UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 22, 2024

REX AMERICAN RESOURCES CORPORATION

(Exact name of registrant as specified in

its charter)

| Delaware | | 001-09097 | | 31-1095548 |

| (State or other jurisdiction | | (Commission File No.) | | (IRS Employer Identification No.) |

| of incorporation) | | | | |

| 7720 Paragon Road Dayton, Ohio | | 45459 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including

area code: (937) 276-3931

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Commons stock, $0.01 par value | REX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On May 22, 2024, REX American Resources

Corporation issued a press release announcing financial results for the three-month period ended April 30, 2024. The press release

is furnished as Exhibit 99 to this report.

Item 9.01. Financial Statements and Exhibits

| |

|

(c) |

Exhibits. The following exhibits are furnished with this report: |

| |

|

|

|

| |

|

|

99 Press Release dated May 22, 2024 |

| |

|

|

104 Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

REX AMERICAN RESOURCES CORPORATION |

| |

|

|

|

|

| Date: May 22, 2024 |

By: |

/s/ DOUGLAS L. BRUGGEMAN |

|

| |

|

Name: |

Douglas L. Bruggeman |

| |

|

Title: |

Vice President - Finance, |

| |

|

|

Chief Financial Officer |

| |

|

|

and Treasurer |

false

0000744187

0000744187

2024-05-22

2024-05-22

Exhibit 99

REX American

Resources Reports Fiscal 2024 First Quarter Net Income Per Share Attributable to REX Common Shareholders of $0.58

Construction phase of carbon capture and

compression facility scheduled for completion in July

Announces securing of 100% of rights of

way for carbon capture pipeline

| § | Generated $0.58 of net income per share in Fiscal Q1 ‘24, the second

best first quarter result in Company history |

| § | Reported gross profit of $14.5 million for Fiscal Q1 ‘24, an increase

of more than 42% over the same period in Fiscal 2023 |

| § | Reported net sales and revenue of $161.2 million for Fiscal Q1 ‘24,

a decrease of approximately 24% over the same period in Fiscal 2023 |

| § | Reported consolidated ethanol sales volumes of 74.5 million gallons for

Fiscal Q1 ‘24, an increase of approximately 4% over the same period in Fiscal 2023 |

| § | Reached agreement with 100% of landowners for rights of way for the planned

carbon pipeline, which would connect the One Earth Energy carbon capture facility to injection wells; agreements eliminate the

need to use eminent domain |

| § | Completion of the construction phase of the One Earth Energy carbon capture

and compression facility remains scheduled for July |

Dayton, OH - Wednesday, May 22, 2024 - REX American Resources

Corporation (“REX” or the “Company”) (NYSE: REX), a leading ethanol production company, today announced

financial and operational results for the Company’s fiscal first quarter 2024.

REX American Resources’ fiscal first quarter 2024 results

principally reflect its interests in six ethanol production facilities. The One Earth Energy, LLC (“One Earth”)

and NuGen Energy, LLC (“NuGen”) ethanol production facilities are consolidated, while the four other ethanol

plants are reported as equity in income of unconsolidated ethanol affiliates.

Fiscal First Quarter 2024 Results

For fiscal first quarter 2024, REX reported

net sales and revenue of $161.2 million, compared with $212.7 million for fiscal first quarter 2023. The year-over-year

net sales and revenue decrease primarily reflects reduced pricing for ethanol and co-products. Fiscal first quarter 2024 gross

profit for the Company was $14.5 million, compared with $10.2 million in fiscal first quarter 2023, reflecting decreased

corn and natural gas prices and increased production levels. Interest and other income for the first fiscal quarter 2024 was $5.9

million, compared to $2.8 million for first fiscal quarter 2023. These increases led to higher fiscal first quarter 2024 income

before income taxes and non-controlling interests of $16.0 million, compared with $8.7 million in the prior year

period.

Net income attributable to REX shareholders

in fiscal first quarter 2024 was $10.2 million, compared to $5.2 million in fiscal first quarter 2023. Fiscal first

quarter 2024 diluted net income per share attributable to REX common shareholders was $0.58, compared to $0.30 per

share in fiscal first quarter 2023. Per share results for fiscal first quarters 2024 and 2023 are based on 17,664,000 and 17,439,000

diluted weighted average shares outstanding, respectively.

Update on One Earth Energy Carbon Capture Project

REX has continued to make progress with construction on the capture

and compression portion of its One Earth Energy carbon capture and sequestration project. Construction of the capture and compression

facility is still expected to be completed in July 2024.

