false

0001929589

00-0000000

0001929589

2024-02-16

2024-02-16

0001929589

MRDB:OrdinarySharesNominalValue0.01PerShareMember

2024-02-16

2024-02-16

0001929589

MRDB:WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtExercisePriceOf11.50PerShareMember

2024-02-16

2024-02-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 16, 2024

MariaDB plc

(Exact name of registrant as specified in its

charter)

| Ireland |

|

001-41571 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

699 Veterans Blvd

Redwood City, CA 94063

(Address of principal executive offices, including

zip code)

(855) 562-7423

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Ordinary Shares, nominal value $0.01 per share |

|

MRDB |

|

New York Stock Exchange |

| Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share |

|

MRDBW |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.02 Termination of a Material Definitive Agreement.

As previously disclosed, on February 5, 2024, MariaDB plc, an Irish

public limited corporation (the “Company”), entered into a Forbearance Agreement (the “Forbearance

Agreement”) by and among the Company, the guarantors under the RP Note (as defined below) (the “Guarantors”),

and RP Ventures LLC (“RP Ventures”) as Agent and Holder of the RP Note, in connection with the maturity on January

31, 2024 of that certain senior secured promissory note, dated as of October 10, 2023 and amended on January 10, 2024, issued by

the Company to RP Ventures in the principal amount of $26,500,000 (the “RP Note”) to allow for further negotiations

with respect to a transaction to restructure all or any material part of the obligations under the RP Note.

Under the terms of the Forbearance Agreement, the Company agreed that

certain actions, whether taken by the Company or a third party, would constitute an immediate event of default under the Forbearance Agreement,

the RP Note, the Guarantee and Collateral Agreement dated as of October 10, 2023 by and between the Company and the Guarantors in favor

of RP Ventures, as Agent and Holder of the RP Note, and other related RP Note documents (collectively, the “RP Note Documents”),

without any notice or grace or cure period. These actions include any public announcement by a third party regarding a proposed offer

or other transaction with the Company that could result in a change of control.

On February 16, 2024, K1 Investment Management LLC (“K1”)

publicly announced a non-binding indicative proposal (the “K1 Proposal”) to acquire the entire issued and to

be issued share capital of the Company through K5 Private Investors, L.P., a fund controlled by K1, which proposal had previously been

delivered to the Company’s Board of Directors on February 15, 2024. The announcement of the K1 Proposal by K1 constitutes an immediate

event of default under the Forbearance Agreement. As a result of such default, the forbearance period under the Forbearance Agreement

terminated on February 16, 2024, allowing RP Ventures the right to declare all principal of and accrued interest on the RP Note to be

immediately due and payable. Interest on amounts due under the RP Note accrues at the default rate of 2% above the otherwise-applicable

non-default interest rate of 10%.

On February 17, 2024, RP Ventures submitted a notice to the Company

regarding the Company’s default under the Forbearance Agreement and reserving RP Ventures’ right to exercise its rights and

remedies under the RP Note Documents. Also on February 17, 2024, RP Ventures provided to the Company a copy of an activation notice that

RP Ventures submitted to Bank of America, N.A. asserting its control rights over the Company’s deposit account. The Company is currently

in discussions with RP Ventures to secure bridge financing in the event the Company is not able to obtain cash through its deposit account.

There can be no guarantee that the Company will be able to secure bridge financing.

Item 2.04 Triggering Events That Accelerate or Increase a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

The disclosure under Item 1.02 of this current report on Form 8-K is

incorporated herein by reference.

Item

8.01 Other Events.

On February 19, 2024, the Company announced the

K1 Proposal made pursuant to The Irish Takeover Panel Act 1997, Takeover Rules, 2022 (the “Irish Takeover Rules”).

A copy of the announcement dated February 19, 2024, is attached hereto

as Exhibit 99.1, and incorporated herein by reference.

Irish Takeover Rules Responsibility Statement

In accordance with Rule 19.2 of the Irish Takeover Rules, the directors

of the Company accept responsibility for the information contained in this filing. To the best of the knowledge and belief of the directors

(who have taken all reasonable care to ensure that such is the case), the information contained in this filing is in accordance with the

facts and does not omit anything likely to affect the import of such information.

