SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of February,

2024

Commission File Number 001-41129

Nu Holdings Ltd.

(Exact name of registrant as specified

in its charter)

Nu Holdings Ltd.

(Translation of Registrant's

name into English)

Campbells Corporate Services

Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1 345 949 2648

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F (X) Form 40-F

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes No (X)

2

Contents

KPMG Auditores Independentes Ltda.

105 Arquiteto Olavo Redig de Campos – 12th floor

- Tower A

Post office 79518 - CEP 04707-970 - São Paulo/SP

- Brazil

Telephone + 55 (11) 3940-1500

kpmg.com.br

Independent

Auditors Report on the Audit of the Consolidated Financial Statements

To the Shareholders

and Board of Directors of Nu Holdings Ltd.

Cayman Islands

We have audited the consolidated financial

statements of Nu Holdings Ltd. (“the Company”), which comprise the consolidated statement of financial position as

of December 31, 2023 the consolidated statements of profit or loss and other comprehensive income, changes in equity and cash flows for

the year then ended, and notes, comprising materials accounting policies and other explanatory information.

In our opinion, the accompanying consolidated

financial statements give a true and fair view of the consolidated financial position of the Nu Holdings Ltd. as of December 31, 2023,

and of its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with International

Financial Reporting Standards (IFRS).

We conducted our audit in accordance

with Brazilian and International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the

Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent

of the Company and its subsidiaries in accordance with the relevant ethical principles provided for in the Accountant's Code of Professional

Ethics and in the professional standards issued by the Federal Accounting Council, and we have fulfilled our other ethical responsibilities

in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a

basis for our opinion.

| | |

| KPMG Auditores Independentes Ltda, uma sociedade simples brasileira e firma-membro da rede KPMG de firmas-membro independentes e afiliadas à KPMG International Cooperative (“KPMG International”), uma entidade suíça. | KPMG Auditores Independentes Ltda, a Brazilian entity and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. |

|

|

| Allowance for expected credit losses |

| See Notes 4(a), 5(a), 7, 13 and 14 to the consolidated financial statements |

| Key Audit Matter |

How our audit approached this matter |

|

As of December 31, 2023, the Company has allowance for expected

credit losses (ECL) related to amounts receivable from credit cards and loans to customers.

The Company recognizes an ECL for the contracts that have experienced

a significant increase in credit risk (SICR) subsequent to recognition or are credit impaired (stage 2 and stage 3, respectively), and

a twelve-month ECL for all other contracts (stage 1).

To calculate ECL the Company segregates the portfolio of amounts

receivable from credit cards and loans to customers based on shared credit risk characteristics, determined by internal scoring models

and uses the methodology of the probability of default (PD), the loss given default (LGD) and the exposure at default (EAD), as well as

consideration of elements of prevision as unused limits, macroeconomic environment and the impact of changes in future macroeconomic scenarios,

including market expectations of Gross Domestic Product (GDP), inflation rate, unemployment rate and interest rate (Selic).

We consider the measurement of the allowance for expected credit

losses related to receivables from credit cards and loans to customers as a key audit matter, since it involves significant measurement

uncertainties, as a result of the complexity of the models and the subjectivity of the assumptions, specifically: (i) the general methodology

of allowance for expected credit losses, including the methods and models used to estimate the PDs, EADs and LGDs and their respective

assumptions, as well as the selection of macro variable assumptions incorporated into the calculation; and (ii) identification of an SICR

(stage 2) and credit impaired exposures (stage 3). |

Our audit procedures included, but were not limited

to:

- Evaluation of the design and operational effectiveness,

by sampling, of relevant internal controls, including controls related to the models, assumptions and methodology used in measuring the

allowance for expected credit losses.

- Assessment, with the involvement of our professionals

with specialized skills and knowledge in credit risk:

(i) the general methodology for calculating the allowance

for expected credit losses.

(ii) of models and modeling techniques by inspecting

model documentation to determine whether models are suitable for their intended use.

(iii) the recalculation of PD, EAD and LGD estimates

using the Company's historical data and forward-looking information.

(iv) the relevance of macroeconomic variables considered

in future scenarios through regression analysis and historical correlation with these indicators.

(v) testing the accuracy of the allocation of stages

according to the Company's criteria through independent re-execution of the allocation, by sampling; and

(vi) the recalculation of the provision for expected

credit losses, by sampling.

- Assessment whether the disclosures in the consolidated

financial statements consider all relevant information.

Based on the evidence obtained through the procedures summarized

above, we consider the measurement of the allowance for expected credit losses to be acceptable, as well as the respective disclosures,

in the context of the consolidated financial statements taken as a whole, referring to the year ended December 31, 2023.

|

| | |

| KPMG Auditores Independentes Ltda, uma sociedade simples brasileira e firma-membro da rede KPMG de firmas-membro independentes e afiliadas à KPMG International Cooperative (“KPMG International”), uma entidade suíça. | KPMG Auditores Independentes Ltda, a Brazilian entity and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. |

| Assessment of the recoverable amount of goodwill |

| See Notes 1, 4(l), 5(c) and 18 (ii) to the consolidated financial statements |

| Key Audit Matter |

How our audit approached this matter |

|

On December 31, 2023, the Company

has intangible assets, which comprise goodwill from investment acquisitions, for which the Company performs impairment tests at least

annually or when there are events or circumstances that indicate that the carrying amount exceeds its fair value. The recoverable amounts

of Cash Generating Units (CGUs) are calculated based on their value in use, determined by discounting expected future cash flows to be

generated by the continued use of the CGUs assets and their final disposal.

Calculating the value in use

of CGUs requires the application of methodology and the use of data and significant assumptions used in evaluation models, including discount

rate and future growth rate. Future growth assumptions include the projected growth rate and long-term inflation expectations.

We consider the assessment of

the recoverable value of goodwill as a key audit matter, since there is subjectivity and complexity in evaluate the methodology, data

and significant assumptions used in the assessment of recoverable value of goodwill recorded in the Company’s financial statements. |

Our audit procedures included,

but were not limited to:

- Evaluation of the design and

operational effectiveness of relevant internal controls, including controls related to (i) review of the budget process; (ii) selection,

review and approval of the main assumptions used in the analysis; and (iii) review of the calculation methodology for carrying out the

impairment test.

- Evaluation, with the involvement

of our corporate finance specialists with knowledge and experience in the sector:

(i) the methodology, data and

assumptions used to estimate the value in use, comparing it with evaluation practices generally accepted in the market.

(iii) adherence to revised projections

in relation to realized cash flows (backtest); and

(iv) the mathematical precision

of present value calculations.

- Assessment whether the disclosures

in the consolidated financial statements consider all relevant information.

