false

0001712463

0001712463

2025-01-28

2025-01-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

January 28, 2025

(Date of Report, Date of earliest event reported)

RANPAK HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

____________________________

| Delaware |

001-38348 |

98-1377160 |

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number) |

(I.R.S. Employer

Identification No.)

|

7990 Auburn Road

Concord Township, Ohio 44077

(Address of principal executive offices) (Zip Code)

(440) 354-4445

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

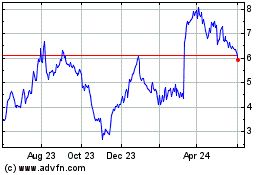

| Class A Common Stock, par value $0.0001 per share |

PACK |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

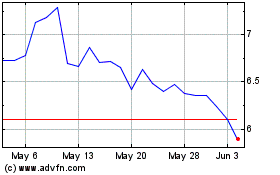

On January 28, 2025, Ranpak Holdings Corp. (“Ranpak”

or the “Company”) and Amazon.com, Inc. (“Parent”) entered into a Transaction Agreement (the “Transaction

Agreement”), under which, among other things, Ranpak agreed to issue to a wholly-owned affiliate of Parent (the “Warrantholder”)

a warrant (the “Warrant”) to acquire up to 18,716,456 shares (the “Warrant Shares”) of the Company’s common

stock (“Common Stock”) at an exercise price of $6.8308 per share, and on the terms and conditions set forth in the Warrant.

1,871,646 Warrant Shares vested on the date of

the Transaction Agreement. The remainder of the Warrant Shares are subject to vesting over time based on payments made by Parent or on

Parent’s behalf under the current and any possible future commercial agreement with the Company, with all Warrant Shares vesting

upon an aggregate spend of $400 million.

The Warrant allows for cashless exercise in part

or in full at the Warranholder’s discretion and expires January 28, 2033. So long as the Warrant is unexercised, the Warrant does

not entitle the Warrantholder to any voting rights or any other common stockholder rights. The exercise price and the number of Warrant

Shares are subject to customary anti-dilution adjustments. The Transaction Agreement includes customary registration rights relating to

the Warrant Shares.

The Warrant was issued, and the Warrant Shares

are expected to be issued, in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as

amended, and rules and regulations of the U.S. Securities and Exchange Commission promulgated thereunder. This current report on Form

8-K does not constitute an offer to sell, or a solicitation of an offer to buy, any security and shall not constitute an offer, solicitation

or sale in any jurisdiction in which such offering would be unlawful.

The foregoing summary does not purport to be complete

and is qualified in its entirety by reference to the Warrant, which is filed as Exhibit 4.1 hereto, and the Transaction Agreement, which

is filed as Exhibit 10.1, and each is incorporated herein by reference.

Item

3.02. Unregistered Sales of Equity Securities.

The information provided under Item 1.01 of this

Current Report on Form 8-K with respect to the issuance of the Warrant is incorporated by reference into this Item 3.02.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits.

Portions of this document have been redacted pursuant to Item 601(b)(10)(iv) of Regulation S-K.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RANPAK HOLDINGS CORP. |

| |

|

| By: |

/s/ William Drew |

| |

William Drew |

| |

Executive Vice President and

Chief Financial Officer

|

Date: January 29, 2025

Exhibit 4.1

PORTIONS OF THIS EXHIBIT (INDICATED BY ASTERISKS) HAVE BEEN OMITTED

BECAUSE THE REGISTRANT HAS DETERMINED THAT THE INFORMATION IS NOT MATERIAL AND IS OF THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR

CONFIDENTIAL.

WARRANT TO PURCHASE

COMMON STOCK

THE SECURITIES REPRESENTED BY THIS INSTRUMENT HAVE NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES LAWS OF ANY STATE AND MAY NOT BE TRANSFERRED, SOLD, OR OTHERWISE DISPOSED

OF EXCEPT IN CONNECTION WITH AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH ACT AND APPLICABLE STATE SECURITIES LAWS OR UNDER AN EXEMPTION

FROM REGISTRATION UNDER SUCH ACT OR SUCH LAWS.

THIS INSTRUMENT IS ISSUED IN CONNECTION WITH AND SUBJECT TO THE RESTRICTIONS

ON TRANSFER AND OTHER PROVISIONS OF A TRANSACTION AGREEMENT, DATED AS OF JANUARY 28, 2025, BY AND BETWEEN THE ISSUER OF THESE SECURITIES

AND AMAZON.COM, INC., A DELAWARE CORPORATION, A COPY OF WHICH IS ON FILE WITH THE ISSUER. THE SECURITIES REPRESENTED BY THIS INSTRUMENT

MAY NOT BE SOLD OR OTHERWISE TRANSFERRED EXCEPT IN COMPLIANCE WITH SAID AGREEMENT. ANY SALE OR OTHER TRANSFER NOT IN COMPLIANCE WITH SAID

AGREEMENT WILL BE VOID.

WARRANT

to purchase

18,716,456

Shares of Common Stock of

Ranpak Holdings Corp.,

a Delaware Corporation

Issue Date: January 28, 2025

1. Number

of Warrant Shares; Exercise Price. This certifies that, for value received, the Warrantholder or its permitted assigns or transferees

is entitled, upon the terms hereinafter set forth, to acquire from the Company, in whole or in part, up to a maximum aggregate of 18,716,456

fully paid and nonassessable shares of Common Stock (the “Warrant Shares”), at a purchase price per share of Common

Stock equal to $6.8308 (the “Exercise Price”); provided, however such Warrant Shares shall be subject to

a reduction such that the maximum shares issuable shall be as required under the applicable New York Stock Exchange (“NYSE”)

Listing Rules, including but not limited to, NYSE Rules 713(a) and 312.03, unless and until the approvals acquired under such

rules are obtained. The Warrant Shares and Exercise Price are subject to adjustment and/or may be supplemented by or converted into other

Equity Securities as provided herein, and all references to “Common Stock,” “Warrant Shares,” and “Exercise

Price” herein shall be deemed to include any such adjustment, supplement, and/or conversion or series of adjustments, supplements,

or conversions.

2. Exercise

of Warrant; Term; Other Agreements; Book Entry; Cancelation.

(i) Promptly

following the end of each calendar quarter during which a Vesting Event has occurred (or promptly after a written request by Amazon for

a Notice of Vesting Event as of a certain day), the Company shall deliver to the Warrantholder a Notice of Vesting Event in the form attached

as Annex A hereto; provided that neither the delivery, nor the failure of the Company to deliver, such Notice of Vesting

Event shall affect or impair the Warrantholder’s rights or the Company’s obligations hereunder.

