- Net income of $15.2 million, or $0.24 per share, reported for

the quarter, which included a facility sale gain of $15.3 million

partially offset by restructuring and other charges totaling $3.1

million (net after-tax benefit of $9.6 million, or $0.16 per

share)

- Adjusted net income of $5.5 million, or $0.09 per share,

excluding the facility sale gain and restructuring charges (a

non-GAAP measure(1))

- Consolidated revenues of $164.6 million decreased 6%

sequentially, driven primarily by lower U.S. land-based activity

and the exit of certain service lines in the third quarter of

2024

- Adjusted EBITDA (a non-GAAP measure(1)) of $18.7 million

- Generated cash flows from operations of $18.2 million

- Sold a previously idled facility for net cash proceeds of $24.8

million, resulting in a pre-tax gain of $15.3 million

- Purchased $9.1 million of our common stock during the

quarter

Oil States International, Inc. (NYSE: OIS):

Three Months Ended

% Change

(Unaudited, In Thousands, Except Per Share

Amounts)

December 31,

2024

September 30,

2024

December 31,

2023

Sequential

Year-over- Year

Consolidated results:

Revenues

$

164,595

$

174,348

$

208,266

(6

)%

(21

)%

Operating income (loss)(3)

$

18,484

$

(11,041

)

$

7,830

n.m.

136

%

Net income (loss)

$

15,164

$

(14,349

)

$

5,963

n.m.

154

%

Adjusted net income (loss), excluding

charges and credits(1)

$

5,537

$

2,696

$

7,071

105

%

(22

)%

Adjusted EBITDA(1)

$

18,734

$

21,531

$

23,978

(13

)%

(22

)%

Revenues by segment(2):

Offshore Manufactured Products

$

107,253

$

102,234

$

126,489

5

%

(15

)%

Completion and Production Services

30,090

40,099

51,208

(25

)%

(41

)%

Downhole Technologies

27,252

32,015

30,569

(15

)%

(11

)%

Revenues by destination:

Offshore and international

$

118,187

$

113,856

$

135,885

4

%

(13

)%

U.S. land

46,408

60,492

72,381

(23

)%

(36

)%

Operating income (loss) by

segment(2)(3):

Offshore Manufactured Products

$

21,009

$

19,310

$

24,167

9

%

(13

)%

Completion and Production Services

(4,004

)

(18,267

)

(1,102

)

78

%

(263

)%

Downhole Technologies

(4,031

)

(3,653

)

(5,726

)

(10

)%

30

%

Corporate

5,510

(8,431

)

(9,509

)

n.m.

n.m.

Adjusted Segment EBITDA(1)(2):

Offshore Manufactured Products

$

24,748

$

23,303

$

28,838

6

%

(14

)%

Completion and Production Services

3,545

5,413

5,903

(35

)%

(40

)%

Downhole Technologies

131

1,078

(1,420

)

(88

)%

n.m.

Corporate

(9,690

)

(8,263

)

(9,343

)

117

%

104

%

___________________

(1)

These are non-GAAP measures. See

“Reconciliations of GAAP to Non-GAAP Financial Information” tables

below for reconciliations to their most comparable GAAP measures as

well as further clarification and explanation.

(2)

In the first quarter of 2024, certain

short-cycle, consumable product operations historically reported

within the Offshore Manufactured Products segment were integrated

into the Downhole Technologies segment. 2023 segment financial

data, backlog and other information (as presented herein) were

conformed with the revised segment presentation. In the third

quarter of 2024, the Well Site Services segment’s name was changed

to Completion and Production Services following the sale of its

remaining drilling rigs and the exit of its flowback and well

testing service offerings.

(3)

Operating income (loss) included charges

totaling: $3.1 million for the three months ended December 31,

2024; $18.2 million for the three months ended September 30, 2024;

and $1.4 million for the three months ended December 31, 2023.

Fourth quarter 2024 results also included a gain of $15.3 million

associated with the sale of a previously idled facility. See

“Segment Data” below for additional information.

Oil States International, Inc. reported net income of $15.2

million, or $0.24 per share, and Adjusted EBITDA of $18.7 million

for the fourth quarter of 2024 on revenues of $164.6 million.

