Regis Appoints New Finance Head - Analyst Blog

December 05 2012 - 8:00AM

Zacks

Regis Corporation

(RGS) has recently appointed Steven M. Spiegel as the Chief

Financial Officer (CFO) and Executive Vice President of the company

with immediate effect. Spiegel replaced Brent Moen who had resigned

from the post of CFO. However, Brent Moen will remain with Regis

till January 4, 2013, to ensure a seamless transition.

Spiegel’s career graph boasts several strategic roles. Previously,

he had served as the Vice President Finance and Corporate

Controller at Unilever Group (formerly Alberto Culver) from 2010 to

May 2012. Prior to that, he acted as the Vice President of

Commercial Finance – Americas, Asia-Pacific and Africa, at Alberto

Culver from 2007.

Earlier, he held the same posts at U.S. Branded Beauty of Alberto

Culver from 2005 to 2007. Considering his vast know-how about

business development, public accounting as well as his prior

experience with leading retailers, we believe that he will bring on

board key expertise to steer Regis’ to growth and

profitability.

Edina-based Regis’ present scenario is not very encouraging as the

company has been struggling for quite some time with a slow traffic

count, which remains a drag on its same-store sales.

However, traffic under its Smart Style segment was positive for the

first time in several quarters in the third quarter of 2012,

supported by a back-to-school coupon event. We believe that despite

this positive signal, Regis still has a long way to go to wipe out

the previous underperformance.

Frequent changes in top management further remain a cause of

concern for Regis. In July this year, Regis appointed a permanent

Chief Executive Officer (CEO) after a seven-month long extensive

search. Meanwhile, Eric A. Bakken acted as the interim CEO of the

company.

In January this year, the company had to undergo another managerial

change owing to the termination of the Chief Operating Officer

(COO) David Bortnem. In such a scenario, the role of a new team

will be vital as the company is currently struggling to revitalize

the brand. An element of uncertainty will linger till we find any

definite signs of progress.

Regis, which competes with Ulta Salon, Cosmetics &

Fragrance Inc. (ULTA), retains a Zacks #4 Rank, implying a

short-term ‘Sell’ rating on the stock.

REGIS CORP/MN (RGS): Free Stock Analysis Report

ULTA SALON COSM (ULTA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

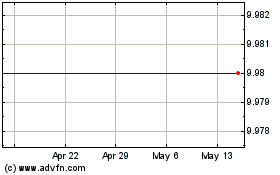

Regis (NYSE:RGS)

Historical Stock Chart

From Jun 2024 to Jul 2024

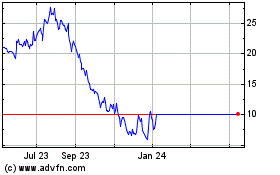

Regis (NYSE:RGS)

Historical Stock Chart

From Jul 2023 to Jul 2024