Expects to Report Fourth Quarter and Full Year

2024 Financial Results on February 28, 2025

Owens & Minor, Inc. (NYSE: OMI) (the “Company”) today

announced selected preliminary financial results for the fourth

quarter and year ended December 31, 2024 in advance of its upcoming

earnings announcement and conference call. The release of the

preliminary results relates to the Company’s commencement of

financing activity related to its previously announced agreement to

acquire Rotech Healthcare Holdings, Inc (“Rotech”).

“We are commencing a process to raise additional debt while the

capital markets are attractive, to finance our previously announced

agreement to acquire Rotech which we continue to expect will close

in the first half of 2025. Our healthy free cash flow provides the

vehicle for this proposed financing as well as helping us achieve

our deleveraging goals over the next few years. Having this

additional facility at attractive interest rates gives us the

ability to remain nimble in a dynamic market,” said Edward A.

Pesicka, President & Chief Executive Officer of Owens &

Minor.

Pesicka added, “Our healthy top-line performance in 2024 is

representative of the demand for our products and services across

both segments of our business. We are particularly excited about

the full-year performance of our Patient Direct segment which

posted solid mid-single digit growth, and even higher in key

categories. In addition, we are pleased that in a year of

meaningful reinvestment in the business we were able to reduce

total debt by over $240 million.”

Preliminary Fourth Quarter 2024 Results Including Non-Cash

Goodwill Impairment (i):

- Revenue of $2.67 – $2.70 billion

- Net loss of $(311) – $(288) million

- Adjusted EBITDA of $135 – $140 million

- Net loss per share $(4.03) – $(3.73)

- Adjusted EPS of $0.52 – $0.55

- Gross capital expenditures of $71 – $76 million

- Capital Expenditures, net of patient service equipment (PSE)

regular sales proceeds, of $53 – $58 million

- Cash provided by operating activities of $70 – $75 million

Preliminary Full Year 2024 Results Including Non-Cash

Goodwill Impairment (i):

- Revenue of $10.67 – $10.70 billion

- Net loss of $(378) – $(355) million

- Adjusted EBITDA of $520 – $525 million

- Net loss per share $(4.92) – $(4.63)

- Adjusted EPS of $1.50 – $1.53

- Gross capital expenditures of $228 – $233 million

- Capital expenditures, net of PSE regular sales proceeds, of

$158 – $163 million

- Total debt of $1.854 – $1.859 billion

- Net debt of $1.805 – $1.810 billion

- Cash provided by operating activities of $160 – $165

million

(i)

Reconciliations of the differences between

the non-GAAP financial measures in this release and their most

directly comparable GAAP financial measures are included in the

tables below.

Non-Cash Goodwill Impairment

The Company expects to record a non-cash goodwill impairment

charge within its Apria division of approximately $310 million, or

approximately ($4.00) net loss per share. The impairment charge

relates to a combination of factors occurring in the fourth quarter

2024. The majority of these factors are related to financial market

changes inclusive of a decline in Owens & Minor’s stock price

and rising interest rates. Additionally, anticipated changes in

pricing of a capitated contract also contributed to this

charge.

Note: Preliminary results and the amount of the non-cash

goodwill impairment remain subject to final management review and

audit.

Investor Conference Call for Fourth Quarter and Full Year

2024 Financial Results

Owens & Minor will host a conference call for investors and

analysts on Friday, February 28, 2025, at 8:30 a.m. ET.

Participants may access the call via the toll-free dial-in number

at 1-888-300-2035, or the toll dial-in number at 1-646-517-7437.

The conference ID access code is 1058917. All interested

stakeholders are encouraged to access the simultaneous live webcast

by visiting the investor relations page of the Owens & Minor

website available at

investors.owens-minor.com/events-and-presentations/. A replay of

the webcast can be accessed following the presentation at the link

provided above.

Safe Harbor

This release is intended to be disclosure through methods

reasonably designed to provide broad, non-exclusionary distribution

to the public in compliance with the SEC’s Fair Disclosure

Regulation. This release contains certain “forward-looking”

statements made pursuant to the Safe Harbor provisions of the

Private Securities Litigation Reform Act of 1995. These statements

include, but are not limited to, the statements in this release

regarding our future prospects and performance, including our

expectations with respect to our financial performance, our 2024

preliminary financial results, our ability to raise additional

financing for our acquisition of Rotech on favorable terms or at

all, the risk that the proposed acquisition of Rotech will not be

consummated in a timely manner or at all, our cost-saving

initiatives, future indebtedness and growth, industry trends, as

well as statements related to our expectations regarding the

performance of our business, including our ability to address macro

and market conditions. Forward-looking statements involve known and

unknown risks and uncertainties that may cause our actual results

in future periods to differ materially from those projected or

contemplated in the forward-looking statements. Investors should

refer to Owens & Minor’s Annual Report on Form 10-K for the

year ended December 31, 2023, filed with the SEC on February 20,

2024, including the sections captioned “Forward-Looking Statements”

