provisions of such plans and as such plans or programs may be in effect from time to time.

4.2 Reimbursement of Business Expenses. The Executive is authorized to incur reasonable expenses in carrying out the Executive’s duties for the Company under this Agreement and shall be entitled to reimbursement for all reasonable business expenses the Executive incurs during the Period of Employment in connection with carrying out the Executive’s duties for the Company, subject to the Company’s expense reimbursement policies and any pre-approval policies in effect from time to time. The Executive agrees to promptly submit and document any reimbursable expenses in accordance with the Company’s expense reimbursement policies to facilitate the timely reimbursement of such expenses.

4.3 Paid Time Office and Other Leave. During the Period of Employment, the Executive’s annual rate of vacation accrual shall be twenty (20) business days per year, with such vacation to accrue and be subject to the Company’s vacation policies in effect from time to time, including any policy which may limit vacation accruals and/or limit the amount of accrued but unused vacation to carry over from year to year. The Executive shall also be entitled to all other holiday and leave pay generally available to other executives of the Company.

4.4 Relocation. The Executive agrees to relocate, promptly following the Effective Date, to a residence that is proximate to the Company’s principal executive office in Los Angeles, California. The Company agrees that it will pay or reimburse the Executive up to $50,000 in the aggregate for the Executive’s reasonable and customary costs incurred in the Executive’s relocation from the Executive’s current principal residence to a location that is proximate to the Company’s principal executive office; provided that (i) the Company shall not be obligated to pay or reimburse any expense incurred after the Period of Employment ends, (ii) the Executive provides the Company with customary supporting documentation for such expenses, (iii) the Executive reasonably cooperates with the Company and its third party providers regarding the Executive’s relocation and reimbursement (including, without limitation, in reviewing and selecting vendors), and (iv) such relocation is completed promptly after the Effective Date and in all events no later than September 30, 2024. The Executive understands and acknowledges that the expenses contemplated by this Section 4.4 should generally be coordinated through and paid directly by the Company so that, to the extent feasible and practicable, they should be non-taxable. In the event that any payment or reimbursement provided by the Company pursuant to this Section 4.4 should be taxable to the Executive, the Company shall provide a tax gross-up payment to the Executive to cover any income, FICA, Medicare or other payroll taxes on any relocation benefits

(including any income, FICA, Medicare or other payroll taxes on the gross-up payment) and all such payments and reimbursements and gross-up payments shall be made no later than the end of the calendar year in which the Effective Date occurs. The Executive agrees to promptly submit such expenses, together with customary supporting documentation, to facilitate such payment timing. Should the Executive’s employment with the Company end before the first anniversary of the date such relocation is completed or should the Executive fail to complete such relocation (in each case, other than due to a termination of employment described in Section 5.3(b) or 5.3(c) or on account of the Executive’s death or Disability), the Executive agrees to promptly repay to the Company the Company’s costs incurred in providing such relocation benefits (including any related tax gross-up payment as provided above).

5. Termination.

5.1 Termination by the Company. During the Period of Employment, the Executive’s employment by the Company, and the Period of Employment, may be terminated at any time by the Company: (i) with Cause, or (ii) with no less than sixty (60) days advance written notice to the Executive (such notice to be delivered in accordance with Section 18), without Cause, or (iii) in the event of the Executive’s death, or (iv) in the event that the Board (or a committee thereof) determines in good faith that the Executive has a Disability.

5.2 Termination by the Executive. During the Period of Employment, the Executive’s employment by the Company, and the Period of Employment, may be terminated by the Executive with no less than sixty (60) days advance written notice to the Company (such notice to be delivered in accordance with Section 18); provided, however, that in the case of a termination for Good Reason, the Executive may provide immediate written notice of termination once the applicable cure period (as contemplated by the definition of Good Reason) has lapsed.

5.3 Benefits upon Termination. If the Executive’s employment by the Company is terminated for any reason by the Company or by the Executive (whether or not during or following the expiration of the Period of Employment) (the date that the Executive’s employment by the Company terminates is referred to as the “Severance Date”), the Company shall have no further obligation to make or provide to the Executive, and the Executive shall have no further right to receive or obtain from the Company, any payments or benefits except as follows:

(a) The Company shall pay the Executive (or, in the event of the Executive’s death, the Executive’s estate) any Accrued Obligations;

(b) If the Executive’s employment with the Company terminates during the Period of Employment as a result of a termination by the Company without Cause (other than due to the Executive’s death or Disability) or a resignation by the Executive for Good Reason, and in either case Section 5.3(c) does not apply, the Executive shall be entitled to the following benefits:

(i) The Company shall pay the Executive (in addition to the Accrued Obligations), subject to tax withholding and other authorized deductions, an amount equal to one (1) times the Executive’s Base Salary at the annualized rate in effect on the Severance Date plus one (1) times the Executive’s target level of annual Incentive Bonus as in effect on the Severance Date. Subject to Section 22(b), the Company shall pay such severance benefit to the Executive in equal monthly installments (each representing the applicable fraction of such total benefit amount, rounded down to the nearest whole cent) over a period of twelve (12) consecutive months commencing with the month following the month in which the Executive’s Separation from Service occurs, with the first installment payable on (or within ten (10) days following) the sixtieth (60th) day following the Executive’s Separation from Service and to include each such installment that was

otherwise (but for such 60-day delay) scheduled to be paid following the Executive’s Separation from Service and prior to the date of such payment.

