False000159767200015976722024-11-052024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED)

November 5, 2024

COMMISSION FILE NUMBER 001-36285

Incorporated in the State of Delaware

I.R.S. Employer Identification Number 46-4559529

Rayonier Advanced Materials Inc.

1301 Riverplace Boulevard, Jacksonville, Florida 32207

(Principal Executive Office)

Telephone Number: (904) 357-4600

Check the appropriate box below if the form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Exchange on which Registered |

| Common Stock, $0.01 par value | | RYAM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 2.02 Results of Operations and Financial Condition

On November 5, 2024, Rayonier Advanced Materials Inc. issued a press release announcing financial results for the quarter ended September 28, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

The information in this Item 2.02, including the accompanying exhibit, is furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and will not be incorporated by reference into any filing pursuant to the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| 99.1 | |

| 104 | Cover page interactive data file (embedded within the Inline XBRL document) |

Signature

Pursuant to the requirements of the Securities Exchange Act of l934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Rayonier Advanced Materials Inc. |

| |

| By: | /s/ GABRIELA GARCIA |

| Gabriela Garcia |

| Chief Accounting Officer and Vice President, Corporate Controller |

| |

| Date: November 5, 2024 |

RYAM Announces Strong Third Quarter 2024 Results, Reiterates EBITDA Guidance,

Increases Free Cash Flow Guidance and Successfully Refinances its Capital Structure

•Net sales for the third quarter of $401 million, up $32 million from prior year quarter

•Loss from continuing operations for the third quarter of $33 million, a decline of $6 million from prior year quarter, inclusive of a non-cash asset impairment of $25 million and indefinite suspension charges of $7 million

•Adjusted EBITDA from continuing operations for the third quarter of $51 million, up $27 million from prior year quarter

•Total debt of $773 million; Net Secured Debt of $622 million with a covenant net secured leverage ratio of 2.8 times

•2024 Adjusted EBITDA guidance of $205 million to $215 million, including impact from fire in Jesup plant

•2024 Adjusted Free Cash Flow guidance increased to $115 million to $125 million

•Successfully raised $700 million of secured term loan financing to refinance capital structure

JACKSONVILLE, Fla., November 5, 2024 - Rayonier Advanced Materials Inc. (NYSE:RYAM) (the “Company”) today reported results for its third quarter ended September 28, 2024.

“RYAM delivered another solid quarter of financial results as we continued to improve our product mix and manage operating costs. Demand for cellulose specialties has remained solid supporting the improved product mix and margins. We also generated $99 million of Adjusted Free Cash Flow, which supported a $37 million reduction of net secured debt in the quarter. As a result, we reduced our net secured leverage ratio to 2.8 times covenant EBITDA,” stated De Lyle Bloomquist, President and CEO of RYAM.

“With three quarters of strong financial results, we were on track to meet or exceed the $215 million high end of our EBITDA guidance for 2024. On October 11, we had an isolated fire at our largest plant in Jesup, Georgia, which we estimate will impact earnings by approximately $10 million and will require $3 million of maintenance capital in 2024. Our emergency response teams, along with local fire departments, did a great job managing the initial incident, while the whole team did a fantastic job getting the facility up and running in less than two weeks without any injuries to employees, contractors or the community. Despite the fire’s impact to EBITDA, we are reiterating our 2024 Adjusted EBITDA guidance of $205 million to $215 million and have increased our Free Cash Flow guidance to $115 million to $125 million.

“On the strength of 2024 earnings and a positive outlook for 2025, we refinanced the aggregate principal amounts of both our $453 million senior secured notes due in 2026 and our $246 million secured term loan due in 2027 with a new $700 million secured term loan due in 2029. We also extended our ABL credit facility for five years. These refinancings provide us with the flexibility and runway to continue to execute our long-term strategy to capture value from the core cellulose specialties business and grow the biomaterials business. In September, we announced price increases of up to 10 percent for our cellulose specialties products. With this announced price increase, along with more favorable supply and demand dynamics for our specialties products, we expect to realize higher pricing and improved margins for our core cellulose specialties business in 2025. Additionally, we expect to make a significant announcement in the coming quarter on the green capital that will help finance our biomaterials strategy,” concluded Mr. Bloomquist.

CORPORATE HEADQUARTERS

1301 Riverplace Boulevard Suite 2300 Jacksonville, FL 32207

904.357.4600 fax 904.357.9101 www.RYAM.com

Third Quarter 2024 Financial Results

The Company reported a net loss of $33 million, or $(0.49) per diluted share, for the quarter ended September 28, 2024, compared to a net loss of $25 million, or $(0.39) per diluted share, for the prior year quarter. Loss from continuing operations for the quarter ended September 28, 2024 was $33 million, or $(0.49) per diluted share, compared to a loss from continuing operations of $27 million, or $(0.41) per diluted share, for the prior year quarter.

The Company operates in three business segments: High Purity Cellulose, Paperboard and High-Yield Pulp.

Net sales was comprised of the following for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| (in millions) | September 28, 2024 | | June 29, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 |

| High Purity Cellulose | $ | 325 | | | $ | 332 | | | $ | 292 | | | $ | 964 | | | $ | 966 | |

| Paperboard | 55 | | | 60 | | | 57 | | | 168 | | | 164 | |

| High-Yield Pulp | 28 | | | 33 | | | 25 | | | 95 | | | 111 | |

| Eliminations | (7) | | | (6) | | | (5) | | | (19) | | | (20) | |

| Net sales | $ | 401 | | | $ | 419 | | | $ | 369 | | | $ | 1,208 | | | $ | 1,221 | |

Operating results were comprised of the following for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| (in millions) | September 28, 2024 | | June 29, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 |

| High Purity Cellulose | $ | (6) | | | $ | 30 | | | $ | (6) | | | $ | 45 | | | $ | 7 | |

| Paperboard | 7 | | | 12 | | | 13 | | | 27 | | | 29 | |

| High-Yield Pulp | — | | | 1 | | | (6) | | | — | | | 2 | |

| Corporate | (18) | | | (15) | | | (15) | | | (44) | | | (42) | |

| Operating income (loss) | $ | (17) | | | $ | 28 | | | $ | (14) | | | $ | 28 | | | $ | (4) | |

