SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

November, 2024

Commission

File Number 1-15182

DR.

REDDY’S LABORATORIES LIMITED

(Translation of registrant’s name into English)

8-2-337, Road No. 3, Banjara Hills

Hyderabad, Telangana 500 034, India

+91-40-49002900

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ______

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ______

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

Indicate by check mark whether by furnishing the

information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

¨ No x

If “Yes” is marked, indicate below the file number assigned

to registrant in connection with Rule 12g3-2(b): 82-________.

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

DR. REDDY’S LABORATORIES LIMITED

(Registrant) |

| |

|

|

Date:

November 19, 2024 |

By: |

/s/ K Randhir Singh |

| |

|

Name: |

K Randhir Singh |

| |

|

Title: |

Company Secretary |

Exhibit 99.1

|

Dr. Reddy’s Laboratories Ltd.

8-2-337, Road No. 3, Banjara Hills,

Hyderabad - 500 034, Telangana,

India.

CIN : L85195TG1984PLC004507

Tel : +91 40 4900 2900

Fax : +91 40 4900 2999

Email : mail@drreddys.com

www.drreddys.com |

November 19, 2024

National Stock Exchange of India Ltd. (Stock Code: DRREDDY-EQ)

BSE Limited (Stock Code: 500124)

New York Stock Exchange Inc. (Stock Code: RDY)

NSE IFSC Ltd. (Stock Code: DRREDDY)

Dear Sir/Madam,

Sub: Disclosure under Regulation 30 of the SEBI (Listing Obligations

and Disclosure Requirements) Regulations, 2015

This is to inform that India Ratings & Research

(Ind-Ra) has taken the following rating actions on Company’s bank facilities. The Outlook on the long-term rating is Stable.

Details of Bank

Limits Rated by

Ind-Ra |

Rated

Amount

(INR million) |

Rating |

Rating Action |

Rating Affirmed /

Assigned on |

| Fund Based Working Capital Limit |

| State Bank of India |

4800 |

IND AA+/Stable/INDA1+ |

Affirmed |

19 Nov 2024 |

| State Bank of India |

12000 |

IND AA+/Stable/INDA1+ |

Assigned |

19 Nov 2024 |

| IndusInd Bank Limited |

5000 |

IND AA+/Stable/INDA1+ |

Assigned |

19 Nov 2024 |

| Bank of America |

5000 |

IND AA+/Stable/INDA1+ |

Assigned |

19 Nov 2024 |

| Non-Fund Based Working Capital Limit |

| State Bank of India |

1200 |

IND AA+/Stable/INDA1+ |

Affirmed |

19 Nov 2024 |

A copy of the rating rationale issued by Ind-Ra

is enclosed.

This is for your information and record.

Thanking you.

Yours faithfully,

For Dr. Reddy’s Laboratories Limited

K Randhir Singh

Company Secretary, Compliance Officer &

Head-CSR

Encl: As above

India Ratings Rates Dr. Reddy’s Laboratories’ Additional

Limits and Affirms Existing Ratings at ‘IND AA+’/Stable

Nov 19, 2024 | Pharmaceuticals

India Ratings and Research (Ind-Ra) has taken

the following rating actions on Dr. Reddy’s Laboratories Limited’s (DRL) bank facilities:

Details of Instruments

| Instrument Type |

Date of

Issuance |

Coupon

Rate |

Maturity

Date |

Size of Issue

(million) |

Rating assigned

along with

Outlook/Watch |

Rating Action |

| Fund-based working capital limits |

- |

- |

- |

INR4,800 |

IND AA+/Stable/IND

A1+ |

Affirmed |

| Fund-based working capital limits |

- |

- |

- |

INR22,000 |

IND AA+/Stable/IND

A1+ |

Assigned |

| Non-fund-based working capital limits |

- |

- |

- |

INR1,200 |

IND AA+/Stable/IND

A1+ |

Affirmed |

Analytical Approach

Analytical Approach: Ind-Ra continues

to take a consolidated view of DRL and its subsidiaries to arrive at the ratings owing to the operational and financial linkages

among them. The company has 52 subsidiaries and step-down subsidiaries in India and overseas, which are engaged in the manufacturing

and selling of pharmaceutical formulations.