(ii) The Company will pay or reimburse the Executive for the Executive’s premiums charged to continue medical coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act (“COBRA”), at the same or reasonably equivalent medical coverage for the Executive (and, if applicable, the Executive’s eligible dependents) as in effect immediately prior to the Severance Date, to the extent that the Executive elects such continued coverage; provided that the Company’s obligation to make any payment or reimbursement pursuant to this clause (ii) shall, subject to Section 22(b), commence with continuation coverage for the month following the month in which the Executive’s Separation from Service occurs and shall cease with continuation coverage for the eighteenth (18th) month following the month in which the Executive’s Separation from Service occurs (or, if earlier, shall cease upon the date the Executive becomes eligible for coverage under the health plan of a future employer, or the date the Company ceases to offer group medical coverage to its active executive employees or the Company is otherwise under no obligation to offer COBRA continuation coverage to the Executive). To the extent the Executive elects COBRA coverage, the Executive shall complete any continuation coverage enrollment procedures the Company may then have in place. The Company’s obligations pursuant to this Section 5.3(b)(ii) are subject to the Company’s ability to comply with applicable law and provide such benefit without resulting in material adverse tax consequences (such as, without limitation, rendering participation in a Company health and welfare plan taxable to participants or resulting in unintended material (relative to the amount of the benefit) tax penalties for the Company).

(iii) The Company shall promptly pay to the Executive any Incentive Bonus that would otherwise be paid to the Executive had the Executive’s employment with the Company not terminated with respect to any fiscal year that ended before the Severance Date, to the extent not theretofore paid.

(iv) The Company shall pay, on (or within ten (10) days following) the sixtieth (60th) day following the Executive’s Separation from Service, an amount in cash equal to (x) the Executive’s target Incentive Bonus for the fiscal year in which the Severance Date occurs, multiplied by (y) a fraction, the numerator of which is the total number of days in such fiscal year in which the Executive was employed by the Company and the denominator of which is the total number of days in such fiscal year.

(v) The Initial Award provided in Section 3.3, to the extent then outstanding and unvested, shall be fully vested as of the Severance Date.

(c) If the Executive’s employment with the Company terminates during the Period of Employment as a result of a termination by the Company without Cause (other than due to the Executive’s death or Disability) or a resignation by the Executive for Good Reason, and in either case such termination occurs within sixty (60) days prior to, upon, or at any time following a Change in Control of the Company, the Executive shall be entitled to the following benefits:

(i) The Company shall pay the Executive (in addition to the Accrued Obligations), subject to tax withholding and other authorized deductions, an amount equal to one (1) times the Executive’s Base Salary at the annualized rate in effect on the Severance Date plus one (1) times the Executive’s target level of annual Incentive Bonus as in effect on the Severance Date. Subject to Section 22(b), the Company shall pay such severance benefit to the Executive in equal monthly installments (each representing the applicable fraction of such total benefit amount, rounded down to the nearest whole cent) over a period of twelve (12) consecutive months commencing with the month following the

month in which the Executive’s Separation from Service occurs, with the first installment payable on (or within ten (10) days following) the sixtieth (60th) day following the Executive’s Separation from Service and to include each such installment that was otherwise (but for such 60-day delay) scheduled to be paid following the Executive’s Separation from Service and prior to the date of such payment; provided, however, that if such Separation from Service occurs on or within two (2) years following a Change in Control that constitutes a change in the ownership or effective control of Kilroy, or in the ownership of a substantial portion of the assets of Kilroy (in each case, such a change in ownership, in effective control or of a substantial portion of assets to be determined within the meaning of Code Section 409A (as defined below)), then (subject to Section 22(b)) the Company shall pay such severance benefit to the Executive in a lump sum on (or within ten (10) days following) the sixtieth (60th) day following the Executive’s Separation from Service.