Based on the evidence obtained

through the procedures summarized above, we consider the assessment of the recoverable amount of goodwill acceptable, as well as the respective

disclosures, in the context of the consolidated financial statements taken as a whole, for the year ended December 31, 2023. |

| Responsibilities of Management and Those Charged with Governance for the consolidated Financial Statements |

Management is responsible for the

preparation and fair presentation of the consolidated financial statements in accordance with IFRS, and for such internal control as management

determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether

due to fraud or error.

In preparing the consolidated financial

statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable,

matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company

and its subsidiaries or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are

responsible for overseeing the Company’s and its subsidiaries financial reporting process.

| | |

| KPMG Auditores Independentes Ltda, uma sociedade simples brasileira e firma-membro da rede KPMG de firmas-membro independentes e afiliadas à KPMG International Cooperative (“KPMG International”), uma entidade suíça. | KPMG Auditores Independentes Ltda, a Brazilian entity and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. |

| Auditors’ Responsibilities for the Audit of the consolidated Financial Statements |

Our objectives are to obtain reasonable

assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or

error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not

a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can

arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence

the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit

in accordance with ISAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

| · | Identify

and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform

audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion.

The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve

collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

| · | Obtain

an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances,

but not for the purpose of expressing an opinion on the effectiveness of the Company’s and its subsidiaries internal control. |

| · | Evaluate

the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

|

| · | Conclude

on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether

a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s and its subsidiaries

ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors’

report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion.

Our conclusions are based on the audit evidence obtained up to the date of our auditors’ report. However, future events or conditions

may cause the Company and its subsidiaries to cease to continue as a going concern. |

| · | Evaluate

the overall presentation, structure, and content of the consolidated financial statements, including the disclosures, and whether the

consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. |

| · | Obtain

sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express

an opinion on the consolidated financial statements. We are responsible for the direction, supervision, and performance of the group audit.

We remain solely responsible for our audit opinion. |

We communicate with those

charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including

any significant deficiencies in internal control that we identify during our audit.

We also provide those

charged with governance with a statement that we have complied with relevant ethical requirements regarding independence and communicate

with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, actions

taken to eliminate threats or safeguards applied.

| | |

| KPMG Auditores Independentes Ltda, uma sociedade simples brasileira e firma-membro da rede KPMG de firmas-membro independentes e afiliadas à KPMG International Cooperative (“KPMG International”), uma entidade suíça. | KPMG Auditores Independentes Ltda, a Brazilian entity and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. |

From the matters communicated

with those charged with governance, we determine those matters that were of most significance in the audit of the consolidated financial

statements of the current period and are therefore the key audit matters. We describe these matters in our auditors’ report unless

law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should

not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest

benefits of such communication.

São Paulo, February

22, 2024

KPMG Auditores Independentes

Ltda.

CRC 2SP014428/O-6

Rodrigo de Mattos Lia

Accountant CRC 1SP252418/O-3

| | |

| KPMG Auditores Independentes Ltda, uma sociedade simples brasileira e firma-membro da rede KPMG de firmas-membro independentes e afiliadas à KPMG International Cooperative (“KPMG International”), uma entidade suíça. | KPMG Auditores Independentes Ltda, a Brazilian entity and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. |

Consolidated Statements

of Profit or Loss

For the years ended December

31, 2023 and 2022

(In thousands of U.S. Dollars,

except earnings (loss) per share)

| |

|

Note |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

| Interest income and gains (losses) on financial instruments |

|

6 |

|

6,439,712 |

|

3,555,213 |

| Fee and commission income |

|

6 |

|

1,589,264 |

|

1,237,018 |

| Total revenue |

|

|

|

8,028,976 |

|

4,792,231 |

| Interest and other financial expenses |

|

6 |

|

(2,036,925) |

|

(1,547,903) |

| Transactional expenses |

|

6 |

|

(215,930) |

|

(176,427) |

| Credit loss allowance expenses |

|

7 |

|

(2,285,218) |

|

(1,404,911) |

| Total cost of financial and transactional services provided |

|

|

|

(4,538,073) |

|

(3,129,241) |

| Gross profit |

|

|

|

3,490,903 |

|

1,662,990 |

| |

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

| Customer support and operations |

|

8 |

|

(488,082) |

|

(335,363) |

| General and administrative expenses (G&A) |

|

8 |

|

(1,042,290) |

|

(1,333,267) |

| Contingent share award (CSA) termination |

|

10b |

|

- |

|

(355,573) |

| G&A - Others |

|

|

|

(1,042,290) |

|

(977,694) |

| Marketing expenses |

|

8 |

|

(171,022) |

|

(152,997) |

| Other expenses (income) |

|

8 |

|

(250,431) |

|

(150,264) |

| Total operating expenses |

|

|

|

(1,951,825) |

|

(1,971,891) |

| |

|

|

|

|

|

|

| Profit (loss) before income taxes |

|

|

|

1,539,078 |

|

(308,901) |

| |

|

|

|

|

|

|

| Income taxes |

|

|

|

|

|

|

| Current taxes |

|

29 |

|

(1,184,230) |

|

(473,345) |

| Deferred taxes |

|

29 |

|

675,682 |

|

417,612 |

| Total income taxes |

|

|

|

(508,548) |

|

(55,733) |

| |

|

|

|

|

|

|

| Profit (loss) for the year |

|

|

|

1,030,530 |

|

(364,634) |

| Profit (loss) attributable to shareholders of the parent company |

|

|

|

1,030,530 |

|

(364,578) |

| Profit (loss) attributable to non-controlling interests |

|

|

|

- |

|

(56) |

| |

|

|

|

|

|

|

| Earnings (loss) per share – Basic |

|

9 |

|

0.2175 |

|

(0.0780) |

| Earnings (loss) per share – Diluted |

|

9 |

|

0.2121 |

|

(0.0780) |

| Weighted average number of outstanding shares – Basic (in thousands of shares) |

|

9 |

|

4,738,841 |

|

4,676,977 |

| Weighted average number of outstanding shares – Diluted (in thousands of shares) |

|

9 |

|

4,857,579 |

|

4,676,977 |

The

accompanying notes are an integral part of these consolidated financial statements.

