UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of February 2025

Commission File Number: 001-40416

Nouveau

Monde Graphite Inc.

(Translation of registrant’s name into English)

481 rue Brassard

Saint-Michel-des-Saints, Quebec

Canada J0K 3B0

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

¨ Form 40-F x

DOCUMENTS TO BE FILED AS PART OF THIS FORM 6-K

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, there unto duly authorized.

| |

Nouveau Monde Graphite Inc. |

| |

(Registrant) |

| |

|

| Date: February 18,

2025 |

/s/ Josée Gagnon |

| |

Josée Gagnon |

| |

Vice President, Legal Affairs & Corporate Secretary |

Exhibit 99.1

FORM 51-102F3

Material

Change Report

| 1. | Name and Address of the Corporation |

NOUVEAU

MONDE GRAPHITE INC. (the “Corporation”)

481 Rue Brassard

Saint-Michel-des-Saints QC, J0K 3B0

| 2. | Date of Material Change |

December 17, 2024

A

news release, in French and English versions, regarding the material change referred to in this report was issued on December 17, 2024

through the facilities of Business Wire. A copy of the news release has been filed under the Corporation’s profile on SEDAR+ at

www.sedarplus.ca.

| 4. | Summary of Material Change |

On December

17, 2024, the Corporation, announced an equity investment by Canada Growth Fund Inc. (“CGF”) and the Government of

Québec, via its agent Investissement Québec (“IQ”), in the Corporation for an aggregate amount of US$50

million to continue advancing its development toward commercial operations, subject to regulatory approvals. As the Corporation prepares

for a final investment decision (“FID”) regarding its Phase-2 Matawinie Mine and Bécancour Battery Material

Plant, the investment is namely set to enable progress on detailed engineering, orders of key long-lead items and support to critical-path

activities

| 5. | Full Description of Material Change |

| 5.1 | Full Description of Material Change |

Each of CGF

and IQ has agreed to subscribe for common shares in the capital of NMG (the “Common Shares”), subject to certain conditions

contained in the subscription agreements entered into between the Corporation and each of CGF and IQ (the “Subscription

Agreements”), for aggregate gross proceeds of US$50 million (the “Offering”). Pursuant to the Offering, the

Corporation will issue 39,682,538 Common Shares at a price of US$1.26 per Common Share.

For each

Common Share so subscribed, the Corporation will issue one share purchase warrant (the “Warrants”) to each of

CGF and IQ. The Warrant will entitle the holder thereof to acquire one Common Share, from FID to the date that is five (5) years

from the closing of the Offering, at a price per Common Share of US$2.38 – the same strike price than the warrants previously issued

to General Motors Holdings LLC, a wholly owned subsidiary of General Motors Co. (collectively, “GM”) (NYSE:

GM), Panasonic Energy Co., Ltd. (“Panasonic Energy”), a wholly owned subsidiary of Panasonic Holdings Corporation

(“Panasonic”) (TYO: 6752), and Mitsui & Co., Ltd. (‘’Mitsui”) (TYO: 8031) in

February 2024. The exercise of the Warrants is subject to certain ownership limitations.

In connection

with the Offering, the Corporation entered into an investor rights agreement (collectively, the “Investor Rights Agreements”)

and a registration rights agreement with each of CGF and IQ at the closing of the Offering. Pursuant to the Investor Rights Agreements,

each of CGF and IQ will be restricted from selling its respective securities until August 28, 2025. The Investor Rights Agreements also

provide each of CGF and IQ with certain rights relating to its investment in the Corporation, including namely certain board nomination

and anti-dilution rights.

The Common

Shares and the Warrants are subject to a four-month hold period under Canadian securities laws. The Offering is subject to certain standard

conditions and regulatory approvals, including the approval of the TSX Venture Exchange and the New York Stock Exchange.

Terms of Warrants

Each Warrant entitles the holder thereof

to acquire one Common Share, from FID to the date that is five years from the closing of the Private Placement, at a price per Common

Share of US$2.38. Pursuant to the terms and conditions of the Warrants, each holder cannot exercise Warrants to own more than 19.9% of

the issued and outstanding common shares of the Company, unless it obtains, if required at the time of the exercise of the Warrants, the

conditional approval of the Canadian exchange on which the shares will then be listed and, as applicable, disinterested shareholder approval.

At

a meeting of the board of directors of the Corporation held on December 16, 2024, the directors of the Corporation who had the right to

vote unanimously approved, based on the recommendation of the Corporation’s management and external legal counsel, the issuance

of the Common Shares and the Warrants to CGF and IQ. Notably, the directors of the Corporation who had the right to vote on such

matters approved the execution of the Subscription Agreements with CGF and IQ, the Investor Rights Agreement with CGF and IQ and the Registration

Rights Agreement with CGF and IQ.

