As filed with the Securities and Exchange Commission on May 6, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SERVICENOW, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| | | | | |

Delaware

(State or other jurisdiction of

incorporation or organization) | 20-2056195

(I.R.S. Employer

Identification Number) |

2225 Lawson Lane

Santa Clara, California 95054

(408) 501-8550

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Russell S. Elmer, Esq.

General Counsel and Secretary

ServiceNow, Inc.

2225 Lawson Lane

Santa Clara, CA 95054

(408) 501-8550

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

| | | | | | | | | | | |

| | | |

Thomas J. Ivey, Esq. Brian D. Paulson, Esq. Skadden, Arps, Slate, Meagher & Flom LLP 525 University Avenue, Suite 1400 Palo Alto, CA 94301 (650) 470-4500 |

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective as determined by market conditions and other factors.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Large accelerated filer | x | | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | | Smaller reporting company | ¨ |

| | | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨ |

PROSPECTUS

SERVICENOW, INC.

Common Stock

Preferred Stock

Debt Securities

Warrants

We may, from time to time, offer to sell common stock, preferred stock, debt securities or warrants. We refer to our common stock, preferred stock, debt securities and warrants collectively as the “securities.” The securities we may offer may be convertible into or exercisable or exchangeable for other securities. We may offer the securities separately or together, in separate classes, series and in amounts, at prices and on terms that will be determined at the time the securities are offered.

In addition, from time to time, the selling securityholders to be named in a prospectus supplement may offer our securities. We will not receive any of the proceeds from the sale of securities by the selling securityholders.

This prospectus describes some of the general terms that may apply to these securities. Each time securities are sold, the specific terms and amounts of the securities to be offered, and any other information relating to the specific offering and, if applicable, the selling securityholders, will be set forth in a supplement to this prospectus. You should read this prospectus and any prospectus supplement carefully before you invest in any of the securities. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

We or any selling securityholder may offer and sell these securities to or through one or more underwriters, dealers and agents, directly to purchasers, or through other means, on a continuous or delayed basis. If any underwriters are involved in the sale of any securities offered by this prospectus and any prospectus supplement, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them, will be set forth, or may be calculable from the information set forth, in the accompanying prospectus supplement.

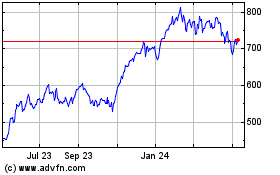

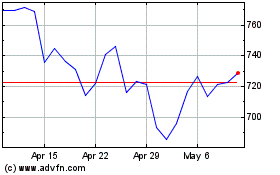

Our common stock is listed on The New York Stock Exchange under the symbol “NOW.”

Investing in our securities involves a high degree of risk. You should carefully consider the “Risk Factors” which may be included in any prospectus supplement or which are incorporated by reference into this prospectus and described under the heading “Risk Factors” beginning on page 1.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 6, 2024.

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission (the “SEC”), using a “shelf” registration process. Under this process, we and/or the selling securityholders to be named in a prospectus supplement may sell any combination of the securities described in this prospectus from time to time in one or more offerings. Before purchasing any securities, you should carefully read this prospectus and any prospectus supplement together with the additional information described under the heading “Information Incorporated by Reference.” We have not authorized anyone to provide you with different or additional information. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus only provides you with a general description of the securities that we may offer. Each time we or the selling securityholders sell securities pursuant to this prospectus, we or the selling securityholders, as the case may be, will provide a prospectus supplement that contains specific information about the terms of that offering, including the specific amounts, prices and terms of the securities offered, and, if applicable, the selling securityholders. In addition, the prospectus supplement may also add, update or change the information contained in this prospectus. If this prospectus is inconsistent with the prospectus supplement, you should rely upon the prospectus supplement.

If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this document does not extend to you.

The information in this prospectus or any prospectus supplement, as well as the information incorporated by reference herein or therein, is accurate only as of the date thereof, unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus, any accompanying prospectus supplement, or any related free writing prospectus, or of any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since those dates.

Unless expressly indicated or the context requires otherwise, the terms “ServiceNow,” “we,” “us,” and “our” in this prospectus, in any accompanying prospectus supplement, or the documents incorporated by reference refer to ServiceNow, Inc., a Delaware corporation, and, where appropriate, its consolidated subsidiaries as of the date of this prospectus.

SERVICENOW, INC.

ServiceNow was founded on a simple premise: to make work flow better. Our purpose is to make the world work better for everyone. We are the end-to-end intelligent workflow automation platform for digital businesses. Our intelligent platform, the Now Platform, is a cloud-based solution with embedded artificial intelligence and machine learning capabilities that helps global enterprises across industries, universities and governments unify and digitize their workflows. By connecting workflows across siloed organizational functions and systems, the Now Platform delivers business outcomes, including unlocking productivity, streamlining processes, and improving experiences for both employees and customers.

Our workflow applications built on the Now Platform are organized in four primary areas: Technology, Customer and Industry, Employee, and Creator. Our Technology Workflows empower Information Technology departments to plan, build, operate and service the IT needs of the business enterprise. Our Customer and Industry Workflows help organizations reimagine the customer experience and increase customer loyalty. Our Employee Workflows help customers simplify how their employees access services they need, creating a consumer-like

experience. Our Creator Workflows enable customers to quickly create, test, and deploy their own low-code applications on the Now Platform.