Consolidated Statements

of Comprehensive Income or Loss For the years ended December 31, 2023 and 2022

(In thousands of U.S. Dollars)

| |

|

Note |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

| Profit (loss) for the year |

|

|

|

1,030,530 |

|

(364,634) |

| |

|

|

|

|

|

|

| Other comprehensive income or loss: |

|

|

|

|

|

|

| Effective portion of changes in fair value |

|

|

|

29,305 |

|

(29,795) |

| Changes in fair value reclassified to profit or loss |

|

|

|

(13,018) |

|

18,007 |

| Deferred income taxes |

|

|

|

3,616 |

|

2,815 |

| Cash flow hedge |

|

19 |

|

19,903 |

|

(8,973) |

| |

|

|

|

|

|

|

| Changes in fair value |

|

|

|

32,246 |

|

(22,053) |

| Deferred income taxes |

|

|

|

(1,950) |

|

(1,986) |

| Financial assets at fair value through other comprehensive income |

|

|

|

30,296 |

|

(24,039) |

| |

|

|

|

|

|

|

| Currency translation on foreign entities |

|

|

|

243,853 |

|

2,580 |

| |

|

|

|

|

|

|

| Total other comprehensive income that may be reclassified to profit or loss subsequently |

|

|

|

294,052 |

|

(30,432) |

| |

|

|

|

|

|

|

| Changes in fair value - own credit adjustment |

|

20 |

|

29 |

|

2,008 |

| Total other comprehensive income or loss that will not be reclassified to profit or loss subsequently |

|

|

|

29 |

|

2,008 |

| Total other comprehensive income (loss), net of tax |

|

|

|

294,081 |

|

(28,424) |

| Total comprehensive income (loss) for the year, net of tax |

|

|

|

1,324,611 |

|

(393,058) |

| Total comprehensive income (loss) attributable to shareholders of the parent company |

|

|

|

1,324,611 |

|

(393,002) |

| Total comprehensive income (loss) attributable to non-controlling interests |

|

|

|

- |

|

(56) |

The accompanying notes are an integral

part of these consolidated financial statements.

Consolidated Statements of Financial

Position

As of December 31, 2023 and 2022

(In thousands of U.S. Dollars)

| |

|

Note |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

11 |

|

5,923,440 |

|

4,172,316 |

| Financial assets at fair value through profit or loss |

|

|

|

389,875 |

|

133,643 |

| Securities |

|

12 |

|

368,574 |

|

91,853 |

| Derivative financial instruments |

|

19 |

|

20,981 |

|

41,485 |

| Collateral for credit card operations |

|

22 |

|

320 |

|

305 |

| Financial assets at fair value through other comprehensive income |

|

|

|

8,805,745 |

|

9,947,138 |

| Securities |

|

12 |

|

8,805,745 |

|

9,947,138 |

| Financial assets at amortized cost |

|

|

|

24,988,919 |

|

13,684,484 |

| Credit card receivables |

|

13 |

|

12,414,133 |

|

8,233,072 |

| Loans to customers |

|

14 |

|

3,202,334 |

|

1,673,440 |

| Compulsory and other deposits at central banks |

|

15 |

|

7,447,483 |

|

2,778,019 |

| Other receivables |

|

16 |

|

1,689,030 |

|

521,670 |

| Other financial assets |

|

|

|

131,519 |

|

478,283 |

| Securities |

|

12 |

|

104,420 |

|

- |

| Other assets |

|

17 |

|

936,209 |

|

541,903 |

| Deferred tax assets |

|

29 |

|

1,537,835 |

|

811,050 |

| Right-of-use assets |

|

|

|

30,459 |

|

18,982 |

| Property, plant and equipment |

|

|

|

39,294 |

|

27,482 |

| Intangible assets |

|

18 |

|

295,881 |

|

182,164 |

| Goodwill |

|

18 |

|

397,538 |

|

397,397 |

| Total assets |

|

|

|

43,345,195 |

|

29,916,559 |

Consolidated Statements of Financial

Position

As of December 31, 2023 and 2022

(In thousands of U.S. Dollars)

| |

|

Note |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

| Financial liabilities at fair value through profit or loss |

|

|

|

242,615 |

|

218,174 |

| Derivative financial instruments |

|

19 |

|

28,173 |

|

9,425 |

| Instruments eligible as capital |

|

20 |

|

3,988 |

|

11,507 |

| Repurchase agreements |

|

|

|

210,454 |

|

197,242 |

| Financial liabilities at amortized cost |

|

|

|

34,582,759 |

|

23,448,892 |

| Deposits |

|

21 |

|

23,691,130 |

|

15,808,541 |

| Payables to network |

|

22 |

|

9,755,285 |

|

7,054,783 |

| Borrowings and financing |

|

23 |

|

1,136,344 |

|

585,568 |

| Salaries, allowances and social security contributions |

|

|

|

166,876 |

|

90,587 |

| Tax liabilities |

|

|

|

1,300,845 |

|

511,017 |

| Lease liabilities |

|

|

|

36,942 |

|

20,353 |

| Provision for lawsuits and administrative proceedings |

|

24 |

|

8,082 |

|

17,947 |

| Deferred income |

|

25 |

|

68,360 |

|

41,688 |

| Deferred tax liabilities |

|

29 |

|

- |

|

41,118 |

| Other liabilities |

|

26 |

|

532,331 |

|

636,000 |

| Total liabilities |

|

|

|

36,938,810 |

|

25,025,776 |

| Equity |

|

|

|

|

|

|

| Share capital |

|

30 |

|

84 |

|

83 |

| Share premium reserve |

|

30 |

|

4,972,922 |

|

4,963,774 |

| Accumulated gains |

|

30 |

|

1,276,949 |

|

64,577 |

| Other comprehensive income (loss) |

|

30 |

|

156,430 |

|

(137,651) |

| Total equity |

|

|

|

6,406,385 |

|

4,890,783 |

| Total liabilities and equity |

|

|

|

43,345,195 |

|

29,916,559 |

The accompanying notes are an integral

part of these consolidated financial statements.

Consolidated Statements of Changes

in Equity

As of December 31, 2023 and 2022

(In thousands of U.S. Dollars)

| |

|

Attributable to shareholders of the parent company |

| |

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

|

| |

Note |

Share

capital |

|

Share

premium

reserve |

|

Accumulated gains |

|

Translation reserve |

|

Cash flow hedge reserve |

|

Financial Assets

at FVTOCI |

|

Own credit revaluation reserve |

|

Total equity |

| Balances as of December 31, 2022 |

|

83 |

|

4,963,774 |

|

64,577 |

|

(108,356) |

|

(7,486) |

|

(22,298) |

|

489 |

|

4,890,783 |

| Profit for the year |

|

- |

|

- |

|

1,030,530 |

|

- |

|

- |

|

- |

|

- |

|

1,030,530 |

| Share-based compensation, net of shares withheld for employee taxes |

10a |

- |

|

- |

|

160,309 |

|

- |

|

- |

|

- |

|

- |

|

160,309 |

| Shares issued to service providers |

30a / 34 |

- |

|

- |

|

21,533 |

|

- |

|

- |

|

- |

|

- |

|

21,533 |

| Shares issued |

30b |

1 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

1 |

| Stock options exercised |

30b |

- |

|

9,148 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

9,148 |

| Other comprehensive income, net of tax |

30f |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flow hedge |

|

- |

|

- |

|

- |

|

- |

|

19,903 |

|

- |

|

- |

|

19,903 |

| Fair value changes - financial assets at FVTOCI |

|

- |

|

- |

|

- |

|

- |

|

- |

|

30,296 |

|

- |

|

30,296 |

| Currency translation on foreign entities |

|

- |

|

- |

|

- |

|

243,853 |

|

- |

|

- |

|

- |

|

243,853 |

| Own credit adjustment |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

29 |

|

29 |

| Balances as of December 31, 2023 |

|

84 |

|

4,972,922 |

|

1,276,949 |

|

135,497 |

|

12,417 |

|

7,998 |

|

518 |

|

6,406,385 |

Consolidated Statements of Changes

in Equity

As of December 31, 2023 and 2022

(In thousands of U.S. Dollars)

