Target Dividend Stocks for Portfolio - Analyst Blog

February 21 2013 - 11:46AM

Zacks

It’s a flagging economy and thus investors will obviously prefer

to bet their bucks in the safer counters. Investors, in order to

shield themselves from the upheavals in the financial world, are

now diligently choosing their portfolio of stocks that can give

them the best returns.

On that note, while building the portfolio, one should not

ignore the underlining dividend growth potential, which can also

enhance the total return.

Investors prefer an income generating stock, and a dividend

paying stock is always a preferable option. Meanwhile, keeping the

hard cash in the bank’s locker is much a safer alternative than

investing in stocks, so offering higher return on stocks becomes

obvious to compensate for the risk undertaken.

Higher dividend growth companies have a better chance to attract

investors that in turn provides an impetus to the share price.

Through this strategy, the companies bolster investors’ confidence

on the stock, thereby persuading them to either buy or hold the

scrip instead of selling them.

A consistent dividend payment and increasing the same at regular

intervals primarily reflect the company’s sound financial position,

defined future prospects and intention to enhance shareholders’

value. But what might hurt shareholders’ sentiment is a dividend

hike in one year, followed by a cut in the next year.

However, not all companies pay dividend regularly, and

furthermore some companies do not declare dividend. Nonetheless,

this never suggests that the stock is devoid of growth

propositions, unless the underlying fundamentals indicate so. It

might be that the companies want to preserve the earnings for

future expansions rather than to payout in the form of dividend.

So, do consider all the factors while picking the stocks.

Every stock has its own strengths and weaknesses that need to be

evaluated. Dividend increase remains one of the criterions to be

considered before taking any investment decision, but apart from

that an investor must take into account the top and bottom lines’

growth potential, free cash flow generation capability, cash flow

per share, return on capital and debt-to-total capital ratio to

name a few. A diligent use of these tools will help in assessing

and scrutinizing equity investments.

Dividend increases have now become a common trend among

companies boasting a stable cash position and healthy cash flows.

These strategies not only enhance shareholders’ return but also

raise the market value of the stock.

The companies which recently increased quarterly dividend

include, video game and entertainment software retailer,

GameStop Corporation (GME) by 10% to 27.5 cents;

textbook publisher and financial information provider, The

McGraw-Hill Companies, Inc. (MHP) by 9.8% to 28 cents;

media and marketing company Meredith Corporation

(MDP) by 6.5% to 40.75 cents; specialty retailer of women’s apparel

Limited Brands Inc. (LTD) by 20% to 30

cents; two beverage companies PepsiCo Inc.

(PEP) by 5.6% to 56.75 cents and Dr Pepper Snapple Group,

Inc. (DPS) by 12% to 38 cents a share.

Few other stocks that are worth a look on the dividend platform

include Comcast Corporation (CMCSA), which raised

its quarterly dividend by 20% to 19.5 cents; oil and gas

exploration company, Occidental Petroleum

Corporation (OXY) that raised its dividend by 18.5% to 64

cents; and Canadian communications and media company,

Rogers Communications Inc. (RCI) hiked its

dividend by 10% to 43.5 cents.

COMCAST CORP A (CMCSA): Free Stock Analysis Report

DR PEPPER SNAPL (DPS): Free Stock Analysis Report

GAMESTOP CORP (GME): Free Stock Analysis Report

LIMITED BRANDS (LTD): Free Stock Analysis Report

MEREDITH CORP (MDP): Free Stock Analysis Report

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

OCCIDENTAL PET (OXY): Free Stock Analysis Report

PEPSICO INC (PEP): Free Stock Analysis Report

ROGERS COMM CLB (RCI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

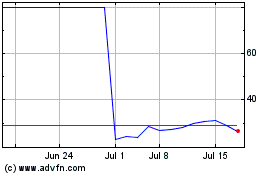

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

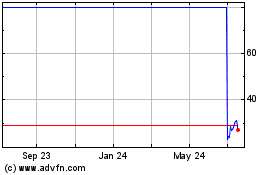

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024