Filed Pursuant to Rule 424(b)(3)

Registration No. 333-269268

PROSPECTUS SUPPLEMENT NO. 13

(to the Prospectus dated March 24, 2023)

MariaDB plc

16,351,314 Ordinary Shares Underlying Warrants

56,414,951 Ordinary Shares by selling holders

7,310,297 Warrants to Purchase Ordinary Shares

by selling holders

This prospectus supplement updates, amends and

supplements the prospectus, dated March 24, 2023 (the “Prospectus”), which forms a part of our registration statement

on Form S-1 (No. 333-269268), with the information contained in our Current Report on Form 8-K filed with the Securities

and Exchange Commission on October 10, 2023 (“Current Report”). Accordingly, we have attached the Current Report to

this prospectus supplement.

The Prospectus and this prospectus supplement

relate to the issuance by us of an aggregate of up to 16,351,314 Ordinary Shares (as defined in the Prospectus), consisting of:

| |

● |

|

up to 7,310,297 Ordinary Shares that are issuable upon the exercise of the Private Placement Warrants (as defined in the Prospectus); |

| |

● |

|

up to 8,850,458 Ordinary Shares that are issuable upon the exercise of the Public Warrants (as defined in the Prospectus); and |

| |

● |

|

up to 190,559 Ordinary Shares that are issuable upon exercise of the Kreos Warrants (as defined in the Prospectus). |

The Public Warrants,

which are exercisable at a price of $11.50 per share, were originally sold as part of the APHC Public Units (as defined in the Prospectus)

purchased by public investors in the APHC IPO (as defined in the Prospectus) at a price of $10.00 per APHC Public Unit. The Private Placement

Warrants, which are exercisable at a price of $11.50 per share, were originally purchased by the Sponsor (as defined in the Prospectus)

concurrent with the consummation of the APHC IPO at a price of $1.00 per warrant. Prior to the consummation of the Irish Domestication

Merger (as defined in the Prospectus), 1,600,000 Private Placement Warrants were transferred by the Sponsor to the Syndicated Investors

(as defined in the Prospectus) pursuant to the At Risk Capital Syndication (as defined in the Prospectus) (at a price per warrant of $1.00),

and 5,710,297 Private Placement Warrants were transferred to the Sponsor’s co-founders, Lionyet International Ltd. (an entity owned

and controlled by Shihuang “Simon” Xie) and Theodore T. Wang. The Kreos Warrants, which are exercisable at a price of €2.29

per share, were originally issued to Kreos (as defined in the Prospectus) by Legacy MariaDB (as defined in the Prospectus) in connection

with a loan facility that is no longer outstanding. The Private Placement Warrants, the Public Warrants and the Kreos Warrants are sometimes

referred to collectively in the Prospectus as the “Warrants.” To the extent that the Warrants are exercised for cash, we will

receive the proceeds from such exercises.

The Prospectus and this

prospectus supplement also relate to the offer and sale from time to time by the selling holders named in the Prospectus or their permitted

transferees (the “selling holders”) of (i) up to 7,310,297 Private Placement Warrants and (ii) up to 56,414,951

Ordinary Shares, consisting of:

| |

● |

|

1,915,790 Ordinary Shares held by the PIPE Investors (as defined in the Prospectus), which they purchased in connection with the consummation of the PIPE Investment (as defined in the Prospectus) at a price of $9.50 per share; |

| |

● |

|

4,857,870 Founder Shares (as defined in the Prospectus) currently held by the Sponsor’s co-founders, Lionyet International Ltd. (an entity owned and controlled by Shihuang “Simon” Xie) and Theodore T. Wang, which were originally acquired by the Sponsor at a price of approximately $0.004 per share and transferred to its co-founders prior to the consummation of the Irish Domestication Merger; |

| |

● |

|

65,000 Founder Shares held by individuals who served as independent directors of APHC or otherwise provided services prior to the consummation of the Business Combination (as defined in the Prospectus), which were transferred from the Sponsor (who originally acquired such shares at a price of approximately $0.004 per share) in consideration of such services; |

| |

● |

|

1,550,000 Founders Shares held by certain Syndicated Investors, which were originally acquired by the Sponsor at a price of approximately $0.004 per share and transferred to such Syndicated Investors prior to the consummation of the Irish Domestication Merger in connection with the At Risk Capital Syndication (at a price of $3.00 per share); |

| |

● |

|

38,897,106 Ordinary Shares held by former affiliates and certain other shareholders of Legacy MariaDB, which, upon consummation of the Merger, were issued to them pursuant to the terms of the Merger Agreement in exchange for shares of (i) Legacy MariaDB they had previously purchased from Legacy MariaDB in private placement transactions or on exercise of Legacy MariaDB Equity Awards or warrants, at prices per share ranging from $0.38 to $7.50, as adjusted based on the Exchange Ratio (as defined in the Prospectus); |

| |

● |

|

1,818,888 Ordinary Shares issuable upon exercise of stock options held by certain of our executive officers and directors, at exercise prices ranging from $0.38 to $4.15 per Ordinary Share; and |

| |

● |

|

7,310,297 Ordinary Shares issuable upon exercise of the Private Placement Warrants held by Lionyet International Ltd. and Dr. Wang, the Sponsor’s co-founders, and the Syndicated Investors. |

We are registering the

Ordinary Shares and Private Placement Warrants that may be offered and sold by selling holders from time to time pursuant to their registration

rights under certain agreements between us and the selling holders or their affiliates, as applicable.

This prospectus supplement is not complete without

the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, including any amendments or supplements

thereto, which is to be delivered with this prospectus supplement., This prospectus supplement is qualified by reference to the Prospectus,

including any amendments or supplements thereto, except to the extent that the information in this prospectus supplement updates or supersedes

the information contained therein. Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings

specified in the Prospectus.

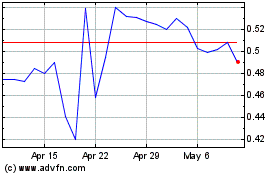

Our Ordinary Shares and Public Warrants are listed

on The New York Stock Exchange (“NYSE”) under the symbols “MRDB” and “MRDBW”, respectively. On October 9,

2023, the closing sale prices of our Ordinary Shares and Public Warrants were $0.6159 and $0.1425, respectively.

We are an “emerging growth company”

and a “smaller reporting company” as defined under the U.S. federal securities laws and, as such, may elect to comply with

certain reduced public company reporting requirements for this and future filings.

Investing in our Ordinary Shares and Warrants

involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 9 of the Prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the Prospectus

or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is October 10,

2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): October 10, 2023

MariaDB plc

(Exact name of registrant as specified in its

charter)

| Ireland |

|

001-41571 |

|

N/A |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

699 Veterans Blvd

Redwood City, CA 94063

(Address of principal executive offices, including

zip code)

(855) 562-7423

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which

registered |

| Ordinary Shares, nominal value $0.01 per share |

|

MRDB |

|

New York Stock Exchange |

| Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share |

|

MRDBW |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry Into a Material Definitive Agreement |

The information set forth in Item 2.03 is incorporated by reference

into this Item 1.01.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

On October 10, 2023 (the “Closing Date”),

MariaDB plc (the “Company”) issued a senior secured promissory note to RP Ventures LLC (“RP Ventures”), a Delaware

limited liability company, in the principal amount of $26.5 million (the “Note”). RP Ventures will also act as the initial

Agent as defined in the Note (in such capacity, the “Agent”).