(ii) The Company will pay or reimburse the Executive for the Executive’s premiums charged to continue medical coverage pursuant to COBRA, at the same or reasonably equivalent medical coverage for the Executive (and, if applicable, the Executive’s eligible dependents) as in effect immediately prior to the Severance Date, to the extent that the Executive elects such continued coverage; provided that the Company’s obligation to make any payment or reimbursement pursuant to this clause (ii) shall, subject to Section 22(b), commence with continuation coverage for the month following the month in which the Executive’s Separation from Service occurs and shall cease with continuation coverage for the eighteenth (18th) month following the month in which the Executive’s Separation from Service occurs (or, if earlier, shall cease upon the date the Executive becomes eligible for coverage under the health plan of a future employer, or the date the Company ceases to offer group medical coverage to its active executive employees or the Company is otherwise under no obligation to offer COBRA continuation coverage to the Executive). To the extent the Executive elects COBRA coverage, the Executive shall complete any continuation coverage enrollment procedures the Company may then have in place. The Company’s obligations pursuant to this Section 5.3(c)(ii) are subject to the Company’s ability to comply with applicable law and provide such benefit without resulting in material adverse tax consequences (such as, without limitation, rendering participation in a Company health and welfare plan taxable to participants or resulting in unintended material (relative to the amount of the benefit) tax penalties for the Company).

(iii) The Company shall promptly pay to the Executive any Incentive Bonus that would otherwise be paid to the Executive had the Executive’s employment with the Company not terminated with respect to any fiscal year that ended before the Severance Date, to the extent not theretofore paid.

(iv) The Company shall pay, on (or within ten (10) days following) the sixtieth (60th) day following the Executive’s Separation from Service, an amount in cash equal to (x) the Executive’s target Incentive Bonus for the fiscal year in which the Severance Date occurs, multiplied by (y) a fraction, the numerator of which is the total number of days in such fiscal year in which the Executive was employed by the Company and the denominator of which is the total number of days in such fiscal year.

(v) Each equity award granted by the Company to the Executive that vests based solely on the Executive’s continued service with the Company, to the extent then outstanding and unvested, shall be fully vested as of the Severance Date. As to any equity award granted by the Company to the Executive that is then (on the Executive’s Severance Date) outstanding and subject to performance-based vesting requirements, the vesting of such award will continue to be governed by its terms, provided that any

service-based vesting requirement under such outstanding equity-based award shall be deemed satisfied in full as of the Severance Date.

(d) If the Executive’s employment with the Company terminates during the Period of Employment as a result of the Executive’s death or Disability, the Company shall pay the Executive the amounts contemplated by Section 5.3(b)(iii) and (iv).

(e) Notwithstanding the foregoing provisions of this Section 5.3, if the Executive materially breaches the Executive’s obligations under the Restrictive Covenants Agreement or this Agreement at any time, from and after the date of such breach and not in any way in limitation of any right or remedy otherwise available to the Company, the Executive will no longer be entitled to, and the Company will no longer be obligated to pay, any remaining unpaid amount contemplated by Section 5.3(b) or 5.3(c); provided that, if the Executive provides the Release contemplated by Section 5.4, in no event shall the Executive be entitled to benefits pursuant to Section 5.3(b)(i) or 5.3(c)(i), as applicable, of less than $5,000 (or the amount of such benefits, if less than $5,000), which amount the parties agree is good and adequate consideration, in and of itself, for the Executive’s Release contemplated by Section 5.4.

(f) The foregoing provisions of this Section 5.3 shall not affect: (i) the Executive’s receipt of benefits otherwise due to terminated employees under group insurance coverage consistent with the terms of the applicable Company welfare benefit plan; (ii) the Executive’s rights under COBRA to continue health coverage; or (iii) the Executive’s receipt of benefits otherwise due in accordance with the terms of the Company’s 401(k) plan (if any).

5.4 Release; Resignations; No Other Severance; Leave.

(a) This Section 5.4 shall apply notwithstanding anything else contained in this Agreement or any stock option or other equity award agreement to the contrary. As a condition precedent to any Company obligation to the Executive pursuant to Section 5.3(b) or 5.3(c), or any other obligation to accelerate vesting of any equity award in connection with the termination of the Executive’s employment, the Executive shall timely provide each of Kilroy and KRLP with a valid, executed general release agreement in substantially the form attached hereto as Exhibit A (with such changes thereto as the Company may make, consistent with the intent of such release, to address changes in the law or to otherwise help ensure the validity and enforceability of the agreement) provided by the Company (the “Release”), and such Release shall have not been revoked by the Executive pursuant to any revocation rights afforded by applicable law. The Company shall provide the form of Release to the Executive not later than seven (7) days following the Severance Date, and the Executive shall be required to execute and return the Release to both Kilroy and KRLP within twenty-one (21) days (or forty-five (45) days if such longer period of time is required to make the Release maximally enforceable under applicable law) after the Company provides the form of Release to the Executive.