| |

|

Attributable to shareholders of the parent company |

|

|

|

|

| |

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

|

|

|

|

|

| |

Note |

Share

capital |

|

Share

premium

reserve |

|

Accumulated gains (losses) |

|

Translation reserve |

|

Cash flow hedge reserve |

|

Financial Assets

at FVTOCI |

|

Own credit revaluation reserve |

|

Total |

|

Total non- controlling interests |

|

Total equity |

| Balances as of December 31, 2021 |

|

83 |

|

4,678,585 |

|

(128,409) |

|

(110,936) |

|

1,487 |

|

1,741 |

|

(1,519) |

|

4,441,032 |

|

1,509 |

|

4,442,541 |

| Loss for the year |

|

- |

|

- |

|

(364,578) |

|

- |

|

- |

|

- |

|

- |

|

(364,578) |

|

(56) |

|

(364,634) |

| Share-based compensation granted, net of shares withheld for employee taxes |

10b |

- |

|

- |

|

201,991 |

|

- |

|

- |

|

- |

|

- |

|

201,991 |

|

- |

|

201,991 |

| Share-based compensation - contingent share award (CSA) termination |

10b |

- |

|

- |

|

355,573 |

|

- |

|

- |

|

- |

|

- |

|

355,573 |

|

- |

|

355,573 |

| Stock options exercised |

30b |

- |

|

4,505 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

4,505 |

|

- |

|

4,505 |

| Shares issued on business acquisition |

|

- |

|

36,671 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

36,671 |

|

- |

|

36,671 |

| Shares issued on IPO over-allotment |

30c |

- |

|

247,998 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

247,998 |

|

- |

|

247,998 |

| Transactions costs from IPO over-allotment |

|

- |

|

(3,985) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(3,985) |

|

- |

|

(3,985) |

| Loss of control of subsidiary |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(1,453) |

|

(1,453) |

| Other comprehensive income or loss, net of tax |

30f |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flow hedge |

|

- |

|

- |

|

- |

|

- |

|

(8,973) |

|

- |

|

- |

|

(8,973) |

|

- |

|

(8,973) |

| Fair value changes - financial assets at FVTOCI |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(24,039) |

|

- |

|

(24,039) |

|

- |

|

(24,039) |

| Currency translation on foreign entities |

|

- |

|

- |

|

- |

|

2,580 |

|

- |

|

- |

|

- |

|

2,580 |

|

- |

|

2,580 |

| Own credit adjustment |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

2,008 |

|

2,008 |

|

- |

|

2,008 |

| Balances as of December 31, 2022 |

|

83 |

|

4,963,774 |

|

64,577 |

|

(108,356) |

|

(7,486) |

|

(22,298) |

|

489 |

|

4,890,783 |

|

- |

|

4,890,783 |

The accompanying notes are an integral

part of these consolidated financial statements.

Consolidated Statements

of Cash Flows

For the years ended December 31,

2023 and 2022

(In thousands of U.S. Dollars)