Reported fourth quarter 2024 net income included a gain of $15.3

million ($12.1 million after-tax or $0.20 per share) associated

with the sale of a previously idled facility and charges of $3.1

million ($2.5 million after-tax or $0.04 per share) associated

primarily with the restructuring of certain U.S. land-based

operations and facility closures. These results compare to revenues

of $174.3 million, a net loss of $14.3 million, or $0.23 per share,

and Adjusted EBITDA of $21.5 million reported in the third quarter

of 2024, which included charges of $18.2 million ($17.0 million

after-tax, or $0.27 per share) associated with the restructuring of

certain U.S. land-based operations, including facility closures,

personnel reductions and patent defense.

For the year ended December 31, 2024, the Company reported a net

loss of $11.3 million, or $0.18 per share, and Adjusted EBITDA of

$77.0 million on revenues of $692.6 million. The full-year 2024

results included a non-cash goodwill impairment charge of $10.0

million ($9.5 million after-tax, or $0.15 per share), charges of

$28.3 million ($22.3 million after-tax or $0.36 per share)

associated with the restructuring of certain U.S. land-based

operations, including facility closures, personnel reductions and

patent defense, partially offset by a gain of $15.3 million ($12.1

million after-tax or $0.20 per share) associated with the sale of a

previously idled facility. The 2024 results compare to net income

of $12.9 million, or $0.20 per share, and Adjusted EBITDA of $87.8

million on revenues of $782.3 million in 2023. The full-year 2023

results included charges of $3.1 million ($2.5 million after-tax,

or $0.04 per share) associated with facility consolidation and

patent defense.

Oil States’ President and Chief Executive Officer, Cindy B.

Taylor, stated:

“Continuing with earlier themes, our offshore and international

operations were very resilient in terms of revenue, Adjusted EBITDA

and bookings during the fourth quarter. However, sequential

improvements in these regions were offset by ongoing declines in

our U.S. land driven operations due to extensive holiday slowdowns

in activity during the quarter. Our completions work in the Gulf of

America was also slow to recover from disruptions noted in the

third quarter, but recently has recovered to much higher activity

levels.

“Our Offshore Manufactured Products segment revenues rose 5%

sequentially, totaling $107 million in the fourth quarter, while

Adjusted Segment EBITDA rose 6% to $25 million on a favorable

revenue mix. Bookings increased 1% sequentially, totaling $113

million compared to $112 million booked in the third quarter of

2024, yielding backlog of $311 million as of December 31 and a

quarterly book-to-bill ratio of 1.1x. The outlook for our offshore

and international project-driven businesses remains strong with

growing market acceptance of our new technology offerings including

our integrated riser joint used in managed pressure drilling

operations.

“Given the highly cyclical nature of select U.S. service lines,

we continued our strategic initiatives around business mix

optimization and capital allocation within our Completion and

Production Services and Downhole Technologies segments. Strategic

efforts to improve our U.S. operational performance along with the

exit of more commoditized business lines should enhance our U.S.

land driven operating margins in future periods.”

Business Segment Results

In first quarter 2024, certain short-cycle, consumable product

operations historically reported within the Offshore Manufactured

Products segment (legacy frac plugs and elastomer products) were

integrated into our Downhole Technologies segment to better align

with the underlying activity demand drivers and current segment

management structure, as well as provide for additional operational

synergies. Historical 2023 segment financial data (GAAP and

non-GAAP), backlog and other information (as presented herein) were

conformed with the revised segment presentation. Additionally,

following the sale of its remaining U.S. land-based drilling rigs

and the exit of the flowback and well testing service offering in

the third quarter of 2024, the Company’s Well Site Services segment

name was changed to Completion and Production Services.

(See Segment Data and Adjusted Segment EBITDA tables below)

Offshore Manufactured Products

Offshore Manufactured Products reported revenues of $107.3

million, operating income of $21.0 million and Adjusted Segment

EBITDA of $24.7 million in the fourth quarter of 2024, compared to

revenues of $102.2 million, operating income of $19.3 million and

Adjusted Segment EBITDA of $23.3 million reported in the third

quarter of 2024. Adjusted Segment EBITDA margin was 23% in both the

fourth and third quarter of 2024.

Backlog totaled $311 million as of December 31, 2024. Fourth

quarter bookings increased 1%, totaling $113 million, compared to

bookings of $112 million in the third quarter – yielding a

quarterly book-to-bill ratio of 1.1x.