(b) The Company and the Executive acknowledge and agree that there is no duty of the Executive to mitigate damages under this Agreement. All amounts paid to the Executive pursuant to Section 5.3 shall be paid without regard to whether the Executive has taken or takes actions to mitigate damages. The Executive agrees to resign (and hereby does so resign), effective on the Severance Date, as an officer and director of each of Kilroy and KRLP, as well as any Affiliate of either of them, and as a fiduciary of any benefit plan of the Company or any Affiliate of the Company. The Executive further agrees to promptly execute and provide to the Company any further documentation, as reasonably requested by the Company, to confirm such resignations, and to remove the Executive as a signatory on any accounts maintained by Kilroy, KRLP, or any Affiliates of either of them (or any of their respective benefit plans).

(c) The Executive shall not be entitled to severance benefits pursuant to any other severance plan, policy or arrangement of Kilroy, KRLP, or any Affiliates of either of them.

(d) In the event that the Company provides the Executive notice of termination without Cause pursuant to Section 5.1 or the Executive provides the Company notice of termination pursuant to Section 5.2, the Company will have the option to place the Executive on paid administrative leave during the notice period.

5.5 Certain Defined Terms.

(a) As used herein, “Accrued Obligations” means:

(i) any Base Salary that had accrued but had not been paid (including accrued and unpaid vacation time) on or before the Severance Date; and

(ii) any reimbursement due to the Executive pursuant to Section 4.2 or Section 4.4 (for clarity, no reimbursement will be due to the Executive pursuant to Section 4.4 for a termination of employment other than a termination of employment (x) described in Section 5.3(b) or 5.3(c) or (y) on account of the Executive’s death or Disability) for expenses reasonably incurred by the Executive on or before the Severance Date and documented and pre-approved, to the extent applicable, in accordance with the Company’s expense reimbursement policies in effect at the applicable time.

(b) As used herein, “Affiliate” of Kilroy, KRLP, or the Company means a Person that directly or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, Kilroy, KRLP, or either of them. As used in this definition, the term “control,” including the correlative terms “controlling,” “controlled by” and “under common control with,” means the possession, directly or indirectly, of the power to direct or cause the direction of management or policies (whether through ownership of securities or any partnership or other ownership interest, by contract or otherwise) of a Person.

(c) As used herein, “Cause” shall mean, as reasonably determined by the Board (or a committee thereof) based on the information then known to it, that one or more of the following has occurred:

(i) the Executive is convicted of, pled guilty or pled nolo contendere to a felony or any crime involving fraud or dishonesty (in each case, under the laws of the United States or any relevant state, or a similar crime or offense under the applicable laws of any relevant foreign jurisdiction);

(ii) the Executive has engaged in acts of fraud, dishonesty or other acts of willful misconduct in the course of the Executive’s duties hereunder;

(iii) the Executive willfully fails to perform or uphold the Executive’s duties under this Agreement and/or willfully fails to comply with reasonable directives of the Board (or a committee thereof) or the CEO; or

(iv) a breach in any material respect by the Executive of this Agreement, the Restrictive Covenants Agreement, or any other contract the Executive is a party to with Kilroy, KRLP, or any Affiliate of either of them, or any written policy of Kilroy, KRLP, or any Affiliate of either of them that is applicable to Company executives or employees generally;

provided, however, that any condition or conditions, as applicable, referenced in clause (iii) or clause (iv) above shall not (if a cure is reasonably possible in the circumstances) constitute Cause unless both (x) the Company provides written notice to the Executive of such condition(s) claimed to constitute Cause (such notice to be delivered in accordance with Section 18), and (y) the Executive fails to remedy such condition(s) within thirty (30) days of receiving such written notice thereof (or, if a cure is reasonably possible in the circumstances but more than thirty (30) days is required to cure such circumstances, the Executive fails to commence taking reasonable steps to cure such condition(s) if it is not reasonably possible to remedy such condition within such thirty (30) day period, or the Executive fails to cure such condition(s) as promptly as reasonably possible and in all cases not more than ninety (90) days of receiving such written notice thereof). For purposes of the foregoing definition of Cause, no act or failure to act, on the Executive’s part shall be considered “willful” unless done, or omitted to be done, by the Executive not in good faith and without reasonable belief that the Executive’s action or omission was in the best interest of the Company.