The Note will mature on the earlier of (i) January 10, 2024, (ii) the occurrence of a Change of Control (as defined in the Note), (iii)

the occurrence of any breach of any of the documentation relating to the Company’s loan from the European Investment Bank (the “EIB

Loan”) or any demand for repayment of the EIB Loan, and (iv) the date on which the Note is otherwise declared due and payable pursuant

to its terms. The proceeds of the Note will be used by the Company to repay all amounts outstanding under the EIB Loan, certain Note-related

expenses, including expenses of RP Ventures, and for working capital purposes as approved by the Company’s board of directors (the

“Board”). The Company will pay RP Ventures a nonrefundable funding fee of $132,500, and has agreed to pay or reimburse RP

Ventures and Runa Capital Fund II, L.P. (“Runa”) for its out-of-pocket expenses related to the Note transaction. Runa currently

beneficially owns approximately 8% of the outstanding ordinary shares of the Company. Michael Fanfant, the sole member and manager of

RP Ventures, is a General Partner of Runa Capital, an affiliate of Runa. See Item 5.02 below for additional information.

Interest on the Note accrues on the principal

amount at the rate of ten percent (10%) per annum and will be paid on a quarterly basis commencing on January 1, 2024. The Company

may prepay any amounts due under the Note without penalty or premium, subject to the prior written consent of RP Ventures, provided that

any prepayment of principal under the Note be accompanied by interest accrued and unpaid through the date of such prepayment. RP Ventures

may demand immediate repayment of certain amounts outstanding under the Note if the Company or any of its subsidiaries incurs additional

indebtedness or disposes, sells, or otherwise transfers any of their property or assets outside of the ordinary course of business, or

if the Company or any of its subsidiaries receives any proceeds from the occurrence of a casualty event.

Until January 10, 2024, the Note restricts

the Company from pursuing or accepting any offer with respect to any recapitalization, reorganization, merger, business combination, purchase,

sale, loan, notes issuance, issuance of other indebtedness or other financing or similar transaction, or to any acquisition by any person

or group, which would result in any person or group becoming the beneficial owner of 2% or more of any class of equity interests or voting

power or consolidated net income, revenue or assets, of the Company, in each case other than with RP Ventures or Runa.

The Note provides that within five (5) business

days after the Closing Date, the Company will retain a Chief Restructuring Officer to provide financial and operational services that

must be satisfactory to the Agent. In addition, pursuant to the Note, the Company has appointed two directors selected by the Agent to

the Board (the “New Board Members”). The Chief Restructuring Officer will report directly to the New Board Members. Further,

as required by the Note, on the Closing Date, Harold Berenson, Alexander Suh, Christine Russell, and Theodore Wang resigned from the Board,

and the size of the Board was fixed at four (4) directors. See Item 5.02 below for related information.

The Note contains certain customary

representations and warranties and covenants of the Company. In addition, the Company has agreed to, among other things, provide to

RP Ventures certain financial information, maintain minimum aggregate liquidity in an amount to be agreed upon after the Closing

Date by the Board and the Agent, and make disbursements and collect receivables based on budget amounts.

The Note limits the ability of the Company to,

among other things, (i) incur indebtedness, (ii) create certain liens, (iii) declare or distribute dividends or make certain

other restricted payments, (iv) be party to a merger, consolidation, division or other fundamental change, (v) transfer, sell

or lease Company assets, (vi) make certain modifications to the Company’s organizational documents or indebtedness, (vii) engage

in certain transactions with affiliates, (viii) change the Company’s business, accounting or reporting practices, name or jurisdiction

or organization, (ix) establish new bank accounts, and (x) establish or acquire any subsidiary. In addition, without the Agent’s

prior consent, the Company will be restricted in, among other things, taking part in transactions outside of the ordinary course of its

existing business, making certain payments, or issuing equity interests.

The Note provides for customary events of default,

including for, among other things, payment defaults, breach of representations and certain covenants, cross defaults, insolvency, dissolution

and bankruptcy, certain judgments against the Company, and material adverse changes. In the case of an event of default, RP Ventures may

demand immediate repayment by the Company of all or part of the amounts outstanding, if any, under the Note.

In connection with issuance of the Note, the Company

and MariaDB USA. Inc. and certain other of the Company’s subsidiaries (the “Guarantors”) entered into a Guarantee and

Collateral Agreement (the “Security Agreement”), pursuant to which the Company and each Guarantor pledged substantially all

of their respective assets as collateral for the Note and each Guarantor guaranteed to RP Ventures the payment of all obligations arising

from the Note.

The foregoing description is only a summary

of the material provisions of the Note and is qualified in its entirety by reference to the Note, a copy of which is filed as

Exhibit 10.1 to this Current Report on Form 8-K (the “Current Report”) and incorporated by reference

herein.

| Item 2.04 |

Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement |

Under terms of the EIB Loan, transactions

contemplated by the Note and the Security Agreement may allow the European Investment Bank to demand the Company immediately repay

all amounts outstanding under the EIB Loan. Pursuant to the terms of the Note, and irrespective of any demand, the Company is

obligated to use proceeds from the Note to repay the EIB Loan in full.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

The information set forth in Item 2.03 is incorporated

by reference into this Item 5.02.

On October 10, 2023, in connection with the

closing of the transactions contemplated by the Note, each of Alexander Suh, Christine Russell, Harold Berenson, and Theodore Wang tendered their resignation from the

Board and, to the extent applicable, all committees thereof, in each case, effective immediately. Current director

Jurgen Ingels will serve as chair of the Board.

Also, on October 10, 2023, pursuant to

the terms of the Note, Yakov “Jack” Zubarev and Michael Fanfant were appointed to the Board as Class II and I

directors, respectively, with terms ending at the 2026 annual general meeting of shareholders and 2024 annual general meeting of

shareholders, respectively. Additional biographical information, any applicable related party transactions, or other

information will be provided in an amendment to this Current Report on Form 8-K.

| Item 7.01 |

Regulation FD Disclosure |

The Company issued a press release on October 10, 2023, announcing transactions contemplated by the Note and the Board changes

as described elsewhere in this Current Report. A copy of this press release is furnished as Exhibit 99.1 to this Current Report

and incorporated herein by reference.

The information contained in Item 7.01 of this

Current Report, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference into any registration statement or

other filing pursuant to the Securities Act of 1933, as amended, except as otherwise expressly stated in the filing.

Forward-Looking Statements

Certain statements in this Current Report are

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words indicating

future events and actions, such as “will,” “intend,” “plan,” and “may,” and variations

of such words, and similar expressions and future-looking language identify forward-looking statements, but their absence does not mean

that the statement is not forward-looking. The forward-looking statements in this periodic report include statements regarding the occurrence

and timing of the disbursement of the advances under the Note, payment of the EIB Loan, and other use of proceeds, the retention of a chief restructuring

officer and changes to Board composition, and related actions and events and the results therefrom, including those regarding the operations

and trading of the Company. Forward-looking statements are not guarantees of future events and actions, which may vary materially from

those expressed or implied in such statements. Differences may result from, among other things, actions taken by the Company or its management

or the Board, or third parties, including those beyond the Company’s control. Such differences and uncertainties and related risks

include, but are not limited to, the possibility that we may not timely receive the full amount under the Note as expected and any action

taken in respect of a default under the EIB Loan and that the New York Stock Exchange may take action, including delisting, due to, among

other things, the Company’s failure to meet Board, committee and other requirements of the exchange. The foregoing list of differences

and risks and uncertainties is illustrative but by no means exhaustive. For more information on factors that may affect the Note and related

events, please review “Risk Factors” and other information included in the Company’s filings and records filed with

the United States Securities and Exchange Commission. These forward-looking statements reflect the Company’s expectations as of

the date hereof. The Company undertakes no obligation to update the information provided herein.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MariaDB plc |

| Dated: October 10, 2023 |

|

| |

By: |

/s/ Paul O’Brien |

| |

|

Paul O’Brien |

| |

|

Chief Executive Officer |

EXHIBIT 10.1

THE SECURITY REPRESENTED HEREBY HAS NOT BEEN

REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR APPLICABLE STATE SECURITIES LAWS, AND MAY NOT

BE OFFERED OR SOLD IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT AND SUCH STATE SECURITIES LAWS, OR AN EXEMPTION

FROM REGISTRATION THEREUNDER.