(ii) Subject

to (A) Section 1, Section 8(iv), and Section 9, (B) compliance with the Antitrust Laws (including

with respect to any Warrant Shares issuable from exercise of this Warrant upon

a Vesting Event or otherwise), and (C) the approvals

required under the applicable NYSE Listing Rules, including but not limited to, NYSE Listing Rules 713(a) and 312.03, as may be applicable,

the right to purchase Warrant Shares represented by this Warrant is exercisable, in whole or in part by the Warrantholder, at any time

or from time to time, from and after the applicable Vesting Event, but in no event later than 5:00 p.m., Seattle time, on January

28, 2033 (subject to extension in accordance with Section 2(iii), such time as extended if applicable, the “Expiration

Time” and such period from and after the applicable Vesting Event through the Expiration Time, the “Exercise Period”),

by (a) the delivery of the Notice of Exercise, to the Company in accordance with Section 13 (or such other office or

agency of the Company in the United States as it may designate by notice to the Warrantholder in accordance with Section 13

hereof (the “Designated Company Office”)) and (b) payment of the Exercise Price for the Warrant Shares thereby

purchased by, at the sole election of the Warrantholder, either: (i) by wire transfer of immediately available funds to an account

designated by the Company (such manner of exercise, a “Cash Exercise”) or (ii) without payment of cash, by reducing

the number of Warrant Shares obtainable upon the exercise of this Warrant (either in full or in part, as applicable) and payment of the

Exercise Price in cash so as to yield a number of Warrant Shares obtainable upon the exercise of this Warrant (either in full or in two

or more parts, as applicable) equal to the product of (x) the number of Warrant Shares issuable upon the exercise of this Warrant (either

in full or in two or more parts, as applicable) (if payment of the Exercise Price were being made in cash) and (y) the Cashless Exercise

Ratio (such manner of exercise, a “Cashless Exercise”); provided that such product shall be rounded to the nearest

whole Warrant Share. Notwithstanding any other provision hereof, if an exercise of any portion of this Warrant is to be made in connection

with a public offering or an Acquisition Transaction, such exercise may at the election of the Warrantholder be conditioned upon the consummation

of such transaction, in which case such exercise shall be inclusive of any vesting that would occur upon the consummation of or immediately

prior to such transaction but not be deemed to be effective until immediately prior to the consummation of such transaction. If

such transaction is not consummated, such exercise shall be deemed void if so requested by Warrantholder in a Notice of Exercise.

(iii) Notwithstanding

the foregoing, (a) if at any time during the Exercise Period the Warrantholder has not exercised this Warrant in full as a result of (I)

there being insufficient Warrant Shares available for issuance, (II) the lack of any required regulatory, corporate or other approval

(including, for the avoidance of doubt, any approval required under the Antitrust Laws (including the Initial Antitrust Clearance), if

so applicable), or (III) the Company has not been current with its Exchange Act public reporting requirements at any time in the previous

30 days (collectively, the “Exercise Conditions”), the Expiration Time shall be extended until 60 days after such date

as the Warrantholder is able to acquire all of the vested Warrant Shares without violating any Exercise Conditions, (b) if at the Expiration

Time, or any time prior to the Expiration Time, the Company is or has been party to a definitive agreement for an Acquisition Transaction

that has not closed, the Expiration Time shall be extended until 5 Business Days after the closing of such Acquisition Transaction, or

20 Business Days after the date on which the definitive agreement for such Acquisition Transaction has been terminated, as the case may

be, or (c) if at any time prior to the Expiration Time, a third party has publicly filed, or announced its intention to file, a tender

offer for the Company which if consummated would result in an Acquisition Transaction, and without a definitive agreement for an Acquisition

Transaction with respect to such tender offer having been executed by the Company, then the Expiration Time shall be extended until the

later of (I) 5 Business Days after the expiration time of the tender offer, or (II) if no tender offer is launched, 25 Business Days after

the public announcement of such third party’s intention to launch such tender offer, but if a tender offer is launched during such

period, then 5 Business Days after the expiration time of the tender offer.

(iv) If

the Warrantholder has not exercised this Warrant in its entirety, following each exercise the Warrantholder shall be entitled to receive

from the Company, upon request, a new warrant of like tenor in substantially identical form for the purchase of that number of Warrant

Shares equal to the

difference between the maximum aggregate number of

Warrant Shares and the number of Warrant Shares as to which this Warrant is or has been so exercised.

(v) The

Company shall either (a) maintain itself, or (b) cause its transfer agent to maintain, in each case, books for the original issuance and

the transfer and exercise of the Warrant issuable in connection therewith, in each case in accordance with the terms hereof in book-entry

form. If the Company maintains books for the Warrant, then (I) the Company agrees that it will accept instructions from the Warrantholder

for the transfer and exercise of the Warrants, to the extent permitted in accordance with the terms of the Warrant and the Transaction

Agreement, and (II) the Company shall not require the delivery of the original Warrant or any copy thereof, in each case in certificated

form, in connection with the transfer or exercise thereof. The Company shall be responsible for all fees and expenses with respect to

maintaining the Warrant in book-entry form. In no event shall Warrantholder be required to post any bond or incur any other financial

cost related to the book entry existence of this Warrant.

(vi) This

Warrant, including with respect to its cancelation, is subject to the terms and conditions of the Transaction Agreement. Without affecting

in any manner any prior exercise of this Warrant (or any Warrant Shares previously issued hereunder), if (a) the Transaction Agreement

is terminated in accordance with Section 8.1 thereof or (b) the Warrantholder delivers to the Company a written, irrevocable

commitment not to exercise this Warrant, then the Company shall have no obligation to issue, and the Warrantholder shall have no right

to acquire, the unvested portion of any Warrant Shares under this Warrant.

3. Issuance

of Warrant Shares; Authorization; Listing; Cash Settlement.

(i) The

Company shall issue a book-entry or book-entries for the Warrant Shares issued upon exercise of this Warrant on or before the second Business

Day following the date of exercise of this Warrant in accordance with its terms in the name of the Warrantholder and shall deliver evidence

of such book-entry or book-entries to the Warrantholder. If the issuance of the Warrant Shares is registered under the Securities Act,

in lieu of issuing a book-entry in Warrantholder’s name, the Company’s transfer agent shall use the DTC Fast Automated Securities

Transfer Program to credit the number of Warrant Shares to which the Warrantholder is entitled in connection with such exercise to the

Warrantholder’s or its designee’s balance account with DTC through its DWAC system. The Company shall be responsible for all

fees and expenses of its transfer agent and all fees and expenses with respect to the issuance of Warrant Shares via DTC, if any, including

without limitation for same-day processing.

(ii) The

Company’s obligations to issue and deliver Warrant Shares in accordance with the terms and subject to the conditions hereof are

absolute and unconditional, irrespective of any action or inaction by the Warrantholder to enforce the same, any waiver or consent with

respect to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim,

recoupment, limitation, or termination; provided, however, that the Company shall not be required to deliver Warrant Shares

with respect to an exercise prior to the Warrantholder’s delivery of the associated Exercise Price (or notice of Cashless Exercise).

(iii) Following

the issuance of any Warrant Shares, the Company shall register such issuance in book-entry form in the name of the Warrantholder. The

Warrant Shares so issued shall be deemed for all purposes to have been issued to the Warrantholder as of the close of business on the

date on which this Warrant and payment of the Exercise Price (or notice of Cashless Exercise) are delivered to the Company in accordance

with the terms of this Warrant, notwithstanding that the stock transfer books of the Company may then be closed or book-entries representing

such Warrant Shares may not be actually delivered on such date or credited to the Warrantholder’s (or its representative’s)

DTC account, as the

case may be. The Company shall at all times reserve

and keep available, out of its authorized but unissued Common Stock, the Warrant Shares, solely for the purpose of providing for the exercise

of this Warrant, the aggregate Warrant Shares then issuable upon exercise of this Warrant in full (disregarding whether or not this Warrant

is exercisable by its terms at any such time).

(iv) The

Company shall, at its sole expense, procure, subject to issuance or notice of issuance, the listing of any Warrant Shares issuable upon

exercise of this Warrant on the Principal Trading Market on which such same class of Equity Securities are then listed or traded, promptly

after such Warrant Shares are eligible for listing thereon.

4. No

Fractional Shares or Scrip. No fractional Warrant Shares or other Equity Securities or scrip representing fractional Warrant Shares

or other Equity Securities shall be issued upon any exercise of this Warrant. In lieu of any fractional share to which a Warrantholder

would otherwise be entitled, the fractional Warrant Shares or other Equity Securities shall be rounded up to the next whole Warrant Share

or other Equity Securities, and the Warrantholder shall be entitled to receive such rounded-up number of Warrant Shares or other Equity

Securities.

