RiverNorth

Opportunities Fund, Inc.

Statement

of Investments

September

30, 2024 (Unaudited)

| Shares | | |

Description | |

Value

(Note 2) | |

| CLOSED-END

FUNDS - COMMON SHARES (77.71%) | |

| Great

Britain - 10.29% | |

| | |

| | 594,131 | | |

Pershing

Square Holdings Ltd. | |

$ | 28,221,223 | |

| | | | |

| |

| | |

| United

States - 67.42% | |

| | |

| | 277,709 | | |

Aberdeen

Emerging Markets Equity Income Fund, Inc. | |

| 1,564,890 | |

| | 100 | | |

Advent

Convertible and Income Fund | |

| 1,174 | |

| | 274,908 | | |

Avenue

Income Credit Strategies Fund | |

| 1,819,892 | |

| | 298,560 | | |

Barings

Participation Investors | |

| 5,057,606 | |

| | 1,188,825 | | |

BlackRock

Capital Allocation Term Trust | |

| 19,556,171 | |

| | 1,355,618 | | |

BlackRock

ESG Capital Allocation Term Trust | |

| 24,048,663 | |

| | 549,708 | | |

BlackRock

Health Sciences Term Trust | |

| 8,707,375 | |

| | 123,344 | | |

BlackRock

Municipal Income Quality Trust | |

| 1,485,062 | |

| | 341,608 | | |

BlackRock

Municipal Income Trust | |

| 3,610,797 | |

| | 331,830 | | |

BlackRock

Municipal Income Trust II | |

| 3,736,406 | |

| | 32,936 | | |

BlackRock

MuniHoldings California Quality Fund, Inc. | |

| 379,423 | |

| | 167,757 | | |

BlackRock

MuniHoldings Fund, Inc. | |

| 2,122,126 | |

| | 287,842 | | |

BlackRock

MuniHoldings Quality Fund II, Inc. | |

| 3,077,031 | |

| | 141,200 | | |

BlackRock

MuniVest Fund II, Inc. | |

| 1,608,268 | |

| | 99,091 | | |

BlackRock

MuniVest Fund, Inc. | |

| 753,092 | |

| | 187,151 | | |

BlackRock

MuniYield Fund, Inc. | |

| 2,139,136 | |

| | 300,215 | | |

BlackRock

MuniYield Quality Fund II, Inc. | |

| 3,248,326 | |

| | 914,358 | | |

BlackRock

Resources & Commodities Strategy Trust | |

| 8,777,837 | |

| | 460,914 | | |

BlackRock

Science and Technology Term Trust | |

| 8,849,549 | |

| | 486,946 | | |

Calamos

Long/Short Equity & Dynamic Income Trust(a) | |

| 7,639,209 | |

| | 369,753 | | |

Clough

Global Dividend and Income Fund | |

| 2,177,845 | |

| | 102,996 | | |

Clough

Global Equity Fund | |

| 714,710 | |

| | 1,095,000 | | |

Clough

Global Opportunities Fund(a) | |

| 5,967,750 | |

| | 228,975 | | |

First

Trust High Yield Opportunities 2027 Term Fund | |

| 3,462,102 | |

| | 186,138 | | |

India

Fund, Inc. | |

| 3,540,345 | |

| | 151,400 | | |

Invesco

Advantage Municipal Income Trust II | |

| 1,409,534 | |

| | 32,374 | | |

Invesco

Dynamic Credit Opportunity Fund | |

| 355,137 | |

| | 207,133 | | |

Invesco

Municipal Opportunity Trust | |

| 2,127,256 | |

| | 313,036 | | |

Miller/Howard

High Dividend Fund | |

| 3,815,909 | |

| | 75,200 | | |

Neuberger

Berman Municipal Fund, Inc. | |

| 835,472 | |

| | 322,328 | | |

Nuveen

AMT-Free Municipal Credit Income Fund | |

| 4,315,972 | |

| | 36,587 | | |

Nuveen

AMT-Free Municipal Value Fund | |

| 520,267 | |

| | 616,459 | | |

Nuveen

AMT-Free Quality Municipal Income Fund(a) | |

| 7,379,014 | |

| | 189,217 | | |

Nuveen

California Quality Municipal Income Fund | |

| 2,249,790 | |

| | 133,401 | | |

Nuveen

Municipal Credit Income Fund | |

| 1,747,553 | |

| | 714,435 | | |

Nuveen

Municipal Value Fund, Inc.(a) | |

| 6,444,204 | |

| | 143,155 | | |

Nuveen

New York Quality Municipal Income Fund | |

| 1,687,797 | |

| | 138,430 | | |

Nuveen

Quality Municipal Income Fund | |

| 1,713,763 | |

| | 341,951 | | |

PIMCO

Global StocksPLUS & Income Fund | |

| 2,868,969 | |

| | 1,275,236 | | |

Saba

Capital Income & Opportunities Fund(a) | |

| 9,679,041 | |

| | 845,000 | | |

Saba

Capital Income & Opportunities Fund II | |

| 7,190,950 | |

| | 226,250 | | |

Special

Opportunities Fund, Inc. | |

| 3,147,137 | |

| | 200,000 | | |

Voya

Emerging Markets High Income Dividend Equity Fund | |

| 1,141,000 | |

| | 100 | | |

Western

Asset Global High Income Fund, Inc. | |

| 694 | |

| | 212,814 | | |

Western

Asset Managed Municipals Fund, Inc. | |

| 2,306,904 | |

| | | | |

| |

| | |

| TOTAL

CLOSED-END FUNDS - COMMON SHARES | |

| | |

| (Cost

$177,713,441) | |

| 213,202,371 | |

| |

| |

| |

| | |

Maturity | | |

Value | |

| Shares |

| |

Description | |

Rate | | |

Date | | |

(Note 2) | |

| CLOSED-END FUNDS - PREFERRED SHARES (1.03%) |

| United States - 1.03% |

|

89,385 |

| |

Virtus Convertible & Income Fund II(b) | |

| 5.500 | % | |

| 12/31/99 | | |

| 1,981,665 | |

| 33,699 |

| |

XAI Octagon Floating Rate Alternative Income Trust | |

| 6.500 | % | |

| 03/31/26 | | |

| 848,878 | |

| |

| |

| |

| | | |

| | | |

| | |

| TOTAL CLOSED-END FUNDS - PREFERRED SHARES |

| | | |

| | | |

| | |

| (Cost $2,744,030) |

| | | |

| | | |

| 2,830,543 | |

| |

| |

| |

| | | |

| | | |

| | |

| BUSINESS DEVELOPMENT COMPANIES - COMMON SHARES (0.81%) |

| United States - 0.81% |

| 136,129 |

| |

Oaktree Specialty Lending Corp. | |

| | | |

| | | |

$ | 2,220,264 | |

| |

| |

| |

| | | |

| | | |

| | |

| TOTAL BUSINESS DEVELOPMENT COMPANIES - COMMON SHARES |

| | | |

| | | |

| | |

| (Cost $2,264,131) |

| | | |

| | | |

| 2,220,264 | |

| |

| |

| |

| | | |

| | | |

| | |

| BUSINESS DEVELOPMENT COMPANIES - PREFERRED SHARES (2.19%) |

| United States - 2.19% |

| 50,000 |

| |

CION Investment Corp. | |

| 7.500 | % | |

| 12/30/29 | | |

| 1,250,000 | |

| 160,246 |

| |

Crescent Capital BDC, Inc. | |

| 5.000 | % | |

| 05/25/26 | | |

| 3,901,990 | |

| 900,000 |

| |

PennantPark Floating Rate Capital, Ltd. | |

| 4.250 | % | |

| 04/01/26 | | |

| 857,455 | |

| |

| |

| |

| | | |

| | | |

| | |