SENIOR SECURED PROMISSORY NOTE

| $26,500,000.00 | October 10,

2023 |

FOR VALUE RECEIVED, and subject to the terms

and conditions set forth herein, MARIADB PLC, an Irish public limited company (hereinafter referred to as “Issuer”),

hereby unconditionally promises to pay to RP VENTURES LLC, a Delaware limited liability company (and together with its successors and

assigns, hereinafter referred to as “Holder”), in the manner hereinafter provided, the aggregate principal sum of

TWENTY-SIX MILLION FIVE HUNDRED THOUSAND Dollars ($26,500,000.00) or, if less, the aggregate unpaid principal amount of all advances

made from time to time by Holder to Issuer pursuant to and in accordance with this Senior Secured Promissory Note (this “Note”),

in immediately available funds and in lawful money of the United States of America, together with interest thereon, all in accordance

with the provisions hereinafter specified.

1. Advances.

Advances under this Note may be requested by Issuer in writing by an authorized representative of Issuer upon ten (10) Business

Days’ prior notice to Agent and shall specify the amount of such advance. Amounts advanced hereunder and repaid may not be reborrowed

without the consent of Agent in its sole discretion. On October 10, 2023 Holder shall advance to Issuer the aggregate principal

sum of TWENTY-SIX MILLION FIVE HUNDRED THOUSAND Dollars ($26,500,000.00) attached hereto. As used herein, (i) the term “Advance

Date” means each date on which Issuer receives a subsequent advance from Holder and (ii) the term “Loan”

means any extension of credit by Holder to Issuer under this Note.

2. Accrual

of Interest. Interest shall accrue and be computed on the principal amount outstanding from time to time under this Note until the

same is repaid in full at a rate equal to 10.0% per annum. Interest shall be calculated hereunder on the basis of a 360-day year for

the actual number of days elapsed.

3. Payment

of Interest. Issuer shall pay interest on this Note commencing on January 1, 2024, and quarterly thereafter in arrears on the

first Business Day of each calendar quarter and on the Maturity Date (as hereafter defined), whichever is earlier, (each an “Interest

Payment Date”), to Agent on behalf of Holder. Interest payable on this Note shall be paid on each Interest Payment Date in

cash during the continuance of an Event of Default, notwithstanding anything else to the contrary contained in this Note, interest payable

on the outstanding principal hereunder and all other Obligations shall bear interest at the then applicable interest rate set forth in

Section 2 plus two percent (2%) per annum and such interest shall be payable upon demand.

4. Fees.

As consideration for the agreements and commitments under this Note, on or prior to the date hereof, Issuer shall pay to Agent on

behalf of Holder in immediately available funds a fee equal to $132,500.00 (i.e. 0.5% of the aggregate principal amount of this Note),

which fee shall be fully earned, due, payable and nonrefundable on the date hereof.

5. Maturity

Date. The entire unpaid principal amount of this Note, together with all accrued unpaid interest, shall be due and payable on the

earlier of (i) on January 10, 2024 (the “Maturity Date”), (ii) upon the occurrence of a Change of Control

(as defined below), (iii) any EIB Default or, (iii) if earlier, the date on which this Note is declared due and payable pursuant

to the terms of this Note, including without limitation as provided in Section 16 of this Note. As used herein, the term

“Change of Control” means for any reason whatsoever, (a) Issuer and the other Note Parties and their Subsidiaries

shall cease to own, directly or indirectly, 100% of each class of the outstanding Equity Interest of such Note Party’s direct and

indirect Subsidiaries, (b) any issuance or sale of any equity interests of Issuer, any of the Note Parties or any of their Subsidiaries

by Issuer or any such Subsidiary representing more than 50% of the outstanding Equity Interests of the Issuer or such Subsidiary, (c) the

acquisition of beneficial ownership, directly or indirectly, by any Person or “group” (within the meaning of the Securities

Exchange Act of 1934 and the rules of the SEC thereunder), of Equity Interests representing more than 35% of the aggregate ordinary

voting power represented by the issued and outstanding Equity Interests of the Company, (d) any sale of all or substantially all

of the property or assets of the Issuer or any other Note Party or any of their Subsidiaries, or (e) any “change of control”

(or any comparable term) in any other financing or equity document of Issuer or any of its Subsidiaries.

6. Voluntary

Prepayments. The principal amount outstanding from time to time under this Note may be prepaid in whole or in part at any time and

from time to time solely with the prior written consent of Agent. Any prepayment of principal shall be accompanied by payment of any

interest accrued and unpaid through the date of such prepayment. No prepayment of principal of this Note shall extend or postpone the

due date of any subsequent payment of principal and interest due hereunder.

7. Mandatory

Prepayments.

7.1. If

Issuer, any Note Party or any Subsidiary thereof disposes, sells or otherwise transfers any of its property or assets outside the ordinary

course of business or receives any proceeds from the occurrence of a casualty event, then Issuer shall give written notice to Agent and

within one (1) Business Day after the date of such receipt Issuer shall, or shall cause such Note Party or Subsidiary to, pay such

proceeds to Agent on behalf of Holder.

7.2. If

Issuer, any Note Party or any Subsidiary thereof incurs any Indebtedness not expressly permitted by this Note to be incurred, then Issuer

shall give written notice to Agent and within one (1) Business Day after the date of such receipt Issuer shall, or shall cause such

Note Party or Subsidiary to, pay such proceeds to Agent on behalf of Holder.

7.3. Notwithstanding

anything to the contrary, acceptance and application of any mandatory prepayment under this Note shall be subject to the Agent’s

prior written approval in its sole discretion.

8. Manner

and Application of Payments. All amounts payable in cash hereunder shall be payable to Agent by wire transfer of immediately available

funds and in lawful money of the United States of America without set-off, deduction or counterclaim at such place(s) and in such

amounts as Agent may from time to time designate in writing to Issuer. Payments hereunder shall be applied first to interest and then

to principal outstanding, in each case, to all of the Notes on a pro rata basis based upon the aggregate outstanding principal amount

of all Notes at the time of such payment; provided however that notwithstanding the foregoing if Agent has incurred any cost or expense

in connection with Notes Documents, Agent shall have the option of applying any monies received from Issuer to payment of such costs

or expenses plus interest thereon before applying any of such monies to any interest or principal then due. The Obligations under each

of the Notes shall be pari passu with respect to the other Notes. If any payment of principal or interest under this Note shall be payable

on a day other than a Business Day such payment shall be made on the next succeeding Business Day and interest shall be payable at the

rate specified in this Note during such extension. The books and records of Agent shall be the best evidence of any amounts at any time

owed under this Note (including but not limited to principal, interest and any fees owed hereunder) and shall be conclusive absent manifest

error.

9. Reserved.

10. Treatment

of Note. This Note and any notes subsequently issued in replacement thereof shall rank senior as to the payment of principal and

interest with all present and future Indebtedness.