(d) As used herein, “Change in Control” shall mean:

(i) A transaction or series of transactions (other than an offering of Kilroy’s common stock to the general public through a registration statement filed with the Securities and Exchange Commission) whereby any “person” or related “group” of “persons” (as such terms are used in Sections 13(d) and 14(d)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and other than Kilroy, any of its subsidiaries, an employee benefit plan maintained by the Kilroy, KRLP, or any of its or their subsidiaries or a “person” that, prior to such transaction, directly or indirectly controls, is controlled by, or is under common control with, Kilroy) directly or indirectly acquires beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of securities of Kilroy and immediately after such acquisition possesses more than 50% of the total combined voting power of Kilroy’s securities outstanding immediately after such acquisition; or

(ii) During any period of two consecutive years, individuals who, at the beginning of such period, constitute the Board together with any new director(s) (other than a director designated by a person who shall have entered into an agreement with Kilroy to effect a transaction described in Section 5.5(d)(i) hereof or Section 5.5(d)(iii) hereof) whose election by the Board or nomination for election by Kilroy’s stockholders was approved by a vote of at least two-thirds of the directors then still in office who either were directors at the beginning of the two-year period or whose election or nomination for election was previously so approved, cease for any reason to constitute a majority thereof; or

(iii) The consummation by Kilroy (whether directly involving Kilroy or indirectly involving Kilroy through one or more intermediaries) of (x) a merger, consolidation, reorganization, or business combination or (y) a sale or other disposition of all or substantially all of Kilroy’s assets in any single transaction or series of related transactions or (z) the acquisition of assets or stock of another entity, in each case other than a transaction:

(x) Which results in Kilroy’s voting securities outstanding immediately before the transaction continuing to represent (either by remaining outstanding or by being converted into voting securities of Kilroy or the person that, as a result of the transaction, controls, directly or indirectly, Kilroy or owns, directly or indirectly, all or substantially all of Kilroy’s assets or otherwise succeeds to the business of Kilroy (Kilroy or such person, the “Successor Entity”)) directly or

indirectly, at least a majority of the combined voting power of the Successor Entity’s outstanding voting securities immediately after the transaction; and

(y) After which no person or group beneficially owns voting securities representing 50% or more of the combined voting power of the Successor Entity; provided, however, that no person or group shall be treated for purposes of this Section 5.5(d)(iii)(y) as beneficially owning 50% or more of combined voting power of the Successor Entity solely as a result of the voting power held in Kilroy prior to the consummation of the transaction; or

(iv) Kilroy’s stockholders approve a liquidation or dissolution of Kilroy and all material contingencies to such liquidation or dissolution have been satisfied or waived.

(e) As used herein, “Disability” shall mean a physical or mental impairment which, as reasonably determined by the Board (or a committee thereof), renders the Executive unable to perform the essential functions of the Executive’s employment with KRLP, even with reasonable accommodation, for more than 90 days in any 180-day period, unless a longer period is required by federal or state law, in which case that longer period would apply. The Executive agrees to reasonably cooperate with the Board (and any committee thereof) in making any such determination as to the existence of Disability.

(f) As used herein, “Good Reason” shall mean the occurrence (without the Executive’s consent) of any one or more of the following conditions:

(i) a material diminution by the Company in the Executive’s rate of Base Salary or target level of annual Incentive Bonus opportunity pursuant to Section 3.2, or (as to fiscal year 2025) the failure by the Company to grant any annual equity award required to be awarded by the Company pursuant to Section 3.4;

(ii) a material diminution by the Company in the Executive’s authority, duties, or responsibilities;

(iii) a material change by the Company in the geographic location of the Executive’s principal office with the Company (for this purpose, in no event shall a relocation of such office to a new location that is not more than fifty (50) miles from the current location of the Company’s executive offices constitute a “material change”); or

(iv) a material breach by the Company of this Agreement;

provided, however, that any such condition or conditions, as applicable, shall not constitute Good Reason unless both (x) the Executive provides written notice to the Company of the condition claimed to constitute Good Reason within sixty (60) days of the initial existence of such condition(s) (such notice to be delivered in accordance with Section 18), and (y) the Company fails to remedy such condition(s) within thirty (30) days of receiving such written notice thereof; and provided, further, that in all events the termination of the Executive’s employment with the Company shall not constitute a termination for Good Reason unless such termination occurs not more than one hundred and twenty (120) days following the initial existence of the condition claimed to constitute Good Reason.

(g) As used herein, the term “Person” shall be construed broadly and shall include, without limitation, an individual, a partnership, a limited liability company, a corporation, an association, a joint stock company, a trust, a joint venture, an unincorporated organization and a governmental entity or any department, agency or political subdivision thereof.

(h) As used herein, a “Separation from Service” occurs when the Executive dies, retires, or otherwise has a termination of employment with the Company that constitutes a “separation from service” within the meaning of Treasury Regulation Section 1.409A-1(h)(1), without regard to the optional alternative definitions available thereunder.

5.6. Notice of Termination; Employment Following Expiration of Period of Employment. Any termination of the Executive’s employment, and the Period of Employment, under this Agreement shall be communicated by written notice of termination from the Executive to the Company, or from the Company to the Executive, as the case may be. This notice of termination must be delivered in accordance with Section 18 and must indicate the specific provision(s) of this Agreement relied upon in effecting the termination. If the Company or the Executive delivers notice of non-renewal of the Period of Employment pursuant to Section 2 and the Executive continues to be employed by the Company following the expiration of the Period of Employment, the Executive’s employment by the Company following the expiration of the Period of Employment shall be on an at-will basis and may be terminated by the Company or by the Executive at any time, for any reason (or for no reason), with or without advance notice.

