0001733998false00017339982024-11-172024-11-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

November 17, 2024

Date of Report (Date of earliest event reported)

NORTHWEST NATURAL HOLDING COMPANY

(Exact name of registrant as specified in its charter)

Commission file number 1-38681

| | | | | | | | |

| Oregon | | 82-4710680 |

(State or other jurisdiction of

incorporation) | | (I.R.S. Employer

Identification No.) |

250 S.W. Taylor Street, Portland, Oregon 97204

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (503) 226-4211

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | | | | |

| Registrant | | Title of each class | | Trading

Symbol | | Name of each exchange

on which registered |

| Northwest Natural Holding Company | | Common Stock | | NWN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | |

| Item 7.01 Regulation FD Disclosure. |

On November 18, 2024, Northwest Natural Holding Company (NW Holdings) issued a press release announcing its agreement to acquire SiEnergy Operating, LLC (SiEnergy) from SiEnergy Capital Partners, LLC, an affiliate of Ridgewood Infrastructure. A copy of the press release is attached as Exhibit 99.1. The press release additionally announced a conference call scheduled for November 19, 2024. NW Holdings intends to display the material attached hereto as Exhibit 99.2 on that conference call.

The information contained in this Item 7.01 shall not be incorporated by reference into any filing of NW Holdings, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing. The information in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

Item 8.01 Other Events

On November 17, 2024, Northwest Natural Holding Company (NW Holdings) entered into a purchase and sale agreement (the PSA) to acquire all of the membership interests of SiEnergy Operating, LLC, a Delaware limited liability company (SiEnergy), from SiEnergy Capital Partners, LLC, an affiliate of Ridgewood Infrastructure, for $273 million in cash and an assumption of $152 million of debt, subject to customary purchase price adjustments.

The PSA contains customary representations, warranties and covenants of each of NW Holdings, SiEnergy and SiEnergy Capital Partners, LLC. Closing of the acquisition is subject to satisfaction of conditions customary for a transaction of this size and nature, including the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. Subject to the satisfaction or waiver of the terms and conditions of the PSA, NW Holdings expects to close the acquisition in the first quarter of 2025.

The commitment to acquire SiEnergy can be terminated prior to closing by mutual written consent of NW Holdings and SiEnergy Capital Partners, LLC, or on the occurrence of other circumstances customary for a transaction of this size and nature, including by either party if the closing has not occurred by February 15, 2025. If the PSA is terminated under certain customary circumstances related to material breaches of covenants by, or material inaccuracies in representations and warranties of, NW Holdings, NW Holdings may be required to pay SiEnergy Capital Partners, LLC a termination fee of $17 million.

NW Holdings has obtained committed financing to fund the purchase price pursuant to a commitment letter (Commitment Letter) entered into on November 17, 2024, with JPMorgan Chase Bank, N.A., which provides commitments for a 364-day term loan facility (the Bridge Facility) in an aggregate initial principal amount of $273 million. The funding of the Bridge Facility is contingent on the satisfaction of customary conditions, including (i) execution and delivery of definitive documentation with respect to the Bridge Facility in accordance with the terms set forth in the Commitment Letter, and (ii) consummation of the acquisition of SiEnergy. NW Holdings currently expects to issue junior subordinated notes in the first half of 2025 for permanent financing of the acquisition.

Forward-Looking Statements

This report, and other presentations made by NW Holdings from time to time, may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipates,” “assumes,” “continues,” “could,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “will” and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements regarding the following: plans; objectives; assumptions; estimates; timing; goals; strategies; future events; projections; expectations; forecasts; outlook; acquisition strategy; acquisitions and timing, completion and integration thereof; pipeline, gas utility and other infrastructure investments; safety; weather; gross domestic product, population and employment growth; economic conditions and development; customer growth; scale and diversification; regulatory, policy and political environments; rate base growth; earnings; growth opportunities; customer backlog; growth rate; financings; regulatory mechanisms; invested capital; system safety and reliability; risk profile; strategic fit; financial profile; shareholder value; financial targets, including FFO/Debt targets; return on invested capital; rate case execution; customer and business growth; business risk; regulatory recovery; water and wastewater industry and investments including timing, completion and integration of such investments; accretion, financial positions and performance; shareholder return and value; capital expenditures; strategic goals and visions; renewable natural gas projects or investments and timing related thereto; return on equity; capital structure; return on invested capital; revenues and earnings and timing thereof; margins; net income; operations and maintenance expense; credit ratings and profile; debt and equity issuances; timing or effects of future regulatory proceedings or future regulatory approvals; timing, outcome and effects of regulatory dockets or mechanisms or approvals; accounting treatment of future events; economic and political conditions; effects of legislation or changes in laws or regulations; inflation; geopolitical uncertainty; and other statements that are other than statements of historical facts.