5. No

Rights as Shareholders; Transfer Books. Without limiting in any respect the provisions of the Transaction Agreement and except as

otherwise provided by the terms of this Warrant, this Warrant does not entitle the Warrantholder to (i) consent to any action of

the shareholders of the Company, (ii) receive notice of or vote at any meeting of the shareholders, (iii) receive notice of

any other proceedings of the Company, or (iv) exercise any other rights whatsoever, in any such case, as a stockholder of the Company

prior to the date of exercise of this Warrant.

6. Charges,

Taxes, and Expenses. Issuance of this Warrant and issuance of certificates for Warrant Shares to the Warrantholder upon the exercise

of this Warrant shall be made without charge to the Warrantholder for any issue, registration or transfer tax, assessment or similar governmental

charge (other than any such taxes, assessments or charges in respect of any transfer occurring contemporaneously therewith) or other incidental

expense in respect of the issuance of such certificates, all of which taxes, assessments, charges, and expenses shall be paid by the Company.

7. Transfer/Assignment.

(i) This

Warrant may be transferred only in accordance with the terms of the Transaction Agreement. Subject to compliance with the first sentence

of this Section 7(i), the legend as set forth on the cover page of this Warrant and the terms of the Transaction Agreement,

this Warrant and all rights hereunder are transferable, in whole or in part, upon the books of the Company by the registered holder hereof

in person or by a duly authorized attorney, and a new Warrant shall be made and delivered by the Company, of the same tenor and date as

this Warrant but registered in the name of one or more transferees. If the transferring holder does not transfer the entirety of its rights

to purchase all Warrant Shares hereunder, such holder shall be entitled to receive from the Company a new Warrant in substantially identical

form for the purchase of that number of Warrant Shares as to which the right to purchase was not transferred. All expenses (other than

stock transfer taxes) and other charges payable in connection with the preparation, execution and delivery of the new Warrant in accordance

with this Section 7 shall be paid by the Company.

(ii) If

and for so long as required by the Transaction Agreement, any Warrant book entry issued hereunder shall contain a legend as set forth

in Section 4.2 of the Transaction Agreement.

8. Adjustments

and Other Rights. The Exercise Price and Warrant Shares issuable upon exercise of this Warrant shall be subject to adjustment from

time to time as follows; provided that, if more

than one subsection of this Section 8

is applicable to a single event, the subsection shall be applied that produces the largest adjustment, and no single event shall cause

an adjustment under more than one subsection of this Section 8 so as to result in duplication.

(i) Stock

Splits, Subdivisions, Reclassifications, or Combinations. If the Company shall at any time or from time to time (a) declare,

order, pay, or make a dividend or make a distribution on its Common Stock in additional shares of Common Stock, (b) split, subdivide,

or reclassify the outstanding shares of Common Stock into a greater number of shares, or (c) combine or reclassify the outstanding

shares of Common Stock into a smaller number of shares, the number of Warrant Shares issuable upon exercise of this Warrant at the time

of the record date for such dividend or distribution or the effective date of such split, subdivision, combination, or reclassification

shall be proportionately adjusted so that the Warrantholder immediately after such record date or effective date, as the case may be,

shall be entitled to purchase the number of shares of Common Stock which such holder would have owned or been entitled to receive in respect

of the shares of Common Stock subject to this Warrant after such date had this Warrant been exercised in full immediately prior to such

record date or effective date, as the case may be (disregarding whether or not this Warrant had been exercisable by its terms at such

time). In the event of such adjustment, the Exercise Price in effect at the time of the record date for such dividend or distribution

or the effective date of such split, subdivision, combination, or reclassification shall be immediately adjusted to the number obtained

by dividing (x) the product of (1) the number of Warrant Shares issuable upon the exercise of this Warrant in full before the

adjustment determined in accordance with the immediately preceding sentence (disregarding whether or not this Warrant was exercisable

by its terms at such time) and (2) the Exercise Price in effect immediately prior to the record or effective date, as the case may

be, for the dividend, distribution, split, subdivision, combination, or reclassification giving rise to such adjustment by (y) the

new number of Warrant Shares issuable upon exercise of the Warrant in full determined in accordance with the immediately preceding sentence

(disregarding whether or not this Warrant is exercisable by its terms at such time).

(ii) Certain

Issuances of Common Stock or Convertible Securities. If the Company shall at any time or from time to time issue shares of Common

Stock (or rights or warrants or any other securities or rights exercisable or convertible into or exchangeable for shares of Common Stock,

including through distributions on outstanding securities (collectively, “Convertible Securities”)) (other than transactions

to which the adjustments set forth in Section 8(i) are applicable), (1) without consideration or (2) at a consideration per

share (or having a conversion price per share) that is less than the Exercise Price (the date of such issuance, the “Pricing

Date”) then, in such event:

(A) the

number of Warrant Shares issuable upon the exercise of this Warrant held by the Warrantholder on the Pricing Date (the “Initial

Number”) shall be increased to the number obtained by multiplying the Initial Number by a fraction (I) the numerator of which

shall be the sum of (x) the number of shares of Common Stock outstanding immediately prior to the Pricing Date and (y) the number of additional

shares of Common Stock issued (or into which Convertible Securities may be converted) on the Pricing Date and (II) the denominator of

which shall be the sum of (x) the number of shares of Common Stock outstanding immediately prior to the Pricing Date and (y) the number

of shares of Common Stock (rounded to the nearest whole share) which the Aggregate Consideration in respect of such issuance of shares

of Common Stock (or Convertible Securities) would purchase at the Market Price of Common Stock on the Trading Day immediately prior to

the Pricing Date; and

(B) the

Exercise Price payable upon exercise of this Warrant held by the Warrantholder on the Pricing Date shall be adjusted by multiplying such

Exercise Price in effect immediately prior to the Pricing Date by a fraction, the numerator of which shall be the number of shares of

Common Stock issuable upon exercise of this Warrant in full immediately prior to the adjustment in accordance with clause (A) above (disregarding

whether or not this Warrant was exercisable by its terms

at such time), and the denominator of which shall be the

number of shares of Common Stock issuable upon exercise of this Warrant in full immediately after the adjustment in accordance with clause

(A) above (disregarding whether or not this Warrant is exercisable by its terms at such time).

For purposes of the foregoing, (1) in

the case of the issuance of such shares of Common Stock or Convertible Securities for, in whole or in part, any noncash property (or in

the case of any noncash property payable upon conversion of any such Convertible Securities), the consideration represented by such noncash

property shall be deemed to be the Market Price (in the case of securities) and/or Fair Market Value (in all other cases), as applicable,

of such noncash property as of the Trading Day immediately prior to the Pricing Date (before deduction of any related expenses payable

to third parties, including discounts and commissions); and (2) if the Exercise Price and the number of Warrant Shares issuable upon exercise

of this Warrant shall have been adjusted upon the issuance of any Convertible Securities in accordance with this Section 8,

solely to the extent the Exercise Price and the number of Warrant Shares has been properly reflected for the actual issuance of shares

of Common Stock upon the actual conversion of such Convertible Securities, no further adjustment of the Exercise Price and the number

of Warrant Shares issuable upon exercise of this Warrant shall be made for the actual issuance of shares of Common Stock upon the actual

conversion of such Convertible Securities in accordance with their terms. Any adjustment made under this Section 8(ii) shall

become effective immediately upon the date of such issuance. For the avoidance of doubt, no increase to the Exercise Price or decrease

in the number of Warrant Shares issuable upon exercise of this Warrant shall be made in accordance with this Section 8(ii).

(iii) Distributions.