We were incorporated as Glidesoft, Inc. in California in June 2004 and changed our name to Service-now.com in February 2006. In May 2012, we reincorporated in Delaware as ServiceNow, Inc. Our principal executive offices are located at 2225 Lawson Lane, Santa Clara, California 95054, and our telephone number is (408) 501-8550. Our website is http://www.servicenow.com. Information contained on our website does not constitute part of this prospectus.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making a decision to invest in our securities, you should carefully consider the risks described under “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and discussed under “Part I, Item 1A. Risk Factors” contained in our most recent annual report on Form 10-K and in “Part II, Item 1A. Risk Factors” in our most recent quarterly report on Form 10-Q filed subsequent to such Form 10-K, as well as any amendments thereto, which are incorporated by reference into this prospectus and the applicable prospectus supplement in their entirety, together with other information in this prospectus and the applicable prospectus supplement, the documents incorporated by reference herein and therein, and any free writing prospectus that we may authorize for use in connection with a specific offering. See “Where You Can Find More Information.” These risks could materially affect our business, financial condition or results of operations and cause the value of our securities to decline. You could lose all or part of your investment.

FORWARD-LOOKING STATEMENTS

This prospectus and any prospectus supplement, including the documents incorporated by reference herein and therein, contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in or incorporated by reference in this prospectus and any prospectus supplement other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “would,” “could,” “should,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including but not limited to the risks described in this prospectus, any accompanying prospectus supplement and any documents incorporated by reference herein or therein, including those described in the “Risk Factors” section incorporated by reference herein. Moreover, we operate in a highly competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this prospectus and any prospectus supplement may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Please take into account that forward-looking statements speak only as of the date of this prospectus or, in the case of any accompanying prospectus supplement or documents

incorporated by reference, the date of any such document. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to review any additional disclosures we make in the documents we subsequently file with the SEC that are incorporated by reference in this prospectus and any prospectus supplement. See “Where You Can Find More Information.”

USE OF PROCEEDS

We will retain broad discretion over the use of the net proceeds from the sale of our securities offered hereby. Unless otherwise indicated in the applicable prospectus supplement, we currently intend to use the net proceeds from the sale of the securities under this prospectus for general corporate purposes; however, we do not currently have any specific uses of the net proceeds planned. General corporate purposes may include acquisitions, repayment of debt, investments, additions to working capital, capital expenditures, repurchases of common stock and advances to or investments in our subsidiaries. Pending the use of net proceeds, we intend to invest these funds in investment-grade, interest-bearing securities, or hold as cash. Unless set forth in an accompanying prospectus supplement, we will not receive any of the proceeds from the sale of securities by selling securityholders.

SELLING SECURITYHOLDERS

Information about selling securityholders, where applicable, will be set forth in a prospectus supplement, in an amendment to the registration statement of which this prospectus is a part, or in filings we make with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are incorporated by reference into this prospectus.

PLAN OF DISTRIBUTION

We and any selling securityholder may offer and sell the securities being offered hereby in one or more of the following ways from time to time:

•to or through underwriters;

•on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

•in the over-the-counter market;

•in transactions other than on these exchanges or systems or in the over-the-counter market;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•a combination of any of these methods of sale; and

•any other method permitted pursuant to applicable law.

We will identify the specific plan of distribution, including any underwriters, dealers, agents or other purchasers, persons or entities and any applicable compensation, in a prospectus supplement, in an amendment to the registration statement of which this prospectus is a part, or in other filings we make with the SEC under the Exchange Act, which are incorporated by reference.

DESCRIPTION OF SECURITIES

This prospectus contains summary descriptions of the common stock, preferred stock, debt securities and warrants that may be offered and sold from time to time. These summary descriptions are not meant to be complete descriptions of each security. Each time we offer securities with this prospectus, the terms of that offering, including the specific amounts, prices and terms of the securities offered, and, if applicable, information about the selling securityholders, will be contained in the applicable prospectus supplement and other offering materials relating to such offering or in other filings we make with the SEC under the Exchange Act, which are incorporated by reference.

DESCRIPTION OF CAPITAL STOCK

General

The following summary description of our capital stock is based on the provisions of the Delaware General Corporation Law (the “DGCL”), our restated certificate of incorporation, as amended, and our restated bylaws, as amended. This description does not purport to be complete and is qualified in its entirety by reference to the full text of the DGCL, as it may be amended from time to time, and to the terms of our restated certificate of incorporation and restated bylaws, as each may be amended from time to time, which are incorporated by reference as exhibits to the registration statement of which this prospectus is a part. See “Where You Can Find More Information.” As used in this “Description of Capital Stock,” the terms “ServiceNow, Inc.”, the “Company”, “we,” “our” and “us” refer to ServiceNow, Inc., a Delaware corporation, and do not, unless otherwise specified, include our subsidiaries.

Our authorized capital stock consists of 600,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock, par value $0.001 per share.

Common Stock

Each holder of common stock is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders. Our restated certificate of incorporation eliminates the right of stockholders to cumulate votes for the election of directors. Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of our common stock are entitled to receive dividends out of funds legally available if our board of directors, in its discretion, determines to issue dividends and only then at the times and in the amounts that our board of directors may determine.

Upon our dissolution, liquidation or winding-up, the assets legally available for distribution to our stockholders are distributable ratably among the holders of our common stock, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights and payment of liquidation preferences, if any, on any outstanding shares of preferred stock.

Our common stock is not entitled to preemptive rights and is not subject to conversion, redemption or sinking fund provisions.

The rights, preferences and privileges of holders of common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future.

Preferred Stock

This section describes the general terms and provisions of preferred stock that we are authorized to issue. An accompanying prospectus supplement will describe the specific terms of the shares of preferred stock offered through that prospectus supplement, as well as any general terms described in this section that will not apply to those shares of preferred stock. If there are differences between the prospectus supplement relating to a particular series of preferred stock and this prospectus, the prospectus supplement will control. We will file a copy of the certificate of amendment to our restated certificate of incorporation that contains the terms of each new series of preferred stock with the Secretary of the State of Delaware and with the SEC each time we issue a new series of preferred stock. Each such certificate of amendment will establish the number of shares included in a designated series and fix the designation, powers, privileges, preferences and rights of the shares of each series as well as any applicable qualifications, limitations or restrictions. You should refer to the applicable certificate of amendment as well as our restated certificate of incorporation before deciding to buy shares of our preferred stock as described in any accompanying prospectus supplement.