Detailed Rationale of the Rating Action

The affirmation reflects DRL’s continued

strong position in the US generic market, its sustained healthy credit metrics and adequate liquidity. Additionally, the ratings reflect

DRL’s healthy revenue growth in FY24, with the strong improvement in EBITDA margin led by improved product mix, launch of the generic

Revlimid in the US market and moderation in price erosion.

List of Key Rating Drivers

Strengths

| ● | US continue to deliver robust growth |

| ● | Improved operating performance |

| ● | Sustained strong credit metrics |

Weaknesses

| ● | Divestment of non-core brands impacted India sales growth in FY24 |

Detailed Description of Key Rating Drivers

Strong Business Profile: DRL’s business

profile continues to benefit from its presence across multiple geographies, the diversification efforts underway to lower its dependence

on the US business, regulatory track record, moderate levels of backward integration, healthy share of complex, limited competition drugs

in the portfolio, healthy revenue diversification by therapeutic area and continued product launches. The company’s business is

geographically well-diversified, and it has presence in the US (46% of its consolidated FY24 revenue of INR280 billion), India (17%),

Europe (7%), Russia (8%), rest of the world (9%), active pharmaceutical ingredients (APIs; 11%), and others (2%). The formulation segment

contributes 89% to its sales and the API segment contributes 11%. The management is focusing on cost leadership in key molecules and strict

adherence to quality standards to increase the resilience of the overall business profile to any regulatory action or pricing pressure.

DRL has a large number of manufacturing facilities of API and formulations; it has a total of 31 plants including R&D sites, 24 in

India and seven international. All the sites are approved by regulatory authorities across the world. For the US market, DRL has filed

251 active drug master files (for API business) and 325 abbreviated new drug applications (ANDAs) for the formulations business.

US Continue to Deliver Robust Growth: DRL’s

US business revenue grew 27.7% yoy in FY24 (FY23: up 35.8% yoy), led by new launches, increased volumes in the base business, favourable

currency movements and a higher revenue contribution from limited competition product such as the generic Revlimid. R&D spend increased

to 8.2% in FY24 (FY23: 7.9%), on account of spending on the biosimilar pipeline and development programs across generics and oncology

assets. Management indicated that the R&D spend to be at 8.5%-9.0% for FY25. Ind-Ra highlights that 20% of the R&D goes towards

the development of biosimilars as the company taps a new wave of biosimilar opportunities. At FYE24, cumulative ANDA filings were 325

while 86 ANDAs were pending for approvals (including 50 Para IV applications, of which around 24 have first-to-file status) from the United

States Food and Drug Administration (USFDA). The company has maintained the guidance of around 20 launches in the US in FY25. DRL continues

to focus on the development and launch of complex product portfolio, including biosimilars and increasing the market share of existing

products. Since the US is a major contributor to DRL’s overall revenue, Ind-Ra believes the company’s performance in this

market will remain critical for the ratings as the business remains exposed to a high regulatory risk.

Strong ROCE Profile: On a consolidated

basis, the company reported ROCE of around 21.4% in FY24 (FY23: 21.1%), supported by the strong EBITDA margin improvement led by the US

generic market (launch of niche products including the generic Revlimid), healthy growth in India and RoW market and recovery in sales

growth in the API business. DRL had reported a strong ROCE of around 20% till FY16, post which it declined, given the pricing challenges

in the key US market, slow ramp-up of the Teva portfolio acquired in FY17 (USD350 million), impairments on key products launches during

FY20-FY21, inventory write-offs and warning letters received for some of the facilities limiting new product launches. Ind-Ra highlights

DRL had impairments of INR16.7 billion and INR6.8 billion in FY20 and FY21, respectively. While on positive side, DRL reported impairments

of just INR3 million in FY24 (FY23: INR699 million). The company had intangible assets including assets under development of INR37.0 billion

at FY24 (FY23: INR30.7 billion; FY22: INR27.0 billion; FY21: INR35.2 billion; FY20: INR26.8 billion). Additionally, a continued higher

proportion of revenue from the high RoCE segments of API and the India business, a stable pricing regime in the US and first-to-file launches

in the US are likely to provide the required boost to the RoCE. The company continues to aspire RoCE at 25% over the next few years.