| TOTAL BUSINESS DEVELOPMENT COMPANIES - PREFERRED SHARES |

| | | |

| | | |

| | |

| (Cost $6,189,979) |

| | | |

| | | |

| 6,009,445 | |

| Principal | | |

| |

| | |

Maturity | | |

Value | |

| Amount | | |

Description | |

Rate | | |

Date | | |

(Note 2) | |

| BUSINESS DEVELOPMENT COMPANY NOTES (3.67%) | |

| United States - 3.67% |

| $ | 1,500,000 | | |

Golub Capital BDC, Inc. | |

| 2.050 | % | |

| 02/15/27 | | |

| 1,385,560 | |

| | 1,000,000 | | |

MidCap Financial Investment Corp. | |

| 4.500 | % | |

| 07/16/26 | | |

| 951,733 | |

| | 5,000,000 | | |

MidCap Financial Investment Corp. | |

| 5.250 | % | |

| 03/03/25 | | |

| 4,968,005 | |

| | 107,745 | | |

MidCap Financial Investment Corp. | |

| 8.000 | % | |

| 12/15/28 | | |

| 2,760,427 | |

| | | | |

| |

| | | |

| | | |

| 10,065,725 | |

| | | | |

| |

| | | |

| | | |

| | |

| TOTAL BUSINESS DEVELOPMENT COMPANY NOTES |

| (Cost $9,920,052) | |

| | | |

| | | |

| 10,065,725 | |

| | | | |

| |

| | | |

| | | |

| | |

| CORPORATE BONDS (17.80%) |

| United States - 17.80% |

| | 2,000,000 | | |

Barings BDC, Inc. | |

| 7.000 | % | |

| 02/15/29 | | |

| 2,090,344 | |

| | 250,000 | | |

BlackRock TCP Capital Corp. | |

| 6.950 | % | |

| 05/30/29 | | |

| 254,968 | |

| | 629 | | |

Blackstone Private Credit Fund(c) | |

| 2.625 | % | |

| 12/15/26 | | |

| 595 | |

| | 5,400,000 | | |

Blackstone Private Credit Fund | |

| 2.625 | % | |

| 12/15/26 | | |

| 5,107,993 | |

| | 157 | | |

Blackstone Private Credit Fund(c) | |

| 3.250 | % | |

| 03/15/27 | | |

| 150 | |

| | 2,850,000 | | |

Blackstone Private Credit Fund | |

| 3.250 | % | |

| 03/15/27 | | |

| 2,716,656 | |

| | 290,000 | | |

Blackstone Secured Lending Fund(d) | |

| 2.125 | % | |

| 02/15/27 | | |

| 270,352 | |

| | 3,000,000 | | |

Blackstone Secured Lending Fund | |

| 2.850 | % | |

| 09/30/28 | | |

| 2,739,180 | |

| | 500,000 | | |

Blue Owl Capital Corp. | |

| 2.875 | % | |

| 06/11/28 | | |

| 458,293 | |

| | 3,000,000 | | |

Blue Owl Capital Corp. | |

| 3.750 | % | |

| 07/22/25 | | |

| 2,965,163 | |

| | 445,000 | | |

Blue Owl Capital Corp. II(c) | |

| 4.625 | % | |

| 11/26/24 | | |

| 444,242 | |

| | 557,000 | | |

Blue Owl Capital Corp. III | |

| 3.125 | % | |

| 04/13/27 | | |

| 527,089 | |

| | 428 | | |

Blue Owl Credit Income Corp.(c) | |

| 3.125 | % | |

| 09/23/26 | | |

| 409 | |

| | 2,492,000 | | |

Blue Owl Credit Income Corp. | |

| 3.125 | % | |

| 09/23/26 | | |

| 2,379,255 | |

| | 752 | | |

Blue Owl Credit Income Corp.(c) | |

| 5.500 | % | |

| 03/21/25 | | |

| 751 | |

| $ | 2,505,000 | | |

Blue Owl Credit Income Corp. | |

| 5.500 | % | |

| 03/21/25 | | |

$ | 2,503,291 | |

| | 2,718,300 | | |

Blue Owl Credit Income Corp. | |

| 7.750 | % | |

| 09/16/27 | | |

| 2,864,769 | |

| | 2,500,000 | | |

Blue Owl Technology Finance Corp.(c) | |

| 4.750 | % | |

| 12/15/25 | | |

| 2,467,455 | |

| | 3,000,000 | | |

Blue Owl Technology Finance Corp.(c) | |

| 6.750 | % | |

| 06/30/25 | | |

| 3,016,910 | |

| | 1,000,000 | | |

Blue Owl Technology Finance Corp. II(c) | |

| 6.750 | % | |

| 04/04/29 | | |

| 1,005,099 | |

| | 3,072,928 | | |

Franklin BSP Capital Corp. | |

| 3.250 | % | |

| 03/30/26 | | |

| 2,974,287 | |

| | 2,370,000 | | |

Franklin BSP Capital Corp.(c) | |

| 4.850 | % | |

| 12/15/24 | | |

| 2,363,153 | |

| | 1,000,000 | | |

FS KKR Capital Corp. | |

| 2.625 | % | |

| 01/15/27 | | |

| 940,803 | |

| | 3,500,000 | | |

New Mountain Finance Corp. | |

| 6.875 | % | |

| 02/01/29 | | |

| 3,544,782 | |

| | 6,000,000 | | |

Oaktree Specialty Lending Corp. | |

| 7.100 | % | |

| 02/15/29 | | |

| 6,242,141 | |

| | 1,000,000 | | |

PennantPark Investment Corp. | |

| 4.000 | % | |

| 11/01/26 | | |

| 948,688 | |

| | | | |

| |

| | | |

| | | |

| 48,826,818 | |

| | | | |

| |

| | | |

| | | |

| | |

| TOTAL CORPORATE BONDS |

| (Cost $46,955,990) | |

| | | |

| | | |

| 48,826,818 | |

| | | | |

| |

| | | |

| | | |

| | |

| Shares | | |

Description | |

Value

(Note 2) | |

| SPECIAL PURPOSE ACQUISITION COMPANIES - COMMON SHARES/UNITS (13.81%)(e) | |

| China - 0.47% | |

| | 65,000 | | |

Future Vision II Acquisition Corp. | |

| 650,650 | |

| | 60,193 | | |

Global Lights Acquisition Corp. | |

| 629,619 | |

| | | | |

| |

| | |

| Hong Kong - 0.54% | |

| | |

| | 46,894 | | |

Black Spade Acquisition II Co. | |

| 467,064 | |

| | 35,100 | | |

JVSPAC Acquisition Corp. | |

| 362,934 | |

| | 65,000 | | |

YHN Acquisition I, Ltd. | |

| 651,300 | |

| | | | |

| |

| | |

| Ireland - 0.00%(f) | |

| | |

| | 19,034 | | |

Heramba Electric PLC | |

| 1,618 | |

| | | | |

| |

| | |

| Israel - 0.00%(f) | |

| | |

| | 120 | | |

REE Automotive, Ltd. | |

| 847 | |

| | 2,547 | | |

Silexion Therapeutics Corp. | |

| 80 | |

| | | | |

| |

| | |

| Malaysia - 0.51% | |

| | |

| | 64,922 | | |

Kairous Acquisition Corp. ltd | |

| 788,802 | |

| | 51,134 | | |

PHP Ventures Acquisition Corp. | |

| 605,427 | |

| | | | |

| |

| | |

| Singapore - 0.55% | |

| | |

| | 53,256 | | |

Chenghe Acquisition II Co. | |

| 533,625 | |

| | 19,616 | | |

Helport AI, Ltd. | |

| 1,962 | |

| | 64,612 | | |

RF Acquisition Corp. | |

| 723,654 | |

| | 25,712 | | |

RF Acquisition Corp. II | |

| 261,445 | |

| | | | |

| |

| | |

| United States - 11.74% | |

| | |

| | 50,000 | | |

AA Mission Acquisition Corp. | |

| 500,500 | |

| | 44,669 | | |

Aimei Health Technology Co., Ltd. | |

| 468,131 | |

| | 65,000 | | |

Andretti Acquisition Corp. II | |

| 650,000 | |

| | 260,926 | | |

Ares Acquisition Corp. II | |

| 2,825,829 | |