If the Company, at any time while this Warrant is outstanding, declares or makes any dividend or distributes to holders of shares of Common

Stock (and not to the Warrantholder) evidence of its indebtedness or assets (including cash and cash dividends or property) or rights

or warrants to subscribe for or purchase any security (including, without limitation, any distribution of cash, stock, or other securities,

property, or options by way of a dividend, spin-off, reclassification, corporate rearrangement, scheme of arrangement, or other similar

transaction other than dividends or distributions under Section 8(i)) (collectively, a “Distribution”),

then the Warrantholder will be entitled to participate in such Distribution and be deemed to have exercised, and be the holder of, all

Warrant Shares, whether vested or not, subject to this Warrant before the record date of such Distribution.

(iv) Acquisition

Transactions. In case of any Acquisition Transaction or reclassification of Common Stock (other than a reclassification of Common

Stock subject to adjustment under Section 8(i)), notwithstanding anything to the contrary contained herein, (a) the Company

shall notify the Warrantholder in writing of such Acquisition Transaction or reclassification as promptly as practicable (but in no event

later than 20 Business Days prior to the effectiveness thereof), which notice shall specify the expected date on which such qualifying

Acquisition Transaction is to take place and set forth the facts with respect thereto as shall be reasonably necessary to indicate the

amount and type of consideration to each outstanding share of Common Stock, (b) an amount of Warrant Shares equal to the remaining unvested

Warrant Shares multiplied by Acquisition Transaction Multiplier shall vest and become nonforfeitable and exercisable immediately prior

to the consummation of such Acquisition Transaction or reclassification, and (c) in the event of the consummation prior to the Expiration

Time of an Acquisition Transaction where the consideration in such transaction is not solely cash consideration, the Warrantholder’s

right to receive Warrant Shares upon exercise of this Warrant shall, at the option of the Warrantholder and to the fullest extent legally

possible under applicable Laws, be converted, effective upon the occurrence of such Acquisition Transaction or reclassification, into

(I) the right to exercise this Warrant to acquire the number of shares of stock or other securities or property (including cash) that

the shares of Common Stock issuable (at the time of such Acquisition Transaction or reclassification) upon exercise of this Warrant immediately

prior to such Acquisition Transaction or reclassification would have been entitled to receive upon consummation of such Acquisition Transaction

or reclassification or, (II) if

any exemption, authorization, consent, notice, or

approval under Applicable Law is required or advisable from a Governmental Entity in connection with such Acquisition Transaction or reclassification

(a “Third Party Approval”), upon Amazon’s election in its sole discretion, cash in an amount equal to the shares

of Common Stock issuable (at the time of such Acquisition Transaction or reclassification) upon exercise of this Warrant immediately prior

to such Acquisition Transaction or reclassification that the Warrantholder would have been entitled to receive upon consummation of such

Acquisition Transaction or reclassification based on the Fair Market Value of such consideration (or in case of a tender offer, at the

price in cash offered by the offeror to the other shareholders). In determining the kind and amount of stock, securities, or property

receivable upon exercise of this Warrant upon and following adjustment under this paragraph, if the holders of Common Stock have the right

to elect the kind or amount of consideration receivable upon consummation of such Acquisition Transaction, then the Warrantholder shall

have the right to make the same election upon exercise of this Warrant with respect to the number of shares of stock or other securities

or property which the Warrantholder shall receive upon exercise of this Warrant. The Company, or the Person or Persons formed by the applicable

Acquisition Transaction or reclassification, or that acquire(s) the applicable shares of Common Stock, as the case may be, shall make

lawful provisions to establish such rights and to provide for such adjustments that, for events from and after such Acquisition Transaction

or reclassification, shall be as nearly equivalent as possible to the rights and adjustments provided for herein, and the Company shall

not be a party to or permit any such Acquisition Transaction or reclassification to occur unless such provisions are made or not precluded,

as the case may be, as a part of the terms thereof.

(v) Rounding

of Calculations; Minimum Adjustments. All calculations under this Section 8 shall be made to the nearest one-tenth (1/10th)

of a cent or to the nearest one-hundredth (1/100th) of a share, as the case may be. Notwithstanding any provision of this Section 8

to the contrary, no adjustment in the Exercise Price or the number of Warrant Shares into which this Warrant is exercisable shall be made

if the amount of such adjustment would be less than $0.01 or one-tenth (1/10th) of a share of Common Stock, but any such amount shall

be carried forward, and an adjustment with respect thereto shall be made at the time of and together with any subsequent adjustment which,

together with such amount and any other amount or amounts so carried forward, shall aggregate $0.01 or one-tenth (1/10th) of a share of

Common Stock, or more.

(vi) Timing

of Issuance of Additional Securities Upon Certain Adjustments. In any event in which (a) the provisions of this Section 8

shall require that an adjustment (the “Subject Adjustment”) shall become effective immediately after a record date

(the “Subject Record Date”) for an event and (b) the Warrantholder exercises this Warrant after the Subject Record

Date and before the consummation of such event, the Company may defer until the consummation of such event issuing to such Warrantholder

the incrementally additional shares of Common Stock or other property issuable upon such exercise by reason of the Subject Adjustment;

provided, however, that the Company upon request shall promptly deliver to such Warrantholder a due bill or other appropriate

instrument evidencing such Warrantholder’s right to receive such additional shares (or other property, as applicable) upon the consummation

of such event.

(vii) Statement

Regarding Adjustments. Whenever the Exercise Price or the Warrant Shares into which this Warrant is exercisable shall be adjusted

as provided in Section 8, the Company shall promptly prepare a statement showing in reasonable detail the facts requiring

such adjustment and the Exercise Price that shall be in effect and the Warrant Shares into which this Warrant shall be exercisable after

such adjustment, and cause a copy of such statement to be delivered to the Warrantholder as promptly as practicable after the event giving

rise to the adjustment.

(viii) Notice

of Adjustment Event. In the event that the Company shall propose to take any action of the type described in this Section 8

(but only if the action of the type described in this

Section 8 would result in an adjustment

in the Exercise Price or the Warrant Shares into which this Warrant is exercisable or a change in the type of securities or property to

be delivered upon exercise of this Warrant), the Company shall provide as promptly as practicable written notice to the Warrantholder,

which notice shall specify the record date, if any, with respect to any such action and the approximate date on which such action is to

take place. Such notice shall also set forth the facts with respect thereto as shall be reasonably necessary to indicate the effect on

the Exercise Price and the number, kind, or class of shares or other securities or property which shall be deliverable upon exercise of

this Warrant. In the case of any action which would require the fixing of a record date, such notice shall be given at least ten days

prior to the date so fixed. In case of all other actions, such notice shall be given at least ten days prior to the taking of such

proposed action unless the Company reasonably determines in good faith that, given the nature of such action, the provision of such notice

at least ten days in advance is not reasonably practicable from a timing perspective, in which case such notice shall be given as

far in advance prior to the taking of such proposed action as is reasonably practicable from a timing perspective.

(ix) Adjustment

Rules. Any adjustments under this Section 8 shall be made successively whenever an event referred to herein shall

occur. If an adjustment in the Exercise Price made hereunder would reduce the Exercise Price to an amount below par value of the Common

Stock, then such adjustment in the Exercise Price made hereunder shall reduce the Exercise Price to the par value of the Common Stock.

(x) No

Impairment. The Company shall not, by amendment of its certificate of incorporation, bylaws, or any other organizational document,

or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue, or sale of securities or any other voluntary

action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Company,

but shall at all times in good faith assist in the carrying out of all the provisions of this Warrant. In furtherance and not in limitation

of the foregoing, the Company shall not take or permit to be taken any action that would (a) increase the par value of any shares

of Common Stock receivable upon the exercise of this Warrant above the Exercise Price then in effect or (b) entitle the Warrantholder

to an adjustment under this Section 8 if the total number of shares of Common Stock issuable after such action upon exercise

of this Warrant in full (disregarding whether or not this Warrant is exercisable by its terms at such time), together with all shares

of Common Stock then outstanding and all shares of Common Stock then issuable upon the exercise in full of any and all outstanding Equity

Securities (disregarding whether or not any such Equity Securities are exercisable by their terms at such time) would exceed the total

number of shares of Common Stock then authorized by its certificate of incorporation.