Forward-looking statements are based on current expectations and assumptions regarding its business, the economy, geopolitical factors, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual results may differ materially from those contemplated by the forward-looking statements. You are therefore cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future operational, economic or financial performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements are discussed by reference to the factors described in Part I, Item 1A "Risk Factors", and Part II, Item 7 and Item 7A "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Quantitative and Qualitative Disclosures about Market Risk" in the most recent Annual Report on Form 10-K and in Part I, Items 2 and 3 "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Quantitative and Qualitative Disclosures About Market Risk", and Part II, Item 1A, "Risk Factors", in the quarterly reports filed thereafter, which, among others, outline legal, regulatory and legislative risks, public health risks, financial, macroeconomic and geopolitical risks, growth and strategic risks, operational risks, business continuity and technology risks, environmental risks and risks related to our water and renewables businesses.

All forward-looking statements made in this report and all subsequent forward-looking statements, whether written or oral and whether made by or on behalf of the Company, are expressly qualified by these cautionary statements. Any forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. New factors emerge from time to time and it is not possible to predict all such factors, nor can they assess

the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

See Exhibit Index below.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Inline XBRL for the cover page of this Current Report on Form 8-K |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | NORTHWEST NATURAL HOLDING COMPANY |

| | (Registrant) |

| | |

| Dated: November 18, 2024 | | /s/ Shawn M. Filippi |

| | Vice President, Chief Compliance Officer & Corporate |

| | Secretary |

EXHIBIT 99.1

FOR IMMEDIATE RELEASE: Nov. 18, 2024

NW Natural Holdings to Acquire Rapidly Growing Gas Utility

Acquisition expands NWN’s presence in Texas

PORTLAND, Ore. – Northwest Natural Holding Company (NYSE: NWN) (NW Natural Holdings) today announced it entered into an agreement to acquire SiEnergy Operating, LLC (SiEnergy or the Company) from SiEnergy Capital Partners, LLC (an affiliate of Ridgewood Infrastructure) for $273 million in cash and the assumption of $152 million of debt. Upon closing the transaction, which is expected to occur in the first quarter of 2025, SiEnergy will become a wholly owned subsidiary of NW Natural Holdings.

SiEnergy is one of the fastest growing natural gas distribution utilities in the nation. The Company serves approximately 70,000 residential and commercial customers in the greater metropolitan areas of Houston, Dallas, and Austin (known as the Texas Triangle). SiEnergy has grown organically by providing infrastructure to residential and commercial developments in high-growth areas and has a current contracted customer backlog of over 180,000. SiEnergy’s regulated business model generates stable earnings and is well positioned for future investment opportunities as communities and new developments in the Texas Triangle continue to expand.

As of Dec. 31, 2024, SiEnergy is expected to have approximately $247 million in rate base and to have achieved rate base and customer growth of 26% and 22% compounded annually, respectively, over the last five years ending in 2024. NW Natural Holdings expects capital expenditures for the Company to be in the range of $450 million to $650 million over the next five years. We estimate rate base growth of 6% to 8% from 2023 to 2028 for our regulated utilities, an increase over our previous 5% to 7% projection.

“The acquisition of SiEnergy builds on our core strength of operating utilities and delivering essential services to customers,” said David H. Anderson, CEO of NW Natural Holdings. “Texas is one of the fastest growing states in the nation with a constructive regulatory and policy environment. SiEnergy has a substantial number of contracts to add new customers in the coming years. We believe we will be well positioned to capture additional growth as Texas' population expands and new housing developments provide opportunities for new customers.”