| | 30,110 | | |

Bayview Acquisition Corp. | |

| 310,735 | |

| | 54,328 | | |

Bellevue Life Sciences Acquisition Corp. | |

| 589,459 | |

| | 65,940 | | |

Black Hawk Acquisition Corp. | |

| 675,226 | |

| | 65,000 | | |

Bowen Acquisition Corp. | |

| 698,750 | |

| | 27,500 | | |

Cantor Equity Partners, Inc. | |

| 275,825 | |

| | 58,500 | | |

Cayson Acquisition Corp. | |

| 586,170 | |

| Shares | | |

Description | |

Value

(Note 2) | |

| | 65,520 | | |

Centurion Acquisition Corp. | |

$ | 656,510 | |

| | 52,128 | | |

Colombier Acquisition Corp. II | |

| 534,833 | |

| | 40,000 | | |

DT Cloud Star Acquisition Corp. | |

| 403,600 | |

| | 65,000 | | |

EQV Ventures Acquisition Corp. | |

| 645,450 | |

| | 34,404 | | |

ESH Acquisition Corp. | |

| 365,026 | |

| | 57,276 | | |

Flag Ship Acquisition Corp. | |

| 579,060 | |

| | 30,880 | | |

FutureTech II Acquisition Corp. | |

| 339,989 | |

| | 50,000 | | |

GigCapital7 Corp | |

| 498,500 | |

| | 65,531 | | |

Globalink Investment, Inc. | |

| 743,122 | |

| | 58,868 | | |

GP-Act III Acquisition Corp. | |

| 593,389 | |

| | 35,000 | | |

Graf Global Corp | |

| 351,050 | |

| | 30,342 | | |

Haymaker Acquisition Corp. 4, Class A | |

| 323,446 | |

| | 25,000 | | |

HCM II Acquisition Corp. | |

| 250,250 | |

| | 64,668 | | |

Horizon Space Acquisition I Corp. | |

| 724,715 | |

| | 33,524 | | |

IB Acquisition Corp. | |

| 335,240 | |

| | 63,942 | | |

Inflection Point Acquisition Corp. II | |

| 687,377 | |

| | 78,504 | | |

Integrated Rail and Resources Acquisition Corp. | |

| 865,114 | |

| | 87,536 | | |

Integrated Wellness Acquisition Corp. | |

| 1,032,049 | |

| | 61,161 | | |

Iron Horse Acquisitions Corp. | |

| 623,231 | |

| | 50,000 | | |

Launch One Acquisition Corp. | |

| 500,000 | |

| | 66,874 | | |

Legato Merger Corp. III | |

| 681,780 | |

| | 55,008 | | |

Lionheart Holdings | |

| 551,180 | |

| | 65,000 | | |

M3-Brigade Acquisition V Corp. | |

| 651,950 | |

| | 58,028 | | |

Melar Acquisition Corp. I | |

| 579,990 | |

| | 66,944 | | |

Nabors Energy Transition Corp. II | |

| 713,623 | |

| | 42,162 | | |

Newbury Street Acquisition Corp. | |

| 460,409 | |

| | 243,512 | | |

Pershing Square Tontine Holdings(g) | |

| 2 | |

| | 285,935 | | |

PIMCO Dynamic Income Strategy Fund | |

| 6,745,207 | |

| | 32,460 | | |

Quetta Acquisition Corp. | |

| 337,584 | |

| | 25,000 | | |

Silverbox Corp. IV | |

| 250,750 | |

| | 50,000 | | |

SIM Acquisition Corp. I | |

| 502,000 | |

| | 32,462 | | |

Spark I Acquisition Corp. | |

| 340,462 | |

| | 65,000 | | |

Vine Hill Capital Investment Corp. | |

| 650,000 | |

| | 50,000 | | |

Voyager Acquisition Corp. | |

| 500,000 | |

| | 52,742 | | |

WinVest Acquisition Corp. | |

| 600,204 | |

| | | | |

| |

| | |

| TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES - COMMON SHARES/UNITS | |

| | |

| (Cost

$32,209,941) | |

| 37,876,744 | |

| | | | |

| |

| | |

| RIGHTS (0.07%) | |

| | |

| China - 0.01% | |

| | |

| | 52,566 | | |

Distoken Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 5,099 | |

| | 60,193 | | |

Global Lights Acquisition Corp, Strike Price $0.01, Expires 12/31/2049 | |

| 8,433 | |

| | | | |

| |

| | |

| Great Britain - 0.00%(f) | |

| | |

| | 62,670 | | |

ClimateRock, Strike Price $0.01, Expires 06/01/2027 | |

| 5,509 | |

| | | | |

| |

| | |

| Hong Kong - 0.00%(f) | |

| | |

| | 35,100 | | |

JVSPAC Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 9,487 | |

| | | | |

| |

| | |

| Malaysia - 0.00%(f) | |

| | |

| | 64,922 | | |

Kairous Acquisition Corp. ltd, Strike Price $11.50, Expires 11/24/2024 | |

| 4,551 | |

| Shares | | |

Description | |

Value

(Note 2) | |

| | 51,134 | | |

PHP Ventures Acquisition Corp., Strike Price $0.01, Expires 12/31/2049(g) | |

$ | 5,165 | |

| | | | |

| |

| | |

| Singapore - 0.01% | |

| | |

| | 50,470 | | |

A SPAC II Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 651 | |

| | 26,628 | | |

Chenghe Acquisition II Co., Strike Price $11.50, Expires 07/29/2029 | |

| 1,864 | |

| | 64,612 | | |

RF Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 7,760 | |

| | | | |

| |

| | |

| United States - 0.05% | |

| | |

| | 100 | | |

Advent Convertible and Income Fund, Strike Price $0.01, Expires 10/17/2024 | |

| 2 | |

| | 44,669 | | |

Aimei Health Technology Co., Ltd., Strike Price $0.01, Expires 12/31/2049 | |

| 10,274 | |

| | 24,649 | | |

Allegro Merger Corp., Strike Price $11.50, Expires 12/31/2049 | |

| – | |

| | 27,690 | | |

Alpha Star Acquisition Corp., Strike Price $0.01, Expires 12/13/2026 | |

| 2,971 | |

| | 51,497 | | |

Bannix Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 3,090 | |

| | 30,110 | | |

Bayview Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 4,519 | |

| | 54,328 | | |

Bellevue Life Sciences Acquisi, Strike Price $0.01, Expires 12/31/2045 | |

| 5,661 | |

| | 13,188 | | |

Black Hawk Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 15,298 | |

| | 65,000 | | |

Bowen Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 12,226 | |

| | 21,512 | | |

Breeze Holdings Acquisition Corp., Strike Price $0.01, Expires 12/31/2049(g) | |

| 3,765 | |

| | 32,760 | | |

Centurion Acquisition Corp., Strike Price $11.50, Expires 08/01/2029 | |

| 2,955 | |

| | 34,404 | | |

ESH Acquisition Corp., Strike Price $10.00, Expires 12/31/2049 | |

| 2,804 | |

| | 65,531 | | |

Globalink Investment, Inc., Strike Price $11.50, Expires 04/15/2025 | |

| 7,864 | |

| | 64,668 | | |

Horizon Space Acquisition I Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 4,850 | |