Completion and Production

Services

Completion and Production Services reported revenues of $30.1

million, an operating loss of $4.0 million and Adjusted Segment

EBITDA of $3.5 million in the fourth quarter of 2024, compared to

revenues of $40.1 million, an operating loss of $18.3 million and

Adjusted Segment EBITDA of $5.4 million reported in the third

quarter of 2024. Adjusted Segment EBITDA margin was 12% in the

fourth quarter of 2024, compared to 13% in the third quarter of

2024.

During the third quarter of 2024, the segment implemented

restructuring actions in its U.S. land-based businesses to reduce

costs and improve future operating margins, which included the exit

of two underperforming service offerings and the closure of several

facilities leading to reductions in its U.S. workforce. The

segment’s U.S. land restructuring initiatives continued into the

fourth quarter of 2024 with additional facility closures. As a

result of these and other strategic actions previously taken, the

segment’s operating loss for the fourth quarter of 2024 included

$1.2 million of operating lease asset impairment charges and $1.9

million of costs associated with the exit of underperforming

service locations. Additionally, during the third and fourth

quarters of 2024, the segment recorded costs totaling $1.4 million

associated with the enforcement of certain patents related to its

proprietary technologies. These patent disputes were settled during

the fourth quarter.

The segment’s exited U.S. land-based businesses collectively

generated revenues of $1.3 million and operating losses of $3.7

million in the current quarter, which included operating lease

asset impairment charges of $1.2 million, facility closure and

other charges totaling $1.9 million as well as depreciation and

amortization expense of $1.0 million. During full-year 2024,

service offerings and facilities exited in 2024 collectively

generated revenues of $40.6 million and operating losses of $19.6

million, which included intangible and operating lease asset

impairment charges of $14.1 million, facility closure and other

charges totaling $7.0 million as well as depreciation and

amortization expense of $7.9 million.

Downhole Technologies

Downhole Technologies reported revenues of $27.3 million, an

operating loss of $4.0 million and Adjusted Segment EBITDA of $0.1

million in the fourth quarter of 2024, compared to revenues of

$32.0 million, an operating loss of $3.7 million and Adjusted

Segment EBITDA of $1.1 million in the third quarter of 2024.

During the third quarter of 2024, the segment implemented

actions to reduce costs and improve future operating margins, which

included the exit of an underperforming location as well as

reductions in its U.S. workforce. The segment’s operating loss in

the third quarter of 2024 included costs of $1.2 million associated

with an operating lease asset impairment, workforce reductions and

a customer bankruptcy.

Corporate

Corporate operating income in the fourth quarter of 2024 totaled

$5.5 million.

During the fourth quarter of 2024, the Company sold a previously

idled facility (held-for-sale) for net cash proceeds of $24.8

million, resulting in the recognition of a gain of $15.3 million,

which is included in operating income (loss) but excluded from

Adjusted EBITDA.

Interest Expense, Net

Net interest expense totaled $1.7 million in the fourth quarter

of 2024, which included $0.3 million of non-cash amortization of

deferred debt issuance costs.

Income Taxes

During the fourth quarter of 2024, the Company recognized tax

expense of $1.8 million on pre-tax income of $17.0 million, which

included unfavorable changes in valuation allowances recorded

against deferred tax assets and certain non-deductible expenses.

The Company recognized income tax expense of $2.2 million on a

pre-tax loss of $12.1 million in the third quarter of 2024, which

included unfavorable changes in valuation allowances recorded

against deferred tax assets and certain non-deductible

expenses.

Cash Flows

During the fourth quarter of 2024, cash flows provided by

operations totaled $18.2 million and cash flows provided by

investing activities totaled $11.1 million, yielding free cash

flows of $29.3 million during the quarter. Net debt (total debt

less cash and cash equivalents) was reduced by $19.4 million during

the quarter after repurchasing $9.1 million of common stock.

On October 24, 2024, the Company’s Board of Directors terminated

the Company’s existing share repurchase program and replaced it

with a new $50 million authorization which expires in October

2026.

Financial Condition

Cash on-hand totaled $65.4 million at December 31, 2024. No

borrowings were outstanding under the Company’s asset-based

revolving credit facility at December 31, 2024.

Conference Call

Information

The call is scheduled for February 21, 2025 at 9:00 a.m. Central

Standard Time, is being webcast and can be accessed from the

Company’s website at www.ir.oilstatesintl.com. Participants may

also join the conference call by dialing 1 (888) 210-3346 in the

United States or by dialing +1 (646) 960-0253 internationally and

using the passcode 7534957. A replay of the conference call will be

available approximately two hours after the completion of the call

and can be accessed from the Company’s website at

www.ir.oilstatesintl.com.

