Moody’s Acquires Numerated Growth Technologies, Expanding Lending Technology Solutions

November 21 2024 - 7:00AM

Business Wire

Moody’s Corporation (NYSE:MCO) announced today that it has

acquired Numerated Growth Technologies (Numerated), a loan

origination platform for financial institutions. The transaction

further expands Moody’s Lending Suite capabilities across the

credit lifecycle, providing banking customers with a powerful

end-to-end loan origination and monitoring solution.

The acquisition builds on a partnership announced in January

2024 that integrated Numerated’s front office, decisioning, and

loan operation technologies with Moody’s credit assessment,

underwriting, and monitoring expertise. Numerated will be

integrated into Moody’s Lending Suite, creating a full loan

origination workflow.

“As our banking customers undergo digital transformation

programs to enhance their user experience, automate processes, and

provide their front office functions with more data, they’re

looking for a credible end-to-end lending solution,” said Rob

Fauber, President and Chief Executive Officer of Moody’s. “By

bringing Numerated and its technology and expertise in-house, we’ll

accelerate our Lending Suite capabilities to equip customers across

asset classes with more of our industry-leading risk data and

analytical solutions.”

Numerated uses data and artificial intelligence to streamline

and enhance bank lending – improving the application,

decision-making, and closing processes through enhanced data

integrity. Financial institutions with a combined $3 trillion in

assets use Numerated, and since its inception, over 500,000

businesses and 30,000 financial institution associates have used

its platform to process over $65 billion in lending.

The terms of the transaction were not disclosed, and it is not

expected to have a material impact on Moody’s 2024 financial

results.

About Moody’s Corporation In a world shaped by

increasingly interconnected risks, Moody’s (NYSE: MCO) data,

insights, and innovative technologies help customers develop a

holistic view of their world and unlock opportunities. With a rich

history of experience in global markets and a diverse workforce of

approximately 15,000 across more than 40 countries, Moody’s gives

customers the comprehensive perspective needed to act with

confidence and thrive. Learn more at moodys.com.

“Safe Harbor” statement under the Private Securities

Litigation Reform Act of 1995 Certain statements contained in

this document are forward-looking statements and are based on

future expectations, plans and prospects for Moody’s business and

operations that involve a number of risks and uncertainties. Such

statements involve estimates, projections, goals, forecasts,

assumptions and uncertainties that could cause actual results or

outcomes to differ materially from those contemplated, expressed,

projected, anticipated or implied in the forward-looking

statements. Stockholders and investors are cautioned not to place

undue reliance on these forward-looking statements. Such statements

include, but are not limited to, statements relating to the impact

of the acquisition of Numerated Growth Technologies on Moody’s

business. The forward-looking statements and other information in

this document are made as of the date hereof, and Moody’s

undertakes no obligation (nor does it intend) to publicly

supplement, update or revise such statements on a going-forward

basis, whether as a result of subsequent developments, changed

expectations or otherwise, except as required by applicable law or

regulation. In connection with the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995, Moody’s is

identifying certain factors that could cause actual results to

differ, perhaps materially, from those indicated by these

forward-looking statements. These factors, risks and uncertainties

include, but are not limited to: the impact of general economic

conditions (including significant government debt and deficit

levels, and inflation and related monetary policy actions by

governments in response to inflation) on worldwide credit markets

and on economic activity, including on the volume of mergers and

acquisitions, and their effects on the volume of debt and other

securities issued in domestic and/or global capital markets; the

uncertain effectiveness and possible collateral consequences of

U.S. and foreign government initiatives and monetary policy to

respond to the current economic climate, including instability of

financial institutions, credit quality concerns, and other

potential impacts of volatility in financial and credit markets;

