P10, Inc. Announces HPS Investment Partners and Enhanced Capital Launch Innovative Partnership to Invest in Energy Transition Projects

November 25 2024 - 5:10PM

P10, Inc. (NYSE: PX), a leading private markets solutions provider,

announced the launch of a new partnership between funds managed by

HPS Investment Partners and Enhanced Capital, a P10 affiliated

manager, that will provide structured capital solutions for

renewable energy and battery energy storage projects throughout the

United States. The investments made by the partnership will be

designed to provide capital to energy transition projects while

simplifying the monetization of renewable energy tax credits

without the need for complex tax equity structures.

The Inflation Reduction Act (IRA) passed in 2022 contained

several provisions aimed at improving access to capital and

reducing barriers to the deployment of renewable energy and energy

storage assets to support economy-wide decarbonization goals. As

part of the legislation, Investment Tax Credits and Production Tax

Credits became eligible for a one-time transfer to third parties,

creating a new avenue to monetize tax credits outside of tax equity

financings. The new platform combines HPS Investment Partners’

track record of investing in renewable energy and infrastructure

businesses and assets with Enhanced Capital’s expertise in tax

credit structuring and monetization.

“We are pleased to partner with Enhanced Capital to offer

comprehensive capital solutions for developers who are actively

enabling the energy transition across the country,” said Michael

Dorenfeld, Managing Director at HPS Investment Partners. “With this

commitment, we are bringing together HPS credit investment

expertise with Enhanced Capital’s capabilities accessing and

funding tax credits across industries.”

“Enhanced Capital has been financing projects with immediate and

lasting impacts on communities and the environment for over two

decades,” said Luke Sarsfield, Chairman and Chief Executive Officer

at P10. “At P10, we are thrilled to see this collaboration with HPS

Investment Partners expand renewable energy and battery storage

financing for developers across the country.”

About HPS Partners

HPS Investment Partners, LLC is a leading global, credit-focused

alternative investment firm that seeks to provide creative capital

solutions in order to generate attractive risk-adjusted returns for

its clients. HPS manages various strategies across the capital

structure, including privately negotiated senior debt; privately

negotiated junior capital solutions in debt, preferred equity and

equity formats; liquid credit including syndicated leveraged loans,

collateralized loan obligations and high yield bonds; asset-based

finance and real estate. The scale and breadth of HPS’s platform

offers the flexibility to invest in companies large and small,

through standard or customized solutions. HPS has approximately

$117 billion of assets under management as of June 2024. For more

information, please visit www.hpspartners.com.

About Enhanced Capital

Enhanced Capital Group, LLC is a leading impact investment firm

with over 24 years of experience investing in Climate Finance,

Impact Real Estate, and Small Business Lending.

From inception in 1999 through June 30th, 2024, inclusive of

proprietary assets and assets managed by affiliates, Enhanced

Capital has raised a total of $6.0 billion. Of the total assets

under management, impact assets represent $3.8 billion invested in

over 950 projects and businesses throughout 40 states, Washington

DC, and Puerto Rico and does not include investments made by

non-impact affiliates.

Enhanced Capital is committed to investing in four main impact

themes: Underserved Communities; Underrepresented Populations;

Environmental Sustainability; and Community Development Programs.

Enhanced Capital is a subsidiary of P10, Inc. (NYSE: PX), a

diversified, multi-asset investment platform. For more information,

please visit www.enhancedcapital.com.

Enhanced Capital Disclaimer

Enhanced Capital Group, LLC, and its affiliates, is an Equal

Opportunity Provider. The information presented is for discussion

purposes only and is neither an offer to sell nor a solicitation of

any offer to buy any securities, investment product, or investment

advisory services. This is not an offering or the solicitation of

an offer to purchase an interest in a fund.

About P10P10 is a leading multi-asset class

private markets solutions provider in the alternative asset

management industry. P10’s mission is to provide its investors

differentiated access to a broad set of investment solutions that

address their diverse investment needs within private markets. As

of September 30, 2024, P10’s products have a global investor base

of more than 3,800 investors across 50 states, 60 countries, and

six continents, which includes some of the world’s largest pension

funds, endowments, foundations, corporate pensions, and financial

institutions. Visit www.p10alts.com.

P10 Investor Contact:info@p10alts.com

P10 Media Contact:Taylor

Donahuepro-p10@prosek.com

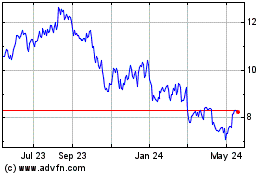

P10 (NYSE:PX)

Historical Stock Chart

From Dec 2024 to Jan 2025

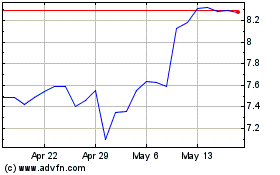

P10 (NYSE:PX)

Historical Stock Chart

From Jan 2024 to Jan 2025