About Oil States

Oil States International, Inc. is a global provider of

manufactured products and services to customers in the energy,

industrial and military sectors. The Company’s manufactured

products include highly engineered capital equipment and consumable

products. Oil States is headquartered in Houston, Texas with

manufacturing and service facilities strategically located across

the globe. Oil States is publicly traded on the New York Stock

Exchange under the symbol “OIS”.

For more information on the Company, please visit Oil States

International’s website at www.oilstatesintl.com.

Cautionary Language Concerning Forward

Looking Statements

The foregoing contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Forward-looking

statements are those that do not state historical facts and are,

therefore, inherently subject to risks and uncertainties. The

forward-looking statements included herein are based on current

expectations and entail various risks and uncertainties that could

cause actual results to differ materially from those

forward-looking statements. Such risks and uncertainties include,

among others, the level of supply and demand for oil and natural

gas, fluctuations in the current and future prices of oil and

natural gas, the level of exploration, drilling and completion

activity, general global economic conditions, the cyclical nature

of the oil and natural gas industry, geopolitical conflicts and

tensions, the financial health of our customers, the actions of the

Organization of Petroleum Exporting Countries (“OPEC”) and other

producing nations with respect to crude oil production levels and

pricing, supply chain disruptions, the impact of changes in tariffs

and duties on imported materials and exported finished goods, the

impact of environmental matters, including executive actions and

regulatory efforts to adopt environmental or climate change

regulations that may result in increased operating costs or reduced

oil and natural gas production or demand globally, consolidation of

our customers, our ability to access and the cost of capital in the

bank and capital markets, our ability to develop new competitive

technologies and products, and other factors discussed in the

“Business” and “Risk Factors” sections of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023, and the

subsequently filed Quarterly Reports on Form 10-Q and Periodic

Reports on Form 8-K. Readers are cautioned not to place undue

reliance on forward-looking statements, which speak only as of the

date hereof, and, except as required by law, the Company undertakes

no obligation to update those statements or to publicly announce

the results of any revisions to any of those statements to reflect

future events or developments.

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In Thousands, Except Per Share

Amounts)

Three Months Ended

Year Ended

December 31,

2024

September 30,

2024

December 31,

2023

December 31,

2024

December 31,

2023

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Revenues:

Products

$

98,859

$

100,798

$

123,444

$

402,565

$

418,550

Services

65,736

73,550

84,822

290,023

363,733

164,595

174,348

208,266

692,588

782,283

Costs and expenses:

Product costs

77,821

79,167

97,291

314,628

328,815

Service costs

47,807

57,422

66,405

221,573

278,073

Cost of revenues (exclusive of

depreciation and amortization expense presented below)

125,628

136,589

163,696

536,201

606,888

Selling, general and administrative

expense

23,386

22,754

22,400

95,009

94,185

Depreciation and amortization expense

12,180

13,635

14,569

54,708

60,778

Impairment of goodwill

—

—

—

10,000

—

Impairments of intangible assets

—

10,787

—

10,787

—

Impairments of operating lease assets

1,188

2,579

—

3,767

—

Other operating income, net

(16,271

)

(955

)

(229

)

(16,195

)

(2,732

)

146,111

185,389

200,436

694,277

759,119

Operating income (loss)

18,484

(11,041

)

7,830

(1,689

)

23,164

Interest expense, net

(1,745

)

(1,824

)

(1,811

)

(7,731

)

(8,189

)

Other income, net

257

731

177

1,568

849

Income (loss) before income taxes

16,996

(12,134

)

6,196

(7,852

)

15,824

Income tax provision

(1,832

)

(2,215

)

(233

)

(3,406

)

(2,933

)

Net income (loss)

$

15,164

$

(14,349

)

$

5,963

$

(11,258

)

$

12,891

Net income (loss) per share:

Basic

$

0.24

$

(0.23

)

$

0.09

$

(0.18

)

$

0.20

Diluted

0.24

(0.23

)

0.09

(0.18

)

0.20

Weighted average number of common shares

outstanding:

Basic

60,947

62,084

62,483

62,004

62,690

Diluted

61,392

62,084

63,004

62,004

63,152

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(In Thousands)