| |

|

Note |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

| Cash flows from operating activities |

|

|

|

|

|

|

| Reconciliation of profit (loss) to net cash flows from operating activities: |

| Profit (loss) for the year |

|

|

|

1,030,530 |

|

(364,634) |

| Adjustments: |

|

|

|

|

|

|

| Depreciation and amortization |

|

8 |

|

62,895 |

|

35,581 |

| Credit loss allowance expenses |

|

7 |

|

2,487,648 |

|

1,440,922 |

| Deferred income taxes |

|

29 |

|

(675,682) |

|

(417,612) |

| Provision for lawsuits and administrative proceedings |

|

|

|

17,098 |

|

(1,174) |

| Unrealized losses on other investments |

|

|

|

20 |

|

848 |

| Unrealized losses on financial instruments |

|

|

|

15,885 |

|

17,794 |

| Interest accrued |

|

|

|

103,572 |

|

32,479 |

| Contingent share award (CSA) - termination |

|

10b |

|

- |

|

355,573 |

| Share-based compensation |

|

|

|

212,551 |

|

253,203 |

| Others |

|

|

|

23,056 |

|

8,203 |

| |

|

|

|

3,277,573 |

|

1,361,183 |

| |

|

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

| Securities |

|

|

|

699,076 |

|

(1,102,864) |

| Compulsory deposits and others at central banks |

|

|

|

(4,540,463) |

|

(1,880,347) |

| Credit card receivables |

|

|

|

(7,878,307) |

|

(5,213,669) |

| Loans to customers |

|

|

|

(3,577,534) |

|

(1,889,278) |

| Other receivables |

|

|

|

(1,136,488) |

|

(481,824) |

| Other assets |

|

|

|

(60,982) |

|

(772,415) |

| Deposits |

|

|

|

7,664,820 |

|

6,278,088 |

| Payables to network |

|

|

|

2,818,592 |

|

2,221,037 |

| Deferred income |

|

|

|

25,935 |

|

11,277 |

| Other liabilities |

|

|

|

1,279,987 |

|

979,277 |

| |

|

|

|

|

|

|

| Interest paid |

|

|

|

(82,904) |

|

(30,935) |

| Income tax paid |

|

|

|

(612,447) |

|

(297,090) |

| Interest received |

|

|

|

3,389,331 |

|

1,573,133 |

| Cash flows (used in) generated from operating activities |

|

|

|

1,266,189 |

|

755,573 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Note |

|

2023 |

|

2022 |

| Cash flows from investing activities |

|

|

|

|

|

|

| Acquisition of property, plant and equipment |

|

|

|

(20,243) |

|

(20,001) |

| Acquisition of intangible assets |

|

|

|

(156,760) |

|

(94,305) |

| Acquisition of subsidiary, net of cash acquired |

|

|

|

- |

|

(10,346) |

| Acquisition of securities - equity instruments |

|

|

|

- |

|

(2,500) |

| Cash flow (used in) generated from investing activities |

|

|

|

(177,003) |

|

(127,152) |

| |

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

| Issuance of shares for over-allotment in IPO |

|

|

|

- |

|

247,998 |

| Transactions costs for over-allotment in IPO |

|

|

|

- |

|

(3,985) |

| Payments of securitized borrowings |

|

|

|

- |

|

(10,633) |

| Proceeds from borrowings and financing |

|

23 |

|

469,501 |

|

581,142 |

| Payments of borrowings and financing |

|

23 |

|

(46,501) |

|

(159,983) |

| Lease payments |

|

|

|

(6,933) |

|

(5,005) |

| Exercise of stock options |

|

30 |

|

9,148 |

|

4,505 |

| Cash flows (used in) generated from financing activities |

|

|

|

425,215 |

|

654,039 |

| Change in cash and cash equivalents |

|

|

|

1,514,401 |

|

1,282,460 |

| |

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

|

|

|

|

| Cash and cash equivalents - beginning of the year |

|

11 |

|

4,172,316 |

|

2,705,675 |

| Foreign exchange rate changes on cash and cash equivalents |

|

|

|

236,723 |

|

184,181 |

| Cash and cash equivalents - end of the year |

|

11 |

|

5,923,440 |

|

4,172,316 |

| Increase (decrease) in cash and cash equivalents |

|

|

|

1,514,401 |

|

1,282,460 |

| |

|

|

|

|

|

|

| Non-cash transactions |

|

|

|

|

|

|

| Olivia's acquisition - share consideration |

|

|

|

- |

|

36,671 |

| Shares issued to service providers |

|

30a |

|

21,533 |

|

- |

| Contingent share award (CSA) - termination |

|

10b |

|

- |

|

355,573 |

The accompanying notes are an integral

part of these consolidated financial statements.

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

Nu Holdings Ltd.

Notes to the Consolidated

Financial Statements

(In thousands of U.S.

Dollars, unless otherwise stated)

1. OPERATIONS

Nu Holdings Ltd. ("Company" or

"Nu Holdings") was incorporated as an exempted Company under the Companies Law of the Cayman Islands on February 26, 2016. The

address of the Company's registered office is Willow House, 4th floor, Cricket Square, Grand Cayman - Cayman Islands. Nu Holdings

has no operating activities with clients.

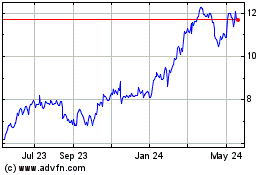

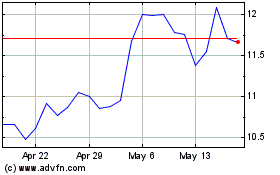

The Company’s shares are publicly traded

on the New York Stock Exchange ("NYSE") under the symbol “NU”. The Company holds investments in several operating

entities and, as of December 31, 2023, its significant operating subsidiaries were:

| ● | Nu Pagamentos S.A. - Instituição de Pagamento (“Nu

Pagamentos”) is an indirect subsidiary domiciled in Brazil. Nu Pagamentos is engaged in the issuance and administration

of credit cards and payment transfers through a prepaid account, and participation in other companies as partner or shareholder. Nu Pagamentos

has as its primary products: (i) a Mastercard international credit card (issued in Brazil which allows payments for purchases to be made

in monthly installments), fully managed through a smartphone app, and (ii) "Conta do Nubank", a 100% digital smartphone app,

maintenance-free prepaid account, which also includes features of a traditional bank account, such as electronic and peer-to-peer transfers

("PIX"), bill payments, withdrawals through the 24 Hours ATM network, instant payments, prepaid credit for mobile top ups and

prepaid cards similar in functionality to debit cards. |

| ● | Nu Financeira S.A. – SCFI (“Nu Financeira”)

is an indirect subsidiary also domiciled in Brazil, with personal loans and retail deposits as its main products. Nu Financeira offers

customers in Brazil the possibility to obtain loans that can be customized in relation to amounts, terms and conditions, number of installments,

and transparent disclosure of any charges involved in the transaction, fully managed through the above-mentioned smartphone app. Loan

issuance, repayment, and prepayments are available 24/7 through "Conta do Nubank", directly in the app. In addition, Nu Financeira

issues the Bank Deposit Receipt (RDB), with daily liquidity and with a defined future maturity date and offered to the Company's customers

through the "Conta do Nubank". Nu Financeira also grants credit to Nu Pagamentos credit card holders, due to overdue invoices,

bill installments and revolving credit. |

| ● | Nu Invest Corretora de Valores S.A. ("Nu Invest")

is an indirect subsidiary acquired in June 2021, domiciled in Brazil, and is a digital investment broker dealer. |

| ● | Nu Distribuidora de Titulos e Valores Mobiliarios

Ltda. ("Nu DTVM") is an indirect subsidiary that executes securities brokerage

activities in Brazil. |

| ● | Nu México Financiera, S.A. de C.V., S.F.P. ("Nu Financiera")

is an indirect subsidiary domiciled in Mexico. Nu Financiera is engaged in the issuance and administration of credit cards, payment transfers

through a prepaid account and offers customers in México the possibility to obtain loans, in addition to offering "Cuenta

Nu", a 100% digital account. It commenced operations in the Mexican market in November 2022 and officially launched in December 2022. |

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

| ● | Nu Colombia S.A. (“Nu Colombia”) is an indirect

subsidiary domiciled in Colombia, with operations related to credit cards, which was launched in September 2020. On August 10, 2022, the

Financial Superintendence of Colombia ("SFC") approved the Group's request to incorporate a financing company in Colombia, Nu

Colombia Compañía de Financiamiento S.A ("Nu Colombia Financiamiento") ("Incorporation License"). |

The Company and its consolidated subsidiaries

are referred to in these consolidated financial statements as the “Group” or "Nu”.

The business plan of Nu provides for the

continued growth of its Brazilian, Mexican, and Colombian operations, not only related to existing businesses, such as credit cards, personal

loans, investments, and insurance, but also complemented by the launch of new products. Accordingly, these consolidated financial statements

were prepared based on the assumption of the Group continuing as a going concern.

The Company’s Board authorized the

issuance of these consolidated financial statements on February 22, 2024.

a) Level III BDRs Program

discontinuation

On June 28, 2023 the Securities and Exchange

Commission of Brazil ("CVM") Collegiate approved the plan for the discontinuance of the Company's Level III BDRs Program and

the cancellation of the Company's registration with the CVM as a foreign public issuer of category "A" securities. The Definition

Period for Level III BDRs holders to make their choices among the possible alternatives within the scope of the discontinuity plan was

closed on August 11, 2023, and the sale of the Class A Common Shares underlying the BDRs that were held by the holders of the BDRs that,

within the scope of the Level III BDRs Program Discontinuance plan, were directed to the Sale Procedures, ended on August 21, 2023.