“We have a proven track record of acquiring utilities, supporting growth and delivering safe and reliable service to customers. This acquisition directly aligns with our strategic and financial goals,” said Justin B. Palfreyman, president of NW Natural Holdings. "Through this transaction, we expect to meaningfully increase our presence in Texas, creating more opportunities for organic growth, and setting the stage for future growth. We are excited for SiEnergy to join the team and will aim to build on their incredible track record and drive shareholder value.”

The transaction is expected to further support management's long-term EPS growth outlook of 4% to 6%. In addition, NW Natural Holdings reaffirmed its 2024 EPS guidance in the range of $1.94 to $2.14 on a GAAP basis or $2.20 to $2.40 on a non-GAAP Adjusted Basis1.

NW Natural Holdings expects to finance the cash portion of the acquisition with junior subordinated notes in the first half of 2025. We do not anticipate issuing common equity to directly fund this transaction. NW Natural Holdings has obtained a committed interim term loan from J.P. Morgan Securities LLC to fund the purchase price of $273 million.

The transaction is expected to close in the first quarter of 2025 subject to customary closing conditions including expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. No regulatory approval is needed from the Railroad Commission of Texas to close this transaction.

J.P. Morgan Securities LLC is serving as exclusive financial advisor to NW Natural Holdings with Stoel Rives, LLP serving as legal advisor.

Conference Call and Webcast

NW Natural Holdings will host a conference call and webcast to discuss the acquisition. A presentation is available for the call and can be accessed on our Investor Relations website.

| | | | | |

| Date and Time: | Tuesday, Nov. 19, 2024 8 a.m. PT (11 a.m. ET) |

| Phone Numbers: | United States 1-833-470-1428 International 1-404-975-4839 Passcode 002854 |

The call will also be webcast in a listen-only format for the media and general public and can be accessed on our Investor Relations website. A replay of the conference call will be available on our website and by dialing 1-866-813-9403 (U.S.) and 1-929-458-6194 (international). The replay access code is 832303.

About NW Natural Holdings

Northwest Natural Holding Company, (NYSE: NWN) (NW Natural Holdings), is headquartered in Portland, Oregon and has been doing business for over 165 years. It owns Northwest Natural Gas Company (NW Natural), NW Natural Water Company (NW Natural Water), NW Natural Renewables Holdings (NW Natural Renewables), and other business interests.

We have a longstanding commitment to safety, environmental stewardship and the energy transition, and taking care of our employees and communities. NW Natural Holdings was recognized by Ethisphere® for three years running as one of the World’s Most Ethical Companies®. NW Natural consistently leads the industry with high J.D. Power & Associates customer satisfaction scores. Learn more in our latest Community and Sustainability Report.

NW Natural is a local distribution company that currently provides natural gas service to approximately 2 million people in more than 140 communities through more than 800,000 meters in Oregon and Southwest Washington with one of the most modern pipeline systems in the nation. NW Natural owns and operates 21.6 Bcf of underground gas storage capacity in Oregon.

NW Natural Water provides water distribution and wastewater services to communities throughout the Pacific Northwest, Texas, Arizona, and California. Today NW Natural Water serves over 188,000 people through approximately 76,000 meters and provides operation and maintenance services to an additional 22,000 connections. Learn more about our water business.

NW Natural Renewables is committed to leading in the energy transition by providing renewable fuels to support decarbonization in the utility, commercial, industrial and transportation sectors. Learn more about our renewable business.

Additional information is available at nwnaturalholdings.com.

“World’s Most Ethical Companies” and “Ethisphere” names and marks are registered trademarks of Ethisphere LLC

Investor Contact:

Nikki Sparley

Phone: 503-721-2530

Email: nikki.sparley@nwnatural.com

Media Contact:

David Roy

Phone: 503-610-7157

Email: david.roy@nwnatural.com

2024 Guidance and Long-Term Targets

NW Natural Holdings reaffirmed its 2024 GAAP EPS guidance of $1.94 to $2.14, or $2.20 to $2.40 on a non-GAAP Adjusted Basis1. This guidance assumes continued customer growth, average weather conditions, and no significant changes in prevailing regulatory policies, mechanisms, or outcomes, or significant local, state or federal laws, legislation or regulations.

| | | | | |

2024 EPS Guidance Reconciliation Table |

GAAP EPS Guidance | $1.94 to $2.14 |

Regulatory Disallowance2 | 0.26 |

Adjusted EPS Guidance1 | $2.20 to $2.40 |

NW Natural Holdings reaffirmed its long-term EPS growth rate target of 4% to 6% compounded annually from 2022 through 2027. 2022 EPS was $2.54.