December 31, 2024

December 31, 2023

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

65,363

$

47,111

Accounts receivable, net

194,336

203,211

Inventories, net

214,836

202,027

Prepaid expenses and other current

assets

23,691

35,648

Total current assets

498,226

487,997

Property, plant, and equipment, net

266,871

280,389

Operating lease assets, net

19,537

21,970

Goodwill, net

69,709

79,867

Other intangible assets, net

125,862

153,010

Other noncurrent assets

24,903

23,253

Total assets

$

1,005,108

$

1,046,486

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Current portion of long-term debt

$

633

$

627

Accounts payable

57,708

67,546

Accrued liabilities

36,861

44,227

Current operating lease liabilities

7,284

6,880

Income taxes payable

2,818

1,233

Deferred revenue

52,399

36,757

Total current liabilities

157,703

157,270

Long-term debt

124,654

135,502

Long-term operating lease liabilities

17,989

18,346

Deferred income taxes

5,350

7,717

Other noncurrent liabilities

18,758

18,106

Total liabilities

324,454

336,941

Stockholders’ equity:

Common stock

786

772

Additional paid-in capital

1,137,949

1,129,240

Retained earnings

273,660

284,918

Accumulated other comprehensive loss

(79,532

)

(69,984

)

Treasury stock

(652,209

)

(635,401

)

Total stockholders’ equity

680,654

709,545

Total liabilities and stockholders’

equity

$

1,005,108

$

1,046,486

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In Thousands)

Year Ended December

31,

2024

2023

(Unaudited)

Cash flows from operating activities:

Net income (loss)

$

(11,258

)

$

12,891

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization expense

54,708

60,778

Impairment of goodwill

10,000

—

Impairments of intangible assets

10,787

—

Impairments of operating lease assets

3,767

—

Stock-based compensation expense

8,723

6,954

Amortization of deferred financing

costs

1,497

1,798

Deferred income tax provision

(benefit)

(2,356

)

226

Gains on disposals of assets

(18,333

)

(4,075

)

Gains on extinguishment of 4.75%

convertible senior notes

(515

)

—

Other, net

(452

)

(1,001

)

Changes in operating assets and

liabilities:

Accounts receivable

5,191

17,132

Inventories

(14,704

)

(19,793

)

Accounts payable and accrued

liabilities

(19,382

)

(11,743

)

Deferred revenue

15,642

(8,033

)

Other operating assets and liabilities,

net

2,579

1,441

Net cash flows provided by operating

activities

45,894

56,575

Cash flows from investing activities:

Capital expenditures

(37,508

)

(30,653

)

Proceeds from disposition of property and

equipment

5,594

5,253

Proceeds from disposition of assets held

for sale

35,070

—

Other, net

(454

)

(186

)

Net cash flows provided by (used in)

investing activities

2,702

(25,586

)

Cash flows from financing activities:

Revolving credit facility borrowings

22,739

35,816

Revolving credit facility repayments

(22,739

)

(35,816

)

Purchases of 4.75% convertible senior

notes

(10,846

)

—

Repayment of 1.50% convertible senior

notes

—

(17,315

)

Other debt and finance lease

repayments

(652

)

(457

)

Payment of financing costs

(1,178

)

(128

)

Purchases of treasury stock

(14,212

)

(6,867

)

Shares added to treasury stock as a result

of net share settlements due to vesting of stock awards

(2,596

)

(1,948

)

Net cash flows used in financing

activities

(29,484

)

(26,715

)

Effect of exchange rate changes on cash

and cash equivalents

(860

)

819

Net change in cash and cash

equivalents

18,252

5,093

Cash and cash equivalents, beginning of

period

47,111

42,018

Cash and cash equivalents, end of

period

$

65,363

$

47,111

Cash paid for:

Interest

$

7,439

$

7,867

Income taxes, net

3,847

1,263

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

SEGMENT DATA

(In Thousands)

(Unaudited)

Three Months Ended

Year Ended

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Revenues(1):

Offshore Manufactured Products

Project-driven:

