Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

November 13 2024 - 4:19PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-270834

Final Term Sheet

November 13, 2024

Highland Holdings S.à r.l.

€850,000,000 2.875% Notes due 2027

|

Issuer:

|

Highland Holdings S.à r.l.

|

| |

|

|

Guarantor:

|

Otis Worldwide Corporation

|

| |

|

|

Title of Securities:

|

2.875% Notes due 2027 (the “Notes”)

|

| |

|

|

Offering Format:

|

SEC Registered

|

| |

|

|

Trade Date:

|

November 13, 2024

|

| |

|

|

Settlement Date*:

|

November 19, 2024 (T+4)

|

| |

|

|

Ratings**:

|

Moody’s: Baa1; S&P: BBB

|

| |

|

|

Principal Amount:

|

€850,000,000

|

| |

|

|

Maturity Date:

|

November 19, 2027

|

| |

|

|

Interest Payment Date:

|

November 19 of each year, commencing November 19, 2025

|

| |

|

| |

If the date on which a payment of interest or principal on the Notes is scheduled to be paid is not a Business Day, then the interest or principal payable on that date will be paid on

the next succeeding Business Day, and no further interest will accrue as a result of such delay.

|

| |

|

|

Mid-Swap Rate:

|

2.242%

|

| |

|

|

Spread to Mid-Swap Rate:

|

+72 basis points

|

| |

|

|

Yield to Maturity:

|

2.962%

|

| |

|

|

Coupon:

|

2.875%

|

| |

|

|

Issue Price to Public:

|

99.754% of the principal amount

|

| |

|

|

Reference Government Security:

|

0.000% DBR due November 15, 2027

|

| |

|

|

Reference Government Security

|

93.960%; 2.098%

|

|

Price / Yield:

|

|

| |

|

|

Spread to Reference

|

+86.4 basis points

|

|

Government Security:

|

|

| |

|

|

Day Count Convention:

|

ACTUAL/ACTUAL (ICMA)

|

|

Optional Redemption:

|

At any time, and from time to time, prior to October 19, 2027 (one month prior to the stated maturity) (the “Par Call Date”), the Issuer may redeem the Notes, in whole or in part, at

the redemption price equal to the greater of (i) 100% of the principal amount of the Notes to be redeemed; and (ii) the sum of the Remaining Scheduled Payments of the Notes to be redeemed from the redemption date to the Par Call Date

discounted to the redemption date on an annual basis (ACTUAL/ACTUAL (ICMA)) at the applicable Comparable Government Bond Rate plus 15 basis points, plus, in each case, accrued and unpaid interest, if any, on the principal amount of the Notes

to be redeemed to, but excluding, the redemption date.

|

| |

|

| |

At any time on or after the Par Call Date, the Issuer may redeem the Notes, in whole or in part, at a redemption price equal to 100% of the principal amount of the Notes to be redeemed,

plus accrued and unpaid interest, if any, on the principal amount of the Notes to be redeemed to, but excluding, the redemption date.

|

| |

|

|

Change of Control Offer:

|

101%

|

| |

|

|

Tax Redemption:

|

The Notes will be redeemable in whole but not in part, at any time at the Issuer’s option in the event of certain developments affecting the tax laws of Luxembourg, the United States or

another relevant taxing jurisdiction as described in the preliminary prospectus supplement dated November 13, 2024 (the “Preliminary Prospectus Supplement”).

|

| |

|

|

Denominations:

|

€100,000 x €1,000

|

| |

|

|

Net Proceeds (before expenses):

|

€844,509,000

|

| |

|

|

Use of Proceeds:

|

The Issuer and the Guarantor intend to use the net proceeds of the offering, together with the net proceeds from the Guarantor’s offering of 5.125% notes due 2031 and cash on hand, to

fund the repayment at maturity of the Guarantor’s 2.056% notes due 2025, of which $1.3 billion principal amount is currently outstanding. The Issuer and the Guarantor intend to use the remainder of the proceeds, if any, to fund the repayment

of certain of the Guarantor’s commercial paper borrowings and for other general corporate purposes.

|

| |

|

|

Joint Book-Running Managers:

|

HSBC Continental Europe

|

|

|

J.P. Morgan Securities plc

|

|

Morgan Stanley & Co. International plc

|

|

SMBC Bank International plc

|

|

BofA Securities Europe SA

|

|

Citigroup Global Markets Limited

|

|

Goldman Sachs & Co. LLC

|

| |

|

|

Senior Co-Managers:

|

Banco Santander, S.A.

|

|

Barclays Bank PLC

|

|

BNP PARIBAS

|

|

Commerzbank Aktiengesellschaft

|

|

Deutsche Bank Aktiengesellschaft

|

|

Intesa Sanpaolo IMI Securities Corp.

|

|

Loop Capital Markets LLC

|

|

Société Générale

|

|

UniCredit Bank GmbH

|

|

Co-Managers:

|

Academy Securities, Inc.

|

|

ICBC Standard Bank Plc

|

|

Westpac Banking Corporation

|

| |

|

|

Paying Agent:

|

The Bank of New York Mellon, London Branch

|

| |

|

Listing:

|

Application will be made for listing on the New York Stock Exchange on terms described in the Preliminary Prospectus Supplement.

|

| |

|

|

Common Code / ISIN:

|

293937010 / XS2939370107

|

*Settlement Period: The closing will occur on November 19, 2024, which will be more than one business day after the date of this pricing term sheet. Rule 15c6-1 under the Securities Exchange Act of 1934 generally requires that securities trades in

the secondary market settle in one business day, unless the parties to a trade expressly agree otherwise.

** Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

Manufacturer target market (MIFID II product governance / UK MiFIR product governance) is eligible counterparties and professional clients only (all distribution channels). No PRIIPs or UK PRIIPs key information document (KID) has been prepared as

not available to retail investors in EEA or the United Kingdom, respectively.

The Issuer and the Guarantor have filed a Registration Statement (File No. 333-270834), including a prospectus dated March 24, 2023 and a preliminary prospectus supplement dated November 13, 2024, with the U.S. Securities and Exchange Commission

(the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that Registration Statement, the preliminary prospectus supplement for the offering to which this communication relates and other

documents the Guarantor has filed with the SEC for more complete information about the Issuer, the Guarantor and this offering. You may get these documents for free by visiting the SEC’s website at www.sec.gov. Alternatively, any underwriter or any

dealer participating in the offering will arrange to send you the prospectus and the prospectus supplement if you request them by calling: HSBC Continental Europe at 1-866-811-8049; J.P. Morgan Securities plc toll-free at +44-207-134-2468 (non-U.S.

investors) or J.P. Morgan Securities LLC (collect) at (212) 834-4533 (U.S. investors); Morgan Stanley & Co. International plc at 1-866-718-1649; or SMBC Bank International plc at +44-204-507-1000. You are advised to obtain a copy of the

prospectus and related prospectus supplement for the offering to which this communication relates and to carefully review the information contained or incorporated by reference therein before making any investment decision.

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another

email system.

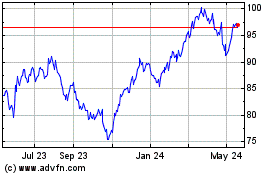

Otis Worldwide (NYSE:OTIS)

Historical Stock Chart

From Dec 2024 to Jan 2025

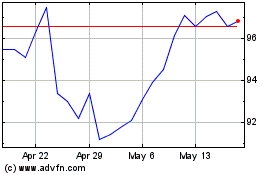

Otis Worldwide (NYSE:OTIS)

Historical Stock Chart

From Jan 2024 to Jan 2025