11. Representations

and Warranties. Issuer and each Note Party hereby represents and warrants that:

11.1. Existence;

Authority. Issuer is validly existing as a public limited company under the laws of Ireland and has the power and authority to execute

and deliver this Note and the other Notes Documents and has duly executed and delivered this Note and the other Notes Documents. Each

Note Party (other than Issuer) is a validly existing corporation or other registered entity under the laws of it jurisdiction of its

organization and has the power and authority to execute and deliver this Note and the other Notes Documents and has duly executed and

delivered this Note and the other Notes Documents.

11.2. Enforceability.

This Note is the legal, valid and binding obligation of Issuer and each other Note Party, enforceable in accordance with its terms.

11.3. No

Conflict. The execution, delivery and performance of this Note and the borrowing evidenced hereby does not (i) require the consent

or approval of any other party (including any governmental or regulatory party), (ii) violate any law, regulation, agreement, order,

writ, judgment, injunction, decree, determination or award presently in effect to which Issuer or any Note Party is a party or to which

Issuer or any Note Party or any of their assets may be subject, or (iii) conflict with or constitute a breach of, or default under,

or require any consent under, or result in the creation of any Lien, charge or encumbrance upon the property or assets of Issuer or any

Note Party or any of their Subsidiaries pursuant to any other agreement or instrument (other than any pledge of or security interest

granted in any Collateral) to which Issuer or any Note Party is a party or is bound or by which its properties may be bound or affected.

11.4. Litigation.

There are no actions, suits, investigations or proceedings pending or, to the best of each Note Party’s knowledge, threatened at

law, in equity, in arbitration or by or before any other authority involving or affecting any Note Party or any of its Subsidiaries that

could reasonably be expected to result in a material adverse effect on the financial condition of any Note Party or any of their Subsidiaries.

11.5. Judgments.

There are currently no judgments entered against Issuer, any other Note Party or any of their Subsidiaries and each of Issuer, Note Parties,

and their Subsidiaries is not in default with respect to any judgment, writ, injunction, order, decree or consent of any court or other

judicial authority, which default could reasonably be expected to result in material adverse effect on the financial condition of Issuer,

any other Note Party or any of its Subsidiaries.

11.6. Use

of Proceeds. The proceeds of this Note shall be used solely (i) to pay all amounts owed under the EIB Debt, (ii) to pay on the Closing Date the out-of-pocket

expenses of the Holder and Runa incurred in connection with this Note, including the amounts indicated on the flow of funds attached hereto

as Exhibit A, and (iii) for working capital as approved by the board of directors of Issuer.

11.7. Indebtedness.

Issuer, Note Parties, and their Subsidiaries do not have any outstanding Indebtedness, other than (i) all Obligations, including

without limitation under this Note and the other Notes and (ii) the EIB Debt.

11.8. Liens.

There are no security interests, Liens or other encumbrances on any assets of Issuer or any of its Subsidiaries, other than Liens in

favor of Agent.

11.9. Financial

Condition. The audited consolidated financial statements of Issuer, relating to the fiscal year ended September 30, 2022, and

(ii) the unaudited consolidated financial statements of Issuer relating to each of the fiscal quarters ended December 31, 2022,

March 31, 2023 and June 30, 2023, respectively, copies of each of which have been delivered to Agent prior to the Closing Date,

were prepared in accordance with GAAP (subject, in the case of such unaudited statements, to the absence of footnotes and to normal year-end

adjustments) and present fairly in all material respects the consolidated financial condition of such Persons as at such dates and the

results of their operations for the periods then ended.

11.10. Ownership

of Properties. The Issuer, each other Note Party, and each Subsidiary of each Note Party owns good and, in the case of owned real

property (if any), marketable title to all of its material properties and assets, real and personal, tangible and intangible, of any

nature whatsoever (including intellectual property rights), free and clear of all Liens, charges and claims, except Liens in favor Agent.

As of the Closing Date, no Note Party nor any Subsidiary of any Note Party owns any real property.

11.11. Capitalization

of Subsidiaries. All issued and outstanding Equity Interests of the Note Parties (other than Issuer) and all Subsidiaries of the

Note Parties are duly authorized and validly issued, and in the case of corporations, fully paid and non-assessable, and in all cases

free and clear of all Liens other than those in favor of Agent, and such securities were issued in compliance with all applicable state

and federal laws concerning the issuance of securities. As of the Closing Date, there are no pre-emptive or other outstanding rights,

options, warrants, conversion rights or other similar agreements or understandings for the purchase or acquisition of any equity interests

of Issuer, any other Note Party or any Subsidiary of any Note Party.

11.12. Investment

Company Act. Neither the Issuer, any other Note Party, nor any Subsidiary of any Note Party is an “investment company”

or a company “controlled” by an “investment company” or a “subsidiary” of an “investment company”,

within the meaning of, and required to be registered under, the Investment Company Act of 1940.

11.13. Taxes.

The Issuer, each other Note Party, and each Subsidiary of each Note Party has filed all federal, state and provincial income tax returns

and all other material tax returns and reports required by law to have been filed by it and has paid all federal, state and provincial

income Taxes and all other Taxes and governmental charges thereby shown to be or otherwise owing, except any such Taxes or charges which

are being diligently contested in good faith by appropriate proceedings and for which adequate reserves have been established and maintained

by the Issuer, each other Note Party, and each Subsidiary of each Note Party’s financial statements in accordance with GAAP. There

is no material proposed Tax assessment against the Issuer, each other Note Party, or any Subsidiary of each Note Party. No Lien in respect

of Taxes has been filed against any assets of the Issuer, each other Note Party, and each Subsidiary of each Note Party.

11.14. No

Default. Other than the EIB Debt, which will be repaid with the proceeds of the Note, no Event of Default or Default exists or would

result from the incurrence by any Note Party of any Indebtedness hereunder or under any other Notes Document.

11.15. Margin

Stock. Neither the Issuer, any other Note Party, nor any Subsidiary of any Note Party is engaged principally, or as one of its important

activities, in the business of extending credit for the purpose of purchasing or carrying Margin Stock. No portion of the Obligations

is secured directly or indirectly by Margin Stock.

11.16. Insurance.

The Issuer, each other Note Party, and each Subsidiary of each Note Party and their respective properties are insured with financially

sound and reputable insurance companies which are not Affiliates of the Issuer, in such amounts, with such deductibles and covering such

risks as are customarily carried by companies engaged in similar businesses and owning similar properties in localities where the Issuer,

such other Note Party, or such Subsidiary of a Note Party operates.

11.17. Information.

All information (other than forward-looking information, pro forma financial statements, projections and information of a general economic

or industry-specific nature) heretofore or contemporaneously herewith furnished in writing by the Issuer or any other Note Party or any

Subsidiary of any Note Party to Agent, Holder or Runa for purposes of or in connection with this Note and the transactions contemplated

hereby is, and all written information (other than projections or statements of a forward-looking nature) hereafter furnished by or on

behalf of the Issuer, any Note Party or any Subsidiary of any Note Party to Agent, Holder or Runa pursuant hereto or in connection herewith

will be, when taken as a whole and after giving effect to modifications, amendments and supplements thereto, true and accurate in all

material respects on the date as of which such information is dated or certified, and none of such information is or will be, when taken

as a whole and after giving effect to modifications, amendments and supplements thereto, incomplete by omitting to state any material

fact necessary to make such information not materially misleading, taken as a whole, in light of the circumstances under which made,

in each case on the date as of which such information is dated or certified.