Our board of directors has the authority, without further action of the shareholders, to provide for the issuance of up to 10,000,000 shares of our preferred stock in multiple series and to fix the rights, preferences, privileges and restrictions thereof, including dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series.

The particular terms of any series of preferred stock will be described in the prospectus supplement relating to that series of preferred stock. Those terms may include:

•the designation of the series, which may be by distinguishing number, letter or title;

•the number of shares within the series;

•whether dividends are cumulative and, if cumulative, the dates from which dividends are cumulative;

•the rate of any dividends, any conditions upon which dividends are payable, and the dates of payment of dividends;

•whether the shares are redeemable, the redemption price and the terms of redemption;

•the amount payable for each share if we dissolve or liquidate;

•whether the shares are convertible or exchangeable, the price or rate of conversion or exchange, and the applicable terms and conditions;

•any restrictions on issuance of shares in the same series or any other series;

•the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights;

•the sinking fund provisions, if applicable, for the preferred stock;

•voting rights applicable to the series of preferred stock; and

•any other rights, priorities, preferences, restrictions or limitations of such series.

The right of a holder of preferred stock to receive payment in respect thereof upon any liquidation, dissolution or winding up of us will be subordinate to the rights of our general creditors.

Anti-Takeover Effects of Provisions of the Certificate of Incorporation, Bylaws and Other Agreements

Certain provisions of the DGCL, our restated certificate of incorporation and our restated bylaws may have the effect of delaying, deferring or discouraging another person from acquiring control of us.

Delaware Law

We are governed by the provisions of Section 203 of the DGCL regulating corporate takeovers. This section prevents some Delaware corporations, including us, from engaging, under some circumstances, in a business combination, which includes a merger or sale of at least 10% of the corporation’s assets with any interested stockholder, meaning a stockholder who, together with affiliates and associates, owns or, within three years prior to the determination of interested stockholder status, did own 15% or more of the corporation’s outstanding voting stock, unless:

•the transaction is approved by the board of directors prior to the time that the interested stockholder became an interested stockholder;

•upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

•at or subsequent to such time that the stockholder became an interested stockholder, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders by at least two-thirds of the outstanding voting stock not owned by the interested stockholder.

A Delaware corporation may “opt out” of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares. We do not plan to “opt out” of these provisions. The statute could prohibit or delay mergers or other takeover or change in control attempts and, accordingly, may discourage attempts to acquire us.

Certificate of Incorporation and Bylaw Provisions

Our restated certificate of incorporation and our restated bylaws include a number of provisions that may have the effect of deterring hostile takeovers or delaying or preventing changes in control, including the following:

•Board of Directors Vacancies. Our restated certificate of incorporation and our restated bylaws authorize only our board of directors to fill vacant directorships. In addition, the number of directors constituting our board of directors is set only by resolution adopted by a majority vote of our entire board of directors. These provisions prevent a stockholder from increasing the size of our board of directors and gaining control of our board of directors by filling the resulting vacancies with its own nominees.

•Stockholder Action; Special Meeting of Stockholders. Our restated certificate of incorporation provides that our stockholders may not take action by written consent, but may only take action at annual or special meetings of our stockholders. Stockholders are not permitted to cumulate their votes for the election of directors. Our restated bylaws further provide that special meetings of our stockholders may be called by the Chairperson of the Board, the Chief Executive Officer, the President, the Board acting pursuant to a resolution adopted by a majority of the total number of authorized directors, whether or not there exist any vacancies in previously authorized directorship, or one or more stockholders holding at least 15% of our outstanding common stock for at least one year.

•Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our restated bylaws provide advance notice procedures for stockholders seeking to bring business before our annual meeting of stockholders, or to nominate candidates for election as directors at our annual meeting of stockholders. Our restated bylaws also specify certain requirements regarding the form and content of a stockholder’s notice. These provisions may preclude our stockholders from bringing matters before our annual meeting of stockholders or from making nominations for directors at our annual meeting of stockholders (though our restated bylaws have implemented stockholder proxy access).

•Issuance of Undesignated Preferred Stock. Our board of directors has the authority, without further action by the stockholders, to issue up to 10,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time by the board of directors. The existence of authorized but unissued shares of preferred stock enables our board of directors to render more difficult

or to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise.

•Super Majority Vote to Amend Certificate of Incorporation and Bylaws. Our restated certificate of incorporation provides that if two-thirds of our board of directors approves the amendment of our certificate of incorporation and bylaws, or any provisions thereof, then such amendment need only be approved by stockholders holding a majority of our outstanding shares of common stock entitled to vote. Otherwise, such amendment must be approved by stockholders holding two-thirds of our outstanding shares of common stock entitled to vote.

Listing

Our common stock is listed on the New York Stock Exchange under the symbol “NOW.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Trust Company, NA.

DESCRIPTION OF DEBT SECURITIES

We may offer debt securities in one or more series, which may be unsubordinated debt securities or subordinated debt securities and which may be convertible into another security, and which may be secured or unsecured.

The following description briefly sets forth certain general terms and provisions of the debt securities. The particular terms of the debt securities offered by any prospectus supplement and the extent, if any, to which the following general terms and provisions may apply to the debt securities, will be described in an accompanying prospectus supplement. Unless otherwise specified in an accompanying prospectus supplement, our debt securities will be issued in one or more series under an indenture, dated as of August 11, 2020, between us and Computershare Trust Company, N.A., as successor to Wells Fargo Bank, National Association, as trustee (the “Trustee”), as supplemented by the first supplemental indenture, dated August 11, 2020, between us and the Trustee. The indenture and the first supplemental indenture are incorporated by reference as an exhibit to the registration statement of which this prospectus forms a part. The terms of the debt securities will include those set forth in the indenture and those made a part of the indenture by the Trust Indenture Act of 1939 (“TIA”). You should read the summary below, any accompanying prospectus supplement and the provisions of the indenture in their entirety before investing in our debt securities. All capitalized terms have the meanings specified in the indentures.