Forward-Looking Statements

Certain statements in this Current

Report are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words

indicating future events and actions, such as “will,” “intend,” “plan,” and “may,” and

variations of such words, and similar expressions and future-looking language identify forward-looking statements, but their absence does

not mean that the statement is not forward-looking. The forward-looking statements in this report include statements regarding whether

RP Ventures will pursue any of its rights and remedies under the RP Note or the Forbearance Agreement, including commencing a legal or

other action against the Company, foreclosure or activation of control of the Company’s deposit accounts, the Company’s ability

to secure bridge financing and whether the K1 Proposal or another transaction proposal is pursued. Forward-looking statements are not

guarantees of future events and actions, which may vary materially from those expressed or implied in such statements. Differences may

result from, among other things, actions taken by the Company or its management or the board of directors of the Company or the special

committee of the board of directors of the Company, or third parties, including those beyond the

Company’s control, such as RP Ventures or its affiliates, K1 or its affiliates, and NYSE. The foregoing list of differences and

risks and uncertainties is illustrative but by no means exhaustive. For more information on factors that may affect the RP Note and related

events and the K1 Proposal or another transaction proposal, please review “Risk Factors” and other information included in

the Company’s filings and records filed with the United States Securities and Exchange Commission, including the Company’s

most recent quarterly filing on Form 10-Q. These forward-looking statements reflect the Company’s expectations as of the date hereof.

The Company undertakes no obligation to update the information provided herein.

Item

9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MariaDB plc |

| Dated: February 20, 2024 |

|

| |

By: |

/s/ Conor McCarthy |

| |

|

Name: |

Conor McCarthy |

| |

|

Title: |

Chief Financial Officer |

3

Exhibit 99.1

For immediate release

Announcement Regarding Possible Offer

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY (IN WHOLE OR IN PART) IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT

LAWS OF SUCH JURISDICTION.

THIS IS AN ANNOUNCEMENT REGARDING A POSSIBLE

OFFER, INCLUDING FOR THE PURPOSES OF RULE 2.12 OF THE IRISH TAKEOVER PANEL ACT 1997, TAKEOVER RULES, 2022 (THE “IRISH TAKEOVER RULES”).

THIS IS NOT AN ANNOUNCEMENT OF A FIRM INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF THE IRISH TAKEOVER RULES AND THERE CAN BE NO CERTAINTY

THAT AN OFFER WILL BE MADE OR AS TO THE TERMS ON WHICH ANY OFFER MIGHT BE MADE.

REDWOOD CITY, Calif., and DUBLIN – February

19, 2024 – The Board of MariaDB plc (NYSE: MRDB) (“MariaDB” or the “Company”) confirms

that on February 15, 2024, it received an unsolicited non-binding indicative proposal from K1 Investment Management LLC (“K1”)

to acquire the entire issued and to be issued share capital of the Company (the “Possible Offer”) through K5 Private

Investors, L.P. (“K5”), a fund controlled by K1. K1 publicly announced such offer on February 16, 2024. The Board of

MariaDB is reviewing and taking advice regarding the Possible Offer. The Possible Offer may or may not lead to an offer being made for

the entire share capital of the Company. There can be no certainty that any offer will be made.

In accordance with Rule 2.6 of the Irish Takeover

Rules, K1 is required, no later than 5:00 pm (New York time) on March 29, 2024, being the 42nd day following the K1 announcement,

to either (i) announce a firm intention to make an offer for the Company in accordance with Rule 2.7 of the Irish Takeover Rules; or (ii)

announce that it does not intend to make an offer for the Company, in which case the announcement will be treated as a statement to which

Rule 2.8 of the Irish Takeover Rules applies. This deadline will only be extended with the consent of the Irish Takeover Panel in accordance

with Rule 2.6(c) of the Takeover Rules, at the request of the Company.

Important

Notices

About

MARIADB

MariaDB is a new generation database company whose

products are used by companies big and small, reaching more than a billion users through Linux distributions and have been downloaded

over one billion times. Deployed in minutes and maintained with ease, leveraging cloud automation, MariaDB database products are engineered

to support any workload, any cloud and any scale – all while saving up to 90% of proprietary database costs. Trusted by organizations

such as Bandwidth, DigiCert, InfoArmor, Oppenheimer and Samsung, MariaDB’s software is the backbone of critical services that people

rely on every day. For more information, please visit mariadb.com.