and “Item 1A. Risk Factors,” as applicable, and subsequent

quarterly reports on Form 10-Q and current reports on Form 8-K

filed with or furnished to the SEC, for a discussion of certain

known risk factors that could cause the Company’s actual results to

differ materially from its current estimates. These filings are

available at www.owens-minor.com. Given these risks and

uncertainties, Owens & Minor can give no assurance that any

forward-looking statements will, in fact, transpire and, therefore,

cautions investors not to place undue reliance on them. Owens &

Minor specifically disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future developments or otherwise.

About Owens & Minor

Owens & Minor, Inc. (NYSE: OMI) is a Fortune 500 global

healthcare solutions company providing essential products and

services that support care from the hospital to the home. For over

100 years, Owens & Minor and its affiliated brands, Apria®,

Byram® and HALYARD*, have helped to make each day better for the

patients, providers, and communities we serve. Powered by more than

20,000 teammates worldwide, Owens & Minor delivers comfort and

confidence behind the scenes so healthcare stays at the forefront.

Owens & Minor exists because every day, everywhere, Life Takes

Care™. For more information about Owens & Minor and our

affiliated brands, visit owens-minor.com or follow us on LinkedIn

and Instagram.

* Registered Trademark or Trademark of O&M Halyard or its

affiliates.

OMI-CORP

OMI-IR

SOURCE: Owens & Minor, Inc.

Owens & Minor, Inc. GAAP/Non-GAAP Reconciliations

(unaudited) (dollars in millions, except per share

data)

The following table provides a reconciliation of expected net

loss and net loss per common share to non-GAAP measures used by

management.

Three Months Ended

December 31, 2024

Year Ended

December 31, 2024

Low

High

Low

High

Net loss, as reported (GAAP)

$

(311)

$

(288)

$

(378)

$

(355)

Pre-tax adjustments:

Acquisition-related charges and

intangible

amortization (1)

25

25

87

87

Exit and realignment charges, net (2)

25

25

110

110

Goodwill impairment charges (3)

320

300

320

300

Litigation and related charges (4)

-

-

17

17

Other (5)

1

1

3

3

Income tax benefit on pre-tax adjustments

(6)

(19)

(19)

(59)

(59)

One-time income tax charge (7)

-

-

17

17

Net income, adjusted (non-GAAP) (Adjusted

Net Income)

$

41

$

44

$

117

$

120

Net loss per share, as reported (GAAP)

$

(4.03)

$

(3.73)

$

(4.92)

$

(4.63)

After-tax adjustments:

Acquisition-related charges and

intangible

amortization (1)

0.21

0.21

0.82

0.82

Exit and realignment charges, net (2)

0.21

0.21

1.04

1.04

Goodwill impairment charges (3)

4.12

3.85

4.14

3.88

Litigation and related charges (4)

-

-

0.17

0.17

Other (5)

0.01

0.01

0.03

0.03

One-time income tax charge (7)

-

-

0.22

0.22

Net income per share, adjusted (non-GAAP)

(Adjusted EPS)

$

0.52

$

0.55

$

1.50

$

1.53

Amounts may not sum due to rounding

Owens & Minor, Inc. GAAP/Non-GAAP Reconciliations

(unaudited), continued (dollars in millions)

The following tables provide reconciliations of expected net

loss and total debt to non-GAAP measures used by management.

Three Months Ended December

31, 2024

Year Ended

December 31, 2024

Low

High

Low

High

Net loss, as reported (GAAP)

$

(311)

$

(288)

$

(378)

$

(355)

Income tax provision (benefit)

(5)

(4)

4

5

Interest expense, net

36

36

144

144

Acquisition-related charges and intangible

amortization (1)

25

25

87

87

Exit and realignment charges, net (2)

25

25

110

110

Goodwill impairment charges (3)

320

300

320

300

Other depreciation and amortization

(8)

46

46

187

187

Litigation and related charges (4)

-

-

17

17

Stock compensation (9)

7

7

25

25

LIFO (credits) charges (10)

(9)

(8)

1

2

Other (5)

1

1

3

3

Adjusted EBITDA (non-GAAP)

$

135

$

140

$

520

$

525

December 31, 2024

Low

High

Total debt, as reported (GAAP)

$

1,854

$

1,859

Cash and cash equivalents

(49)

(49)

Net debt (non-GAAP)

$

1,805

$

1,810

Amounts may not sum due to rounding

The following items have been excluded in our non-GAAP financial

measures:

(1)

Acquisition-related charges and intangible

amortization includes one-time costs related to the expected

acquisition of Rotech including legal and other professional fees.

