Filed Pursuant to Rule 424(b)(3)

Registration No. 333-269268

PROSPECTUS SUPPLEMENT NO. 19

(to the Prospectus dated March 24, 2023)

MariaDB plc

16,351,314 Ordinary Shares Underlying Warrants

56,414,951 Ordinary Shares by selling holders

7,310,297 Warrants to Purchase Ordinary Shares by selling holders

This prospectus supplement updates, amends and supplements the prospectus, dated March 24, 2023 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-269268), with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission on January 10, 2024 (“Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of an aggregate of up to 16,351,314 Ordinary Shares (as defined in the Prospectus), consisting of:

| | | | | | | | | | | |

| • | | up to 7,310,297 Ordinary Shares that are issuable upon the exercise of the Private Placement Warrants (as defined in the Prospectus); |

| | | | | | | | | | | |

| • | | up to 8,850,458 Ordinary Shares that are issuable upon the exercise of the Public Warrants (as defined in the Prospectus); and |

| | | | | | | | | | | |

| • | | up to 190,559 Ordinary Shares that are issuable upon exercise of the Kreos Warrants (as defined in the Prospectus). |

The Public Warrants, which are exercisable at a price of $11.50 per share, were originally sold as part of the APHC Public Units (as defined in the Prospectus) purchased by public investors in the APHC IPO (as defined in the Prospectus) at a price of $10.00 per APHC Public Unit. The Private Placement Warrants, which are exercisable at a price of $11.50 per share, were originally purchased by the Sponsor (as defined in the Prospectus) concurrent with the consummation of the APHC IPO at a price of $1.00 per warrant. Prior to the consummation of the Irish Domestication Merger (as defined in the Prospectus), 1,600,000 Private Placement Warrants were transferred by the Sponsor to the Syndicated Investors (as defined in the Prospectus) pursuant to the At Risk Capital Syndication (as defined in the Prospectus) (at a price per warrant of $1.00), and 5,710,297 Private Placement Warrants were transferred to the Sponsor’s co-founders, Lionyet International Ltd. (an entity owned and controlled by Shihuang “Simon” Xie) and Theodore T. Wang. The Kreos Warrants, which are exercisable at a price of €2.29 per share, were originally issued to Kreos (as defined in the Prospectus) by Legacy MariaDB (as defined in the Prospectus) in connection with a loan facility that is no longer outstanding. The Private Placement Warrants, the Public Warrants and the Kreos Warrants are sometimes referred to collectively in the Prospectus as the “Warrants.” To the extent that the Warrants are exercised for cash, we will receive the proceeds from such exercises.

The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling holders named in the Prospectus or their permitted transferees (the “selling holders”) of (i) up to 7,310,297 Private Placement Warrants and (ii) up to 56,414,951 Ordinary Shares, consisting of:

| | | | | | | | | | | |

| • | | 1,915,790 Ordinary Shares held by the PIPE Investors (as defined in the Prospectus), which they purchased in connection with the consummation of the PIPE Investment (as defined in the Prospectus) at a price of $9.50 per share; |

| | | | | | | | | | | |

| • | | 4,857,870 Founder Shares (as defined in the Prospectus) currently held by the Sponsor’s co-founders, Lionyet International Ltd. (an entity owned and controlled by Shihuang “Simon” Xie) and Theodore T. Wang, which were originally acquired by the Sponsor at a price of approximately $0.004 per share and transferred to its co-founders prior to the consummation of the Irish Domestication Merger; |

| | | | | | | | | | | |

| • | | 65,000 Founder Shares held by individuals who served as independent directors of APHC or otherwise provided services prior to the consummation of the Business Combination (as defined in the Prospectus), which were transferred from the Sponsor (who originally acquired such shares at a price of approximately $0.004 per share) in consideration of such services; |

| | | | | | | | | | | |

| • | | 1,550,000 Founders Shares held by certain Syndicated Investors, which were originally acquired by the Sponsor at a price of approximately $0.004 per share and transferred to such Syndicated Investors prior to the consummation of the Irish Domestication Merger in connection with the At Risk Capital Syndication (at a price of $3.00 per share); |