On September 22, 2023 the Company submitted

a request to CVM to cancel the registration of the Level III BDRs Program and, consequently, to cancel Company's registry as a foreign

issuer before CVM. On October 31, 2023 the cancellation was approved by CVM.

b) Nucoin

In February of 2023, Nu commenced the distribution

of Nucoin, the native blockchain token issued by the Company, designed to support a loyalty network known as the "Nucoin Network''

between Nu and its customers. The long-term objective for Nu is to onboard other sponsoring companies, referred to as "Sponsors",

who commit to adopting Nucoin as their loyalty program. These Sponsors will be entitled to a certain number of Nucoins to distribute to

their own customer base and will be required to provide incentives and benefits to Nucoin holders, thereby fostering network adoption

and enhancing the utility of Nucoin within its communities.

As of December 31, 2023, in addition to the

provision for customer crypto safeguard asset and liability from SAB 121, as shown in note 34, the Group had a refund liability of US$9,271

due its commitment to sponsor the liquidity pool pertaining to Nucoins.

c) Contingent share

award - Termination

On November 29, 2022, Mr. David Vélez,

the Company's Chief Executive Officer, informed the Company of his unilateral decision to terminate the 2021 Contingent Share Award ("CSA").

As a result of the termination, the Company recorded expenses on that date of US$355,573 due to the acceleration of the vesting. After

such one-time recognition, the Company no longer accounted for any expense associated with the 2021 Contingent Share Award. The termination

did not impact cash flows and no shares were issued under this CSA. Additional information is disclosed on Note 10b.

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

d) License to operate

as a financial institution in Colombia

Nu Colombia Compañía de Financiamiento

S.A ("Nu Colombia Financiamiento") was granted a license to operate as a financial institution in Colombia by

the Financial Superintendence of Colombia ("SFC") which came into effect in January,

2024. Nubank plans to introduce "Cuenta Nu" and other products in Colombia.

2. STATEMENT OF COMPLIANCE

The Company's consolidated financial statements

are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting

Standards Board (“IASB”).

a) Functional currency

and foreign currency translation

i) Nu Holding's functional

and presentation currency

Nu Holdings does not have any direct customers

and its main direct activities are (i) investing in the operating entities in Brazil, Mexico, Colombia, as well as in other countries,

(ii) financing, either equity or debt; and (iii) the payment of certain general and administrative expenses. As a result, these are considered

its primary and secondary activities and all of them are substantially based on US Dollars (“US$”), which was selected as

the functional and presentation currency of Nu Holdings.

ii) Subsidiary's functional

currency

For each subsidiary of the Group, the Company

determines the currency that best reflects the economic substance of the underlying events and circumstances relevant to that entity (“functional

currency”). Items included in the financial statements of each subsidiary are measured using that functional currency. The functional

currency of the Brazilian operating entities is the Brazilian Real, the Mexican entities is the Mexican Peso, and the Colombian entity

is the Colombian Pesos.

iii) Translation of

transactions and balances

Foreign currency transactions and balances

are translated in two consecutive stages:

| ● | Foreign currency transactions are translated to the subsidiaries’ functional currency at the exchange

rates at the date of the transactions; and the exchange differences arising on the translation of foreign currency balances to the functional

currency are recognized under “Other expenses (income)” in the consolidated statements of profit or loss. Monetary assets

and liabilities denominated in foreign currencies are translated into the functional currency at the exchange rate at the reporting date.

Revenues and expenses are translated using a monthly average exchange rate. Non-monetary assets and liabilities that are measured at fair

value in a foreign currency are translated into the functional currency at the exchange rate when the fair value was determined. Non-monetary

items that are measured based on historical cost in a foreign currency are translated at the exchange rate at the date of the transaction. |

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

| ● | The financial statements of the subsidiaries held in functional currencies that are not US$ (foreign subsidiaries)

are translated into US$, and the exchange differences arising from the translation to US$ of the financial statements denominated in functional

currencies other than the US$ is recognized in the consolidated statements of comprehensive income or loss ("OCI") as an item

that may be reclassified to profit or loss within “currency translation on foreign entities”. |

The main criteria applied to the translation

of financial statements of foreign subsidiaries to US$ are as follows:

| ● | assets and liabilities are converted into US$ at the exchange rate at the reporting date; |

| ● | equity is translated into US$ at historical cost; |

| ● | revenues and expenses are translated using a monthly average exchange rate. When applying this criterion,

the Group considers whether there have been significant changes in the exchange rates in the reporting period which, in view of their

materiality with respect to the consolidated financial statements taken as a whole, would make it necessary to use the exchange rates

at the transaction date rather than the aforementioned average exchange rates; and |

| ● | statements of cash flow items are translated into US$ using the monthly average exchange rate unless significant

variances occur, when the rate of the transaction date is used instead. |

b) New or revised accounting

pronouncements adopted in 2023

The following new or revised standards have

been issued by IASB, were effective for the period covered by these consolidated financial statements, and had no significant impact.

| ● | Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice Statement 2); |

| ● | Definition of Accounting Estimates (Amendments to IAS 8); and |

| ● | Deferred Tax related to Assets and Liabilities arising from a Single Transaction (Amendments to IAS 12). |

c) Other new standards

and interpretations issued but not yet effective

| ● | Non-current Liabilities with Covenants (Amendments to IAS 1). |

Management does not expect the adoption of

the amendments described above to have a significant impact, other than additional disclosures, on the consolidated financial statements.

3. BASIS OF CONSOLIDATION

These consolidated financial statements include

the accounting balances of Nu Holdings and all those subsidiaries over which the Company exercises control, directly or indirectly. Control

is achieved where the Company has (i) power over the investee; (ii) is exposed, or has rights, to variable returns from its involvement

with the investee; and (iii) can use its power to affect its profits.

The Company re-assesses whether it maintains

control of an investee if facts and circumstances indicate that there are changes to one or more of the three above mentioned elements

of control.

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

The consolidation of a subsidiary begins

when the Company obtains control over it and ceases when the Company loses control over it. Assets, liabilities, income, and expenses

of a subsidiary acquired or disposed of during the reporting period are included in the consolidated statements of profit or loss from

the date the Company gains control until the date the Company ceases to control the subsidiary.

The financial information of the subsidiaries

was prepared in the same period as the Company and consistent accounting policies were applied. The financial statements of the subsidiaries

are fully consolidated with those of the Company. Accordingly, all balances, transactions and any unrealized income and expenses arising

between consolidated entities are eliminated in the consolidation, except for foreign-currency gain and losses on translation of intercompany

loans. Profit or loss and each component of other comprehensive income or loss are attributed to the shareholders of the parent and to

the non-controlling interests, when applicable.

