Key Highlights:

- Millionaire Millennials and Gen X are more than twice as likely

to prefer sharing their wealth with the next generation during

their lifetime compared to millionaire Boomers.

- Three in five wealthy Americans who intend to pass on wealth

say they started planning their wealth transfer before the age of

45, and more than half started planning once they had a net worth

of at least $1 million.

- Younger wealthy Americans are significantly more likely to

stipulate how their wealth can be used by future generations.

A generational shift is emerging among wealthy Americans

planning to pass their wealth, according to Schwab’s new survey of

more than 1,000 high net worth1 (HNW) Americans, as younger wealthy

Americans break from tradition by opting to transfer their wealth

during their lives, rather than waiting until after death. They’re

also planning a more prescriptive approach to how their wealth is

used.

Schwab’s survey shows that among wealthy Americans, defined as

those with more than $1 million in investable assets, 97% plan to

transfer their wealth, with 36% preferring that the next generation

enjoy their wealth while they’re still living and 39% preferring to

preserve their money for the next generation until after they pass

away.

Wealthy Millennials and Gen Xers are more than twice as likely

to say they want to share their wealth with the next generation

during their lives compared to millionaire Boomers, who are more

likely to say they want to enjoy their money themselves during

their lifetime. Younger wealthy Americans expect to distribute over

twice as much of their wealth while alive compared to wealthy

Boomers.

Overall, three in five (61%) wealthy Americans say that passing

at least some of their wealth during their lifetime is important

because they can help provide financial support and assistance to

their beneficiaries (46%), share in their joy, and make memories

together (36%). Most wealthy Americans anticipate a mix of both

approaches, with plans to distribute about 40% of their assets

during their lives and leave the remainder to pass after death.

All Wealthy Americans

Wealthy Millennials

Wealthy

Gen X

Wealthy Boomers

I want to preserve my money for the next

generation or others after I pass

39%

32%

45%

34%

I want the next generation to enjoy my

money while I’m still alive

36%

53%

44%

21%

I want to enjoy my money for myself while

I’m still alive

25%

15%

11%

45%

I plan to distribute some portion of their

wealth during my lifetime

80%

97%

97%

56%

Portion of wealth I plan to pass on during

my lifetime (average, among those who plan to pass on assets)

39%

52%

49%

19%

I plan to distribute some portion of my

wealth after my lifetime

87%

97%

98%

73%

Portion of wealth I plan to pass on after

my lifetime (average, among those who plan to pass on assets)

61%

48%

51%

81%

“Schwab serves over a million multi-millionaires, and as they

move from building wealth to preserving and passing it, we see an

increasing need for specialized services and support around estate

planning, wealth transfer, and legacy planning,” said Andrew

D’Anna, Managing Director of Retail Client Experience at Charles

Schwab. “According to our survey, younger Americans could be poised

to reshape legacy planning and the future of how wealth is passed

to the next generation. Understanding the changing dynamics

underway, we are continually evolving and enhancing our services,

such as increasing access to tax, trust, and estate planning

specialists, creating self-serve digital experiences to help

clients manage inheritance tasks, building out our planning and

educational resources specific to this significant life event, and

encouraging engagement and discourse across family members and

generations.”

Wealth Distribution and Family Dialogue

On average, wealthy Americans who plan to pass their wealth

estimate they will distribute about $4.1 million in assets, with

about 40% of that value in the form of real estate ($1.6 million),

and the rest in investments (31%), cash (18%), and death benefit

proceeds from life insurance (11%). The vast majority (85%) feel

that the amount is “enough.” Ultra-high net worth (UHNW) Americans,

those with more than $10 million in investable assets, plan to pass

on significantly more, reporting an average value of $11.9 million,

with one in five (23%) fearing they may be giving too much to their

heirs.

All Wealthy Americans

Wealthy Millennials

Wealthy

Gen X

Wealthy Boomers

Approximate value I expect to pass

(Total)

$4.1M

$4.7M

$4.8M

$3.1M

Approximate value of real estate I expect

to pass

$1.6M

$2.2M

$2.5M

$750K

Approximate value of investments I expect

to pass

$1.3M

$770K

$780K

$1.6M

Approximate value of cash I expect to

pass

$740K

$1.0M

$830K

$550K

Approximate value of death benefit

proceeds I expect to pass

$440K

$670K

$710K

$170K

Three in five wealthy Americans (63%) who intend to pass on

wealth say they started planning their wealth transfer before the

age of 45 and recommend others do the same. In terms of assets,

more than half of wealthy Americans (56%) started planning once

they had a net worth of $1 million or more. About half (49%) agree

that people should start planning even if they have a net worth

below $1 million.

Most wealthy Americans plan to distribute their wealth primarily

across their spouse or partner, children, and charities, and most

have communicated their plans with their beneficiaries,

particularly their spouse (92%) and children (78%). Those surveyed

largely have important documents in place to facilitate their

wealth transfer, including wills (57%), powers of attorney (38%),

and trusts (34%). More than half have worked with a financial

advisor (56%) or an attorney (55%) to prepare their documents.