5.7 Limitation on Benefits.

(a) Notwithstanding anything contained in this Agreement to the contrary, to the extent that the payments and benefits provided under this Agreement and benefits provided to, or for the benefit of, the Executive under any other Company plan or agreement (such payments or benefits are collectively referred to as the “Benefits”) would be subject to the excise tax (the “Excise Tax”) imposed under Section 4999 of the Internal Revenue Code of 1986, as amended (the “Code”), the Benefits shall be reduced (but not below zero) if and to the extent that a reduction in the Benefits would result in the Executive retaining a larger amount, on an after-tax basis (taking into account federal, state and local income taxes and the Excise Tax), than if the Executive received all of the Benefits (such reduced amount is referred to hereinafter as the “Limited Benefit Amount”). Unless the Executive elects a different order of reduction, any such election to be consistent with the requirements of Section 409A of the Code, to the extent that a reduction in payments or benefits is required pursuant to this Section 5.7(a), the Company shall reduce or eliminate amounts which are payable first from any cash severance and cash bonuses, then from any payment in respect of an equity award that is not covered by Treas. Reg. Section 1.280G-1 Q/A-24(b) or (c), then from any payment in respect of an equity award that is covered by Treas. Reg. Section 1.280G-1 Q/A-24(c), in each case in reverse order beginning with payments or benefits which are to be paid the farthest in time from the Determination (as defined below). Any election given by the Executive pursuant to the preceding sentence shall take precedence over the provisions of any other plan, arrangement or agreement governing the Executive’s rights and entitlements to any benefits or compensation. Nothing in this Section 5.7(a) shall require the Company or any of its affiliates to be responsible for, or have any liability or obligation with respect to, the Executive’s excise tax liabilities under Section 4999 of the Code so long as this Section 5.7(a) is correctly applied by the Company.

(b) A determination as to whether the Benefits shall be reduced to the Limited Benefit Amount pursuant to this Agreement and the amount of such Limited Benefit Amount shall be made by the Company’s independent public accountants or another certified public accounting firm or executive compensation consulting firm of national reputation designated by the Company (the “Firm”) at the Company’s expense. The Firm shall provide its determination (the “Determination”), together with detailed supporting calculations (including the value of any post-termination non-compete and other obligations of the Executive taken into account for purposes of the Determination) and documentation to the Company and the Executive within ten (10) business days of the date of termination of the Executive’s employment, if applicable, or such other time as reasonably requested by the Company or the Executive (provided the Executive reasonably believes that any of the Benefits may be subject to the Excise Tax), and if the Firm determines that

no Excise Tax is payable by the Executive with respect to any Benefits, it shall furnish the Executive with an opinion reasonably acceptable to the Executive that no Excise Tax will be imposed with respect to any such Benefits. Unless the Executive provides written notice to the Company within ten (10) business days of the delivery of the Determination to the Executive that the Executive disputes such Determination, the Determination shall be binding, final and conclusive upon the Company and the Executive.

6. Confidentiality and Indemnification Agreements; Liability Insurance. Concurrently herewith, the Executive shall execute and deliver to each of Kilroy and KRLP a Non-Competition, Non-Solicitation and Non-Disclosure Agreement in the form previously provided by the Company to the Executive (the “Restrictive Covenants Agreement”). No later than on the Effective Date, the Company shall execute and deliver to the Executive an Indemnification Agreement in the form previously provided by the Company to the Executive (the “Indemnification Agreement”).

The Company shall cover the Executive under directors and officers liability insurance both during and after the Period of Employment in the same amount and to the same extent as the Company covers its other active officers and directors (except that, in no event shall the Company be required to maintain such coverage for a period of more than six years after the later of the last day on which the Executive served as an employee of the Company).

7. Withholding Taxes. Notwithstanding anything else herein to the contrary, the Company may withhold (or cause there to be withheld, as the case may be) from any amounts otherwise due or payable under or pursuant to this Agreement such federal, state and local income, employment, or other taxes as may be required to be withheld pursuant to any applicable law or regulation. Except for such withholding rights, the Executive is solely responsible for any and all tax liability that may arise with respect to the compensation provided under or pursuant to this Agreement.

8. Successors and Assigns.

(a) This Agreement is personal to the Executive and without the prior written consent of the Company shall not be assignable by the Executive otherwise than by will or the laws of descent and distribution. This Agreement shall inure to the benefit of and be enforceable by the Executive’s legal representatives.