For purposes of this section of this prospectus, references to “we,” “us” and “our” are to ServiceNow, Inc. and not to any of its subsidiaries.

General

The indentures do not limit the amount of debt securities that we may issue. The securities may be issued in one or more series. All securities of a series shall be identical except as may be set forth in a Board Resolution, a supplemental indenture or an Officer’s Certificate detailing the adoption of the terms thereof pursuant to the authority granted under a Board Resolution. In the case of securities of a series to be issued from time to time, the Board Resolution, Officer’s Certificate or supplemental indenture may provide for the method by which specified terms (such as interest rate, Stated Maturity, record date or date from which interest shall accrue) are to be determined. Securities may differ between series in respect of any matters, provided, that all series of securities shall be equally and ratably entitled to the benefits of the indenture.

The prospectus supplement relating to any series of debt securities that we may offer will contain the specific terms of the debt securities. These terms may include, among others, the following:

•the title and aggregate principal amount of the debt securities and any limit on the aggregate principal amount of such series;

•any applicable subordination provisions for any subordinated debt securities;

•the maturity date(s) or method for determining same;

•the interest rate(s) or the method for determining same;

•the dates on which interest will accrue or the method for determining dates on which interest will accrue and dates on which interest will be payable and whether interest will be payable in cash, additional securities or some combination thereof;

•whether the debt securities are convertible or exchangeable into other securities and any related terms and conditions;

•redemption or early repayment provisions;

•authorized denominations;

•if other than the principal amount, the principal amount of debt securities payable upon acceleration;

•place(s) where payment of principal and interest may be made, where debt securities may be presented and where notices or demands upon the company may be made;

•the form or forms of the debt securities of the series including such legends as may be required by applicable law;

•whether the debt securities will be issued in whole or in part in the form of one or more global securities and the date as of which the securities are dated if other than the date of original issuance;

•whether the debt securities are secured and the terms of such security;

•the amount of discount or premium, if any, with which the debt securities will be issued;

•any covenants applicable to the particular debt securities being issued;

•any additions or changes in the defaults and events of default applicable to the particular debt securities being issued;

•the guarantors of each series, if any, and the extent of the guarantees (including provisions relating to seniority, subordination and release of the guarantees), if any;

•the currency, currencies or currency units in which the purchase price for, the principal of and any premium and any interest on, the debt securities will be payable;

•the time period within which, the manner in which and the terms and conditions upon which we or the holders of the debt securities can select the payment currency;

•our obligation or right to redeem, purchase or repay debt securities under a sinking fund, amortization or analogous provision;

•any restriction or conditions on the transferability of the debt securities;

•the provisions, if any, relating to any collateral provided for the securities of the series;

•provisions granting special rights to holders of the debt securities upon occurrence of specified events;

•additions or changes relating to compensation or reimbursement of the trustee of the series of debt securities;

•the names of any trustees, depositories, interest rate calculation agents, exchange rate calculation agents or other agents with respect to the debt securities;

•provisions relating to the modification of the indenture both with and without the consent of holders of debt securities issued under the indenture and the execution of supplemental indentures for such series; and

•any other terms of the debt securities (which terms shall not be inconsistent with the provisions of the TIA, but may modify, amend, supplement or delete any of the terms of the indenture with respect to such series of debt securities).

United States federal income tax consequences and special considerations, if any, applicable to any such series will be described in an accompanying prospectus supplement.

Global Securities

Unless we inform you otherwise in an accompanying prospectus supplement, the debt securities of a series may be issued in whole or in part in the form of one or more global securities that will be deposited with, or on behalf of, a depositary identified in an accompanying prospectus supplement. Unless and until a global security is exchanged in whole or in part for the individual debt securities, a global security may not be transferred except as a whole by the depositary for such global security to a nominee of such depositary or by a nominee of such depositary to such depositary or another nominee of such depositary or by such depositary or any such nominee to a successor of such depositary or a nominee of such successor.

Governing Law

The indenture and the debt securities shall be construed in accordance with and governed by the laws of the State of New York.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of shares of our common stock, shares of preferred stock or our debt securities. We may issue warrants independently or together with other securities, and they may be attached to or separate from the other securities. Each series of warrants will be issued under a separate warrant agreement that we will enter into with a bank or trust company, as warrant agent, as detailed in an accompanying prospectus supplement. The warrant agent will act solely as our agent in connection with the warrants and will not assume any obligation, or agency or trust relationship, with you.

The prospectus supplement relating to a particular issue of warrants will describe the terms of those warrants, including, when applicable:

•the offering price;

•the currency or currencies, including composite currencies, in which the purchase price and/or exercise price of the warrants may be payable;

•the number of warrants offered;

•the exercise price and the amount of securities you will receive upon exercise;

•the procedure for exercise of the warrants and the circumstances, if any, that will cause the warrants to be automatically exercised;

•the rights, if any, we have to redeem the warrants;

•the date on which the right to exercise the warrants will commence and the date on which the warrants will expire;

•the name of the warrant agent; and

•any other material terms of the warrants.

After warrants expire they will become void. The prospectus supplement may provide for the adjustment of the exercise price of the warrants.

Warrants may be exercised at the appropriate office of the warrant agent or any other office indicated in an accompanying prospectus supplement. Before the exercise of warrants, holders will not have any of the rights of holders of the securities purchasable upon exercise and will not be entitled to payments made to holders of those securities.