The Corporation did not file a material

change report in respect of the Offering at least 21 days before the anticipated closing of the Offering, due to the fact that it was

conditional upon the execution of the above-mentioned agreements and that this abbreviated period is reasonable and necessary in the circumstances

as all the terms and conditions of the Offering and the above-mentioned were not fixed.

| 6. | Reliance on subsection 7.1(2) of Regulation 51-102 |

Not applicable.

Not applicable.

For

all additional information, please contact:

Me Josée Gagnon

Vice President – Legal Affairs

Telephone: (450) 757-8905 #405

December 27, 2024

Exhibit 99.2

FORM 51-102F3

Material

Change Report

| 1. | Name and Address of the Corporation |

NOUVEAU

MONDE GRAPHITE INC. (the “Corporation”)

481 Rue Brassard

Saint-Michel-des-Saints QC, J0K 3B0

| 2. | Date of Material Change |

December 17, 2024

A

news release, in French and English versions, regarding the material change referred to in this report was issued on December 17,

2024 through the facilities of Business Wire. A copy of the news release has been filed under the Corporation’s profile on SEDAR+

at www.sedarplus.ca.

| 4. | Summary of Material Change |

On December 17,

2024, the Corporation, announced an equity investment by Canada Growth Fund Inc. (“CGF”) and the Government of Québec,

via its agent Investissement Québec (“IQ”), in the Corporation for an aggregate amount of US$50 million to continue

advancing its development toward commercial operations, subject to regulatory approvals. As the Corporation prepares for a final investment

decision (“FID”) regarding its Phase-2 Matawinie Mine and Bécancour Battery Material Plant, the investment is

namely set to enable progress on detailed engineering, orders of key long-lead items and support to critical-path activities

| 5. | Full Description of Material Change |

| 5.1 | Full Description of Material Change |

Each of CGF

and IQ has agreed to subscribe for common shares in the capital of NMG (the “Common Shares”), subject to certain conditions

contained in the subscription agreements entered into between the Corporation and each of CGF and IQ (the “Subscription

Agreements”), for aggregate gross proceeds of US$50 million (the “Offering”). Pursuant to the Offering, the

Corporation will issue 39,682,538 Common Shares at a price of US$1.26 per Common Share.

For each Common

Share so subscribed, the Corporation will issue one share purchase warrant (the “Warrants”) to each of CGF and

IQ. The Warrant will entitle the holder thereof to acquire one Common Share, from FID to the date that is five (5) years from

the closing of the Offering, at a price per Common Share of US$2.38 – the same strike price than the warrants previously issued

to General Motors Holdings LLC, a wholly owned subsidiary of General Motors Co. (collectively, “GM”) (NYSE:

GM), Panasonic Energy Co., Ltd. (“Panasonic Energy”), a wholly owned subsidiary of Panasonic Holdings

Corporation (“Panasonic”) (TYO: 6752), and Mitsui & Co., Ltd. (‘’Mitsui”)

(TYO: 8031) in February 2024. The exercise of the Warrants is subject to certain ownership limitations.

In connection

with the Offering, the Corporation entered into an investor rights agreement (collectively, the “Investor Rights Agreements”)

and a registration rights agreement with each of CGF and IQ at the closing of the Offering. Pursuant to the Investor Rights Agreements,

each of CGF and IQ will be restricted from selling its respective securities until August 28, 2025. The Investor Rights Agreements

also provide each of CGF and IQ with certain rights relating to its investment in the Corporation, including namely certain board nomination

and anti-dilution rights.

The Common

Shares and the Warrants are subject to a four-month hold period under Canadian securities laws. The Offering is subject to certain standard

conditions and regulatory approvals, including the approval of the TSX Venture Exchange and the New York Stock Exchange.

Terms of Warrants

Each Warrant entitles the holder thereof

to acquire one Common Share, from FID to the date that is five years from the closing of the Private Placement, at a price per Common

Share of US$2.38. Pursuant to the terms and conditions of the Warrants, each holder cannot exercise Warrants to own more than 19.9% of

the issued and outstanding common shares of the Company, unless it obtains, if required at the time of the exercise of the Warrants, the

conditional approval of the Canadian exchange on which the shares will then be listed and, as applicable, disinterested shareholder approval.

| 6. | Reliance on subsection 7.1(2) of Regulation 51-102 |

Not applicable.

Not applicable.

For

all additional information, please contact:

Me Josée Gagnon

Vice President – Legal Affairs

Telephone: (450) 757-8905 #405

February 3, 2025

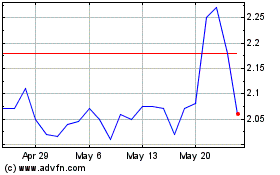

Nouveau Monde Graphite (NYSE:NMG)

Historical Stock Chart

From Jan 2025 to Feb 2025

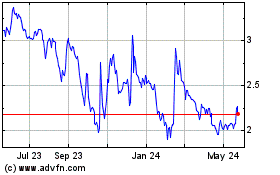

Nouveau Monde Graphite (NYSE:NMG)

Historical Stock Chart

From Feb 2024 to Feb 2025