| | 33,524 | | |

IB Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 2,849 | |

| | 61,161 | | |

Iron Horse Acquisitions Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 9,786 | |

| | 67,493 | | |

Mars Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 15,523 | |

| | 29,014 | | |

Melar Acquisition Corp. I, Strike Price $11.50, Expires 06/01/2031 | |

| 2,611 | |

| | 67,514 | | |

Mountain Crest Acquisition Corp. V, Strike Price $0.01, Expires 12/31/2049 | |

| 5,401 | |

| | 69,600 | | |

NorthView Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 3,557 | |

| | 35,695 | | |

OneMedNet Corp., Strike Price $11.50, Expires 12/31/2028 | |

| 1,210 | |

| | 3,246 | | |

Quetta Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 4,220 | |

| | 32,618 | | |

Viveon Health Acquisition Corp., Strike Price $0.01, Expires 12/31/2049(g) | |

| 1,967 | |

| Shares | | |

Description | |

Value

(Note 2) | |

| | 66,708 | | |

Welsbach Technology Metals Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

$ | 7,338 | |

| | 102 | | |

Western Asset Global High Income Fund, Inc., Strike Price $0.01, Expires 10/10/2024 | |

| 1 | |

| | 52,742 | | |

WinVest Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 8,439 | |

| | 60,341 | | |

Yotta Acquisition Corp., Strike Price $0.01, Expires 12/31/2049 | |

| 5,437 | |

| | | | |

| |

| | |

| TOTAL RIGHTS | |

| | |

| (Cost $287,323) | |

| 193,137 | |

| | | | |

| |

| | |

| WARRANTS (0.06%) | |

| | |

| Austria - 0.01% | |

| | |

| | 41,618 | | |

Critical Metals Corp., Strike Price $11.50, Expires 06/06/2028 | |

| 9,988 | |

| | | | |

| |

| | |

| Canada - 0.00%(f) | |

| | |

| | 53,236 | | |

Borealis Foods, Inc., Strike Price $11.50, Expires 08/26/2026 | |

| 3,418 | |

| | 32,785 | | |

Swiftmerge Acquisition Corp., Strike Price $11.50, Expires 06/17/2028 | |

| 2,131 | |

| | | | |

| |

| | |

| Cayman Islands - 0.00%(f) | |

| | |

| | 7,840 | | |

Blockchain Coinvestors Acquisition Corp. I, Strike Price $11.50, Expires 11/01/2028 | |

| 180 | |

| | 24,010 | | |

Finnovate Acquisition Corp., Strike Price $11.50, Expires 09/30/2026 | |

| 480 | |

| | 25,071 | | |

Healthcare AI Acquisition Corp., Strike Price $11.50, Expires 12/14/2026 | |

| 627 | |

| | 32,014 | | |

Nvni Group, Ltd., Strike Price $11.50, Expires 11/01/2028 | |

| 659 | |

| | 14,153 | | |

Zapp Electric Vehicles Group, Ltd., Strike Price $11.50, Expires 03/03/2028 | |

| 140 | |

| | | | |

| |

| | |

| China - 0.00%(f) | |

| | |

| | 52,566 | | |

Distoken Acquisition Corp., Strike Price $11.50, Expires 03/30/2028 | |

| 747 | |

| | 2,171 | | |

ECARX Holdings, Inc., Strike Price $11.50, Expires 12/21/2027 | |

| 46 | |

| | 16,878 | | |

MicroAlgo, Inc., Strike Price $11.50, Expires 12/31/2027 | |

| 214 | |

| | 10,728 | | |

SunCar Technology Group, Inc., Strike Price $11.50, Expires 05/18/2028 | |

| 2,360 | |

| | | | |

| |

| | |

| Great Britain - 0.00%(f) | |

| | |

| | 31,335 | | |

ClimateRock, Strike Price $11.50, Expires 06/01/2027 | |

| 708 | |

| | | | |

| |

| | |

| Hong Kong - 0.00%(f) | |

| | |

| | 28,984 | | |

AGBA Group Holding, Ltd., Strike Price $11.50, Expires 03/15/2027 | |

| 6,376 | |

| | 20,306 | | |

MultiMetaVerse Holdings, Ltd., Strike Price $11.50, Expires 03/15/2027 | |

| 1,168 | |

| | 36,015 | | |

NewGenIvf Group, Ltd., Strike Price $11.50, Expires 06/26/2028 | |

| 605 | |

| | 7,982 | | |

Prenetics Global, Ltd., Strike Price $8.91, Expires 05/17/2027 | |

| 86 | |

| | | | |

| |

| | |

| Ireland - 0.00%(f) | |

| | |

| | 51,043 | | |

SMX Security Matters PLC, Strike Price $11.50, Expires 03/07/2028 | |

| 414 | |

| Shares | | |

Description | |

Value

(Note 2) | |

| Israel - 0.00%(f) | |

| | 55,368 | | |

Holdco Nuvo Group DG, Ltd., Strike Price $11.50, Expires 10/23/2028 | |

$ | 22 | |

| | 44,569 | | |

Hub Cyber Security, Ltd., Strike Price $11.50, Expires 02/27/2028 | |

| 637 | |

| | 77,424 | | |

Spree Acquisition Corp. 1, Ltd., Strike Price $11.50, Expires 12/22/2028(g) | |

| 8 | |

| | | | |

| |

| | |

| Luxembourg - 0.00%(f) | |

| | |

| | 14,063 | | |

Moolec Science SA, Strike Price $11.50, Expires 09/27/2027 | |

| 563 | |

| | | | |

| |

| | |

| Malaysia - 0.00%(f) | |

| | |

| | 32,461 | | |

Kairous Acquisition Corp. ltd, Strike Price $11.50, Expires 09/15/2026 | |

| 179 | |

| | 25,567 | | |

PHP Ventures Acquisition Corp., Strike Price $11.50, Expires 08/16/2028(g) | |

| 1,127 | |

| | | | |

| |

| | |

| Singapore - 0.01% | |

| | |

| | 25,235 | | |

A SPAC II Acquisition Corp., Strike Price $11.50, Expires 05/03/2027 | |

| 182 | |

| | 38,763 | | |

BitFuFu, Inc., Strike Price $11.50, Expires 06/07/2028 | |

| 14,497 | |

| | 53,773 | | |

ESGL Holdings, Ltd., Strike Price $11.50, Expires 09/24/2026 | |

| 591 | |

| | 54,501 | | |

Euda Health Holdings, Ltd., Strike Price $11.50, Expires 09/24/2026 | |

| 3,815 | |

| | 64,612 | | |

RF Acquisition Corp., Strike Price $11.50, Expires 05/01/2028 | |

| 1,299 | |

| | 25,712 | | |

RF Acquisition Corp. II, Strike Price $0.01, Expires 01/01/2049 | |

| 1,628 | |

| | | | |

| |

| | |

| Switzerland - 0.00%(f) | |

| | |

| | 43,768 | | |

Genesis Growth Tech Acquisition Corp., Strike Price $11.50, Expires 05/19/2028 | |