The description in an accompanying prospectus supplement of any warrants we offer will not necessarily be complete and will be qualified in its entirety by reference to the applicable warrant agreement, which will be filed with the SEC if we offer warrants. For more information on how you can obtain copies of any warrant agreement if we offer warrants, see “Where You Can Find More Information.” We urge you to read the applicable warrant agreement and any accompanying prospectus supplement in their entirety.

LEGAL MATTERS

Unless otherwise stated in any accompanying prospectus supplement, Skadden, Arps, Slate, Meagher & Flom LLP, will opine as to the legality of the securities offered under this prospectus. As appropriate, legal counsel representing any underwriters, dealers, agents or selling securityholder will be named in the applicable prospectus supplement.

EXPERTS

The financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Item 9A. Management’s Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to the Annual Report on Form 10-K of ServiceNow, Inc. for the year ended December 31, 2023 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus certain information required to be included. This means that we can disclose important information to you by referring you to those documents where the information resides. The information we incorporate by reference is considered a part of this prospectus, and later information we file with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, on or after the date of this prospectus (other than information “furnished” under any current report or otherwise “furnished” to the SEC, and XBRL-related information, unless otherwise stated) until the termination of the registration statement of which this prospectus is a part:

•Our Annual Report on Form 10-K filed with the SEC on January 25, 2024 for the year ended December 31, 2023; •The information specifically incorporated by reference into our Annual Report on Form 10-K from our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 4, 2024; •Our Quarterly Report on Form 10-Q filed with the SEC on May 6, 2024 for the quarter ended March 31, 2024; and •The description of our common stock as set forth in our registration statement on Form 8-A (File No. 001-35580), which was filed on June 19, 2012 pursuant to Section 12 of the Exchange Act, as updated by Exhibit 4.5 to our Annual Report on Form 10-K filed with the SEC on February 3, 2022 for the year ended December 31, 2021, including any subsequent amendments or reports filed for the purpose of updating such description. You may obtain any of the documents incorporated by reference through the SEC or the SEC’s website as described above. You may also obtain copies of these documents, other than exhibits (except to the extent such exhibits are specifically incorporated by reference into such documents), free of charge by contacting our investor relations department at our principal executive offices located at 2225 Lawson Lane, Santa Clara, California 95054, telephone number (408) 501-8550, or through our website at www.servicenow.com. Information contained on our website is not a part of this prospectus and is not incorporated by reference into this prospectus.

WHERE YOU CAN FIND MORE INFORMATION

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy, registration and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

This prospectus is part of a registration statement on Form S-3 filed by us with the SEC under the Securities Act of 1933, as amended (the “Securities Act”). As permitted by the SEC, this prospectus does not contain all the information in the registration statement filed with the SEC. For a more complete understanding of any offering made under this prospectus and any applicable prospectus supplement, you should refer to the complete registration statement on Form S-3 that may be obtained from the locations described under “Information Incorporated by Reference” above. Statements contained in this prospectus or in any prospectus supplement about the contents of any contract or other document are not necessarily complete. If we have filed any contract or other document as an exhibit to the registration statement or any other document incorporated by reference in the registration statement, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract or other document is qualified in its entirety by reference to the actual document.

SERVICENOW, INC.

Common Stock

Preferred Stock

Debt Securities

Warrants

PROSPECTUS

May 6, 2024

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 14. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

The following table sets forth the estimated costs and expenses, other than underwriting discounts, payable by the registrant in connection with the offering of the securities being registered.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Amount

to be Paid |

| SEC registration fee | $ * |

| Blue Sky, qualification fees and expenses | ** |

| FINRA filing fees | ** |

| The New York Stock Exchange listing fee | ** |

| Transfer Agent and registrar fees and expenses | ** |

| Printing costs | ** |

| Legal fees and expenses | ** |

| Trustee fees and expenses | ** |

| Accounting fees and expenses | ** |

| Warrant agent fees and expenses | ** |

| Miscellaneous costs | ** |

| Total | $ ** |

_____________________

* In accordance with Rules 456(b) and 457(r) of the Securities Act, we are deferring payment of the registration fee for the securities offered.

** To be provided as applicable by amendment or in a filing with the SEC pursuant to the Exchange Act, and incorporated herein by reference.

ITEM 15. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers under certain circumstances and subject to certain limitations. The terms of Section 145 of the Delaware General Corporation Law are sufficiently broad to permit indemnification under certain circumstances for liabilities, including reimbursement of expenses incurred, arising under the Securities Act.

As permitted by the Delaware General Corporation Law, the Registrant’s restated certificate of incorporation contains provisions that eliminate the personal liability of its directors for monetary damages for any breach of fiduciary duties as a director, except liability for the following:

•any breach of the director’s duty of loyalty to the Registrant or its stockholders;

•acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

•under Section 174 of the Delaware General Corporation Law (regarding unlawful dividends and stock purchases); or

•any transaction from which the director derived an improper personal benefit.

As permitted by the Delaware General Corporation Law, the Registrant’s restated bylaws provide that:

•the Registrant is required to indemnify its directors and executive officers to the fullest extent permitted by the Delaware General Corporation Law, subject to very limited exceptions;

•the Registrant may indemnify its other employees and agents as set forth in the Delaware General Corporation Law;

•the Registrant is required to advance expenses, as incurred, to its directors and executive officers in connection with a legal proceeding to the fullest extent permitted by the Delaware General Corporation Law, subject to very limited exceptions; and

•the rights conferred in the bylaws are not exclusive.

The Registrant has entered into separate indemnification agreements with its directors and executive officers to provide these directors and executive officers additional contractual assurances regarding the scope of the indemnification set forth in the Registrant’s restated certificate of incorporation, as amended, and restated bylaws and to provide additional procedural protections. The indemnification provisions in the Registrant’s restated certificate of incorporation, as amended, restated bylaws, and the indemnification agreements entered into between the Registrant and each of its directors and executive officers may be sufficiently broad to permit indemnification of the Registrant’s directors and executive officers for liabilities arising under the Securities Act.