Products

$

61,814

$

58,164

$

82,839

$

232,867

$

235,080

Services

34,895

32,754

32,875

123,906

112,742

96,709

90,918

115,714

356,773

347,822

Military and other products

10,544

11,316

10,775

41,127

33,889

Total Offshore Manufactured Products

107,253

102,234

126,489

397,900

381,711

Completion and Production Services

30,090

40,099

51,208

163,902

242,633

Downhole Technologies

27,252

32,015

30,569

130,786

157,939

Total revenues

$

164,595

$

174,348

$

208,266

$

692,588

$

782,283

Operating income (loss)(1):

Offshore Manufactured Products(2)

$

21,009

$

19,310

$

24,167

$

65,279

$

56,289

Completion and Production Services(3)

(4,004

)

(18,267

)

(1,102

)

(23,225

)

13,881

Downhole Technologies(4)

(4,031

)

(3,653

)

(5,726

)

(20,904

)

(5,874

)

Corporate(5)

5,510

(8,431

)

(9,509

)

(22,839

)

(41,132

)

Total operating income (loss)

$

18,484

$

(11,041

)

$

7,830

$

(1,689

)

$

23,164

________________

(1)

In the first quarter 2024, certain

short-cycle, consumable product operations historically reported

within the Offshore Manufactured Products segment were integrated

into the Downhole Technologies segment. Historical 2023 segment

financial results were conformed with the revised segment

presentation. Additionally, following the sale of its remaining

U.S. land-based drilling rigs and the exit of the flowback and well

testing service offerings in the third quarter of 2024, the

Company’s Well Site Services segment name was changed to Completion

and Production Services.

(2)

Operating income for the three months

ended September 30, 2024 and the year ended December 31, 2024,

included facility consolidation charges of $0.4 million and $3.4

million respectively. Operating income for the three months ended

December 31, 2023 and the year ended December 31, 2023 included

facility consolidation charges of $0.8 million and $2.5 million,

respectively, associated with the consolidation and relocation of

certain manufacturing and service locations.

(3)

Operating loss for the three months ended

December 31, 2024 and September 30, 2024, and the year ended

December 31, 2024, included $3.0 million, $15.9 million and $21.5

million, respectively, in costs associated with consolidation and

exit of certain underperforming service offerings and locations.

Additionally, during the three months ended December 31, 2024 and

September 30, 2024, and the year ended December 31, 2024, the

segment incurred $0.1 million, $1.3 million and $2.8 million,

respectively, of costs associated with the defense of certain

patents related to proprietary technologies. Operating income

(loss) for the three months and the year ended December 31, 2023

included $0.6 million of costs associated with the defense of

certain patents related to proprietary technologies.

(4)

Operating loss for the three months ended

September 30, 2024 included $0.6 million in restructuring costs.

Operating loss for the year ended December 31, 2024 included a

non-cash goodwill impairment charge of $10.0 million, recognized in

connection with the 2024 segment realignment, and $0.6 million in

restructuring costs.

(5)

Operating income (loss) for the three

months and the year ended December 31, 2024 included a $15.3

million gain on sale of a previously idled facility.

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO

NON-GAAP FINANCIAL INFORMATION

ADJUSTED EBITDA (A)

(In Thousands)

(Unaudited)

Three Months Ended

Year Ended

December 31,

2024

September 30,

2024

December 31,

2023

December 31,

2024

December 31,

2023

Net income (loss)

$

15,164

$

(14,349

)

$

5,963

$

(11,258

)

$

12,891

Interest expense, net

1,745

1,824

1,811

7,731

8,189

Income tax provision

1,832

2,215

233

3,406

2,933

Depreciation and amortization expense

12,180

13,635

14,569

54,708

60,778

Impairment of goodwill

—

—

—

10,000

—

Impairments of intangible assets

—

10,787

—

10,787

—

Impairments of operating lease assets

1,188

2,579

—

3,767

—

Facility consolidation/closure and other

charges

1,941

4,840

1,402

13,716

3,051

Gain on disposal of property held for

sale

(15,316

)

—

—

(15,316

)

—

Gains on extinguishment of 4.75%

convertible senior notes

—

—

—

(515

)

—

Adjusted EBITDA

$

18,734

$

21,531

$

23,978

$

77,026

$

87,842

________________

(A)

The term Adjusted EBITDA consists of net

income (loss) plus net interest expense, taxes, depreciation and

amortization expense, impairments of goodwill, intangible and

operating lease assets, and facility consolidation/closure and

other charges, less gains on the sale of a previously idled

property and extinguishment of 4.75% convertible senior notes

(“2026 Notes”). Adjusted EBITDA is not a measure of financial

performance under generally accepted accounting principles (“GAAP”)

and should not be considered in isolation from or as a substitute

for net income (loss) or cash flow measures prepared in accordance

with GAAP or as a measure of profitability or liquidity.