1 See "Non-GAAP Financial Measures" for a definition and further information on Adjusted Basis EPS.

2 Non-GAAP guidance excludes the $13.7 million non-cash, pre-tax regulatory charge (approximately $10.1 million or $0.26 per share after-tax) related to the Oregon general rate case recorded in the fourth quarter of 2024. Impact on EPS assumes average diluted shares of 39.0 million and an income tax rate of 26.5%.

Non-GAAP Financial Measures

Management uses "adjusted net income" and "adjusted basis earnings per share," both of which are non-GAAP financial measures, when evaluating NW Natural Holdings' overall performance. Management believes that these non-GAAP measures provide meaningful information to investors about NW Natural Holdings' performance because they eliminate the impacts of significant discrete items that can affect the comparison of period-over-period results. In addition to presenting the results of operations and earnings amounts in total, certain financial measures are expressed in cents per share, which are non-GAAP financial measures. All references to EPS are on the basis of diluted shares.

Such non-GAAP financial measures are used to analyze our financial performance because we believe they provide useful information to our investors and creditors in evaluating our financial condition and results of operations. Our non-GAAP financial measures should not be considered a substitute for, or superior to, measures calculated in accordance with U.S. GAAP. Moreover, these non-GAAP financial measures have limitations in that they do not reflect all the items associated with the operations of the business as determined in accordance with GAAP. Other companies may calculate similarly titled non-GAAP financial measures differently than how such measures are calculated in this report, limiting the usefulness of those measures for comparative purposes. A reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure is provided in the table above.

Forward-Looking Statements

This press release, and other presentations made by NW Natural Holdings from time to time, may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipates," "assumes," “continues,” “could,”

"intends," "plans," "seeks," "believes," "estimates," "expects," "will" and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements regarding the following: plans, objectives, assumptions, estimates, expectations, forecasts, outlook, timing, goals, visions, strategies, commitments, future events, financial positions, acquisition strategy and pending acquisitions, and timing, approval, completion and integration thereof, investments, valuations, timing and amount of capital expenditures, rate base growth, strategic fit, performance, risks, risk profile, stability, the likelihood and success associated with any transaction, customer and business growth, growth opportunities, weather, customer rates or rate recovery, investment strategy and financial effects of acquisitions, shareholder return and value, financial results, including estimated income, availability and sources of liquidity, capital markets, financing transactions, debt or equity issuances, expenses, positions, revenues, returns, cost of capital, timing, and earnings, earnings guidance and estimated future growth rates, regulatory strategy, performance, timing, outcome, or effects of regulatory proceedings or mechanisms or approvals, accounting treatment of future events, economic and political conditions, effects of legislation or changes in laws or regulations, inflation, geopolitical uncertainty, and other statements that are other than statements of historical facts.

Forward-looking statements are based on current expectations and assumptions regarding its business, the economy, geopolitical factors, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual results may differ materially from those contemplated by the forward-looking statements. You are therefore cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future operational, economic or financial performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements are discussed by reference to the factors described in Part I, Item 1A "Risk Factors", and Part II, Item 7 and Item 7A "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Quantitative and Qualitative Disclosure about Market Risk" in the most recent Annual Report on Form 10-K and in Part I, Items 2 and 3 "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Quantitative and Qualitative Disclosures About Market Risk", and Part II, Item 1A, "Risk Factors", in the quarterly reports filed thereafter, which, among others, outline legal, regulatory and legislative risks, public health risks, financial, macroeconomic and geopolitical risks, growth and strategic risks, operational risks, business continuity and technology risks, environmental risks and risks related to our water and renewables businesses.

All forward-looking statements made in this report and all subsequent forward-looking statements, whether written or oral and whether made by or on behalf of NW Natural Holdings or NW Natural, are expressly qualified by these cautionary statements. Any forward-looking statement speaks only as of the date on which

such statement is made, and NW Natural Holdings and NW Natural undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. New factors emerge from time to time and it is not possible to predict all such factors, nor can it assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements.

