Kennedy Wilson Renews Unsecured Revolving Credit Facility

September 13 2024 - 5:00AM

Business Wire

Credit facility has a three-year term and a

one year extension option; facility expands to $550 million

Global real estate investment company Kennedy Wilson (NYSE:KW)

today announced the expansion of its $500 million unsecured

revolving credit facility to $550 million in partnership with a

group of 10 banks. The new credit facility has a three-year term

and two six-month extension options.

Loans under the new credit facility bear interest at a rate

equal to SOFR plus a spread of 1.75% to 2.75%.

“This credit facility provides us with an efficient and flexible

source of funding that positions us to act quickly on opportunities

that we believe will continue to emerge in the short term,” said

Kennedy Wilson Chairman and CEO William McMorrow. “We appreciate

the support of our bank group in this expanded credit facility that

will enable us to build on the growth we have experienced in many

areas of our business this year.”

“We highly value the support from our bank group, including

those who have been with us for decades, as well as new

partnerships established through this facility,” said Matt

Windisch, President of Kennedy Wilson. “We are pleased to push the

fully extended maturity out to September 2028, and we believe that

the increase in the size of the facility reflects the continued

confidence in our business strategy moving forward.”

The revolving credit facility has current outstanding borrowings

of approximately $175 million. Bank of America, N.A. will serve as

administrative agent. BofA Securities, Inc., JPMorgan Chase Bank,

N.A., and M&T Bank acted as the joint lead arrangers.

About Kennedy Wilson

Kennedy Wilson (NYSE: KW) is a leading real estate investment

company with over $27 billion of assets under management in high

growth markets across the United States, the UK and Ireland.

Drawing on decades of experience, our relationship-oriented team

excels at identifying opportunities and building value through

market cycles, closing more than $50 billion in total transactions

across the property spectrum since going public in 2009. Kennedy

Wilson owns, operates, and builds real estate within our

high-quality, core real estate portfolio and through our investment

management platform, where we target opportunistic equity and debt

investments alongside our partners. For further information, please

visit www.kennedywilson.com.

Special Note Regarding Forward-Looking Statements

Statements in this press release that are not historical facts

are “forward-looking statements” within the meaning of U.S. federal

securities laws. These forward-looking statements are estimates

that reflect our management’s current expectations, are based on

our current estimates, expectations, forecasts, projections and

assumptions that may prove to be inaccurate and involve known and

unknown risks. Accordingly, our actual results, performance or

achievement, or industry results, may differ materially and

adversely from the results, performance or achievement, or industry

results, expressed or implied by these forward-looking statements,

including for reasons that are beyond our control. Some of the

forward-looking statements may be identified by words like

“believes”, “expects”, “anticipates”, “estimates”, “plans”,

“intends”, “projects”, “indicates”, “could”, “may” and similar

expressions. These statements are not guarantees of future

performance and involve a number of risks, uncertainties and

assumptions. We assume no duty to update the forward-looking

statements, except as may be required by law.

KW-IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240913188414/en/

Investors Daven Bhavsar, CFA Head of Investor Relations

+1 (310) 887-3431 dbhavsar@kennedywilson.com

Media Emily Heidt Vice President, Communications +1 (310)

887-3499 eheidt@kennedywilson.com

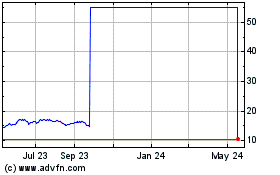

Kennedy Wilson (NYSE:KW)

Historical Stock Chart

From Nov 2024 to Dec 2024

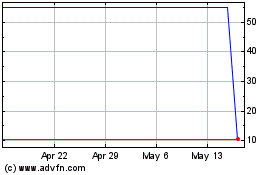

Kennedy Wilson (NYSE:KW)

Historical Stock Chart

From Dec 2023 to Dec 2024