High Purity Cellulose

Net sales for the third quarter increased $33 million, or 11 percent, compared to the same prior year quarter. Included in the current and prior year quarters were $26 million and $28 million, respectively, of other sales primarily from bio-based energy and lignosulfonates. Total sales prices increased 13 percent due to a higher mix of cellulose specialties and included 2 percent and 5 percent increases in cellulose specialties and commodity prices, respectively. Total sales volumes were nearly flat as a 32 percent increase in cellulose specialties volumes was offset by a 24 percent decrease in commodity volumes. The cellulose specialties sales volumes increase includes additional volumes sold to customers affected by the indefinite suspension of Temiscaming HPC operations that began in the third quarter, the closure of a competitor’s plant in late 2023, the easing of prior year customer destocking and a continued uptick in ethers sales volumes. The decrease in commodity sales volumes was primarily driven by a higher mix of cellulose specialties production and the indefinite suspension of Temiscaming HPC operations.

Net sales for the nine months ended September 28, 2024 was nearly flat compared to the same prior year period. Included in the current and prior year nine-month periods were $72 million and $73 million, respectively, of other sales primarily from bio-based energy and lignosulfonates. Total sales prices increased 5 percent due to a 1 percent increase in cellulose specialties prices that was partially offset by a 3 percent decrease in commodity prices. Despite a cellulose specialties sales volumes increase of 10 percent, total sales volumes decreased 5 percent driven by a 19 percent decrease in commodity volumes. Increased cellulose specialties sales volumes resulting from the additional volumes sold ahead of the suspension of Temiscaming HPC operations, the closure of a competitor’s plant in late 2023, the easing of prior year customer destocking and an uptick in ethers sales volumes were partially offset by the one-time favorable impact from a change in customer contract terms in the prior year first quarter. The decrease in commodity sales volumes was primarily driven by a higher mix of cellulose specialties production and the indefinite suspension of Temiscaming HPC operations.

CORPORATE HEADQUARTERS

1301 Riverplace Boulevard Suite 2300 Jacksonville, FL 32207

904.357.4600 fax 904.357.9101 www.RYAM.com

Operating results for the quarter and nine months ended September 28, 2024 were nearly flat and improved $38 million, respectively, compared to the same prior year periods despite one-time charges of $7 million and $14 million, respectively, related to the indefinite suspension of Temiscaming HPC operations and an associated $25 million non-cash asset impairment. Results also included $4 million of Temiscaming HPC continuing custodial site costs. The quarter results were driven by the higher cellulose specialties sales prices and volumes and lower key input costs, offset by the indefinite suspension charges, asset impairment, custodial site costs and lower commodity sales volumes. The increase in operating income in the nine-month period was driven by the higher cellulose specialties sales prices and volumes, lower key input and logistics costs and the recognition of $5 million in Canada Emergency Wage Subsidy (CEWS) benefit claims deferred since 2021. Partially offsetting these increases were the indefinite suspension charges, asset impairment, custodial site costs, the lower commodity sales prices and volumes, the impact of the timing of planned maintenance outages compared to the prior year, the prior year recognition of a $3 million benefit from payroll tax credit carryforwards that is not expected to repeat and $11 million of energy cost benefits from sales of excess emission allowances recognized in the prior year, the current year sales of which are expected in the fourth quarter.

Compared to the second quarter of 2024, net sales decreased $7 million as cellulose specialties sales prices were nearly flat and commodity sales prices decreased 3 percent. Total sales volumes decreased 3 percent, driven by a 1 percent decrease in cellulose specialties volumes and a 6 percent decrease in commodity volumes due to the indefinite suspension of operations in Temiscaming. Operating results declined $36 million primarily due to the third-quarter asset impairment, the decreases in sales prices and volumes, the impact of the timing of planned maintenance outages compared to last quarter and the second-quarter CEWS benefit. Third quarter results also included $4 million of continuing custodial site costs. Partially offsetting these declines were lower logistics costs.

Paperboard

Net sales for the third quarter decreased $2 million, or 4 percent, compared to the same prior year quarter. Net sales for the nine months ended September 28, 2024 increased $4 million, or 2 percent, compared to the same period year period. Sales volumes were nearly flat and increased 11 percent during the quarter and nine-month periods, respectively, with the increase driven by the easing of prior year customer destocking in the current year. Sales prices decreased 4 percent and 8 percent, respectively, driven by mix and increased competitive activity from European imports.

Operating income for the quarter and nine months ended September 28, 2024 decreased $6 million and $2 million, respectively, compared to the same prior year periods. The quarter decrease was driven by the lower sales prices and higher purchased pulp costs. The nine-month decrease was driven by the lower sales prices and the impact of the planned maintenance outage in the prior year, partially offset by the higher sales volumes, lower purchased pulp costs and the recognition of $2 million in CEWS benefit claims deferred since 2021.

Compared to the second quarter of 2024, operating income decreased $5 million driven by an 11 percent decrease in sales volumes, due to decreased demand, higher purchased pulp costs and the second-quarter CEWS benefit, partially offset by a 1 percent increase in sales prices.

High-Yield Pulp

Net sales for the third quarter increased $3 million, or 12 percent, compared to the same prior year quarter driven by a 14 percent increase in sales prices, partially offset by a 3 percent decrease in sales volumes driven by timing of shipments. Net sales for the nine months ended September 28, 2024 decreased $16 million, or 14 percent, compared to the same prior year period driven by 11 percent and 6 percent decreases in sales prices and volumes, respectively, due to market supply dynamics in China, lower demand and timing of shipments.

Operating results for the quarter and nine months ended September 28, 2024 improved $6 million and decreased $2 million, respectively, compared to the same prior year periods. The improvement in the quarter results was driven by the higher sales prices and higher productivity, partially offset by the lower sales volumes. The decline in the nine-month results was driven by the lower sales prices and volumes, partially offset by lower logistics, chemicals and wood costs, higher productivity and the recognition of $2 million in CEWS benefit claims deferred since 2021.

Compared to the second quarter of 2024, operating income decreased $1 million driven by to 3 percent and 16 percent decreases in sales prices and volumes, respectively, and the second-quarter CEWS benefit, partially offset by higher productivity.