| | | | | | | | | | | |

| • | | 38,897,106 Ordinary Shares held by former affiliates and certain other shareholders of Legacy MariaDB, which, upon consummation of the Merger, were issued to them pursuant to the terms of the Merger Agreement in exchange for shares of (i) Legacy MariaDB they had previously purchased from Legacy MariaDB in private placement transactions or on exercise of Legacy MariaDB Equity Awards or warrants, at prices per share ranging from $0.38 to $7.50, as adjusted based on the Exchange Ratio (as defined in the Prospectus); |

| | | | | | | | | | | |

| • | | 1,818,888 Ordinary Shares issuable upon exercise of stock options held by certain of our executive officers and directors, at exercise prices ranging from $0.38 to $4.15 per Ordinary Share; and |

| | | | | | | | | | | |

| • | | 7,310,297 Ordinary Shares issuable upon exercise of the Private Placement Warrants held by Lionyet International Ltd. and Dr. Wang, the Sponsor’s co-founders, and the Syndicated Investors. |

We are registering the Ordinary Shares and Private Placement Warrants that may be offered and sold by selling holders from time to time pursuant to their registration rights under certain agreements between us and the selling holders or their affiliates, as applicable.

This prospectus supplement is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, including any amendments or supplements thereto, which is to be delivered with this prospectus supplement., This prospectus supplement is qualified by reference to the Prospectus, including any amendments or supplements thereto, except to the extent that the information in this prospectus supplement updates or supersedes the information contained therein. Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

Our Ordinary Shares and Public Warrants are listed on The New York Stock Exchange (“NYSE”) under the symbols “MRDB” and “MRDBW”, respectively. On January 9, 2024, the closing sale prices of our Ordinary Shares and Public Warrants were $0.1948 and $0.0201, respectively.

We are an “emerging growth company” and a “smaller reporting company” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings.

Investing in our Ordinary Shares and Warrants involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 9 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is January 10, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 10, 2024

MariaDB plc

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Ireland | | 001-41571 | | N/A |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

699 Veterans Blvd

Redwood City, CA 94063

(Address of principal executive offices, including zip code)

(855) 562-7423

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

¨ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Ordinary Shares, nominal value $0.01 per share | | MRDB | | New York Stock Exchange |

Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share | | MRDBW | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement

On January 10, 2024, MariaDB plc (“MariaDB”) entered into an amendment (the “First Amendment”) of the senior secured promissory note issued to RP Ventures LLC (“RP Ventures”) on October 10, 2023 (the “RPV Note”). The First Amendment, among and between MariaDB, RP Ventures, and other note parties to the RPV Note, extends (i) the maturity date of the RPV Note from January 10, 2024 to January 31, 2024, providing time for the Company to continue to work with parties related to the noteholder on a recapitalization structure and (ii) the exclusivity period under the RPV Note from January 10, 2024 to January 31, 2024, pursuant to which the Company is restricted from pursuing or accepting any offer with respect to any recapitalization, reorganization, merger, business combination, purchase, sale, loan, notes issuance, issuance of other indebtedness or other financing or similar transaction, or to any acquisition by any person or group, which would result in any person or group becoming the beneficial owner of 2% or more of any class of equity interests or voting power or consolidated net income, revenue or assets, of the Company, in each case other than with RP Ventures, Runa Capital Fund II, L.P. (“Runa”) or Runa affiliates.

The Company will pay RP Ventures a nonrefundable funding fee of $75,000 relating to the First Amendment.

Except for the foregoing, no material changes were made to the RPV Note.

The foregoing description of the First Amendment is only a summary and is qualified in its entirety by reference to the full text of the First Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein. The other material terms of the RPV Note, dated as of October 10, 2023, are described in the Current Report on Form 8-K filed with the Securities and Exchange Commission on October 10, 2023, which is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information required by this Item 2.03 is set forth in Item 1.01 of this Current Report on Form 8-K and is incorporated herein by reference.