(xi) Proceedings

Prior to Any Action Requiring Adjustment. As a condition precedent to the taking of any action which would require an adjustment under

this Section 8, the Company shall promptly take any and all action which may be necessary, including obtaining approvals

of regulatory or other governmental bodies, the Principal Trading Market, or other applicable securities exchange, corporate, or shareholder

approvals or exemptions, so that the Company may thereafter validly and legally issue as fully paid and nonassessable all shares of Common

Stock, or all other securities or other property, that the Warrantholder is entitled to receive upon exercise of this Warrant in accordance

with this Section 8.

(xii) No

Adjustment for Permitted Transactions. Notwithstanding anything in this Warrant to the contrary, no adjustment shall be made under

this Section 8 in connection with any Permitted Transaction.

(xiii) Warrant

Shares Cap. Notwithstanding anything in this Agreement to the contrary, if any adjustment or other change to the number of Warrant

Shares issuable upon exercise of this Warrant

would result in the aggregate number of Warrant Shares

issued under this Warrant to exceed 16,645,146 (the “Warrant Shares Cap”), then the number of Warrant Shares issuable

upon exercise of this Warrant after such adjustment or change shall be reduced to the number of shares equal to the Warrant Shares Cap

(for purposes of this calculation, rounded down to the nearest whole share); provided that, upon obtaining the Requisite Stockholder Approval,

the aggregate number of the Warrant Shares issuable upon the exercise of this Warrant shall be adjusted and changed to equal the number

of shares assuming the reduction(s) set forth in this Section 8(xiii) did not occur.

9. Beneficial

Ownership Limitation.

(i) Notwithstanding

anything in this Warrant to the contrary, the Company shall not honor any exercise of this Warrant, and a Warrantholder shall not have

the right to exercise any portion of this Warrant, to the extent that, after giving effect to an attempted exercise set forth on an applicable

Notice of Exercise, such Warrantholder (together with such Warrantholder’s Affiliates, and any other Person whose beneficial ownership

of Common Stock would be aggregated with the Warrantholder’s for purposes of Section 13(d) or Section 16 of the Exchange

Act, and any other applicable regulations of the Commission, including any Group of which the Warrantholder is a member (the foregoing,

“Attribution Parties”)) would beneficially own a number of shares of Common Stock in excess of the Beneficial Ownership

Limitation. For purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by such Warrantholder and

its Attribution Parties shall include the number of Warrant Shares issuable under the Notice of Exercise with respect to which such determination

is being made, but shall exclude the number of shares of Common Stock which are issuable upon (a) exercise of the remaining, unexercised

portion of any Warrant beneficially owned by such Warrantholder or any of its Attribution Parties and (b) exercise or conversion

of the unexercised or unconverted portion of any other securities of the Company (including any warrants) beneficially owned by such Warrantholder

or any of its Attribution Parties that are subject to a limitation on conversion or exercise similar to the limitation contained herein.

For purposes of this Section 9, beneficial ownership shall be calculated in accordance with Section 13(d) of

the Exchange Act and any other applicable regulations of the Commission. For purposes of this Section 9, in determining

the number of outstanding shares of Common Stock, a Warrantholder may rely on the number of outstanding shares of Common Stock as stated

in the most recent of the following: (X) the Company’s most recent periodic or annual filing with the Commission,

as the case may be, (Y) a more recent public announcement by the Company that is filed with the Commission, or (Z) a more recent

notice by the Company or the Company’s transfer agent to the Warrantholder setting forth the number of shares of Common Stock then

outstanding. Upon the written request of a Warrantholder, the Company shall, within three Trading Days thereof, confirm in writing

to such Warrantholder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares of Common Stock

shall be determined after giving effect to any actual conversion or exercise of securities of the Company, including the exercise of this

Warrant, by such Warrantholder or its Attribution Parties since the date as of which such number of outstanding shares of Common Stock

was last publicly reported or confirmed to the Warrantholder. The Company shall be entitled to rely on representations made to it by the

Warrantholder in any Notice of Exercise regarding its Beneficial Ownership Limitation. The Warrantholder acknowledges that the Warrantholder

is solely responsible for any schedules or statements required to be filed by it in accordance with Section 13(d) or Section 16(a) of

the Exchange Act.

(ii) The

“Beneficial Ownership Limitation” shall initially be 4.999% of the number of shares of the Common Stock outstanding

immediately after giving effect to the issuance of Warrant Shares pursuant to such Notice of Exercise (to the extent permitted under this Section 9);

provided, however, that by written notice to the Company, which will not be effective until the 61st day after such notice

is given by the Warrantholder to the Company, the Warrantholder may waive or amend the provisions of this Section 9

to change the Beneficial Ownership Limitation to any other number, and the

provisions of this Section 9 shall

continue to apply. Upon any such waiver or amendment to the Beneficial Ownership Limitation, the Beneficial Ownership Limitation may not

be further waived or amended by the Warrantholder without first providing the minimum written notice required by the immediately preceding

sentence. Notwithstanding the foregoing, at any time following notice of an Acquisition Transaction under Section 8(iv) with

respect to an Acquisition Transaction that is pursuant to any tender offer or exchange offer (by the Company or another Person (other

than the Warrantholder or any Affiliate of the Warrantholder)), the Warrantholder may waive or amend the Beneficial Ownership Limitation

effective immediately upon written notice to the Company and may reinstitute a Beneficial Ownership Limitation at any time thereafter

effective immediately upon written notice to the Company.

(iii) Notwithstanding

the provisions of this Section 9, none of the provisions of this Section 9 shall restrict in any way

the number of shares of Common Stock which the Warrantholder may receive or beneficially own in order to determine the amount of securities

or other consideration that the Warrantholder may receive in the event of an Acquisition Transaction as contemplated in Section 8

of this Warrant.

10. Governing

Law and Jurisdiction. This Warrant shall be governed by, and construed and enforced in accordance with, the laws of the State of

Delaware, without regard to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction)

that would cause the application of the laws of any jurisdiction other than the State of Delaware. In addition, each of the parties expressly

(a) submits to the personal jurisdiction and venue of the Chancery Court of Delaware, or if such court is unavailable, the United

States District Court for Delaware (the “Chosen Courts”), in the event any dispute (whether in contract, tort, or otherwise)

arises out of this Warrant or the transactions contemplated hereby, (b) agrees that it shall not attempt to deny or defeat such personal

jurisdiction by motion or other request for leave from any such court and waives any claim of lack of personal jurisdiction, improper

venue and any claims that such courts are an inconvenient forum, and (c) agrees that it shall not bring any claim, action, or proceeding

relating to this Warrant or the transactions contemplated hereby in any court other than the Chosen Courts, and in stipulated preference

ranking, of the preceding clause (a). Each party agrees that service of process upon such party in any such claim, action, or proceeding

shall be effective if notice is given in accordance with the provisions of this Warrant. EACH PARTY HEREBY WAIVES TO THE FULLEST EXTENT

PERMITTED BY APPLICABLE LAW ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY CLAIM, ACTION, OR PROCEEDING DIRECTLY OR INDIRECTLY

ARISING OUT OF, UNDER, OR IN CONNECTION WITH THIS WARRANT OR THE TRANSACTIONS CONTEMPLATED HEREBY. EACH PARTY (i) CERTIFIES THAT

NO REPRESENTATIVE, AGENT, OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN

THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (ii) ACKNOWLEDGES THAT IT HAS BEEN INDUCED TO ENTER INTO THIS WARRANT

BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 10.