CORPORATE HEADQUARTERS

1301 Riverplace Boulevard Suite 2300 Jacksonville, FL 32207

904.357.4600 fax 904.357.9101 www.RYAM.com

Corporate

Operating loss for the quarter and nine months ended September 28, 2024 increased $3 million and $2 million, respectively, compared to the same prior year periods. The increase in the quarter loss was driven by unfavorable foreign exchange rates in the current period compared to favorable rates in the prior period and higher environmental and variable compensation expense. The increase in the nine-month period loss was driven by higher costs related to the Company’s ERP transformation project, variable and other compensation and discounting and financing fees, partially offset by favorable foreign exchange rates in the current period compared to unfavorable rates in the prior period.

Compared to the second quarter of 2024, the operating loss increased $3 million driven by unfavorable foreign exchange rates in the current quarter compared to favorable rates in the second quarter and higher discounting and financing fees and environmental expense.

Non-Operating Income & Expense

Interest expense for the quarter and nine months ended September 28, 2024 was nearly flat and increased $10 million, respectively, compared to the same prior year periods. The increase in the nine-month period was driven by an increase in the average effective interest rate on debt, partially offset by a decrease in the average outstanding principal balance. Total debt increased $24 million from September 30, 2023 to September 28, 2024, as the Company secured $26 million of green capital to further its biomaterials strategy.

Interest income for the quarter and nine months ended September 28, 2024 decreased $2 million and $3 million, respectively, compared to the same prior year periods driven by the prior year timing of the receipt of the 2027 Term Loan proceeds and their subsequent use in the repayment of senior notes.

Unfavorable foreign exchange rates during the quarter ended September 28, 2024 compared to favorable rates in the same prior year quarter resulted in a net unfavorable impact of $1 million. The net impact when comparing the current and prior year nine-month periods was favorable but immaterial.

Also included in “other income, net” in the quarter and nine months ended September 30, 2023 was a $1 million net loss on debt extinguishment. Additionally, a $2 million gain on a passive land sale and a $2 million pension settlement loss were recorded during the prior year nine-month period.

Income Taxes

The effective tax rate on the loss from continuing operations for the quarter and nine months ended September 28, 2024 was a benefit of 13 percent and 19 percent, respectively. The 2024 effective tax rate differed from the federal statutory rate of 21 percent primarily due to changes in the valuation allowance on disallowed interest deductions, the release of certain tax reserves, different statutory tax rates in foreign jurisdictions, U.S. tax credits, excess deficit on vested stock compensation and return-to-accrual adjustments.

The effective tax rate on the loss from continuing operations for the quarter and nine months ended September 30, 2023 was a benefit of 17 percent and 22 percent, respectively. The 2023 effective tax rates differed from the federal statutory rate of 21 percent primarily due to disallowed interest deductions in the U.S. and nondeductible executive compensation, offset by U.S. tax credits, return-to-accrual adjustments related to previously filed tax returns, changes in the valuation allowance on disallowed interest deductions and interest received on overpayments of tax from prior years. The effective tax rate for the nine-month period was also impacted by an excess tax benefit on vested stock compensation.

Discontinued Operations

During the nine months ended September 28, 2024, the Company recorded pre-tax income from discontinued operations of $5 million related to CEWS benefit claims deferred since 2021 and a pre-tax loss of $1 million on the sale of its softwood lumber duty refund rights.

During the quarter and nine months ended September 30, 2023, the USDOC completed its administrative review of duties applied to Canada softwood lumber exports to the U.S. during 2021 and reduced rates applicable to the Company, for which the Company recorded a pre-tax gain of $2 million. Also during the nine months ended September 30, 2023, the Company incurred a $2 million pre-tax loss related to the settlement of a claim pursuant to the representations and warranties in the asset purchase agreement.

CORPORATE HEADQUARTERS

1301 Riverplace Boulevard Suite 2300 Jacksonville, FL 32207

904.357.4600 fax 904.357.9101 www.RYAM.com

Cash Flows & Liquidity

The Company generated operating cash flows of $149 million during the nine months ended September 28, 2024, driven by proceeds of $39 million for the sale of its softwood lumber duty refund rights and net tax refunds of $20 million, partially offset by cash outflows from working capital and payments of interest on long-term debt.

The Company used $80 million in investing activities during the nine months ended September 28, 2024 related to net capital expenditures, which included $30 million of strategic capital spending focused on the investment in the 2G bioethanol plant in Tartas.

The Company had $10 million of net cash outflows from financing activities during the nine months ended September 28, 2024 primarily for the net repayment of long-term debt and Term Loan financing fees paid in the first quarter.

In October 2024, the Company raised $700 million in aggregate principal amount of secured term loan financing and received net proceeds of $683 million after original issue discount, which will be used in the fourth quarter, together with cash on hand, to redeem the respective $453 million and $246 million outstanding principal balances of the 2026 Notes and 2027 Term Loan and pay fees and expenses related to the transaction. The 2029 Term Loan matures in October 2029, bears interest at an annual rate equal to three-month Term SOFR plus an initial spread of 7 percent and requires quarterly principal payments of $1.75 million. The initial spread may fluctuate by one half percent based on the Company’s net secured leverage ratio. The Company may voluntarily make prepayments at any time, subject to customary breakage costs and, if within the first three anniversaries of closing, an additional premium. The agreement governing the 2029 Term Loan contains various customary covenants, including the requirement to maintain a specified consolidated net secured leverage ratio, based on covenant EBITDA.

In conjunction with the successful refinancing of its capital structure, the Company secured commitments for a five-year $175 million ABL credit facility that better aligns with its current portfolio. The facility is initially priced at Term SOFR plus a spread of 2 percent. As of the end of the quarter, there were no outstanding borrowings on the existing ABL Credit Facility and $35 million in letters of credit issued.

In September 2024, the Company repurchased $12 million principal of its 2026 Notes through open-market transactions for $12 million cash.

The Company ended the third quarter with $281 million of global liquidity, including $136 million of cash, borrowing capacity under the ABL Credit Facility of $135 million and $10 million of availability under the France factoring facility.