| 9 | |

| | | | |

| |

| | |

| Taiwan - 0.00%(f) | |

| | |

| | 20,390 | | |

Gorilla Technology Group, Inc., Strike Price $11.50, Expires 07/14/2027 | |

| 846 | |

| | | | |

| |

| | |

| United States - 0.04% | |

| | |

| | 28,748 | | |

Achari Ventures Holdings Corp. I, Strike Price $11.50, Expires 08/05/2026 | |

| 190 | |

| | 21,731 | | |

Aeries Technology, Inc., Strike Price $11.50, Expires 10/20/2026 | |

| 548 | |

| | 24,649 | | |

Allegro Merger Corp., Strike Price $11.50, Expires 12/31/2049 | |

| – | |

| | 27,690 | | |

Alpha Star Acquisition Corp., Strike Price $11.50, Expires 12/13/2026 | |

| 399 | |

| | 11,896 | | |

AltEnergy Acquisition Corp., Strike Price $11.50, Expires 11/02/2028 | |

| 133 | |

| | 8,612 | | |

Apexigen, Inc., Strike Price $11.50, Expires 08/31/2027(g) | |

| 225 | |

| | 130,463 | | |

Ares Acquisition Corp. II, Strike Price $11.50, Expires 06/12/2028 | |

| 20,874 | |

| | 30,397 | | |

AtlasClear Holdings, Inc., Strike Price $11.50, Expires 10/25/2028 | |

| 334 | |

| | 32,655 | | |

Ault Disruptive Technologies Corp., Strike Price $11.50, Expires 06/20/2028 | |

| 105 | |

| | 51,497 | | |

Bannix Acquisition Corp., Strike Price $11.50, Expires 07/31/2026 | |

| 1,030 | |

| | 1,245 | | |

Banzai International, Inc., Strike Price $575.00, Expires 12/31/2026 | |

| 10 | |

| Shares | | |

Description | |

Value

(Note 2) | |

| | 54,641 | | |

Battery Future Acquisition Corp., Strike Price $11.50, Expires 05/26/2028 | |

$ | 557 | |

| | 54,328 | | |

Bellevue Life Sciences Acquisi, Strike Price $11.50, Expires 02/10/2028 | |

| 1,304 | |

| | 81,786 | | |

Beneficient, Strike Price $11.50, Expires 03/14/2028 | |

| 703 | |

| | 15,057 | | |

Binah Capital Group, Inc., Strike Price $11.50, Expires 06/07/2028 | |

| 527 | |

| | 57,401 | | |

Blue Ocean Acquisition Corp., Strike Price $11.50, Expires 10/21/2028 | |

| 930 | |

| | 5,688 | | |

Brand Engagement Network, Inc., Strike Price $11.50, Expires 03/14/2029 | |

| 398 | |

| | 12,512 | | |

Breeze Holdings Acquisition Corp., Strike Price $11.50, Expires 05/25/2027 | |

| 2,628 | |

| | 23,792 | | |

Cactus Acquisition Corp. 1, Ltd., Strike Price $11.50, Expires 10/29/2026 | |

| 557 | |

| | 5,294 | | |

CERo Therapeutics Holdings, Inc., Strike Price $11.50, Expires 09/01/2026 | |

| 27 | |

| | 17,376 | | |

Colombier Acquisition Corp. II, Strike Price $11.50, Expires 12/31/2028 | |

| 5,560 | |

| | 15,030 | | |

Concord Acquisition Corp. II, Strike Price $11.50, Expires 12/31/2028 | |

| 526 | |

| | 51,016 | | |

Conduit Pharmaceuticals, Inc., Strike Price $11.50, Expires 02/03/2027 | |

| 612 | |

| | 2,087 | | |

Corner Growth Acquisition Corp., Strike Price $11.50, Expires 12/31/2027 | |

| – | |

| | 72,474 | | |

DIH Holdings US, Inc., Strike Price $11.50, Expires 02/07/2028 | |

| 2,899 | |

| | 17,658 | | |

Direct Selling Acquisition Corp., Strike Price $11.50, Expires 09/30/2028 | |

| 530 | |

| | 54,641 | | |

EVe Mobility Acquisition Corp., Strike Price $11.50, Expires 05/12/2028 | |

| 2,131 | |

| | 17,137 | | |

Everest Consolidator Acquisition Corp., Strike Price $11.50, Expires 07/19/2028 | |

| 509 | |

| | 4,804 | | |

ExcelFin Acquisition Corp., Strike Price $11.50, Expires 10/21/2026 | |

| 717 | |

| | 20,705 | | |

FOXO Technologies, Inc., Strike Price $11.50, Expires 08/01/2027 | |

| 27 | |

| | 30,880 | | |

FutureTech II Acquisition Corp., Strike Price $11.50, Expires 02/16/2027 | |

| 784 | |

| | 9,479 | | |

Global Gas Corp., Strike Price $11.50, Expires 10/29/2027 | |

| 37 | |

| | 65,531 | | |

Globalink Investment, Inc., Strike Price $11.50, Expires 12/03/2026 | |

| 1,638 | |

| | 29,434 | | |

GP-Act III Acquisition Corp., Strike Price $11.50, Expires 12/31/2027 | |

| 3,238 | |

| | 14,320 | | |

Griid Infrastructure, Inc., Strike Price $11.50, Expires 12/31/2027 | |

| 480 | |

| | 15,171 | | |

Haymaker Acquisition Corp. 4, Strike Price $11.50, Expires 09/12/2028 | |

| 2,427 | |

| | 24,100 | | |

Hennessy Capital Investment Corp. VI, Strike Price $11.50, Expires 12/31/2027 | |

| 1,687 | |

| | 64,668 | | |

Horizon Space Acquisition I Corp., Strike Price $11.50, Expires 01/26/2028 | |

| 983 | |

| | 50,640 | | |

iCoreConnect, Inc., Strike Price $11.50, Expires 05/15/2028 | |

| 56 | |

| | 31,971 | | |

Inflection Point Acquisition Corp. II, Strike Price $11.50, Expires 07/17/2028 | |

| 7,638 | |

| Shares | | |

Description | |

Value

(Note 2) | |

| | 39,252 | | |

Integrated Rail and Resources Acquisition Corp., Strike Price $11.50, Expires 11/12/2026 | |

$ | 1,570 | |

| | 43,768 | | |

Integrated Wellness Acquisition Corp., Strike Price $11.50, Expires 10/31/2028 | |

| 687 | |

| | 61,161 | | |

Iron Horse Acquisitions Corp., Strike Price $11.50, Expires 02/16/2029 | |

| 1,535 | |

| | 16,682 | | |

Jaws Mustang Acquisition Corp., Strike Price $11.50, Expires 01/30/2026 | |

| 385 | |

| | 68,194 | | |

Klotho Neurosciences, Inc., Strike Price $11.50, Expires 06/21/2029 | |

| 2,728 | |

| | 4,787 | | |

Learn CW Investment Corp., Strike Price $11.50, Expires 12/31/2028 | |

| 407 | |

| | 33,437 | | |

Legato Merger Corp. III, Strike Price $11.50, Expires 03/28/2029 | |

| 5,016 | |

| | 7,755 | | |

Maquia Capital Acquisition Corp., Strike Price $11.50, Expires 12/31/2027 | |

| 178 | |

| | 13,723 | | |

MSP Recovery, Inc., Strike Price $0.00, Expires 02/14/2026 | |

| 550 | |

| | 10,806 | | |

MultiSensor AI Holdings, Inc., Strike Price $11.50, Expires 09/01/2027 | |

| 281 | |

| | 33,472 | | |

Nabors Energy Transition Corp. II, Strike Price $11.50, Expires 09/05/2028 | |

| 3,013 | |

| | 19,815 | | |

Nature's Miracle Holding, Inc., Strike Price $11.50, Expires 03/12/2029 | |

| 260 | |

| | 32,271 | | |

New Horizon Aircraft, Ltd., Strike Price $11.50, Expires 04/03/2028 | |

| 397 | |

| | 21,081 | | |

Newbury Street Acquisition Corp., Strike Price $11.50, Expires 12/31/2027 | |

| 1,897 | |

| | 9,664 | | |

NKGen Biotech, Inc., Strike Price $11.50, Expires 05/31/2028 | |

| 683 | |

| | 4,228 | | |

Northern Revival Acquisition Corp., Strike Price $11.50, Expires 12/31/2027(g) | |

