Kennedy Wilson Originates $175 Million Construction Loan for Artwalk Towers in Jersey City, NJ

November 12 2024 - 5:00AM

Business Wire

Real estate debt platform reaches $2.4 billion

in originations over the past year

Kennedy Wilson, a leading global real estate investment company

and one of the most active multifamily and student housing lenders

in the country, has closed a $175 million senior construction loan

for the development of Artwalk Towers, a 595-unit multifamily

community in Jersey City, New Jersey.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241112090210/en/

Artwalk Towers (Graphic: Business

Wire)

The new multifamily loan is the latest in an active year for

Kennedy Wilson’s debt investment platform. Summer 2024 marked the

one-year anniversary of Kennedy Wilson’s acquisition of a $4.1

billion construction loan portfolio. Since then, Kennedy Wilson has

completed $2.4 billion of multifamily and student housing

construction originations totaling 8,900 units with high-quality

institutional sponsors across the country. The company currently

has a strong pipeline of multifamily and student housing loans.

Artwalk Towers, located in the heart of Jersey City’s Journal

Square, will be a 49-story residential tower offering a full range

of amenities, including an Art Walk connector to a PATH station

that provides direct access to Manhattan, resort-style pool, BBQ

area, state-of-the-art gym, co-working spaces, and a sky lounge

with views of New York City. The project’s sponsor is Kushner Real

Estate Group, one of the most prolific developers in Journal Square

that has delivered over 1,800 units across multiple projects.

Artwalk Towers is expected to be completed in Q4 2027.

"We are excited to close on our first loan with the Kushner Real

Estate Group, which has a proven track record of delivering

top-tier projects that meet the needs of the area’s residents,"

said Thomas Whitesell, Head of Kennedy Wilson's Debt Investment

Group. "The Artwalk Towers loan aligns with our strategy to support

transformative multifamily developments in urban areas, and this

closing is a great way to celebrate the debt group’s one year

anniversary at Kennedy Wilson, which has included more than $2.4

billion of originations to high-impact multifamily and student

housing projects across the country.”

Kennedy Wilson has a 2.5% weighted average ownership in the

loans closed since Summer 2024. The company is earning customary

management fees in its role as asset manager.

About Kennedy Wilson

Kennedy Wilson (NYSE: KW) is a leading real estate investment

company with over $28 billion of assets under management in high

growth markets across the United States, the UK, and Ireland.

Drawing on decades of experience, our relationship-oriented team

excels at identifying opportunities and building value through

market cycles, closing more than $50 billion in total transactions

across the property spectrum since going public in 2009. Kennedy

Wilson owns, operates, and builds real estate within our

high-quality, core real estate portfolio and through our investment

management platform, where we target opportunistic equity and debt

investments alongside our partners. For further information, please

visit www.kennedywilson.com.

KW-IR

Special Note Regarding Forward-Looking Statements

Statements in this press release that are not historical facts

are “forward-looking statements” within the meaning of U.S. federal

securities laws. These forward-looking statements are estimates

that reflect our management’s current expectations, are based on

our current estimates, expectations, forecasts, projections and

assumptions that may prove to be inaccurate and involve known and

unknown risks. Accordingly, our actual results, performance or

achievement, or industry results, may differ materially and

adversely from the results, performance or achievement, or industry

results, expressed or implied by these forward-looking statements,

including for reasons that are beyond our control. Some of the

forward-looking statements may be identified by words like

“believes”, “expects”, “anticipates”, “estimates”, “plans”,

“intends”, “projects”, “indicates”, “could”, “may” and similar

expressions. These statements are not guarantees of future

performance and involve a number of risks, uncertainties and

assumptions. We assume no duty to update the forward-looking

statements, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112090210/en/

Investors Daven Bhavsar, CFA Head of Investor Relations

+1 (310) 887-3431 dbhavsar@kennedywilson.com Media Emily

Heidt Vice President, Communications +1 (310) 887-3499

eheidt@kennedywilson.com

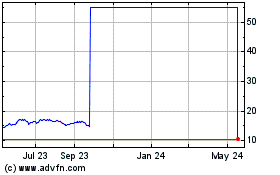

Kennedy Wilson (NYSE:KW)

Historical Stock Chart

From Dec 2024 to Jan 2025

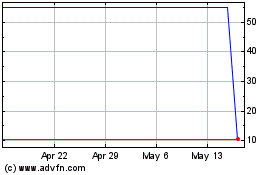

Kennedy Wilson (NYSE:KW)

Historical Stock Chart

From Jan 2024 to Jan 2025