11. Binding

Effect. This Warrant shall be binding upon any successors or assigns of the Company.

12. Amendments.

This Warrant may be amended and the observance of any term of this Warrant may be waived only with the written consent of the Company

and the Warrantholder.

13. Notices.

Any notice, request, instruction or other document to be given hereunder by any party to the other shall be in writing and shall be deemed

to have been duly given if (a) sent by the U.S. Postal Service (registered, return receipt service required), United Parcel Service or

FedEx, in each case

on an overnight basis, signature receipt required,

one Business Day after mailing, or (b) if otherwise personally delivered, when delivered with signature receipt required. No notice,

request, or instruction may be deemed given through e-mail, and the e-mail addresses provided in this section are simply for courtesy

purposes but in no event shall constitute notice under this Warrant. All notices hereunder shall be delivered as set forth below, or in

accordance with such other instructions as may be designated in writing by the party to receive such notice.

If to the Company, to:

| Name: |

Ranpak Holdings Corp. |

| Address: |

7990 Auburn Road |

| |

Concord Township, OH 44077 |

| Email: |

horvath.sara@ranpak.com |

| Attn: |

Sara Horvath |

with a copy to (which copy alone shall

not constitute notice):

| Name: |

Davis Polk & Wardwell LLP |

| Address: |

450 Lexington Avenue |

| |

New York, NY 10014 |

| Email: |

john.meade@davispolk.com;

lee.hochbaum@davispolk.com |

| Attn: |

John Meade, Lee Hochbaum |

If to Amazon.com NV Investment Holdings

LLC, to:

| Name: |

Amazon.com NV Investment Holdings LLC |

| |

c/o Amazon.com, Inc. |

| Address: |

410 Terry Avenue North |

| |

Seattle, Washington 98109-5210 |

| Attn: |

General Counsel |

| Email: |

AmazonWarrants@amazon.com |

with a copy to (which copy alone shall

not constitute notice):

| Name: |

Gibson, Dunn & Crutcher LLP |

| Address: |

310 University Avenue |

|

Palo Alto, California 94301 |

| Attn: |

Ed Batts, Esq. |

| |

Chris Trester, Esq. |

| Email: |

ebatts@gibsondunn.com |

| |

ctrester@gibsondunn.com |

14. Entire

Agreement. The Transaction Documents and the Confidentiality Agreement constitute the entire agreement and supersede all other prior

agreements, understandings, representations, and warranties, both written and oral, between the parties, with respect to the subject matter

hereof.

15. Specific

Performance. The parties agree that the failure of any party to perform its agreements and covenants under this Warrant, including

a party’s failure to take all actions as are

necessary on such party’s part in accordance

with the terms and conditions of this Warrant to consummate the transactions contemplated by this Warrant, will cause irreparable injury

to the other party, for which monetary damages, even if available, will not be an adequate remedy. It is agreed that the parties shall

be entitled to equitable relief, including injunctive relief and specific performance of the terms hereof, without the requirement of

posting a bond or other security, and each party hereby consents to the issuance of injunctive relief by any court of competent jurisdiction

to compel performance of a party’s obligations and to the granting by any court of the remedy of specific performance of such party’s

obligations under this Warrant, this being in addition to any other remedies to which the parties are entitled at law or equity.

16. Cumulative

Remedies. The rights and remedies provided in this Warrant are cumulative and are not exclusive of, and are in addition to, and not

in substitution for, any other rights or remedies available at law, in equity or otherwise.

17. Limitation

of Liability. No provision of this Warrant, in the absence of any affirmative action by the Warrantholder to exercise this Warrant

to purchase Warrant Shares, and no enumeration herein of the rights or privileges of Warrantholder, shall give rise to any liability of

the Warrantholder for the purchase price of any Warrant Shares or as a shareholder of the Company, whether such liability is asserted

by the Company or by creditors of the Company. The sole liability of the Warrantholder under this Warrant shall be the applicable aggregate

Exercise Price if and when this Warrant is exercised in part or in whole.

18. Interpretation.

Unless otherwise specified in this Warrant or the context otherwise requires:

(i) when

a reference is made in this Warrant to “Sections” or “Annexes” such reference shall be to a Section of, or Annex

to, this Warrant unless otherwise indicated;

(ii) references

to “parties” refer to the parties to this Warrant;

(iii) the

headings contained in this Warrant are for reference purposes only and are not part of this Warrant;

(iv) any

reference to a wholly owned subsidiary of a Person shall mean such subsidiary is directly or indirectly wholly owned by such Person;

(v) the

terms defined in the singular have a comparable meaning when used in the plural and vice versa;

(vi) if

a term is defined as one part of speech (such as a noun), it shall have a corresponding meaning when used as another part of speech (such

as a verb);

(vii) the

terms defined in the singular shall have a comparable meaning when used in the plural and vice versa;

(viii) words

importing the masculine gender shall include the feminine and neutral genders and vice versa;

(ix) references

to “hereto,” “herein,” “hereby,” “hereof,” “hereunder,” and the like refer

to this Warrant as a whole and not to any particular section or provision, unless the context requires otherwise;

(x) the

word “extent” in the phrase “to the extent” shall mean the degree to which a subject or other thing extends and

such phrase shall not mean simply “if;”

(xi) whenever

the words “include,” “includes,” or “including” are used in this Warrant, they shall be deemed followed

by the words “without limitation;”

(xii) the

rule known as the ejusdem generis rule shall not apply, and accordingly, general words introduced by the word “other”

shall not be given a restrictive meaning by reason of the fact that they are preceded by words indicating a particular class of acts,

matters or things;

(xiii) No

rule of construction against the draftsperson shall be applied in connection with the interpretation or enforcement of this Warrant. The

parties have jointly negotiated and drafted this Warrant, and if an ambiguity or a question of intent or interpretation arises, this Warrant

shall be construed as if drafted jointly by the parties, and no presumption or burden of proof shall arise favoring or disfavoring any

party by virtue of the authorship of any provision of this Warrant;

(xiv) any

forms of agreements attached to this Warrant as exhibits shall be subject only to such ministerial additions, deletions, and modifications

as necessary to complete any missing terms contemplated by the form to be completed by the parties or to correct any scrivener’s

errors in the form;

(xv) the

term “dollars” and the symbol “$” mean U.S. Dollars and all amounts in this Warrant shall be paid in U.S. Dollars,

and if any amounts, costs, fees or expenses incurred by any party in connection with this Warrant are denominated in a currency other

than U.S. Dollars, to the extent applicable, the U.S. Dollar equivalent for such costs, fees and expenses shall be determined by converting

such other currency to U.S. Dollars at the foreign exchange rates published in the Wall Street Journal or, if not reported thereby, another

authoritative source reasonably determined by Warrantholder, in effect at the time such amount, cost, fee or expense is incurred, and

if the resulting conversion yields a number that extends beyond two decimal points, rounded to the nearest penny;

(xvi) except

as expressly stated in this Warrant, all references to any statute, rule, or regulation are to the statute, rule or regulation as amended,

modified, supplemented, or replaced from time to time (and, in the case of statutes, include any rules and regulations promulgated under

the statute) and to any section of any statute, rule, or regulation include any successor to the section;

(xvii) when

calculating the period of time within which, or following which, any action is to be taken under this Warrant, the date that is the reference

day in calculating such period shall be excluded and if the last day of the period is a non-Business Day, the period in question shall

end on the next Business Day or if any action must be taken hereunder on or by a day that is not a Business Day, then such action may

be validly taken on or by the next day that is a Business Day and references to a number of days shall refer to calendar days unless Business

Days are specified.