| 92 | |

| | 34,800 | | |

NorthView Acquisition Corp., Strike Price $11.50, Expires 08/02/2027 | |

| 1,305 | |

| | 5,790 | | |

Nuburu, Inc., Strike Price $11.50, Expires 09/07/2027 | |

| 30 | |

| | 6,735 | | |

Nukkleus, Inc., Strike Price $11.50, Expires 12/31/2025 | |

| 63 | |

| | 48,836 | | |

OceanTech Acquisitions I Corp., Strike Price $11.50, Expires 05/10/2026 | |

| – | |

| | 8,341 | | |

Onyx Acquisition Co. I, Strike Price $11.50, Expires 11/30/2028 | |

| 94 | |

| | 1,733 | | |

Peak Bio, Inc., Strike Price $11.50, Expires 12/31/2027 | |

| – | |

| | 60,878 | | |

PERSHING SQUARE SPARC HOLDINGS, Strike Price $0.01, Expires 12/31/2049(g) | |

| 1 | |

| | 35,388 | | |

Presto Automation, Inc., Strike Price $11.50, Expires 09/30/2025 | |

| 42 | |

| | 16,945 | | |

Priveterra Acquisition Corp. II, Strike Price $11.50, Expires 12/31/2025 | |

| 339 | |

| | 42,380 | | |

QT Imaging Holdings, Inc., Strike Price $11.50, Expires 12/31/2028 | |

| 466 | |

| | 37,808 | | |

Relativity Acquisition Corp., Strike Price $11.50, Expires 02/11/2027(g) | |

| 1,781 | |

| | 69 | | |

RMG Acquisition Corp. III, Strike Price $11.50, Expires 12/31/2027 | |

| – | |

| | 15,598 | | |

Roadzen, Inc., Strike Price $11.50, Expires 11/30/2028 | |

| 1,073 | |

| | 953 | | |

Roth CH Acquisition Co., Strike Price $11.50, Expires 10/29/2028 | |

| 1 | |

| | 30,975 | | |

Roth CH Acquisition V Co., Strike Price $11.50, Expires 12/10/2026 | |

| 1,462 | |

| Shares | | |

Description | |

Value

(Note 2) | |

| | 13,545 | | |

Royalty Management Holding Corp., Strike Price $11.50, Expires 05/28/2026 | |

$ | 142 | |

| | 20,602 | | |

Southland Holdings, Inc., Strike Price $11.50, Expires 09/01/2026 | |

| 7,652 | |

| | 32,793 | | |

Southport Acquisition Corp., Strike Price $11.50, Expires 05/24/2028 | |

| 2,623 | |

| | 16,231 | | |

Spark I Acquisition Corp., Strike Price $11.50, Expires 11/27/2028 | |

| 2,110 | |

| | 41,072 | | |

Syntec Optics Holdings, Inc., Strike Price $11.50, Expires 11/08/2026 | |

| 2,875 | |

| | 6,195 | | |

TLGY Acquisition Corp., Strike Price $11.50, Expires 01/14/2028 | |

| 186 | |

| | 32,618 | | |

Viveon Health Acquisition Corp., Strike Price $11.50, Expires 12/31/2027(g) | |

| 196 | |

| | 34,072 | | |

Volato Group, Inc., Strike Price $11.50, Expires 12/03/2028 | |

| 174 | |

| | 19,208 | | |

VSee Health, Inc., Strike Price $11.50, Expires 11/04/2028 | |

| 768 | |

| | 52,742 | | |

WinVest Acquisition Corp., Strike Price $11.50, Expires 02/19/2026 | |

| 717 | |

| | 6,768 | | |

XBP Europe Holdings, Inc., Strike Price $11.50, Expires 12/31/2027 | |

| 87 | |

| | 60,341 | | |

Yotta Acquisition Corp., Strike Price $11.50, Expires 03/15/2027 | |

| 1,267 | |

| | 48,471 | | |

ZyVersa Therapeutics, Inc., Strike Price $11.50, Expires 12/20/2026(g) | |

| 3,393 | |

| | | | |

| |

| | |

| TOTAL WARRANTS | |

| | |

| (Cost $785,576) | |

| 168,234 | |

| | | | |

| |

| | |

| EXCHANGE TRADED FUNDS (1.47%) | |

| | |

| United States - 1.47% | |

| | |

| | 50,000 | | |

Utilities Select Sector SPDR®

Fund | |

| 4,039,000 | |

| | | | |

| |

| | |

| TOTAL EXCHANGE TRADED FUNDS | |

| | |

| (Cost $2,922,186) | |

| 4,039,000 | |

| | | | |

| |

| | |

| Principal | | |

| |

| | |

Maturity | | |

Value | |

| Amount | | |

Description | |

Rate | | |

Date | | |

(Note 2) | |

| GOVERNMENT BOND (3.64%) | |

| United States - 3.64% |

| $ | 1,000,000 | | |

U.S. Treasury Note | |

| 0.140 | % | |

| 11/30/24 | | |

| 999,641 | |

| | 4,000,000 | | |

U.S. Treasury Note | |

| 0.200 | % | |

| 12/31/24 | | |

| 3,995,684 | |

| | 5,000,000 | | |

U.S. Treasury Note | |

| 0.380 | % | |

| 05/31/25 | | |

| 5,001,301 | |

| | | | |

| |

| | | |

| | | |

| | |

| TOTAL GOVERNMENT BOND |

| (Cost $9,985,065) | |

| | | |

| | | |

| 9,996,626 | |

| | | | |

| |

| | | |

| | | |

| | |

| |

| |

| |

7-Day | | |

Value | |

| Shares |

| |

Description | |

Yield | | |

(Note 2) | |

| SHORT-TERM INVESTMENTS (14.17%) |

| Money Market Fund - 14.17% |

| |

38,865,547 |

| |

State Street Institutional Treasury Money Market Fund Premier Class | |

| 4.97 | % | |

| 38,865,547 | |

| |

| |

| |

| | | |

| | |

| TOTAL SHORT-TERM INVESTMENTS |

| | | |

| | |

| (Cost $38,865,547) | |

| | | |

| 38,865,547 | |

| | |

| | |

7-Day | | |

Value | |

| Shares | |

Description | | |

Yield | | |

(Note 2) | |

| TOTAL INVESTMENTS (136.43%) | |

| | | |

| | |

| (Cost $330,843,261) | |

| | | |

$ | 374,294,454 | |

| | |

| | |

| | | |

| | |

| Series A Cumulative Perpetual Preferred Shares (-35.63) | |

| | | |

| (97,750,000 | ) |

| Liabilities in Excess of Other Assets (-0.80%)(h) | |

| | | |

| (2,182,610 | ) |

| NET ASSETS ATTRIBUTABLE TO COMMON SHAREHOLDERS (100.00%) | |

| | | |

$ | 274,361,844 | |

|

SCHEDULE

OF SECURITIES SOLD SHORT

| Description | |

Shares | | |

Value

(Note 2) | |

| EXCHANGE TRADED FUNDS - COMMON SHARES (-13.95%) | |

| | | |

| | |

| Invesco S&P 500 Equal Weight ETF | |

| (100,895 | ) | |

$ | (18,076,348 | ) |

| iShares Core S&P 500 ETF | |

| (35,000 | ) | |

| (20,188,700 | ) |

| | |

| | | |

| | |

| TOTAL EXCHANGE TRADED FUNDS - COMMON SHARES | |

| | | |

| (38,265,048 | ) |

| | |

| | | |

| | |

| TOTAL SECURITIES SOLD SHORT | |

| | | |

| | |

| (Proceeds $36,616,531) | |

| | | |

$ | (38,265,048 | ) |

| | |

| | | |

| | |

| (a) |

All

or a portion of the security is pledged as collateral for securities sold short. As of September 30, 2024, the aggregate value

of those securities was $17,243,500 representing 6.28% of net assets. |

| (b) |

Perpetual

maturity. |

| (c) |

Security exempt

from registration under Rule 144A of the Securities Act of 1933, as amended. This security may be resold in transactions exempt

from registration, normally to qualified institutional buyers. As of September 30, 2024, the market value of those Rule 144A

securities held by the Fund was $9,298,764 representing 3.39% of the Fund's net assets. |

| (d) |

Securities

were purchased pursuant to Regulation S under the Securities Act of 1933, as amended, which exempts securities offered and

sold outside of the United States from registration. Such securities cannot be sold in the United States without either an

effective registration statement filed pursuant to the Securities Act of 1933, as amended, or pursuant to an exemption from

registration. These securities have been deemed liquid under procedures approved by the Fund's Board of Directors (the "Board").

