Form 8-K - Current report

February 14 2024 - 4:24PM

Edgar (US Regulatory)

FALSE000192958900019295892024-02-142024-02-140001929589us-gaap:CommonStockMember2024-02-142024-02-140001929589us-gaap:WarrantMember2024-02-142024-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 14, 2024

MariaDB plc

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Ireland | 001-41571 | N/A |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

699 Veterans Blvd

Redwood City, CA 94063

(Address of principal executive offices, including zip code)

(855) 562-7423

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Ordinary Shares, nominal value $0.01 per share | | MRDB | | New York Stock Exchange |

| Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share | | MRDBW | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 14, 2024, MariaDB plc issued a press release announcing its financial results for its first fiscal quarter ended December 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information furnished under this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor will it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| | | | | |

| Exhibit No. | Description |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MariaDB plc |

| Dated: February 14, 2024 | |

| By: | /s/ Conor McCarthy |

| | Name: | Conor McCarthy |

| | Title: | Chief Financial Officer |

EXHIBIT 99.1 MariaDB Files First Quarter Fiscal 2024 Financial Results REDWOOD CITY, Calif., and DUBLIN – February 14, 2024 – MariaDB plc (NYSE:MRDB) today filed its financial results for the first quarter of fiscal year 2024, which ended December 31, 2023. “Annual Recurring Revenue (ARR) is up 11% year-over-year in the first quarter of fiscal year 2024 coupled with a 77% improvement in Adjusted EBITDA loss of $2.7 million versus the prior fiscal year first quarter loss of $11.6 million,” said Paul O’Brien, CEO at MariaDB plc. “This is a result of the measures we have taken over the last few months to discontinue certain products and focus on our core MariaDB Enterprise Server product, as well as an overall company-wide effort to reduce spending.” The Net Loss for the first quarter was $8.8 million, an improvement of $3.9 million as compared to a Net Loss of $12.7 million in the prior period. The financial results can be found in the Quarterly Report Form 10-Q, which is available on the Securities & Exchange Commission’s (SEC’s) website at https://www.sec.gov and on MariaDB’s Investor Relations website at https://investors.mariadb.com under Financials. About MariaDB MariaDB is a new generation database company whose products are used by companies big and small, reaching more than a billion users through Linux distributions and have been downloaded over one billion times. Deployed in minutes and maintained with ease, leveraging cloud automation, MariaDB database products are engineered to support any workload, any cloud and any scale – all while saving up to 90% of proprietary database costs. Trusted by organizations such as Bandwidth, DigiCert, InfoArmor, Oppenheimer and Samsung, MariaDB’s software is the backbone of critical services that people rely on every day. For more information, please visit mariadb.com. Key Business Metrics We review a number of operating and financial metrics, including Annual Recurring Revenue ("ARR"), to evaluate our business, measure our performance, identify trends affecting our business, formulate business plans and make strategic decisions. We view ARR as an important indicator of our financial performance and operating results given the renewable nature of our business. ARR does not have a standardized meaning and is therefore unlikely to be comparable to similarly titled metrics presented by other companies. We define ARR as the annualized revenue for our subscription customers, excluding revenue from nonrecurring contract services (e.g., time and material consulting services). For our annual subscription customers, we calculate ARR as the annualized value of their subscription contracts as of the measurement date, assuming any contract that expires during the next 12