The Registrant currently carries liability insurance for its directors and officers.

ITEM 16. EXHIBITS

The following exhibits are filed as part of this registration statement:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Incorporated by Reference |

| Exhibit Number | Exhibit Description | Form | File No. | Exhibit | Filing Date | Filed Herewith |

| 1.1* | Form of Underwriting Agreement | | | | | |

| | 8-K | 001-35580 | 3.1 | 6/9/2021 | |

| | 8-K | 001-35580 | 3.2 | 6/9/2021 | |

| | 8-K | 001-35580 | 4.1 | 8/11/2020 | |

| | 8-K | 001-35580 | 4.2 | 8/11/2020 | |

| | S-1/A | 333-180486 | 4.1 | 6/19/2012 | |

| 4.6* | Form of Preferred Stock Certificate | | | | | |

| 4.7* | Form of Warrant Agreement (including Form of Warrant Certificate) | | | | | |

| 4.8* | Form of Debt Securities | | | | | |

| | 10-K | 001-35580 | 4.5 | 2/3/2022 | |

| | | | | | X |

| | | | | | X |

| | | | | | X |

| | | | | | X |

| | | | | | X |

| | | | | | X |

_____________________

* To be filed by amendment, as an exhibit to a report on Form 8-K under the Exchange Act or by other applicable filing with the SEC, and incorporated herein by reference.

ITEM 17. UNDERTAKINGS

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that subparagraphs (i),(ii), and (iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(i) each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however , that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(6) That, for purposes of determining any liability under the Securities Act, each filing of the Registrant's annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

(8) To file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the SEC under Section 305(b)(2) of the Trust Indenture Act.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Santa Clara, State of California, on May 6, 2024. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| SERVICENOW, INC. | |

| | | | |

| By: | | /s/ William R. McDermott | |

| | | William R. McDermott Chief Executive Officer | |

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints William R. McDermott and Gina Mastantuono, and each of them, as his or her true and lawful attorneys-in-fact and agents, each with the full power of substitution, for him or her and in his or her name, place or stead, in any and all capacities, to sign any and all amendments to this registration statement (including post-effective amendments) to this Registration Statement on Form S-3, and to file the same, with all exhibits thereto and documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or their or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons on behalf of the Registrant in the capacities and on the dates indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

| /s/ William R. McDermott | | Chairman and Chief Executive Officer (Principal Executive Officer) | | May 6, 2024 |

| William R. McDermott | | | |

| | | | |

| /s/ Gina Mastantuono | | Chief Financial Officer (Principal Financial Officer) | | May 6, 2024 |

| Gina Mastantuono | | | |

| | | | |

| /s/ Kevin T. McBride | | Chief Accounting Officer (Principal Accounting Officer) | | May 6, 2024 |

| Kevin T. McBride | | | |

| | | | |

| /s/ Frederic B. Luddy | | Director | | May 6, 2024 |

| Frederic B. Luddy | | | | |

| | | | |

| /s/ Deborah Black | | Director | | May 6, 2024 |

| Deborah Black | | | | |

| | | | |

| /s/ Susan L. Bostrom | | Director | | May 6, 2024 |

| Susan L. Bostrom | | | | |

| | | | |

| /s/ Teresa Briggs | | Director | | May 6, 2024 |

| Teresa Briggs | | | | |

| | | | |

| /s/ Jonathan C. Chadwick | | Director | | May 6, 2024 |

| Jonathan C. Chadwick | | | | |

| | | | |

| /s/ Paul E. Chamberlain | | Director | | May 6, 2024 |

| Paul E. Chamberlain | | | | |

| /s/ Lawrence J. Jackson, Jr. | | Director | | May 6, 2024 |

| Lawrence J. Jackson, Jr. | | | | |

| /s/ Jeffrey A. Miller | | Director | | May 6, 2024 |

| Jeffrey A. Miller | | | | |

| /s/ Joseph M. Quinlan | | Director | | May 6, 2024 |

| Joseph M. Quinlan | | | | |

| /s/ Anita M. Sands | | Director | | May 6, 2024 |

| Anita M. Sands | | | | |

| | | | | |

| May 6, 2024 |

| |

ServiceNow, Inc. 2225 Lawson Lane Santa Clara, CA 95054 | |

| | | | | | | | |

| Re: | ServiceNow, Inc. |

| | Registration Statement on Form S-3 |

Ladies and Gentlemen:

We have acted as special counsel to ServiceNow, Inc., a Delaware corporation (the “Company”), in connection with the registration statement on Form S-3 (the “Registration Statement”) to be filed on the date hereof by the Company with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement relates to the issuance and sale by the Company from time to time, pursuant to Rule 415 of the General Rules and Regulations of the Commission promulgated under the Securities Act (the “Rules and Regulations”), of (i) shares of common stock, par value $0.001 per share, of the Company (“Common Stock”), (ii) shares of preferred stock, par value $0.001 per share, of the Company (“Preferred Stock”), which may be issued in one or more series, (iii) debt securities of the Company (“Debt Securities”), which may be issued in one or more series under the indenture (the “Indenture”), dated as of August 11, 2020, between the Company and Computershare Trust Company, N.A., as successor to Wells Fargo Bank, National Association, as trustee, which is incorporated by reference as an exhibit to the Registration Statement, and any supplemental indenture thereto, (iv) warrants to purchase shares of Common Stock, shares of Preferred Stock or Debt Securities (“Warrants”), which may be issued pursuant

ServiceNow, Inc.