As of September 30, 2024, the aggregate fair value of those securities was $270,352 representing 0.10% of net assets. |

| (e) |

Non-income

producing security. |

| (f) |

Less than

0.005%. |

| (g) |

As a result

of the use of significant unobservable inputs to determine fair value, the investment has been classified as a Level 3 asset. |

| (h) |

Includes cash

in the amount of $35,027,298 which is being held as collateral for securities sold short. |

See

Notes to Quarterly Statement of Investments.

RiverNorth

Opportunities Fund, Inc.

Notes

to Quarterly Statement of Investments

September

30, 2024 (Unaudited)

1.

ORGANIZATION

RiverNorth

Opportunities Fund, Inc. (the “Fund”) was organized as a Maryland corporation on September 9, 2010. The Fund commenced

operations on December 24, 2015, and had no operations until that date other than those related to organizational matters and

the registration of its shares under applicable securities laws.

The

Fund is a diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended

(the “1940 Act”). The Fund’s Articles of Amendment and Restatement permit the Board of Directors (the “Board”

or “Directors”) to authorize and issue 37,500,000 shares of common stock with $0.0001 par value per share, 3,910,000

of which have been reclassified as Series A Perpetual Preferred Stock. The Fund is considered an investment company and therefore

follows the Investment Company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”)

Accounting Standards Codification (“ASC”) Topic 946 Financial Services – Investment Companies.

The

Fund may be converted to an open-end investment company at any time if approved by two-thirds of the Board and at least two-thirds

of the Fund’s total outstanding shares. If the Fund converted to an open-end investment company, it would be required to

redeem all preferred stock of the Fund then outstanding, if any (requiring in turn that it liquidate a portion of its investment

portfolio). Conversion to open-end status could also require the Fund to modify certain investment restrictions and policies.

The Board may at any time (but is not required to) propose conversion of the Fund to open-end status, depending upon its judgment

regarding the advisability of such action in light of circumstances then prevailing.

The

Fund’s investment adviser is RiverNorth Capital Management, LLC (the “Adviser”). The Fund’s investment

objective is total return consisting of capital appreciation and current income.

2.

SIGNIFICANT ACCOUNTING POLICIES

The

following is a summary of significant accounting policies followed by the Fund. These policies are in conformity with generally

accepted accounting principles in the United States of America (“U.S. GAAP”). The financial statements are prepared

in accordance with U.S. GAAP, which requires management to make estimates and assumptions that affect the reported amounts and

disclosures, including the disclosure of contingent assets and liabilities, in the financial statements during the reporting period.

Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates,

and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon

sale of the securities. The financial statements have been prepared as of the close of the New York Stock Exchange (“NYSE”)

on June 30, 2024.

The

Fund invests in closed-end funds, exchange-traded funds and business development companies (collectively, “Underlying Funds”),

each of which has its own investment risks. Those risks can affect the value of the Fund’s investments and therefore the

value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Underlying Fund than in another,

the Fund will have greater exposure to the risks of that Underlying Fund.

Security

Valuation: The Fund’s investments are generally valued at their fair value using market quotations. If a market quotation

is unavailable, a security may be valued at its estimated fair value as described in Note 3.

Securities

Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income

is recorded on the ex-dividend date. Interest income, which includes accretion of discounts and amortization of premiums calculated

using yield to maturity, is accrued and recorded as earned. Realized gains and losses from securities transactions and unrealized

appreciation and depreciation of securities are determined using the specific identification method for both financial reporting

and tax purposes.

3.

SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair

value is defined as the price that the Fund might reasonably expect to receive upon selling an investment in a timely transaction

to an independent buyer in the principal or most advantageous market of the investment. U.S. GAAP establishes a three-tier hierarchy

to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair

value measurements for disclosure purposes.

Inputs

refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about

risk, for example, the risk inherent in a particular valuation technique used to measure fair value including using such a pricing

model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable

inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based

on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting

entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed

based on the best information available in the circumstances.

Various

inputs are used in determining the value of the Fund’s investments. These inputs are

summarized in the three broad levels listed below.

Level

1 – Unadjusted quoted prices in active markets for identical investments, unrestricted assets or

liabilities that the Fund has the ability to access at the measurement date;

Level

2 – Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets

or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the

asset or liability; and

Level

3 – Significant unobservable prices or inputs (including the Fund’s own assumptions in determining

the fair value of investments) where there is little or no market activity for the asset or liability at the measurement

date.

The

inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes,

the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the

lowest level input that is significant to the fair value measurement in its entirety.

Equity

securities, including closed-end funds, exchange-traded funds and business development companies, are generally valued by using

market quotations, but may be valued on the basis of prices furnished by a pricing service when the Adviser believes such prices

more accurately reflect the fair market value of such securities. Securities that are traded on any stock exchange are generally

valued by the pricing service at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally

valued by the pricing service at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued

by the pricing service at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the

pricing service and when the market is considered active, the security will be classified as a Level 1 security. Sometimes, an

equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the

market is considered inactive. When this happens, the security will be classified as a Level 2 security. When market quotations

are not readily available, when the Adviser determines that the market quotation or the price provided by the pricing service

does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities

are valued as determined in good faith by the Adviser, as valuation designee, in conformity with guidelines adopted by and subject

to review by the Board. These securities will be categorized as Level 3 securities.

Investments

in mutual funds, including short term investments, are generally priced at the ending NAV provided by the service agent of the

funds. These securities will be classified as Level 1 securities.

Domestic

and foreign fixed income securities, including foreign and U.S. corporate bonds, foreign and U.S. government bonds, and business

development company notes are normally valued on the basis of quotes obtained from brokers and dealers or independent pricing

services. Foreign currency positions, including forward foreign currency contracts, are priced at the mean between the closing

bid and asked prices at 4:00 p.m. Eastern Time. Prices obtained from independent pricing services typically use information provided

by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics.

Data used to establish quotes includes analysis of cash flows, pre-payment speeds, default rates, delinquency assumptions and

assumptions regarding collateral and loss assumptions. These securities will be classified as Level 2 securities.

Pursuant

to the requirements of Rule 2a-5 under the 1940 Act, the Board approved updated valuation procedures for the Fund and designated

the Adviser as the Fund’s valuation designee to make all fair valuation determinations with respect to the Fund’s

portfolio investments, subject to the Board’s oversight.

In

accordance with the Fund’s good faith pricing guidelines, the Adviser is required to consider all appropriate factors relevant

to the value of securities for which it has determined other pricing sources are not available or reliable as described above.

No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case.