Responsibility

Statement

The directors of the Company accept responsibility

for the information contained in this announcement. To the best of the knowledge and belief of the directors (who have taken all reasonable

care to ensure that such is the case), the information contained in this announcement is in accordance with the facts and does not omit

anything likely to affect the import of such information.

Disclosure

Requirements of the Irish Takeover Rules

Under Rule 8.3(a) of the Irish Takeover Rules,

any person who is ‘interested’ in 1% or more of any class of ‘relevant securities’ of the Company or a securities

exchange offeror (being any offeror other than an offeror which has announced that its offer is, or is likely to be, solely in cash) must

make an ‘opening position disclosure’ following the commencement of the ‘offer period’ and, if later, following

the announcement in which any securities exchange offeror is first identified. An ‘opening position disclosure’ must contain,

among other things, details of the person’s ‘interests’ and ‘short positions’ in any ‘relevant securities’

of each of (i) the Company and (ii) any securities exchange offeror(s). An ‘opening position disclosure’ by a person to whom

Rule 8.3(a) applies must be made by no later than 3:30 pm (New York time) on the day that is ten ‘business days’ following

the commencement of the ‘offer period’ and, if appropriate, by no later than 3:30 pm (New York time) on the day that is ten

‘business days’ following the announcement in which any securities exchange offeror is first identified.

Under Rule 8.3(b) of the Irish Takeover Rules,

if any person is, or becomes, ‘interested’ (directly or indirectly) in 1% or more of any class of ‘relevant securities’

of the Company, all ‘dealings’ in any ‘relevant securities’ of the Company or any securities exchange offeror

(including by means of an option in respect of, or a derivative referenced to, any such ‘relevant securities’) must be publicly

disclosed by not later than 3:30 pm (New York time) on the ‘business day’ following the date of the relevant transaction.

This requirement will continue until the ‘offer period’ ends. If two or more persons cooperate on the basis of any agreement

either express or tacit, either oral or written, to acquire an ‘interest’ in ‘relevant securities’ of the Company,

they will be deemed to be a single person for the purpose of Rule 8.3 of the Irish Takeover Rules. A disclosure table, giving details

of the companies in whose ‘relevant securities’ ‘dealings’ should be disclosed can be found on the Irish Takeover

Panel’s website at www.irishtakeoverpanel.ie.

In general, interests in securities arise when

a person has long economic exposure, whether conditional or absolute, to changes in the price of the securities. In particular, a person

will be treated as having an ‘interest’ by virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Irish

Takeover Rules, which can be found on the Irish Takeover Panel’s website. If you are in any doubt as to whether or not you are required

to disclose a ‘dealing’ under Rule 8, please consult the Irish Takeover Panel’s website at www.irishtakeoverpanel.ie

or contact the Irish Takeover Panel at telephone number +353 1 678 9020.

Rule

2.12 – Relevant Securities in Issue

In accordance with Rule 2.12 of the Irish Takeover

Rules, the Company confirms that as of January 31, 2024 its issued share capital was comprised of 67,749,429 ordinary shares, nominal

value $0.01 per share (the “Ordinary Shares”). The Ordinary Shares are admitted to trading on the New York Stock Exchange

under the ticker symbol MRDB. The International Securities Identification Number for these securities is IE0008908NI4.

The Company confirms that as of January 31, 2024

there were outstanding options to purchase up to 6,453,538 Ordinary Shares and outstanding restricted stock units and performance stock

units conferring on their holders vested or unvested rights to convert into, or to receive, up to an aggregate of 3,595,354 Ordinary Shares.

The Company confirms that as of January 31, 2024 there were outstanding warrants to subscribe for an aggregate of 16,351,314 Ordinary

Shares.