May 6, 2024

Page 2

to one or more warrant agreements (each, a “Warrant Agreement”) proposed to be entered into by the Company and one or more warrant agents to be named therein, and (v) such indeterminate number of shares of Common Stock or Preferred Stock and indeterminate amount of Debt Securities as may be issued upon conversion, exchange or exercise, as applicable, of any Preferred Stock, Debt Securities or Warrants, including such shares of Common Stock or Preferred Stock as may be issued pursuant to anti-dilution adjustments determined at the time of offering (collectively, “Indeterminate Securities”). The Common Stock, Preferred Stock, Debt Securities, Warrants and Indeterminate Securities offered pursuant to the Registration Statement are collectively referred to herein as the “Securities.”

This opinion is being furnished in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act.

In rendering the opinions stated herein, we have examined and relied upon the following:

(a)the Registration Statement;

(b)an executed copy of the Indenture, incorporated by reference as an exhibit to the Registration Statement;

(c)an executed copy of a certificate of Russell S. Elmer, Secretary of the Company, dated the date hereof (the “Secretary’s Certificate”);

(d)a copy of the Company’s Restated Certificate of Incorporation, as amended, certified by the Secretary of State of the State of Delaware as of May 6, 2024, and certified pursuant to the Secretary’s Certificate;

(e)a copy of the Company’s restated bylaws, as amended and in effect as of the date hereof and certified pursuant to the Secretary’s Certificate; and

(f)a copy of certain resolutions of the Board of Directors of the Company, adopted on April 23, 2024, certified pursuant to the Secretary’s Certificate.

We have also examined originals or copies, certified or otherwise identified to our satisfaction, of such records of the Company and such agreements, certificates and receipts of public officials, certificates of officers or other representatives of the Company and others, and such other documents as we have deemed necessary or appropriate as a basis for the opinions stated below.

In our examination, we have assumed the genuineness of all signatures, including electronic signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic, certified or photocopied copies, and the authenticity of the originals of such copies. As to any facts relevant to the opinions stated herein

ServiceNow, Inc.

May 6, 2024

Page 3

that we did not independently establish or verify, we have relied upon statements and representations of officers and other representatives of the Company and others and of public officials, including those in the Secretary’s Certificate.

We do not express any opinion with respect to the laws of any jurisdiction other than (i) the laws of the State of New York, and (ii) the General Corporation Law of the State of Delaware (the “DGCL”) (all of the foregoing being referred to as “Opined-on Law”).

As used herein, “Transaction Documents” means the Indenture and any supplemental indentures and officer’s certificates establishing the terms of the Debt Securities pursuant thereto, the Warrant Agreements and any applicable underwriting or purchase agreement.

The opinions stated in paragraphs 1 through 4 below presume that all of the following (collectively, the “general conditions”) shall have occurred prior to the issuance of the Securities referred to therein: (i) the Registration Statement, as finally amended (including all necessary post-effective amendments), has become effective under the Securities Act; (ii) an appropriate prospectus supplement or term sheet with respect to such Securities has been prepared, delivered and filed in compliance with the Securities Act and the applicable Rules and Regulations; (iii) the applicable Transaction Documents shall have been duly authorized, executed and delivered by the Company and the other parties thereto, including, if such Securities are to be sold or otherwise distributed pursuant to a firm commitment underwritten offering, the underwriting agreement or purchase agreement with respect thereto; (iv) the Board of Directors of the Company, including any duly authorized committee thereof, shall have taken all necessary corporate action to approve the issuance and sale of such Securities and related matters and appropriate officers of the Company have taken all related action as directed by or under the direction of the Board of Directors of the Company; and (v) the terms of the applicable Transaction Documents and the issuance and sale of such Securities have been duly established in conformity with the certificate of incorporation of the Company so as not to violate any applicable law, the certificate of incorporation of the Company or the bylaws of the Company, or result in a default under or breach of any agreement or instrument binding upon the Company, and so as to comply with any requirement or restriction imposed by any court or governmental body having jurisdiction over the Company.

Based upon the foregoing and subject to the qualifications and assumptions stated herein, we are of the opinion that:

1.With respect to any shares of Common Stock offered by the Company, including any Indeterminate Securities constituting Common Stock (the “Offered Common Stock”), when (a) the general conditions shall have been satisfied, (b) if the Offered Common Stock is to be certificated, certificates in the form required under the DGCL representing the shares of Offered Common Stock are duly executed and countersigned and (c) the shares of Offered Common Stock are registered in the Company’s share registry and delivered upon payment of the agreed-upon consideration therefor, the shares of Offered Common Stock, when

ServiceNow, Inc.

May 6, 2024

Page 4

issued and sold or otherwise distributed in accordance with the provisions of the applicable Transaction Document, will be duly authorized by all requisite corporate action on the part of the Company under the DGCL and validly issued, fully paid and nonassessable, provided that the consideration therefor is not less than $0.001 per share of Common Stock.

2.With respect to the shares of any series of Preferred Stock offered by the Company, including any Indeterminate Securities constituting Preferred Stock of such series (the “Offered Preferred Stock”), when (a) the general conditions shall have been satisfied, (b) the Board of Directors of the Company, or a duly authorized committee thereof, has duly adopted a Certificate of Designations for the Offered Preferred Stock in accordance with the DGCL (the “Certificate”), (c) the filing of the Certificate with the Secretary of State of the State of Delaware has duly occurred, (d) if the Offered Preferred Stock is to be certificated, certificates in the form required under the DGCL representing the shares of Offered Preferred Stock are duly executed and countersigned and (e) the shares of Offered Preferred Stock are registered in the Company’s share registry and delivered upon payment of the agreed-upon consideration therefor, the shares of Offered Preferred Stock, when issued and sold or otherwise distributed in accordance with the provisions of the applicable Transaction Document, will be duly authorized by all requisite corporate action on the part of the Company under the DGCL and validly issued, fully paid and nonassessable, provided that the consideration therefor is not less than $0.001 per share of Preferred Stock.