Additionally, Adjusted EBITDA may not be comparable to other

similarly titled measures of other companies. The Company has

included Adjusted EBITDA as a supplemental disclosure because its

management believes that Adjusted EBITDA provides useful

information regarding its ability to service debt and to fund

capital expenditures and provides investors a helpful measure for

comparing its operating performance with the performance of other

companies that have different financing and capital structures or

tax rates. The Company uses Adjusted EBITDA to compare and to

monitor the performance of the Company and its business segments to

other comparable public companies and as a benchmark for the award

of incentive compensation under its annual incentive compensation

plan. The table above sets forth reconciliations of Adjusted EBITDA

to net income (loss), which is the most directly comparable measure

of financial performance calculated under GAAP.

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO

NON-GAAP FINANCIAL INFORMATION

ADJUSTED SEGMENT EBITDA

(B)

(In Thousands)

(Unaudited)

Three Months Ended

Year Ended

December 31,

2024

September 30,

2024

December 31,

2023

December 31,

2024

December 31,

2023

Offshore Manufactured Products:

Operating income

$

21,009

$

19,310

$

24,167

$

65,279

$

56,289

Other income, net

105

8

44

134

358

Depreciation and amortization expense

3,634

3,631

3,802

15,205

16,357

Facility consolidation/closure and other

charges

—

354

825

3,364

2,474

Adjusted Segment EBITDA

$

24,748

$

23,303

$

28,838

$

83,982

$

75,478

Completion and Production

Services:

Operating income (loss)

$

(4,004

)

$

(18,267

)

$

(1,102

)

$

(23,225

)

$

13,881

Other income, net

152

723

133

919

491

Depreciation and amortization expense

4,268

5,749

6,295

22,143

25,318

Impairments of intangible assets

—

10,787

—

10,787

—

Impairments of operating lease assets

1,188

2,092

—

3,280

—

Facility consolidation/closure and other

charges

1,941

4,329

577

10,195

577

Adjusted Segment EBITDA

$

3,545

$

5,413

$

5,903

$

24,099

$

40,267

Downhole Technologies:

Operating loss

$

(4,031

)

$

(3,653

)

$

(5,726

)

$

(20,904

)

$

(5,874

)

Depreciation and amortization expense

4,162

4,121

4,306

16,808

18,467

Impairment of goodwill

—

—

—

10,000

—

Impairments of operating lease assets

—

487

—

487

—

Facility consolidation/closure and other

charges

—

123

—

123

—

Adjusted Segment EBITDA

$

131

$

1,078

$

(1,420

)

$

6,514

$

12,593

Corporate:

Operating income (loss)

$

5,510

$

(8,431

)

$

(9,509

)

$

(22,839

)

$

(41,132

)

Other income, net

—

—

—

515

—

Depreciation and amortization expense

116

134

166

552

636

Other charges

—

34

—

34

—

Gain on disposal of property held for

sale

(15,316

)

—

—

(15,316

)

—

Gains on extinguishment of 4.75%

convertible senior notes

—

—

—

(515

)

—

Adjusted Segment EBITDA

$

(9,690

)

$

(8,263

)

$

(9,343

)

$

(37,569

)

$

(40,496

)

________________

(B)

The term Adjusted Segment EBITDA consists

of operating income (loss) plus other income (expense),

depreciation and amortization expense, impairments of goodwill,

intangible and operating lease assets, and facility

consolidation/closure and other charges, less gains on the sale of

a previously idled property and extinguishment of 2026 Notes.

Adjusted Segment EBITDA is not a measure of financial performance

under GAAP and should not be considered in isolation from or as a

substitute for operating income (loss) or cash flow measures

prepared in accordance with GAAP or as a measure of profitability

or liquidity. Additionally, Adjusted Segment EBITDA may not be

comparable to other similarly titled measures of other companies.

