AG Mortgage Investment Trust, Inc. Increases Quarterly Common Dividend 5.6% to $0.19 per Share

June 13 2024 - 3:05PM

Business Wire

AG Mortgage Investment Trust, Inc. (NYSE: MITT) (the “Company”)

announced today that its Board of Directors has declared a dividend

of $0.19 per common share for the second quarter 2024, representing

a 5.6% increase over the prior quarter dividend of $0.18 per common

share. The dividend is payable on July 31, 2024 to shareholders of

record at the close of business on June 28, 2024.

“We believe in steadily increasing our dividend to align with

our long-term earnings growth, and this increase reflects the

sustainability and continuing strength of the earnings power in our

investment portfolio along with additional scale created by the

recently completed merger,” said TJ Durkin, Chief Executive Officer

and President. “We remain committed to executing our strategy to

further optimize our capital structure and scale to drive long-term

shareholder value.”

About AG Mortgage Investment Trust, Inc.

AG Mortgage Investment Trust, Inc. is a residential mortgage

REIT with a focus on investing in a diversified risk-adjusted

portfolio of residential mortgage-related assets in the U.S.

mortgage market. AG Mortgage Investment Trust, Inc. is externally

managed and advised by AG REIT Management, LLC, a subsidiary of

Angelo, Gordon & Co., L.P., a diversified credit and real

estate investing platform within TPG.

Additional information can be found on the Company’s website at

www.agmit.com.

About TPG Angelo Gordon

Founded in 1988, Angelo, Gordon & Co., L.P. (“TPG Angelo

Gordon”) is a diversified credit and real estate investing platform

within TPG. The platform currently manages approximately $80

billion across a broad range of credit and real estate strategies.

For more information, visit www.angelogordon.com.

Forward-Looking Statements

This press release contains certain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. The Company intends such statements to be covered by the

safe harbor provisions for forward-looking statements contained in

the Private Securities Litigation Reform Act of 1995 and includes

this statement for purposes of complying with the safe harbor

provisions. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates,” “will,” “should,” “may,”

“projects,” “could,” “estimates” or variations of such words and

other similar expressions are intended to identify such

forward-looking statements, which generally are not historical in

nature, but not all forward-looking statements include such

identifying words. Forward-looking statements regarding the Company

include, but are not limited to, statements regarding the Company’s

ability to execute its strategy, including to further optimize its

capital structure and scale to drive long-term shareholder value,

the amount and timing of dividends, including the Company’s ability

to steadily increase its dividend to align with long-term earnings

growth or at all, and the sustainability and continuing strength of

the Company’s earnings power. These forward-looking statements are

subject to various risks and uncertainties. Accordingly, there are

or will be important factors that could cause actual outcomes or

results to differ materially from those indicated in these

statements. The Company believes these factors include, without

limitation, the risk factors contained in the Company’s filings

with the Securities and Exchange Commission (“SEC”), including

those described under the headings “Forward-Looking Statements” and

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023 and in other reports and

documents filed by the Company with the SEC from time to time.

Moreover, other risks and uncertainties of which the Company is not

currently aware may also affect the Company’s forward-looking

statements and may cause actual results and the timing of events to

differ materially from those anticipated. The forward-looking

statements made in this press release are made only as of the date

of this press release or as of the dates indicated in the

forward-looking statements, even if they are subsequently made

available by the Company on its website or otherwise. The Company

undertakes no obligation to update or supplement any

forward-looking statements to reflect actual results, new

information, future events, changes in its expectations or other

circumstances that exist after the date as of which the

forward-looking statements were made, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240613924656/en/

Investors AG Mortgage Investment Trust, Inc. Investor

Relations (212) 692-2110 ir@agmit.com

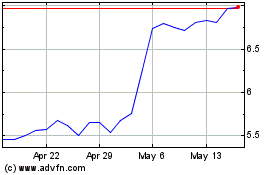

AG Mortgage Investment (NYSE:MITT)

Historical Stock Chart

From Nov 2024 to Dec 2024

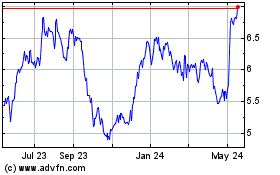

AG Mortgage Investment (NYSE:MITT)

Historical Stock Chart

From Dec 2023 to Dec 2024