As of September 28, 2024, the Company’s consolidated net secured leverage ratio was 2.8 times covenant EBITDA.

Business Outlook

In October 2023, the Company announced that it is exploring the potential sale of its Paperboard and High-Yield Pulp assets located at its Temiscaming site. The Company remains committed to pursuing a sale of these assets at a fair price.

In July 2024, the Company indefinitely suspended operations at its Temiscaming HPC plant. This plan is expected to mitigate high capital needs and operating losses related to exposure to commodity viscose products and improve the Company’s consolidated free cash flow; however, future operational loss reductions will be partially offset by continuing custodial site expenses. In connection with the suspension of operations, the Company has incurred one-time operating charges, including mothballing and severance and other employee costs, of $14 million and a $25 million non-cash asset impairment. Potential remaining one-time charges to be incurred in the fourth quarter are estimated at $2 million to $3 million. For 2024, the suspension of the Temiscaming HPC plant is expected to be positive to Adjusted EBITDA. Free cash flow is expected to increase by $30 million to $35 million in 2024 as lower capital expenditures and benefits from the monetization of working capital are expected to more than offset the one-time and other cash costs associated with the suspension of operations.

In October 2024, an isolated fire occurred at the Company’s Jesup plant during planned maintenance activity. There were no injuries to employees or contractors and no risk to the surrounding community. The plant’s C line operations resumed within two days and the A and B lines’ operations resumed within a two-week period. While the Company continues to assess the financial impact of the incident, the unfavorable impact to EBITDA in 2024 is expected to approximate $10 million, with an additional required $3 million of maintenance capital. Additional capital expenditures will be required over the next couple of years to complete repairs. The Company carries insurance for property and business interruption loss with a $15 million combined deductible.

CORPORATE HEADQUARTERS

1301 Riverplace Boulevard Suite 2300 Jacksonville, FL 32207

904.357.4600 fax 904.357.9101 www.RYAM.com

The Company expects to generate $205 million to $215 million of Adjusted EBITDA in 2024 with $115 million to $125 million of Adjusted Free Cash Flow, including passive asset sales but excluding any operating asset sales.

The following market assessment represents the Company’s current outlook of its business segments’ future performance.

High Purity Cellulose

Average sales prices for cellulose specialties in 2024 are expected to increase by a low single-digit percentage as compared to average sales prices in 2023 as the Company continues to prioritize value over volume. Sales volumes for cellulose specialties are expected to increase compared to 2023 driven by increased volumes from the closure of a competitor’s plant, a modest increase in ethers demand and additional volume sold to customers affected by the indefinite suspension of Temiscaming HPC operations, partially offset by a one-time favorable impact from a change in customer contract terms in the prior year first quarter, customer destocking in the acetate markets and reduced sales related to the fire in Jesup. Demand for RYAM’s commodity products remains steady. Sales prices for fluff products are expected to decline by a high single-digit percentage compared to 2023, while sales volumes are projected to increase by nearly 30 percent year over year. For non-fluff commodities, average sales prices are expected to rise by a mid-single-digit percentage over 2023 levels, though sales volumes are expected to decrease nearly 50 percent compared to 2023 levels, aligned with strategic initiatives to reduce exposure to non-fluff commodities. Pricing for all commodity HPC products is forecasted to soften slightly in Q4, with volumes seeing a modest increase sequentially. Costs are expected to be lower in 2024 driven by lower key input and logistics costs, improved productivity and the suspension of operations at the Temiscaming HPC plant, partially offset by increased costs due to the timing of maintenance projects, net custodial site expenses related to the suspension and recovery costs related to the Jesup fire. The Company’s bioethanol facility in Tartas, France became operational in the first quarter of 2024 and is expected to deliver approximately $3 million to $4 million of EBITDA in 2024, growing to $8 million to $10 million beginning in 2025. EBITDA in the fourth quarter of 2024 is expected to be lower than the third quarter of 2024 due to the anticipated net custodial site expenses at the Temiscaming site, Jesup fire repair costs and the impact of the fire on sales and costs.

Looking forward to 2025, the Company announced price increases of up to 10 percent for its cellulose specialties products, as contracts allow, and expects higher margins for cellulose specialties in the coming year. The Company expects to continue reducing its exposure to non-fluff commodities in 2025.

Paperboard

Paperboard prices are expected to decrease in the fourth quarter while sales volumes are expected to increase. Raw material prices are expected to increase compared to the third quarter. Overall, the Company expects a decline in EBITDA from this segment in the coming quarters as market pressure continues with new competitive supply coming online in 2025.

High-Yield Pulp

High-Yield Pulp prices are expected to decline in the fourth quarter, while sales volumes are expected to increase significantly due to timing of shipments. Overall, the Company expects to incur a loss in EBITDA from this segment in the coming quarter due to the decline in sales prices. Current pricing is expected to remain low in the coming quarters.

Corporate

Corporate costs are expected to decrease in the fourth quarter subject to fluctuations in foreign exchange rates.

Biomaterials Strategy

The Company continues to invest in new products to provide both increased end market diversity and incremental profitability. These new products will target the growing green energy and renewable product markets. Current projects include:

•The Company’s bioethanol facility in Tartas, France is operating to available feedstock and represents a significant milestone towards the Company’s goal of generating $42 million of annual EBITDA from all of RYAM’s future biomaterial products in 2027.

•The Company has submitted notice of its GRAS (generally recognized as safe) self-certification for a prebiotics product to the U.S. Food and Drug Administration and continues to move forward with plans for a bioethanol facility in Fernandina.

CORPORATE HEADQUARTERS

1301 Riverplace Boulevard Suite 2300 Jacksonville, FL 32207

904.357.4600 fax 904.357.9101 www.RYAM.com

•The Company’s involvement in AGE (Altamaha Green Energy), a company that aims to utilize renewable forestry waste and other biomass generally discarded as waste to generate sustainable electricity for the state of Georgia. While still in the development phase, the project achieved a significant milestone when AGE was recently awarded a Purchase Power Agreement to sell electricity to Georgia Power Company. Additional information regarding the progress of this project will be shared in 2025.