NW Natural Holdings SiEnergy Acquisition November 19, 2024

Investor Information Company Information NW Natural Holdings 250 SW Taylor Street Portland, OR 97204 nwnaturalholdings.com Nikki Sparley Director, Investor Relations and Treasury (503) 721-2530 nikki.sparley@nwnatural.com FORWARD LOOKING STATEMENTS This and other presentations made by NW Natural Holdings from time to time, may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, which are subject to the safe harbors created by such Act. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “will,” and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements regarding the following: plans; objectives; estimates; timing; goals; strategies; future events; projections; expectations; forecasts; outlook; acquisitions and timing, completion and integration thereof; pipeline, gas utility and other infrastructure investments; safety; gross domestic product, population and employment growth; economic conditions and development; customer growth; scale and diversification; regulatory, policy and political environments; rate base growth; earnings; growth opportunities; customer backlog; growth rate; financings; regulatory mechanisms; invested capital; system safety and reliability; risk profile; strategic fit; financial profile; shareholder value; financial targets, including FFO/Debt targets; return on invested capital; rate case execution; customer and business growth; business risk; regulatory recovery; water and wastewater industry and investments including timing, completion and integration of such investments; accretion, financial positions and performance; shareholder return and value; capital expenditures; strategic goals and visions; renewable natural gas projects or investments and timing related thereto; return on equity; capital structure; return on invested capital; revenues and earnings and timing thereof; margins; net income; operations and maintenance expense; credit ratings and profile; debt and equity issuances; timing or effects of future regulatory proceedings or future regulatory approvals; timing, outcome and effects of regulatory dockets or mechanisms or approvals; and other statements that are other than statements of historical facts. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements, so we caution you against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements are discussed by reference to the factors described in Part I, Item 1A “Risk Factors,” and Part II, Item 7 and Item 7A “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosure about Market Risk” in the Company’s most recent Annual Report on Form 10-K, and in Part I, Items 2 and 3 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Quantitative and Qualitative Disclosures About Market Risk”, and Part II, Item 1A, “Risk Factors”, in the Company’s quarterly reports filed thereafter. All forward-looking statements made in this presentation and all subsequent forward-looking statements, whether written or oral and whether made by or on behalf of NW Holdings, are expressly qualified by these cautionary statements. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. 2

Leadership Presenting Today David H. Anderson Chief Executive Officer Ray J. Kaszuba SVP & CFO Justin B. Palfreyman President 3

4 • Signed agreement to acquire SiEnergy Operating, LLC (SiEnergy) for $273 million in cash and the assumption of $152 million of debt • Unique opportunity to acquire a regulated natural gas utility in the fast-growing metropolitan areas of Houston, Dallas- Fort Worth and Austin, Texas • Provides incremental growth, scale, and diversification • Located in a constructive regulatory and policy environment • Double-digit customer growth and rate base growth expected over the next five years for SiEnergy • Further supports NW Natural Holdings’ long-term EPS growth outlook of 4-6% and increases rate base growth forecast to 6-8% Acquiring a High-Growth Utility

OVERVIEW • SiEnergy is a regulated utility founded in 1997 that distributes natural gas to residential and commercial customers in the desirable and fast-growing major metropolitan areas of the Texas Triangle1 • Strong historic customer growth of 20%+ with Texas economic development expected to continue, supporting projections for double-digit customer and rate base growth long term • Provides NW Natural Holdings regulated growth opportunities in a constructive regulatory and policy environment • Meaningful acquisition that further improves growth opportunities, scale and diversification of NW Natural Holdings’ portfolio • Further supports NW Natural Holdings’ long-term EPS growth outlook of 4-6% 5 1 Includes the Houston, Dallas-Fort Worth, and Austin areas 2 Reflects counties in which SiEnergy has active and backlog customers F Indicates a Forecasted number E Indicates an Expected number based on current information for 2024 KEY STATISTICS AND PROJECTIONS 70,000+ Gas LDC Customers (12/31/24E) 180,000+ Contracted Backlog of New Customers $247 million Rate Base (12/31/24E) $450 - $650 million Cap-Ex (2025F-2030F) 22% Historical Customer CAGR (2019A-2024E) One of the Fastest Growing Natural Gas Utilities in the Nation through Organic Customer Additions SERVICE TERRITORIES Acquisition of SiEnergy Strategic investment in high-growth, constructive market that further supports NWN’s long-term EPS growth target 26% Historical Rate Base CAGR (2019A-2024E) Service Territories2 DALLAS-FORT WORTH AUSTIN HOUSTON Up to 20% Customer CAGR (2025F-2030F)

