PennyMac Financial Services, Inc. Announces Upsizing and Pricing of Private Offering of $850 Million of Senior Notes

February 04 2025 - 5:05PM

Business Wire

PennyMac Financial Services, Inc. (NYSE: PFSI) and its

subsidiaries (the “Company”) today announced the pricing of its

previously announced offering of $850 million aggregate principal

amount of 6.875% Senior Notes due 2033 (the “Notes”). The offering

size was increased from the previously announced offering size of

$650 million aggregate principal amount of Notes. The Notes will

bear interest at 6.875% per annum and will mature on February 15,

2033. Interest on the Notes will be payable semi-annually on

February 15 and August 15 of each year, beginning on August 15,

2025. The Notes will be fully and unconditionally guaranteed on an

unsecured senior basis by the Company’s existing and future wholly

owned domestic subsidiaries, other than certain excluded

subsidiaries. Proceeds from the offering will be used for the

repayment of certain of our indebtedness, which may include the

repayment of borrowings under our secured MSR facilities and other

secured indebtedness, for the repurchase or repayment of a portion

of our 5.375% senior notes due October 2025, and for other general

corporate purposes. The offering is expected to close on February

6, 2025, subject to customary closing conditions.

The offering was made solely by means of a private placement to

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended (the “Securities Act”), and to

certain non-U.S. persons pursuant to Regulation S under the

Securities Act. The Notes have not been and are not expected to be

registered under the Securities Act or under any state securities

laws and, unless so registered, may not be offered or sold in the

United States or to U.S. persons absent an applicable exemption

from the registration requirements of the Securities Act and

applicable state securities laws.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any security and shall not

constitute an offer, solicitation or sale of any security in any

jurisdiction in which such offering, solicitation or sale would be

unlawful.

About PennyMac Financial Services, Inc.

PennyMac Financial Services, Inc. is a specialty financial

services firm focused on the production and servicing of U.S.

mortgage loans and the management of investments related to the

U.S. mortgage market. Founded in 2008, the company is recognized as

a leader in the U.S. residential mortgage industry and employs

approximately 4,100 people across the country. In 2024, PennyMac

Financial’s production of newly originated loans totaled $116

billion in unpaid principal balance, making it a top lender in the

nation. As of December 31, 2024, PennyMac Financial serviced loans

totaling $666 billion in unpaid principal balance, making it a top

mortgage servicer in the nation.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, regarding management’s beliefs, estimates, projections

and assumptions with respect to, among other things, the expected

timing for the closing of the offering of Notes and the use of

proceeds therefrom. Words like “believe,” “expect,” “anticipate,”

“promise,” “project,” “plan,” and other expressions or words of

similar meanings, as well as future or conditional verbs such as

“will,” “would,” “should,” “could,” or “may” are generally intended

to identify forward-looking statements. Actual results and

operations for any future period may vary materially from those

projected herein and from past results discussed herein. Factors

which could cause actual results to differ materially from

historical results or those anticipated include, but are not

limited to: interest rate changes; changes in real estate values,

housing prices and housing sales; changes in macroeconomic,

consumer and real estate market conditions; the continually

changing federal, state and local laws and regulations applicable

to the highly regulated industry in which we operate; lawsuits or

governmental actions that may result from any noncompliance with

the laws and regulations applicable to our business; the mortgage

lending and servicing-related regulations promulgated by the

Consumer Financial Protection Bureau and its enforcement of these

regulations; the licensing and operational requirements of states

and other jurisdictions applicable to our business, to which our

bank competitors are not subject; foreclosure delays and changes in

foreclosure practices; difficulties inherent in adjusting the size

of our operations to reflect changes in business levels; purchase

opportunities for mortgage servicing rights; our substantial amount

of indebtedness; increases in loan delinquencies, defaults and

forbearances; our dependence on U.S. government-sponsored entities

and changes in their current roles or their guarantees or

guidelines; our reliance on PennyMac Mortgage Investment Trust

(NYSE: PMT) as a significant contributor to our mortgage banking

business; maintaining sufficient capital and liquidity and

compliance with financial covenants; our obligation to indemnify

third-party purchasers or repurchase loans if loans that we

originate, acquire, service or assist in the fulfillment of fail to

meet certain criteria; our obligation to indemnify PMT if our

services fail to meet certain criteria or characteristics or under

other circumstances; investment management and incentive fees;

conflicts of interest in allocating our services and investment

opportunities among us and our advised entity; our ability to

mitigate cybersecurity risks, cyber incidents and technology

disruptions; the development of artificial intelligence; the effect

of public opinion on our reputation; our exposure to risks of loss

and disruptions in operations resulting from severe weather events,

man-made or other natural conditions, including climate change and

pandemics; our ability to effectively identify, manage and hedge

our credit, interest rate, prepayment, liquidity and climate risks;

our initiation or expansion of new business activities or

strategies; our ability to detect misconduct and fraud; our ability

to pay dividends to our stockholders; our use of the proceeds from

the offering of the Notes; and our organizational structure and

certain requirements in our charter documents. You should not place

undue reliance on any forward- looking statement and should

consider all of the uncertainties and risks described above, as

well as those more fully discussed in reports and other documents

filed by the Company with the Securities and Exchange Commission

from time to time. The Company undertakes no obligation to publicly

update or revise any forward-looking statements or any other

information contained herein, and the statements made in this press

release are current as of the date of this release only.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204893807/en/

Media Kristyn Clark mediarelations@pennymac.com

805.395.9943

Investors Kevin Chamberlain Isaac Garden

PFSI_IR@pennymac.com 818.224.7028

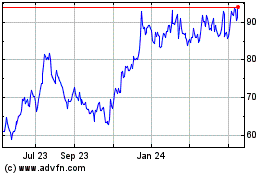

PennyMac Financial Servi... (NYSE:PFSI)

Historical Stock Chart

From Jan 2025 to Feb 2025

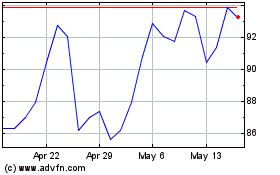

PennyMac Financial Servi... (NYSE:PFSI)

Historical Stock Chart

From Feb 2024 to Feb 2025