Acquisition expands NWN’s presence in Texas

Northwest Natural Holding Company (NYSE: NWN) (NW Natural

Holdings) today announced it entered into an agreement to acquire

SiEnergy Operating, LLC (SiEnergy or the Company) from SiEnergy

Capital Partners, LLC (an affiliate of Ridgewood Infrastructure)

for $273 million in cash and the assumption of $152 million of

debt. Upon closing the transaction, which is expected to occur in

the first quarter of 2025, SiEnergy will become a wholly owned

subsidiary of NW Natural Holdings.

SiEnergy is one of the fastest growing natural gas distribution

utilities in the nation. The Company serves approximately 70,000

residential and commercial customers in the greater metropolitan

areas of Houston, Dallas, and Austin (known as the Texas Triangle).

SiEnergy has grown organically by providing infrastructure to

residential and commercial developments in high-growth areas and

has a current contracted customer backlog of over 180,000.

SiEnergy’s regulated business model generates stable earnings and

is well positioned for future investment opportunities as

communities and new developments in the Texas Triangle continue to

expand.

As of Dec. 31, 2024, SiEnergy is expected to have approximately

$247 million in rate base and to have achieved rate base and

customer growth of 26% and 22% compounded annually, respectively,

over the last five years ending in 2024. NW Natural Holdings

expects capital expenditures for the Company to be in the range of

$450 million to $650 million over the next five years. We estimate

rate base growth of 6% to 8% from 2023 to 2028 for our regulated

utilities, an increase over our previous 5% to 7% projection.

“The acquisition of SiEnergy builds on our core strength of

operating utilities and delivering essential services to

customers,” said David H. Anderson, CEO of NW Natural Holdings.

“Texas is one of the fastest growing states in the nation with a

constructive regulatory and policy environment. SiEnergy has a

substantial number of contracts to add new customers in the coming

years. We believe we will be well positioned to capture additional

growth as Texas' population expands and new housing developments

provide opportunities for new customers.”

“We have a proven track record of acquiring utilities,

supporting growth and delivering safe and reliable service to

customers. This acquisition directly aligns with our strategic and

financial goals,” said Justin B. Palfreyman, president of NW

Natural Holdings. “Through this transaction, we expect to

meaningfully increase our presence in Texas, creating more

opportunities for organic growth, and setting the stage for future

growth. We are excited for SiEnergy to join the team and will aim

to build on their incredible track record and drive shareholder

value.”

The transaction is expected to further support management's

long-term EPS growth outlook of 4% to 6%. In addition, NW Natural

Holdings reaffirmed its 2024 EPS guidance in the range of $1.94 to

$2.14 on a GAAP basis or $2.20 to $2.40 on a non-GAAP Adjusted

Basis1.

NW Natural Holdings expects to finance the cash portion of the

acquisition with junior subordinated notes in the first half of

2025. We do not anticipate issuing common equity to directly fund

this transaction. NW Natural Holdings has obtained a committed

interim term loan from J.P. Morgan Securities LLC to fund the

purchase price of $273 million.

The transaction is expected to close in the first quarter of

2025 subject to customary closing conditions including expiration

of the waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, as amended. No regulatory approval is

needed from the Railroad Commission of Texas to close this

transaction.

J.P. Morgan Securities LLC is serving as exclusive financial

advisor to NW Natural Holdings with Stoel Rives, LLP serving as

legal advisor.

Conference Call and Webcast

NW Natural Holdings will host a conference call and webcast to

discuss the acquisition. A presentation is available for the call

and can be accessed on our Investor Relations website.

Date and Time:

Tuesday, Nov. 19, 2024

8 a.m. PT (11 a.m. ET)

Phone Numbers:

United States 1-833-470-1428

International 1-404-975-4839

Passcode 002854

The call will also be webcast in a listen-only format for the

media and general public and can be accessed on our Investor

Relations website. A replay of the conference call will be

available on our website and by dialing 1-866-813-9403 (U.S.) and

1-929-458-6194 (international). The replay access code is

832303.

