Kite Realty Group Recasts Its $1.1 Billion Unsecured Revolving Credit Facility and Amends Its $250 Million Term Loan Facility

October 08 2024 - 3:15PM

Kite Realty Group Trust (NYSE: KRG) (the “Company”), a premier

owner and operator of high-quality, open-air grocery-anchored

centers and vibrant mixed-use assets, announced today that, on

October 3, 2024, it closed on an amended $1.1 billion unsecured

revolving credit facility (the “Revolving Credit Facility”) and an

amended $250 million unsecured term loan facility (the “Term Loan

Facility”).

The term of the Revolving Credit Facility was

extended three years and now matures on October 3, 2028 with the

option to further extend such maturity date by either one 1-year

period or up to two 6-month periods, subject to the payment of an

extension fee and certain other customary conditions. In addition

to the extended maturity date, the Revolving Credit Facility

provides the Company with the ability to obtain more favorable

pricing in certain circumstances when the Company’s total leverage

ratio meets defined targets (the “Leverage Toggle”).

The interest rate margin on the Term Loan

Facility was reduced and includes a Leverage Toggle that generally

conforms to the Revolving Credit Facility. Interest will now accrue

at a rate of Adjusted Term SOFR plus a margin ranging from 0.75% to

1.60% (from 2.00% to 2.50% previously). The maturity date, assuming

exercise of all extension options, of October 24, 2028 remains

unchanged.

KeyBank National Association served as

Administrative Agent.

About Kite Realty GroupKite

Realty Group Trust (NYSE: KRG) is a real estate investment trust

(REIT) headquartered in Indianapolis, IN that is one of the largest

publicly traded owners and operators of open-air shopping centers

and mixed-use assets. The Company’s primarily grocery-anchored

portfolio is located in high-growth Sun Belt and select strategic

gateway markets. The combination of necessity-based

grocery-anchored neighborhood and community centers, along with

vibrant mixed-use assets makes the KRG portfolio an ideal mix for

both retailers and consumers. Publicly listed since 2004, KRG has

over 60 years of experience in developing, constructing and

operating real estate. Using operational, investment, development,

and redevelopment expertise, KRG continuously optimizes its

portfolio to maximize value and return to shareholders. As of June

30, 2024, the Company owned interests in 178 U.S. open-air shopping

centers and mixed-use assets, comprising approximately 27.6 million

square feet of gross leasable space. For more information, please

visit kiterealty.com.

Connect with

KRG: LinkedIn | X | Instagram | Facebook

Contact Information: Kite Realty Group Trust

Tyler HenshawSVP, Capital Markets & Investor

Relations317.713.7780thenshaw@kiterealty.com

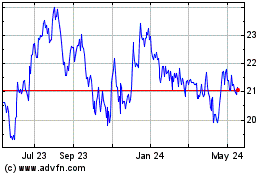

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Dec 2024 to Jan 2025

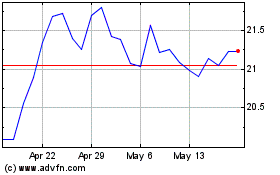

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Jan 2024 to Jan 2025