false

0001498710

0001498710

2024-11-19

2024-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 19, 2024

____________________________

Spirit Airlines,

Inc.

(Exact name of registrant as specified in its charter)

____________________________

| Delaware |

001-35186 |

38-1747023 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

1731 Radiant Drive

Dania Beach, Florida

33004

(Address of principal executive

offices, including zip code)

(954) 447-7920

(Registrant’s

telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act:

|

Class |

|

Trading

symbol(s) |

|

Name

of each exchange

on which registered |

|

Common Stock, $0.0001 par value

|

|

SAVE(1)

|

|

New York Stock Exchange

|

| (1) | On November 18, 2024, Spirit Airlines, Inc., a Delaware corporation

(“Spirit”), was notified by the staff of the NYSE Regulation (“NYSE Regulation”) that it plans to file a delisting

application with the Securities and Exchange Commission (the “SEC”) to delist the common stock, par value $0.0001, of Spirit

(the “Common Stock”) from the New York Stock Exchange (“NYSE”) upon the completion of all applicable procedures

and that trading in the Common Stock was suspended immediately. Ten days after the Form 25 is filed by NYSE Regulation, the delisting

will become effective. The deregistration of the Common Stock under Section 12(b) of the Securities Exchange Act of 1934, as amended,

will be effective 90 days, or such shorter period as the SEC may determine, after the filing of the Form 25. The Common Stock is expected

to begin trading on the OTC Pink Market under the symbol “SAVEQ”. |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On November 19, 2024, Spirit launched a consent solicitation (the

“Consent Solicitation”) with respect to its 8.00% Senior Secured Notes due 2025 (the “2025 Notes”). The

purpose of the Consent Solicitation is to seek consents to remove certain bankruptcy remote provisions from the agreements governing

the 2025 Notes (the “Proposed Amendments”), including (i) the Indenture dated as of September 17, 2020, among Spirit IP

Cayman Ltd., and Spirit Loyalty Cayman Ltd., as co-issuers (the “Co-Issuers”), Spirit, Spirit Finance Cayman 1 Ltd.

(“HoldCo 1”) and Spirit Finance Cayman 2 Ltd. (“Holdco 2”) as guarantors (the “Guarantors”), and

Wilmington Trust, National Association as trustee (the “Trustee”) and collateral custodian, as amended by a first

supplemental indenture dated as of November 17, 2022, (ii) the Collateral Agency and Accounts Agreement dated as of September 17,

2020 among the Co-Issuers, Spirit, HoldCo 1 and Holdco 2, and Wilmington as depositary (the “Depositary”), collateral

agent (the “Collateral Agent”) and the Trustee and each other senior secured debt representative from time to time party

thereto and (iii) the Security Agreement dated as of September 17, 2020 among the Co-Issuers, HoldCo 1 and HoldCo 2 and the

Collateral Agent.

In addition, the Consent Solicitation will seek consent to give

certain directions and authorization to the Trustee to (and/or, as applicable, direct the Collateral Agent to) execute and deliver

certain amendments to the applicable documentation and to take any and all other action necessary or expedient and reasonably

requested by the Co-Issuers or the Company to facilitate the filing of the Co-Issuers, HoldCo 1 and HoldCo 2 (the “Additional

Company Parties”) for bankruptcy along with Spirit in the Southern District of New York pursuant to Chapter 11 of the Bankruptcy

Code consistent with the special voting share provisions applicable to such entities.

As of the date hereof, the beneficial owners of more than 78.6% of

the outstanding principal amount of the 2025 Notes have signed that certain Restructuring Support Agreement, dated as of November 17,

2024 that requires them to consent to the Proposed Amendments. Each of the Co-Issuers, HoldCo 1 and HoldCo 2 will execute and deliver

a Company Acknowledgement to become a party to the Restructuring Support Agreement upon completion

of the Consent Solicitation.

After giving effect to the Proposed Amendments, Spirit expects that

the Additional Company Parties will commence chapter 11 cases and file a motion seeking joint administration of the chapter 11 cases of

Spirit and the Additional Company Parties (collectively, the “Chapter 11 Cases”).

The information included in this Current Report on Form 8-K under Item

7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to liabilities of that Section, unless the registrant specifically states

that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under

the Exchange Act or the Securities Act of 1933, as amended.

Cautionary Statement Regarding Forward Looking Statements

This Current Report on Form 8-K (this “Current Report”)

contains various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) which are subject to

the “safe harbor” created by those sections. Forward-looking statements are based on our management's beliefs and assumptions

and on information currently available to our management. All statements other than statements of historical facts are “forward-looking

statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,”

“will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,”

“believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions

intended to identify forward-looking statements. Forward-looking statements include, but are not limited to, the Consent Solicitation,

the Proposed Amendments and the Chapter 11 Cases. Forward-looking statements are subject to risks, uncertainties and other important factors

that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such

forward-looking statements. Factors include, among others, risks attendant to the bankruptcy process, including the Company's ability

to obtain court approval from the Court with respect to motions or other requests made to the Court throughout the course of Chapter 11,

including with respect the DIP; the

effects of Chapter 11, including increased legal and other professional

costs necessary to execute the Company's restructuring process, on the Company's liquidity (including the availability of operating capital

during the pendency of Chapter 11); the effects of Chapter 11 on the interests of various constituents and financial stakeholders; the

length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the

pendency of Chapter 11; objections to the Company's restructuring process, the DIP, or other pleadings filed that could protract Chapter

11; risks associated with third-party motions in Chapter 11; Court rulings in the Chapter 11 and the outcome of Chapter 11 in general;

the Company's ability to comply with the restrictions imposed by the terms and conditions of the DIP and other financing arrangements;

employee attrition and the Company's ability to retain senior management and other key personnel due to the distractions and uncertainties;

risks associated with the potential delisting or the suspension of trading in its common stock by the New York Stock Exchange, the impact

of litigation and regulatory proceedings; whether Spirit will receive sufficient consents to give effect to the Proposed Amendments; the

inability to complete the Consent Solicitation; and other factors discussed in the Company's Annual Report on Form 10-K and subsequent

quarterly reports on Form 10-Q filed with the SEC and other factors, as described in the Company's filings with the Securities and Exchange

Commission, including the detailed factors discussed under the heading “Risk Factors” in the Company's Annual Report on Form

10-K for the fiscal year ended December 31, 2023, as supplemented in the Company’s Quarterly Report on Form 10-Q for the fiscal

quarters ended March 31, 2024 and June 30, 2024. Furthermore, such forward-looking statements speak only as of the date of this Current

Report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances

after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial,

or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

|

Exhibit No. |

|

Description |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 19, 2024 |

SPIRIT AIRLINES, INC. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Thomas Canfield |

|

| |

Name: |

Thomas Canfield |

|

| |

Title: |

Senior Vice President and General Counsel |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

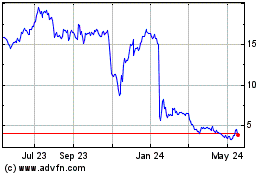

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Mar 2025 to Apr 2025

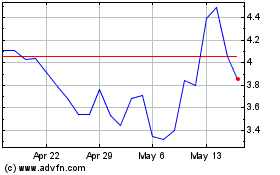

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Apr 2024 to Apr 2025