The subsidiaries below are the most relevant

entities included in these consolidated financial statements:

| Entity |

|

Control |

|

Principal activities |

|

Functional currency |

|

Country |

|

2023 |

|

2022 |

| Nu Pagamentos S.A. - Instituição de Pagamentos (“Nu Pagamentos”) |

|

Indirect |

|

Credit card and prepaid account operations |

|

BRL |

|

Brazil |

|

100% |

|

100% |

| Nu Financeira S.A. – SCFI (“Nu Financeira”) |

|

Indirect |

|

Loan operations |

|

BRL |

|

Brazil |

|

100% |

|

100% |

| Nu Distribuidora de Titulos e Valores Mobiliarios Ltda. ("Nu DTVM") |

|

Indirect |

|

Securities distribution |

|

BRL |

|

Brazil |

|

100% |

|

100% |

| Nu Invest Corretora de Valores S.A ("Nu Invest") |

|

Indirect |

|

Investment platform |

|

BRL |

|

Brazil |

|

100% |

|

100% |

| Nu Pay for Business Instituição de Pagamentos Ltda. ("Nu Pay") |

|

Indirect |

|

Payment hub |

|

BRL |

|

Brazil |

|

100% |

|

100% |

| Nu México Financiera, S.A. de C.V., S.F.P. ("Nu Financiera") |

|

Indirect |

|

Multiple purpose financial company |

|

MXN |

|

Mexico |

|

100% |

|

100% |

| Nu Colombia S.A. (“Nu Colombia”) |

|

Indirect |

|

Credit card operations |

|

COP |

|

Colombia |

|

100% |

|

100% |

In addition, the Company consolidated the

following investment fund for December 31, 2023 and 2022, in which the Group’s companies hold a substantial interest or the entirety

of the interests and are therefore exposed, or have rights, to variable returns and have the ability to affect those returns through power

over the entity:

| Name of the entity |

|

Country |

| Fundo de Investimento Ostrum Soberano Renda Fixa Referenciado DI (“Fundo Ostrum”) |

|

Brazil |

Nu Pagamentos, Nu Financeira, Nu DTVM, Nu

Invest and Nu Pay, Brazilian subsidiaries, are regulated by Central Bank of Brazil (“BACEN”); Nu México Financiera,

S.A. de C.V., S.F.P. ("Nu Financiera"), a Mexican subsidiary, is regulated by both the Mexican Central Bank ("BANXICO")

and Mexican National Banking and Stock Commission (“CNBV”); Nu Colombia and Nu Colombia Financiamento, Colombian subsidiaries,

are regulated by Industry and Commerce Superintendency and by Financial Superintendence of Colombia ("SFC"); and as such, there

are some regulatory requirements that restrict the ability of the Group to access and transfer assets freely to or from these entities

within the Group and to settle liabilities of the Group.

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

4. MATERIAL ACCOUNTING

POLICIES

The accounting policies described below have

been applied consistently through the years presented in these consolidated financial statements.

a)

Financial instruments

Initial recognition and

measurement

Financial assets and liabilities are initially

recognized when the Group becomes a party to the contractual terms of the instrument. The Group determines the classification of its financial

assets and liabilities at initial recognition and measures a financial asset or financial liability at its fair value plus or minus, in

the case of a financial asset or financial liability not at fair value through profit or loss ("FVTPL"), transaction costs that

are incremental and directly attributable to the acquisition or issue of the financial asset or financial liability.

Transaction costs of financial assets and

financial liabilities carried at fair value through profit or loss are expensed in profit or loss. Immediately after initial recognition,

an expected credit loss ("ECL") allowance is recognized for financial assets measured at amortized cost and investments in debt

instruments measured at fair value through other comprehensive income ("FVTOCI"), if any.

Classification and subsequent

measurement

Financial assets and financial liabilities

are classified as FVTPL where there is a requirement to do so or where they are otherwise designated at FVTPL on initial recognition.

Financial assets and financial liabilities which are required to be held at FVTPL include:

| ● | | Financial assets and financial liabilities held for trading; |

| ● | | Debt instruments that do not have solely payments of principal and interest ("SPPI")

characteristics. Otherwise, such instruments must be measured at amortized cost or FVTOCI; and |

| ● | | Equity instruments that have not been designated as held at FVTOCI. |

Financial assets and financial liabilities

are classified as held for trading if they are derivatives or if they are acquired or incurred mainly for the purpose of selling or being

repurchased in the near-term, or form part of a portfolio of financial instruments that are managed together and for which there is evidence

of short-term profit-taking.

In certain circumstances, other financial

assets and financial liabilities are designated at FVTPL where this results in the more relevant information. This may arise because it

significantly reduces a measurement inconsistency that would otherwise arise from measuring assets or liabilities or recognizing the gains

or losses on them on a different basis, where the assets and liabilities are managed and their performance evaluated on a fair value basis

or, in the case of financial liabilities, where it contains one or more embedded derivatives which are not closely related to the host

contract.

The classification and measurement requirements

for financial asset debt and equity instruments and financial liabilities are set out below.

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

Financial assets - debt

instruments

Debt instruments are those instruments that

meet the definition of financial liability from the issuer's perspective, such as loans and government and corporate bonds.

The classification criteria and subsequent

measurement for financial assets depends on the business model for their management and the characteristics of their contractual flows.

The business models refer to the way in which the Group manages its financial assets to generate cash flows. In this definition, the following

factors are taken into consideration, among others:

| ● | | How key management assess and report on the performance of the business model and the financial

assets held in the business model; |

| ● | | The risks that affect the performance of the business model (and the financial assets held

in the business model) and, specifically, the way in which these risks are managed; and |

| ● | | The frequency and volume of sales in previous years, as well as expectations of future sales. |

Depending on these factors, the asset can

be measured at amortized cost, at fair value with changes in other comprehensive income, or at fair value with changes through profit

or loss.

Business

model: The business model reflects how the Group manages the assets to generate cash flows and, specifically, whether the

Group’s objective is solely to (i) collect the contractual cash flows from the assets or (ii) is to collect both the contractual

cash flows and cash flows arising from the sale of the assets. If neither of these is applicable, such as where the financial assets are

held for trading purposes, then the financial assets are classified as part of an "other” business model and measured at FVTPL.

To assess business models, the Group considers risks that affect the performance of the business model; how the managers of the business

are compensated; and how the performance of the business model is assessed and reported to Management.

When a financial asset is subject to business

models (i) and (ii), the application of the SPPI test is required, as explained below.

Solely

Payments of Principal and Interest – SPPI test: Where the business model is to hold assets to collect contractual

cash flows or to collect contractual cash flows and sell, the Group assesses whether the assets’ cash flows represent SPPI. In making

this assessment, the Group considers whether the contractual cash flows are consistent with a basic lending arrangement (i.e., interest

includes only consideration for the time value of money, credit risk, other basic lending risks, and a profit margin that is consistent

with a basic lending arrangement). Where the contractual terms introduce exposure to risk or volatility that is inconsistent with a basic

lending arrangement, the related asset is classified and measured at FVTPL. Financial assets with embedded derivatives are considered

in their entirety when determining whether their cash flows are SPPI.