The Company is also advancing various other projects and expects to secure financing for many of these projects in the coming quarter.

Conference Call Information

RYAM will host a conference call and live webcast at 9:00 a.m. ET on Wednesday, November 6, 2024, to discuss these results. Supplemental materials and access to the live audio webcast will be available at www.RYAM.com. A replay of this webcast will be archived on the Company’s website shortly after the call.

Investors may listen to the conference call by dialing 877-407-8293, no passcode required. For international parties, dial 201-689-8349. A replay of the teleconference will be available one hour after the call ends until 6:00 p.m. ET on Wednesday, November 20, 2024. The replay dial-in number within the U.S. is 877-660-6853, international is 201-612-7415, Conference ID: 13749556.

About RYAM

RYAM is a global leader of cellulose-based technologies, including high purity cellulose specialties, a natural polymer commonly used in the production of filters, food, pharmaceuticals and other industrial applications. RYAM’s specialized assets, capable of creating the world’s leading high purity cellulose products, are also used to produce biofuels, bioelectricity and other biomaterials such as bioethanol and tall oils. The Company also manufactures products for the paper and packaging markets. With manufacturing operations in the U.S., Canada and France, RYAM generated $1.6 billion of revenue in 2023. More information is available at www.RYAM.com.

Contacts

| | | | | | | | |

| Media | Ryan Houck | 904-357-9134 |

| Investors | Mickey Walsh | 904-357-9162 |

Forward-Looking Statements

Certain statements in this document regarding anticipated financial, business, legal or other outcomes, including business and market conditions, outlook and other similar statements relating to future events, developments or financial or operational performance or results, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “should,” “expect,” “estimate,” “target,” “believe,” “intend,” “plan,” “forecast,” “anticipate,” “guidance” and other similar language. However, the absence of these or similar words or expressions does not mean a statement is not forward-looking. Forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that these expectations will be attained, and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. All statements made in this earnings release are made only as of the date set forth at the beginning of this release. The Company undertakes no obligation to update the information made in this release in the event facts or circumstances subsequently change after the date of this release. The Company has not filed its Form 10-Q for the quarter ended September 28, 2024. As a result, all financial results described in this earnings release should be considered preliminary, and are subject to change to reflect any necessary adjustments or changes in accounting estimates, that are identified prior to the time the Company files its Form 10-Q.

The Company’s operations are subject to a number of risks and uncertainties including, but not limited to, those listed below. When considering an investment in the Company’s securities, you should carefully read and consider these risks, together with all other information in the Company’s Annual Report on Form 10-K and other filings and submissions to the SEC, which provide more information and detail on the risks described below. If any of the events described in the following risk factors occur, the Company’s business, financial condition, operating results and cash flows, as well as the market price of the Company’s securities, could be materially adversely affected. These risks and events include, without limitation: Macroeconomic and Industry Risks The Company’s business, financial condition and results of operations could be adversely affected by disruptions in the global economy caused by geopolitical conflicts and related impacts. The Company is subject to risks associated with epidemics and pandemics, which could have a material adverse impact on the Company’s business, financial condition, results of operations and cash flows. The businesses the Company operates are highly competitive and many of them are cyclical, which may result in fluctuations in pricing and volume that can materially adversely affect the Company’s business, financial condition, results of operations and cash flows. Changes in the availability and price of raw materials and energy and continued

CORPORATE HEADQUARTERS

1301 Riverplace Boulevard Suite 2300 Jacksonville, FL 32207

904.357.4600 fax 904.357.9101 www.RYAM.com

inflationary pressure could have a material adverse effect on the Company’s business, financial condition and results of operations. The Company is subject to material risks associated with doing business outside of the United States. Foreign currency exchange fluctuations may have a material adverse impact on the Company’s business, financial condition and results of operations. Restrictions on trade through tariffs, countervailing and anti-dumping duties, quotas and other trade barriers, in the United States and internationally, could materially adversely affect the Company’s ability to access certain markets. Business and Operational Risks The Company’s ten largest customers represented approximately 40 percent of 2023 revenue and the loss of all or a substantial portion of revenue from these customers could have a material adverse effect on the Company’s business. A material disruption at any of the Company’s manufacturing plants could prevent the Company from meeting customer demand, reduce sales and profitability, increase the cost of production and capital needs, or otherwise materially adversely affect the Company’s business, financial condition and results of operations. Unfavorable changes in the availability of, and prices for, wood fiber may have a material adverse impact on the Company’s business, financial condition and results of operations. Substantial capital is required to maintain the Company’s production facilities, and the cost to repair or replace equipment, as well as the associated downtime, could materially adversely affect the Company’s business. The Company faces substantial asset risk, including the potential for impairment related to long-lived assets and the potential impact to the value of recorded deferred tax assets. The Company depends on third parties for transportation services and unfavorable changes in the cost and availability of transportation could materially adversely affect the Company’s business. Failure to maintain satisfactory labor relations could have a material adverse effect on the Company’s business. The Company is dependent upon attracting and retaining key personnel, the loss of whom could materially adversely affect the Company’s business. Failure to develop new products or discover new applications for existing products, or inability to protect the intellectual property underlying new products or applications, could have a material adverse impact on the Company’s business. Loss of Company intellectual property and sensitive data or disruption of manufacturing operations due to a cybersecurity incident could materially adversely impact the business. Regulatory and Environmental Risks The Company’s business is subject to extensive environmental laws, regulations and permits that may materially restrict or adversely affect how the Company conducts business and its financial results. The potential longer-term impacts of climate-related risks remain uncertain at this time. Regulatory measures to address climate change may materially restrict how the Company conducts business or adversely affect its financial results. Financial Risks The Company may need to make significant additional cash contributions to its retirement benefit plans if investment returns on pension assets are lower than expected or interest rates decline, and/or due to changes to regulatory, accounting and actuarial requirements. The Company has debt obligations that could materially adversely affect the Company’s business and its ability to meet its obligations. Covenants in the Company’s debt agreements may impair its ability to operate its business. Challenges in the commercial and credit environments may materially adversely affect the Company’s future access to capital. The Company may require additional financing in the future to meet its capital needs or to make acquisitions, and such financing may not be available on favorable terms, if at all, and may be dilutive to existing stockholders. Common Stock and Certain Corporate Matters Risks Stockholders’ ownership in RYAM may be diluted. Certain provisions in the Company’s amended and restated certificate of incorporation and bylaws, and of Delaware law, could prevent or delay an acquisition of the Company, which could decrease the price of its common stock.

