The Boston Beer Company, Inc. (NYSE: SAM), today reported financial

results for the third quarter ended September 28, 2024. Key results

were:

Third Quarter 2024 Summary:

- Depletions decreased 3% and shipments decreased 1.9%

- Net revenue increased 0.6% to $605.5 million

- Gross margin of 46.3% up 60 basis points year over year

- GAAP diluted earnings per share of $2.86, which includes a

non-cash brand impairment charge of $2.49 per share recorded in the

third quarter of 2024

- Non-GAAP diluted earnings per share of $5.35

Year-to-date 2024 Summary:

- Depletions decreased 3% and shipments decreased 2.9%

- Net revenue decreased 0.3% to $1.611 billion

- Gross margin of 45.5% up 190 basis points year over year

- GAAP diluted earnings per share of $8.27, which includes a

non-cash brand impairment charge of $2.49 per share recorded in the

third quarter of 2024

- Non-GAAP diluted earnings per share of $10.76

Capital Structure

- Generated $207.0 million in operating cash flow

year-to-date

- Ended the third quarter with $255.6 million in cash and no

debt

- Repurchased $191.0 million in shares from January 2, 2024 to

October 18, 2024

- Increased expenditure authorization for stock repurchase

program by $400 million

“We continue to believe that there is significant

growth opportunity in Beyond Beer categories despite some near-term

variability in alcoholic beverage demand. The Boston Beer Company

has a proven track record in creating new categories, producing

beyond beer beverages and getting them into the hands of drinkers,”

said Chairman and Founder Jim Koch. “We are using the strong cash

generation of the business to invest in our brands and return cash

to shareholders. Based on our view of the long-term growth

prospects for the company, we recently expanded our share

repurchase authorization by $400 million.”

“We continue to make progress on our strategic

priorities to nurture our core brands, launch and support

innovation in a disciplined way and modernize our supply chain,”

said President and CEO Michael Spillane. “Our guidance has

been narrowed to reflect three quarters of results, somewhat softer

near-term category trends and solid gross margin delivery. We are

focused on implementing plans to position the company for an

improvement in operational and financial performance in 2025 and

beyond.”

Details of the results were as follows:

Third Quarter 2024 (13 weeks ended

September 28, 2024) Summary of Results

Depletions for the third quarter decreased 3% from

the prior year. Shipment volume for the quarter was approximately

2.24 million barrels, a 1.9% decrease from the prior year,

primarily due to declines in Truly Hard Seltzer that were partially

offset by growth in the Company’s Twisted Tea, Sun Cruiser and Hard

Mountain Dew brands.

The Company believes distributor inventory as of

September 28, 2024 averaged approximately five and a half weeks on

hand which is slightly higher than its target level of four to five

weeks. This is expected to have a negative impact on fourth-quarter

shipment volume which is reflected in the Company’s updated volume

guidance.

Net revenue for the quarter increased 0.6% due to

price increases and lower returns, partially offset by lower

volumes.

Gross margin of 46.3% increased 60 basis points

from the 45.7% margin realized in the prior year. Gross margin

primarily benefited from price increases, procurement savings and

lower returns, which more than offset higher inventory obsolescence

and increased inflationary costs.

The third quarter gross margin of 46.3% includes

$0.6 million of shortfall fees, which negatively impacted gross

margin by approximately 10 basis points on an absolute basis, and a

non-cash expense of third-party production pre-payments of $6.1

million that negatively impacted gross margins by approximately 100

basis points on an absolute basis.

Advertising, promotional and selling expenses for

the third quarter of 2024 decreased $4.6 million or 3.0% from the

third quarter of 2023, due to decreased freight to distributors of

$2.8 million from improved efficiencies and lower volumes. Brand

and selling costs decreased $1.8 million due to lower salaries and

benefits.

General and administrative expenses increased by

$1.6 million or 3.7% from the third quarter of 2023, primarily due

to increased professional fees.