The Company has included Adjusted Segment EBITDA as supplemental

disclosure because its management believes that Adjusted Segment

EBITDA provides useful information regarding its ability to service

debt and to fund capital expenditures and provides investors a

helpful measure for comparing its operating performance with the

performance of other companies that have different financing and

capital structures or tax rates. The Company uses Adjusted Segment

EBITDA to compare and to monitor the performance of its business

segments to other comparable public companies and as a benchmark

for the award of incentive compensation under its annual incentive

compensation plan. The table above sets forth reconciliations of

Adjusted Segment EBITDA to operating income (loss), which is the

most directly comparable measure of financial performance

calculated under GAAP.

OIL STATES INTERNATIONAL, INC.

AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO

NON-GAAP FINANCIAL INFORMATION

ADJUSTED NET INCOME (LOSS),

EXCLUDING CHARGES AND CREDITS (C) AND

ADJUSTED NET INCOME (LOSS) PER

SHARE, EXCLUDING CHARGES AND CREDITS (D)

(In Thousands, Except Per Share

Amounts)

(Unaudited)

Three Months Ended

Year Ended

December 31,

2024

September 30,

2024

December 31,

2023

December 31,

2024

December 31,

2023

Net income (loss)

$

15,164

$

(14,349

)

$

5,963

$

(11,258

)

$

12,891

Impairment of goodwill

—

—

—

10,000

—

Impairments of intangible assets

—

10,787

—

10,787

—

Impairments of operating lease assets

1,188

2,579

—

3,767

—

Facility consolidation/closure and other

charges

1,941

4,840

1,402

13,716

3,051

Gain on disposal of property held for

sale

(15,316

)

—

—

(15,316

)

—

Gains on extinguishment of 4.75%

convertible senior notes

—

—

—

(515

)

—

Total adjustments, before taxes

(12,187

)

18,206

1,402

22,439

3,051

Tax provision (benefit)

2,560

(1,161

)

(294

)

(430

)

(640

)

Total adjustments, net of taxes

(9,627

)

17,045

1,108

22,009

2,411

Adjusted net income, excluding charges and

credits

$

5,537

$

2,696

$

7,071

$

10,751

$

15,302

Adjusted weighted average number of

diluted common shares outstanding (E)

61,392

62,412

63,004

62,376

63,152

Adjusted diluted net income per share,

excluding charges and credits (E)

$

0.09

$

0.04

$

0.11

$

0.17

$

0.24

________________

(C)

Adjusted net income, excluding charges and

credits consists of net income (loss) plus impairments of goodwill,

intangible and operating lease assets, and facility

consolidation/closure and other charges, less gains on the sale of

a previously idled property and extinguishment of the 2026 Notes.

Adjusted net income, excluding charges and credits is not a measure

of financial performance under GAAP and should not be considered in

isolation from or as a substitute for net income (loss) as prepared

in accordance with GAAP. The Company has included adjusted net

income, excluding charges and credits as a supplemental disclosure

because its management believes that adjusted net income, excluding

charges and credits provides investors a helpful measure for

comparing its operating performance with previous and subsequent

periods.

(D)

Adjusted net income per share, excluding

charges and credits is calculated as adjusted net income, excluding

charges and credits divided by the weighted average number of

common shares outstanding. Adjusted net income per share, excluding

charges and credits is not a measure of financial performance under

GAAP and should not be considered in isolation from or as a

substitute for net income (loss) per share as prepared in

accordance with GAAP. The Company has included adjusted net income

per share, excluding charges and credits as a supplemental

disclosure because its management believes that adjusted net income

per share, excluding charges and credits provides investors a

helpful measure for comparing its operating performance with

previous and subsequent periods.

(E)

The calculation of diluted adjusted

earnings per share for the three month period ended September 30,

2024 and the year ended December 31, 2024 included 328 thousand

shares and 372 thousand shares, respectively, issuable pursuant to

outstanding performance share units.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250221077278/en/

Company Contact: Lloyd A. Hajdik Oil States International, Inc.

Executive Vice President, Chief Financial Officer and Treasurer

(713) 652-0582

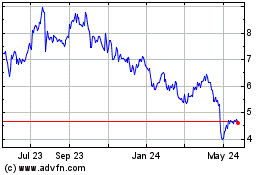

Oil States (NYSE:OIS)

Historical Stock Chart

From Feb 2025 to Mar 2025

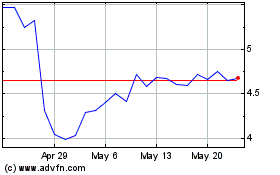

Oil States (NYSE:OIS)

Historical Stock Chart

From Mar 2024 to Mar 2025