11.18. Intellectual

Property. The Issuer, each other Note Party and each Subsidiary of each Note Party owns and possesses or has a license or other right

to use all software, patents, patent rights, trademarks, trademark rights, trade names, trade name rights, service marks, service mark

rights, trade secrets, and copyrights as are necessary for the conduct of the business of the Issuer, the other Note Parties and their

Subsidiaries, without any infringement upon rights of others.

11.19. Restrictive

Provisions. Neither the Issuer nor any other Note Party nor any of their Subsidiaries is a party to any agreement or contract or

subject to any restriction contained in its operative documents that would restrict the execution, delivery and performance of the Notes

Documents or could reasonably be expected to result in a Material Adverse Effect.

11.20. Status

of Obligations as Senior Indebtedness. All Obligations constitute senior Indebtedness. Each Note Party acknowledges that Agent and

each Note Holder is entering into each Note in reliance upon this Section 11.20.

11.21. Foreign

Assets Control Regulations and Anti-Money Laundering.

11.21.1. Each

Note Party is and will remain in compliance in all material respects with all United States economic sanctions laws, executive orders

and implementing regulations as promulgated by the United States Treasury Department’s Office of Foreign Assets Control (“OFAC”),

and all applicable anti-money laundering and counter-terrorism financing provisions of the Bank Secrecy Act (P.L. 91-508, 84 Stat. 1118

(1970)) (the “BSA”) and all regulations issued pursuant to it. No Note Party or Person directly or indirectly controlling

a Note Party (i) is a Person designated by the United States government on the list of the Specially Designated Nationals and Blocked

Persons (the “SDN List”) with which a United States Person cannot deal with or otherwise engage in business transactions,

(ii) is a Person who is otherwise the target of United States economic sanctions laws such that a United States Person cannot deal

or otherwise engage in business transactions with such Person, or (iii) is controlled by (including by virtue of such person being

a director or owning voting shares or interests), or acts, directly or indirectly, for or on behalf of, any person or entity on the SDN

List or a foreign government that is the target of United States economic sanctions prohibitions such that the entry into, or performance

under, this Note or any other Note Document would be prohibited under United States law.

11.21.2. The

Note Parties are in compliance, in all material respects, with the USA Patriot Act (Title III of Pub. L. 107-56 (signed into law October 26,

2001)) (the “Patriot Act”). No part of the proceeds of the Loans will be used, directly or indirectly, in violation

of the Patriot Act, OFAC or other anti-terrorism laws or for any payments to any governmental official or employee, political party,

official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain

or direct business or obtain any improper advantage, in violation of the United States Foreign Corrupt Practices Act of 1977, as amended,

or any other similar anti-corruption laws.

11.22. Compliance

with Laws. Each Note Party and each Subsidiary of each Note Party is in compliance, in all material respects, with, and is conducting

and has conducted its respective business and operations in compliance with the requirements of all applicable laws, rules, regulations,

decrees, orders, judgments, licenses and permits.

11.23. Public

Company Compliance.

11.23.1. Since

October 24, 2022, the Issuer has filed all reports, schedules, forms, statements and other documents required to be filed by it

with the SEC pursuant to the reporting requirements of the Securities Exchange Act of 1934 Act, as amended (the “1934 Act”)

and all documents filed under the Securities Act of 1933, as amended (the “1933 Act”) (all of the foregoing filed

prior to the date this representation is made (including all exhibits included therein and financial statements and schedules thereto

and documents incorporated by reference therein) being hereinafter referred to as the “SEC Documents”). The Issuer

has made available to Agent or its representatives, or filed and made publicly available on the SEC’s Electronic Data Gathering,

Analysis, and Retrieval system (or successor thereto) (“EDGAR”) true and complete copies of the SEC Documents. Each

of the SEC Documents was filed with the SEC within the time frames prescribed by the SEC for the filing of such SEC Documents such that

each filing was timely filed with the SEC. As of their respective dates, the SEC Documents complied in all material respects with the

requirements of the 1934 Act and the 1933 Act and the rules and regulations of the SEC promulgated thereunder applicable to the

SEC Documents. None of the SEC Documents, at the time they were filed with the SEC, contained any untrue statement of a material fact

or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in light of the

circumstances under which they were made, not misleading. Since the filing of the SEC Documents, no event has occurred that would require

an amendment or supplement to any of the SEC Documents and as to which such amendment has not been filed and made publicly available

on the SEC’s EDGAR system. The Issuer has not received any written comments from the SEC staff that have not been resolved to the

satisfaction of the SEC staff.

11.23.2. The

Issuer is in all material respects in compliance with applicable provisions of the Sarbanes-Oxley Act of 2002, as amended, and the rules and

regulations thereunder (collectively, “Sarbanes-Oxley”).

11.23.3. Since

October 24, 2022, neither the Issuer nor any director, officer or employee, of the Issuer, has received or otherwise obtained any

material written or oral complaint, allegation, assertion or claim regarding the accounting or auditing practices, procedures, methodologies

or methods of the Issuer or its internal accounting controls, including any complaint, allegation, assertion or claim that the Issuer

has engaged in illegal and/or improper accounting or auditing practices. Since October 24, 2022, there have been no internal or

SEC investigations regarding accounting or revenue recognition discussed with, reviewed by or initiated at the direction of the chief

executive officer, principal financial officer, the Issuer Board or any committee thereof. All correspondence received from the SEC from

or provided to the SEC by the Issuer or its representatives has been provided to the Agent.

11.24. Brokers.

The execution, delivery or performance of the Notes shall not result in any obligations to any investment bankers, brokers or similar

advisors other than as consented to by Agent in writing in its sole discretion.

As of any Advance Date, each Note Party represents

and warrants to Agent and Holder that: (i) no Default (as defined below) or Event of Default (as defined below) has occurred and

is continuing as of such date; and (ii) each Note Party’s representations and warranties in the Notes Documents are true and

correct as of such date as though made on such date (except to the extent that any such representations and warranties relate to a specific

date, in which case, such representations and warranties shall be true and correct as of such specific date).

12. Affirmative

Covenants.

12.1. Maintenance

of Existence. Each Note Party shall, and shall cause each of its direct and indirect Subsidiaries to, preserve, renew and maintain

in full force and effect its corporate or organizational existence and take all reasonable action to maintain all rights and privileges

necessary or desirable in the ordinary course of business.

12.2. Notices

of Defaults and Other Events.

12.2.1. As

soon as possible and in any event within one (1) Business Day after any Note Party becomes aware of a default or event of default

under any Indebtedness of a Note Party, including but not limited to a Default or Event of Default under this Note and any EIB Default, Issuer

shall notify Agent in writing of the nature and extent of such default or event of default and the action, if any, any Note Party has

taken or proposes to take with respect to such default or event of default.

12.2.2. As

soon as possible and in any event within one (1) Business Day after any Note Party becomes aware of any litigation, arbitration

or governmental investigation or proceeding which has been instituted or threatened against Issuer, any Note Party or any Subsidiary

thereof or to which any of the properties of any of the foregoing is subject to and any developments with respect to the foregoing.

12.3. Financial

Reporting. Issuer shall furnish, or cause to be furnished, to Agent, as soon as available:

12.3.1. After

the end of each fiscal year (but, in any event, no later than one hundred twenty (120) days thereafter), annual audited financial statements

for Issuer, Note Parties, and their Subsidiaries on a consolidated basis for such fiscal year and as of such fiscal year-end, such statements

to include consolidated balance sheets, income statements and statements of sources and applications of cash flow for the fiscal year

then ended, all in reasonable detail and stating in comparative form the corresponding figures for the preceding fiscal year and as of

the preceding fiscal year-end, which financial statements shall have been audited by an independent certified public accountant reasonably

satisfactory to Agent, and shall be accompanied by a certificate of such accountant to the effect that such statements are made without

qualification and present fairly the consolidated financial condition and results of operations of Issuer, Note Parties, and their Subsidiaries

for such year and were prepared in accordance with GAAP, consistently applied.