Impairment of intangible assets reflects a $42.6

million non-cash impairment charge recorded primarily for the

Dogfish Head brand, taken as a result of the Company’s annual

impairment analysis as of September 1, 2024. The impairment

determination was primarily based on the latest forecasts of brand

performance which has been below our projections made on the

acquisition date. Beginning in the fourth quarter of 2024 the

Company will be amortizing the remaining intangible asset of $14.4

million over a 10 year life and does not expect any future

impairments related to the Dogfish Head brand.

The Company’s effective tax rate for the third

quarter of 31.7% compared to 29.3% in the prior year. The increased

effective tax rate is due to the impact of the impairment charge

which resulted in lower pre-tax income compared to the prior year

and higher non-deductible compensation expense.

Third quarter net income of $33.5 million or $2.86

per share, represented a decrease of $11.8 million or $0.84 per

diluted share compared to the prior year. This decrease between

periods was primarily driven by brand impairment and a higher tax

rate partially offset by higher revenue, higher gross margins and

lower advertising, promotional and selling expenses.

Year-to-date 2024 (39 weeks ended September

28, 2024) Summary of Results

Net revenue year-to-date of $1.611 billion

decreased 0.3% compared to year-to-date 2023.

Depletions year-to-date decreased 3% from the prior

year. Shipment volume year-to-date was approximately 6.0 million

barrels, a 2.9% decrease from the prior year, primarily due to

declines in Truly Hard Seltzer that were partially offset by growth

in Twisted Tea and Sun Cruiser brands.

Gross margin year-to-date of 45.5% increased from

the 43.6% margin realized in year-to-date 2023, or an increase of

190 basis points year over year. Gross margin primarily benefited

from price increases, procurement savings, lower returns and a

non-recurring payment in the prior year to a third-party contract

brewery, partially offset by higher brewery processing costs per

barrel due to lower volumes and increased inflationary costs.

The year-to-date gross margin of 45.5% includes

$4.6 million of shortfall fees, which negatively impacted gross

margin by approximately 30 basis points on an absolute basis and a

non-cash expense of third-party production pre-payments of $16.5

million that negatively impacted gross margins by approximately 100

basis points on an absolute basis.

Advertising, promotional and selling expenses

year-to-date decreased $14.9 million or 3.5% from year-to-date

2023, primarily due to decreased freight to distributors of $9.2

million from lower rates and volumes. Brand and selling costs

decreased $5.7 million, primarily due to lower consulting

costs.

General and administrative expenses year-to-date

increased by $11.4 million or 8.7% from year-to-date 2023,

primarily due to higher salaries and benefits costs resulting from

Chief Executive Officer transition costs recorded in the first

quarter and inflation costs.

The Company’s effective tax rate year-to-date was

30.3% compared to 28.4% year-to-date 2023 is due to higher

non-deductible compensation primarily related to Chief Executive

Officer transition costs.

Net income year-to-date of $98.5 million or $8.27

per share, represented an increase of $4.1 million or $0.60 per

diluted share compared to year-to-date 2023. This increase between

periods was primarily driven by higher gross margins, partially

offset by lower revenue, increased brand impairment and an

increased tax rate.

The Company expects that its September 28, 2024

cash balance of $255.6 million, together with its projected future

operating cash flows and the unused balance on its $150.0 million

line of credit, will be sufficient to fund future cash

requirements.

During the 39-week period ended September 28, 2024

and the period from September 30, 2024 through October 18, 2024,

the Company repurchased shares of its Class A Common Stock in the

amounts of $176.0 million and $15.0 million, respectively, for a

total of $191.0 million year to date. As of October 18, 2024, the

Company had approximately $476 million remaining on the $1.6

billion share buyback expenditure limit set by the Board of

Directors.

Depletions Estimate

Year-to-date depletions through the 42-week period

ended October 18, 2024 are estimated by the Company to have

decreased approximately 2% from the comparable period in 2023.