Forward-Looking Statements

Certain statements in this Current Report are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words indicating future events and actions, such as “will,” “intend,” “plan,” and “may,” and variations of such words, and similar expressions and future-looking language identify forward-looking statements, but their absence does not mean that the statement is not forward-looking. The forward-looking statements in this report include statements regarding the future liquidity, solvency, operations and trading of the Company following the execution of the First Amendment and under the RPV Note. Forward-looking statements are not guarantees of future events and actions, which may vary materially from those expressed or implied in such statements. Differences may result from, among other things, actions taken by the Company or its management or the Board, or third parties, including those beyond the Company’s control, such as RP Ventures and Runa. Such differences and uncertainties and related risks include, but are not limited to, the possibility that we may default under the RPV Note, may not reach a long-term funding or liquidity solution or that the New York Stock Exchange may take action, including delisting, due to, among other things, the Company’s failure to meet market capitalization standards within the next 18 months or other requirements of the exchange. The foregoing list of differences and risks and uncertainties is illustrative but by no means exhaustive. For more information on factors that may affect the RPV Note and related events, please review “Risk Factors” and other information included in the Company’s filings and records filed with the United States Securities and Exchange Commission. These forward-looking statements reflect the Company’s expectations as of the date hereof. The Company undertakes no obligation to update the information provided herein.

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MariaDB plc |

| Dated: January 11, 2024 | |

| By: | /s/ Conor McCarthy |

| | Name: | Conor McCarthy |

| | Title: | Chief Financial Officer |

EXHIBIT 10.1

FIRST AMENDMENT TO SENIOR SECURED PROMISSORY NOTE

This FIRST AMENDMENT TO SENIOR SECURED PROMISSORY NOTE (this “Amendment”) is entered into as of January 10, 2024, by and among MARIADB PLC, an Irish public limited company, as Issuer, the other Note Parties party hereto and RP Ventures LLC, as Agent and Holder.

W I T N E S S E T H:

WHEREAS, Issuer, the other Note Parties from time to time party thereto, Agent and Holder have entered into that certain Senior Secured Promissory Note, dated as of October 10, 2023 (as the same may be amended, supplemented and otherwise modified prior to the effectiveness of this Amendment, the “Existing Note”; the Existing Note, as amended by this Amendment and as the same may be hereafter further amended, restated, supplemented or otherwise modified and in effect from time to time, herein is referred to as the “Note”), pursuant to which Holder agreed to make certain financial accommodations to the Issuer.

WHEREAS, the Note Parties have requested, and Agent and Holder have agreed to, amend certain provisions of the Existing Note, in each case, on the terms and subject to the conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual agreements, provisions and covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

SECTION 1. Defined Terms. Capitalized terms used herein (including in the preamble and recitals above) but not otherwise defined herein shall have the respective meanings ascribed to such terms in the Note.

SECTION 2. Amendments to Existing Credit Agreement. Subject to the satisfaction of the conditions precedent in Section 3 herein, and in reliance upon the representations, warranties, agreements, covenants and acknowledgments of the Note Parties herein contained:

(a) Section 5 of the Existing Note is hereby amended by changing the definition of “Maturity Date” from January 10, 2024 to January 31, 2024; and

(b) Section 12.5.1 of the Existing Note is hereby amended by changing the definition of “Exclusivity Date” from January 10, 2024 to January 31, 2024.

SECTION 3. Conditions. The effectiveness of this Amendment is subject to the satisfaction or waiver by the Agent of the following conditions precedent:

(a) the execution and delivery of this Amendment by Issuer, the other Note Parties, Agent and Holder, in form and substance reasonably satisfactory to Agent;

(b) the representations and warranties in Section 4 hereof being true and correct; and

(c) Issuer shall have paid in full an amendment fee to the Agent, for the account of the Note Holders, in the amount of $75,000.