As of April, the Company has secured agreements with landholders

for 100% of the necessary rights of way for the planned 6-mile carbon transport pipeline, which would carry captured CO2

from the capture and compression facility to the planned injection wells. Permitting for the carbon transport pipeline is ongoing

with the Illinois Commerce Commission.

REX has also secured easements for more than 100% of the subsurface

area around the first planned injection well, necessary to allow the Company to sequester all carbon emissions from the One Earth

Energy facility over the next 15 years, at a minimum, based on modeling.

The Environmental Protection Agency (EPA) Class VI injection

well permitting process is ongoing. Approval of REX’s Class VI injection well application is necessary to begin construction

on the sequestration portion of the project and to begin operations.

In addition, REX has also made substantial progress on the expansion

of its One Earth Energy ethanol production facility. This initial phase will increase the plant’s production capacity from

150 million to 175 million gallons per year. Once achieved, REX plans to move forward with the further permitting of the facility

to produce 200 million gallons per year of ethanol, which the Company expects will require no further capital expenditure.

Through the end of fiscal first quarter 2024, capital expenditures

related to the One Earth Energy carbon capture and sequestration project and expansion of ethanol production capacity at the Gibson

City location total $78.1 million. The Company is currently budgeting $165-$175 million for this project.

Balance Sheet

At the end of fiscal first quarter 2024 on April 30, 2024, REX

had $351.8 million of cash, cash equivalents, and short-term investments available and no bank debt.

Management Commentary

“REX American has continued to turn in industry-leading

earnings from our ethanol operations, as well as progressing on our carbon capture and ethanol production expansion projects,”

said Zafar Rizvi, REX Chief Executive Officer. “Going forward, we plan to build on these achievements to make REX an even

stronger company, with greater opportunity for growth in a decarbonizing economy, as evidenced by the One Earth Energy projects.

As I’ve said before, our laser focus is on profitable, sustainable operations, and this remains the most important goal for

me and the entire management team.

“The One Earth Energy projects took great steps forward

over the past few months. The securing of rights for 100% of the land for our carbon pipeline rights of way, as well as the necessary

subsurface easements to allow our first injection well to sequester all the carbon emissions from our One Earth ethanol operations

for 15 years, are major achievements, and ones in which we were able to partner with our neighbors. We look forward to continuing

these partnerships as we attempt to move toward project completion,” concluded Mr. Rizvi.

Change in Accounting Principles

As previously discussed, during the

fiscal quarter ended July 31, 2023 the Company made a change in the method of accounting to begin classifying shipping

and handling costs as cost of sales, instead of within selling, general and administrative expenses (SG&A), as historically

presented, in order to improve the comparability of gross profit and SG&A reported. The Company has applied a retrospective

application of the new accounting policy.

Conference Call Information

REX will host a conference call at 11:00 a.m. ET today

to discuss the Company’s quarterly results and will also host a question and answer session. To access the conference call,

interested parties may dial (877) 269-7751 (US) or (201) 389-0908 (international). Participants can also view an updated presentation,

as well as listen to a live webcast of the call by going to the Investors section on the REX website at www.rexamerican.com.

A replay will be available shortly after the live conference call and can be accessed by dialing (844) 512-2921 (US) or (412) 317-6671 (international). The passcode for the replay is 13746658. The replay will be available

for 30 days after the call.

About REX American Resources Corporation

REX American Resources Corporation has interests in six ethanol production facilities, which in aggregate have production capacity

totaling approximately 730 million gallons per year. REX’s effective ownership of annual volumes is approximately 300 million

gallons. Further information about REX is available at www.rexamerican.com.

Forward-Looking Statements

This news announcement contains or may contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements can be identified by use

of forward-looking terminology such as “may,” “expect,” “believe,” “estimate,”

“anticipate” or “continue” or the negative thereof or other variations thereon or comparable terminology.

Readers are cautioned that there are risks and uncertainties that could cause actual events or results to differ materially from

those referred to in such forward-looking statements. These risks and uncertainties include the risk factors set forth from time

to time in the Company’s filings with the Securities and Exchange Commission and include among other things: the

effect of pandemics such as COVID-19 on the Company’s business operations, including impacts on supplies, demand, personnel

and other factors, the impact of legislative and regulatory changes, the price volatility and availability of corn, distillers

grains, ethanol, distillers corn oil, commodity market risk, gasoline and natural gas, ethanol plants operating efficiently and

according to forecasts and projections, logistical interruptions, success in permitting and developing the planned carbon sequestration

facility near the One Earth Energy ethanol plant, changes in the international, national or regional economies, the impact of inflation,

the ability to attract employees, weather, results of income tax audits, changes in income tax laws or regulations, the impact

of U.S. foreign trade policy, changes in foreign currency exchange rates and the effects of terrorism or acts of war.