Other important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements that may have been made in this document are described or will be described in the Company’s filings with the U.S. Securities and Exchange Commission, including the Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The Company assumes no obligation to update these statements except as is required by law.

Non-GAAP Financial Measures

This earnings release and the accompanying schedules contain certain non-GAAP financial measures, including EBITDA, adjusted EBITDA, adjusted free cash flow, adjusted net income, adjusted net debt and net secured debt. The Company believes these non-GAAP financial measures provide useful information to its Board of Directors, management and investors regarding its financial condition and results of operations. Management uses these non-GAAP financial measures to compare its performance to that of prior periods for trend analyses, to determine management incentive compensation and for budgeting, forecasting and planning purposes.

The Company does not consider these non-GAAP financial measures an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they may exclude significant expense and income items that are required by GAAP to be recognized in the consolidated financial statements. In addition, they reflect the exercise of management’s judgment about which expense and income items are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, reconciliations of the non-GAAP financial measures to their most directly comparable GAAP financial measures are provided below. Non-GAAP financial measures are not necessarily indicative of results that may be generated in future periods and should not be relied upon, in whole or part, in evaluating the financial condition, results of operations or future prospects of the Company.

CORPORATE HEADQUARTERS

1301 Riverplace Boulevard Suite 2300 Jacksonville, FL 32207

904.357.4600 fax 904.357.9101 www.RYAM.com

Rayonier Advanced Materials Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(in millions, except share and per share information)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 28, 2024 | | June 29, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 |

| Net sales | $ | 401 | | | $ | 419 | | | $ | 369 | | | $ | 1,208 | | | $ | 1,221 | |

| Cost of sales | (357) | | | (371) | | | (360) | | | (1,079) | | | (1,160) | |

| Gross margin | 44 | | | 48 | | | 9 | | | 129 | | | 61 | |

| Selling, general and administrative expense | (24) | | | (21) | | | (22) | | | (66) | | | (59) | |

| Foreign exchange gain (loss) | (2) | | | — | | | 1 | | | 1 | | | (1) | |

| Asset impairment | (25) | | | — | | | — | | | (25) | | | — | |

| Indefinite suspension charges | (7) | | | (7) | | | — | | | (14) | | | — | |

| Other operating income (expense), net | (3) | | | 8 | | | (2) | | | 3 | | | (5) | |

| Operating income (loss) | (17) | | | 28 | | | (14) | | | 28 | | | (4) | |

| Interest expense | (20) | | | (21) | | | (21) | | | (62) | | | (52) | |

| | | | | | | | | |

| Other income, net | 1 | | | 1 | | | 4 | | | 4 | | | 6 | |

| Income (loss) from continuing operations before income tax | (36) | | | 8 | | | (31) | | | (30) | | | (50) | |

| Income tax benefit | 4 | | | 1 | | | 5 | | | 6 | | | 11 | |

| Equity in loss of equity method investment | (1) | | | (1) | | | (1) | | | (2) | | | (2) | |

| Income (loss) from continuing operations | (33) | | | 8 | | | (27) | | | (26) | | | (41) | |

| Income from discontinued operations, net of tax | — | | | 3 | | | 2 | | | 3 | | | 1 | |

| Net income (loss) | $ | (33) | | | $ | 11 | | | $ | (25) | | | $ | (23) | | | $ | (40) | |

| | | | | | | | | |

| Basic and Diluted earnings per common share | | | | | | | | | |

| Income (loss) from continuing operations | $ | (0.49) | | | $ | 0.12 | | | $ | (0.41) | | | $ | (0.40) | | | $ | (0.62) | |

| Income from discontinued operations | — | | | 0.05 | | | 0.02 | | | 0.05 | | | — | |

| Net income (loss) | $ | (0.49) | | | $ | 0.17 | | | $ | (0.39) | | | $ | (0.35) | | | $ | (0.62) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Weighted average shares used in determining EPS | | | | | | | | | |

| Basic EPS | 65,892,750 | | | 65,716,362 | | | 65,343,418 | | | 65,686,397 | | | 65,024,654 | |

| Diluted EPS | 65,892,750 | | | 68,790,311 | | | 65,343,418 | | | 65,686,397 | | | 65,024,654 | |

Rayonier Advanced Materials Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(in millions)

| | | | | | | | | | | |

| |

| September 28, 2024 | | December 31, 2023 |

| Assets | | | |

| Cash and cash equivalents | $ | 136 | | | $ | 76 | |

| Other current assets | 493 | | | 499 | |

| Property, plant and equipment, net | 1,022 | | | 1,075 | |

| Other assets | 508 | | | 533 | |

| Total assets | $ | 2,159 | | | $ | 2,183 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Debt due within one year | $ | 25 | | | $ | 25 | |

| Other current liabilities | 339 | | | 351 | |

| Long-term debt | 748 | | | 752 | |

| Non-current environmental liabilities | 160 | | | 160 | |

| Other liabilities | 154 | | | 148 | |

| Total stockholders’ equity | 733 | | | 747 | |

| Total liabilities and stockholders’ equity | $ | 2,159 | | | $ | 2,183 | |

Rayonier Advanced Materials Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(in millions)

| | | | | | | | | | | |

| Nine Months Ended |

| September 28, 2024 | | September 30, 2023 |

| Operating Activities | | | |

| Net loss | $ | (23) | | | $ | (40) | |

| Adjustments to reconcile net loss to cash provided by operating activities: | | | |

| Income from discontinued operations | (3) | | | (1) | |

| Depreciation and amortization | 103 | | | 104 | |

| Asset impairment | 25 | | | — | |

| Other | 6 | | | (3) | |

| Changes in working capital and other assets and liabilities | 41 | | | 22 | |

| | | |

| | | |

| Cash provided by operating activities | 149 | | | 82 | |

| | | |

| Investing Activities | | | |

| Capital expenditures, net of proceeds | (80) | | | (95) | |

| | | |

| | | |

| | | |

| Cash used in investing activities | (80) | | | (95) | |

| | | |

| Financing Activities | | | |

| Changes in debt | (7) | | | (97) | |

| Other | (3) | | | (15) | |

| Cash used in financing activities | (10) | | | (112) | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 59 | | | (125) | |

| Net effect of foreign exchange on cash and cash equivalents | 1 | | | — | |

| Balance, beginning of period | 76 | | | 152 | |

| Balance, end of period | $ | 136 | | | $ | 27 | |

Rayonier Advanced Materials Inc.