Based on these factors, the Group classifies

its instruments into one of the following measurement categories.

Amortized cost:

Financial assets that are held

for collection of contractual cash flows where those cash flows represent SPPI, and that are not designated at FVTPL, are measured at

amortized cost. The carrying amount of these assets is adjusted by any ECL recognized and measured. Interest income from these financial

assets is included in the statement of profit or loss using the effective interest rate method. When estimates of future cash flows are

revised, the carrying amount of the respective financial assets or financial liabilities is adjusted to reflect the new estimate discounted

using the original effective interest rate. Any changes are recognized in the statement of profit or loss.

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

FVTOCI:

Financial assets that are both

held for collection of contractual cash flows, where those cash flows represent SPPI, and for sale, depending on the Group's best interests,

which are not designated at FVTPL, are measured at fair value through other comprehensive income ("FVTOCI"). The carrying amount

of these assets is adjusted by any ECL recognized and measured. Interest income from these financial assets is included in the statement

of comprehensive income or loss using the effective interest rate method.

FVTPL:

Financial assets that do not meet

the criteria for amortized cost or FVTOCI are measured at FVTPL. A gain or loss on a debt instrument that is subsequently measured at

FVTPL, including any debt instruments designated at fair value, is recognized in profit or loss, and presented in the statement of profit

or loss in the period in which it arises.

The Group reclassifies financial assets when

and only when its business model for managing those assets changes. The reclassification takes place from the start of the first period

following the change.

Classification of financial

assets for presentation purposes

Financial assets are classified by nature

into the following items in the consolidated statements of financial position:

| ● | | Cash and cash equivalents; |

| ● | | Collateral for credit card operations; |

| ● | | Derivative financial instruments; |

| ● | | Compulsory and other deposits at central banks; |

| ● | | Credit card receivables and loans to customers; |

Financial liabilities

Financial liabilities are initially classified

into the various categories used for management and measurement purposes, unless they have to be presented as liabilities associated with

non-current assets held for sale or they relate to hedging derivatives or changes in the fair value of hedged items in portfolio hedges

of interest rate risk, which are reported separately.

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

Financial liabilities are included for measurement

purposes in one of the following categories:

| ● | | Financial liabilities held for trading (at FVTPL): this category includes financial liabilities

incurred for the purpose of generating a profit in the near term from fluctuations in their prices and financial derivatives not designated

as hedging instruments. |

| ● | | Financial liabilities designated at FVTPL: financial liabilities are included in this category

when they provide more relevant information, either because this eliminates or significantly reduces recognition or measurement inconsistencies

(accounting mismatches) that would otherwise arise from measuring assets or liabilities or recognizing the gains or losses on them on

different bases, or because a group of financial liabilities or financial assets and liabilities is managed and its performance is evaluated

on a fair value basis, in accordance with a documented risk management or investment strategy, and information about the group is provided

on that basis to the Group’s key management personnel. Liabilities may only be included in this category on the date when they

are incurred or originated. This classification is applied to derivatives, financial liabilities held for trading, and other financial

liabilities designated as such at initial recognition. The Group has designated the instruments eligible as capital as fair value through

profit or loss at its initial recognition. Gains or losses on financial liabilities designated at fair value through profit or loss are

presented partially in other comprehensive income (the amount of change in the fair value of the financial liability that is attributable

to changes in the credit risk of that liability) and partially in profit or loss (the remaining amount of change in the fair value of

the liability). |

| ● | | Financial liabilities at amortized cost: financial liabilities, irrespective of their instrumentation

and maturity, not included in any of the above-mentioned categories which arise from the ordinary borrowing activities carried on by

financial institutions. |

Classification of financial

liabilities for presentation purposes

Financial liabilities are classified by nature

into the following items in the consolidated statements of financial position:

| ● | | Derivative financial instruments; |

| ● | | Instruments eligible as capital; |

| ● | | Borrowings and financing, and securitized borrowings. |

Credit loss allowance

of financial assets

The Group calculates an expected credit

loss ("ECL") for its financial assets. This way, ECLs should account for forecast elements such as undrawn limits and macroeconomic

conditions that might affect the Group’s receivables.

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

The Group calculates different provisions

for the financial instruments classified into:

| ● | | Stage 1 - no significant increase in credit risk (“SICR”); |

| ● | | Stage 2 - significant increase in credit risk subsequent to recognition; and |

| ● | | Stage 3 - credit impaired. |

Based on these concepts, Nu’s approach

was to calculate ECL through the probability of default ("PD"), exposure at default ("EAD") and loss given default

("LGD") methodology.

Definitions of stages

Stage 1 definition –

no significant increase in credit risk

All receivables not classified in stages

2 and 3.

Stage 2 definition –

significant increase in credit risk subsequent to recognition

The Group utilizes two guidelines for determining

stage 2:

| (i) | absolute criteria: the financial asset is more than 30 (thirty) days but less than 90 (ninety) days in

arrears; or |

| (ii) | relative criteria: in addition to the absolute criteria, the Group analyzes monthly the evolution of the

risk of each financial instrument, comparing the current behavior score attributed to a given client with the one given in the moment

of recognition of the financial asset. The behavior score considers credit behavior variables, such as delinquency in other products and

market data about the client. |

A cure criteria is adopted for stage 2, considering

if the financial asset is no longer meeting the significant increase in credit risk criteria as stated above.

Stage 3 definition –

credit impaired

Stage 3 definition follows the definition

of default:

| (i) | The financial asset is more than 90 (ninety) days in arrears; or |

| (ii) | There are indicatives that the financial asset will not be fully paid without a collateral or financial

guarantee being triggered. |

Indication that an obligation will not

be fully paid includes forbearance of financial instruments that implies advantages being granted to the counterparty following deterioration

in the credit quality of the counterparty.

The group also assumes a cure criteria

for stage 3, taking into account triggers that assess the payment capacity of the counterparty such as the percentage of the total debt

paid or time threshold meeting the debt current obligations

Lifetime definition

The maximum period over which expected credit

losses shall be measured is the maximum contractual period over which the entity is exposed to credit risk. For loan commitments, this

is the maximum contractual period over which an entity has a present contractual obligation to extend credit. Thus, for the lending product,

the lifetime is straightforward, being equal to the number of months for the remaining loan installments to be defaulted on.

| Nu Holdings Ltd. Consolidated Financial Statements as of December 31, 2023 and 2022 |

| | |

However, the credit card includes both a

loan and an undrawn commitment component and does not have a fixed term or repayment structure. Thus, the period over which to measure

expected credit losses are based on historical information and experience about the length of time for related default to occur on similar

financial instruments following a significant increase in credit risk.

In turn, a study was conducted for the