Forward

Looking Statements

Certain

statements in this announcement are “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995. Words indicating future events and actions, such as “will” and “may,” and variations of such words,

and similar expressions and future-looking language identify forward-looking statements, but their absence does not mean that the statement

is not forward-looking. The forward-looking statements in this announcement include statements regarding the Possible Offer and related

actions and events. Forward-looking statements are not guarantees of future events and actions, which may vary materially from those expressed

or implied in such statements. Differences may result from, among other things, actions taken by the Company or its management or board

or third parties, including those beyond the Company’s control. Such differences and uncertainties and related risks include, but

are not limited to, the possibility that an offer will not be made, the possibility that even if an offer is made, the parties

will not agree on a price or other terms or will not otherwise pursue a transaction or if pursued, that a transaction will not be consummated,

any negative effects of this announcement or failure to consummate a transaction on the market price of the Ordinary Shares and other

Company securities (including warrants) or otherwise (including on our outstanding debt obligations), and potentially significant transaction

and related costs. The foregoing list of differences and risks and uncertainties is illustrative,

but by no means exhaustive. For more information on factors that may affect the Possible Offer and related actions and events, please

review “Risk Factors” and other information described in the Company’s filings and records filed with the United States

Securities and Exchange Commission. These forward-looking statements reflect the Company’s expectations as of the date hereof. The

Company undertakes no obligation to update the information provided herein.

Further

Information

In accordance with Rule 26.1 of the Irish Takeover

Rules, a copy of this announcement will be available on the Company’s website at https://investors.mariadb.com/ by no later than

12:00 noon (New York time) on the business day following this announcement. The content of any website referred to in this announcement

is not incorporated into, and does not form part of, this announcement.

This announcement is not intended to, and does

not, constitute or form part of (1) an offer or invitation to purchase or otherwise acquire, subscribe for, tender, exchange, sell or

otherwise dispose of any securities; (2) the solicitation of an offer or invitation to purchase or otherwise acquire, subscribe for, tender,

exchange, sell or otherwise dispose of any securities; or (3) the solicitation of any vote or approval in any jurisdiction, pursuant to

this announcement or otherwise.

The release, publication or distribution of this

announcement in, into, or from, certain jurisdictions other than Ireland may be restricted or affected by the laws of those jurisdictions.

Accordingly, copies of this announcement are not being, and must not be, mailed or otherwise forwarded, distributed or sent in, into,

or from any such jurisdiction. Therefore, persons who receive this announcement (including without limitation nominees, trustees and custodians)

and are subject to the laws of any jurisdiction other than Ireland who are not resident in Ireland will need to inform themselves about,

and observe any applicable restrictions or requirements. Any failure to do so may constitute a violation of the securities laws of any

such jurisdiction.

No statement in this announcement is intended

to constitute a profit forecast for any period, nor should any statements be interpreted as an indication of what the Company’s

future financial or operating results may be, nor should any statements be interpreted to mean that earnings or earnings per share will

necessarily be greater or lesser than those for the relevant preceding financial periods for the Company. No statement in this announcement

constitutes an asset valuation. No statement in this announcement constitutes an estimate of the anticipated financial effects of an acquisition

of the Company, whether for the Company or any other person.

Requesting

hard copy information

Any MariaDB shareholder may request a copy

of this announcement in hard copy form by writing to Investor Relations via e-mail at ir@mariadb.com. Any written requests must include

the identity of the MariaDB shareholder and any hard copy documents will be posted to the address of the MariaDB shareholder provided

in the written request.

A hard copy of this announcement will not

be sent to MariaDB shareholders unless requested.

Source: MariaDB

| Contacts: |

|

| |

|

| Investors: |

Media: |

| ir@mariadb.com |

pr@mariadb.com |

3

v3.24.0.1

Cover

|

Feb. 16, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 16, 2024

|

| Entity File Number |

001-41571

|

| Entity Registrant Name |

MariaDB plc

|

| Entity Central Index Key |

0001929589

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity Address, Address Line One |

699 Veterans Blvd

|

| Entity Address, City or Town |

Redwood City

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94063

|

| City Area Code |

855

|

| Local Phone Number |

562-7423

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Ordinary Shares, nominal value $0.01 per share |

|

| Title of 12(b) Security |

Ordinary Shares, nominal value $0.01 per share

|

| Trading Symbol |

MRDB

|

| Security Exchange Name |

NYSE

|

| Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share

|

| Trading Symbol |

MRDBW

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MRDB_OrdinarySharesNominalValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MRDB_WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

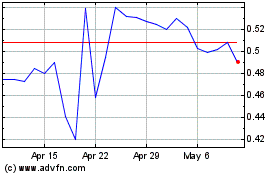

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Mar 2024 to Apr 2024

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Apr 2023 to Apr 2024