Full-Year 2024 Projections

The Company has updated its full year guidance. The

Company’s actual 2024 results could vary significantly from the

current projection and are highly sensitive to changes in volume

projections and supply chain performance as well as inflationary

impacts.

|

Full Year 2024 |

Current Guidance |

Prior Guidance |

|

Depletions and Shipments Percentage Decrease |

Down low single digits |

Down low single digit to zero |

|

Price Increases |

2% |

1% to 2% |

|

Gross Margin |

44% to 45% |

43% to 45% |

|

Advertising, Promotion, and Selling Expense

Year Over Year Change ($

million) |

($5) to $15 |

($5) to $15 |

|

Effective Tax Rate |

30% |

28.5% |

|

GAAP EPS |

$5.50 to $7.50 |

$7.00 to $11.00 |

|

Non-GAAP EPS |

$8.00 to $10.00 |

- |

|

Capital Spending ($ million) |

$80 to $95 |

$90 to $110 |

|

|

|

|

The non-GAAP earnings per share (Non-GAAP EPS)

projection excludes the impact of the non-cash brand impairments of

$42.6 million or $2.49 per diluted share.

Underlying the Company's current 2024 projections

are the following full-year estimates and targets:

- The advertising, selling and promotional expense projection

does not include any changes in freight costs for the shipment of

products to the Company’s distributors.

- During full year 2024, the Company estimates shortfall fees

will negatively impact gross margin by 65 to 75 basis points and

the non-cash expense of third-party production pre-payments will

negatively impact gross margins by 95 to 105 basis points.

- The Company’s business is seasonal, with the first quarter and

fourth quarter being lower volume quarters and the fourth quarter

typically the lowest absolute gross margin rate of the year.

- The increase in the estimated full year effective tax rate is

due to the impact of the third quarter non-cash brand impairment

charge which decreased estimated full year pre-tax income but did

not significantly change estimated full year non-deductible

expenses.

2025 Financial Guidance

The Company is planning to provide full year 2025

financial guidance during its fourth quarter earnings call in

February 2025.

Use of Non-GAAP Measures

Non-GAAP EPS is not a defined term under U.S.

generally accepted accounting principles (“GAAP”). Non-GAAP EPS, or

Non-GAAP earnings per diluted share, excludes from projected GAAP

EPS the impact of the non-cash asset impairment charge of $42.6

million, or $2.49 per diluted share, recognized in the third

quarter of fiscal 2024 relating primarily to the Dogfish Head

brand. This non-GAAP measure should not be considered in isolation

or as a substitute for diluted earnings per share prepared in

accordance with GAAP, and may not be comparable to calculations of

similarly titled measures by other companies. Management uses this

non-GAAP financial measure to make operating and strategic

decisions and to evaluate the Company’s underlying business

performance. Management believes this forward-looking non-GAAP

measure provides meaningful and useful information to investors and

analysts regarding the Company’s outlook for its ongoing financial

and business performance or trends and facilitates period to period

comparisons of its forecasted financial performance.

Forward-Looking Statements

Statements made in this press release that state

the Company’s or management’s intentions, hopes, beliefs,

expectations or predictions of the future are forward-looking

statements. It is important to note that the Company’s actual

results could differ materially from those projected in such

forward-looking statements. Additional information concerning

factors that could cause actual results to differ materially from

those in the forward-looking statements is contained from time to

time in the Company’s SEC filings, including, but not limited to,

the Company’s report on Form 10-K for the year ended December 30,

2023 and subsequent reports filed by the Company with the SEC on

Forms 10-Q and 8-K. Copies of these documents are available

from the SEC and may be found on the Company’s website,

www.bostonbeer.com. You should not place undue reliance on

forward-looking statements, which speak only as of the date they

are made. The Company undertakes no obligation to publicly update

or revise any forward-looking statements.