the global impacts of the Russia - Ukraine military conflict and

the military conflict in the Middle East on volatility in world

financial markets, on general economic conditions and GDP in the

U.S. and worldwide, on global relations and on the Company's own

operations and personnel; other matters that could affect the

volume of debt and other securities issued in domestic and/or

global capital markets, including regulation, increased utilization

of technologies that have the potential to intensify competition

and accelerate disruption and disintermediation in the financial

services industry, as well as the number of issuances of securities

without ratings or securities which are rated or evaluated by

non-traditional parties; the level of merger and acquisition

activity in the U.S. and abroad; the uncertain effectiveness and

possible collateral consequences of U.S. and foreign government

actions affecting credit markets, international trade and economic

policy, including those related to tariffs, tax agreements and

trade barriers; the impact of MIS’s withdrawal of its credit

ratings on countries or entities within countries and of Moody’s no

longer conducting commercial operations in countries where

political instability warrants such actions; concerns in the

marketplace affecting our credibility or otherwise affecting market

perceptions of the integrity or utility of independent credit

agency ratings; the introduction or development of competing and/or

emerging technologies and products; pricing pressure from

competitors and/or customers; the level of success of new product

development and global expansion; the impact of regulation as an

NRSRO, the potential for new U.S., state and local legislation and

regulations; the potential for increased competition and regulation

in the jurisdictions in which we operate, including the EU;

exposure to litigation related to our rating opinions, as well as

any other litigation, government and regulatory proceedings,

investigations and inquiries to which Moody’s may be subject from

time to time; provisions in U.S. legislation modifying the pleading

standards and EU regulations modifying the liability standards

applicable to credit rating agencies in a manner adverse to credit

rating agencies; provisions of EU regulations imposing additional

procedural and substantive requirements on the pricing of services

and the expansion of supervisory remit to include non-EU ratings

used for regulatory purposes; uncertainty regarding the future

relationship between the U.S. and China; the possible loss of key

employees and the impact of the global labor environment; failures

or malfunctions of our operations and infrastructure; any

vulnerabilities to cyber threats or other cybersecurity concerns;

the timing and effectiveness of any restructuring programs;

currency and foreign exchange volatility; the outcome of any review

by tax authorities of Moody’s global tax planning initiatives;

exposure to potential criminal sanctions or civil remedies if

Moody’s fails to comply with foreign and U.S. laws and regulations

that are applicable in the jurisdictions in which Moody’s operates,

including data protection and privacy laws, sanctions laws,

anti-corruption laws, and local laws prohibiting corrupt payments

to government officials; the impact of mergers, acquisitions or

other business combinations and the ability of Moody’s to

successfully integrate acquired businesses; the level of future

cash flows; the levels of capital investments; and a decline in the

demand for credit risk management tools by financial institutions.

These factors, risks and uncertainties as well as other risks and

uncertainties that could cause Moody’s actual results to differ

materially from those contemplated, expressed, projected,

anticipated or implied in the forward-looking statements are

described in greater detail under “Risk Factors” in Part I, Item 1A

of Moody’s annual report on Form 10-K for the year ended December

31, 2023, and in other filings made by the Company from time to

time with the SEC or in materials incorporated herein or therein.

Stockholders and investors are cautioned that the occurrence of any

of these factors, risks and uncertainties may cause the Company’s

actual results to differ materially from those contemplated,

expressed, projected, anticipated or implied in the forward-looking

statements, which could have a material and adverse effect on the

Company’s business, results of operations and financial condition.

New factors may emerge from time to time, and it is not possible

for the Company to predict new factors, nor can the Company assess

the potential effect of any new factors on it. Forward-looking and

other statements in this document may also address our corporate

responsibility progress, plans, and goals (including sustainability

and environmental matters), and the inclusion of such statements is

not an indication that these contents are necessarily material to

investors or required to be disclosed in the Company’s filings with

the Securities and Exchange Commission. In addition, historical,

current, and forward-looking sustainability-related statements may

be based on standards for measuring progress that are still

developing, internal controls and processes that continue to

evolve, and assumptions that are subject to change in the

future.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241121381551/en/

For Moody’s Investor Relations: Shivani Kak Moody’s Corporation

+1 212-553-0298 Shivani.Kak@moodys.com

For Moody’s Communications: Joe Mielenhausen Moody’s Corporation

+1 212-553-1461 Joe.Mielenhausen@moodys.com

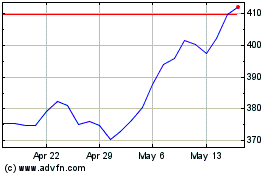

Moodys (NYSE:MCO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Moodys (NYSE:MCO)

Historical Stock Chart

From Jan 2024 to Jan 2025