About NW Natural Holdings

Northwest Natural Holding Company, (NYSE: NWN) (NW Natural

Holdings), is headquartered in Portland, Oregon and has been doing

business for over 165 years. It owns Northwest Natural Gas Company

(NW Natural), NW Natural Water Company (NW Natural Water), NW

Natural Renewables Holdings (NW Natural Renewables), and other

business interests.

We have a longstanding commitment to safety, environmental

stewardship and the energy transition, and taking care of our

employees and communities. NW Natural Holdings was recognized by

Ethisphere® for three years running as one of the World’s Most

Ethical Companies®. NW Natural consistently leads the industry with

high J.D. Power & Associates customer satisfaction scores.

Learn more in our latest Community and Sustainability Report.

NW Natural is a local distribution company that currently

provides natural gas service to approximately 2 million people in

more than 140 communities through more than 800,000 meters in

Oregon and Southwest Washington with one of the most modern

pipeline systems in the nation. NW Natural owns and operates 21.6

Bcf of underground gas storage capacity in Oregon.

NW Natural Water provides water distribution and wastewater

services to communities throughout the Pacific Northwest, Texas,

Arizona, and California. Today NW Natural Water serves over 188,000

people through approximately 76,000 meters and provides operation

and maintenance services to an additional 22,000 connections. Learn

more about our water business.

NW Natural Renewables is committed to leading in the energy

transition by providing renewable fuels to support decarbonization

in the utility, commercial, industrial and transportation sectors.

Learn more about our renewable business.

Additional information is available at

nwnaturalholdings.com.

“World’s Most Ethical Companies” and “Ethisphere” names and

marks are registered trademarks of Ethisphere LLC

2024 Guidance and Long-Term Targets

NW Natural Holdings reaffirmed its 2024 GAAP EPS guidance of

$1.94 to $2.14, or $2.20 to $2.40 on a non-GAAP Adjusted Basis1.

This guidance assumes continued customer growth, average weather

conditions, and no significant changes in prevailing regulatory

policies, mechanisms, or outcomes, or significant local, state or

federal laws, legislation or regulations.

2024 EPS Guidance Reconciliation

Table

GAAP EPS Guidance

$1.94 to $2.14

Regulatory Disallowance2

0.26

Adjusted EPS Guidance1

$2.20 to $2.40

NW Natural Holdings reaffirmed its long-term EPS growth rate

target of 4% to 6% compounded annually from 2022 through 2027. 2022

EPS was $2.54.

1 See "Non-GAAP Financial Measures" for a

definition and further information on Adjusted Basis EPS.

2 Non-GAAP guidance excludes the $13.7

million non-cash, pre-tax regulatory charge (approximately $10.1

million or $0.26 per share after-tax) related to the Oregon general

rate case recorded in the fourth quarter of 2024. Impact on EPS

assumes average diluted shares of 39.0 million and an income tax

rate of 26.5%.

Non-GAAP Financial Measures

Management uses "adjusted net income" and "adjusted basis

earnings per share," both of which are non-GAAP financial measures,

when evaluating NW Natural Holdings' overall performance.

Management believes that these non-GAAP measures provide meaningful

information to investors about NW Natural Holdings' performance

because they eliminate the impacts of significant discrete items

that can affect the comparison of period-over-period results. In

addition to presenting the results of operations and earnings

amounts in total, certain financial measures are expressed in cents

per share, which are non-GAAP financial measures. All references to

EPS are on the basis of diluted shares.

Such non-GAAP financial measures are used to analyze our

financial performance because we believe they provide useful

information to our investors and creditors in evaluating our

financial condition and results of operations. Our non-GAAP

financial measures should not be considered a substitute for, or

superior to, measures calculated in accordance with U.S. GAAP.

Moreover, these non-GAAP financial measures have limitations in

that they do not reflect all the items associated with the

operations of the business as determined in accordance with GAAP.

Other companies may calculate similarly titled non-GAAP financial

measures differently than how such measures are calculated in this

report, limiting the usefulness of those measures for comparative

purposes. A reconciliation of each non-GAAP financial measure to

the most directly comparable GAAP financial measure is provided in

the table above.