About the Company

The Boston Beer Company, Inc. (NYSE: SAM) began

brewing Samuel Adams beer in 1984 and has since grown to become one

of the largest and most respected craft brewers in the United

States. We consistently offer the highest-quality products to our

drinkers, and we apply what we’ve learned from making great-tasting

craft beer to making great-tasting and innovative “beyond beer”

products. Boston Beer Company has pioneered not only craft beer but

also hard cider, hard seltzer and hard tea. Our core brands include

household names like Angry Orchard Hard Cider, Dogfish Head, Sun

Cruiser, Truly Hard Seltzer, Twisted Tea Hard Iced Tea, and Samuel

Adams. We have taprooms and hospitality locations in California,

Delaware, Massachusetts, New York and Ohio. For more information,

please visit our website at www.bostonbeer.com, which includes

links to our respective brand websites.

| |

|

THE BOSTON BEER COMPANY, INC. AND SUBSIDIARIESCONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME(in

thousands, except per share data) |

| |

(unaudited) |

|

|

Thirteen weeks ended |

|

|

Thirty-nine weeks ended |

|

|

|

September 28, 2024 |

|

|

September 30, 2023 |

|

|

September 28, 2024 |

|

|

September 30, 2023 |

|

|

Revenue |

$ |

642,131 |

|

|

$ |

639,394 |

|

|

$ |

1,708,555 |

|

|

$ |

1,715,883 |

|

| Less excise taxes |

|

36,654 |

|

|

|

37,795 |

|

|

|

97,928 |

|

|

|

100,980 |

|

|

Net revenue |

|

605,477 |

|

|

|

601,599 |

|

|

|

1,610,627 |

|

|

|

1,614,903 |

|

| Cost of goods sold |

|

325,236 |

|

|

|

326,951 |

|

|

|

877,580 |

|

|

|

910,430 |

|

|

Gross profit |

|

280,241 |

|

|

|

274,648 |

|

|

|

733,047 |

|

|

|

704,473 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Advertising, promotional, and selling expenses |

|

147,986 |

|

|

|

152,579 |

|

|

|

412,484 |

|

|

|

427,369 |

|

|

General and administrative expenses |

|

43,818 |

|

|

|

42,241 |

|

|

|

142,226 |

|

|

|

130,834 |

|

|

Impairment of intangible assets |

|

42,584 |

|

|

|

16,426 |

|

|

|

42,584 |

|

|

|

16,426 |

|

|

Impairment of brewery assets |

|

20 |

|

|

|

1,900 |

|

|

|

3,751 |

|

|

|

3,916 |

|

|

Total operating expenses |

|

234,408 |

|

|

|

213,146 |

|

|

|

601,045 |

|

|

|

578,545 |

|

| Operating income |

|

45,833 |

|

|

|

61,502 |

|

|

|

132,002 |

|

|

|

125,928 |

|

| Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

3,582 |

|

|

|

3,478 |

|

|

|

10,021 |

|

|

|

6,977 |

|

|

Other expense |

|

(317 |

) |

|

|

(913 |

) |

|

|

(795 |

) |

|

|

(1,137 |

) |

|

Total other income |

|

3,265 |

|

|

|

2,565 |

|

|

|

9,226 |

|

|

|

5,840 |

|

| Income before income tax

provision |

|

49,098 |

|

|

|

64,067 |

|

|

|

141,228 |

|

|

|

131,768 |

|

| Income tax provision |

|

15,584 |

|

|

|

18,772 |

|

|

|

42,778 |

|

|

|

37,394 |

|

|

Net income |

$ |

33,514 |

|

|

$ |

45,295 |

|

|

$ |

98,450 |

|

|

$ |

94,374 |

|

| Net income per common share –

basic |

$ |

2.87 |

|

|

$ |

3.70 |

|

|

$ |

8.29 |

|

|

$ |

7.69 |

|

| Net income per common share –

diluted |

$ |

2.86 |

|

|

$ |

3.70 |

|

|

$ |

8.27 |

|

|

$ |

7.67 |

|

| Weighted-average number of common

shares – basic |

|

11,682 |

|

|

|

12,228 |

|

|

|

11,878 |

|

|

|

12,268 |

|

| Weighted-average number of common

shares – diluted |

|

11,671 |

|

|

|

12,233 |

|

|

|

11,871 |

|

|

|

12,280 |

|

|

Net income |

$ |

33,514 |

|

|

$ |

45,295 |

|

|

$ |

98,450 |

|

|

$ |

94,374 |

|

| Other comprehensive income (loss)