SECTION 4. Representations and Warranties. Issuer and each Note Party hereby jointly and severally represents and warrants that:

1

(a) the representations and warranties of the Note Parties set forth in the Notes Documents are true in all material respects on the date as of which such representation or warranty was made or deemed made;

(b) the execution, delivery and performance of this Amendment does not (i) require the consent or approval of any other party (including any governmental or regulatory party), (ii) violate any law, regulation, agreement, order, writ, judgment, injunction, decree, determination or award presently in effect to which Issuer or any Note Party is a party or to which Issuer or any Note Party or any of their assets may be subject, or (iii) conflict with or constitute a breach of, or default under, or require any consent under, or result in the creation of any Lien, charge or encumbrance upon the property or assets of Issuer or any Note Party or any of their Subsidiaries pursuant to any other agreement or instrument to which Issuer or any Note Party is a party or is bound or by which its properties may be bound or affected; and

(c) this Amendment is the legal, valid and binding obligation of Issuer and each other Note Party, enforceable in accordance with its terms.

SECTION 5. Captions. Captions used in this Amendment are for convenience only and shall not affect the construction of this Amendment.

SECTION 6. Counterparts. This Amendment may be executed in any number of counterparts and by the different parties hereto on separate counterparts and each such counterpart shall be deemed to be an original, but all such counterparts shall together constitute but one and the same Amendment. Receipt by telecopy of any executed signature page to this Amendment shall constitute effective delivery of such signature page. This Amendment, to the extent signed and delivered by means of a facsimile machine or other electronic transmission (including “pdf”), shall be treated in all manner and respects and for all purposes as an original agreement or amendment and shall be considered to have the same binding legal effect as if it were the original signed version thereof delivered in person. No party hereto or to any other Notes Document shall raise the use of a facsimile machine or other electronic transmission to deliver a signature or the fact that any signature or agreement or amendment was transmitted or communicated through the use of a facsimile machine or other electronic transmission as a defense to the formation or enforceability of a contract and each such party forever waives any such defense.

SECTION 7. Severability. The illegality or unenforceability of any provision of this Amendment or any instrument or agreement required hereunder shall not in any way affect or impair the legality or enforceability of the remaining provisions of this Amendment or any instrument or agreement required hereunder.

SECTION 8. Entire Agreement; Notes Document. The Note, as amended hereby, together with all other Notes Documents, embodies the entire agreement and understanding among the parties hereto and thereto and supersedes all prior or contemporaneous agreements and understandings of such Persons, verbal or written, relating to the subject matter hereof and thereof. This Amendment shall constitute a Notes Document.

SECTION 9. Successors; Assigns. This Amendment will be binding upon and inure to the benefit of each of the parties hereto and their respective successors and assigns. Neither the Issuer, nor any Note Party may transfer, assign or delegate any of its rights or obligations hereunder or under the Note without the prior written consent of Agent. Agent and Note Holders shall have the right, without the consent of Issuer or any Note Party, to assign, participate or transfer, in whole or in part, its rights and interests in and to this Amendment and the Note, and as used herein, the term “Agent” and “Note Holders” shall mean and include such successors and assigns.

2

SECTION 10. Governing Law. THIS AMENDMENT SHALL BE A CONTRACT MADE UNDER AND GOVERNED BY THE INTERNAL LAWS OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS MADE AND TO BE PERFORMED ENTIRELY WITHIN SUCH STATE, WITHOUT REGARD TO CONFLICT OF LAWS PRINCIPLES.

SECTION 11. Forum Selection; Consent to Jurisdiction. Any litigation based hereon, or arising out of, under, or in connection with this Amendment or the Note, shall be brought and maintained exclusively in the courts of the state of New York located in the city of New York, New York County or in the United States District Court for the Southern District of New York; provided that any suit seeking enforcement against any collateral or other property may be brought, at Agent’s option, in the courts of any jurisdiction where such collateral or other property may be found. Each party hereto hereby expressly and irrevocably submits to the jurisdiction of any such court referred to above for the purpose of any such litigation as set forth above. Each party hereto further irrevocably consents to the service of process by registered mail, postage prepaid, or by personal service within or without the state of New York. Each party hereto hereby expressly and irrevocably waives, to the fullest extent permitted by law, any objection which it may now or hereafter have to the laying of venue of any such litigation brought in any such court referred to above and any claim that any such litigation has been brought in an inconvenient forum.

SECTION 12. Waiver of Jury Trial. Issuer and each Note Party hereby waives any right to a trial by jury in any action or proceeding to enforce or defend any rights under this Amendment and the Note, and any amendment, instrument, document or agreement delivered or which may in the future be delivered in connection herewith or therewith or arising from any financing relationship existing in connection with any of the foregoing, and agrees that any such action or proceeding shall be tried before a court and not before a jury.