Improved Operating Performance: DRL’s

consolidated gross margin (considering only raw material) improved to 70.7% in FY24 (FY23: 69.0%) due to a softening of raw material costs

and better product mix. Ind-Ra expects the gross margin to remain at 68%-69% in FY25-FY26 (FY20-FY24: average 67%), driven by the better

product mix and overall cost optimisation efforts undertaken by the company. DRL delivered a strong improvement in EBITDA margin to 28.3%

in FY24 (FY23: 26.0%), on account of the launch of generic Revlimid in the US market and moderation in price erosion. Ind-Ra expects R&D

expense to continue to be 8.5%-9.0% of the revenue over FY25-FY28, as against the past 10-year average spend of 10% of sales. The company

aims to have a sustainable base business EBITDA margin of over 25% in the next few years on account of the ongoing cost-saving measures,

improved product/geography mix, and higher field force productivity in India.

Sustained Strong Credit Metrics: On a

consolidated basis, the credit metrics continue to be strong, given the strong positive free cash flow generation, which has led to

a net cash position (FY24: INR41.3 billion; FY23: INR48.3 billion). DRL has maintained stable credit metrics over the past 12 years.

Its net debt/EBITDA stayed at average of 0.1x over FY12- FY24. Consequently, the net adjusted leverage (net debt/EBITDA) remained

negative 0.52x in FY24 (FY23: negative 0.75x) and the interest coverage (EBITDA/interest expense) remained strong at 46.37x

(44.95x). Ind-Ra expects the net adjusted leverage to remain below 1.0x in FY25-FY28, in the absence of any major debt-funded capex

and improving profitability. The agency expects DRL’s credit metrics to remain stable between FY25 to FY28, despite assuming

the high capex of around INR27.4 billion per year, stabilising operating profitability driven by a recovery in domestic markets,

strong traction in the US market and niche product launches.

Divestment of Non-core Brands Impacted India

Sales Growth in FY24: Ind-Ra expects DRL’s India business to deliver higher growth than the Indian pharmaceutical market in

the near-to-medium term. Overall, India business fell 5% yoy to INR46.4 billion in FY24 (FY23: up 16.6% yoy) due to the divestment of

a few non-core brands in FY23 and FY24, offset by revenues from new product launches and higher sales prices. Excluding the divestment

income, the India formulation business grew in mid-single digit in FY24. Ind-Ra highlights DRL divested non-core brands with 1) Torrent

Pharmaceuticals Limited (‘IND AA+’/Stable) in May 2022 for a sales consideration of INR1.4 billion, 2) J.B.Chemicals &

Pharmaceuticals Ltd in June 2022 for a sales consideration of INR0.98 billion, and 3) Eris Lifesciences Limited (debt rated at ‘IND

AA-’/Positive) in March 2023 for a sales consideration of INR2.7 billion. In FY24, DRL had a total of 391 branded products in India

and a field force of over 8,600 sales representatives. According to IQVIA MAT March 2024, the secondary sales grew 7.3% while the market

rank was 10th as per moving quarterly total (MQT). There are 14 brands are among the top 300 brands of the Indian pharmaceuticals market

while 22 brands had revenues in excess of INR1 billion in FY24.

Regulatory Concerns: Ind-Ra believes USFDA’s

scrutiny of Indian pharma companies’ manufacturing facilities (API or formulations) is part and parcel of the industry, considering

Indian companies strong positioning in the US generic market. Given DRL’s high exposure to regulated markets (US: 46% of sales;

Europe: 7%; API: 11%), Ind-Ra believes the company remains exposed to any adverse regulatory action. Overall USFDA inspections to Indian

facilities are still below the pre- COVID-19 levels, while Ind-Ra highlights USFDA inspections have been rising gradually. The resolution

of any pending issues on key facilities will remain a key monitorable.

Moreover, 13%-14% of DRL’s products

were under price control in India as per All Indian Origin Chemists & Distributors- Advanced Working, Action & Correction

System. However, the company’s ability to increase its chronic focus through in house launches and ramping-up of its

in-licensed products, and an improvement in field force productivity will be critical in improving its domestic competitive

position.