Forward-Looking Statements

This press release, and other presentations made by NW Natural

Holdings from time to time, may contain forward-looking statements

within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995. Forward-looking statements can be identified by words

such as "anticipates," "assumes," “continues,” “could,” "intends,"

"plans," "seeks," "believes," "estimates," "expects," "will" and

similar references to future periods. Examples of forward-looking

statements include, but are not limited to, statements regarding

the following: plans, objectives, assumptions, estimates,

expectations, forecasts, outlook, timing, goals, visions,

strategies, commitments, future events, financial positions,

acquisition strategy and pending acquisitions, and timing,

approval, completion and integration thereof, investments,

valuations, timing and amount of capital expenditures, rate base

growth, strategic fit, performance, risks, risk profile, stability,

the likelihood and success associated with any transaction,

customer and business growth, growth opportunities, weather,

customer rates or rate recovery, investment strategy and financial

effects of acquisitions, shareholder return and value, financial

results, including estimated income, availability and sources of

liquidity, capital markets, financing transactions, debt or equity

issuances, expenses, positions, revenues, returns, cost of capital,

timing, and earnings, earnings guidance and estimated future growth

rates, regulatory strategy, performance, timing, outcome, or

effects of regulatory proceedings or mechanisms or approvals,

accounting treatment of future events, economic and political

conditions, effects of legislation or changes in laws or

regulations, inflation, geopolitical uncertainty, and other

statements that are other than statements of historical facts.

Forward-looking statements are based on current expectations and

assumptions regarding its business, the economy, geopolitical

factors, and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. Actual results may differ materially from

those contemplated by the forward-looking statements. You are

therefore cautioned against relying on any of these forward-looking

statements. They are neither statements of historical fact nor

guarantees or assurances of future operational, economic or

financial performance. Important factors that could cause actual

results to differ materially from those in the forward-looking

statements are discussed by reference to the factors described in

Part I, Item 1A "Risk Factors", and Part II, Item 7 and Item 7A

"Management's Discussion and Analysis of Financial Condition and

Results of Operations" and "Quantitative and Qualitative Disclosure

about Market Risk" in the most recent Annual Report on Form 10-K

and in Part I, Items 2 and 3 "Management's Discussion and Analysis

of Financial Condition and Results of Operations" and "Quantitative

and Qualitative Disclosures About Market Risk", and Part II, Item

1A, "Risk Factors", in the quarterly reports filed thereafter,

which, among others, outline legal, regulatory and legislative

risks, public health risks, financial, macroeconomic and

geopolitical risks, growth and strategic risks, operational risks,

business continuity and technology risks, environmental risks and

risks related to our water and renewables businesses.

All forward-looking statements made in this report and all

subsequent forward-looking statements, whether written or oral and

whether made by or on behalf of NW Natural Holdings or NW Natural,

are expressly qualified by these cautionary statements. Any

forward-looking statement speaks only as of the date on which such

statement is made, and NW Natural Holdings and NW Natural undertake

no obligation to publicly update any forward-looking statement,

whether as a result of new information, future developments or

otherwise, except as may be required by law. New factors emerge

from time to time and it is not possible to predict all such

factors, nor can it assess the impact of each such factor or the

extent to which any factor, or combination of factors, may cause

results to differ materially from those contained in any

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241118390111/en/

Investor Contact: Nikki Sparley Phone: 503-721-2530 Email:

nikki.sparley@nwnatural.com

Media Contact: David Roy Phone: 503-610-7157 Email:

david.roy@nwnatural.com

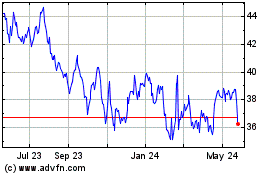

Northwest Natural (NYSE:NWN)

Historical Stock Chart

From Jan 2025 to Feb 2025

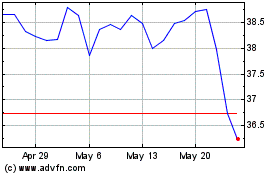

Northwest Natural (NYSE:NWN)

Historical Stock Chart

From Feb 2024 to Feb 2025