19. Definitions.

Unless the context otherwise requires, when used herein, the following terms shall have the meanings indicated.

“30-Day VWAP” means, as of any

date, the volume-weighted average price per share of the Common Stock, or any successor security thereto (rounded to the nearest second

decimal place) on the Principal Trading Market (as reported by Bloomberg L.P. (or its successor) or if not available, by Dow Jones &

Company Inc., or if neither is available, by another authoritative source mutually agreed by the Company and the Warrantholder) from and

including the Trading Day that is 30 Trading Days preceding such date to and including the last Trading Day immediately preceding such

date.

“Acquisition Transaction” has

the meaning ascribed to it in the Transaction Agreement.

“Acquisition Transaction

Multiplier” means (1) [***], if Company and/or any of its Affiliates have, directly

or indirectly, collectively received aggregate gross payments totaling less than [***] from any Amazon Payor on or after the Issue

Date, and (2) [***] if Company and/or any of its Affiliates have, directly or indirectly,

collectively received aggregate gross payments totaling [***] or greater from any Amazon Payor on or after the Issue Date.

“Affiliate” has the meaning

ascribed to it in the Transaction Agreement.

“Aggregate Consideration” means,

in respect of an issuance of shares of Common Stock (or Convertible Securities) as set forth in Section 8(ii), an amount equal

to the sum of the gross offering price (before deduction of any related expenses payable to third parties, including discounts and commissions)

of all such shares of Common Stock and Convertible Securities, plus the aggregate amount, if any, payable upon conversion of any such

Convertible Securities (assuming conversion in accordance with their terms immediately following their issuance (and further assuming

for this purpose that such Convertible Securities are convertible at such time)).

“Amazon” means Amazon.com, Inc.,

a Delaware corporation.

“Amazon Payor” means (i) Amazon

and its Affiliates and (ii) any third party acting on behalf of Amazon or its Affiliates for which the Company or its Affiliates provides

services.

“Antitrust Laws” has the meaning

ascribed to it in the Transaction Agreement.

“Applicable Law” has the meaning

ascribed to it in the Transaction Agreement.

“Appraisal Procedure” means

a procedure in accordance with the American Institute of Certified Public Accountants, Inc. (“AICPA”) “VS Section

100 - Valuation of a Business, Business Ownership Interest, Security or Intangible Asset” and such other associated AICPA guidance

as is reasonable and applicable whereby two independent appraisers, each employed by a firm nationally recognized for its valuation expertise

and each reasonably experienced in appraising the market value of securities of size in value and characteristics of the Warrant (each

a “Qualified Appraiser”), one chosen by the Company and one chosen by the Warrantholder, shall mutually agree upon

the determinations then the subject of appraisal. Each party shall deliver a notice to the other party appointing its Qualified Appraiser

within 15 days after the date that the Appraisal Procedure is invoked. If within 30 days after receipt by each party of the other party’s

notice appointing its Qualified Appraiser, such appraisers are unable to agree upon the amount in question, a third Qualified Appraiser

shall be chosen within ten days after the end of such 30-day period: (i) by the mutual consent of such first two Qualified

Appraisers; or (ii) if such two first Qualified Appraisers fail to agree upon the appointment of a third appraiser, such appointment shall

be made by the American Arbitration Association, or any organization successor thereto, from a panel of Qualified Appraisers on the application

of either of the first two Qualified Appraisers. If any Qualified Appraiser initially appointed shall, for any reason, be unable to serve,

a successor Qualified Appraiser shall be appointed in accordance with the procedures under which the predecessor Qualified Appraiser was

appointed. In the event a third Qualified Appraiser is appointed, the decision of such third Qualified Appraiser shall be given within

30 days after such Qualified Appraiser’s appointment. If three Qualified Appraisers are appointed and the determination of one appraiser

is disparate from the middle determination by more than twice the amount by which the other determination is disparate from the middle

determination, then (a) the determination of such appraiser shall be excluded, (b) the remaining two determinations shall be averaged,

and (c) such average shall be binding and conclusive upon the Company and the Warrantholder; otherwise, the average of all three determinations

shall be binding and

conclusive upon the Company and the Warrantholder.

The costs of conducting any Appraisal Procedure shall be borne 50% by the Company and 50% by the Warrantholder. The Qualified Appraisers

shall act as experts and not arbitrators.

“Attribution Parties” has the

meaning set forth in Section 9(i).

“Beneficial Ownership Limitation”

has the meaning set forth in Section 9(ii).

“Board” has the meaning ascribed

to it in the Transaction Agreement.

“Business Day” has the meaning

ascribed to it in the Transaction Agreement.

“Cash Exercise” has the meaning

set forth in Section 2(ii).

“Cashless Exercise” has the

meaning set forth in Section 2(ii).

“Cashless Exercise Ratio” with

respect to any exercise of this Warrant means a fraction (i) the numerator of which is the excess of (x) the 30-Day VWAP as of the exercise

date over (y) the Exercise Price, and (ii) the denominator of which is the 30-Day VWAP as of the exercise date.

“Chosen Courts” has the meaning

set forth in Section 10.

“Class C Common Stock” means

the Convertible Class C Common Stock, par value $0.0001 per share, of the Company.

“Commission” has the meaning

ascribed to it in the Transaction Agreement.

“Common Stock” means the Class

A Common Stock, $0.0001 par value per share, of the Company.

“Company” means Ranpak Holdings

Corp., a Delaware corporation.

“Confidentiality Agreement”

has the meaning ascribed to it in the Transaction Agreement.

“conversion” has the meaning

ascribed to it in the Transaction Agreement.

“Convertible Securities” has

the meaning set forth in Section 8(ii).

“Designated Company Office”

has the meaning set forth in Section 2(ii).

“Distribution” has the meaning

set forth in Section 8(iii).

“DTC” has the meaning ascribed

to it in the Transaction Agreement.

“DWAC” has the meaning ascribed

to it in the Transaction Agreement.

“Equity Securities” has the

meaning ascribed to it in the Transaction Agreement.

“Exchange Act” means the Securities

Exchange Act of 1934, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

“Exercise Conditions” has the

meaning set forth in Section 2(iii).

“Exercise Period” has the meaning

set forth in Section 2(ii).

“Exercise Price” has the meaning

set forth in Section 1.

“Expiration Time” has the meaning

set forth in Section 2(ii).

“Fair Market Value” means, with

respect to any security or other property, the fair market value of such security or other property as determined by the Board, acting

reasonably, in good faith and evidenced by a written notice delivered promptly to the Warrantholder (which written notice shall include

certified resolutions of the Board in respect thereof). If the Warrantholder objects in writing to the Board’s calculation of fair

market value within ten Business Days after receipt of written notice thereof, and the Warrantholder and the Company are unable to

agree on the fair market value during the ten-day period following the delivery of the Warrantholder’s objection, the Appraisal

Procedure may be invoked by either the Company or the Warrantholder to determine the fair market value of such security or other property

by delivering written notification thereof not later than the 30th day after delivery of the Warrantholder objection. For the avoidance

of doubt, the Fair Market Value of cash shall be the amount of such cash.

“Governmental Entity” has the

meaning ascribed to it in the Transaction Agreement.

“Group” has the meaning ascribed

to it in the Transaction Agreement.

“Initial Antitrust Clearance”

has the meaning ascribed to it in the Transaction Agreement.

“Initial Number” has the meaning

set forth in Section 8(ii).