Sales Volumes and Average Prices

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 28, 2024 | | June 29, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 |

| Average Sales Prices ($ per metric ton) |

| High Purity Cellulose | $ | 1,369 | | | $ | 1,371 | | | $ | 1,215 | | | $ | 1,346 | | | $ | 1,282 | |

| Paperboard | $ | 1,400 | | | $ | 1,384 | | | $ | 1,459 | | | $ | 1,388 | | | $ | 1,508 | |

| High-Yield Pulp (external sales) | $ | 559 | | | $ | 574 | | | $ | 489 | | | $ | 564 | | | $ | 635 | |

| | | | | | | | | |

| Sales Volumes (‘000s of metric tons) |

| High Purity Cellulose | 218 | | | 225 | | | 217 | | | 663 | | | 696 | |

| Paperboard | 39 | | | 44 | | | 39 | | | 121 | | | 109 | |

| High-Yield Pulp (external sales) | 38 | | | 45 | | | 39 | | | 133 | | | 142 | |

Rayonier Advanced Materials Inc.

Reconciliation of Non-GAAP Measures

(Unaudited)

(in millions)

EBITDA and Adjusted EBITDA by Segment(a)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 28, 2024 |

| High Purity Cellulose | | Paperboard | | High-Yield Pulp | | Corporate | | Total |

| Income (loss) from continuing operations | $ | (5) | | | $ | 7 | | | $ | 1 | | | $ | (36) | | | $ | (33) | |

| Depreciation and amortization | 32 | | | 4 | | | — | | | — | | | 36 | |

| Interest expense, net | — | | | — | | | — | | | 20 | | | 20 | |

| Income tax benefit | — | | | — | | | — | | | (4) | | | (4) | |

| EBITDA-continuing operations | 27 | | | 11 | | | 1 | | | (20) | | | 19 | |

| Asset impairment | 25 | | | — | | | — | | | — | | | 25 | |

| | | | | | | | | |

| Indefinite suspension charges | 7 | | | — | | | — | | | — | | | 7 | |

| | | | | | | | | |

| Adjusted EBITDA-continuing operations | $ | 59 | | | $ | 11 | | | $ | 1 | | | $ | (20) | | | $ | 51 | |

| | | | | | | | | |

| Three Months Ended June 29, 2024 |

| High Purity Cellulose | | Paperboard | | High-Yield Pulp | | Corporate | | Total |

| Income (loss) from continuing operations | $ | 30 | | | $ | 13 | | | $ | 1 | | | $ | (36) | | | $ | 8 | |

| Depreciation and amortization | 29 | | | 2 | | | 1 | | | 1 | | | 33 | |

| Interest expense, net | — | | | — | | | — | | | 21 | | | 21 | |

| Income tax benefit | — | | | — | | | — | | | (1) | | | (1) | |

| EBITDA-continuing operations | 59 | | | 15 | | | 2 | | | (15) | | | 61 | |

| | | | | | | | | |

| | | | | | | | | |

| Indefinite suspension charges | 7 | | | — | | | — | | | — | | | 7 | |

| | | | | | | | | |

| Adjusted EBITDA-continuing operations | $ | 66 | | | $ | 15 | | | $ | 2 | | | $ | (15) | | | $ | 68 | |

| | | | | | | | | |

| Three Months Ended September 30, 2023 |

| High Purity Cellulose | | Paperboard | | High-Yield Pulp | | Corporate | | Total |

| Income (loss) from continuing operations | $ | (5) | | | $ | 14 | | | $ | (6) | | | $ | (30) | | | $ | (27) | |

| Depreciation and amortization | 32 | | | 3 | | | 1 | | | — | | | 36 | |

| Interest expense, net | — | | | — | | | — | | | 19 | | | 19 | |

| Income tax benefit | — | | | — | | | — | | | (5) | | | (5) | |

| EBITDA-continuing operations | 27 | | | 17 | | | (5) | | | (16) | | | 23 | |

| | | | | | | | | |

| | | | | | | | | |

| Loss on debt extinguishment | — | | | — | | | — | | | 1 | | | 1 | |

| | | | | | | | | |

| Adjusted EBITDA-continuing operations | $ | 27 | | | $ | 17 | | | $ | (5) | | | $ | (15) | | | $ | 24 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 28, 2024 | |

| High Purity Cellulose | | Paperboard | | High-Yield Pulp | | Corporate | | Total | |

| Income (loss) from continuing operations | $ | 46 | | | $ | 28 | | | $ | 1 | | | $ | (101) | | | $ | (26) | | |

| Depreciation and amortization | 90 | | | 10 | | | 2 | | | 1 | | | 103 | | |

| Interest expense, net | — | | | — | | | — | | | 61 | | | 61 | | |

| Income tax benefit | — | | | — | | | — | | | (6) | | | (6) | | |

| EBITDA-continuing operations | 136 | | | 38 | | | 3 | | | (45) | | | 132 | | |

| Asset impairment | 25 | | | — | | | — | | | — | | | 25 | | |

| | | | | | | | | | |

| Indefinite suspension charges | 14 | | | — | | | — | | | — | | | 14 | | |

| | | | | | | | | | |

| Adjusted EBITDA-continuing operations | $ | 175 | | | $ | 38 | | | $ | 3 | | | $ | (45) | | | $ | 171 | | |

| | | | | | | | | | |

| Nine Months Ended September 30, 2023 | |

| High Purity Cellulose | | Paperboard | | High-Yield Pulp | | Corporate | | Total | |

| Income (loss) from continuing operations | $ | 8 | | | $ | 30 | | | $ | 2 | | | $ | (81) | | | $ | (41) | | |