months is renewed on its existing terms (including contracts for which we are negotiating a renewal). In the event that we are still negotiating a renewal with a customer after the expiration of their subscription, we continue to include that revenue in ARR for a maximum period of 30 days after the subscription end date. Our calculation of ARR is not adjusted for the impact of any known or projected events that may cause any such contract not to be renewed on its existing terms. Consequently, our ARR may fluctuate within each quarter and from quarter to quarter. This metric should be viewed independently of U.S. GAAP revenue and does not represent U.S. GAAP revenue on an annualized basis, as it is an operating metric that can be impacted by contract start and end dates and renewal rates. ARR is not intended to be a replacement for or forecast of revenue. We define Adjusted EBITDA as net loss before (1) interest expense, (2) income tax expense or benefit, (3) depreciation and amortization, (4) stock-based compensation, (5) change in fair value of warrant liabilities, (6) other income (expense), net, (7) net costs associated with discontinued products pursuant to the Company's October 2023 restructuring plan, and any other one-time non-recurring transaction amounts impacting the statement of operations during the relevant period. We believe that Adjusted EBITDA is useful to investors and other users of our financial statements in evaluating our operating performance because it provides them with an additional tool to compare business performance across periods. Our management uses Adjusted EBITDA to assess our operating performance and to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that Adjusted EBITDA, when considered together with our GAAP financial results, provides meaningful supplemental information regarding our operating performance by excluding certain items that may not be indicative of our business, results of operations or outlook, such as the impact of our capital structure (primarily interest charges) and asset base (primarily depreciation and amortization), items outside the control of the management team (taxes), expenses that do not relate to our core operations, and other non-cash items, including stock-based compensation, unrealized gains and losses related to foreign currency translation (included in other income (expense), net), and change in fair value of warrant liabilities. We consider Adjusted EBITDA to be an important measure because it helps illustrate underlying trends in our business and our historical operating performance on a more consistent basis. Adjusted EBITDA Margin means Adjusted EBITDA as a percentage of revenue determined in accordance with GAAP. We calculate Adjusted EBITDA Margin by dividing Adjusted EBITDA by total GAAP revenue. We believe that Adjusted EBITDA Margin helps us to better understand MariaDB’s normalized operating performance (excluding certain non-indicative items) in the context of GAAP revenue providing management with important supplemental information in understanding business efficiency and trends. Our calculation of Adjusted EBITDA and Adjusted EBITDA Margin may differ from how other companies, including companies in our industry, calculate these or similarly titled non-GAAP measures, which could reduce the usefulness of these measures as tools for comparison. Because of these limitations, when evaluating our performance, you should consider Adjusted

EBITDA and Adjusted EBITDA Margin alongside other financial performance measures, including our net loss and other GAAP results. Three Months Ended December 31, ($ in thousands) 2023 2022 Net Loss $ (8,768) $ (12,696) Adjustments: Interest expense 3,109 232 Income tax benefit (167) (56) Depreciation and amortization — 238 Stock-based compensation 13 616 Change in fair value of warrant liabilities (639) (1,731) Other income (expense), net 908 1,829 Restructuring and other charges 2,767 — Gain on divestitures (933) — Costs associated with discontinued products, net 992 — Adjusted EBITDA $ (2,718) $ (11,568) Net Loss Margin (64.4) % (99.1) % Adjusted EBITDA Margin (20.0) % (90.3) % Forward-Looking Statements This report includes expectations, beliefs, projections, estimates, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts and that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements may appear throughout this report, including, but not limited to, Management’s Discussion and Analysis of Financial Condition and Results of Operations”. The forward-looking statements included in this report include statements regarding our future financial position and operating results, as well as our strategy, future operations, prospects, plans and objectives of management. In some cases, you can identify these forward-looking statements by the use of terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “projects,” “anticipates,” or the negative version of these words or other comparable words or phrases. These forward-looking statements are based on management’s current expectations, assumptions, hopes, beliefs, intentions, strategies, and plans regarding future events and performance and are based on currently available information as to the outcome and timing of

future events and performance. We caution you that these forward-looking statements are subject to risks and uncertainties (including those described in our filings with the Securities and Exchange Commission, including the 10-Q filing for the first quarter of the 2024 financial year), most of which are difficult to predict and many of which are beyond our control, incident to our operations. These forward-looking statements are based on information available as of the date of this report. While our management believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. Current expectations, forecasts and assumptions involve a number of risks and uncertainties. Accordingly, forward-looking statements in this report should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Source: MariaDB #earn-news Investors: ir@mariadb.com Media: pr@mariadb.com

v3.24.0.1

Cover

|

Feb. 14, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

MariaDB plc

|

| Document Period End Date |

Feb. 14, 2024

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

001-41571

|

| Entity Address, Address Line One |

699 Veterans Blvd

|

| Entity Address, City or Town |

Redwood City,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94063

|

| City Area Code |

855

|

| Local Phone Number |

562-7423

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001929589

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Ordinary Shares, nominal value $0.01 per share

|

| Trading Symbol |

MRDB

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share

|

| Trading Symbol |

MRDBW

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

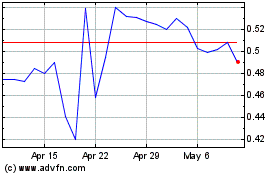

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Mar 2024 to Apr 2024

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Apr 2023 to Apr 2024