This also includes amortization of intangible assets established

during acquisition method of accounting for business combinations.

These amounts are highly dependent on the size and frequency of

acquisitions and are being excluded to allow for a more consistent

comparison with forecasted, current and historical results.

(2)

Exit and realignment charges, net

primarily related to our Operating Model Realignment Program,

including professional fees, severance, and other costs to

streamline functions and processes and costs related to IT

strategic initiatives such as converting certain divisions to

common IT systems. These costs are not normal recurring, cash

operating expenses necessary for the Company to operate its

business on an ongoing basis.

(3)

Goodwill impairment charge relates to a

combination of factors occurring in the fourth quarter of 2024. The

majority of these factors are related to financial market changes

inclusive of a decline in Owens & Minor’s stock price and

rising interest rates. Additionally, anticipated changes in pricing

of a capitated contract also contributed to this charge.

(4)

Litigation and related charges include

settlement costs and related charges of legal matters within our

Apria division. These costs do not occur in the ordinary course of

our business, are non-recurring/infrequent and are inherently

unpredictable in timing and amount.

(5)

Other includes interest costs and net

actuarial losses related to our frozen noncontributory, unfunded

retirement plan for certain retirees in the United States (U.S).

Additionally, other includes losses on extinguishment of debt for

the three months and twelve months ended December 31, 2024.

(6)

Income tax benefit on pre-tax adjustments

these charges have been tax effected by determining the income tax

rate depending on the amount of charges incurred in different tax

jurisdictions and the deductibility of those charges for income tax

purposes.

(7)

One-time income tax charge relates to a

decision during 2024 with Notice of Proposed Adjustments received

in 2020 and 2021. The matter at hand, as discussed in previously

filed SEC documents, is related to past transfer price methodology.

We believe the matter will be concluded without further impact to

our financial results.

(8)

Other depreciation and amortization

relates to property and equipment and capitalized computer

software, excluding such amounts captured within exit and

realignment charges, net or acquisition-related charges and

intangible amortization.

(9)

Stock compensation includes share-based

compensation expense related to our share-based compensation plans,

excluding such amounts captured within exit and realignment

charges, net or acquisition-related charges and intangible

amortization.

(10)

LIFO (credits) charges includes non-cash

adjustments to merchandise inventories valued at the lower of cost

or market, with the approximate cost determined by the last-in,

first-out (LIFO) method for distribution inventories in the U.S.

within our Products & Healthcare Services segment.

Use of Non-GAAP

Measures

This preliminary earnings release contains financial measures

that are not calculated in accordance with U.S. generally accepted

accounting principles (GAAP). In general, the measures exclude

items and charges that (i) management does not believe reflect the

Company’s core business and relate more to strategic, multi-year

corporate activities; or (ii) relate to activities or actions that

may have occurred over multiple or in prior periods without

predictable trends. Management uses these non-GAAP financial

measures internally to evaluate the Company’s performance, evaluate

the balance sheet, engage in financial and operational planning and

determine incentive compensation.

Management provides these non-GAAP financial measures to

investors as supplemental metrics to assist readers in assessing

the effects of items and events on its financial and operating

results and in comparing the Company’s performance to that of its

competitors. However, the non-GAAP financial measures used by the

Company may be calculated differently from, and therefore may not

be comparable to, similarly titled measures used by other

companies.

The non-GAAP financial measures disclosed by the Company should

not be considered substitutes for, or superior to, financial

measures calculated in accordance with GAAP, and the financial

results calculated in accordance with GAAP and reconciliations to

those financial statements set forth above should be carefully

evaluated.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203782518/en/

Investors Alpha IR Group

Jackie Marcus or Nick Teves OMI@alpha-ir.com

Media Stacy Law

media@owens-minor.com

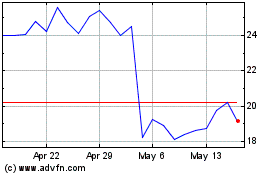

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Feb 2025 to Mar 2025

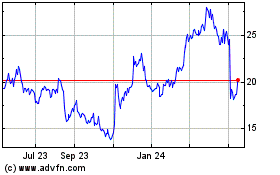

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Mar 2024 to Mar 2025