As a general principle, the current fair value of an issue of securities being valued by the Adviser would appear to be the amount

which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this

principle may, for example, be based on (i) a multiple of earnings; (ii) discounted cash flow models; (iii) weighted average cost

or weighted average price; (iv) a discount from market of a similar freely traded security (including a derivative security or

a basket of securities traded on other markets, exchanges or among dealers); or (v) yield to maturity with respect to debt issues,

or a combination of these and other methods. Good faith pricing is permitted if, in the Adviser’s opinion, the validity

of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a

small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation

that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of

market quotations.

Good

faith pricing may also be used in instances when the bonds in which the Fund invests default or otherwise cease to have market

quotations readily available.

The

following is a summary of the inputs used to value the Fund’s investments as of September 30, 2024:

| Investments in Securities at Value | |

Level 1 -

Quoted Prices | | |

Level 2 -

Other Significant Observable Inputs | | |

Level 3 -

Significant Unobservable Inputs | | |

Total | |

| Closed-End Funds - Common Shares | |

$ | 213,202,371 | | |

$ | – | | |

$ | – | | |

$ | 213,202,371 | |

| Closed-End Funds - Preferred Shares | |

| 2,830,543 | | |

| – | | |

| – | | |

| 2,830,543 | |

| Business Development Companies - Preferred Shares | |

| 3,901,990 | | |

| 2,107,455 | | |

| – | | |

| 6,009,445 | |

| Business Development Companies - Common Shares | |

| 2,220,264 | | |

| – | | |

| – | | |

| 2,220,264 | |

| Business Development Company Notes | |

| 2,760,427 | | |

| 7,305,298 | | |

| – | | |

| 10,065,725 | |

| Corporate Bonds | |

| – | | |

| 48,826,818 | | |

| – | | |

| 48,826,818 | |

| Special Purpose Acquisition Companies - Common Shares/Units | |

| 36,095,466 | | |

| 1,781,276 | | |

| 2 | | |

| 37,876,744 | |

| Rights | |

| 152,883 | | |

| 29,357 | | |

| 10,897 | | |

| 193,137 | |

| Warrants | |

| 154,995 | | |

| 6,416 | | |

| 6,823 | | |

| 168,234 | |

| Exchange Traded Funds | |

| 4,039,000 | | |

| – | | |

| – | | |

| 4,039,000 | |

| Government Bond | |

| – | | |

| 9,996,626 | | |

| – | | |

| 9,996,626 | |

| Short-Term Investments | |

| 38,865,547 | | |

| – | | |

| – | | |

| 38,865,547 | |

| Total | |

$ | 304,223,486 | | |

$ | 70,053,246 | | |

$ | 17,722 | | |

$ | 374,294,454 | |

| Other Financial Instruments | |

| | | |

| | | |

| | | |

| | |

| Liabilities: |

| Securities Sold Short |

| Exchange Traded Funds - Common Shares | |

$ | (38,265,048 | ) | |

$ | – | | |

$ | – | | |

$ | (38,265,048 | ) |

| Total | |

$ | (38,265,048 | ) | |

$ | – | | |

$ | – | | |

$ | (38,265,048 | ) |

For

the period ended September 30, 2024, there were no significant transfers into/out of Level 3.

Short

Sale Risks: The Fund and the Underlying Funds may engage in short sales. A short sale is a transaction in which a fund sells

a security it does not own in anticipation that the market price of that security will decline. To establish a short position,

a fund must first borrow the security from a broker or other institution. The fund may not always be able to borrow a security

at a particular time or at an acceptable price. Accordingly, there is a risk that a fund may be unable to implement its investment

strategy due to the lack of available securities or for other reasons. After selling a borrowed security, a fund is obligated

to “cover” the short sale by purchasing and returning the security to the lender at a later date. The Fund and the

Underlying Funds cannot guarantee that the security will be available at an acceptable price. Positions in shorted securities

are speculative and more risky than long positions (purchases) in securities because the maximum sustainable loss on a security

purchased is limited to the amount paid for the security plus the transaction costs, whereas there is no maximum attainable price

of the shorted security. Therefore, in theory, securities sold short have unlimited risk. Short selling will also result in higher

transaction costs (such as interest and dividends), and may result in higher taxes, which reduce a fund’s return.

Special

Purpose Acquisition Company Risk: The Fund

may invest in special purpose acquisition companies (“SPACs”). SPACs are collective investment structures that pool

funds in order to seek potential acquisition opportunities. SPACs are generally publicly traded companies that raise funds through

an initial public offering (“IPO”) for the purpose of acquiring or merging with another company to be identified subsequent

to the SPAC’s IPO. The securities of a SPAC are often issued in “units” that include one share of common stock

and one right or warrant (or partial right or warrant) conveying the right to purchase additional shares or partial shares. Unless

and until an acquisition is completed, a SPAC generally invests its assets (less an amount to cover expenses) in U.S. Government

securities, money market fund securities and cash. SPACs and similar entities may be blank check companies with no operating history

or ongoing business other than to seek a potential acquisition. Accordingly, the value of their securities is particularly dependent

on the ability of the entity’s management to identify and complete a profitable acquisition. Certain SPACs may seek acquisitions

only in limited industries or regions, which may increase the volatility of their prices. If an acquisition or merger that meets

the requirements for the SPAC is not completed within a predetermined period of time, the invested funds are returned to the entity’s

shareholders, less certain permitted expenses. Accordingly, any rights or warrants issued by the SPAC will expire worthless. Certain

private investments in SPACs may be illiquid and/or be subject to restrictions on resale. Additionally, the Fund may acquire certain

private rights and other interests issued by a SPAC (commonly referred to as “founder shares”), which may be subject

to forfeiture or expire worthless and which typically have more limited liquidity than SPAC shares issued in an IPO. To the extent

the SPAC is invested in cash or similar securities, this may impact a Fund’s ability to meet its investment objective.

Private

Debt Risk: The Fund may invest in notes issued

by private funds (“private debt”). Private debt often may be illiquid and is typically not listed on an exchange and

traded less actively than similar securities issued by public funds. For certain private debt, trading may only be possible through

the assistance of the broker who originally brought the security to the market and has a relationship with the issuer. Due to

the limited trading market, independent pricing services may be unable to provide a price for private debt, and as such the fair

value of the securities may be determined in good faith under procedures approved by the Board, which typically will include the

use of one or more independent broker quotes.

Rights

and Warrants Risks: Warrants are securities giving the holder the right, but not the obligation, to buy the stock of an issuer

at a given price (generally higher than the value of the stock at the time of issuance) during a specified period or perpetually.

Warrants do not carry with them the right to dividends or voting rights with respect to the securities that they entitle their

holder to purchase and they do not represent any rights in the assets of the issuer. As a result, warrants may be considered to

have more speculative characteristics than certain other types of investments. In addition, the value of a warrant does not necessarily

change with the value of the underlying securities and a warrant ceases to have value if it is not exercised prior to its expiration

date.

Rights

are usually granted to existing shareholders of a corporation to subscribe to shares of a new issue of common stock before it

is issued to the public. The right entitles its holder to buy common stock at a specified price. Rights have similar features

to warrants, except that the life of a right is typically much shorter, usually a few weeks.

During

the period ended September 30, 2024, the Fund invested in rights and warrants, which are disclosed in the Statement of Investments.

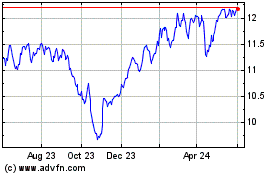

RiverNorth Opportunities (NYSE:RIV)

Historical Stock Chart

From Jan 2025 to Feb 2025

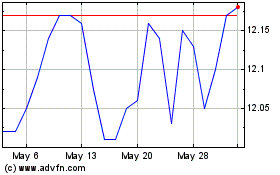

RiverNorth Opportunities (NYSE:RIV)

Historical Stock Chart

From Feb 2024 to Feb 2025