3.With respect to any series of Debt Securities offered by the Company, including any Indeterminate Securities constituting Debt Securities of such series (the “Offered Debt Securities”), when (a) the general conditions shall have been satisfied, (b) a Form T-1 for the trustee has been filed under the Trust Indenture Act of 1939, (c) the issuance, sale and terms of the Offered Debt Securities and related matters have been approved and established in conformity with the applicable Transaction Documents and (d) the certificates evidencing the Offered Debt Securities have been issued in a form that complies with the provisions of the applicable Transaction Documents and have been duly executed and authenticated in accordance with the provisions of the Indenture and any other applicable Transaction Documents and issued and sold or otherwise distributed in accordance with the provisions of the applicable Transaction Document upon payment of the agreed-upon consideration therefor, the Offered Debt Securities will constitute valid and binding obligations of the Company, enforceable against the Company in accordance with their respective terms under the laws of the State of New York.

4.With respect to any Warrants offered by the Company (the “Offered Warrants”), when (a) the general conditions shall have been satisfied, (b) the Common Stock, Preferred Stock and/or Debt Securities for which the Offered Warrants are exercisable have been duly authorized for issuance by the Company and (c) certificates evidencing the Offered Warrants have been duly executed, delivered and countersigned in accordance with the provisions of the applicable Warrant Agreement, the Offered Warrants, when issued and sold or otherwise distributed in accordance with the provisions of the applicable Transaction Document upon payment of the agreed-upon consideration therefor, will constitute valid and binding

ServiceNow, Inc.

May 6, 2024

Page 5

obligations of the Company, enforceable against the Company in accordance with their respective terms under the laws of the State of New York.

The opinions stated herein are subject to the following qualifications:

(a) we do not express any opinion with respect to the effect on the opinions stated herein of any bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer, preference and other similar laws and governmental orders affecting creditors’ rights generally, and the opinions stated herein are limited by such laws and orders and by general principles of equity (regardless of whether enforcement is sought in equity or at law);

(b) we do not express any opinion with respect to any law, rule or regulation that is applicable to any party to any of the Transaction Documents or the transactions contemplated thereby solely because such law, rule or regulation is part of a regulatory regime applicable to any such party or any of its affiliates as a result of the specific assets or business operations of such party or such affiliates;

(c) except to the extent expressly stated in the opinions contained herein, we have assumed that each of the Transaction Documents constitutes the valid and binding obligation of each party to such Transaction Document, enforceable against such party in accordance with its terms;

(d) we do not express any opinion with respect to the enforceability of any provision contained in any Transaction Document relating to any indemnification, contribution, non-reliance, exculpation, release, limitation or exclusion of remedies, waiver or other provisions having similar effect that may be contrary to public policy or violative of federal or state securities laws, rules or regulations, or to the extent any such provision purports to, or has the effect of, waiving or altering any statute of limitations;

(e) we do not express any opinion with respect to the enforceability of any provision of any Transaction Document to the extent that such section purports to bind the Company to the exclusive jurisdiction of any particular federal court or courts;

(f) we call to your attention that irrespective of the agreement of the parties to any Transaction Document, a court may decline to hear a case on grounds of forum non conveniens or other doctrine limiting the availability of such court as a forum for resolution of disputes; in addition, we call to your attention that we do not express any opinion with respect to the subject matter jurisdiction of the federal courts of the United States of America in any action arising out of or relating to any Transaction Document;

(g) we have assumed that any agent of service will have accepted appointment as agent to receive service of process and call to your attention that we do not express any opinion if and to the extent such agent shall resign such appointment. Further, we do not express any opinion with respect to the irrevocability of the designation of such agent to receive service of process;

ServiceNow, Inc.

May 6, 2024

Page 6

(h) we have assumed that the choice of New York law to govern the Indenture and any supplemental indenture thereto is a valid and legal provision;

(i) we have assumed that the laws of the State of New York will be chosen to govern any Warrant Agreements and that such choice is and will be a valid and legal provision; and

(j) to the extent that any opinion relates to the enforceability of the choice of New York law and choice of New York forum provisions contained in any Transaction Document, the opinions stated herein are subject to the qualification that such enforceability may be subject to, in each case, (i) the exceptions and limitations in New York General Obligations Law sections 5-1401 and 5-1402 and (ii) principles of comity and constitutionality;

In addition, in rendering the foregoing opinions we have assumed that:

(a)neither the execution and delivery by the Company of the Transaction Documents nor the performance by the Company of its obligations thereunder, including the issuance and sale of the applicable Securities: (i) constitutes or will constitute a violation of, or a default under, any lease, indenture, agreement or other instrument to which the Company or its property is subject, (ii) contravenes or will contravene any order or decree of any governmental authority to which the Company or its property is subject, or (iii) violates or will violate any law, rule or regulation to which the Company or its property is subject (except that we do not make the assumption set forth in this clause (iii) with respect to the Opined-on Law); and

(b)neither the execution and delivery by the Company of the Transaction Documents nor the performance by the Company of its obligations thereunder, including the issuance and sale of the applicable Securities, requires or will require the consent, approval, licensing or authorization of, or any filing, recording or registration with, any governmental authority under any law, rule or regulation of any jurisdiction.

We hereby consent to the reference to our firm under the heading “Legal Matters” in the prospectus forming part of the Registration Statement. We also hereby consent to the filing of this opinion with the Commission as an exhibit to the Registration Statement. In giving this consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the Rules and Regulations. This opinion is expressed as of the date hereof unless otherwise expressly stated, and we disclaim any undertaking to advise you of any subsequent changes in the facts stated or assumed herein or of any subsequent changes in applicable laws.

Very truly yours,