All amounts expressed in U.S. dollars unless otherwise

indicated. Unaudited tabular amounts are in millions of U.S.

dollars and thousands of shares, options, and warrants, except per

share amounts, unless otherwise noted.

Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) ("Pan

American" or the "Company") reports unaudited results for the

quarter ended September 30, 2023 ("Q3 2023").

"We are reaffirming our annual 2023 guidance ranges for silver

and gold production with the expectation that production for both

will come in at the low end of the ranges. We expect Gold Segment

Cash Costs and AISC to be within the guidance ranges and Silver

Segment Cash Costs and AISC to be marginally above their guidance

ranges," said Michael Steinmann, President and Chief Executive

Officer. "While mine operating performance was broadly in line with

the plan across the portfolio, ventilation constraints at La

Colorada and lower grades at El Peñon weighed on silver and gold

production."

"With the recent sales of the MARA project, the Morococha mine

and our interest in Agua de la Falda, which was completed on

November 6, 2023, we have advanced our objectives to rationalize

the portfolio as well as reduce debt and future financial

obligations. We expect to save approximately $90 million in cash

annually, primarily from the elimination of care and maintenance,

project development and reclamation costs associated with MARA and

Morococha, in addition to interest expense from having repaid the

$280 million that was drawn on our credit facility at the end of

June 30, 2023."

"We expect to capture a further $40 million to $60 million in

annual savings through synergies associated with integrating the

Yamana assets. The integration is progressing well, and we are

currently evaluating optimization and exploration plans for the

newly acquired mines. We will also continue to evaluate ways to

further rationalize our overall portfolio," added Mr.

Steinmann.

The following highlights for Q3 2023 include certain measures

that are not generally accepted accounting principles ("non-GAAP")

financial measures. Please refer to the section titled “Alternative

Performance (Non-GAAP) Measures” at the end of this news release

for further information on these measures.

Consolidated Q3 2023 Highlights:

- Silver production of 5.7 million ounces and gold production of

244.2 thousand ounces. Silver production was at the low end and

gold production was slightly below management's guidance ranges for

Q3 2023.

- Revenue was $616.3 million.

- Net loss of $22.7 million ($0.06 basic loss per share),

impacted by higher taxes.

- Adjusted earnings were $3.1 million, or $0.01 adjusted earnings

per share.

- Cash flow from operations was $114.6 million, net of $35.8

million in tax payments.

- Silver Segment Cash Costs and All-in Sustaining Costs ("AISC")

per silver ounce of $13.13 and $18.19, respectively.

- Gold Segment Cash Costs and AISC per gold ounce of $1,187 and

$1,451, respectively.

- Based on operating results to date, and expected results for

the remainder of the year, the Company reaffirms its 2023 Operating

Outlook, as provided in the Company's Q1 2023 MD&A dated May

10, 2023, for silver and gold production but expects both to be at

the low-end of their respective annual guidance ranges, and Silver

Segment Cash Costs and AISC to come in marginally above the

high-end of the guidance ranges. The Company reaffirms its 2023

Operating Outlook for production of base metals, Gold Segment Cash

Costs and AISC, and sustaining and project capital expenditures,

all of which are expected to be within guidance ranges.

- As at September 30, 2023, the Company had working capital of

$832.1 million, inclusive of cash and investments of $386.0

million, and $750.0 million available under its revolving

sustainability-linked credit facility ("SL-Credit Facility"). The

Company made a net repayment of $280.0 million on the SL-Credit

Facility in Q3 2023. Total debt of $809.1 million is primarily

related to two senior notes Pan American assumed through the

acquisition of Yamana Gold Inc. ("Yamana"), as well as construction

and other loans and leases.

- A cash dividend of $0.10 per common share with respect to Q3

2023 was declared on November 7, 2023, payable on or about December

1, 2023, to holders of record of Pan American’s common shares as of

the close of markets on November 20, 2023. For the nine-months

ended September 30, 2023, the Company paid cash dividends totaling

$94.0 million. The dividends are eligible dividends for Canadian

income tax purposes.

- At the La Colorada mine, the Company invested $14.0 million of

project capital in Q3 2023 to advance the La Colorada Skarn

project, largely for exploration and the preliminary economic study

underway, as well as advancing the excavation of the concrete-lined

ventilation shaft. The shaft reached a depth of 522 meters by the

end of Q3 2023 and is expected to be fully excavated to a depth of

593 meters by the end of 2023. The installation of two large

exhaust fans on the surface of the shaft is expected to be

completed by mid-2024, following which ventilation conditions in

the mine are expected to improve significantly. The preliminary

economic study for the Skarn project is on schedule to be released

by year-end 2023.