Liquidity

Adequate: DRL’s liquidity remains

supported by a healthy cash balance of INR61.3 billion in FY24 (FY23: INR61.8 billion; FY22: INR44.01 billion). Also, the company generated

positive free cash flow of INR10.9 billion in FY24 (FY23: INR33.9 billion; FY22: INR4.4 billion), driven by its healthy operating performance

and well-managed working capital cycle of 153 days (146 days). However, it incurred a higher capex of INR27.4 billion during FY24 (FY23:

INR18.9 billion) using internal accruals. Ind-Ra expects the company to keep funding its capex using internal accruals. Given the strong

operating performance, Ind-Ra expects DRL to remain free cash flow positive. The company had a total debt of INR20.0 billion at FYE24

(FYE23: INR13.5 billion), largely comprising short-term borrowings and packing credit facilities availed to fund working capital requirements.

Rating Sensitivities

Positive: Improved revenue diversification

across geographies, the company’s ability to timely launch meaningful products in the US, ROCE of 18%-20% along with maintaining

the credit metrics, all on a sustained basis, will be positive for the ratings.

Negative: Future developments that may,

individually or collectively, lead to negative rating action include:

- deterioration in the business profile due to the company’s

inability to launch meaningful products and/or greater-than- expected price pressure in its relevant markets, and

- an increase in the net debt levels due to large, debt-funded acquisitions

and/or capex, leading to the net adjusted leverage exceeding 1.5x on a sustained basis.

Any Other Information

Standalone Performance: DRL’s standalone revenue was INR125.4

billion in 1HFY25 (FY24: INR194.8 billion), EBITDA was INR47.1 billion (INR59.5 billion), EBITDA margin was 37.5% (30.6%), interest coverage

was 132.6x (273.0x) and net leverage was 0.13x (net cash).

About the Company

DRL was established in 1984 by Dr. K. Anji Reddy and his associates.

The company is a vertically-integrated pharmaceutical formulation manufacturer based out of Hyderabad. It has a diversified manufacturing

footprint spread across India, the US, the UK, China and Mexico. The facilities have regulatory approvals from major international drug

regulators. The company is listed on BSE Ltd, National Stock Exchange of India Limited and New York Stock Exchange.

Key Financial Indicators

| Particulars |

FY24 |

FY23 |

| Revenue (INR billion) |

280.1 |

246.7 |

| EBITDA (INR billion) |

79.3 |

64.2 |

| EBITDA margin (%) |

28.3 |

26.0 |

| Gross interest coverage (x) |

46.4 |

45.0 |

| Net financial leverage (x) |

n.m |

n.m |

| Total adjusted debt (INR billion) |

20.0 |

13.5 |

| Free cash and liquid Investments (INR billion) |

61.3 |

61.8 |

Source: DRL, Ind-Ra

Note: Financial measures such as EBITDA, ROCE and cash flow have been

computed in line with the agency’s rating criteria

n.m: not meaningful

Status of Non-Cooperation with previous rating agency

Not applicabe

Rating History

| Instrument Type |

Current Rating/Outlook |

Historical Rating/Outlook |

Rating

Type |

Rated

Limits

(million) |

Rating |

23

September

2024 |

20

October

2023 |

27

June 2023 |

4 April 2022 |

29 April

2021 |

| Issuer rating |

Long-term |

- |

- |

- |

WD |

IND AA+/Stable |

IND AA+/Stable |

IND AA+/Stable |

| Fund-based working capital limits |

Long-term/ short-term |

INR26,800 |

IND

AA+/Stable/IND

A1+ |

IND AA+/Stable /IND A1+ |

- |

IND AA+/Stable /IND A1+ |

IND AA+/Stable /IND A1+ |

IND AA+/Stable /IND A1+ |

| Non-fund-based working capital limits |

Long- term/Short- term |

INR1,200 |

IND AA+/Stable/IND

A1+ |

IND AA+/Stable /IND A1+ |

- |

IND AA+/Stable /IND A1+ |

IND AA+/Stable /IND A1+ |

IND AA+/Stable /IND A1+ |

Bank wise Facilities Details

The details are as reported by the issuer as on (19 Nov 2024)