According to wealthy Americans, the top reasons someone should

create a plan are wealth and asset protection (56%), eliminating

conflicts between the recipients (44%), avoiding probate court

(43%), and minimizing taxes (39%).

“It’s encouraging to see that a majority of wealthy Americans

who plan to pass their wealth have started to formalize those plans

and documents and communicate with their families,” said Susan

Hirshman, Director of Wealth Management for Schwab Wealth Advisory

and Schwab Center for Financial Research. “In addition to those

foundational steps, we encourage families to ground discussions and

planning around shared values and goals for wealth being

transferred. These conversations can help heirs see themselves as

wealth stewards, rather than just beneficiaries, and gain important

perspective on the meaning of wealth, legacy, and the

responsibilities that come with it.”

Legacy with Limits

Seventy percent of wealthy Americans who plan to pass on their

fortune also use the wealth transfer process to stipulate how their

wealth is used, such as setting an age at which the money can be

accessed (34%), selecting recipients for specific items (29%), and

specifying how the money can be spent (27%).

Nine in ten UHNW Americans stipulate how their wealth is used,

and they often have stricter guidelines, such as requiring certain

life milestones for distribution, mandating that funds be used for

familial responsibilities, and maintaining career performance to

access funds.

Younger wealthy Americans are more likely to provide their

wealth with strings attached compared to older generations. Nearly

all Millennials (97%) and Gen X (94%) have stipulations included in

their wealth transfer plans, compared to only one in three Boomers

(34%). Millennials are most likely to stipulate how money can be

used (43%), while Gen X is most likely to set an age for when the

money can be used (46%).

All Wealthy Americans

Wealthy Millennials

Wealthy

Gen X

Wealthy Boomers

(NET) Have some kind of

stipulation

70%

97%

94%

34%

The age at which the money can be used

34%

39%

46%

17%

The recipients of specific items

29%

40%

41%

14%

How the money can be used

27%

43%

41%

7%

Tying distributions to life milestones

(e.g., graduation, purchasing first home, marriage, children)

19%

35%

26%

5%

Using funds for certain familial

responsibilities (e.g., family reunion)

15%

28%

22%

4%

Making a charitable gift as a prerequisite

to distribution

12%

19%

15%

7%

Maintaining certain career performance

(e.g., distribution based on earned income)

10%

19%

14%

2%

Maintaining certain academic performance

(e.g., minimum GPA)

5%

14%

6%

1%

“It’s common for those who have built their wealth over time to

want to have a say and guide how those assets are used, with

benefits and safeguards for future generations top of mind,” said

Hirshman. “We often see wealthy families add stipulations to help

protect and preserve assets for multiple generations, encourage

self-driven financial responsibility, and uphold long-term family

values. They’re really trying to ensure that the family wealth has

a positive impact.”

See the detailed results from Schwab’s survey of HNW Americans

here.

About Schwab’s High Net Worth Investor Survey

The online survey was conducted by Logica Research from August

8, 2024, to September 2, 2024, among a national sample of 1,005

wealthy Americans with $1 million or more in investable assets,

including 105 UHNW investors with $10 million or more in investable

assets. All respondents were aged 18 or over.

Disclosures

The information here is for general informational purposes only

and should not be considered an individualized recommendation or

personalized investment advice. The investment strategies mentioned

here may not be suitable for everyone. Each investor needs to

review an investment strategy for his or her own particular

situation before making any investment decision.

All expressions of opinion are subject to change without notice

in reaction to shifting market, economic or geopolitical

conditions.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with 36.1 million active brokerage

accounts, 5.4 million workplace plan participant accounts, 2.0

million banking accounts, and $9.85 trillion in client assets as of

October 31, 2024. Through its operating subsidiaries, the company

provides a full range of wealth management, securities brokerage,

banking, asset management, custody, and financial advisory services

to individual investors and independent investment advisors. Its

broker-dealer subsidiary, Charles Schwab & Co., Inc. (member

SIPC, https://www.sipc.org), and its affiliates offer a complete

range of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

referrals to independent, fee-based investment advisors; and

custodial, operational and trading support for independent,

fee-based investment advisors through Schwab Advisor Services. Its

primary banking subsidiary, Charles Schwab Bank, SSB (member FDIC

and an Equal Housing Lender), provides banking and lending services

and products.

More information is available at https://www.aboutschwab.com.

Follow us on X, Facebook, YouTube and LinkedIn.

(1224-72Z1)

1 High net worth is defined as having more than $1 million in

investable assets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209249389/en/

Hibah Shariff Charles Schwab 415-667-0507

hibah.shariff@schwab.com

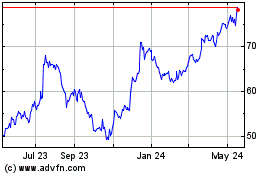

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Nov 2024 to Dec 2024

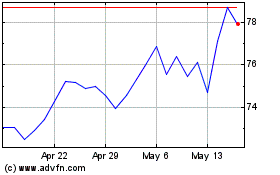

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Dec 2023 to Dec 2024