The Company does not intend to update publicly any forward-looking statements except as required by law.

Investor Contacts

Douglas Bruggeman

Chief Financial Officer

Caldwell Bailey

ICR, Inc.

rexamerican@icrinc.com

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIES

Consolidated Statements

of Operations

(in thousands, except

per share amounts)

Unaudited

| | |

Three Months Ended |

|

| | |

April 30, |

|

| | |

2024 | | |

2023 | |

| Net sales and revenue | |

$ | 161,231 | | |

$ | 212,714 | |

| Cost of sales | |

| 146,780 | | |

| 202,548 | |

| Gross profit | |

| 14,451 | | |

| 10,166 | |

| Selling, general and administrative expenses | |

| (6,111) | | |

| (5,769) | |

| Equity in income of unconsolidated ethanol affiliates | |

| 1,718 | | |

| 1,490 | |

| Interest and other income, net | |

| 5,905 | | |

| 2,801 | |

| Income before income taxes and noncontrolling interests | |

| 15,963 | | |

| 8,688 | |

| Provision for income taxes | |

| (3,690) | | |

| (1,988) | |

| Net Income | |

| 12,273 | | |

| 6,700 | |

| Net Income attributable to noncontrolling

interests | |

| (2,082) | | |

| (1,464) | |

| Net income attributable to REX common shareholders | |

$ | 10,191 | | |

$ | 5,236 | |

| | |

| | | |

| | |

| Weighted average shares outstanding – basic | |

| 17,546 | | |

| 17,439 | |

| | |

| | | |

| | |

| Basic net income per share attributable to REX common

shareholders | |

$ | 0.58 | | |

$ | 0.30 | |

| | |

| | | |

| | |

| Weighted average shares outstanding – diluted | |

| 17,664 | | |

| 17,439 | |

| | |

| | | |

| | |

| Diluted net income per share attributable to REX common

shareholders | |

$ | 0.58 | | |

$ | 0.30 | |

REX AMERICAN RESOURCES

CORPORATION AND SUBSIDIARIES

Consolidated

Balance Sheets

(in thousands)

Unaudited

| | |

April 30, | | |

January 31, | |

| | |

2024 | | |

2024 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 231,200 | | |

$ | 223,397 | |

| Short-term investments | |

| 120,564 | | |

| 155,260 | |

| Accounts receivable | |

| 21,535 | | |

| 23,185 | |

| Inventory | |

| 27,100 | | |

| 26,984 | |

| Refundable income taxes | |

| 4,586 | | |

| 5,728 | |

| Prepaid expenses and other | |

| 16,628 | | |

| 17,549 | |

| Total current assets | |

| 421,613 | | |

| 452,103 | |

| Property and equipment, net | |

| 179,024 | | |

| 155,587 | |

| Operating lease right-of-use assets | |

| 11,561 | | |

| 13,038 | |

| Other assets | |

| 22,167 | | |

| 9,138 | |

| Equity method investment | |

| 36,654 | | |

| 34,936 | |

| TOTAL ASSETS | |

$ | 671,019 | | |

$ | 664,802 | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable – trade | |

$ | 43,216 | | |

$ | 42,073 | |

| Current operating lease liabilities | |

| 3,724 | | |

| 4,469 | |

| Accrued expenses and other current liabilities | |

| 15,760 | | |

| 19,717 | |

| Total current liabilities | |

| 62,700 | | |

| 66,259 | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Deferred taxes | |

| 1,598 | | |

| 1,598 | |

| Long-term operating lease liabilities | |

| 7,729 | | |

| 8,378 | |

| Other long-term liabilities | |

| 593 | | |

| 970 | |

| Total long-term liabilities | |

| 9,920 | | |

| 10,946 | |

| EQUITY: | |

| | | |

| | |

| REX shareholders’ equity: | |

| | | |

| | |

| Common stock | |

| 299 | | |

| 299 | |

| Paid-in capital | |

| 4,064 | | |

| 3,769 | |

| Retained earnings | |

| 711,952 | | |

| 701,761 | |

| Treasury stock | |

| (191,848) | | |

| (191,911) | |

| Total REX shareholders’ equity | |

| 524,467 | | |

| 513,918 | |

| Noncontrolling interests | |

| 73,932 | | |

| 73,679 | |

| Total equity | |

| 598,399 | | |

| 587,597 | |

| TOTAL LIABILITIES AND EQUITY | |

$ | 671,019 | | |

$ | 664,802 | |

REX AMERICAN RESOURCES

CORPORATION AND SUBSIDIARIES

Consolidated Statements

of Cash Flows

(in thousands)