“Market Price” means, with respect

to the Common Stock or any other security, on any given day, the last sale price, regular way, or, in case no such sale takes place on

such day, the average of the closing bid and asked prices, regular way, of the Common Stock or of such other security, as applicable,

on the Principal Trading Market on such day (as reported by Bloomberg L.P. (or its successor) or if not available, by Dow Jones &

Company Inc., or if neither is available, by another authoritative source mutually agreed by the Company and the Warrantholder). If the

Common Stock or such other security, as applicable, is not listed on the Principal Trading Market as of any date of determination, the

Market Price of the Common Stock or such other security, as applicable, on such date of determination means the closing sale price on

such date as reported in the composite transactions for the principal U.S. national or regional securities exchange on which the Common

Stock or such other security, as applicable, is so listed or quoted or, if no closing sale price is reported, the last reported sale price

on such date on the principal U.S. national or regional securities exchange on which the Common Stock or such other security, as applicable,

is so listed or quoted, or if the Common Stock or such other security, as applicable, is not so listed or quoted on a U.S. national or

regional securities exchange, the last quoted bid price on such date for the Common Stock or such other security, as applicable, in the

over-the-counter market as reported by OTC Markets Group Inc. or a similar organization, or if that bid price is not available, the Market

Price of the Common Stock or such other security, as applicable, on that date shall mean the Fair Market Value per share as of such date

of the Common Stock or such other security (as reported by Bloomberg L.P. (or its successor) or if not available, by Dow Jones & Company

Inc., or if neither is available, by another authoritative source mutually agreed by the Company and the Warrantholder). To determine

the Market Price of the Common Stock or any such other security, as applicable, on the Trading Day preceding, on, or following the occurrence

of an event, (a) that Trading Day shall be deemed to commence immediately after the regularly scheduled closing time of trading on

the applicable exchange, market or organization, or if trading is closed at an earlier time, such earlier time and (b) that Trading

Day shall end at the next regularly scheduled closing time, or if trading is closed at an earlier time, such earlier time (for the

avoidance of doubt, and as an example, if the Market

Price is to be determined as of the last Trading Day preceding a specified event and the closing time of trading on a particular day is

4:00 p.m. (New York City time), and the specified event occurs at 5:00 p.m. (New York City time) on that day, the Market Price

would be determined by reference to such 4:00 p.m. (New York City time) closing price).

“Notice of Exercise” means a

duly completed notice of exercise in substantially the form attached as Annex B hereto and executed by Warrantholder.

“Notice of Vesting Event” means

a duly completed notice of Vesting Event in substantially the form attached as Annex A hereto and executed by the Company.

“Permitted Transactions” means

(a) issuances of shares of Common Stock (including upon exercise of options, granting of restricted stock awards, or settlement of restricted

stock units or as matching contributions under a 401(k) plan) to directors, advisors, employees, or consultants of the Company in accordance

with a stock option plan, employee stock purchase plan, restricted stock plan, other employee benefit plan, or other similar compensatory

agreement or arrangement approved by the Board, (b) issuances of shares of Common Stock upon conversion of shares of Class C Common Stock,

(c) issuances of shares of Common Stock issuable upon exercise of this Warrant, and (d) any sale of shares of Common Stock or Convertible

Securities in a financing for capital raising purposes at a consideration per share (or having a conversion price per share) at or above

the Market Price of the Common Stock as of the last Business Day prior to the earliest of (i) the pricing of the transaction, or (ii)

the public announcement of a proposed sale (or in the case of an underwritten public (including sales of Convertible Securities pursuant

to Rule 144A) offering, at or above 95% of the Market Price of the Common Stock as of the Business Day prior to the public announcement

of the launch of such offering).

“Person” has the meaning given

to it in Section 3(a)(9) of the Exchange Act and as used in Sections 13(d)(3) and 14(d)(2) of the Exchange

Act.

“Pricing Date” has the meaning

set forth in Section 8(ii).

“Principal Trading Market” means

the trading market on which the Common Stock, or any successor security thereto, is primarily listed and quoted for trading, and which,

as of the Issue Date is the New York Stock Exchange.

“Qualified Appraiser” has the

meaning set forth in the definition of “Appraisal Procedure.”

“Requisite Stockholder Approval”

has the meaning ascribed to it in the Transaction Agreement.

“Securities Act” means the Securities

Act of 1933, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

“Subject Adjustment” has the

meaning set forth in Section 8(vi).

“Subject Record Date” has the

meaning set forth in Section 8(vi).

“subsidiary” has the meaning

ascribed to it in the Transaction Agreement.

“Third Party Approval” has the

meaning set forth in Section 8(iv).

“Trading Day” means a day on

which the Principal Trading Market is open for trading.

“Transaction Agreement” means

the Transaction Agreement, dated as of the date hereof, as it may be amended from time to time, by and between the Company and Amazon,

including all annexes, schedules, and exhibits thereto.

“Transaction Documents” has

the meaning ascribed to it in the Transaction Agreement.

“Vesting Event” means (a)

with respect to 1,871,646 Warrant Shares, the execution of the Transaction Agreement, and (b) with respect to increments of [***]

Warrant Shares, each time at which the Company and/or any of its Affiliates have collectively received aggregate gross payments

totaling [***] from any Amazon Payor until such time as the Company and/or any of its Affiliates have collectively received

$400,000,000 from any Amazon Payor. Aggregate gross payments from Amazon Payors shall be measured as and from the date of the

Transaction Agreement. Aggregate gross payments made on or after [***] related to [***] shall not include any amounts attributable

to the cost of paper [***]. Aggregate gross payments

made on or after [***] related to [***] shall not include any amounts attributable to the cost of

paper [***]. For the avoidance of doubt, (i) Vesting Events

shall stop occurring once the maximum aggregate number of Warrant Shares specified under Section 1 have vested in accordance

with such Vesting Events, (ii) if a given Vesting Event would cause the number of shares vested to exceed the number of Warrant

Shares specified under Section 1 then only the number of shares up to and including the maximum aggregate number of Warrant

Shares specified under Section 1 (subject to applicable adjustment or supplementation under this Warrant) shall vest during the

final such Vesting Event, and (iii) the number of Warrant Shares that will vest in connection with a Vesting Event is subject to

adjustments as provided herein, (iv) the Warrant Shares that will vest first shall consist of such shares that are not subject to

the approvals required under the applicable NYSE Rules, and (v) upon receipt of any approval required under the applicable NYSE

Listing Rules, the amount of Warrant Shares vested hereunder shall be adjusted, if applicable, to reflect the same amount of Warrant

Shares that would have been vested had such approval not been required. For purposes of interpretation only, a vested Warrant Share

(or words of like import) means a Warrant Share that may be purchased upon exercise, in whole or in part, of the Warrant and an

unvested Warrant Share (or word of like import) means a Warrant Share that may not yet be purchased because a Vesting Event in

respect of such Warrant Share has not yet occurred.

“Warrant” means this Warrant,

issued in connection with the Transaction Agreement.

“Warrant Shares” has the meaning

set forth in Section 1.

“Warrant Shares Cap” has the

meaning set forth in Section 8(xiii).

“Warrantholder” means, in relation

to this Warrant, the Person who is the holder of this Warrant. The Warrantholder shall initially be Amazon.com NV Investment Holdings

LLC, a Nevada limited liability company.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the Company has caused this

Warrant to be duly executed by a duly authorized officer.

Dated: January 28, 2025

| |

RANPAK HOLDINGS

CORP. |

| |

|

| |

By: |

/s/ William Drew |

| |

|

Name: William Drew |

| |

|

Title: Executive Vice President and Chief Financial Officer |

| |

Acknowledged and Agreed |

| |

|

| |

AMAZON.COM NV INVESTMENT HOLDINGS LLC |

| |

|

| |

By: |

/s/ Torben Severson |

| |

|

Name: Torben Severson |

| |

|

Title: Authorized Signatory |

[Signature

Page to Warrant]

Annex A