| Depreciation and amortization | 91 | | | 10 | | | 2 | | | 1 | | | 104 | | |

| Interest expense, net | — | | | — | | | — | | | 48 | | | 48 | | |

| Income tax benefit | — | | | — | | | — | | | (11) | | | (11) | | |

| EBITDA-continuing operations | 99 | | | 40 | | | 4 | | | (43) | | | 100 | | |

| | | | | | | | | | |

| Pension settlement loss | — | | | — | | | — | | | 2 | | | 2 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted EBITDA-continuing operations | $ | 99 | | | $ | 40 | | | $ | 4 | | | $ | (41) | | | $ | 102 | | |

| | | | | | | | | | | |

| Annual Guidance |

| 2024 |

| Low | | High |

| Loss from continuing operations | $ | (43) | | | $ | (34) | |

| Depreciation and amortization | 140 | | | 140 | |

| Interest expense, net | 80 | | | 80 | |

Income tax benefit(b) | (13) | | | (13) | |

| EBITDA-continuing operations | 164 | | | 173 | |

| Asset impairment | 25 | | | 25 | |

| Indefinite suspension charges | 16 | | | 17 | |

| Adjusted EBITDA-continuing operations | $ | 205 | | | $ | 215 | |

(a)EBITDA is defined as net income (loss) before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA adjusted for items that management believes are not representative of core operations. EBITDA and Adjusted EBITDA are non-GAAP measures used by management, existing stockholders and potential stockholders to measure how the Company is performing relative to the assets under management.

(b)Estimated using the statutory rates of each jurisdiction and ignoring all permanent book-to-tax differences.

Rayonier Advanced Materials Inc.

Reconciliation of Non-GAAP Measures (Continued)

(Unaudited)

(in millions)

Adjusted Free Cash Flow(a)

| | | | | | | | | | | |

| Nine Months Ended |

| September 28, 2024 | | September 30, 2023 |

| Cash provided by operating activities | $ | 149 | | | $ | 82 | |

| Capital expenditures, net | (50) | | | (55) | |

| Adjusted free cash flow | $ | 99 | | | $ | 27 | |

| | | | | | | | | | | |

| Annual Guidance |

| 2024 |

| Low | | High |

| Cash provided by operating activities | $ | 193 | | | $ | 203 | |

| Capital expenditures, net | (78) | | | (78) | |

| Adjusted free cash flow | $ | 115 | | | $ | 125 | |

(a)Adjusted free cash flow is defined as cash provided by (used in) operating activities adjusted for capital expenditures, net of proceeds from the sale of assets and excluding strategic capital expenditures. Adjusted free cash flow is a non-GAAP measure of cash generated during a period which is available for dividend distribution, debt reduction, strategic acquisitions and repurchase of the Company’s common stock.

Rayonier Advanced Materials Inc.

Reconciliation of Non-GAAP Measures (Continued)

(Unaudited)

(in millions, except per share information)

Adjusted Net Debt and Net Secured Debt(a)

| | | | | | | | | | | |

| |

| September 28, 2024 | | December 31, 2023 |

| Debt due within one year | $ | 25 | | | $ | 25 | |

| Long-term debt | 748 | | | 752 | |

| Total debt | 773 | | | 777 | |

| Unamortized premium, discount and issuance costs | 16 | | | 20 | |

| Cash and cash equivalents | (136) | | | (76) | |

| Adjusted net debt | 653 | | | 721 | |

| Unsecured debt | (31) | | | (23) | |

| Net secured debt | $ | 622 | | | $ | 698 | |

(a)Adjusted net debt is defined as the amount of debt after the consideration of debt premium, discount and issuance costs, less cash. Net secured debt is defined as adjusted net debt less unsecured debt.

Adjusted Income (Loss) from Continuing Operations(a)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 28, 2024 | | June 29, 2024 | | September 30, 2023 | | September 28, 2024 | | September 30, 2023 |

| $ | | Per Diluted Share | | $ | | Per Diluted Share | | $ | | Per Diluted Share | | $ | | Per Diluted Share | | $ | | Per Diluted Share |

| Income (loss) from continuing operations | $ | (33) | | | $ | (0.49) | | | $ | 8 | | | $ | 0.12 | | | $ | (27) | | | $ | (0.41) | | | $ | (26) | | | $ | (0.40) | | | $ | (41) | | | $ | (0.62) | |

| Asset impairment | 25 | | | 0.38 | | | — | | | — | | | — | | | — | | | 25 | | | 0.38 | | | — | | | — | |

| Indefinite suspension charges | 7 | | | 0.12 | | | 7 | | | 0.10 | | | — | | | — | | | 14 | | | 0.22 | | | — | | | — | |

| Pension settlement loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 2 | | | 0.04 | |

| Loss on debt extinguishment | — | | | — | | | — | | | — | | | 1 | | | 0.01 | | | — | | | — | | | — | | | — | |

| Tax effect of adjustments | (8) | | | (0.13) | | | (2) | | | (0.03) | | | — | | | — | | | (10) | | | (0.15) | | | — | | | — | |

| Adjusted income (loss) from continuing operations | $ | (9) | | | $ | (0.12) | | | $ | 13 | | | $ | 0.19 | | | $ | (26) | | | $ | (0.40) | | | $ | 3 | | | $ | 0.05 | | | $ | (39) | | | $ | (0.58) | |

(a)Adjusted income (loss) from continuing operations is defined as income (loss) from continuing operations adjusted net of tax for items that management believes are not representative of core operations.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

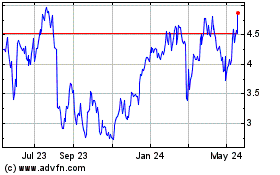

Rayonier Advanced Materi... (NYSE:RYAM)

Historical Stock Chart

From Nov 2024 to Dec 2024

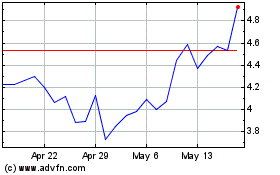

Rayonier Advanced Materi... (NYSE:RYAM)

Historical Stock Chart

From Dec 2023 to Dec 2024