- At the Escobal mine in Guatemala, Pan American hosted three

visits to the mine for Xinka Indigenous representatives and their

advisors and participated in several other meetings with the Xinka

representatives and Guatemala’s Ministry of Energy and Mines during

Q3 2023. At this time, no date has been set for the completion of

the ILO 169 consultation process, or a potential restart of

operations at Escobal. In September 2023, Guatemala’s Chamber of

Industry awarded Pan American first place in the Environment

category for a reforestation and conservation project, which

involved an innovative approach for the reproduction of native oak

trees within the Escobal mine area.

Completion of the sale of Agua de la Falda

On November 6, 2023, Pan American completed the previously

announced divestment of its 57.74% interest in Agua de la Falda

S.A. (“ADLF”), a Chilean company that holds the historical Jeronimo

project, located in the Atacama region of northern Chile, as well

as several adjoining concessions.

Under the terms of the agreement, Rio Tinto Chile SPA (“Rio

Tinto”), a subsidiary of Rio Tinto Limited, paid US$45.55 million,

in cash, for the shares in ADLF and granted to a Pan American

subsidiary a net smelter return royalty of 1.25% on all precious

metals and a net smelter return royalty of 0.2% on all base metals,

on production from certain mineral concessions of ADLF, applied on

a pro rata basis in accordance with the ownership interest acquired

in such concessions. The remaining 42.26% interest is held by

Corporación Nacional del Cobre de Chile.

CONSOLIDATED RESULTS

Three months ended September

30, 2023

Twelve months ended December 31,

2022

Weighted average shares during period

(millions)

364.4

210.5

Shares outstanding end of period

(millions)

364.4

210.7

Three months ended

September 30,

2023

2022

FINANCIAL

Revenue

$

616.3

$

338.9

Mine operating earnings (loss)

$

61.9

$

(21.8

)

Net loss

$

(22.7

)

$

(71.2

)

Basic loss per share(1)

$

(0.06

)

$

(0.34

)

Adjusted earnings (loss)(2)

$

3.1

$

(2.8

)

Basic adjusted earnings (loss) per

share(1)

$

0.01

$

(0.01

)

Net cash generated from operating

activities

$

114.6

$

54.4

Net cash generated from operating

activities before changes in working capital(2)

$

117.6

$

32.8

Sustaining capital expenditures(2)

$

76.7

$

48.7

Non-sustaining capital expenditures(2)

$

48.7

$

26.2

Cash dividend paid per share

$

0.10

$

0.11

PRODUCTION

Silver (thousand ounces)

5,687

4,537

Gold (thousand ounces)

244.2

128.8

Zinc (thousand tonnes)

9.5

8.9

Lead (thousand tonnes)

4.9

4.4

Copper (thousand tonnes)

1.2

0.9

CASH COSTS(2) ($/ounce)

Silver Segment

13.13

14.62

Gold Segment

1,187

1,184

AISC(2) ($/ounce)

Silver Segment

18.19

17.97

Gold Segment

1,451

1,614

AVERAGE REALIZED PRICES(3)

Silver ($/ounce)

23.11

18.76

Gold ($/ounce)

1,927

1,705

Zinc ($/tonne)

2,336

3,232

Lead ($/tonne)

2,170

1,944

Copper ($/tonne)

8,343

7,707

(1)

Per share amounts are based on basic

weighted average common shares.

(2)

Non-GAAP measure; please refer to the

"Alternative Performance (non-GAAP) Measures" section of this news

release for further information on these measures.

(3)

Metal prices stated are inclusive of final

settlement adjustments on concentrate sales.

Cash Costs, AISC, adjusted earnings, basic adjusted earnings per

share, sustaining and non-sustaining capital, working capital,

total debt and net cash are non-GAAP financial measures. Please

refer to the "Alternative Performance (non-GAAP) Measures" section

of this news release for further information on these measures.

This news release should be read in conjunction with Pan

American's unaudited Condensed Interim Consolidated Financial

Statements and our MD&A for the three and nine months ended

September 30, 2023. This material is available on Pan American’s

website at panamericansilver.com, on SEDAR+ at www.sedarplus.ca and

on EDGAR at www.sec.gov.

CONFERENCE CALL AND WEBCAST

Date:

November 8, 2023

Time:

11:00 am ET (8:00 am PT)

Dial-in numbers:

1-888-886-7786 (toll-free in Canada and

the U.S.)

+1-416-764-8658 (international

participants)

Conference ID:

94321211

Webcast:

https://events.q4inc.com/attendee/486024912

The live webcast, presentation slides and the report for Q3 2023

will be available at

https://www.panamericansilver.com/invest/events-and-presentations/.