(b) This Agreement shall inure to the benefit of and be binding upon the Company and its successors and assigns. Without limiting the generality of the preceding sentence, the Company will require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of the Company to assume expressly and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place. As used in this Agreement, “Company” shall mean the Company as hereinbefore defined and any successor or assignee, as applicable, which assumes and agrees to perform this Agreement by operation of law or otherwise.

9. Number and Gender; Examples. Where the context requires, the singular shall include the plural, the plural shall include the singular, and any gender shall include all other genders. Where specific language is used to clarify by example a general statement contained herein, such specific language shall not be deemed to modify, limit or restrict in any manner the construction of the general statement to which it relates.

10. Section Headings. The section headings of, and titles of paragraphs and subparagraphs contained in, this Agreement are for the purpose of convenience only, and they neither form a part of this Agreement nor are they to be used in the construction or interpretation thereof.

11. Governing Law. This Agreement will be governed by and construed in accordance with the laws of the state of California, without giving effect to any choice of law or conflicting provision or rule (whether of

the state of California or any other jurisdiction) that would cause the laws of any jurisdiction other than the state of California to be applied.

12. Severability. It is the desire and intent of the parties hereto that the provisions of this Agreement be enforced to the fullest extent permissible under the laws and public policies applied in each jurisdiction in which enforcement is sought. Accordingly, if any particular provision of this Agreement shall be adjudicated by a court of competent jurisdiction or determined by an arbitrator pursuant to Section 16 to be invalid, prohibited or unenforceable under any present or future law, and if the rights and obligations of any party under this Agreement will not be materially and adversely affected thereby, such provision, as to such jurisdiction, shall be ineffective, without invalidating the remaining provisions of this Agreement or affecting the validity or enforceability of such provision in any other jurisdiction, and to this end the provisions of this Agreement are declared to be severable; furthermore, in lieu of such invalid or unenforceable provision there will be added automatically as a part of this Agreement, a legal, valid and enforceable provision as similar in terms to such invalid or unenforceable provision as may be possible. Notwithstanding the foregoing, if such provision could be more narrowly drawn (as to geographic scope, period of duration or otherwise) so as not to be invalid, prohibited or unenforceable in such jurisdiction, it shall, as to such jurisdiction, be so narrowly drawn, without invalidating the remaining provisions of this Agreement or affecting the validity or enforceability of such provision in any other jurisdiction.

13. Entire Agreement. This Agreement, the Restrictive Covenants Agreement and the Indemnification Agreement (together, the “Integrated Agreement”) embody the entire agreement of the parties hereto respecting the matters within its scope. The Integrated Agreement supersedes all prior and contemporaneous agreements of the parties hereto that directly or indirectly bears upon the subject matter hereof. Any prior negotiations, correspondence, agreements, proposals or understandings relating to the subject matter hereof shall be deemed to have been merged into the Integrated Agreement, and to the extent inconsistent herewith, such negotiations, correspondence, agreements, proposals, or understandings shall be deemed to be of no force or effect. There are no representations, warranties, or agreements, whether express or implied, or oral or written, with respect to the subject matter hereof, except as expressly set forth in the Integrated Agreement.

14. Modifications. This Agreement may not be amended, modified or changed (in whole or in part), except by a formal, definitive written agreement expressly referring to this Agreement, which agreement is executed by both of the parties hereto.

15. Waiver. Neither the failure nor any delay on the part of a party to exercise any right, remedy, power or privilege under this Agreement shall operate as a waiver thereof, nor shall any single or partial exercise of any right, remedy, power or privilege preclude any other or further exercise of the same or of any right, remedy, power or privilege, nor shall any waiver of any right, remedy, power or privilege with respect to any occurrence be construed as a waiver of such right, remedy, power or privilege with respect to any other occurrence. No waiver shall be effective unless it is in writing and is signed by the party asserted to have granted such waiver.

16. Arbitration. Except as provided in Section 17 and Section 7 of the Restrictive Covenants Agreement, any non-time barred, legally actionable controversy or claim arising out of or relating to this Agreement, its enforcement, arbitrability or interpretation, or because of an alleged breach, default, or misrepresentation in connection with any of its provisions, or any other non-time barred, legally actionable controversy or claim arising out of or relating to the Executive’s employment or association with the Company or termination of the same, including, without limiting the generality of the foregoing, any alleged violation of state or federal statute, common law or constitution, shall be submitted to individual, final and binding arbitration, to be held in Los Angeles County, California, before a single arbitrator selected from Judicial Arbitration and Mediation Services, Inc. (“JAMS”), in accordance with the then-current JAMS Arbitration Rules and Procedures for employment disputes, as modified by the terms and conditions in this Section (which may be found at www.jamsadr.com under the Rules/Clauses tab). The parties will select the arbitrator by mutual agreement or, if the parties cannot agree, then by obtaining a list of nine qualified arbitrators