12.3.2. On

or before October 18, 2023, a 13-week operating budget for Issuer and the other Note Parties and their Subsidiaries (the “Cash

Flow Projection”) in form and substance acceptable to Agent.

12.3.3. On

or before October 18, 2023, and on each Wednesday of each calendar week thereafter, an updated Cash Flow Projection (on a rolling

13-week basis) in form and substance acceptable to Agent.

12.3.4. On

or before end of business on Wednesday of each calendar week commencing on October 25, 2023: a weekly cash flow comparison that

compares the Note Parties’ actual receipts and expenses for the prior week to the Cash Flow Projection with respect to such week

and detailed information relating to Liquidity, cumulative disbursements, minimum collections, and other matters for the prior week.

12.3.5. After

the end of each calendar month (but, in any event, no later than thirty (30) days thereafter), monthly unaudited financial statements

for Issuer, Note Parties, and their Subsidiaries on a consolidated basis for such month, such statements to include consolidated balance

sheets, income statements and statements of sources and applications of cash flow for the calendar month then ended, all in reasonable

detail and stating in comparative form the corresponding figures for the preceding calendar month and comparative portion of the previous

fiscal year.

12.3.6. On

or before November 15, 2023, an updated business plan/budget for Issuer and the other Note Parties for 2023.

12.3.7. On

or before December 15, 2023, an updated business plan/budget for Issuer and the other Note Parties for 2024 and 2025.

12.3.8. Contemporaneously

with the delivery of each of the foregoing a compliance certificate in the form provided by Agent, certified on behalf of Issuer by a

Responsible Officer of Issuer in each case in form and substance acceptable to Agent.

12.3.9. Other

periodic reports as Agent may request from time to time regarding efforts by Issuer and the other Note Parties to improve revenue cycle

management processes and procedures, accounting and finance, information systems and other matters.

12.3.10. Any

financial reporting or other information provided to any other holder of Indebtedness or Equity Interests of Issuer or any Note Party,

including without limitation the holder of the EIB Debt, contemporaneously to Agent.

12.4. Cash

Management. Issuer, the other Note Parties and their Subsidiaries shall maintain in such Person’s name a deposit account at

a bank acceptable to Agent in its sole discretion and identified by Agent and Issuer (the “Deposit Account”). The

Note Parties shall use their Deposit Accounts as such Note Party’s only operating account, including depositing all funds from

collection of receivables into the Deposit Account.

12.5. Exclusivity &

Continued Cooperation.

12.5.1. Until

January 10 2024 (the “Exclusivity Date”), without Agent’s prior written consent (in its sole discretion),

each of the Note Parties shall not, and shall cause its Related Parties (as defined below) not to, directly or indirectly, (a) initiate,

solicit, facilitate, encourage, discuss, negotiate, respond to or participate in any discussions or negotiations in connection with,

or accept any proposal, inquiry, offer or other effort (whether initiated by them or otherwise) to or from any person or persons (other

than Holder or Runa) with respect to, or that could reasonably be expected to lead to, (i) any inquiry, proposal or offer with respect

to a merger, joint venture, partnership, consolidation, dissolution, liquidation, tender offer, recapitalization, reorganization, spin-off,

share exchange, business combination, purchase, loan, notes issuance, issuance of other Indebtedness or other financing or similar transaction

involving the Issuer, the Note Parties or any of their Subsidiaries or (ii) any acquisition by any person or group (as defined in

or under Section 13 of the Exchange Act of 1934) or proposal or offer, which, in the case of each of clauses (i) (other than

with respect to any loan, notes issuance, issuance of other Indebtedness or other financing or similar transaction) and (ii), if consummated

would result in any person or group (as defined in or under Section 13 of the Securities Exchange Act of 1934) becoming the beneficial

owner, directly or indirectly, in one or a series of related transactions, of 2% or more of any class of Equity Interests of the Issuer,

any Note Party or any of their Subsidiaries, 2% or more of the voting power of the Issuer, any Note Party or any of their Subsidiaries,

or 2% or more of the consolidated net income, consolidated net revenue or consolidated total assets (including Equity Interests of its

Subsidiaries) of the Issuer, the Note Parties and their Subsidiaries (in each case other than any transaction with Holder and its Affiliates),

whether in one transaction or a series of transactions, directly or indirectly, by operation of law or otherwise, each a “Potential

Proposal”), (b) provide any information or afford access to the assets, properties, books, records or Related Party of

the Issuer, any Note Party or any of its Affiliates to any third party in connection with a Potential Proposal (including, but not limited

to (i) the use of a physical or online data room and (ii) any connection or affiliation between any of the directors and executive

officers of Issuer and such counterparties) and, in each case provide regular updates with respect to such Potential Proposal, (c) waive

or amend any standstill provision that any third party has entered into with the Issuer or any Note Party or their Subsidiaries, with

respect to a Potential Proposal, or (d) approve, authorize, recommend, enter into or make any public statement regarding, any contract,

agreement, arrangement or understanding (whether oral or written), term sheet, letter of intent or similar instrument with any third

party (i) requiring or which would reasonably be expected to require the Issuer or any Note Party or any of their Subsidiaries to

delay, abandon, terminate or fail to consummate a strategic transaction with Holder and its Affiliates or (ii) concerning or relating

to any Potential Proposal unless, and solely to the extent, required by law or regulatory authorities and prior written notice of this

requirement is provided to Holder, with Holder having the opportunity to minimize such disclosure.

12.5.2. The

Issuer, the Note Parties and their Subsidiaries shall, and shall cause their Related Parties to, immediately cease and cause to be terminated

any and all existing activities, discussions or negotiations with any third party conducted on or prior to the date hereof in connection

with any Potential Proposal and terminate access to any non-public information of the Issuer, any Note Party and their affiliates and

Subsidiaries immediately, including, for the avoidance of doubt, terminating access to any physical or online data room.

12.5.3. In

the event the Issuer, any Note Party or any of their Subsidiaries or Related Parties receives a Potential Proposal from any third party

during the Exclusivity Period, the Issuer and Note Parties and their Subsidiaries, shall inform such third party that it is contractually

prohibited from engaging in discussions with, or otherwise responding to, such third party in response thereto and will promptly (in

any event, within 24 hours) provide Holder with notice thereof. The Issuer and each Note Party hereby represents and warrants that neither

it, nor its Related Persons, are currently bound by any other agreement relating to a Potential Proposal and that the execution of this

Note and the Note Documents does not and will not violate any agreement by which any such Person is bound or to which any of their respective

assets are subject.

12.5.4. On

the Closing Date, Issuer and the Note Parties shall disclose to the New Board Members all existing Potential Proposals and all Potential

Proposals made to the Issuer, the Note Parties or their Subsidiaries in the twelve (12) months prior to the Closing Date, including without

limitation all alternative equity and financing proposals and any relationships or other connections between directors and executive

officers of the Issuer and stockholders of the Issuer holding 5% or more of the ordinary shares of the Issuer, on one hand, and any other

party to such Potential Proposals, on the other hand..

12.5.5. Reserved.

12.5.6. The

agreements in this Section 12.5 shall survive termination, satisfaction, repayment or discharge of the Notes and all related

Obligations.