An archive of the webcast will also be available for three

months.

About Pan American

Pan American Silver is a leading producer of precious metals in

the Americas, operating silver and gold mines in Canada, Mexico,

Peru, Bolivia, Argentina, Chile and Brazil. We also own the Escobal

mine in Guatemala that is currently not operating, and we hold

interests in exploration and development projects. We have been

operating in the Americas for nearly three decades, earning an

industry-leading reputation for sustainability performance,

operational excellence and prudent financial management. We are

headquartered in Vancouver, B.C. and our shares trade on the New

York Stock Exchange and the Toronto Stock Exchange under the symbol

"PAAS".

Learn more at panamericansilver.com

Follow us on LinkedIn

Alternative Performance (Non-GAAP) Measures

In this news release, we refer to measures that are non-GAAP

financial measures. These measures are widely used in the mining

industry as a benchmark for performance, but do not have a

standardized meaning as prescribed by IFRS as an indicator of

performance, and may differ from methods used by other companies

with similar descriptions. These non-GAAP financial measures

include:

- Cash Costs. Pan American's method of calculating cash costs may

differ from the methods used by other entities and, accordingly,

Pan American's Cash Costs may not be comparable to similarly titled

measures used by other entities. Investors are cautioned that Cash

Costs should not be construed as an alternative to production

costs, depreciation and amortization, and royalties determined in

accordance with IFRS as an indicator of performance.

- Adjusted earnings and basic adjusted earnings per share. Pan

American believes that these measures better reflect normalized

earnings as they eliminate items that in management's judgment are

subject to volatility as a result of factors, which are unrelated

to operations in the period, and/or relate to items that will

settle in future periods.

- All-in Sustaining Costs per silver or gold ounce sold, net of

by-product credits ("AISC"). Pan American has adopted AISC as a

measure of its consolidated operating performance and its ability

to generate cash from all operations collectively, and Pan American

believes it is a more comprehensive measure of the cost of

operating our consolidated business than traditional cash costs per

payable ounce, as it includes the cost of replacing ounces through

exploration, the cost of ongoing capital investments (sustaining

capital), general and administrative expenses, as well as other

items that affect Pan American's consolidated earnings and cash

flow.

- Total debt is calculated as the total current and non-current

portions of: long-term debt, finance lease liabilities and loans

payable. Total debt does not have any standardized meaning

prescribed by GAAP and is therefore unlikely to be comparable to

similar measures presented by other companies. Pan American and

certain investors use this information to evaluate the financial

debt leverage of Pan American.

- Working capital is calculated as current assets less current

liabilities. Working capital does not have any standardized meaning

prescribed by GAAP and is therefore unlikely to be comparable to

similar measures presented by other companies. Pan American and

certain investors use this information to evaluate whether Pan

American is able to meet its current obligations using its current

assets.

- Total available liquidity is calculated as the sum of cash and

cash equivalents, Short-term Investments, and the amount available

on the Credit Facility. Total available liquidity does not have any

standardized meaning prescribed by GAAP and is therefore unlikely

to be comparable to similar measures presented by other companies.

Pan American and certain investors use this information to evaluate

the liquid assets available to Pan American.

Readers should refer to the "Alternative Performance (non-GAAP)

Measures" section of Pan American’s Q3 2023 MD&A for a more

detailed discussion of these and other non-GAAP measures and their

calculation.

Cautionary Note Regarding Forward-Looking Statements and

Information

Certain of the statements and information in this news release

constitute "forward-looking statements" within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian provincial securities laws. All statements, other than

statements of historical fact, are forward-looking statements or

information. Forward-looking statements or information in this news

release relate to, among other things: future financial or

operational performance, including our estimated production of

silver, gold and other metals forecasted for 2023, our estimated

Cash Costs and AISC, and our sustaining and project capital

expenditures in 2023; the anticipated synergies associated with the

Yamana integration; expectations with respect to mineral grades and

the impact of any variations relative to actual grades experienced;

the anticipated dividend payment date of December 1, 2023; the

anticipated impact of the disposition of non-core assets on Pan

American’s future financial or operational performance; the

estimated timing for the release of the preliminary assessment of

the La Colorada Skarn deposit; future anticipated prices for gold,

silver and other metals and assumed foreign exchange rates; and Pan

American’s plans and expectations for its properties and

operations.