SECTION 13. Reaffirmation. Issuer and each other Note Party, as debtor, grantor, pledgor, guarantor, assignor, or in any other similar capacity in which such Person grants liens or security interests in its property or otherwise acts as accommodation party or guarantor, as the case may be, in each case, pursuant to any Notes Document, hereby (i) ratifies and reaffirms all of its payment and performance obligations, contingent or otherwise, under the Note and each other Notes Document to which it is a party (after giving effect hereto) and (ii) to the extent such Person granted liens on or security interests in any of its property pursuant to any Notes Document as security for or otherwise guaranteed the Obligations under or with respect to the Notes Documents, ratifies and reaffirms such guarantee and grant of security interests and liens and confirms and agrees that such security interests and liens hereafter secure all of the Obligations as amended hereby. Issuer and each other Note Party hereby consents to this Amendment and acknowledges that each of the Note, as amended hereby, and each other Notes Document remains in full force and effect and is hereby ratified and reaffirmed (after giving effect hereto). Except as expressly set forth herein, the execution of this Amendment shall not operate as a waiver of any right, power or remedy of Agent or the Note Holders, constitute a waiver of any provision of the Note or any other Notes Document or serve to effect a novation of the Obligations.

SECTION 14. Release of Claims. In consideration of, among other things, Agent and Holder’s execution and delivery of this Amendment, Issuer and each other Note Party, for itself and on behalf of its successors, assigns, officers, directors, employees, agents and attorneys, and any Person acting for or on behalf of, or claiming through it, to the fullest extent permitted by applicable law, hereby waives, releases, remises and forever discharges, and agrees to hold harmless, Agent, each Note Holder, Runa, each Related Person of the foregoing and each of their affiliates, partners, members, directors, managers, officers, employees, agents, attorneys-in-fact, trustees, advisors and other representatives, and any successor or assign thereof (collectively, the “Releasees”) from and against any and all liabilities, actual losses, damages, claims, fees and expenses of any kind or nature whatsoever (collectively, “Claims”) that

3

any Note Party has, had or may have against the Releasees which arise from or relate to any actions which the Releasees may have taken or omitted to take in connection with the Note or the other Notes Documents prior to the date of this Amendment, in any way relating to or arising out of or in connection with or by reason of, or any actual or prospective claim, litigation, investigation or proceeding in any way relating to, arising out of, in connection with or by reason of, any of the following, whether based on contract, tort or any other theory (including any investigation of, preparation for, or defense of any pending or threatened claim, investigation, litigation or proceeding); provided that no Note Party waives, releases, remises, discharges or agrees to hold harmless any Releasee to the extent that such Claims are determined by a court of competent jurisdiction in a final and non-appealable judgment to have resulted from the gross negligence or willful misconduct of such Releasee. Each Note Party understands, acknowledges and agrees that the release set forth above may be pleaded as a full and complete defense to any Claim and may be used as a basis for an injunction against any action, suit or other proceeding which may be instituted, prosecuted or attempted in breach of the provisions of such release. Each Note Party agrees that no fact, event, circumstance, evidence or transaction which could now be asserted or which may hereafter be discovered will affect in any manner the final, absolute and unconditional nature of the release set forth above. This Section 14 shall survive and continue in full force and effect whether or not any Note Party shall satisfy all other provisions of this Amendment, the Note or the other Notes Documents, including payment in full of all Obligations.