Strategic Rationale Further Supports Long-Term Growth Outlook ✓ Further supports NW Natural Holdings’ long-term EPS growth outlook of 4-6% ✓ Increases long-term rate base growth target from 5-7% to 6-8% Provides Scale and Diversification ✓ Scale creates a stronger platform to support and finance long-term growth ✓ Diversifies gas utility operations and supports greater stability of earnings Constructive Texas Regulatory and Economic Environment ✓ Constructive regulatory and policy environment in Texas ✓ Supportive regulatory mechanisms that minimize lag and allow for efficient return on invested capital ✓ Strong Texas economy and policy support for long-term natural gas utility growth Strategic Fit with Core Competencies and Existing Operations in Texas ✓ Aligned with NW Natural Holdings’ core operational competencies and values ✓ Modern and safe distribution system comprised of recently installed infrastructure ✓ Strategic fit for NWN with complementary service territories to NWN’s Texas water business Aligned with Acquisition Strategy ✓ Reinforces NW Natural Holdings’ strong track record of executing strategic acquisitions to strengthen its financial profile and drive long-term value for shareholders 6

LIQUIDITY OF AND FINANCINGStrong Texas Triangle Growth 7 Service territories in three of the fastest growing metro areas in the U.S. and is forecasted to continue delivering outsized growth • On average, ~400,000 new residents moved to Texas each year from 2000 - 2022 • Houston, Dallas and Austin are among the top 10 metro areas with the most annual new home starts in the U.S. • Roughly 300 corporations relocated to Texas between 2015 and April 2024 • Three of the Top 20 Hottest U.S. Job Markets per the WSJ are in the Texas Triangle • SiEnergy has strong relationships with housing developers, providing line-of-sight to new customers and continued growth • Current customer backlog of approximately 180,000 connections SiEnergy’s service territories are seeing… …1.4x faster real GDP growth… … 3.3x faster population growth… …and 2.3x faster employment growth than the U.S. Real GDP Growth1 (2018-2022) Population Growth (2018-2023) Employment Growth2 (2018-2023) 1.6% 0.5% TX Triangle U.S. Total 2.3% 1.0% TX Triangle U.S. Total Source: U.S. Bureau of Labor Statistics, U.S. Department of the Treasury, U.S. Census Bureau., Wall Street Journal as of April 2024; 1 Real GDP growth by metro area is only available through 2022; 2 Based on non-farm payrolls 3.2% 2.2% TX Triangle U.S. Total

LIQUIDITY OF AND FINANCING Fast-Growing Service Territories 8 Source: U.S. Census Bureau, Vintage 2023 Population Estimates Service territories located in three of the fastest-growing metro areas in the U.S. SiEnergy Service Territories Top 10 U.S. Metro Areas Ranked in Numeric Population Growth (July 2022-2023) 1 Dallas, TX Population +153k 2 Houston, TX Population +140k 3 Atlanta, GA Population +69k 4 Orlando, FL Population +55k 5 Tampa, FL Population +52k 6 Charlotte, NC Population +50k 7 Austin, TX Population +50k 8 Phoenix, AZ Population +49k 9 San Antonio, TX Population +48k 10 Miami, FL Population +44k