These forward-looking statements and information reflect Pan

American’s current views with respect to future events and are

necessarily based upon a number of assumptions that, while

considered reasonable by Pan American, are inherently subject to

significant operational, business, economic and regulatory

uncertainties and contingencies. These assumptions include: the

impact of inflation and disruptions to the global, regional and

local supply chains; tonnage of ore to be mined and processed;

future anticipated prices for gold, silver and other metals and

assumed foreign exchange rates; the timing and impact of planned

capital expenditure projects, including anticipated sustaining,

project, and exploration expenditures; the ongoing impact and

timing of the court-mandated ILO 169 consultation process in

Guatemala; ore grades and recoveries; capital, decommissioning and

reclamation estimates; our mineral reserve and mineral resource

estimates and the assumptions upon which they are based; prices for

energy inputs, labour, materials, supplies and services (including

transportation); no labour-related disruptions at any of our

operations; no unplanned delays or interruptions in scheduled

production; all necessary permits, licenses and regulatory

approvals for our operations are received in a timely manner; our

ability to secure and maintain title and ownership to mineral

properties and the surface rights necessary for our operations;

whether Pan American is able to maintain a strong financial

condition and have sufficient capital, or have access to capital

through our corporate sustainability-linked credit facility or

otherwise, to sustain our business and operations; and our ability

to comply with environmental, health and safety laws. The foregoing

list of assumptions is not exhaustive.

Pan American cautions the reader that forward-looking statements

and information involve known and unknown risks, uncertainties and

other factors that may cause actual results and developments to

differ materially from those expressed or implied by such

forward-looking statements or information contained in this news

release and Pan American has made assumptions and estimates based

on or related to many of these factors. Such factors include,

without limitation: the duration and effect of local and world-wide

inflationary pressures and the potential for economic recessions;

fluctuations in silver, gold and base metal prices; fluctuations in

prices for energy inputs, labour, materials, supplies and services

(including transportation); fluctuations in currency markets (such

as the PEN, MXN, ARS, BOB, GTQ, CAD, CLP and BRL versus the USD);

operational risks and hazards inherent with the business of mining

(including environmental accidents and hazards, industrial

accidents, equipment breakdown, unusual or unexpected geological or

structural formations, cave-ins, flooding and severe weather);

risks relating to the credit worthiness or financial condition of

suppliers, refiners and other parties with whom Pan American does

business; inadequate insurance, or inability to obtain insurance,

to cover these risks and hazards; employee relations; relationships

with, and claims by, local communities and indigenous populations;

our ability to obtain all necessary permits, licenses and

regulatory approvals in a timely manner; changes in laws,

regulations and government practices in the jurisdictions where we

operate, including environmental, export and import laws and

regulations; changes in national and local government, legislation,

taxation, controls or regulations and political, legal or economic

developments in Canada, the United States, Mexico, Peru, Argentina,

Bolivia, Guatemala, Chile, Brazil or other countries where Pan

American may carry on business, including legal restrictions

relating to mining, including in Chubut, Argentina, risks relating

to expropriation and risks relating to the constitutional

court-mandated ILO 169 consultation process in Guatemala;

diminishing quantities or grades of mineral reserves as properties

are mined; increased competition in the mining industry for

equipment and qualified personnel; those factors identified under

the caption "Risks Related to Pan American's Business" in Pan

American's most recent form 40-F and Annual Information Form filed

with the United States Securities and Exchange Commission and

Canadian provincial securities regulatory authorities,

respectively; and those factors identified under the caption "Risks

of the Business" in Yamana's most recent form 40-F and Annual

Information Form filed with the United States Securities and

Exchange Commission and Canadian provincial securities regulatory

authorities, respectively.

Although Pan American has attempted to identify important

factors that could cause actual results to differ materially, there

may be other factors that cause results not to be as anticipated,

estimated, described or intended. Investors are cautioned against

undue reliance on forward-looking statements or information.

Forward-looking statements and information are designed to help

readers understand management's current views of our near- and

longer-term prospects and may not be appropriate for other

purposes. Pan American does not intend, nor does it assume any

obligation to update or revise forward-looking statements or

information, whether as a result of new information, changes in

assumptions, future events or otherwise, except to the extent

required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231106137034/en/

For more information contact: Siren Fisekci VP, Investor

Relations & Corporate Communications Ph: 604-806-3191 Email:

ir@panamericansilver.com

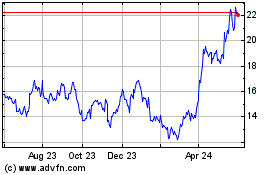

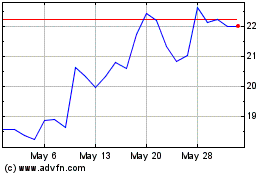

Pan American Silver (NYSE:PAAS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Pan American Silver (NYSE:PAAS)

Historical Stock Chart

From Feb 2024 to Feb 2025