[Signature Pages Follow]

4

IN WITNESS WHEREOF, each of the undersigned has caused the Amendment to be duly executed and delivered as of the date first above written.

| | | | | | | | |

| ISSUER: | |

| | |

| MARIADB PLC | |

| | |

| By: | /s/ Paul O'Brien |

| Name: | Paul O'Brien |

| Title: | Chief Executive Officer |

| | |

| OTHER NOTE PARTIES: |

| | |

| MARIADB USA, INC. |

| | |

| By: | /s/ Paul O'Brien |

| Name: | Paul O'Brien |

| Title: | Chief Executive Officer |

| | |

| MARIADB CANADA CORP. |

| | |

| By: | /s/ Paul O'Brien |

| Name: | Paul O'Brien |

| Title: | Chief Executive Officer |

| | |

| MARIADB UK LTD |

| | |

| By: | /s/ Conor McCarthy |

| Name: | Conor McCarthy |

| Title: | CFO |

| | |

| MARIADB BULGARIA EOOD |

| | |

| By: | /s/ Maria Angelova |

| Name: | Maria Angelova |

| Title: | Managing Director |

| | |

| | |

IN WITNESS WHEREOF, each of the undersigned has caused the Amendment to be duly executed and delivered as of the date first above written.

| | | | | | | | |

| AGENT AND HOLDER: |

| | |

| RP VENTURES LLC, as Agent |

| | |

| By: | /s/ Michael Fanfant |

| Name: | Michael Fanfant |

| Title: | Manager |

| | |

| RP VENTURES LLC, as Holder |

| | |

| By: | /s/ Michael Fanfant |

| Name: | Michael Fanfant |

| Title: | Manager |

| | |

EXHIBIT 99.1

MariaDB Reaches Agreement to Amend Senior Secured Promissory Note

REDWOOD CITY, Calif., and DUBLIN – January 11, 2024 – MariaDB plc (NYSE:MRDB) today announced that that the $26.5 million senior secured promissory note entered into with RP Ventures LLC (“the RPV Note”) that was due January 10, 2024, has been amended, and the RPV Note will now expire on January 31, 2024.

Further details on this transaction can be found on MariaDB’s most recently filed 8-K, which is available on the Securities & Exchange Commission’s (SEC’s) website at https://www.sec.gov and on MariaDB’s Investor Relations website at https://investors.mariadb.com under Financials.

About MariaDB

MariaDB is a new generation database company whose products are used by companies big and small, reaching more than a billion users through Linux distributions and have been downloaded over one billion times. Deployed in minutes and maintained with ease, leveraging cloud automation, MariaDB database products are engineered to support any workload, any cloud and any scale – all while saving up to 90% of proprietary database costs. Trusted by organizations such as Bandwidth, DigiCert, InfoArmor, Oppenheimer and Samsung, MariaDB’s software is the backbone of critical services that people rely on every day. For more information, please visit mariadb.com.

Forward-Looking Statements

Certain statements in this announcement are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words indicating future events and actions, such as “will,” “intend,” “plan,” and “may,” and variations of such words, and similar expressions and future-looking language identify forward-looking statements, but their absence does not mean that the statement is not forward-looking. The forward-looking statements in this report include statements regarding the future liquidity, solvency, operations and trading of MariaDB plc (the “Company”) following the execution of the amendment and under the RPV Note. Forward-looking statements are not guarantees of future events and actions, which may vary materially from those expressed or implied in such statements. Differences may result from, among other things, actions taken by the Company or its management or the company’s Board of Directors, or third parties, including those beyond the Company’s control, such as RP Ventures, Runa Capital and their affiliates. Such differences and uncertainties and related risks include, but are not limited to, the possibility that we may default under the RPV Note, may not reach a long-term funding or liquidity solution or that the New York Stock Exchange may take action, including delisting, due to, among other things, the Company’s failure to meet market capitalization standards within the next 18 months or other requirements of the exchange. The foregoing list of differences and risks and uncertainties is illustrative but by no means exhaustive. For more information on factors that may affect the RPV Note and related events,

please review “Risk Factors” and other information included in the Company’s filings and records filed with the United States Securities and Exchange Commission. These forward-looking statements reflect the Company’s expectations as of the date hereof. The Company undertakes no obligation to update the information provided herein.

Source: MariaDB

Investors: ir@mariadb.com

Media: pr@mariadb.com

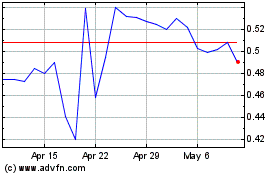

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Apr 2024 to May 2024

MariaDB (NYSE:MRDB)

Historical Stock Chart

From May 2023 to May 2024