Constructive Regulatory Environment Supports Growing Gas Utility LIQUIDITY OF AND FINANCINGConstructive Texas Regulatory Environment 9 (1) Rated Average / 1 by Regulatory Research Associates (RRA). RRC regulates rates through original jurisdiction in areas outside of cities and through appellate jurisdiction for areas inside of cities. (2) Known and Measurable adjustments. (3) Adjusted by excluding 2024E ADIT of $6.0mm and adding in 2024E CWIP of $4.4mm.(4) Source: S&P Capital IQ, reflected median of TX natural gas rate case decisions in 2023 (5) GRIP requires GRC filing no later than five years after the most recent GRC. Regulatory Highlights Regulatory Commission Texas Railroad Commission RRA Ranking Average / 11 Primary Rate-Making Construct General Rate Case Test Year Historic + KMA2 SiEnergy 2024E Rate Base $247 million3 Texas Median Allowed Equity Portion of Cap Structure 59.7%4 Texas Provides Multiple Regulatory Mechanisms Currently Used by SiEnergy General Rate Case Gas Cost Recovery Adjustment Weather Normalization Adjustment Gas Reliability Infrastructure Program5 • Annual rate adjustments that allow for recovery on and of new invested capital between rate cases Available to request for future use

LIQUIDITY OF AND FINANCING Transaction and Financing Details 10 • Acquiring 100% of SiEnergy Operating, LLC and its subsidiaries in sale of membership interests from SiEnergy Capital Partners, LLC • At closing, subject to customary closing adjustments: — Estimated cash payment of $273 million — Debt assumed at closing of $152 million • Underwritten term loan commitment in place for interim financing with a permanent financing plan intended to maintain a strong balance sheet and solid investment grade credit rating. Expect to execute permanent financing in the first half of 2025. Currently, we do not anticipate issuing common equity to fund the transaction • Closing expected in Q1 2025, subject to customary closing conditions including expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. No regulatory approval is needed from the Railroad Commission of Texas to close this transaction • J.P. Morgan Securities LLC serving as exclusive financial advisor and engaged to act as lead on permanent financing

1 S&P rating agency FFO/Adjusted Debt calculation Strong Balance Sheet with Ample Liquidity Financing Needs Equity • Issued $90.4 million YTD 9/30/24 through ATM • No additional ATM issuances expected in 2024 • 2025 equity issuance currently expected to be lower than 2024 levels Debt • $150 million NW Natural Holdings bonds issued in 2024 to refinance term loans totaling the same amount. No NW Natural Gas Company bonds maturing in 2024 • Expect to issue $60 million NW Natural Holdings and $75 million NW Natural Gas Company bonds in the coming 12 months to support the business and refinance $30 million maturing bond at NW Natural Gas Company • SiEnergy acquisition initially financed with underwritten term loan. Permanent financing plan currently includes junior subordinated notes. Expect issuance in the 1st half of 2025 • Currently, we do not anticipate issuing common equity to fund the transaction • FFO/Debt target ~14% for NW Natural Holdings1 over the long term Available Liquidity As of September 30, 2024 (In millions) 11 Cash, $35 NW Natural Line of Credit $300 Holdings Line of Credit $140

Supports NWN’s goal of continuing to deliver strong, consistent long-term EPS growth of 4-6% Positioned for Long-Term Success After a strong year of execution, NWN is well-positioned to deliver on its financial and strategic objectives Successful Oregon Gas Rate Case Outcome • New customer rates in Oregon on Nov. 1 includes approval of all-party settlement • Allows for strong return on invested capital Scale Water Platform with Attractive Growth Outlook • Rapidly growing water and wastewater utility platform through both organic growth and acquisitions • Supported by successful rate case execution in 2024 for crucial safety investments that provides a strong foundation for earnings going forward • Completed Puttman/ICH acquisition adding a new pipeline of growth Successful Start-up of First RNG Facility • Successful start-up of first NW Natural Renewables project • Provides strong, contracted cash flow profile Acquisition of High-Growth Texas gas LDC Platform • Acquisition of high-growth Texas gas LDC platform further supports long-term growth outlook 12

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

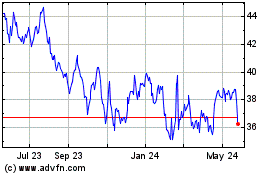

Northwest Natural (NYSE:NWN)

Historical Stock Chart

From Jan 2025 to Feb 2025

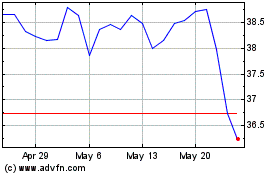

Northwest Natural (NYSE:NWN)

Historical Stock Chart

From Feb 2024 to Feb 2025