: |

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustment |

|

40 |

|

|

|

(144 |

) |

|

|

(181 |

) |

|

|

— |

|

|

Total other comprehensive income (loss) |

|

40 |

|

|

|

(144 |

) |

|

|

(181 |

) |

|

|

— |

|

|

Comprehensive income |

$ |

33,554 |

|

|

$ |

45,151 |

|

|

$ |

98,269 |

|

|

$ |

94,374 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE BOSTON BEER COMPANY, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands, except share data) |

|

|

(unaudited) |

|

|

|

|

|

|

September 28, 2024 |

|

|

December 30, 2023 |

|

|

Assets |

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

255,601 |

|

|

$ |

298,491 |

|

|

Accounts receivable |

|

94,101 |

|

|

|

66,997 |

|

|

Inventories |

|

160,322 |

|

|

|

115,773 |

|

|

Prepaid expenses and other current assets |

|

25,659 |

|

|

|

20,538 |

|

|

Income tax receivable |

|

- |

|

|

|

1,711 |

|

|

Total current assets |

|

535,683 |

|

|

|

503,510 |

|

| Property, plant, and equipment,

net |

|

619,013 |

|

|

|

642,509 |

|

| Operating right-of-use

assets |

|

29,766 |

|

|

|

35,559 |

|

| Goodwill |

|

112,529 |

|

|

|

112,529 |

|

| Intangible assets, net |

|

16,870 |

|

|

|

59,644 |

|

| Third-party production

prepayments |

|

18,015 |

|

|

|

33,581 |

|

| Note receivable |

|

16,606 |

|

|

|

— |

|

| Other assets |

|

33,510 |

|

|

|

42,661 |

|

|

Total assets |

$ |

1,381,992 |

|

|

$ |

1,429,993 |

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

102,906 |

|

|

$ |

87,245 |

|

|

Accrued expenses and other current liabilities |

|

154,139 |

|

|

|

126,930 |

|

|

Current operating lease liabilities |

|

6,602 |

|

|

|

9,113 |

|

|

Total current liabilities |

|

263,647 |

|

|

|

223,288 |

|

| Deferred income taxes, net |

|

66,445 |

|

|

|

85,721 |

|

| Non-current operating lease

liabilities |

|

31,592 |

|

|

|

36,161 |

|

| Other liabilities |

|

6,151 |

|

|

|

6,894 |

|

|

Total liabilities |

|

367,835 |

|

|

|

352,064 |

|

| Stockholders' Equity: |

|

|

|

|

|

|

Class A Common Stock, $0.01 par value; 22,700,000 shares

authorized; 9,470,066 and 10,033,303 issued and outstanding as of

September 28, 2024 and December 30, 2023

respectively |

|

95 |

|

|

|

100 |

|

|

Class B Common Stock, $0.01 par value; 4,200,000 shares authorized;