supplied by JAMS from their labor and employment law panel, with each party confidentially submitting a “rank and strike” list that ranks in order of priority six arbitrators and strikes three arbitrators, and the most favored arbitrator based on the cumulative rankings who was not struck by either party shall be appointed arbitrator. Final resolution of any dispute through arbitration may include any remedy or relief that is provided for through any applicable state or federal statutes, or common law. Statutes of limitations shall be the same as would be applicable were the action to be brought in court. The arbitrator selected pursuant to this Agreement may order such discovery as is necessary for a full and fair exploration of the issues and dispute, consistent with the expedited nature of arbitration. At the conclusion of the arbitration, the arbitrator shall issue a written decision that sets forth the essential findings and conclusions upon which the arbitrator’s award or decision is based. Any award or relief granted by the arbitrator under this Agreement shall be final and binding on the parties to this Agreement and may be enforced by any court of competent jurisdiction. The Company will pay those arbitration costs that are unique to arbitration, including the arbitrator’s fee (recognizing that each side bears its own deposition, witness, expert and attorneys’ fees and other expenses to the same extent as if the matter were being heard in court). If, however, any party prevails on a statutory claim, which affords the prevailing party attorneys’ fees and costs, then the arbitrator may (to the extent required by law in order for this arbitration provision to be enforceable) award reasonable fees and costs to the prevailing party. The arbitrator may not award attorneys’ fees to a party that would not otherwise be entitled to such an award under the applicable statute (for clarity, the arbitrator may not award attorneys’ fees for contractual claims). The arbitrator shall resolve any dispute as to the reasonableness of any fee or cost. Except as provided in Section 7 of the Restrictive Covenants Agreement, the parties acknowledge and agree that they are hereby waiving any rights to trial by jury or a court in any action or proceeding brought by either of the parties against the other in connection with any matter whatsoever arising out of or in any way connected with this Agreement or the Executive’s employment.

17. Remedies. Each of the parties to this Agreement and any Person granted rights hereunder whether or not such person or entity is a signatory hereto shall be entitled to enforce its rights under this Agreement specifically to recover damages and costs for any breach of any provision of this Agreement and to exercise all other rights existing in its favor. The parties hereto agree and acknowledge that monetary damages may not be an adequate remedy for any breach of the provisions of this Agreement and that each party (as well as each other Person granted rights hereunder) may in its sole discretion obtain permanent injunctive or equitable relief in any arbitration filed pursuant to Section 16 and enforce any such relief awarded by the arbitrator in any court of competent jurisdiction. In addition, each party may also apply to any court of law or equity of competent jurisdiction for provisional injunctive or equitable relief, including a temporary restraining or preliminary injunction (without any requirement to post any bond or deposit), to ensure that the relief sought in arbitration is not rendered ineffectual by interim harm. Each party shall be responsible for paying its own attorneys’ fees, costs and other expenses pertaining to any such legal proceeding and enforcement regardless of whether an award or finding or any judgment or verdict thereon is entered against either party.

18. Notices. Any notice provided for in this Agreement must be in writing and must be either personally delivered, transmitted via telecopier, mailed by first class mail (postage prepaid and return receipt requested) or sent by reputable overnight courier service (charges prepaid) to the recipient at the address below indicated or at such other address or to the attention of such other person as the recipient party has specified by prior written notice to the sending party. Notices will be deemed to have been given hereunder and received when delivered personally, when received if transmitted via telecopier, five days after deposit in the U.S. mail and one day after deposit with a reputable overnight courier service.

if to Kilroy and/or KRLP:

Kilroy Realty Corporation

12200 West Olympic Boulevard, Suite 200

Los Angeles, CA 90064

Attention: Senior Vice President, Corporate Counsel

if to the Executive, to the address most recently on file in the payroll records of KRLP.

19. Counterparts; Electronic Signature. This Agreement may be signed and/or transmitted in one or more counterparts by facsimile, e-mail of a .PDF, .TIF, .GIF, .JPG or similar attachment or using electronic signature technology (e.g., via DocuSign or similar electronic signature technology), all of which will be considered one and the same agreement and will become effective when one or more counterparts have been signed by each of the parties hereto and delivered to the other parties, it being understood that all parties need not sign the same counterpart, and that any such signed electronic record shall be valid and as effective to bind the party so signing as a paper copy bearing such party’s hand-written signature. The parties further consent and agree that (1) to the extent a party signs this Agreement using electronic signature technology, by clicking “sign” (or similar acknowledgement of acceptance), such party is signing this Agreement electronically, and (2) that electronic signatures appearing on this Agreement shall be treated, for purposes of validity, enforceability and admissibility, the same as hand-written signatures.