12.6. Use

of Proceeds. Issuer and the Note Parties shall use the proceeds of the Loans only as provided in Section 11.6.

12.7. Restructuring.

12.7.1. Appointment

of Chief Restructuring Officer. Within five (5) Business Days after the Closing Date (or such later date as Agent may agree

in its sole discretion), Issuer and the other Note Parties and their Subsidiaries shall retain, and thereafter shall continue to

retain, a Chief Restructuring Officer (“CRO”) satisfactory to Agent in its sole discretion, on terms and conditions

and with a scope of services acceptable to Agent in its sole discretion, including without limitation access to all financial and other

information of the Note Parties and their Subsidiaries. Each Note Party’s officers and all other executive management members shall

inform CRO of any actions or decisions taken or to be taken, including without limitation any proposals to be made or discussed with

the board of directors of any Note Party or their Subsidiaries. The CRO shall report directly to the New Board Members and the foregoing

shall be entitled to fully communicate with each other with respect to the Issuer, the Note Parties and their Subsidiaries. All costs

relating to the CRO shall be paid by the Note Parties.

12.7.2. Board

Matters.

12.7.2.1. On

or prior to the Closing Date (or such later date as Agent may agree in its sole discretion), Issuer and each Note Party and their

Subsidiaries, shall appoint two individuals selected by Agent (the “New Board Members”) to (a) its board of directors

or similar governing body and (b) to the extent requested by Agent, any committee or subcommittee of any board of directors or similar

governing body. If any New Board Member resigns, is removed, is replaced, becomes incompetent or such board seat becomes vacant for any

reason, Agent may propose replacement individuals to be the New Board Members. For the avoidance of doubt the Agent may remove or replace

any New Board Member in its sole discretion and Issuer shall immediately procure that any replacement board members be appointed to the

board of directors of Issuer as soon as practicable.

12.7.2.2. On

or prior to the Closing Date, Harold R. Berenson, Alexander B. Suh, Christine A. Russell and Dr. Theodore Wang shall have resigned,

or the Issuer shall have caused such resignation or removal, as directors of the Issuer. The Issuer shall not fill any vacancy of the

Board of Directors of Issuer without the consent of Agent.

12.7.2.3. On

or prior to the Closing Date, (a) the Issuer shall cause the size of the Board of Directors of Issuer to be reduced to and set at

four (4) members, (b) the size of the Board of Directors of Issuer shall remain at four (4) members and (c) the Board

of Directors of Issuer shall consist initially of the New Board Members, Juergen Ingels, and Paul O’Brien.

12.7.3. Survival.

The agreements in this Section 12.7 shall survive termination, satisfaction, repayment or discharge of the Notes and all

related Obligations.

12.8. Books;

Records; Inspections. Issuer and each Note Party and their Subsidiaries shall:

12.8.1. Keep,

and cause each Note Party to keep, its books and records in accordance with sound business practices sufficient to allow the preparation

of financial statements in accordance with GAAP;

12.8.2. Provide

Agent and its advisors with full and complete access to all financial, corporate and other information of Note Parties, and cooperate,

and cause all agents and advisors to Note Parties to cooperate with Agent and its advisors in respect of any request made pursuant to

the Notes Documents, including without limitation monitoring Note Parties’ compliance with the Notes Documents, excluding however,

materials protected by attorney-client privilege (which may be inspected by the New Board Members); and

12.8.3. Permit,

and cause each other Note Party to permit, at any reasonable time during normal business hours, Agent, any Note Holder or any representative

thereof to (i) visit any or all of its offices, to discuss its financial matters with its officers, its independent auditors (and

each Note Party hereby authorizes such independent auditors to discuss such financial matters with any Agent, any Note Holder or any

representative thereof), (ii) inspect the properties and operations of Note Parties, (iii) perform appraisals of the property

and business of Issuer or such Note Party and (iv) inspect, examine, audit, check and make copies of and extracts from the books,

records, computer data, computer programs, journals, orders, receipts, correspondence and other data relating to any Collateral. Notwithstanding

the foregoing, Agent’s inspection rights shall not apply to any materials that are subject to attorney-client privilege. All such

visits, inspections, examinations, appraisals or audits by Agent shall be at the Note Parties’ expense.

12.9. Maintenance

of Properties. Issuer shall, and shall cause each other Note Party and each Subsidiary of each Note Party to keep, all property useful

and necessary in the business of the Issuer, such other Note Party and such Subsidiary of a Note Party in good working order and condition,

ordinary wear and tear excepted.

12.10. Collateral

and Guaranty. (a) Issuer shall cause each direct or indirect Subsidiary of Issuer to guaranty the Obligations and (b) Issuer

shall, and shall cause each direct or indirect Subsidiary of Issuer, to grant a security interest to Agent in all of such Person’s

property and assets as provided in the Guarantee and Collateral Agreement, and, in each case, in such other guaranty and collateral documentation

as Agent may request from time to time in its sole discretion.

12.11. Further

Assurances. Issuer shall, and shall cause each of its direct and indirect Subsidiaries to, execute, acknowledge and deliver, or cause

to be executed, acknowledged or delivered, any and all such further assurances and other agreements or instruments, and take or cause

to be taken all such other action, as shall be reasonably necessary or desirable from time to time to give full effect to the Note and

the Obligations hereunder and the other Note Documents.

12.12. Public

Company Compliance. From the date of this Note until the termination of this Note (the period ending on such latest date, the “Reporting

Period”), the Issuer shall timely file all reports required to be filed with the SEC pursuant to the 1934 Act, and the Issuer

shall not terminate the registration of its ordinary shares under the 1934 Act or otherwise terminate its status as an issuer required

to file reports under the 1934 Act, even if the securities laws would otherwise permit any such termination. The Issuer hereby agrees

that, during the Reporting Period, the Issuer shall send to Agent copies of any notices and other information made available or given

to the shareholders of the Issuer generally, contemporaneously with the Issuer’s making available or giving such notices and other

information to the shareholders (unless otherwise available on EDGAR). During the Reporting Period, all reports, schedules, forms, statements

and other documents required to be filed by it with the SEC pursuant to the reporting requirements of the 1934 Act or the 1933 Act, shall

comply in all material respects with the requirements of the 1934 Act and the 1933 Act and the rules and regulations of the SEC

promulgated thereunder, and none of such documents, at the time they will be filed with the SEC, shall contain any untrue statement of

a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein,

in light of the circumstances under which they were made, not misleading. Prior to filing any document with the SEC, the Issuer shall

provide the Agent and its counsel a reasonable opportunity to review and comment on any documents (including correspondence) filed or

furnished to the SEC, including all amendments and supplements thereto, and Agent and its representatives shall be provided a reasonable

opportunity to review and comment on such documents. Promptly upon receipt, the Issuer shall provide to Agent copies of all correspondence

that it receives from, and will summarize all communications that it has with, the SEC, and Agent shall be entitled to review and comment

on any correspondence (or communications) of the Issuer or its representatives to the SEC prior to their occurrence.

12.13. Payment

of Taxes. Issuer shall, and shall cause each other Note Party and each Subsidiary of each Note Party to pay, discharge or otherwise

satisfy as the same shall become due and payable in the normal conduct of its business, all its obligations and liabilities in respect

of Taxes and similar claims imposed upon it or upon its income or profits or in respect of its property, except to the extent any such

Tax is being contested in good faith and by appropriate proceedings and with respect to which appropriate reserves have been established

and maintained in accordance with GAAP.