2,068,000 issued and outstanding at September 28, 2024 and

December 30, 2023 |

|

21 |

|

|

|

21 |

|

| Additional paid-in capital |

|

671,781 |

|

|

|

656,297 |

|

| Accumulated other comprehensive

loss |

|

(238 |

) |

|

|

(57 |

) |

| Retained earnings |

|

342,498 |

|

|

|

421,568 |

|

|

Total stockholders' equity |

|

1,014,157 |

|

|

|

1,077,929 |

|

|

Total liabilities and stockholders' equity |

$ |

1,381,992 |

|

|

$ |

1,429,993 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE BOSTON BEER COMPANY, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(in thousands) |

| |

(unaudited) |

|

|

|

Thirty-nine weeks ended |

|

|

|

September 28, 2024 |

|

|

September 30, 2023 |

|

| Cash flows provided by

operating activities: |

|

|

|

|

|

|

Net income |

$ |

98,450 |

|

|

$ |

94,374 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

70,904 |

|

|

|

66,603 |

|

|

Impairment of intangible assets |

|

42,584 |

|

|

|

16,426 |

|

|

Impairment of brewery assets |

|

3,751 |

|

|

|

3,916 |

|

|

Gain on sale of property, plant, and equipment |

|

(263 |

) |

|

|

— |

|

|

Change in right-of-use assets |

|

5,793 |

|

|

|

5,781 |

|

|

Stock-based compensation expense |

|

14,686 |

|

|

|

12,313 |

|

|

Deferred income taxes |

|

(19,276 |

) |

|

|

(10,349 |

) |

|

Other non-cash expense |

|

220 |

|

|

|

40 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(27,324 |

) |

|

|

(31,253 |

) |

|

Inventories |

|

(40,148 |

) |

|

|

3,786 |

|

|

Prepaid expenses, income tax receivable, and other assets |

|

(3,429 |

) |

|

|

3,986 |

|

|

Third-party production prepayments |

|

15,566 |

|

|

|

22,130 |

|

|

Other assets |

|

4,987 |

|

|

|

(9,368 |

) |

|

Accounts payable |

|

18,053 |

|

|

|

31,341 |

|

|

Accrued expenses and other liabilities |

|

29,244 |

|

|

|

29,217 |

|

|

Operating lease liabilities |

|

(6,808 |

) |

|

|

(6,542 |

) |

|

Net cash provided by operating activities |

|

206,990 |

|

|

|

232,401 |

|

| Cash flows used in

investing activities: |

|

|

|

|

|

|

Cash paid for note receivable |

|

(20,000 |

) |

|

|

— |

|

|

Purchases of property, plant, and equipment |

|

(52,770 |

) |

|

|

(48,777 |

) |

|

Proceeds from disposal of property, plant, and equipment |

|

23 |

|

|

|

1,708 |

|

|

Net cash used in investing activities |

|

(72,747 |

) |

|

|

(47,069 |

) |

| Cash flows used in

financing activities: |

|

|

|

|

|

|

Repurchases and retirement of Class A common stock |

|

(175,953 |

) |

|

|

(62,477 |

) |

|

Proceeds from exercise of stock options and sale of investment

shares |

|

2,699 |

|

|

|

10,660 |

|

|

Cash paid on finance leases |

|

(1,473 |

) |

|

|

(1,184 |

) |

|

Payment of tax withholding on stock-based payment awards and

investment shares |

|

(2,406 |

) |

|

|

(2,113 |

) |

|

Net cash used in financing activities |

|

(177,133 |

) |

|

|

(55,114 |

) |

| Change in cash and cash

equivalents |

|

(42,890 |

) |

|

|

130,218 |

|

| Cash and cash equivalents at

beginning of period |

|

298,491 |

|

|

|

180,560 |

|

| Cash and cash equivalents at end

of period |

$ |

255,601 |

|

|

$ |

310,778 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Copies of The Boston Beer Company's press releases,

including quarterly financial results,are

available on the Internet at www.bostonbeer.com |

| |

|

| Investor Relations Contact:Jennifer

Larson(617)

368-5152jennifer.larson@bostonbeer.com |

Media Contact:Dave

DeCecco(914)

261-6572dave.dececco@bostonbeer.com |

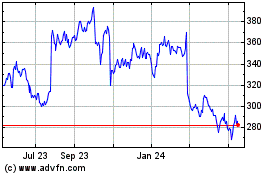

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Dec 2023 to Dec 2024