| # |

Bank Name |

Instrument Description |

Rated Amount (INR

million) |

Rating |

| 1 |

State Bank of India |

Fund Based Working Capital Limit |

4800 |

IND AA+/Stable/IND

A1+ |

| 2 |

State Bank of India |

Non-Fund Based Working Capital Limit |

1200 |

IND AA+/Stable/IND

A1+ |

| 3 |

State Bank of India |

Fund Based Working Capital Limit |

12000 |

IND AA+/Stable/IND

A1+ |

| 4 |

IndusInd Bank

Limited |

Fund Based Working Capital Limit |

5000 |

IND AA+/Stable/IND

A1+ |

| 5 |

Bank of America |

Fund Based Working Capital Limit |

5000 |

IND AA+/Stable/IND

A1+ |

Complexity Level of the Instruments

| Instrument Type |

Complexity Indicator |

| Fund-based working capital limit |

Low |

| Non-fund-based working capital limits |

Low |

For details on the complexity level of the instruments, please visit

https://www.indiaratings.co.in/complexity- indicators.

Annexure

Contact

Primary Analyst

Krishnanath Munde

Associate Director

India Ratings and Research Pvt Ltd

Wockhardt Towers, 4th Floor, West Wing, Bandra Kurla Complex, Bandra

East,Mumbai - 400051

+91 22 40001768

For queries, please contact: infogrp@indiaratings.co.in

Secondary Analyst

Shashikala Hegde

Senior Analyst

Media Relation

Ameya Bodkhe

Marketing Manager

+91 22 40356121

About India Ratings and Research: India Ratings and Research

(Ind-Ra) is committed to providing India's credit markets accurate, timely and prospective credit opinions. Built on a foundation of independent

thinking, rigorous analytics, and an open and balanced approach towards credit research, Ind-Ra has grown rapidly during the past decade,

gaining significant market presence in India's fixed income market.

Ind-Ra currently maintains coverage of corporate

issuers, financial institutions (including banks and insurance companies), finance and leasing companies, managed funds, urban local bodies

and project finance companies.

Headquartered in Mumbai, Ind-Ra has seven branch

offices located in Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Kolkata and Pune. Ind-Ra is recognised by the Securities and Exchange

Board of India, the Reserve Bank of India and National Housing Bank.

India Ratings is a 100% owned subsidiary of the

Fitch Group.

For more information, visit www.indiaratings.co.in.

Solicitation Disclosures

Additional information is available at www.indiaratings.co.in.

The ratings above were solicited by, or on behalf of, the issuer, and therefore, India Ratings has been compensated for the provision

of the ratings.

Ratings are not a recommendation or suggestion,

directly or indirectly, to you or any other person, to buy, sell, make or hold any investment, loan or security or to undertake any investment

strategy with respect to any investment, loan or security or any issuer.

APPLICABLE CRITERIA AND POLICIES

Evaluating Corporate Governance

Short-Term Ratings Criteria for Non-Financial

Corporates

Corporate Rating Methodology

The Rating Process

DISCLAIMER

All credit ratings assigned by india ratings are subject to certain

limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.indiaratings.co.in/rating-definitions.

In addition, rating definitions and the terms of use of such ratings are available on the agency's public website www.indiaratings.co.in.

Published ratings, criteria, and methodologies are available from this site at all times. India ratings’ code of conduct, confidentiality,

conflicts of interest, affiliate firewall, compliance, and other relevant policies and procedures are also available from the code of

conduct section of this site.

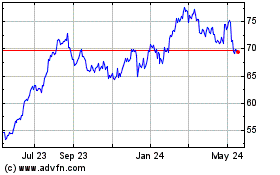

Dr Reddys Laboratories (NYSE:RDY)

Historical Stock Chart

From Oct 2024 to Nov 2024

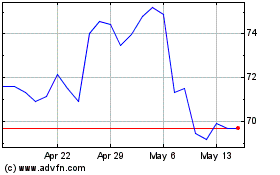

Dr Reddys Laboratories (NYSE:RDY)

Historical Stock Chart

From Nov 2023 to Nov 2024