Unaudited

| | |

Three Months Ended | |

| | |

April 30, | | |

April 30, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net Income including noncontrolling interest | |

$ | 12,273 | | |

$ | 6,700 | |

| Adjustments to reconcile net income to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 4,414 | | |

| 4,420 | |

| Amortization of operating lease right-of-use assets | |

| 1,478 | | |

| 1,334 | |

| Income from equity method investments | |

| (1,718) | | |

| (1,490) | |

| Interest income from investments | |

| (1,816) | | |

| (2,052) | |

| Deferred income taxes | |

| 2,479 | | |

| 1,342 | |

| Stock based compensation expense | |

| 716 | | |

| 612 | |

| Gain on sale of property and equipment – net | |

| - | | |

| (10) | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 1,650 | | |

| (4,055) | |

| Inventories | |

| (116) | | |

| 7,445 | |

| Refundable income taxes | |

| 1,142 | | |

| (2,021) | |

| Other assets | |

| (3,797) | | |

| (6,167) | |

| Accounts payable – trade | |

| (12,733) | | |

| (16,066) | |

| Other liabilities | |

| (6,235) | | |

| (3,998) | |

| Net cash used in operating activities | |

| (2,263) | | |

| (14,006) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Capital expenditures | |

| (24,832) | | |

| (4,199) | |

| Purchase of short-term investments | |

| (84,978) | | |

| (102,348) | |

| Maturity of short-term investments | |

| 121,490 | | |

| 127,588 | |

| Deposits | |

| 215 | | |

| (9) | |

| Proceeds from sale of real estate and property and equipment | |

| - | | |

| 10 | |

| Net cash provided by investing activities: | |

| 11,895 | | |

| 21,042 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Payments to noncontrolling interests holders | |

| (1,829) | | |

| (716) | |

| Net cash used in financing activities | |

| (1,829) | | |

| (716) | |

| | |

| | | |

| | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | |

| 7,803 | | |

| 6,320 | |

| CASH AND CASH EQUIVALENTS – Beginning of period | |

| 223,397 | | |

| 71,347 | |

| CASH AND CASH EQUIVALENTS– End of period | |

$ | 231,200 | | |

$ | 77,667 | |

| | |

| | | |

| | |

| Non-cash financing activities – Stock awards accrued | |

$ | 358 | | |

$ | 189 | |

| Non-cash investing activities – Accrued capital expenditures | |

$ | 3,938 | | |

$ | 274 | |

| Prepaid lease payment, prior to lease commencement | |

$ | 15,600 | | |

$ | - | |

| Right-of-use assets acquired and liabilities incurred upon lease execution | |

$ | - | | |

$ | 97 | |

The following table summarizes the impact

of the Company’s

retrospective change in accounting principle:

| | |

Three Months Ended |

| | |

April 30, 2023 |

| | |

|

| | |

As Previously

Reported | |

Effect of

Change | |

As Currently

Reported |

| Cost of Sales | |

|

$ | 197,685 | | |

|

$ | 4,863 | | |

|

$ | 202,548 | |

| | |

|

| | | |

|

| | | |

|

| | |

| Gross Profit | |

|

$ | 15,029 | | |

|

$ | (4,863) | | |

|

$ | 10,166 | |

| | |

|

| | | |

|

| | | |

|

| | |

| Selling, general and administrative expenses | |

|

$ | (10,632) | | |

|

$ | 4,863 | | |

|

$ | (5,769) | |

Source: REX American Resources

Corporation

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

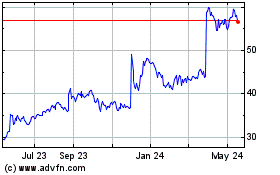

REX American Resources (NYSE:REX)

Historical Stock Chart

From Jan 2025 to Feb 2025

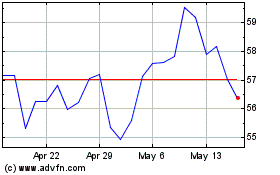

REX American Resources (NYSE:REX)

Historical Stock Chart

From Feb 2024 to Feb 2025