Withholding.

Any and all payments by or on account of any obligation of the Issuer, each other Note Party and each Subsidiary of each Note Party under

this Note shall be made without deduction or withholding for any Taxes, except as required by applicable law. If any applicable law requires

the deduction or withholding of any Tax from any such payment by the Issuer, each other Note Party, each Subsidiary of each Note Party

or the Agent, then such party shall be entitled to make such deduction or withholding and shall timely pay the full amount deducted or

withheld to the relevant taxing authority in accordance with applicable law, and the sum payable by the Issuer, each other Note Party

and each Subsidiary of each Note Party shall be increased as necessary so that after such deduction or withholding has been made (including

such deductions and withholdings applicable to additional sums payable under this Section 12.14) the Holder receives an amount

equal to the sum it would have received had no such deduction or withholding been made.

13. Negative

Covenants. Issuer and the other Note Parties shall note, and shall cause each of its direct and indirect Subsidiaries not to:

13.1. Indebtedness.

Create, incur, assume or permit to exist any Indebtedness, other than the EIB Debt and the Obligations.

13.2. Liens.

Create, incur, assume or permit to exist any Liens on the assets of Issuer, the Note Parties or their Subsidiaries other than Liens in

favor of Agent.

13.3. Restricted

Payments. Declare or pay (i) any dividend or distribution on account of any Equity Interests of Issuer, the Note Parties or

any of their Subsidiaries, or any payment (whether in cash, securities or other property), including any sinking fund or similar deposit,

on account of the purchase, redemption, retirement, acquisition, cancellation or termination of any such Equity Interests or on account

of any return of capital to any of Issuer’s stockholders (or the equivalent person thereof), (ii) any management fee or similar

fee to a holder of Equity Interests of Issuer and the Note Parties or any Subsidiary thereof or any of their Affiliates, and (c) any

payment or prepayment of interest on, principal of, premium, if any, fees, redemption, conversion, exchange, purchase, retirement, defeasance,

sinking fund or similar payment with respect to, any Indebtedness (other than the EIB Debt).

13.4. Fundamental

Changes. Be a party to any merger, consolidation, division or other fundamental change.

13.5. Asset

Sales. Sell, transfer, dispose of, convey or lease any of its assets or Equity Interests, or sell or assign with or without recourse

any receivables, except for sales of inventory, equipment or non-exclusive licenses of software, in each case, in the ordinary course

of business.

13.6. Modification

of Organizational Documents and Indebtedness. Permit (a) the organizational documents of Issuer, any other Note Party or any

of their Subsidiaries to be amended or modified in any way which could adversely affect the interests of Agent or any Note Holder and

(b) any Indebtedness of Issuer, any other Note Party or any of their Subsidiaries to be amended or modified in any way which could

adversely affect the interests of Agent or any Note Holder.

13.7. Transactions

with Affiliates. Engage into, or cause, suffer or permit to exist any transaction, arrangement or contract with any of its Affiliates

(including, without limitation, any officer or director of the Issuer or any of its Subsidiaries or any Affiliate thereof), except (i) transactions,

arrangements and contracts solely among the Note Parties and (ii) employment arrangements between the Issuer and its Subsidiaries

and their respective directors, officers, employees, members of management or consultants in the ordinary course of business and in existence

on the Closing Date.

13.8. Business

Activities. Engage in any line of business other than the businesses engaged in on the Closing Date or activities reasonably related

thereto.

13.9. Changes

in Accounting, Name and Jurisdiction of Organization. (i) Make any significant change in accounting treatment or reporting practices,

except as required by GAAP, (ii) change the fiscal year or method for determining fiscal quarters of any Note Party or of any Subsidiary

of any Note Party, in the case of clauses (i) and (ii), without Agent’s prior written consent, (iii) change its name

as it appears in official filings in its jurisdiction of organization or (iv) change its jurisdiction of organization, and in the

case of clauses (iii) and (iv), without at least thirty (30) days’ (or such shorter period as Agent may permit in its sole

discretion) prior written notice to Agent.

13.10. Bank

Accounts. Maintain or establish any new bank accounts other than the bank accounts set existing on the Closing Date without prior

written notice to Agent and Holder and unless Agent, Issuer or such other applicable Note Party and the bank or other financial

institution at which the account is opened enter into a Control Agreement regarding such bank account prior to or concurrently with the

opening of such new bank account. The Note Parties shall cause a Control Agreement to be executed within five (5) days of the Closing

Date (or such longer date as Agent may agree in its sole discretion) with respect to the Deposit Account and each other deposit, securities

or commodities account of the Note Parties. The Note Parties and their Subsidiaries shall not open any deposit, securities or commodities

account with the prior written consent of the Agent in its sole discretion.

13.11. Subsidiaries.

Establish or acquire any Subsidiary.

13.12. OFAC;

Patriot Act. Fail to comply in any material respect with the laws, regulations and executive orders referred to in Section 11.21.

13.13. Inconsistent

Agreements.

13.13.1. Directly

or indirectly, create or otherwise cause or suffer to exist or become effective any consensual restriction or encumbrance of any kind

on the ability of any Note Party or Subsidiary to pay dividends or make any other distribution on any of such Note Party’s or such

Subsidiary’s stock or to pay fees or make other payments and distributions to Issuer, any other Note Party or any Subsidiary of

a Note Party, except by reason of (i) the Notes Documents or (ii) negative pledges and restrictions on Liens in favor of the

holder of the EIB Debt as in existence on the Closing Date.

13.13.2. Directly

or indirectly, enter into, assume or become subject to any contractual obligation prohibiting or otherwise restricting the existence

of any Lien upon any of its assets in favor of Agent, whether now owned or hereafter acquired except in connection with any document

or instrument relating to the EIB Debt, in each case, as in existence on the Closing Date.

13.14. Conduct

of Business. Without Agent’s prior written consent (a) enter into any transaction other than those in the ordinary course

of such Note Party or Subsidiary’s existing business, consistent with its past practices; (b) make any disbursements or other

payments to any Person (other than Agent, the Note Holders and the holders of EIB Debt), in one or a series of transactions, or incur

any obligation, in excess of $50,000; or (c) issue any Equity Interests to any Person; provided however, that notwithstanding anything

to the contrary in this Note or any of the Note Documents, the Issuer will obtain directors and officers insurance in an amount not to

exceed the most recent annual premium, for its directors and officers.

14. Financial

Covenants.

14.1. Minimum

Liquidity. The Note Parties' aggregate Liquidity at any time shall not be less than an amount to be agreed after the Closing Date

by Issuer (as determined by its board of directors) and Agent.

14.2. Cumulative

Disbursements. The aggregate cumulative disbursements by the Note Parties for each consecutive four-week period set forth in the

Cash Flow Projection most recently provided pursuant to Section 12.3 (which period, for the avoidance of doubt, shall include weeks

prior to the Closing Date, as applicable) shall not exceed an amount that is 115% of the aggregate cumulative disbursement amount budgeted

for such time period in such Cash Flow Projection.

14.3. Minimum

Collections. The aggregate cumulative collections by the Note Parties for each consecutive four-week period set forth in the Cash

Flow Projection most recently provided pursuant to Section 12.3 (which period, for the avoidance of doubt, shall include weeks prior

to the Effective Date, as applicable) shall not be less than 80% of the amount of the aggregate cumulative collections budgeted for such

time period in such Cash Flow Projection.

15. Events

of Default. Each of the following acts, events or circumstances shall constitute an Event of Default (each an “Event of

Default”) hereunder:

15.1. Non-Payment.